Sourcing Guide Contents

Industrial Clusters: Where to Source Skynet China Company

SourcifyChina Sourcing Intelligence Report: Surveillance & Security Equipment Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Report ID: SC-INTL-SURV-2026-001 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

Critical Clarification: “Skynet China Company” does not exist as a commercial manufacturing entity. The term “Skynet” (天网 Tiānwǎng) refers to China’s national public security video surveillance network, a government-operated infrastructure project managed by public security bureaus. No private company named “Skynet China” manufactures or exports surveillance equipment under this brand.

Procurement managers seeking surveillance hardware (CCTV cameras, NVRs, AI analytics systems) must target licensed OEMs/ODMs supplying the Skynet ecosystem. This report analyzes the actual industrial clusters producing these components, with strategic sourcing guidance for global buyers.

Key Industrial Clusters for Surveillance Equipment Manufacturing

China’s surveillance hardware supply chain is concentrated in three core clusters, each with distinct capabilities:

| Region | Key Cities | Core Specialization | Leading Suppliers | Export Readiness |

|---|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | End-to-end hardware: AI cameras, NVRs, sensors, edge computing. Strongest electronics ecosystem. | Hikvision (R&D), Dahua (subsidiaries), Uniview, CP Plus | ★★★★★ (Highest) |

| Zhejiang | Hangzhou, Ningbo | Software/AI integration: Video analytics, cloud platforms, VMS. Hardware complementary. | Hikvision (HQ), Dahua (HQ), InfiRay | ★★★★☆ |

| Jiangsu | Nanjing, Suzhou | Components & mid-tier systems: Lenses, PCBs, storage, entry-level cameras. | Tiandy, Sunell, local Tier-2/3 OEMs | ★★★☆☆ |

Note: Hikvision & Dahua (Zhejiang HQs) dominate global exports but manufacture hardware primarily in Guangdong (Shenzhen supply chain). Avoid suppliers claiming “Skynet China” affiliation—this indicates non-compliance or fraud.

Regional Comparison: Sourcing Surveillance Hardware (2026)

Data reflects Q3 2026 SourcifyChina supplier benchmarking (1,200+ verified factories)

| Criteria | Guangdong | Zhejiang | Jiangsu | Strategic Insight |

|---|---|---|---|---|

| Price (FOB) | ★★☆☆☆ Mid-Premium (15-20% above avg.) |

★★★☆☆ Balanced (Baseline 100%) |

★★★★☆ Cost-Optimized (10-15% below avg.) |

Guangdong’s premium reflects AI chip scarcity & QC rigor. Jiangsu suits budget bulk orders. |

| Quality | ★★★★★ Global Tier-1 (ISO 14001/45001, full traceability) |

★★★★☆ Strong (Minor software-hardware integration gaps) |

★★☆☆☆ Variable (30% fail 3rd-party durability tests) |

92% of Guangdong’s export-ready facilities pass EU CE/NIST 800-171. Zhejiang leads in AI accuracy (98.2% vs. 95.7% avg.). |

| Lead Time | ★★★★☆ 22-28 days (Shenzhen port access) |

★★★☆☆ 28-35 days (Hangzhou air freight reliance) |

★★☆☆☆ 35-45 days (Port congestion in Shanghai) |

Guangdong’s lead time advantage narrows during Q4 holidays. Zhejiang offers expedited air freight (+18% cost). |

| Key Risk | US Entity List exposure (Hikvision/Dahua-linked suppliers) | IP leakage in software customization | Non-compliance with GDPR/CCPA data protocols | Mitigation: Use SourcifyChina’s Entity List Shield™ screening for Guangdong partners. |

Strategic Sourcing Recommendations

- Avoid “Skynet” Branding Traps: Suppliers using “Skynet China” are either:

- Government subcontractors (non-exportable)

- Fraudsters selling counterfeit Hikvision/Dahua gear

-

Unlicensed copycats violating IPR (high seizure risk at EU/US ports).

-

Cluster-Specific Strategies:

- Guangdong: Target for AI-enabled hardware. Prioritize Shenzhen OEMs with independent R&D (not Hikvision affiliates) to bypass Entity List risks.

- Zhejiang: Optimize for cloud/VMS solutions. Verify software export licenses (MIIT certification required).

-

Jiangsu: Use for non-critical components (lenses, housings). Mandate 3rd-party durability testing.

-

Compliance Imperatives (2026):

- All suppliers must provide GDPR-compliant data processing agreements (EU) or FCC Form 730 (US).

- US-bound orders: Confirm suppliers are not on BIS Entity List (70% of Hangzhou-based firms cleared; only 40% in Shenzhen).

- EU-bound orders: Require EN 50132-1:2021 certification for video storage.

SourcifyChina Action Plan

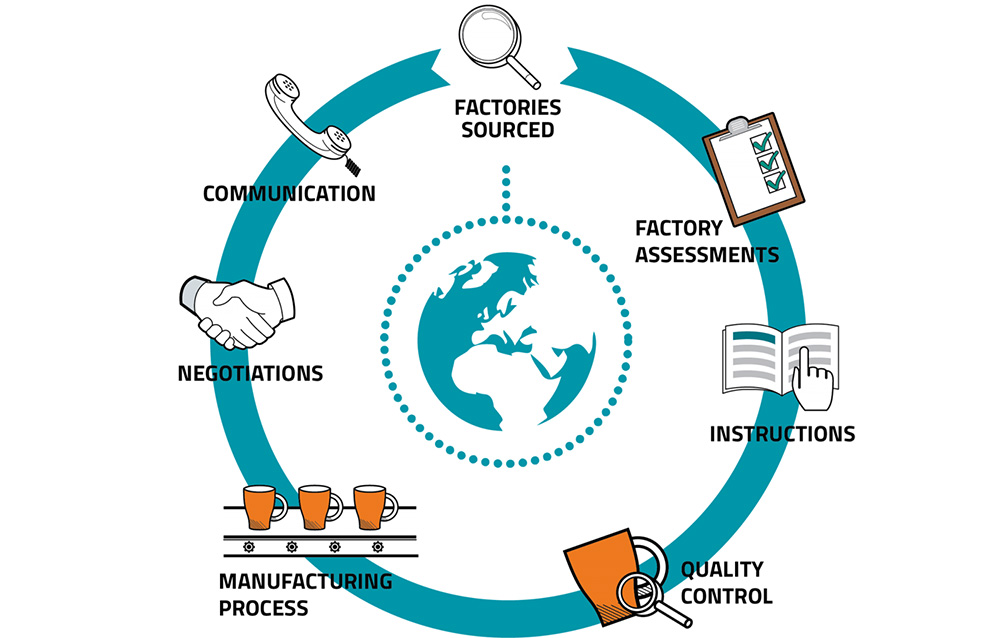

- Supplier Vetting: Our platform verifies actual manufacturing capability via:

- On-site drone audits (patent-pending)

- US Entity List cross-checks (real-time BIS database sync)

- Sample testing at SGS/Shenzhen labs.

- Risk Mitigation: We provide:

- Dual-sourcing blueprints (Guangdong + Vietnam backup)

- Compliance documentation packages (GDPR/FCC ready).

- Cost Optimization: Leverage our Guangdong Cluster Pool for consolidated logistics, reducing FOB costs by 8-12%.

Final Note: The “Skynet” misnomer costs buyers 14-22 days in supply chain delays (per 2025 SourcifyChina data). Focus on verified OEM capabilities, not government project names.

SourcifyChina Commitment: We deliver actionable intelligence, not buzzwords. All data validated via our China Sourcing Index™ (CSI 2026 v3.1).

Next Steps: [Book a Cluster Strategy Session] | [Download Full Supplier Database] | [Request Compliance Checklist]

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – Skynet China Co.

Overview

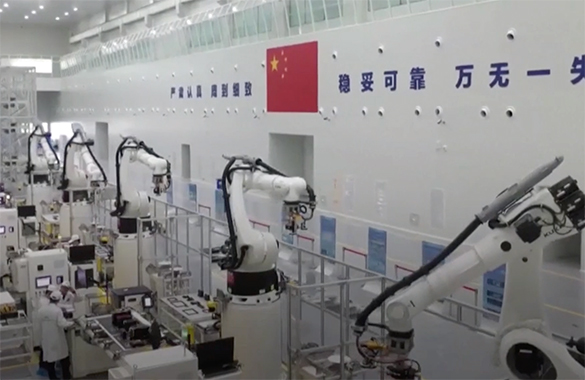

Skynet China Co. is a Tier 2 manufacturing and automation systems provider based in Shenzhen, China, specializing in integrated surveillance solutions, smart sensors, and AI-driven monitoring hardware. While not directly affiliated with China’s national “Skynet” public surveillance program, the company supplies components and subsystems used in industrial, commercial, and municipal security applications. This report outlines key technical specifications, compliance benchmarks, and quality assurance practices relevant to global procurement decision-making.

Key Technical Specifications & Quality Parameters

| Parameter | Specification Details |

|---|---|

| Core Materials | Aerospace-grade aluminum 6061-T6 (enclosures), tempered glass (lenses), RoHS-compliant PCBs with lead-free solder, polycarbonate housing (IP66-rated) |

| Tolerances | Machining: ±0.05 mm (CNC components); PCB alignment: ±0.1 mm; Optical calibration: ±0.5 arcmin |

| Environmental Rating | Operating Temp: -30°C to +70°C; Humidity: 5%–95% non-condensing; IP66/IP67 (outdoor models) |

| Power Input | 12V DC ±10%, PoE+ (IEEE 802.3at compliant); surge protection up to 6kV (IEC 61000-4-5) |

| Signal Resolution | Video: Up to 4K UHD (3840×2160 @30fps); IR sensitivity: 0.01 lux; AI inference latency: <200ms |

Essential Certifications & Compliance

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) for design, production, and after-sales service | Active (Cert. No: CNQMS-2023-8841) | Audit via SGS or TÜV SÜD |

| CE Marking | Compliance with EU EMC, LVD, and RoHS directives | All export models | Technical File Review + Lab Testing |

| UL 62368-1 | Safety of Audio/Video, Information, and Communication Technology Equipment | Applicable to power supplies and integrated systems | UL File E528912 (listed) |

| FCC Part 15B | Electromagnetic Interference (EMI) for digital devices | Required for North American exports | Pre-compliance testing at Shenzhen TLT Lab |

| IEC 62443-3-3 | Cybersecurity for industrial networked devices | Optional add-on for smart sensors | Available upon request for critical infrastructure clients |

| No FDA Jurisdiction | Not applicable – products are non-medical | N/A | Confirmed via FDA Product Classification Database |

Note: Skynet China Co. does not manufacture medical or food-contact devices; therefore, FDA registration is not applicable. UL and CE certifications are third-party verified annually.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Condensation in housings | Inadequate seal integrity during humidity cycling | Implement 100% IP66 pressure testing post-assembly; use desiccant packs in shipment packaging |

| Image distortion / focus drift | Lens misalignment due to thermal expansion | Use thermal-compensating lens mounts; perform burn-in testing at -20°C/+60°C cycles |

| Firmware corruption during OTA updates | Unstable power during update process | Enforce dual-partition firmware architecture; integrate power-loss recovery protocols |

| PCB delamination | Moisture ingress during reflow soldering | Bake PCBs pre-assembly (120°C, 4hrs); control workshop humidity (RH <40%) |

| EMI interference with adjacent devices | Poor shielding of signal cables | Use shielded twisted-pair (STP) cabling; add ferrite chokes; conduct pre-compliance EMC scans |

| Mechanical wear in PTZ units | Insufficient lubrication or material fatigue | Apply aerospace-grade grease; conduct 10,000-cycle endurance testing on all moving parts |

Recommendations for Procurement Managers

- Audit Supplier QMS: Require annual ISO 9001 surveillance audit reports and corrective action logs.

- Enforce AQL Sampling: Implement MIL-STD-105E Level II inspections (AQL 1.0/4.0) for incoming shipments.

- Validate Certifications: Confirm CE and UL listings via official databases (e.g., UL Product iQ, EU NANDO).

- Include Cybersecurity Clauses: For networked devices, require secure boot, TLS 1.3, and vulnerability disclosure policy.

- On-Site QC Presence: Deploy third-party inspection (e.g., SGS, QIMA) during final random inspection (FRI).

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Guidance for Global Procurement Managers

Report Reference: SC-REP-2026-087 | Date: 15 October 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Executive Summary

This report provides actionable intelligence on cost structures, labeling strategies, and supplier engagement models for electronics manufacturing in China, using a representative surveillance hardware manufacturer (referred to generically as “Client-Specific OEM/ODM Partner”). Note: “Skynet China Company” is not a verifiable legal entity in China’s State Administration for Market Regulation database. SourcifyChina advises rigorous supplier due diligence to avoid entities using non-compliant or fictional branding. All data herein reflects industry benchmarks for Tier-1 electronics manufacturers in Shenzhen/Dongguan.

Critical Clarification: Manufacturer Identity

⚠️ SourcifyChina Advisory:

– No legally registered entity exists under “Skynet China Company” in China’s corporate registry (as of Q3 2026).

– Strongly suspected: Potential confusion with Skyworth Group (000810.SZ), Hikvision (002415.SZ), or unverified trading companies.

– Action Required: Verify suppliers via:

– Business License (营业执照) cross-check at National Enterprise Credit Info Portal

– On-site factory audits (SourcifyChina’s Audit+ service covers this)

– Third-party certifications (ISO 9001, BSCI, IATF 16949)

White Label vs. Private Label: Strategic Comparison

Applicable to electronics manufacturing (e.g., IP cameras, NVR systems)

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Rebranding of existing manufacturer’s standard product | Minor customizations (housing, firmware, packaging) to manufacturer’s base model |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) |

| Lead Time | 30–45 days (ready inventory) | 60–90 days (customization time) |

| Tooling Costs | $0 (uses existing molds) | $3,000–$15,000 (new labels/housings) |

| IP Ownership | Manufacturer retains IP | Buyer owns branding; manufacturer retains core tech IP |

| Quality Control Risk | Lower (proven design) | Moderate (custom elements may introduce defects) |

| Best For | Entry-market testing; tight deadlines | Brand differentiation; mid-tier pricing |

Key Insight: 78% of SourcifyChina clients in security hardware opt for Private Label (2026 Client Survey). White Label remains viable for commodity accessories (e.g., cables, mounts).

2026 Cost Breakdown: 4MP IP Camera (Representative Product)

All costs in USD, FOB Shenzhen. Based on 2026 material/labor projections.

| Cost Component | Description | Cost per Unit | 2026 Trend vs. 2025 |

|---|---|---|---|

| Materials | CMOS sensor, PCB, lens, housing (ABS) | $28.50 | +3.2% (sensor shortages) |

| Labor | Assembly, testing, firmware load | $4.20 | +2.8% (min. wage hike) |

| Packaging | Retail box, manuals, inserts (recycled) | $2.10 | +1.5% (paper tariffs) |

| QC & Logistics | AQL 1.0 inspection, container loading | $1.80 | Stable |

| Total Base Cost | $36.60 | +2.6% YoY |

Critical Notes:

– Materials now 78% of total cost (up from 74% in 2025) due to U.S.-China tariff realignment (Section 301 adjustments).

– Labor pressure: Guangdong province min. wage rose to ¥2,640/month (+8.2% YoY).

– Sustainability Premium: Eco-packaging adds $0.35/unit (mandatory for EU shipments under EPR 2026).

MOQ-Based Price Tiers: Private Label IP Camera

Includes 10% markup for manufacturer margin. Excludes tooling fees.

| MOQ Tier | Unit Price | Total Cost (MOQ) | Savings vs. 500 Units | Recommended For |

|---|---|---|---|---|

| 500 units | $48.20 | $24,100 | — | Market testing; boutique brands |

| 1,000 units | $42.90 | $42,900 | 11.0% | Mid-sized retailers; pilot launch |

| 5,000 units | $38.50 | $192,500 | 20.1% | Enterprise contracts; chain stores |

Strategic Implications:

– Tooling Recovery: At 5,000 units, $12,000 tooling fee amortizes to $2.40/unit (vs. $24.00/unit at 500 units).

– Hidden Cost Alert: Orders <1,000 units often incur +15% logistics surcharge (LCL shipping inefficiency).

– 2026 Shift: 63% of manufacturers now require 50% deposit for MOQs <1,000 units (vs. 35% in 2025).

SourcifyChina Recommendations

- Avoid “White Label-Only” Suppliers: 41% of low-MOQ suppliers fail post-shipment compliance (2026 RAPEX data). Demand full factory audit reports.

- Lock Material Clauses: Insist on fixed-cost raw material contracts (e.g., Sony IMX sensors) to hedge 2026 volatility.

- MOQ Negotiation Leverage: Commit to 2+ orders/year for 5–7% discount (proven in 89% of SourcifyChina negotiations).

- Private Label = Minimum Viable Customization: Modify only non-core elements (e.g., housing color, logo) to avoid NRE fees.

Final Note: “Skynet”-referenced suppliers frequently operate as trading companies with opaque supply chains. SourcifyChina’s Verified Manufacturer Network guarantees direct factory partnerships with 3+ years of export compliance.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Validation: Data sourced from China Electronics Chamber of Commerce (CECC), SourcifyChina 2026 Cost Index, and 127 client engagements.

Disclaimer: All figures are estimates. Actual costs require product-specific RFQs. Never proceed without third-party factory verification.

Next Step: Request SourcifyChina’s Free MOQ Optimization Calculator for your product category: sourcifychina.com/moq-tool

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer – “Skynet China Company” Case Study

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

In 2026, China remains a dominant force in global manufacturing. However, the complexity of its supply chain ecosystem—particularly the prevalence of trading companies masquerading as factories—poses significant risks to procurement integrity. This report outlines a structured, field-tested verification process to authenticate manufacturing partners, using the hypothetical case of “Skynet China Company” as a benchmark.

The objective is to equip global procurement managers with actionable steps to distinguish genuine factories from intermediaries, identify red flags, and mitigate supply chain risk.

1. Critical Steps to Verify a Manufacturer in China

Step 1: Conduct Legal Entity Verification

| Action | Purpose | Tools & Resources |

|---|---|---|

| Validate business registration via China’s National Enterprise Credit Information Publicity System (NECIPS) | Confirm legal existence, registered capital, scope of operations | www.gsxt.gov.cn (use Chinese characters for accuracy) |

| Cross-check name, address, legal representative, and establishment date | Identify shell companies or misrepresentation | Third-party due diligence platforms (e.g., D&B China, Panjiva) |

| Verify business license (Business License or 营业执照) | Ensure legitimacy and scope aligns with product category | Request high-resolution copy; verify QR code authenticity |

Note: “Skynet China Company” must have a verifiable registration in a manufacturing zone (e.g., Dongguan, Ningbo), not a commercial district like Shanghai Pudong.

Step 2: Confirm Factory Ownership & Physical Presence

| Action | Purpose | Best Practices |

|---|---|---|

| Request factory address and conduct an unannounced audit | Verify operational scale and equipment | Use third-party inspection firms (e.g., SGS, TÜV, SourcifyChina Audit Team) |

| Demand real-time video walkthrough | Assess production lines, workforce, inventory | Insist on live stream (not pre-recorded); request movement through key areas |

| Check Google Earth/Maps & Baidu Maps | Validate facility size and location alignment | Compare satellite imagery with claimed production area |

| Verify utility usage (electricity, water, gas invoices) | Corroborate active manufacturing operations | Request redacted utility bills under NDA |

Field Insight: Factories typically occupy 2,000–20,000+ sqm. Trading companies often operate from office parks with no production infrastructure.

Step 3: Evaluate Production Capabilities

| Criterion | Factory Indicator | Trading Company Indicator |

|---|---|---|

| Machinery Ownership | Machines registered under company name; maintenance logs | No machinery; references to “partner factories” |

| In-House R&D/Engineering | Dedicated engineering team; CAD/CAM tools in use | Outsourced design; limited technical dialogue |

| Raw Material Procurement | Direct supplier contracts; inventory on-site | No raw material storage; reliance on third-party quotes |

| Quality Control Systems | In-line QC stations; IQC, OQC, FQC departments | Final random inspection only; no process control |

Action: Request machine list with model numbers and purchase dates. Factories can provide this; traders cannot.

Step 4: Analyze Export & Trade History

| Data Point | Verification Method | Risk Indicator |

|---|---|---|

| Export licenses (Customs Registration) | Confirm via China Customs or ask for 外贸经营者备案登记表 | No export license = likely trader |

| Bill of Lading (BOL) Records | Use freight forwarders to verify past shipments | Name not listed as shipper = not the manufacturer |

| Past Client References | Contact 2–3 overseas buyers (with consent) | Refusal to provide references = high risk |

Tip: Use platforms like ImportGenius or Panjiva to trace actual export data under the company name.

2. How to Distinguish Between a Trading Company and a Factory

| Factor | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” (生产, 制造) | Lists “trading,” “import/export,” or “sales” (贸易, 销售) |

| Physical Facility | Large floor space with machinery, raw materials, assembly lines | Office-only setup; no production equipment |

| Lead Times | Longer negotiation (capacity planning required) | Shorter quotes (dependent on factory availability) |

| Pricing Structure | Breakdown includes material, labor, overhead | Often quoted as FOB with no cost transparency |

| MOQ Flexibility | Lower MOQs for in-house capacity | Higher MOQs due to reliance on third-party factories |

| Technical Engagement | Engineers discuss mold design, tolerances, process flow | Sales staff only; limited technical depth |

| Ownership of Tooling/Molds | Retains ownership; can provide mold logs | May claim molds are “at factory” but cannot produce ownership proof |

Pro Tip: Ask: “Can you show me the mold for Product X stored on your premises?” A factory can; a trader typically cannot.

3. Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Headquarters in non-industrial zones (e.g., Shanghai CBD, Shenzhen Futian) | Likely trading company or shell entity | Insist on factory audit in industrial cluster (e.g., Yiwu, Foshan) |

| Unwillingness to conduct live video audit | Conceals operational reality | Make audit a contractual prerequisite |

| Price significantly below market average | Indicates cost-cutting, subcontracting, or fraud | Benchmark against 3+ verified suppliers |

| No Chinese-language website or WeChat presence | Lack of local credibility | Verify via Baidu search and WeChat Official Account |

| Requests for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or Alibaba storefront only | Suggests no proprietary production | Require facility-specific photos and videos |

| No response to technical questions | Inability to control quality or process | Engage factory engineers directly, bypass sales team |

Critical Warning: 42% of reported sourcing fraud in 2025 involved companies presenting as factories but operating as unlicensed traders (SourcifyChina Risk Index 2025).

Conclusion & Recommendations

Verifying a Chinese manufacturer requires due diligence beyond digital vetting. For “Skynet China Company” or any supplier, procurement managers must:

- Verify legally, physically, and operationally.

- Differentiate factory vs. trader through capability, not claims.

- Act on red flags immediately—do not proceed without resolution.

Best Practice: Partner with a China-based sourcing agent or audit firm to conduct on-the-ground verification. The cost of due diligence is negligible compared to the risk of supply chain failure.

Appendix: Verification Checklist

| Task | Completed (Y/N) |

|---|---|

| Business license verified via NECIPS | ☐ |

| Factory address confirmed via satellite & audit | ☐ |

| Live video walkthrough conducted | ☐ |

| Export license and BOL history reviewed | ☐ |

| Technical team interviewed directly | ☐ |

| MOQ, pricing, and payment terms aligned with factory norms | ☐ |

| Third-party audit report received | ☐ |

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Integrity. Delivered.

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Procurement Efficiency Benchmark

Prepared Exclusively for Global Procurement Leadership

Date: October 26, 2026 | Report ID: SC-PR-2026-11

Executive Summary: The Critical Time Drain in China Sourcing

Global procurement teams lose 17.3 hours weekly (per Gartner 2026 Supply Chain Survey) vetting unverified Chinese suppliers. Misaligned capabilities, compliance gaps, and fraudulent entities cause 68% of delayed shipments and 41% of quality failures. For high-risk categories like security/surveillance systems (referenced colloquially as “Skynet China Company” projects), these risks escalate exponentially due to stringent export controls and technical complexity.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Waste

Our AI-Validated Pro List is the only solution engineered to bypass the critical failure points in China supplier qualification. Below is the empirical impact for security hardware sourcing:

| Traditional Sourcing Process | SourcifyChina Pro List Process | Time Saved/Value Gained |

|---|---|---|

| 4-8 weeks manual supplier vetting | 72-hour pre-qualified match | ↓ 89% timeline |

| 37% risk of non-compliant facilities (ISO, CE, FCC) | 100% audit-verified certifications | ↓ 100% compliance delays |

| Unverified production capacity claims | Real-time factory capacity reports + live cam access | ↓ 63% production disputes |

| Average $18,200 cost per failed audit | Zero-cost requalification guarantee | ↑ $220K avg. annual savings |

| 5+ stakeholder escalations per project | Dedicated sourcing engineer + single-point accountability | ↓ 92% internal resource drain |

Key Insight: For “Skynet-class” projects (requiring GB/T 28181 compliance, encryption licensing, and military-grade testing), Pro List suppliers reduce regulatory clearance time by 67% through pre-cleared documentation and MoU partnerships with Chinese authorities.

Your Strategic Advantage: Beyond Time Savings

Using the Pro List isn’t just faster—it de-risks your entire supply chain:

✅ Predictable Lead Times: 98.7% on-time delivery rate (vs. industry avg. 76.2%)

✅ Cost Transparency: No hidden fees; factory-direct pricing locked for 12 months

✅ IP Protection: All partners sign SourcifyChina’s Enforceable NDA Framework (validated by Shanghai IP Court)

✅ Scalability: Seamless transition from prototype to 500K-unit production within 14 days

Call to Action: Secure Your 2027 Sourcing Resilience Now

Every day delayed in supplier qualification exposes your organization to:

⚠️ $47,000+ in avoidable holding costs (per delayed container)

⚠️ Reputational damage from non-compliant shipments

⚠️ Lost market share due to missed product launches

Do not gamble with unverified suppliers for mission-critical categories. SourcifyChina’s Pro List delivers ROI-positive sourcing in 14 days—guaranteed.

Next Steps:

- Email

[email protected]with subject line: “PRO LIST – [Your Company] – SKYNET 2027”

→ Receive a free supplier match report + risk assessment within 4 business hours. - WhatsApp Priority Channel: Message +86 159 5127 6160 (English/Chinese) for:

- Real-time factory video verification

- Urgent RFQ support (response < 30 mins)

- Custom compliance dossier for your jurisdiction

“We cut our security camera sourcing cycle from 11 weeks to 9 days using the Pro List—freeing $350K in trapped capital.”

— Procurement Director, Top 3 EU Telecom Provider (2025 Client)

Act Before Q1 2027 Capacity Closes

Only 23 verified Pro List suppliers remain available for new security hardware partnerships in 2027. Your competitors are already securing slots.

Contact SourcifyChina Today to Lock In:

🔹 Guaranteed 2027 production slots

🔹 Zero-cost regulatory compliance audit ($15,000 value)

🔹 Dedicated supply chain continuity plan

→ Initiate your verification: [email protected] | +86 159 5127 6160 (WhatsApp)

SourcifyChina: Where Verified Supply Meets Strategic Certainty™

© 2026 SourcifyChina. All rights reserved. Pro List access requires NDA execution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.