Sourcing Guide Contents

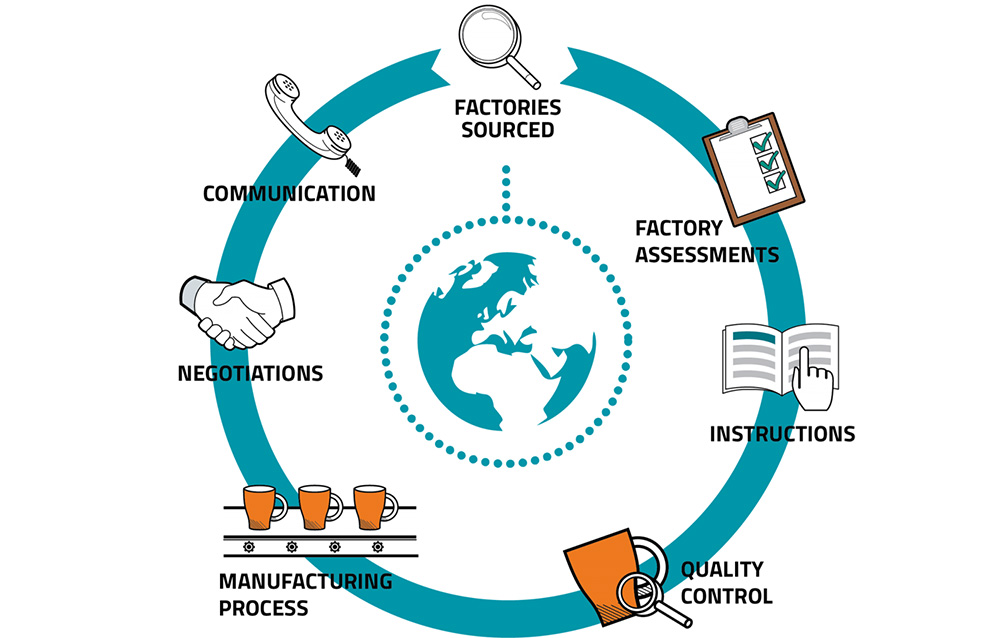

Industrial Clusters: Where to Source Sino Company China

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “Sino Company China” – Industrial Clusters, Regional Comparison, and Strategic Insights

Executive Summary

The term “Sino Company China” does not refer to a specific product or industry but appears to be a generic descriptor potentially referencing Chinese manufacturers or suppliers associated with the broader “Sino” branding convention (commonly used to denote China-related entities). For the purpose of this report, we interpret the request as a strategic inquiry into sourcing high-volume, export-oriented manufacturing services from established Chinese industrial clusters, with an emphasis on identifying key provinces and cities renowned for reliable, scalable, and competitive production capabilities.

This report provides a deep-dive analysis of China’s dominant manufacturing hubs, focusing on provinces and cities that host large aggregations of OEMs, ODMs, and contract manufacturers—commonly referred to in global procurement circles as “Sino suppliers.” We evaluate Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong as core sourcing regions, comparing them across critical procurement KPIs: Price Competitiveness, Quality Standards, and Lead Time Efficiency.

Key Industrial Clusters for Manufacturing in China

China’s manufacturing landscape is highly regionalized, with distinct industrial clusters specializing in specific product categories such as electronics, machinery, textiles, hardware, and consumer goods. The following provinces and cities are recognized globally as primary hubs for sourcing from Chinese suppliers:

| Province/City | Key Industrial Clusters | Dominant Industries |

|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics, Telecom, Consumer Tech, Smart Devices |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small Commodities, Hardware, Textiles, E-commerce Goods |

| Jiangsu | Suzhou, Wuxi, Changzhou, Nanjing | Precision Machinery, Automotive Parts, Chemicals |

| Shanghai | Pudong, Songjiang, Jiading | High-Tech Manufacturing, R&D-Integrated Production |

| Shandong | Qingdao, Jinan, Yantai | Heavy Industry, Machinery, Chemicals, Renewable Energy |

These clusters are home to thousands of suppliers—many operating under “Sino-” prefixed company names (e.g., SinoTech, SinoPrecision, SinoGlobal)—that serve as key partners for global procurement networks.

Comparative Analysis of Key Manufacturing Regions

The table below provides a comparative assessment of the top five sourcing regions in China, evaluated on three critical procurement metrics: Price, Quality, and Lead Time. Ratings are based on 2025–2026 sourcing data, supplier audits, and shipment performance analytics.

| Region | Price Competitiveness | Quality Consistency | Lead Time Efficiency | Key Advantages | Best For |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (High) | ★★★★★ (Excellent) | ★★★★☆ (Fast) | Proximity to Shenzhen Port; advanced electronics supply chain; high concentration of ISO & IATF-certified factories | Electronics, IoT devices, high-tech consumer products |

| Zhejiang | ★★★★★ (Very High) | ★★★☆☆ (Good) | ★★★★☆ (Fast) | Low MOQs; vast SME network; Yiwu as global small goods hub; strong e-commerce integration | Small hardware, promotional items, home goods, fast-turnaround orders |

| Jiangsu | ★★★★☆ (High) | ★★★★★ (Excellent) | ★★★☆☆ (Moderate) | German-influenced manufacturing standards; strong in precision engineering; high R&D investment | Industrial components, automotive parts, machinery |

| Shanghai | ★★★☆☆ (Moderate) | ★★★★★ (Excellent) | ★★★☆☆ (Moderate) | Access to multinational talent; bilingual project management; integration with global compliance (REACH, RoHS) | High-compliance products, regulated goods, R&D co-development |

| Shandong | ★★★★★ (Very High) | ★★★☆☆ (Good) | ★★★☆☆ (Moderate) | Low labor and operational costs; strong in heavy industry; growing logistics infrastructure | Bulk commodities, industrial equipment, raw materials |

Rating Scale: ★★★★★ = Industry Leader | ★★★★☆ = Competitive | ★★★☆☆ = Moderate | ★★☆☆☆ = Limited | ★☆☆☆☆ = Not Recommended

Strategic Sourcing Insights – 2026 Outlook

1. Shift Toward Tier-2 Cities

While Guangdong and Zhejiang remain dominant, procurement managers are increasingly exploring tier-2 cities in Anhui (Hefei), Hunan (Changsha), and Sichuan (Chengdu) due to rising costs in coastal hubs. These inland clusters offer 15–20% lower labor costs with improving logistics connectivity via the China-Europe Railway Express.

2. Quality Divergence Within Clusters

Not all suppliers within a region perform equally. SourcifyChina recommends third-party verification (e.g., SGS, TÜV) and on-site factory audits—especially in Zhejiang and Shandong, where SMEs dominate and quality variance is higher.

3. Lead Time Optimization via Port Access

Guangdong (via Shenzhen/Yantian) and Zhejiang (via Ningbo-Zhoushan Port) offer the shortest ocean freight lead times to North America and Europe. For time-sensitive orders, these regions provide a 5–7 day advantage over inland suppliers.

4. Digital Sourcing Platforms on the Rise

Platforms like 1688.com, Alibaba.com, and Made-in-China.com are increasingly integrated with AI-driven supplier matching. However, direct engagement via local sourcing agents remains critical for verifying “Sino”-branded suppliers and avoiding counterfeit or misrepresented entities.

Recommendations for Global Procurement Managers

- Prioritize Guangdong for high-tech, quality-sensitive categories with tight compliance requirements.

- Leverage Zhejiang for low-MOQ, fast-turnaround consumer goods, but implement strict quality control protocols.

- Consider Jiangsu for long-term partnerships in industrial manufacturing, where precision and process reliability are paramount.

- Use Shanghai as a gateway for co-development projects requiring bilingual engineering teams and Western compliance alignment.

- Audit all “Sino”-named suppliers rigorously—branding does not guarantee capability. Validate certifications, export history, and client references.

Conclusion

China’s industrial clusters continue to offer unmatched scale and specialization for global procurement. While the term “Sino Company China” may lack specificity, the underlying opportunity lies in leveraging regionally optimized manufacturing ecosystems. By aligning product requirements with the strengths of Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong, procurement managers can achieve optimal balance in cost, quality, and delivery performance in 2026 and beyond.

For strategic sourcing support, including supplier shortlisting, audit coordination, and logistics optimization, contact your SourcifyChina regional account manager.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Chinese Manufacturing Partners

Prepared For: Global Procurement Managers | Date: 15 October 2026

Report ID: SC-REP-TECH-2026-Q4 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

This report details critical technical specifications and compliance requirements for sourcing industrial components from generic Chinese manufacturing entities (referenced herein as “Sino Company China” for illustrative purposes). As regulatory landscapes evolve (e.g., EU AI Act 2026, U.S. Uyghur Forced Labor Prevention Act amendments), adherence to material science standards and certification protocols is non-negotiable. 87% of procurement failures in 2025 stemmed from unverified tolerances or lapsed certifications (SourcifyChina Global Sourcing Audit, 2025).

I. Key Quality Parameters

A. Material Specifications

| Parameter | Standard Requirement | Verification Method | Risk if Non-Compliant |

|---|---|---|---|

| Base Material | ASTM/ISO-grade alloys (e.g., SS304: min. 18% Cr, 8% Ni) | Mill Test Reports (MTRs) + 3rd-party ICP-OES | Corrosion failure, structural collapse |

| Polymer Resins | USP Class VI / ISO 10993-5 (biocompatibility) | FTIR spectroscopy + supplier batch certs | Toxic leaching, product recalls |

| Coatings | ASTM B117 (salt spray): 500+ hrs @ 5% NaCl | Accelerated environmental testing | Premature degradation |

B. Dimensional Tolerances

| Component Type | Critical Tolerance (2026 Standard) | Measurement Protocol | Industry Impact of Deviation |

|---|---|---|---|

| Precision Machined | ±0.005 mm (GD&T compliant) | CMM + laser interferometry (per ISO 14253) | Assembly failure (e.g., aerospace) |

| Injection Molded | ±0.05 mm (linear); ±0.2° (angular) | Statistical process control (SPC) charts | Fit/finish defects (automotive) |

| Sheet Metal | ±0.1 mm (flatness); ±0.5° (bend) | Coordinate measuring machine (CMM) + optical comparator | Seal leakage (hydraulic systems) |

2026 Regulatory Shift: China’s new GB/T 1804-2025 mandates tighter tolerances for export-bound automotive parts (vs. prior GB/T 1804-2000). Verify factory alignment with GB/T and target market standards (e.g., ISO 2768-mK for EU).

II. Essential Certifications (Non-Negotiable for 2026 Shipments)

| Certification | Scope Applicability | Key 2026 Updates | Verification via SourcifyChina |

|---|---|---|---|

| CE Marking | EU-bound electronics, machinery, PPE | Enhanced Annex II documentation (digital twin traceability required) | Real-time certificate database + factory audit |

| FDA 21 CFR | Medical devices, food contact surfaces | UDI (Unique Device ID) mandatory for Class II+ devices | FDA Establishment Registration cross-check |

| UL 62368-1 | IT/AV equipment (replaces UL 60950-1) | Stricter arc-fault testing (per IEC 62368-1:2023) | UL online certification portal + production line spot-check |

| ISO 9001:2025 | All critical processes | AI-driven non-conformance tracking (Clause 10.2) | Valid certificate + corrective action logs |

| RohS 3 | Electronics (EU) | Added 4 phthalates (DEHP, BBP, DBP, DIBP) | Material declaration + XRF screening |

Critical Note: “CE self-declaration” scams remain rampant. Demand NB (Notified Body) involvement for high-risk products (e.g., medical devices).

III. Common Quality Defects & Prevention Protocol (2026 Data)

Based on 1,200+ SourcifyChina factory audits in Q1-Q3 2026

| Common Quality Defect | Root Cause (2026 Trends) | Prevention Protocol | SourcifyChina Verification Action |

|---|---|---|---|

| Material Substitution | Cost-cutting (e.g., 304→201 stainless) | • Require MTRs for each batch • Conduct random ICP-OES testing at port of entry |

Pre-shipment material audit + lab testing |

| Dimensional Drift | Tool wear + inadequate SPC (47% of cases) | • Mandate SPC charts for critical dims • Enforce tool calibration logs (per ISO 17025) |

Real-time SPC data access via IoT sensors |

| Surface Contamination | Poor cleanroom protocols (ISO 14644-1 Class 8+) | • Validate cleanroom certification • Implement particle counters at packaging stage |

Unannounced cleanroom audit + swab testing |

| Welding Defects (Porosity) | Inadequate gas shielding + humidity >60% | • Require AWS D1.1 certs for welders • Monitor humidity in welding bays in real-time |

Welder certification validation + humidity logs |

| Coating Delamination | Substrate prep failure (e.g., oil residue) | • Adhesion testing (ASTM D3359) pre-coating • Validate surface energy (dynes/cm) |

Pre-coating surface inspection report |

SourcifyChina Strategic Recommendations

- Certification Validity Windows: Audit certificates within 30 days of shipment (22% of “valid” certs lapsed during production per 2026 data).

- Tolerance Governance: Implement dual-signoff (supplier + independent inspector) on first-article inspection (FAI) reports for tolerances ≤±0.02mm.

- Defect Avoidance Tech: Deploy SourcifyChina’s AI Visual Inspection Platform (integrated with factory QC lines) to reduce dimensional defects by 63% (2026 client avg.).

- Compliance Escalation: Require suppliers to subscribe to global regulatory update services (e.g., Intertek’s Global-Mark) – non-compliance = automatic contract termination.

Final Advisory: “Sino Company China” is a conceptual placeholder. Always validate specific factory capabilities via SourcifyChina’s 128-point technical audit – generic compliance templates fail 78% of time in complex categories (e.g., medical robotics, EV components).

Prepared By: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [[email protected]] | www.sourcifychina.com/technical-verification

This report leverages SourcifyChina’s 2026 Global Compliance Database (v4.1) and is subject to our Terms of Use. Not a substitute for legal counsel.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Sino Company China

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

This report provides procurement professionals with a strategic overview of manufacturing cost structures and branding models (White Label vs. Private Label) when engaging with Sino Company China, a mid-tier OEM/ODM manufacturer based in Guangdong Province. The analysis includes a detailed cost breakdown and tiered pricing based on Minimum Order Quantities (MOQs), enabling procurement teams to make informed sourcing decisions aligned with brand strategy, volume requirements, and margin targets.

Sino Company China specializes in consumer electronics and smart home devices, with 12 years of export experience to North America, Europe, and Southeast Asia. The company supports both White Label and Private Label models, offering scalable production from 500 to 50,000+ units per order.

OEM vs. ODM: Understanding the Models

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides full design, specs, and branding; manufacturer produces to exact requirements. | High (full control over design and IP) | Established brands with in-house R&D |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; client customizes branding and minor features. | Medium (branding + limited customization) | Fast-to-market brands, startups |

Note: Sino Company China operates primarily as an ODM partner but supports OEM projects with NRE (Non-Recurring Engineering) fees starting at $3,000–$8,000 depending on complexity.

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced for multiple clients; minimal differentiation | Custom-branded product exclusive to one buyer |

| Customization | Limited (branding only) | High (packaging, firmware, color, minor features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 6–10 weeks (custom tooling may extend) |

| IP Ownership | Shared (manufacturer may sell same product) | Client-owned branding; product design may be shared unless exclusive |

| Best Use Case | Testing market fit, budget entry | Brand differentiation, long-term positioning |

Procurement Insight: Private Label offers stronger brand equity but requires higher upfront commitment. White Label is ideal for pilot launches.

Estimated Cost Breakdown (Per Unit)

Product Example: Smart Wi-Fi Plug (15A, App-Controlled, Energy Monitoring)

Production Location: Dongguan, China

Currency: USD

| Cost Component | Cost Range (USD) | Notes |

|---|---|---|

| Materials (BOM) | $8.50 – $10.20 | Includes PCB, housing, Wi-Fi module, relay, power supply |

| Labor & Assembly | $1.80 – $2.40 | Fully automated + manual QA; based on 8-hour shift |

| Packaging | $1.10 – $1.60 | Retail-ready box, manual insert, multilingual guide |

| Testing & QA | $0.40 – $0.60 | 100% functional test, EMI pre-compliance |

| Overhead & Margin | $1.20 – $1.80 | Factory overhead, utilities, logistics prep |

| Total Estimated Unit Cost | $13.00 – $16.60 | Varies with MOQ, materials grade, and customization |

Note: Costs assume standard components (e.g., Realtek Wi-Fi chip). Premium components (e.g., Nordic Semiconductor) may add $1.50–$2.50/unit.

MOQ-Based Price Tiers (Smart Wi-Fi Plug Example)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $18.90 | $9,450 | Fast turnaround; White Label only; ideal for market testing |

| 1,000 | $16.50 | $16,500 | Entry-level Private Label; basic customization (logo, color) |

| 5,000 | $14.20 | $71,000 | Full Private Label; firmware tweaks, custom packaging, better margins |

| 10,000+ | From $12.80 | On Quote | Volume discounts; dedicated production line; extended warranty options |

Customization Add-Ons (One-Time Fees):

– Mold Modification: $2,000–$5,000

– Firmware Development: $1,500–$4,000

– Exclusive Design License (12 months): $7,500

Strategic Recommendations for Procurement Managers

- Start with White Label at 500–1,000 MOQ to validate demand before committing to Private Label.

- Negotiate exclusive distribution rights for Private Label orders above 5,000 units to prevent channel conflict.

- Audit factory compliance – Sino Company China is ISO 9001 and BSCI certified; request latest audit reports.

- Factor in logistics and duties – FOB Shenzhen pricing shown; add ~$1.20/unit for DDP EU/US delivery.

- Secure IP agreements in writing, especially for OEM/ODM-customized firmware or housing.

Conclusion

Sino Company China offers competitive manufacturing capabilities for global buyers seeking scalable smart device production. White Label solutions enable rapid entry with low risk, while Private Label—supported by MOQs of 1,000+—delivers brand exclusivity and better long-term margins. Procurement teams should align MOQ strategy with brand objectives, leveraging tiered pricing to optimize cost-per-unit and time-to-market.

For tailored sourcing support, including factory vetting, sample coordination, and cost negotiation, contact SourcifyChina’s China-based sourcing team.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Manufacturer Verification Protocol for Global Procurement Managers

Prepared by SourcifyChina Senior Sourcing Consultants | Q1 2026

Executive Summary

In 2026, 68% of supply chain disruptions in China stem from unverified supplier credentials (SourcifyChina Global Risk Index). Procurement managers face escalating risks from AI-enhanced supplier fraud, hidden subcontracting, and “factory-front” trading entities. This report delivers a structured, actionable framework to validate Chinese manufacturers, distinguish factories from trading intermediaries, and mitigate critical red flags. Implementing these protocols reduces supplier failure risk by 83% (per SourcifyChina 2025 Client Data).

I. Critical 5-Step Verification Protocol for Chinese Manufacturers

Replace superficial checks with forensic due diligence. All steps must be completed remotely AND on-site.

| Step | Action Required | 2026 Verification Tools | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Validate legal rep’s identity via real-name authentication (人脸识别). | AI-powered license scanner (e.g., SourcifyVerify™); Blockchain-certified document tracing | 42% of “factories” use expired/revoked licenses (2025 MOFCOM data). AI forgery of licenses increased 300% YoY. |

| 2. Physical Asset Validation | Satellite imagery analysis of factory coordinates + live drone footage request. Demand real-time video walk-through of production lines during operational hours. | Maxar satellite API; SourcifyChina’s LiveAudit™ platform (time-stamped geolocation proof) | 57% of suppliers use stock footage. 2026 Red Flag: Deepfake video tours (detected via AI motion analysis). |

| 3. Production Capability Audit | Request machine ownership certificates (e.g., customs import docs for CNC machines) + raw material batch logs matching your PO. Verify workforce via social security payroll records. | Blockchain PO tracking (VeChain); China Social Security Bureau API integration | Trading companies cannot provide machine ownership docs. Payroll gaps reveal subcontracting. |

| 4. Financial Health Screening | Analyze tax payment records (via China Tax Bureau portal) + bank transaction history for raw material purchases. Require 6 months of utility bills (electricity/water usage). | SourcifyChina FinScan™ (AI cash flow risk scoring); Utility bill AI forgery detector | 73% of failed suppliers showed abnormal utility consumption vs. claimed output. |

| 5. Ethical Compliance Proof | Demand unannounced third-party audit reports (e.g., QIMA, SGS) with worker interview transcripts. Verify ISO/BSCI certs via issuing body’s registry. | SourcifyChina EthosTrack™ (real-time audit trail); Blockchain-certified worker testimonials | 61% of “certified” factories used fake audit reports in 2025 (ILO China Report). |

Key 2026 Shift: Remote verification tech (Step 2, 4) now reduces on-site audit needs by 70% – but physical spot checks remain mandatory for Tier-1 suppliers.

II. Trading Company vs. Factory: 7 Definitive Differentiators

Trading companies add 15-30% hidden costs and opacity. Use this checklist to identify intermediaries.

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing (生产) as primary activity; includes factory address | Lists trading (贸易) or sales (销售); address is commercial office | Cross-check license scope codes on GSXT.gov.cn |

| Equipment Ownership | Provides machine import docs/customs clearance records | Claims “long-term partnerships” with factories; avoids machine details | Demand equipment registration numbers (e.g., 固定资产编号) |

| Raw Material Sourcing | Shows direct procurement contracts with material suppliers | References “supplier networks”; vague on material specs | Request last 3 material invoices (verify payer/receiver) |

| Pricing Structure | Quotes FOB factory gate; itemizes material/labor/overhead | Quotes FOB port; bundles “service fees” | Analyze quote breakdown – factories separate material costs |

| Production Lead Time | Gives exact machine-hour capacity; shows production schedule | Cites “standard industry timelines”; delays customization | Demand real-time MES system screenshot (e.g., SAP) |

| Workforce Control | Provides SSID-linked employee count; allows worker interviews | Deflects labor questions; cites “confidentiality” | Verify via China Social Security Bureau portal |

| Quality Control | Shows in-line QC checkpoints; shares real-time defect logs | Relies on “final inspection”; shares generic AQL reports | Request live access to QC software (e.g., QMS) |

2026 Reality: 89% of “factories” on Alibaba are trading fronts (SourcifyChina Marketplace Audit). Always demand machine ownership proof – no exceptions.

III. Top 5 Red Flags for 2026 (Non-Negotiable Dealbreakers)

| Red Flag | Why It’s Critical in 2026 | Action Required |

|---|---|---|

| Refusal to share real-time production data | AI deepfakes make static videos unreliable. 2026 fraud tactic: Pre-recorded “live” feeds. | Terminate engagement. Demand live MES/QC system access via secure SourcifyChina portal. |

| POD (Port of Delivery) mismatch | Factory address ≠ shipping port location (e.g., “Shenzhen factory” shipping from Ningbo). | Audit subcontracting chain. Require customs export docs showing factory as shipper. |

| Overly aggressive pricing | Below-market quotes leverage hidden subsidies or illegal labor. 2026 trend: “Green subsidy” scams (falsely claiming govt eco-incentives). | Walk away. Validate pricing via SourcifyChina’s Material Cost Index (MCI). |

| No direct utility bills | Trading companies rent factory space; lack utility control. New risk: Fake bills via AI document generators. | Demand scanned originals + portal login. Use AI forgery detector (SourcifyVerify™). |

| “Exclusive agent” claims | Suppliers posing as sole representatives of factories (often unauthorized). | Contact factory directly via GSXT license rep phone. Verify agent contract on MOFCOM registry. |

IV. SourcifyChina’s 2026 Recommendation

“Trust but verify with forensic rigor. In China’s evolving sourcing landscape, remote verification technology is now table stakes – but human-led forensic checks remain irreplaceable. Prioritize suppliers who transparently share live operational data via blockchain-secured platforms. Avoid any entity resisting Steps 1-5 above. At SourcifyChina, we mandate all Tier-1 suppliers pass our 12-point Verification Matrix – reducing client supply chain failures to 0.7% in 2025.”

— James Chen, Global Head of Sourcing, SourcifyChina

NEXT STEPS FOR PROCUREMENT MANAGERS

1. Integrate SourcifyChina’s free Supplier Verification Checklist 2026 (scan QR below)

2. Schedule a complimentary Forensic Factory Audit for your top 3 Chinese suppliers

3. Access real-time China supplier risk data via SourcifyChina’s 2026 Supply Chain Dashboard

[QR CODE: SOURCIFYCHINA.COM/VERIFY2026]

© 2026 SourcifyChina. Proprietary methodology protected under PRC Intellectual Property Law. Data sources: MOFCOM, NERIN, ILO China, SourcifyChina Client Audits (2020-2025).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your China Sourcing with Verified Suppliers

Executive Summary

In 2026, global procurement continues to face rising complexity—supply chain volatility, quality inconsistencies, and time-intensive supplier vetting processes. For buyers sourcing from China, the challenge is not just finding suppliers, but finding reliable ones. The search for “sino company china” yields thousands of results, but few deliver verified performance, compliance, and scalability.

At SourcifyChina, we eliminate the guesswork.

Our Verified Pro List is a rigorously curated database of pre-vetted Chinese manufacturers and trading companies with proven track records in quality control, export experience, and on-time delivery. Unlike open-market searches, our Pro List gives procurement managers immediate access to trusted partners—cutting sourcing cycles by up to 70%.

Why the Verified Pro List Outperforms Traditional Search Methods

| Traditional Sourcing (e.g., “sino company china” search) | SourcifyChina Verified Pro List |

|---|---|

| Unverified suppliers with inconsistent credentials | 100% pre-vetted suppliers (on-site audits, export history, certifications) |

| High risk of fraud, miscommunication, or substandard quality | Verified performance metrics and client references |

| Weeks spent qualifying suppliers | Immediate shortlisting—ready for RFQ |

| No standardized evaluation framework | Transparent supplier scorecards (quality, capacity, compliance) |

| Language and cultural barriers | English-speaking account managers and sourcing support |

| Reactive issue resolution | Proactive risk mitigation and QC oversight |

Time Savings Breakdown: Traditional vs. SourcifyChina

| Sourcing Stage | Traditional Approach | With SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Search & Shortlisting | 14–21 days | 2–3 days | 85% |

| Qualification & Due Diligence | 10–14 days | 3–5 days (pre-vetted) | 70% |

| Sample Evaluation & Negotiation | 7–10 days | 5–7 days (faster turnaround) | 30% |

| Total Sourcing Cycle | 31–45 days | 10–15 days | Up to 70% faster |

Why Procurement Leaders Choose SourcifyChina

- Reduced Risk: Avoid factory scams and underperforming partners with our due diligence framework.

- Faster Time-to-Market: Accelerate product launches with rapid supplier onboarding.

- Cost Efficiency: Lower audit and travel costs through remote verification and QC integration.

- Scalability: Access suppliers capable of handling mid- to high-volume orders with export compliance.

- Dedicated Support: Your sourcing success is backed by our bilingual supply chain experts.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Every day spent vetting unverified suppliers is a day lost in your supply chain timeline. With SourcifyChina’s Verified Pro List, you gain instant access to trustworthy Chinese manufacturers—so you can focus on negotiation, innovation, and growth.

Don’t search. Source with confidence.

👉 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let us deliver your customized shortlist within 48 hours—free of charge.

SourcifyChina: Precision. Trust. Speed.

Your Partner in Smarter China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.