The global fasteners market, fueled by robust demand from construction, woodworking, and DIY sectors, is projected to grow at a CAGR of 5.2% from 2023 to 2028, according to Mordor Intelligence. Within this expanding landscape, small finishing nails—a critical component in precision carpentry, cabinetry, and interior trim work—have seen rising demand for high-quality, corrosion-resistant, and dimensionally accurate products. As residential construction and remodeling activities gain momentum worldwide, particularly in North America and Europe, the need for reliable small finishing nail manufacturers has intensified. This list highlights the top eight manufacturers excelling in product consistency, innovation, and market reach, positioning them at the forefront of a niche yet essential segment in the fastener industry.

Top 8 Small Finishing Nails Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Nails

Domain Est. 1993

#2 Maze Nails Company

Domain Est. 1995

Website: mazenails.com

Key Highlights: Maze Nails have been trusted by professionals for more than a century. Our top quality hot dip galvanizing process delivers superior corrosion resistance….

#3 Trim Nails

Domain Est. 1995

Website: strongtie.com

Key Highlights: These 20° angle, adhesive-collated, 16-gauge finishing nails are ideal for finishing, millwork and trim applications, featuring a T-style head for easy ……

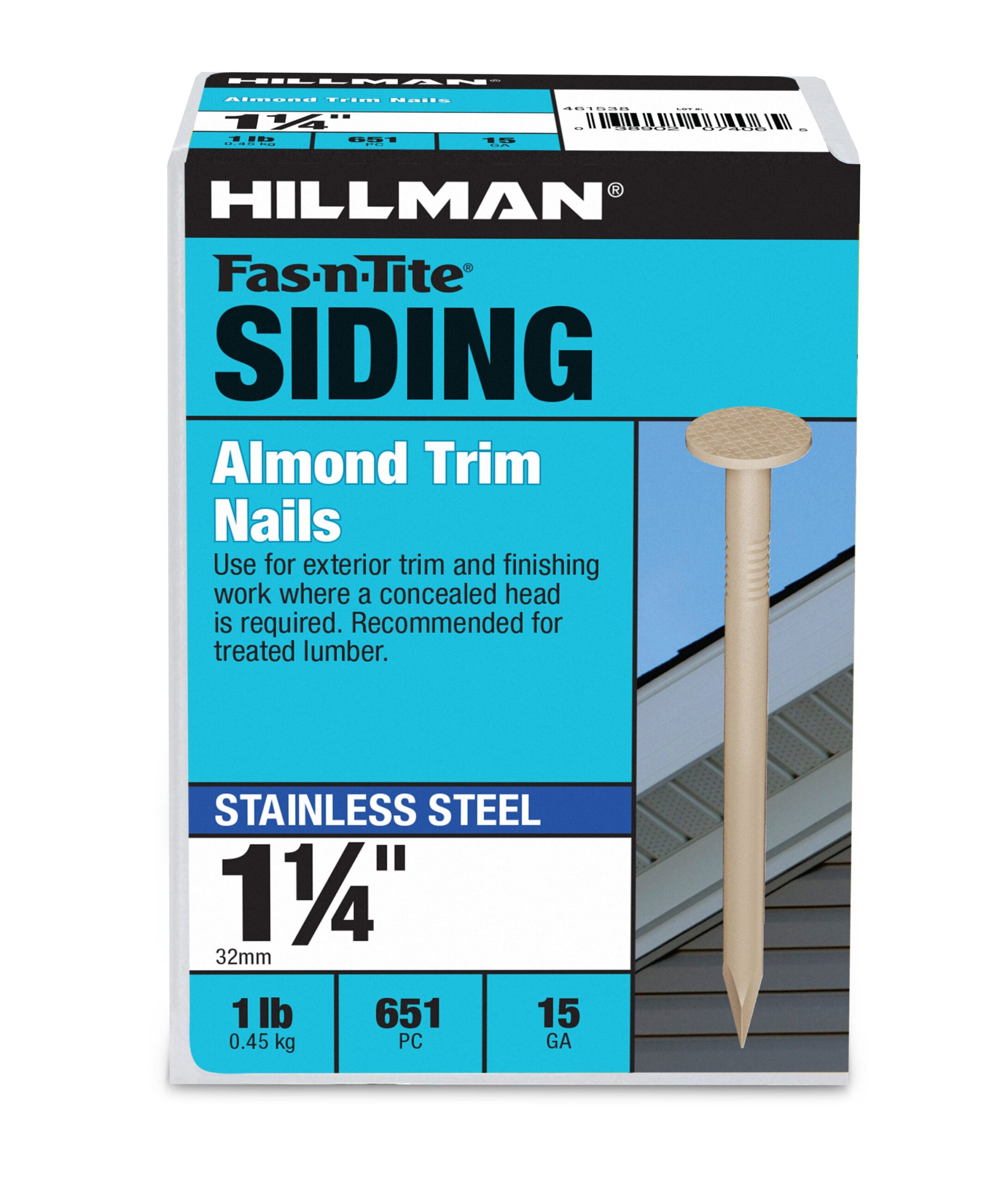

#4 16 Gauge Straight Galvanized Finish Nails

Domain Est. 1996

Website: paslode.com

Key Highlights: Our 16 Gauge Straight Galvanized Finish Nails are designed to create smaller holes and help prevent splitting in expensive trim woods….

#5 Fine Finish Nail

Domain Est. 2000

Website: tremontnail.com

Key Highlights: Fine Finish nails are popular where a slim brad-head nail is appropriate. Often used in furniture repair, cabinet work, batten doors, paneling, and countertops….

#6 Finishing Nails

Domain Est. 2002

Website: grip-rite.com

Key Highlights: Small heads for flush finish. Strong base material for lasting performance. Types of Finishing Nails. We offer four major types of finish nails. Finish Nails….

#7 Finish Nails Archives

Domain Est. 2006

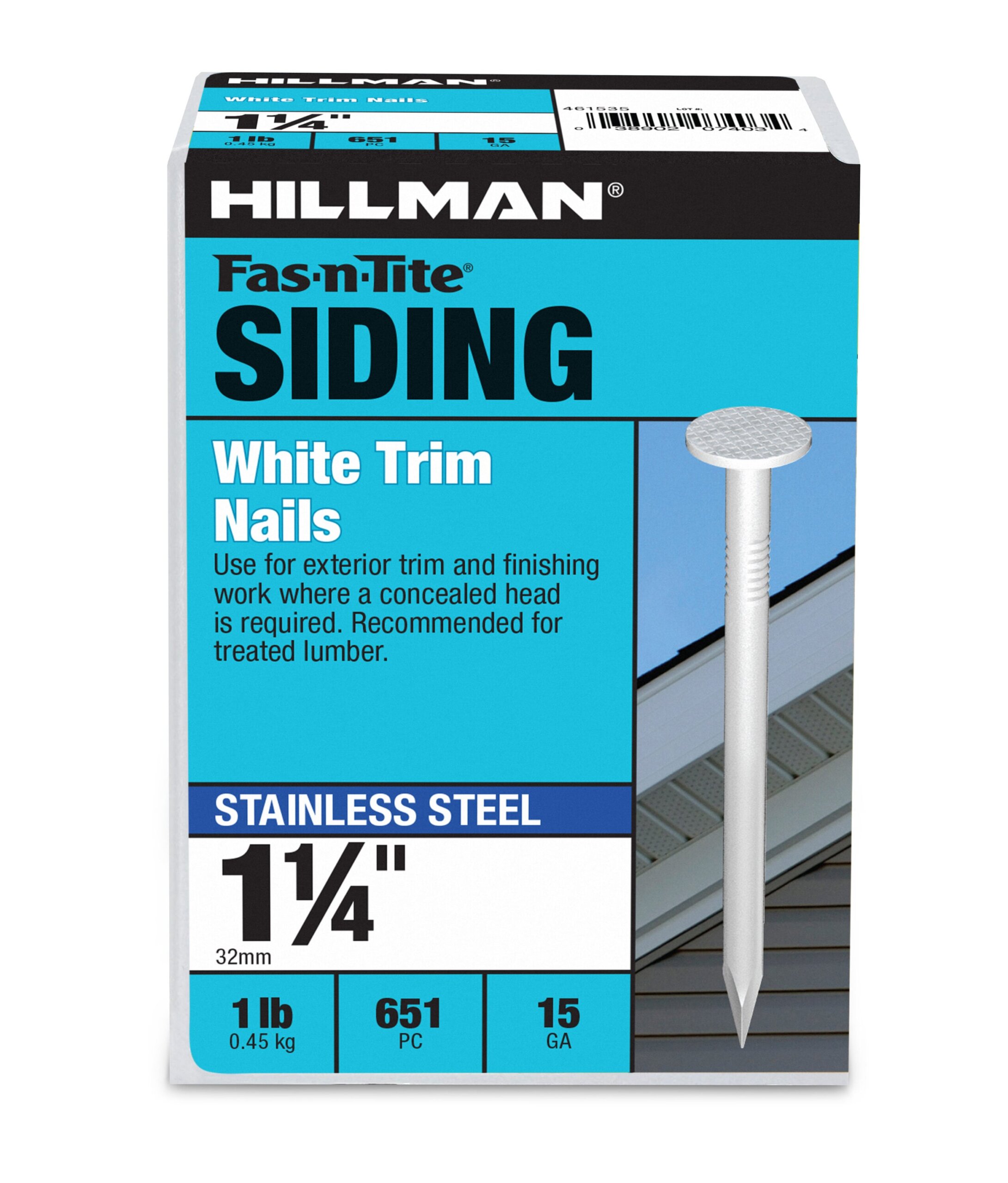

#8 Nails

Domain Est. 1996

Website: doitbest.com

Key Highlights: 2-day deliveryExplore a wide selection of premium Nails at Do it Best, including Finishing Nails, Common Nails, Roofing Nails. ✓ Same day pick-up or home delivery….

Expert Sourcing Insights for Small Finishing Nails

H2: 2026 Market Trends for Small Finishing Nails

The global market for small finishing nails is expected to undergo notable shifts by 2026, driven by advancements in construction technologies, evolving consumer preferences, and sustainability initiatives. As demand for precision and aesthetic appeal in woodworking and interior finishing grows, small finishing nails—typically ranging from 1 to 2 inches in length and used in trim, molding, cabinetry, and furniture assembly—are gaining increased attention.

One of the primary drivers shaping the 2026 market is the expansion of residential and commercial construction, particularly in emerging economies across Asia-Pacific and Latin America. Urbanization and infrastructure development are fueling demand for high-quality finishing materials, including corrosion-resistant and precision-engineered nails made from materials like stainless steel, coated steel, and aluminum.

Additionally, the trend toward DIY (Do-It-Yourself) home improvement projects, accelerated by digital platforms and online tutorials, is expanding the consumer base beyond professional contractors. This shift is prompting manufacturers to offer user-friendly packaging, specialty sets for specific applications, and compatibility with popular nail guns, especially pneumatic and cordless models.

Sustainability is another critical trend influencing the market. By 2026, there is expected to be greater emphasis on recyclable materials and eco-friendly production processes. Leading manufacturers are investing in energy-efficient manufacturing and reducing carbon footprints, aligning with global environmental standards and green building certifications such as LEED.

Technological innovation is also playing a pivotal role. The integration of automation and precision manufacturing is improving nail consistency, reducing defects, and enabling tighter tolerances—essential for high-end finishes. Moreover, smart inventory and supply chain solutions are helping distributors and retailers manage stock more efficiently, reducing waste and improving time-to-market.

Regionally, North America and Europe are expected to maintain strong demand due to ongoing renovation activities and strict building codes favoring durable, high-performance fasteners. In contrast, the Asia-Pacific region is projected to register the highest growth rate, supported by rapid urban development and increasing disposable incomes.

In conclusion, the 2026 market for small finishing nails will be characterized by technological refinement, sustainability, and expanding applications across both professional and consumer segments. Companies that innovate in materials, distribution, and eco-design are likely to gain competitive advantage in this evolving landscape.

Common Pitfalls When Sourcing Small Finishing Nails (Quality, IP)

Sourcing small finishing nails may seem straightforward, but overlooking key quality and intellectual property (IP) considerations can lead to product failures, compliance issues, and legal risks. Here are common pitfalls to avoid:

Poor Material Quality and Inconsistent Dimensions

Low-grade steel or improper alloy composition can result in nails that are brittle, prone to bending, or prone to corrosion. Inconsistent lengths, diameters, or head sizes not only affect performance but can also jam pneumatic nail guns. Always verify material specifications (e.g., 100% copper-coated or stainless steel) and demand dimensional tolerance documentation.

Inadequate Coating or Surface Treatment

Many small finishing nails rely on coatings (e.g., cement, vinyl, or epoxy) to improve nail gun feed and holding power. Substandard or uneven coatings can cause misfires or poor adhesion. Additionally, nails intended for outdoor or high-moisture applications require corrosion-resistant finishes—failing to specify this can lead to premature rusting.

Lack of Compliance with Industry Standards

Reputable suppliers adhere to ASTM, ANSI, or ISO standards for finishing nails (e.g., ASTM F1667 for staple and nail driving tools compatibility). Sourcing from non-compliant manufacturers risks safety issues and incompatibility with professional tools. Always confirm compliance and request test certifications.

Intellectual Property Infringement Risks

Some nail designs—particularly specialized head profiles, grooved shanks, or proprietary coatings—may be protected by patents. Sourcing generic versions that mimic patented features (e.g., certain twist nails or high-hold designs) can expose your business to IP litigation. Conduct due diligence on designs and request IP indemnification from suppliers.

Inconsistent Manufacturing Processes

Inconsistent heat treatment or heading processes can weaken nails or create flawed heads. Suppliers with poor quality control may mix batches, leading to variability in performance. Audit manufacturing facilities or require third-party QC reports to ensure consistency.

Misrepresentation of “Finish” vs. “Brad” Nails

Suppliers may incorrectly label brad nails (typically 18-gauge) as finish nails (usually 15- or 16-gauge), leading to inadequate holding power in trim applications. Clarify gauge, shank type, and intended use to ensure correct product selection.

Overlooking Packaging and Traceability

Bulk-packed or poorly labeled nails can lead to mix-ups on job sites or during inventory management. Reputable suppliers offer batch-coded packaging for traceability—essential for quality control and recalls. Ensure packaging includes specifications, certifications, and lot numbers.

By addressing these pitfalls proactively, businesses can ensure they source reliable, compliant, and legally safe small finishing nails that meet performance expectations.

Logistics & Compliance Guide for Small Finishing Nails

Product Classification and HS Code

Small finishing nails are typically classified under the Harmonized System (HS) code 7317.11 for “Nails, tacks, drawing pins, corrugated nails, staples (other than those of heading 83.05), of iron or steel, whether or not with heads, of hardened steel.” Accurate classification is essential for international shipping, tariff determination, and customs clearance. Confirm the exact HS code with your local customs authority or trade consultant based on nail composition, size, and coating (if any).

Packaging and Labeling Requirements

Proper packaging ensures product integrity and compliance with transportation regulations. Small finishing nails should be packed in sturdy, sealed containers—such as polypropylene bags, cardboard boxes, or metal tins—to prevent spillage and moisture exposure. Labeling must include:

– Product description (e.g., “1-inch Galvanized Finishing Nails”)

– Net weight or quantity

– Manufacturer or distributor name and address

– Country of origin

– Applicable safety warnings (e.g., “Sharp Object – Handle with Care”)

For international shipments, labels may need to be multilingual and comply with destination country requirements.

Transportation and Shipping Regulations

Small finishing nails are generally non-hazardous and can be shipped via standard ground, air, or sea freight. However:

– Use secure packaging to meet carrier requirements and prevent damage during transit.

– Declare contents accurately on shipping manifests.

– Comply with International Air Transport Association (IATA) and International Maritime Organization (IMO) guidelines when exporting.

– For air freight, ensure packages meet dimensional and weight standards to avoid surcharges.

Import/Export Documentation

Key documents for international trade include:

– Commercial Invoice

– Packing List

– Bill of Lading (for sea) or Air Waybill (for air)

– Certificate of Origin (if claiming preferential tariffs under trade agreements)

Maintain accurate records for at least five years to support audit or customs verification processes.

Regulatory and Safety Compliance

- REACH & RoHS (EU): Ensure nails are free of restricted substances like lead or cadmium, especially if coated.

- Proposition 65 (California, USA): If nails contain chemicals on California’s list (e.g., chromium VI), provide appropriate warnings.

- OSHA & WHMIS (North America): While small nails are not typically classified as hazardous, provide safety data if requested, especially for industrial clients.

Storage and Handling

Store in a dry, climate-controlled environment to prevent rust, especially for non-coated or galvanized nails. Use pallets to elevate containers off the floor and rotate stock using FIFO (First In, First Out) to minimize aging and corrosion risks.

Environmental and Disposal Considerations

Used or excess nails should be recycled as scrap metal through certified recyclers. Do not dispose of in general waste due to metal content and potential environmental impact. Follow local regulations for industrial waste handling where applicable.

Quality Assurance and Traceability

Maintain batch-level traceability to support recalls or compliance audits. Implement quality checks for dimensions, coating thickness, and head integrity. Certifications such as ISO 9001 can enhance market credibility and customer trust.

In conclusion, sourcing small finishing nails requires careful consideration of factors such as nail size, material, quantity, supplier reliability, and cost-efficiency. Whether purchasing for a small DIY project or large-scale construction, it is essential to balance quality with affordability. Local hardware stores offer immediate availability and expert advice, while online retailers often provide a broader selection and competitive pricing—especially for bulk orders. Additionally, evaluating the specific application (e.g., trim work, cabinetry, or molding) ensures the right type of nail (such as brad nails or 18-gauge finish nails) is selected for optimal performance and finish. By comparing suppliers, checking product reviews, and considering long-term needs, buyers can make informed decisions that ensure durability, aesthetic results, and value for money.