The global MRI equipment market is experiencing steady expansion, driven by rising demand for early disease diagnosis, advancements in imaging technology, and increasing investments in healthcare infrastructure. According to a report by Grand View Research, the global MRI market size was valued at USD 7.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. Siemens Healthineers, a leading innovator in medical imaging, plays a pivotal role in shaping this landscape with its high-field and advanced MRI systems. As healthcare providers evaluate cost, performance, and technological integration, a growing number of manufacturers have emerged to offer competitive alternatives—some directly producing Siemens-compatible components, others offering systems engineered to match Siemens-level performance at varying price points. This analysis explores the top eight manufacturers known for delivering MRI systems with cost structures reflective of Siemens’ standards, combining market insights, product specifications, and pricing trends to guide strategic procurement decisions in diagnostic imaging.

Top 8 Siemens Mri Machine Cost Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Effects of MRI scanner manufacturers in classification tasks …

Domain Est. 1994

Website: nature.com

Key Highlights: This study analyzes the performance of multiple disease classification tasks using multi-center MRI data obtained from three widely used scanner manufacturers….

#2 Siemens MRI Machine Cost & Models

Domain Est. 2019

Website: directmedimaging.com

Key Highlights: The average price of a new 1.5T MRI machine across all manufacturers is $1.3 million for the machine itself, plus additional charges for servicing, logistics, ……

#3 Imaging

Domain Est. 1986

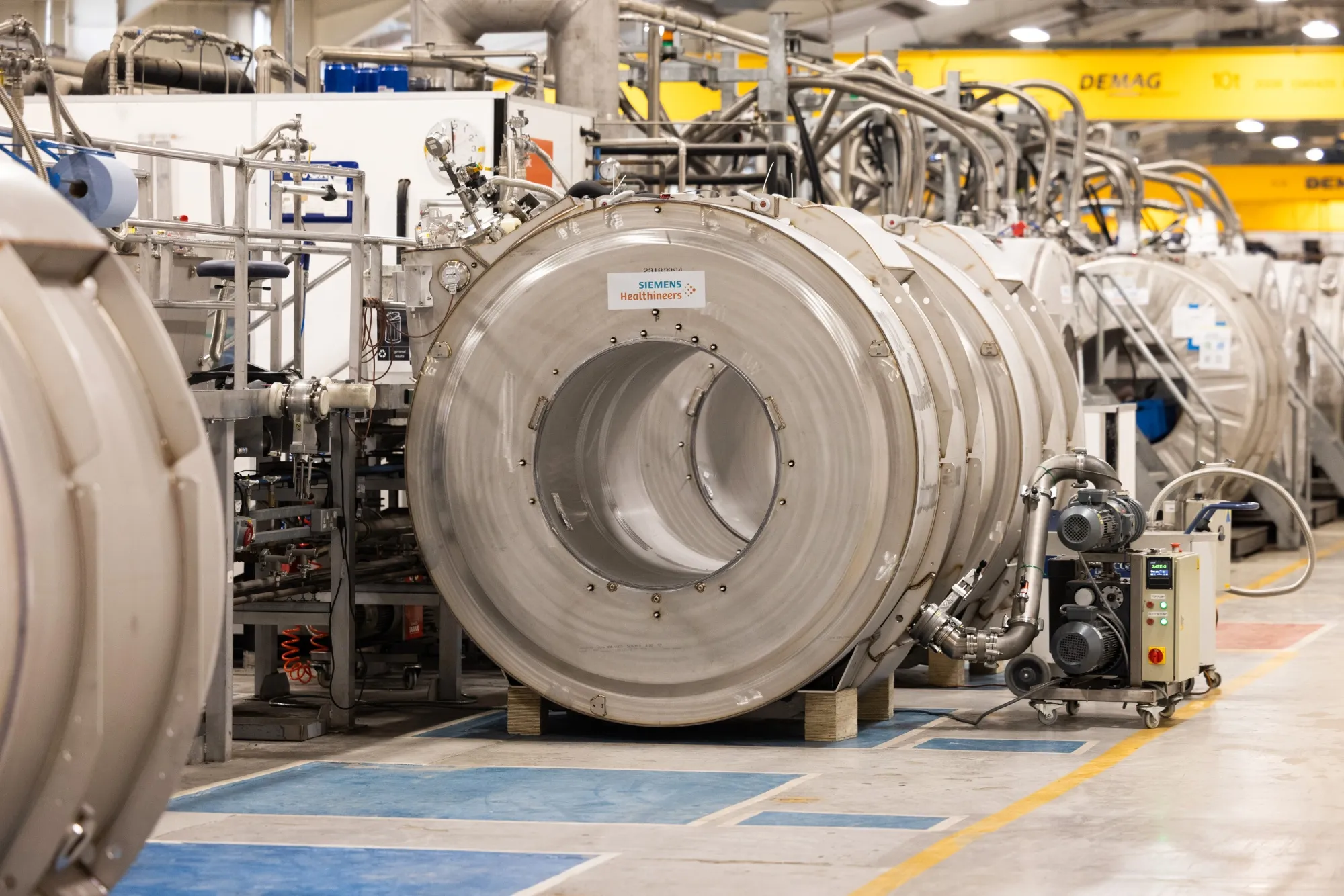

Website: siemens.com

Key Highlights: The new company quickly grew to become the world’s largest specialist supplier of electromedical equipment. … (MRI) system, the MAGNETOM. Further developments ……

#4 Reduction in energy, cost and emissions in MRI machines

Domain Est. 1986

Website: news.siemens.com

Key Highlights: Research from Siemens and UCSF shows medical centers can save energy, reduce emissions, and lower MRI costs by using low-power settings….

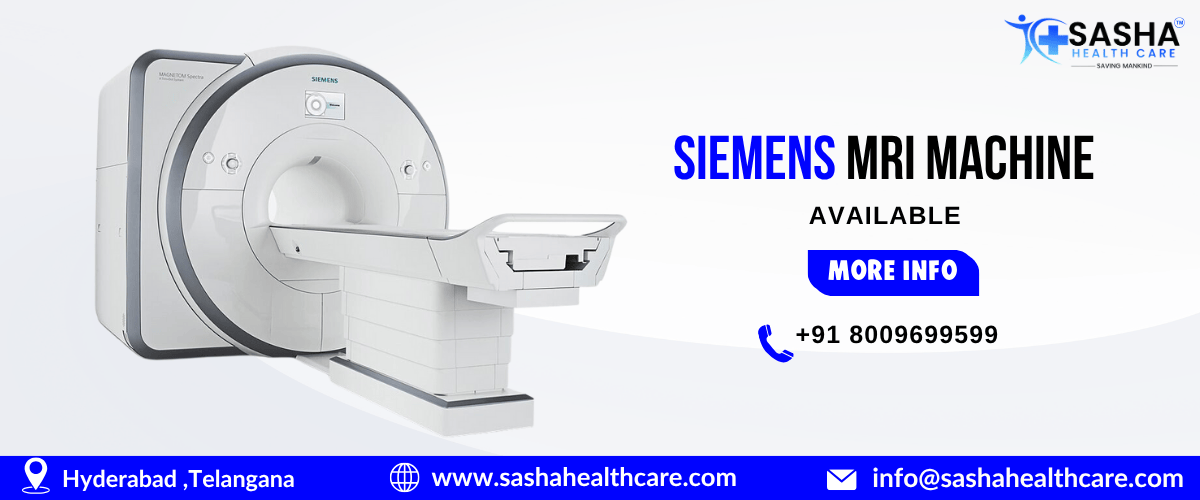

#5 Siemens MAGNETOM Skyra 3.0T

Domain Est. 1996

Website: meridianleasing.com

Key Highlights: $21,994.12 / MO (36 Months); $17,478.11 / MO (48 Months); $14,989.63 / MO (60 Months). Product Description. The Siemens MAGNETOM Skyra MRI machine combines ……

#6 How Much Does an MRI Machine Cost in 2025?

Domain Est. 1998

Website: blockimaging.com

Key Highlights: For MRI machine pricing you can expect to pay anywhere from $100,000 for entry-level machines and upwards of $450,000 for premium models. This is where most ……

#7 Researchers Create an MRI Scanner from Parts in Just Four Days

Domain Est. 2008

Website: nyulangone.org

Key Highlights: A typical clinical MRI scanner weighs up to 17 tons and can cost as much as $3 million. Each machine requires three dedicated rooms—one for ……

#8 Magnetic Resonance Imaging

Domain Est. 2016

Website: siemens-healthineers.com

Key Highlights: The definitive portfolio for MRI. Our innovative technologies enable you to achieve exceptional speed, efficiency, and precision in MRI to improve patient care ……

Expert Sourcing Insights for Siemens Mri Machine Cost

2026 Market Trends for Siemens MRI Machine Cost

The global market for Magnetic Resonance Imaging (MRI) equipment, including systems manufactured by Siemens Healthineers, is poised for significant evolution by 2026. As one of the leading innovators in medical imaging technology, Siemens plays a pivotal role in shaping pricing dynamics, technological advancements, and market accessibility. This analysis explores the key trends expected to influence the cost of Siemens MRI machines in 2026.

Technological Innovation Driving Premium Pricing

Siemens continues to invest heavily in AI integration, high-field and ultra-high-field imaging (e.g., 3T and emerging 7T systems), and software-driven diagnostic tools. By 2026, next-generation platforms such as the Magnetom Free.Max and AI-enhanced workflow solutions like myExam Companion are expected to dominate the market. These advanced features justify premium pricing, particularly for research hospitals and specialized clinics seeking cutting-edge diagnostic capabilities. As a result, high-end Siemens MRI systems are likely to maintain or increase in cost, with top-tier models potentially exceeding $3 million.

Cost Optimization in Mid-Range and Compact Models

In parallel, Siemens is expanding its portfolio of cost-effective, compact MRI systems—such as the Magnetom Amira and Magnetom C!—to meet demand from outpatient centers, rural hospitals, and emerging markets. These systems offer reduced installation footprints, lower operational costs, and simplified maintenance. By 2026, increased production scale and modular design are expected to reduce per-unit manufacturing costs, potentially stabilizing or slightly decreasing prices in the mid-tier segment ($1 million to $1.5 million). This trend supports broader market penetration while maintaining profitability through volume sales.

Supply Chain and Geopolitical Influences

Global supply chain dynamics, including semiconductor availability, rare earth material costs, and logistics disruptions, will continue to affect MRI machine pricing. Siemens, with its extensive European and U.S.-based manufacturing, may face cost pressures from inflation and energy prices. However, strategic partnerships and localized production (e.g., in China and India) could mitigate these risks. By 2026, regional pricing disparities are expected to persist, with higher costs in North America and Western Europe compared to Asia-Pacific and Latin America due to tariffs, import regulations, and service infrastructure.

Service and Subscription-Based Pricing Models

A notable shift toward value-based healthcare is driving Siemens’ expansion of service contracts, remote diagnostics, and subscription-based pricing (e.g., “MRI as a Service”). These models allow healthcare providers to access advanced imaging without large upfront capital expenditures. By 2026, over 30% of Siemens MRI installations may adopt such flexible financial arrangements, influencing the perception of machine “cost” — shifting from a one-time purchase to a long-term operational expense. This could lower barriers to entry but may result in higher total cost of ownership over time.

Regulatory and Reimbursement Landscape

Regulatory approvals and reimbursement policies will indirectly affect Siemens MRI pricing. Stricter FDA and EU MDR requirements may increase compliance costs, while favorable reimbursement for AI-assisted diagnostics could justify higher prices. In markets where public healthcare systems emphasize cost containment (e.g., Germany, Canada), competitive tendering may pressure Siemens to offer discounts, limiting price growth.

Conclusion

By 2026, the cost of Siemens MRI machines will reflect a bifurcated market: premium pricing for AI-integrated, high-performance systems and stabilized or slightly declining prices for mid-range and compact models. Technological leadership, supply chain resilience, and innovative financing will be key determinants of pricing strategy. Healthcare providers can expect greater flexibility in acquisition models, but overall costs will remain sensitive to innovation pace and regional economic conditions.

Common Pitfalls When Sourcing Siemens MRI Machine Costs (Quality, IP)

Sourcing a Siemens MRI machine involves more than just comparing price tags. Overlooking critical quality and intellectual property (IP) factors can lead to significant long-term risks and hidden costs. Below are key pitfalls to avoid:

Underestimating Total Cost of Ownership Beyond Purchase Price

Focusing solely on the initial acquisition cost often leads buyers to overlook expenses related to installation, site preparation, service contracts, software upgrades, and energy consumption. Siemens MRI systems, especially advanced models like the Magnetom Skyra or Vida, require specialized infrastructure and ongoing maintenance. Choosing a lower-cost refurbished unit without verified service history can result in frequent downtime and costly repairs, eroding savings.

Prioritizing Price Over System Quality and Clinical Performance

Cheaper alternatives—particularly third-party refurbished or reconditioned units—may lack Siemens’ original quality assurance. Components like gradient coils, RF amplifiers, and magnet homogeneity degrade over time and affect image quality and patient throughput. Non-OEM (original equipment manufacturer) refurbishments may not adhere to Siemens’ stringent calibration standards, leading to inconsistent diagnostic accuracy and potential regulatory compliance issues.

Ignoring Software Licensing and Intellectual Property Risks

Siemens MRI systems rely on proprietary software (e.g., syngo platform, AI-powered applications like BioMatrix or myExam Companion) protected by strict IP rights. Unauthorized software installations, cracked licenses, or use of non-genuine software updates can violate licensing agreements, expose facilities to legal action, and disable critical features. Additionally, third-party vendors may offer “pre-loaded” software without valid licenses, jeopardizing system functionality and compliance.

Falling for Non-OEM or Gray Market Equipment with Questionable Provenance

Purchasing Siemens MRI machines through unauthorized resellers or gray market channels may offer lower prices but carries significant risks. These units may have unknown service histories, expired warranties, or tampered serial numbers. Siemens may refuse service support or software updates for non-validated systems, leaving buyers stranded. Furthermore, gray market equipment can involve IP infringement if components or software have been improperly sourced or cloned.

Overlooking Service Contracts and IP-Protected Maintenance Requirements

Siemens often ties service and software support to genuine parts and authorized technicians. Using third-party service providers or non-OEM replacement parts can void warranties and block access to software updates. Since many advanced features are IP-protected and require active service contracts, losing authorized support means losing functionality—effectively downgrading your system over time.

Neglecting Compliance with Regulatory and Cybersecurity Standards

Siemens regularly updates MRI software to meet evolving regulatory (e.g., FDA, CE) and cybersecurity standards. Unauthorized modifications or outdated software from unlicensed sources can expose healthcare providers to compliance violations and data breaches. Ensuring that the sourcing process includes access to legitimate software updates and Siemens’ cybersecurity patches is critical for patient safety and legal compliance.

Conclusion

When sourcing Siemens MRI machines, buyers must look beyond upfront cost and evaluate long-term quality, IP compliance, and total cost of ownership. Partnering with authorized distributors, verifying equipment provenance, and securing proper software licenses are essential steps to avoid operational, legal, and clinical pitfalls.

Logistics & Compliance Guide for Siemens MRI Machine Cost

When acquiring a Siemens MRI machine, understanding the full scope of logistics and compliance requirements is essential to accurately assess total cost and ensure a smooth installation. These factors significantly influence both upfront and ongoing expenses, and non-compliance can lead to delays, fines, or operational shutdowns.

Site Planning and Facility Requirements

Proper site preparation is critical and impacts overall cost. Siemens MRI systems require specific structural, electrical, and environmental conditions:

- Structural Reinforcement: MRI scanners, especially high-field models (1.5T and 3T), are extremely heavy. Floors often require reinforcement to support 6,000–13,000 lbs. Structural engineering assessments and modifications can add $50,000–$200,000+ to total cost.

- Room Dimensions and Layout: The scan room must accommodate the MRI unit, patient table movement, and service access. Siemens provides detailed room planning guides; deviations may lead to rework or redesign costs.

- Shielding Requirements: RF shielding (copper or steel) is necessary to prevent signal interference. Installation typically costs $50,000–$150,000. Magnetic shielding (passive or active) may also be needed to contain the fringe field.

- Cryogen Venting: Superconducting magnets require liquid helium. A quench pipe must be installed to safely vent helium gas in case of a magnet quench, complying with building and fire codes.

Transportation and Handling

Transporting an MRI machine involves complex logistics due to size, weight, and sensitivity:

- Specialized Freight: MRI components are shipped via flatbed trucks or cargo planes. Oversized load permits, route surveys, and police escorts may be required, adding $10,000–$50,000.

- Crane and Rigging: In many cases, cranes are needed to lift the scanner through walls or roofs. Rigging costs vary based on accessibility and building constraints ($15,000–$75,000).

- White-Glove Handling: MRI magnets are sensitive to shock and tilt. Handling must comply with Siemens’ transport guidelines to avoid demagnetization or warranty voidance.

Regulatory and Safety Compliance

Compliance with national and local regulations is mandatory and affects both cost and timeline:

- FDA 510(k) Clearance: In the U.S., all MRI systems must have FDA clearance. Siemens provides this, but facility must ensure the purchased model is approved for intended use.

- State and Local Permits: Installation often requires permits for construction, electrical work, and medical equipment. Costs vary by jurisdiction ($2,000–$20,000).

- Radiation Safety and Zoning: Although MRI uses non-ionizing radiation, facilities must comply with magnetic field safety zones (Zone I–IV per ACR/ACEM guidelines). Proper signage, access control, and staff training are required.

- Joint Commission and ACR Accreditation: For reimbursement and credibility, facilities may need to meet ACR MRI accreditation standards, which include image quality, safety protocols, and personnel qualifications.

Installation and Commissioning

Professional installation by Siemens-certified engineers ensures compliance and optimal performance:

- Factory Acceptance Testing (FAT): Conducted at Siemens facility before shipment.

- Site Acceptance Testing (SAT): Performed on-site to verify system performance, safety, and compliance with specifications. Included in service contract but may incur travel fees for remote locations.

- Magnet Ramping and Shimming: Time-consuming process that ensures magnetic field homogeneity. Requires trained personnel and stable environmental conditions.

Ongoing Compliance and Maintenance

Long-term costs include compliance with service and safety standards:

- Preventive Maintenance Contracts: Siemens offers service plans (e.g., Premium, Performance) ranging from $100,000–$250,000 annually, covering parts, labor, and software updates.

- Helium Replenishment: Although modern systems are “zero boil-off,” periodic refills may still be needed (~$20,000–$50,000 per refill).

- Software and Cybersecurity Updates: Regular updates are required to maintain compliance with HIPAA and medical device cybersecurity standards (e.g., IEC 62304, FDA guidance).

- Staff Training and Certification: Technologists and radiologists must be trained on the specific Siemens model and safety protocols. Training programs may cost $5,000–$15,000.

International Import Considerations (if applicable)

For cross-border shipments, additional costs and compliance steps apply:

- Customs Duties and VAT: MRI machines may be subject to import tariffs (e.g., 0–5% in some countries under HS Code 9018.12). VAT/GST applies in most regions.

- CE Marking and Local Approvals: In the EU, ensure the device has valid CE marking under MDR (EU 2017/745). Other regions (e.g., Health Canada, TGA Australia) require local certification.

- Language and Documentation: User manuals and safety labels must comply with local language requirements.

Conclusion

The total cost of a Siemens MRI machine extends far beyond the purchase price. Logistics and compliance factors—including site prep, transport, regulatory approvals, installation, and ongoing maintenance—can add 20–50% to the initial investment. Early engagement with Siemens project managers, facility engineers, and regulatory consultants is crucial to accurate budgeting and timely deployment. Always request a detailed site planning and compliance checklist from Siemens for your specific model and location.

Conclusion:

Sourcing a Siemens MRI machine involves a significant financial investment, with costs varying widely based on the model, configuration, new vs. refurbished status, and additional features such as advanced software packages, higher magnetic field strength (e.g., 1.5T vs. 3T), and service agreements. New Siemens MRI systems typically range from $1 million to over $3 million, while certified refurbished units offer a more cost-effective alternative, often priced between $300,000 and $1 million, depending on specifications and condition.

Other cost considerations include installation, site preparation, ongoing maintenance, training, and compliance with regulatory requirements. Partnering with authorized distributors or Siemens Healthineers directly ensures technical support, warranty coverage, and access to the latest technology updates. Alternatively, sourcing through third-party vendors may reduce initial costs but requires due diligence to verify equipment history and service support.

In conclusion, while Siemens MRI machines represent a premium option known for reliability, image quality, and innovation, successful sourcing depends on aligning the machine’s capabilities with clinical needs and budget constraints. A thorough cost-benefit analysis, including total cost of ownership, is essential to make a strategic and sustainable procurement decision.