The global sliding partition doors market is experiencing robust growth, driven by rising demand for space-optimizing architectural solutions in both residential and commercial spaces. According to Grand View Research, the global interior doors market was valued at USD 45.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, with sliding and movable partitions gaining traction due to their flexibility and design efficiency—particularly in high-density urban environments. Similarly, Mordor Intelligence projects the sliding doors market to grow at a CAGR of over 6% during the forecast period of 2023–2028, citing increased construction activities and modernization of infrastructure as key drivers. As demand for sleek, functional, and customizable partitions rises, manufacturers are innovating in materials, acoustics, and automation to meet evolving architectural standards. In this competitive landscape, the following nine manufacturers have emerged as leaders, combining technological advancement, global reach, and product diversity to shape the future of sliding partition systems.

Top 9 Sliding Partition Doors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hawa Sliding Solutions

Domain Est. 1999

Website: hawa.com

Key Highlights: Hawa Sliding Solutions is the global technology and market leader of sliding hardware for doors, furniture, partition walls and facades. Innovative sliding ……

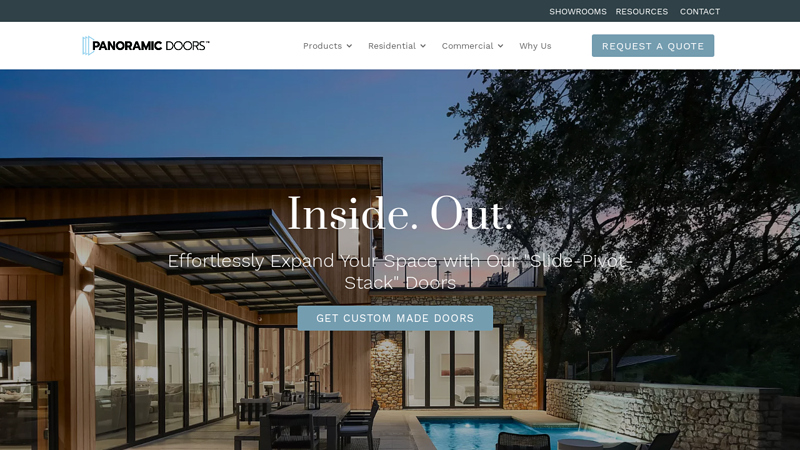

#2 Panoramic Doors

Domain Est. 2009

Website: panoramicdoors.com

Key Highlights: Discover the world of Panoramic Doors. See the most innovative sliding glass doors. We make your renovation or build easier and more affordable….

#3

Domain Est. 1996

Website: jeld-wen.com

Key Highlights: High quality, innovative bifold, accordion, multi slide, swing and sliding doors and windows. EXPLORE…

#4 Sliding Door Systems

Domain Est. 1996

Website: special-lite.com

Key Highlights: Our door slider systems are made with durable and sustainable aluminum and are available in several finishes. Choose from aluminum framed glass doors, sliding ……

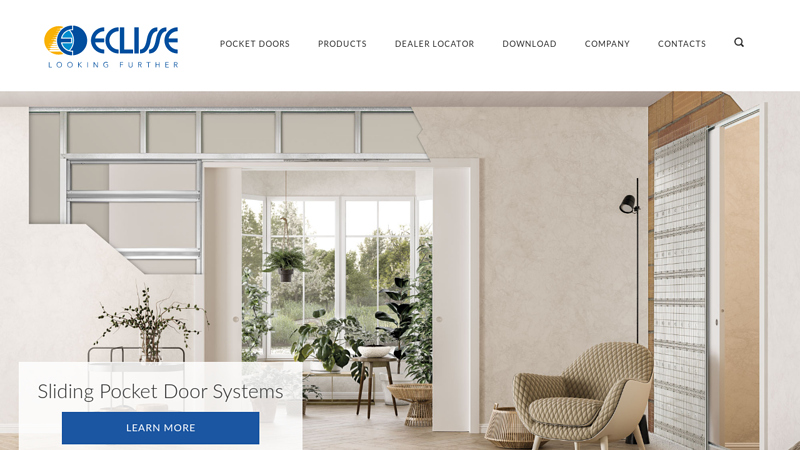

#5 Sliding Pocket Door Systems

Domain Est. 2001 | Founded: 1989

Website: eclisse.com

Key Highlights: Since 1989, ECLISSE has been designing and manufacturing sliding pocket door systems, flush hinged doors, wall panels, trapdoors and accessories….

#6 DIRTT Construction Systems

Domain Est. 2003

Website: dirtt.com

Key Highlights: Speed up construction by up to 30% with DIRTT’s modular construction systems. Get accurate, real-time pricing and adaptable solutions for any project….

#7 Homepage

Domain Est. 2004

Website: spaceplus.com

Key Highlights: We provide state-of-the-art glass office dividers, pop-up kiosks, swing doors, partition walls, bi-fold doors, suspended doors, wall slide doors, storage ……

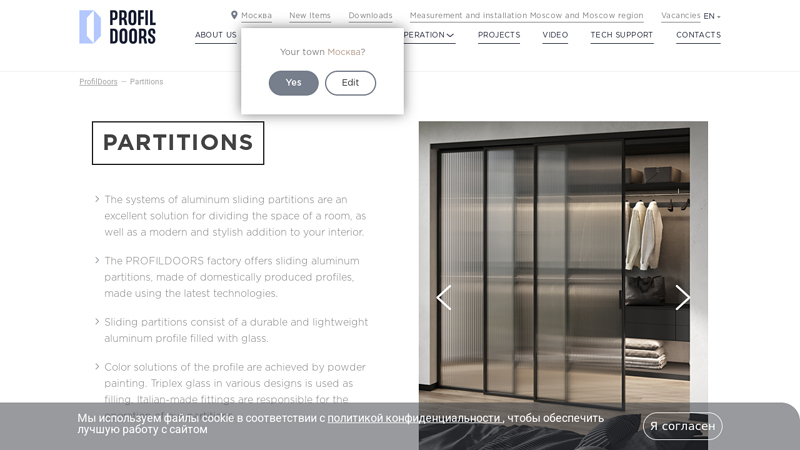

#8 Sliding partitions

Domain Est. 2013

Website: profildoors.com

Key Highlights: The production of sliding partitions is based on a system of exclusive aluminum profiles made in Russia….

#9 Sliding doors hardware

Website: klein.pro

Key Highlights: KLEIN’s sliding doors hardware are the ideal solution for interior space partitioning or dividing projects, whether in homes, hotels or offices….

Expert Sourcing Insights for Sliding Partition Doors

2026 Market Trends for Sliding Partition Doors

The global sliding partition door market is poised for significant evolution by 2026, driven by shifting consumer preferences, technological advancements, and broader economic and societal trends. Key developments expected to shape the market include:

1. Heightened Demand for Flexible and Multi-Functional Spaces

Continuing the momentum from remote work and hybrid living models, consumers and businesses will increasingly prioritize adaptable interiors. Sliding partition doors offer a seamless way to transform open layouts into private offices, guest rooms, or quiet zones, supporting the need for space optimization in smaller urban dwellings and dynamic commercial environments such as co-working spaces and multi-functional retail.

2. Integration of Smart Technology

Smart home adoption will drive demand for intelligent sliding partitions. By 2026, expect widespread integration of features such as voice control (via Alexa, Google Assistant, or Siri), app-based operation, automated opening/closing schedules, and integration with home security systems. Sensors for occupancy, ambient light, and sound will enhance convenience and energy efficiency, positioning high-tech partitions as premium, value-added solutions.

3. Emphasis on Sustainable and Eco-Friendly Materials

Environmental consciousness will influence material selection across the supply chain. Manufacturers will increasingly utilize recycled aluminum, FSC-certified wood, low-VOC finishes, and recyclable composites. Energy-efficient glazing options—such as double or triple-pane glass with low-emissivity coatings—will gain traction, contributing to improved insulation and reduced carbon footprints in both residential and commercial buildings.

4. Growth in Commercial and Institutional Applications

Beyond residential use, the commercial sector—including hotels, hospitals, educational institutions, and office complexes—will drive demand for high-performance acoustic partitions. Products offering superior sound insulation (STC 50+) will be critical in environments where privacy and noise control are essential. Modular and reconfigurable systems will appeal to facilities seeking cost-effective ways to adapt spaces without structural renovations.

5. Aesthetic Customization and Minimalist Design

Consumers will favor sleek, frameless, and slim-profile designs that align with minimalist and modern interior aesthetics. Customization options—such as choice of finishes, colors, glass types (frosted, tinted, smart glass), and hardware—will become standard offerings. Invisible or pocket sliding systems that disappear into walls will gain popularity for their clean, unobtrusive appearance.

6. Regional Market Expansion and Emerging Economies

While North America and Europe remain key markets due to high renovation activity and smart home penetration, Asia-Pacific—particularly China, India, and Southeast Asia—will witness accelerated growth. Urbanization, rising disposable income, and modernization of infrastructure will fuel demand for space-saving solutions in densely populated cities.

7. Supply Chain Resilience and Localized Manufacturing

Ongoing global supply chain disruptions will push manufacturers toward regional production and localized sourcing of materials. This shift will reduce lead times, lower transportation costs, and improve responsiveness to market demands, ultimately enhancing competitiveness in the 2026 landscape.

In summary, the 2026 sliding partition door market will be defined by innovation, sustainability, and adaptability—catering to a world where space, technology, and environmental responsibility converge.

Common Pitfalls When Sourcing Sliding Partition Doors (Quality, IP)

Sourcing sliding partition doors—especially those designed for commercial or industrial environments where Ingress Protection (IP) ratings matter—can present several challenges. Overlooking key factors can result in poor performance, safety hazards, or costly replacements. Below are common pitfalls to avoid:

Inadequate Attention to Build Quality

One of the most frequent issues is selecting doors based solely on price without assessing material quality. Low-cost options may use thin aluminum frames, substandard rollers, or weak seals, leading to premature wear, misalignment, or difficulty in operation. Always verify the thickness of materials, type of hardware, and overall construction before procurement.

Misunderstanding IP Ratings

Ingress Protection (IP) ratings indicate how well a door resists dust and water. A common mistake is assuming all sliding partitions are IP-rated or choosing a rating that doesn’t match the environment. For example, using an IP54-rated door in a high-moisture washdown area requiring IP65 can result in water ingress and equipment damage. Ensure the specified IP rating aligns with the operational environment.

Poor Sealing and Gasket Design

Even with a high IP rating, ineffective seals can compromise performance. Poorly designed or low-quality gaskets may degrade quickly or fail to form a tight seal when closed. Inspect the door’s sealing mechanism and confirm that continuous, compression-type seals are used along all edges, especially at meeting stiles and floor interfaces.

Overlooking Testing and Certification

Many suppliers claim IP compliance without third-party verification. A major pitfall is trusting self-declared ratings. Always request certified test reports from accredited laboratories to confirm that the entire door assembly—not just individual components—meets the stated IP standard under real-world conditions.

Incompatibility with Environmental Conditions

Sliding partition doors used in extreme temperatures, high humidity, or corrosive environments (e.g., food processing, pharmaceuticals) require specific materials and finishes. Using standard components in such settings can lead to corrosion, warping, or seal failure. Confirm material compatibility (e.g., stainless steel, anodized aluminum) with the intended environment.

Neglecting Operational Reliability

Smooth, long-term operation depends on high-quality rollers, tracks, and alignment systems. Cheap or undersized hardware increases friction, leading to jamming or excessive maintenance. Verify the load rating of the hardware and ensure the system is designed for frequent use, especially in high-traffic areas.

Insufficient Acoustic or Thermal Performance

While focusing on IP and structural quality, buyers may overlook insulation properties. In environments requiring temperature control or noise reduction (e.g., cleanrooms, server rooms), poor thermal or acoustic performance can undermine the door’s purpose. Confirm U-values and sound transmission class (STC) ratings if needed.

Lack of Customization and Integration Support

Standard-sized doors may not fit unique openings or integrate with existing building management or safety systems. Assuming off-the-shelf solutions will suffice can lead to installation delays or functional gaps. Work with suppliers who offer engineering support and customization for seamless integration.

Underestimating Installation Complexity

Even high-quality doors can underperform if improperly installed. Poor alignment, inadequate support, or incorrect seal compression can void warranties and compromise IP ratings. Ensure installers are trained and follow manufacturer guidelines—preferably using certified partners.

Ignoring Long-Term Maintenance and Spare Parts

Some suppliers disappear or discontinue models, leaving buyers without access to replacement rollers, seals, or gaskets. Before purchasing, verify the supplier’s track record, product lifecycle, and availability of spare parts to support long-term maintenance needs.

Avoiding these pitfalls requires due diligence, clear specifications, and collaboration with reputable manufacturers who provide full documentation and testing. Prioritizing quality and verified IP performance ensures reliable, safe, and durable sliding partition doors.

Logistics & Compliance Guide for Sliding Partition Doors

Product Classification & HS Code

Sliding partition doors are typically classified under Harmonized System (HS) codes related to building materials and architectural components. The most common HS code is 7308.30 for doors, windows, and their frames and thresholds, of iron or steel. For wooden partition doors, 4418.20 may apply. Accurate classification is essential for customs clearance, duty calculation, and import/export compliance. Always verify the correct HS code based on material composition and country-specific tariff schedules.

Packaging & Handling Requirements

Proper packaging is crucial to prevent damage during transit. Sliding partition doors should be crated or palletized with protective corner guards, foam wrapping, and waterproof covering. Panels must be stored vertically to avoid warping, and hardware components (tracks, rollers, handles) should be packed separately in labeled, moisture-resistant containers. Use non-slip pallets and secure load-securing methods (strapping, stretch wrap) to prevent shifting during transport.

Shipping & Transportation

Transport sliding partition doors via flatbed trucks or enclosed freight carriers with climate control when necessary. Avoid exposure to extreme temperatures or humidity, which can affect wood, glass, or finish integrity. For international shipments, comply with International Maritime Dangerous Goods (IMDG) Code if applicable, and ensure proper containerization for sea freight. Air freight is suitable for urgent, high-value components but requires strict adherence to weight and dimensional limits.

Import/Export Documentation

Ensure all shipments include a commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. For regulated markets, additional documents may include a conformity assessment, test reports (e.g., fire resistance), and a declaration of performance (DoP) under EU Construction Products Regulation (CPR). Export declarations must align with the exporting country’s requirements, such as the Automated Export System (AES) filing in the U.S.

Regulatory Compliance (Regional)

Compliance varies by region. In the European Union, sliding partition doors must meet CE marking requirements under Regulation (EU) No 305/2011 (CPR), demonstrating performance in fire resistance, acoustic insulation, and structural stability. In the United States, products should comply with IBC (International Building Code) and ADA (Americans with Disabilities Act) standards for accessibility, including clear opening width and operable force. In Canada, adherence to NBC (National Building Code) and CSA standards is required.

Safety & Testing Standards

Manufacturers must provide test reports from accredited laboratories verifying compliance with relevant standards. Key tests include:

– Fire Resistance: ASTM E119 or EN 1364-1

– Acoustic Performance: ASTM E90 or EN ISO 10140

– Cycling Durability: ASTM E330 or EN 1192 (minimum 50,000 cycles for rollers)

– Load Capacity: Track deflection and roller load testing per manufacturer specifications

Labeling & Traceability

Each unit or batch must be clearly labeled with product identification, model number, manufacturing date, and compliance markings (e.g., CE, UL, or Intertek). Include installation instructions and maintenance guidelines in the local language of the destination market. Maintain traceability through batch or serial number tracking for recall management and quality assurance.

Installation & Site Compliance

Coordinate logistics with on-site schedules to avoid storage delays. Deliver only after rough construction is complete and environmental conditions (humidity, temperature) are stabilized. Confirm that building infrastructure (headers, flooring, electrical for motorized systems) aligns with door specifications prior to installation. Certified installers should follow manufacturer guidelines and local building authority requirements.

Environmental & Sustainability Considerations

Comply with environmental regulations such as REACH (EU) for chemical substances and TSCA Title VI (U.S.) for formaldehyde emissions in composite wood components. Use recyclable packaging and document sustainable sourcing (e.g., FSC-certified wood) where applicable. Provide Environmental Product Declarations (EPDs) to support green building certifications like LEED or BREEAM.

After-Sales & Warranty Logistics

Establish a spare parts logistics network for rollers, seals, and tracks to support maintenance. Warranty claims must be processed in accordance with local consumer protection laws. Maintain compliance records for a minimum of 10 years post-installation for audit and liability purposes.

In conclusion, sourcing sliding partition doors requires a careful evaluation of several key factors including quality, design, materials, functionality, and supplier reliability. It is essential to balance cost-effectiveness with durability and aesthetic appeal to meet the specific needs of the intended space—whether commercial, residential, or hospitality. Conducting thorough market research, comparing multiple suppliers, and reviewing certifications and customer feedback can greatly enhance sourcing decisions. Additionally, considering customization options, installation support, and after-sales service ensures long-term satisfaction and performance. By prioritizing these aspects, businesses and individuals can successfully source sliding partition doors that offer both practical space optimization and visual elegance.