The global slatwall panel market has experienced consistent growth, driven by rising demand for modular and space-efficient retail and storage solutions across commercial and residential sectors. According to a 2023 report by Grand View Research, the global wall panel market—encompassing slatboard systems—was valued at USD 17.8 billion and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This expansion is fueled by increasing urbanization, the proliferation of compact living spaces, and the retail industry’s shift toward customizable display systems. Additionally, Mordor Intelligence forecasts steady growth in the retail fixtures market, citing rising investments in store modernization and omnichannel retail strategies as key accelerants for slatboard adoption. With these market dynamics in play, the competition among manufacturers has intensified, pushing innovation in materials, design flexibility, and sustainability. In this evolving landscape, identifying the top slatboard panel manufacturers becomes critical for retailers, contractors, and facility managers seeking high-performance, durable, and aesthetically versatile solutions.

Top 10 Slatboard Panels Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Slatwall Systems

Domain Est. 2000

Website: slatwallsystems.com

Key Highlights: We are a full service manufacturer committed to providing top quality Slatwall for a variety of applications. We start with quality MDF (medium density ……

#2 MegaWall

Domain Est. 2001

Website: megawall.com

Key Highlights: As a premier manufacturer of high-quality slatwall display systems, Megawall delivers innovative products that not only help you keep track of inventory….

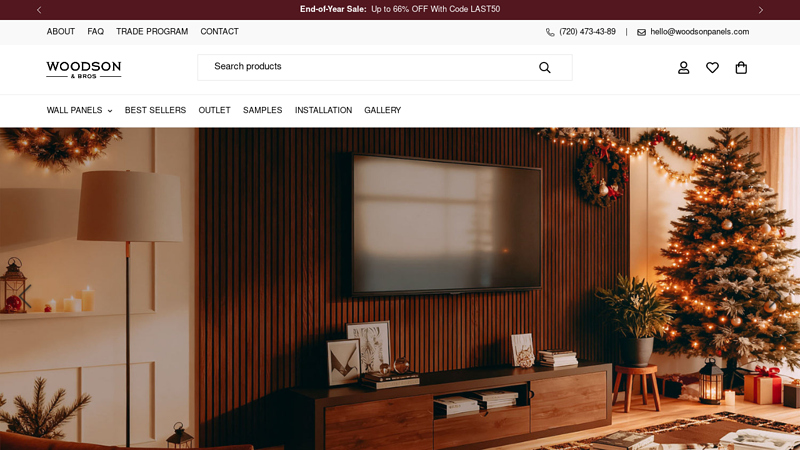

#3 Wooden Slat Wall, Wood Veneer & Acoustic Panels

Domain Est. 2023

Website: woodsonpanels.com

Key Highlights: Free delivery over $450 30-day returnsThe Ash Acoustic Slat Panels … This company offers high-quality acoustic wood panels that create peaceful, focused environments while enhanc…

#4 Storewall

Domain Est. 1998

#5 Slatwall Panels Made to Specification

Domain Est. 2000

Website: pacificpanel.com

Key Highlights: Pacific Panel is the industry leader in slatwall panels. Click in to learn more about our custom displays and design options….

#6 Wind Mill Slatwall Products

Domain Est. 2004

Website: windmillslatwall.com

Key Highlights: Wind Mill Slatwall Products manufactures custom slatwall, retail display panels, fixtures and a vast array of wood component parts….

#7 Portable Lightweight Modular Slatwall displays Snap Panel

Domain Est. 2011

Website: snappaneldisplays.com

Key Highlights: Lightweight – each slatwall panel is less than 5.5lbs. · Panels are made of strong, high-impact plastics. · Modular panels allow for endless design possibilities….

#8 Retail Slatwall Panels

Domain Est. 2014

Website: kmldesignerfinishes.com

Key Highlights: We offer slatwall panels in over 800 décor colors and 8 unique textures that will elevate the look and feel of any retail space….

#9 Slatwall Accessories

Domain Est. 2018

Website: slatwallaccessories.com

Key Highlights: SlatWall Accessories is an online portal to provide you products from your local dealer using the ease and simplicity of online ordering….

#10 slatsolution.com

Domain Est. 2023

Website: slatsolution.com

Key Highlights: SlatSolution’s premium line of acoustic slat wall panels combine the elegance of wood and functionality. Constructed from unrivalled noise canceling materials: ……

Expert Sourcing Insights for Slatboard Panels

2026 Market Trends for Slatboard Panels

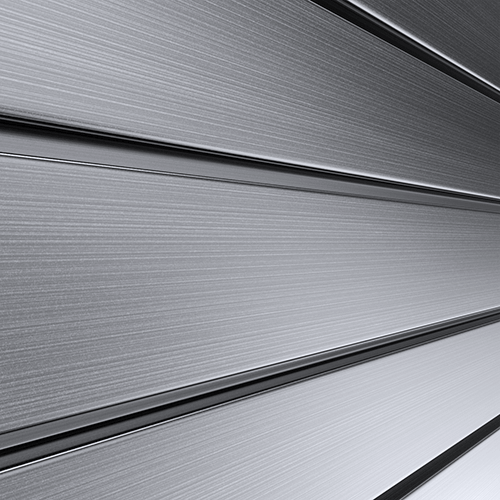

The global market for Slatboard Panels is projected to experience significant transformation by 2026, driven by shifts in construction practices, rising demand for sustainable materials, and advancements in modular design. Slatboard Panels—engineered wood products composed of oriented strand board (OSB) or medium-density fiberboard (MDF) with vertical grooves for aesthetic and functional purposes—are increasingly being adopted across residential, commercial, and retail interiors. This analysis explores key trends expected to shape the Slatboard Panel market through 2026.

Growing Demand in Interior Design and Retail Fit-Outs

One of the most prominent drivers of Slatboard Panel adoption is the rising emphasis on modern, minimalist interior aesthetics. Architects and designers are increasingly specifying slatboard solutions for feature walls, ceiling treatments, and display fixtures due to their clean lines and acoustic properties. In retail environments, slatboards offer both visual appeal and practical utility by integrating product displays directly into wall systems. By 2026, the retail and hospitality sectors are expected to account for over 40% of global slatboard demand, particularly in urban centers across North America, Europe, and parts of Asia-Pacific.

Sustainability and Eco-Friendly Material Preferences

Environmental concerns are reshaping material selection in construction and design. Slatboard manufacturers are responding by introducing panels made from recycled wood fibers, low-emission adhesives, and FSC-certified wood sources. By 2026, regulatory pressures and green building certifications (such as LEED and BREEAM) are expected to make sustainability a decisive factor in procurement decisions. Companies offering carbon-neutral or biodegradable slatboard options are likely to gain a competitive edge in environmentally conscious markets.

Technological Innovations and Customization

Digital manufacturing technologies, including CNC routing and 3D printing, are enabling unprecedented levels of customization in slatboard designs. Consumers and businesses alike are demanding personalized patterns, finishes, and integrated lighting solutions. By 2026, the integration of smart materials—such as panels with embedded sensors or acoustic dampening properties—is expected to create new niches within the market. Additionally, augmented reality (AR) tools are enhancing the design and visualization process, allowing clients to preview slatboard installations before purchase.

Expansion in E-Commerce and DIY Markets

The rise of online home improvement platforms and the do-it-yourself (DIY) movement are expanding access to slatboard products. Pre-finished, easy-to-install slatboard kits are gaining popularity among homeowners seeking affordable upgrades. By 2026, e-commerce is projected to account for nearly 30% of slatboard sales, particularly in regions with high internet penetration and strong DIY cultures such as the United States, Germany, and South Korea. Manufacturers are investing in direct-to-consumer models and influencer marketing to capture this growing segment.

Regional Market Dynamics

Regionally, North America remains the largest market for slatboard panels, driven by robust construction activity and design innovation. However, Asia-Pacific is expected to register the highest compound annual growth rate (CAGR) through 2026, fueled by urbanization, rising disposable incomes, and the expansion of commercial real estate in countries like India and Vietnam. Meanwhile, Europe’s market growth will be tempered by regulatory standards but supported by demand for energy-efficient and modular building solutions.

Challenges and Competitive Landscape

Despite favorable trends, the slatboard panel market faces challenges, including price volatility in raw materials (such as wood and resins) and competition from alternative wall systems like metal panels and 3D wall tiles. To maintain market share, leading players are focusing on vertical integration, R&D investment, and strategic partnerships with design firms and contractors.

In conclusion, the 2026 outlook for Slatboard Panels is positive, with growth anchored in design versatility, sustainability, and technological integration. Companies that adapt to evolving consumer preferences and leverage digital distribution channels will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Slatwall Panels (Quality & Intellectual Property)

Sourcing slatwall panels—especially from overseas suppliers—can present significant challenges related to both product quality and intellectual property (IP) protection. Being aware of these common pitfalls can help buyers make informed decisions and avoid costly mistakes.

Quality Inconsistencies and Substandard Materials

One of the most frequent issues when sourcing slatwall panels is inconsistent product quality. Suppliers may use lower-grade materials such as particleboard instead of MDF or moisture-resistant MDF, leading to warping, chipping, or poor durability. Surface finishes may peel or scratch easily, and slot precision can vary, affecting the fit of display accessories. Buyers often receive samples that look promising but differ significantly from bulk production units. This inconsistency undermines retail functionality and brand reputation.

Lack of Standardization and Dimensional Accuracy

Slatwall panels must meet precise dimensional standards to ensure compatibility with standard slatwall accessories (hooks, bins, shelves). Poor manufacturing tolerances—such as uneven slot spacing, incorrect slot width, or inconsistent panel thickness—can render panels unusable with common retail fixtures. Without clear specifications and third-party quality inspections, buyers risk receiving non-interchangeable or defective products.

Insufficient Moisture and Impact Resistance

In environments like retail stores, garages, or workshops, slatwall panels are exposed to humidity, temperature changes, and physical impact. Many low-cost panels lack proper sealing or use subpar laminates, resulting in swelling, delamination, or surface damage. Buyers may not discover these flaws until after installation, leading to costly replacements and operational downtime.

Intellectual Property (IP) Infringement Risks

Sourcing slatwall panels, particularly from regions with lax IP enforcement, exposes buyers to legal and reputational risks. Many generic panels mimic the design, slot patterns, or branding of patented or trademarked products (e.g., systems like Wallboard®, Perforated Panel Systems, or branded modular displays). Unknowingly importing or selling such products can lead to customs seizures, legal disputes, or cease-and-desist orders from IP holders.

Inadequate Supplier Verification and Due Diligence

Relying solely on online marketplaces or unverified suppliers increases the risk of fraud or misrepresentation. Some suppliers may lack manufacturing capabilities and act as intermediaries, further distancing buyers from the actual production process. Without on-site audits, material certifications, or compliance documentation (e.g., CARB, FSC, or fire safety ratings), buyers have little recourse if products fail to meet expectations.

Hidden Costs from Rejection, Returns, or Remanufacturing

Poor quality or IP-infringing products often result in shipment rejections, returns, or the need for rework. These issues lead to hidden costs such as warehousing fees, disposal, air freight for replacements, and lost sales due to delayed installations. The total landed cost can far exceed initial quotes, especially when factoring in logistics and compliance penalties.

Failure to Secure IP Ownership or Licensing

Buyers developing custom slatwall designs must ensure they retain full intellectual property rights or obtain proper licensing. Some suppliers may claim ownership of tooling, molds, or design files, restricting the buyer’s ability to switch manufacturers or scale production. Clear contractual agreements are essential to protect innovation and ensure long-term supply chain flexibility.

By addressing these pitfalls early—through rigorous supplier vetting, third-party inspections, IP clearance, and clear contractual terms—businesses can source slatwall panels that are both high-quality and legally compliant.

Logistics & Compliance Guide for Slatboard Panels

Product Overview

Slatboard panels are modular wall systems composed of interlocking slats, typically made from wood, metal, or composite materials. They are commonly used for interior design, retail displays, and acoustic applications. Proper logistics planning and regulatory compliance are essential for efficient shipping, handling, and safe installation.

Packaging & Handling Requirements

Slatboard panels are generally shipped flat or in bundled configurations. Use edge protectors and corner guards to prevent damage during transit. Panels should be stored horizontally on a flat, dry surface and kept in their original packaging until installation. Avoid exposure to moisture, direct sunlight, and extreme temperatures.

Transportation Guidelines

Use enclosed, dry trucks or containers to transport slatboard panels. Secure loads with straps or braces to prevent shifting. For international shipments, ensure compliance with International Safe Transit Association (ISTA) standards. Label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” as applicable.

Import & Export Compliance

Verify all applicable Harmonized System (HS) codes for slatboard panels, which may vary by material (e.g., wood, aluminum). Declare accurate product descriptions, values, and country of origin. For wood-based panels, ensure compliance with the Lacey Act (U.S.) or EU Timber Regulation (EUTR) to prevent illegal sourcing. Provide required documentation such as commercial invoices, packing lists, and certificates of origin.

Safety & Material Compliance

Confirm that slatboard materials meet relevant safety standards, such as fire resistance ratings (e.g., ASTM E84 for surface burning characteristics). Volatile Organic Compound (VOC) emissions should comply with regulations like CARB (California Air Resources Board) or REACH (EU). Include Safety Data Sheets (SDS) when required.

Installation & Building Code Considerations

Ensure panels meet local building codes for wall coverings, including fire safety, insulation, and structural attachment. Use appropriate fasteners and follow manufacturer guidelines for installation. In commercial or public spaces, verify compliance with accessibility standards such as the ADA (Americans with Disabilities Act), where applicable.

Sustainability & Environmental Regulations

Source slatboard panels from suppliers with documented sustainable practices. Recyclable or FSC-certified (Forest Stewardship Council) materials may be required for green building certifications like LEED. Properly dispose of packaging materials in accordance with local recycling regulations.

Documentation & Recordkeeping

Maintain detailed records of supplier certifications, test reports, shipping documents, and compliance paperwork for a minimum of five years. This supports audits and ensures traceability throughout the supply chain.

Conclusion

Effective logistics and compliance management for slatboard panels minimizes risk, ensures on-time delivery, and supports regulatory adherence. Partner with certified suppliers and logistics providers to maintain quality and compliance across all stages of distribution.

Conclusion for Sourcing Slatwall Panels:

Sourcing slatwall panels requires a strategic approach that balances quality, cost, durability, and supplier reliability. After evaluating various suppliers, materials (such as MDF, HDF, or PVC), finish options, and pricing structures, it is evident that selecting the right slatwall panels involves more than just upfront cost considerations. Factors such as resistance to wear, ease of installation, aesthetic appeal, and long-term maintenance play a crucial role in determining the best fit for retail, warehouse, or workshop environments.

Establishing partnerships with reputable manufacturers or distributors who offer consistency in product quality, customization options, and timely delivery ensures operational efficiency and customer satisfaction. Additionally, considering sustainability—such as sourcing FSC-certified wood or recyclable materials—can align procurement with environmental and corporate social responsibility goals.

In conclusion, a successful sourcing strategy for slatwall panels integrates thorough market research, clear requirements definition, and strong supplier relationships. By prioritizing durability, functionality, and total cost of ownership, organizations can effectively enhance their display and storage solutions while achieving long-term value and operational effectiveness.