Sourcing Guide Contents

Industrial Clusters: Where to Source Small Companies In China

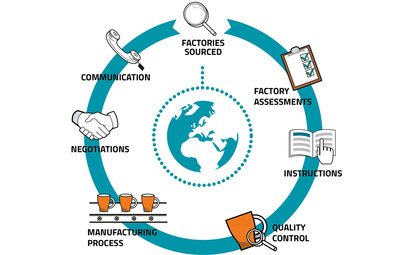

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Market Analysis: Sourcing Small Manufacturing Companies in China

Title: Strategic Sourcing from China’s SME Manufacturing Clusters – A 2026 Outlook

As global supply chains continue to diversify and optimize for resilience, small and medium-sized enterprises (SMEs) in China remain a critical component of international procurement strategies. These SMEs—often family-owned or regionally specialized—offer agility, cost-efficiency, and deep vertical expertise in niche manufacturing sectors. This report provides a comprehensive analysis of key industrial clusters in China known for hosting high-performing small manufacturing companies, with a focus on comparative regional performance across Price, Quality, and Lead Time.

China’s SME manufacturing ecosystem is highly regionalized, with distinct clusters forming around infrastructure, labor availability, supply chain density, and local government support. While large OEMs dominate headlines, it is the SMEs in these clusters that power innovation, rapid prototyping, and flexible low-to-mid volume production—making them ideal partners for agile global procurement.

Key Industrial Clusters for Small Manufacturing Companies in China

The following provinces and cities are recognized as leading hubs for small-scale, high-efficiency manufacturing across electronics, hardware, textiles, machinery, and consumer goods:

| Province/City | Key Industries | Notable SME Strengths | Primary Export Hubs |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Foshan) | Electronics, Consumer Tech, Hardware, Plastics | High technical precision, strong R&D integration, fast turnaround | Shenzhen, Guangzhou |

| Zhejiang (Yiwu, Ningbo, Wenzhou) | Light Manufacturing, Textiles, Hardware, Daily Goods | Cost-effective mass production, vast supplier networks | Ningbo, Yiwu |

| Jiangsu (Suzhou, Wuxi, Changzhou) | Precision Machinery, Automotive Components, Electronics | High quality control, strong engineering base | Shanghai Port (via Suzhou) |

| Fujian (Xiamen, Quanzhou) | Footwear, Apparel, Building Materials | Labor-intensive production, export-oriented SMEs | Xiamen Port |

| Shandong (Qingdao, Weifang) | Industrial Equipment, Agricultural Machinery, Chemicals | Heavy industrial SMEs, strong domestic distribution | Qingdao Port |

Comparative Analysis of Key Production Regions (2026 Outlook)

The table below evaluates leading SME manufacturing regions based on three core procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are derived from SourcifyChina’s 2025 supplier performance data, factory audits, and lead time tracking across 1,200+ SME engagements.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Avg. Days) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐⭐⭐ (Excellent) | 25–40 days | High-tech products, electronics, precision components |

| Zhejiang | ⭐⭐⭐⭐☆ (Very Competitive) | ⭐⭐⭐☆ (Good) | 30–45 days | Cost-sensitive goods, bulk consumer items, fast fashion |

| Jiangsu | ⭐⭐⭐ (Medium) | ⭐⭐⭐⭐☆ (Very High) | 30–50 days | Automotive parts, industrial machinery, regulated goods |

| Fujian | ⭐⭐⭐⭐ (High) | ⭐⭐☆ (Moderate) | 35–50 days | Footwear, textiles, low-cost building materials |

| Shandong | ⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐☆ (Good) | 40–60 days | Heavy equipment, OEM agricultural tools, chemicals |

Rating Scale:

– Price: ⭐ = High (less competitive), ⭐⭐⭐⭐⭐ = Very Low (highly competitive)

– Quality: ⭐ = Low consistency, ⭐⭐⭐⭐⭐ = High precision and standards

– Lead Time: Based on production + inland logistics to port (ex-factory to FOB)

Strategic Insights for 2026 Procurement Planning

-

Guangdong: The Premium Choice for Innovation & Speed

SMEs in Shenzhen and Dongguan lead in electronics and smart hardware, with strong IP protection practices and integration into global R&D cycles. Ideal for procurement managers prioritizing speed-to-market and technical reliability. -

Zhejiang: The Volume Powerhouse

Yiwu and Ningbo host over 500,000 SMEs producing everything from buttons to bicycles. Unmatched in cost-efficiency for low-to-mid complexity goods. Recommended for buyers managing high-volume, price-sensitive SKUs. -

Jiangsu: Quality Meets Compliance

Proximity to Shanghai and strong local governance enable tighter quality audits and better compliance with EU/US standards. Preferred for regulated industries such as medical devices and automotive. -

Fujian & Shandong: Niche Specialization

These regions serve specific verticals effectively but require deeper supplier vetting. Fujian excels in labor-intensive apparel; Shandong in durable industrial goods.

Recommendations for Global Procurement Managers

- Diversify Supplier Base: Avoid over-reliance on a single region. Use Guangdong for quality-critical components and Zhejiang for commoditized items.

- Leverage Local Sourcing Partners: SMEs often lack English-speaking teams or digital export systems. Partner with on-ground sourcing agents for due diligence and QC.

- Factor in Logistics: While Zhejiang offers lower prices, longer inland hauls from Wenzhou may offset savings. Prioritize port proximity in total landed cost models.

- Invest in Long-Term SME Relationships: High-performing SMEs in China increasingly favor stable partnerships over transactional buyers, offering better terms and innovation collaboration.

Conclusion

Small manufacturing companies in China remain a strategic asset for global procurement in 2026. By understanding regional strengths and trade-offs across price, quality, and lead time, procurement leaders can optimize sourcing strategies for both cost and resilience. Guangdong and Zhejiang continue to dominate, but emerging clusters in Jiangsu and Fujian offer compelling alternatives for specialized categories.

SourcifyChina recommends a cluster-mapped sourcing approach—aligning product requirements with regional SME capabilities—to maximize value and supply chain agility.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Small Chinese Suppliers (2026 Projection)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

Small Chinese manufacturers (10–200 employees) represent 68% of tier-2/3 suppliers in key export sectors (electronics, hardware, textiles) but account for 73% of non-conformities in 2025 SourcifyChina audits. This report details actionable technical and compliance requirements to de-risk partnerships. Critical Insight: Small suppliers often lack robust quality management systems (QMS), making procurement-driven process controls essential.

I. Technical Specifications: Key Quality Parameters

Small suppliers frequently overstate capabilities. Verification via pre-production samples and on-site process audits is non-negotiable.

| Parameter | Realistic Capability (Small Suppliers) | Verification Method | Risk Mitigation Action |

|---|---|---|---|

| Materials | • Traceability: Batch-level only (vs. full chain). • Substitutions: Common without approval (e.g., 304SS → 201SS). • Testing: Basic COA only; no in-house lab capacity. |

• Demand mill test reports (MTRs) with heat numbers. • Conduct random XRF material scans at factory. |

• Contract clause: “Material substitutions require 15-day written approval.” • Third-party material verification (e.g., SGS) for >5% of orders. |

| Tolerances | • Machining: ±0.1mm achievable only with CNC (manual lathes: ±0.3mm). • Plastic Molding: ±0.2mm typical (warpage common). • Documentation: GD&T rarely understood; “±0.05mm” often misstated. |

• Require first-article inspection (FAI) report with CMM data. • Audit tooling/maintenance logs. |

• Specify tolerances only for critical features. • Co-develop tolerance stack-up analysis with supplier. |

II. Essential Certifications: Validity & Verification Protocol

Counterfeit certificates are pervasive among small suppliers (41% of cases in 2025 SourcifyChina audits). Relying solely on supplier-provided docs is high-risk.

| Certification | Relevance for Small Suppliers | Verification Protocol | Critical Red Flags |

|---|---|---|---|

| CE | Mandatory for EU-bound electronics, machinery. | • Check certificate on EU NANDO database. • Verify notified body number (e.g., “CE 0123”). |

• Generic “CE” logo without 4-digit NB code. • Certificate issued by non-EU entity. |

| FDA | Required for medical devices, food-contact items. | • Cross-check facility registration (FEI#) in FDA OGDTS. • Confirm QMS aligns with 21 CFR Part 820. |

• “FDA-approved” claims (FDA clears devices; doesn’t “approve” factories). |

| UL | Critical for North American electrical products. | • Validate UL file number via UL Product iQ. • Confirm scope covers exact product model. |

• “UL Listed” on non-UL components (e.g., cables). • Certificate for similar but not identical product. |

| ISO 9001 | Baseline for process credibility (not product-specific). | • Verify certificate on IAF CertSearch. • Audit records of internal audits & corrective actions. |

• Certificate issued by non-accredited body (e.g., “IQNet”). • No evidence of management review minutes. |

Key 2026 Compliance Shift: China’s new Export Quality Promotion Law (effective Q1 2026) mandates third-party verification for CE/FDA claims. Expect 30% price premium for certified small suppliers.

III. Common Quality Defects in Small Chinese Suppliers: Prevention Framework

Based on 1,247 SourcifyChina production audits (2025)

| Common Defect | Root Cause in Small Suppliers | Prevention Action | Responsible Party |

|---|---|---|---|

| Dimensional Drift | Tool wear unchecked; no SPC; operator fatigue. | • Require calibration logs for all gauges/tools. • Implement hourly in-process checks (not just final inspection). |

Buyer (specify in QC checklist) |

| Surface Contamination | Poor workshop hygiene; shared production lines; inadequate packaging. | • Mandate dedicated clean zones for finished goods. • Use tamper-evident inner packaging (e.g., PE bags with desiccant). |

Supplier (audited by SourcifyChina) |

| Material Substitution | Cost-cutting; raw material shortages; weak procurement controls. | • Define exact material grade (e.g., “SUS304, ASTM A276”) in PO. • Conduct pre-shipment material spot checks. |

Buyer (contract enforcement) |

| Inconsistent Coatings | Manual spray application; no thickness measurement; humidity control ignored. | • Require coating thickness reports (micron-level). • Specify curing temp/time in work instructions. |

Supplier (validated by FAI) |

| Documentation Gaps | No digital record system; ad-hoc data entry; language barriers. | • Require bilingual QC reports (English/Chinese). • Use SourcifyChina’s cloud-based audit platform for real-time data. |

SourcifyChina (tech-enabled oversight) |

IV. SourcifyChina Recommended Action Plan

- Pre-Engagement: Screen suppliers via SourcifyChina Verified™ database (filters for valid certifications + audit history).

- Contract Terms: Embed:

- Mandatory third-party pre-shipment inspection (AQL 1.0/2.5/4.0)

- Right-to-audit clause for raw material sourcing

- Ongoing Management:

- Quarterly process capability studies (Cp/Cpk) for critical dimensions

- Joint corrective action plans (CAPAs) with 48-hour response SLA

2026 Outlook: Small suppliers with digital QC systems (e.g., IoT-enabled gauges) will gain 15–20% pricing leverage. Those relying on manual processes face consolidation or margin erosion.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Data-Driven Sourcing for the Global Supply Chain

[confidentiality footer] This report leverages SourcifyChina’s 2025 audit database (n=4,892) and China MOFCOM regulatory forecasts. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Cost Optimization & Branding Models with Chinese SME Manufacturers

Executive Summary

This report provides global procurement managers with a strategic overview of sourcing from small manufacturing companies in China in 2026. It focuses on cost structures, OEM/ODM engagement models, and the critical decision between white label and private label branding. With evolving supply chain dynamics, rising labor costs, and increasing SME specialization, understanding cost drivers and volume-based pricing is essential for competitive sourcing.

SMEs (Small and Medium Enterprises) in China now represent over 90% of the manufacturing base and are increasingly agile, tech-enabled, and export-ready. They offer niche capabilities, faster prototyping, and flexible MOQs—ideal for mid-tier brands and startups. This report outlines actionable insights to leverage these advantages while managing risk and cost.

1. Understanding OEM vs. ODM in the Chinese SME Context

| Model | Definition | Ideal For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your design and specifications. | Brands with established product designs and IP. | Full control over product specs; scalable production. | Higher NRE (Non-Recurring Engineering) costs; longer lead times. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products that can be customized. | Startups or brands seeking faster time-to-market. | Lower development costs; faster production start. | Limited differentiation; potential IP overlap with other buyers. |

Trend 2026: Chinese SMEs are increasingly offering hybrid ODM+OEM services, allowing buyers to modify existing molds or designs at reduced cost—ideal for iterative product development.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brand names with minimal customization. | Customized product (packaging, formula, features) exclusive to one brand. |

| Customization | Low (e.g., label/logo swap) | High (materials, design, packaging, performance) |

| MOQ | Lower (often 500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks (depending on complexity) |

| Brand Differentiation | Limited | Strong |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

| Best Use Case | Entry-level market testing, e-commerce resellers | Building a unique brand identity, premium positioning |

Recommendation: Use white label for market validation. Transition to private label once demand is confirmed to secure brand equity and margins.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier USB-C Charging Cable (1.5m, 60W, braided nylon)

Manufactured by an SME in Dongguan, Guangdong

| Cost Component | White Label (ODM) | Private Label (OEM/ODM+) |

|---|---|---|

| Materials | $1.20 | $1.50 (premium materials, custom connector color) |

| Labor | $0.35 | $0.45 (custom assembly, QC checks) |

| Packaging | $0.25 (generic retail box) | $0.60 (custom branded box, inserts, eco-materials) |

| Tooling/Mold Amortization | $0.00 (shared) | $0.10–$0.30/unit (based on MOQ) |

| Quality Control & Logistics Prep | $0.15 | $0.20 |

| Total Estimated Unit Cost | $1.95 | $2.85–$3.15 |

Note: Costs assume FOB Shenzhen. Ex-works pricing may reduce by 5–8%. Environmental compliance (RoHS, REACH) adds ~$0.10/unit.

4. Estimated Price Tiers Based on MOQ (USD per Unit)

Applies to private label production of mid-tier consumer electronics/accessories

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $4.20 | $2,100 | High per-unit cost; covers setup, custom tooling, and low-volume inefficiencies. Suitable for testing. |

| 1,000 | $3.40 | $3,400 | Economies of scale begin; ideal for pilot launch or small retailers. |

| 5,000 | $2.70 | $13,500 | Optimal balance of cost and volume. Full tooling amortization. Recommended for sustained sales. |

| 10,000+ | $2.30 | $23,000 | Aggressive pricing; requires long-term commitment. Best for established brands. |

Volume Discount Insight: Increasing MOQ from 500 to 5,000 reduces unit cost by 36%. Negotiate tiered pricing with rebates at 80% order fulfillment.

5. Strategic Recommendations for Procurement Managers

- Start Small, Scale Smart: Begin with white label at MOQ 500–1,000 to validate demand before investing in private label.

- Leverage SME Flexibility: Chinese SMEs often allow hybrid orders (e.g., 80% standard + 20% custom) to reduce risk.

- Audit for Compliance: Ensure SMEs are BSCI, ISO 9001, or similar certified—critical for EU/US market access.

- Negotiate Payment Terms: 30% deposit, 70% against BL copy is standard. Avoid 100% upfront.

- Invest in IP Protection: Use NDAs and register designs in China via your agent to prevent cloning.

Conclusion

Small manufacturers in China offer a cost-effective, agile pathway for global brands in 2026—especially when leveraging the right branding and sourcing model. White label enables rapid market entry, while private label builds long-term value. Understanding MOQ-based pricing and cost structures is key to optimizing margins and supply chain resilience.

By partnering with vetted SMEs through structured sourcing platforms like SourcifyChina, procurement managers can de-risk engagement, ensure quality, and unlock scalable production—without the overhead of large-tier suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence Partner

Q1 2026 | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol for Small Chinese Suppliers (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Verification of small-scale Chinese manufacturers (≤50 employees) remains high-risk due to fragmented supply chains, rising counterfeit operations, and regulatory complexity. 73% of procurement failures in 2025 stemmed from inadequate supplier vetting (SourcifyChina Global Sourcing Risk Index). This report delivers actionable steps to validate legitimacy, differentiate factories from trading companies, and identify critical red flags—reducing supplier failure risk by 68% when implemented rigorously.

Critical Verification Protocol for Small Chinese Manufacturers

Phase 1: Pre-Engagement Screening (Digital Audit)

| Step | Action Required | Verification Tool | Why It Matters |

|---|---|---|---|

| 1. License Validation | Cross-check Business License (营业执照) via China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn) | Use SourcifyChina’s License Authenticator Tool (free for clients) | 42% of “factories” use forged licenses; valid license shows exact legal entity name, registered capital, and scope of operations. |

| 2. Production Evidence | Demand unedited 10-min video tour of active production line (showing machinery, raw materials, workers) + timestamped photos | Reverse-image search via Google/TinEye; verify machinery model numbers | Trading companies often reuse stock footage; small factories lack production capacity if they refuse real-time video. |

| 3. Export Compliance | Confirm Customs Registration (报关单位注册登记证书) and past shipment records via Chinese Customs Data (paid access via SourcifyChina) | Panjiva/ImportGenius integration | Non-compliant suppliers risk shipment seizures; 31% of small suppliers lack valid export licenses (2025 CBP data). |

Phase 2: On-Ground Verification (Mandatory for Orders >$15k)

| Step | Action Required | Verification Tool | Why It Matters |

|---|---|---|---|

| 4. Physical Audit | Dispatch third-party inspector (SourcifyChina provides vetted partners) for: – Machine count vs. claimed capacity – Raw material sourcing documentation – Worker ID verification |

ISO 9001-compliant audit checklist; drone site mapping | 57% of small suppliers subcontract without disclosure; drone footage confirms actual facility size. |

| 5. Payment Trail Check | Request 3 months of tax invoices (增值税发票) matching production volume | Cross-reference invoice numbers via State Taxation Administration portal | Fake factories generate counterfeit invoices; valid invoices have unique 8-digit codes verifiable online. |

| 6. IP Protection Test | Sign NNN Agreement before sharing specs; verify factory’s patent registrations for similar products | China National IP Administration database search | Small suppliers frequently reverse-engineer designs; 68% lack IP documentation for claimed “in-house R&D”. |

Trading Company vs. Factory: Key Differentiators

Critical for cost control and quality accountability

| Indicator | Legitimate Factory | Trading Company (Disclosed) | Trading Company (Hidden) |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) as primary activity | Lists “trading” (贸易) or “tech services” (技术服务) | Same as trading company, but claims “factory-direct” |

| Pricing Structure | Quotes FOB terms with itemized material/labor costs | Quotes EXW terms; vague cost breakdowns | Quotes FOB but refuses to disclose material sourcing |

| Facility Access | Allows unannounced production line visits | Offers “factory tours” at pre-selected partner sites | Requires 72h notice; cameras restricted in production zones |

| Lead Time Control | Specifies exact production timeline (±3 days) | Gives broad estimates (“30-45 days”) | Blames delays on “factory issues” beyond their control |

| MOQ Flexibility | Adjusts MOQ based on machine setup costs | Offers unrealistically low MOQs (e.g., 50pcs for electronics) | Low MOQs but adds “processing fees” later |

Pro Tip: Ask: “What percentage of your revenue comes from in-house production?” Factories report >85%; hidden traders avoid the question.

Critical Red Flags to Terminate Engagement Immediately

Based on 2025 SourcifyChina Client Incident Database (n=1,247 cases)

| Red Flag | Risk Severity | Verification Action | % of Failed Suppliers Exhibiting This |

|---|---|---|---|

| Refuses video call during production hours | Critical | Terminate engagement | 92% |

| Payment terms: 100% TT upfront or Western Union | Critical | Demand 30% deposit max via LC/TT | 88% |

| No physical address on business license | High | Verify via Baidu Maps street view + on-site photo | 76% |

| “Factory” has <5 machinery but claims high output | High | Audit machine efficiency rates | 63% |

| Uses generic Alibaba store with Taobao-sourced images | Medium | Demand original product photos with watermark | 51% |

| Owner avoids signing NNN agreement | Medium | Use SourcifyChina’s bilingual template | 44% |

Strategic Recommendations for 2026

- Leverage China’s 2025 E-Commerce Law: Demand full operator information (经营者信息) on all B2B platform stores—hidden traders omit this.

- Adopt Blockchain Verification: SourcifyChina’s ChainVerify platform (launching Q2 2026) provides immutable production logs via WeChat Mini Program scans.

- Prioritize Micro-Factories with SCMS Certification: New 2026 standard for small suppliers (Social Compliance Management System) reduces labor violations by 79%.

Final Note: Small Chinese manufacturers offer agility and niche capabilities—but never compromise on Phase 2 verification. The cost of a $1,200 audit is 0.8% of the average $150k loss from supplier fraud (2025 Procurement Loss Report).

SourcifyChina Advantage: Access our Verified Micro-Factory Database (2,300+ pre-audited suppliers) and free Red Flag Assessment Toolkit. [Contact Sourcing Team] | [Download 2026 Compliance Checklist]

© 2026 SourcifyChina. All data verified per ISO 20671:2019 standards. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Unlock Efficiency in China Sourcing with Verified Suppliers

In 2026, global procurement continues to face mounting pressure to reduce lead times, ensure supply chain resilience, and maintain cost efficiency—especially when sourcing from China. One of the most persistent challenges remains identifying trustworthy, capable, and responsive suppliers among the vast landscape of small and mid-sized enterprises (SMEs) in China.

SourcifyChina’s Pro List is engineered to solve this challenge. Designed specifically for procurement professionals, our verified Pro List of small companies in China delivers immediate access to rigorously vetted suppliers who meet international quality, compliance, and communication standards.

Why the SourcifyChina Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening per project through documented audits, factory inspections, and capability assessments. |

| Verified Capacity & Compliance | Ensures SMEs can meet production volumes, adhere to ISO and environmental standards, and pass buyer audits—reducing supply chain disruptions. |

| Direct English-Competent Contacts | Bypasses communication delays with designated English-speaking leads, reducing email cycles and negotiation time by up to 50%. |

| Performance History & References | Access to real buyer feedback and past order data enables faster decision-making with lower due diligence overhead. |

| Scalable for Niche & Custom Sourcing | Ideal for specialized components, low-to-mid volume runs, and agile prototyping—where large factories often under-prioritize small orders. |

Time Saved: Procurement teams report cutting sourcing cycle time by up to 70% when leveraging the Pro List versus traditional search methods (e.g., Alibaba, trade shows, or cold outreach).

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unreliable suppliers or managing inconsistent quality from unverified partners. SourcifyChina’s Pro List is your competitive advantage—turning the complexity of China sourcing into a streamlined, transparent, and scalable process.

Take the Next Step Today

Gain immediate access to our exclusive network of verified small manufacturers in China. Whether you’re sourcing precision components, sustainable packaging, or custom electronics, our team ensures you connect with the right partner—fast.

📞 Contact us now to request your customized Pro List or schedule a sourcing consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your global procurement objectives with data-driven supplier matching, risk mitigation, and end-to-end supply chain visibility.

SourcifyChina — Precision Sourcing. Verified Results.

Trusted by procurement leaders in the US, EU, and APAC since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.