The global aluminum building materials market is experiencing robust growth, driven by rising demand for energy-efficient, durable, and low-maintenance construction solutions. According to Grand View Research, the global aluminum cladding market size was valued at USD 51.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is fueled by increasing urbanization, infrastructure development, and a shift toward sustainable building practices—trends that have elevated the importance of high-performance siding and trim systems. As aluminum trim becomes a critical component in both residential and commercial façades for its weather resistance, design flexibility, and corrosion protection, sourcing from reliable manufacturers is more crucial than ever. Based on production capacity, geographic reach, innovation in finish technologies, and market presence, the following ten companies represent the leading aluminum trim manufacturers shaping the future of modern siding solutions.

Top 10 Siding Aluminum Trim Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Klauer Manufacturing

Domain Est. 1996

Website: klauer.com

Key Highlights: Klauer Manufacturing offers premium sheet metal building products. Our steel siding is easy to install & requires minimal maintenance. Shop now!…

#2 Berridge Manufacturing Co.

Domain Est. 1996

Website: berridge.com

Key Highlights: Berridge Manufacturing Company is the preferred architectural metal manufacturer with the highest quality metal roofing and siding products in the industry….

#3 Maibec, Aluminium Siding manufacturer from nature to architecture

Domain Est. 1997

Website: archi.maibec.com

Key Highlights: At Maibec, we specialize in manufacturing high-performance, visually stunning, and durable cladding solutions that set new standards in architectural design….

#4 RISE Siding and Trim

Domain Est. 1995

Website: certainteed.com

Key Highlights: RISE Siding and Trim products are designed for demanding jobs. Quality synthetic fibers such as polyester, nylon, and fiberglass are core ingredients….

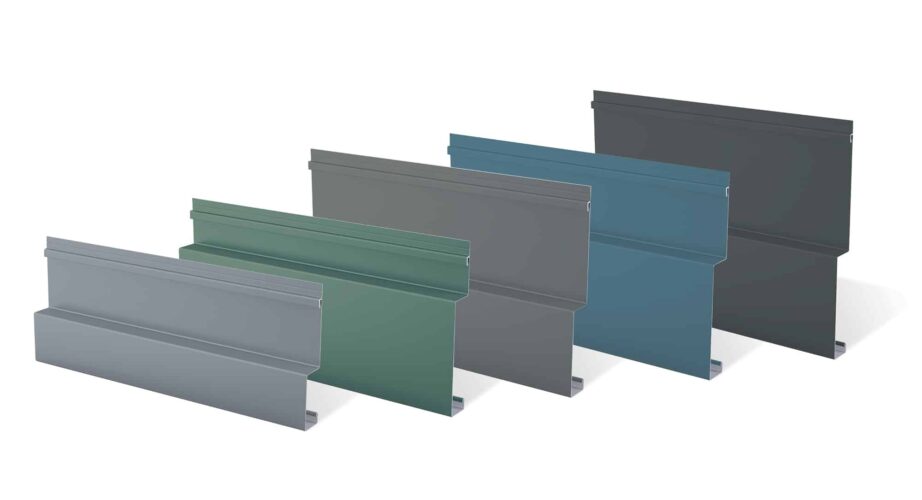

#5 Tamlyn

Domain Est. 1996

Website: tamlyn.com

Key Highlights: Versatile Trim Creates Modern Look Without Blowing the Budget. An off-the-shelf trim gives a mixed-used development a sleek, custom aesthetic. resilience ……

#6 Exterior Improvement Products

Domain Est. 1997

Website: kaycan.com

Key Highlights: Select aluminum for your home’s exterior and enhance its appeal with a wide range of aluminum claddings, soffits, moldings, and accessories. Our ……

#7 Fry Reglet

Domain Est. 1998 | Founded: 1949

Website: fryreglet.com

Key Highlights: Established in 1949, Fry Reglet engineers and manufactures precision architectural metal systems. We take pride in quality craftsmanship, ……

#8 Siding

Domain Est. 2000

Website: plygem.com

Key Highlights: Vinyl and aluminum product lines from the Ply Gem Portfolio of Brands are engineered to ensure exceptional durability, longevity and performance in all regions ……

#9 Engage Building Products

Domain Est. 2017

#10 Central States

Domain Est. 2020

Website: centralstatesco.com

Key Highlights: Central States is a 100% employee owned company who manufactures high quality metal roof, siding, and packages for buildings of all kinds….

Expert Sourcing Insights for Siding Aluminum Trim

H2: 2026 Market Trends for Siding Aluminum Trim

The global market for aluminum trim in siding applications is anticipated to experience steady growth through 2026, driven by shifting construction practices, material innovation, and sustainability demands. As part of the broader exterior building materials sector, aluminum trim—used for corners, window and door surrounds, and architectural detailing—is increasingly favored for its durability, low maintenance, and aesthetic versatility. Below is an analysis of key trends expected to shape the siding aluminum trim market in 2026.

1. Rising Demand in Residential and Commercial Construction

The expansion of urban infrastructure and the growth of both high-end residential developments and energy-efficient commercial buildings are key drivers. Aluminum trim complements modern architectural styles, including minimalist and industrial designs, and is commonly used with composite and fiber cement siding systems. In North America and Europe, renovation activities are boosting demand, while emerging markets in Asia-Pacific and the Middle East are seeing increased adoption due to urbanization and rising disposable incomes.

2. Emphasis on Sustainability and Recyclability

Aluminum’s high recyclability without loss of quality aligns with global green building standards such as LEED and BREEAM. As environmental regulations tighten and consumers prioritize eco-friendly materials, aluminum trim offers a competitive advantage over PVC and wood-based trims. By 2026, manufacturers are expected to emphasize closed-loop recycling and low-carbon production methods to meet corporate sustainability goals.

3. Technological Advancements and Coating Innovations

Improvements in powder coating and anodizing technologies enhance the weather resistance, color retention, and scratch resistance of aluminum trim. Pre-finished aluminum trims with factory-applied coatings reduce on-site labor and ensure consistent quality. Digital color matching and custom finishes are becoming more accessible, enabling architects and builders to achieve design-specific aesthetics. Integration with rainscreen and ventilated façade systems is also expected to grow.

4. Competitive Pressure from Alternative Materials

Despite its advantages, aluminum trim faces competition from PVC, uPVC, and composite trims, which are often lower in cost. However, aluminum’s superior strength-to-weight ratio, fire resistance, and longevity are key differentiators. By 2026, market players are likely to focus on cost optimization through efficient extrusion processes and economies of scale to maintain pricing competitiveness.

5. Regional Market Dynamics

– North America: Strong demand due to housing renovations and hurricane-resistant construction in coastal regions.

– Europe: Growth driven by energy efficiency mandates and architectural modernization.

– Asia-Pacific: Fastest-growing region, fueled by infrastructure development in China, India, and Southeast Asia.

– Middle East & Africa: Increasing use in high-rise developments and luxury projects.

6. Supply Chain Resilience and Raw Material Costs

Fluctuations in aluminum prices, influenced by energy costs and geopolitical factors, remain a concern. By 2026, manufacturers are expected to adopt diversified sourcing strategies, localized production, and long-term supply contracts to mitigate volatility. Investments in energy-efficient smelting and recycling will also help stabilize input costs.

7. Integration with Smart Building Systems

Emerging trends in smart homes and intelligent building envelopes may open new applications for aluminum trim. While not a primary function, aluminum’s conductivity and structural role could support integrated sensors or lighting systems in high-tech façades, positioning it as part of a broader ecosystem in future-ready buildings.

Conclusion

By 2026, the siding aluminum trim market will be characterized by innovation, sustainability, and geographic expansion. Companies that invest in advanced coatings, sustainable production, and design flexibility will be well-positioned to capture growing demand. As the construction industry evolves toward resilience and aesthetics, aluminum trim is set to remain a preferred choice for modern, high-performance building envelopes.

Common Pitfalls When Sourcing Siding Aluminum Trim (Quality, IP)

Sourcing aluminum trim for siding projects requires careful attention to quality and intellectual property (IP) considerations. Overlooking these factors can lead to performance issues, legal risks, and project delays. Below are key pitfalls to avoid:

Poor Material Quality and Finishes

One of the most frequent issues is receiving aluminum trim made from substandard alloys or with inadequate surface treatments. Low-grade aluminum may lack the necessary strength, corrosion resistance, or longevity for exterior applications. Additionally, inferior powder coatings or anodized finishes can fade, peel, or chalk prematurely when exposed to UV rays and weather. Buyers should verify material specifications (such as ASTM B209 for aluminum alloy) and request test reports for coating durability (e.g., AAMA 2605 standards).

Inconsistent Dimensional Accuracy

Aluminum trim components must fit precisely with other siding elements. Poorly manufactured trims with inconsistent bends, lengths, or profiles can lead to installation challenges, gaps, and compromised weather resistance. This often stems from using outdated or poorly maintained fabrication equipment. Always request samples and inspect dimensional tolerances before placing bulk orders.

Lack of Compliance with Building Codes and Standards

Some suppliers may offer products that do not meet regional building codes or performance standards (e.g., fire resistance, wind load ratings). Using non-compliant trim can result in failed inspections, liability issues, and costly rework. Ensure the supplier provides documentation showing compliance with relevant standards such as ICC-ES or local building regulations.

Intellectual Property Infringement

A significant but often overlooked risk is sourcing trim that copies patented designs or profiles. Some manufacturers replicate proprietary trims from well-known brands without authorization. Purchasing such products—even unknowingly—can expose contractors and developers to legal action for contributory infringement. Always verify that the trim design does not mimic patented profiles and request IP indemnification from the supplier.

Inadequate Supplier Transparency

Unreliable suppliers may withhold information about material sources, manufacturing processes, or coating certifications. This lack of transparency makes it difficult to assess product quality or trace issues if failures occur. Prioritize suppliers who openly share technical data sheets, mill certifications, and factory audit reports.

Insufficient Warranties and Support

Low-cost suppliers may offer limited or vague warranty terms, excluding coverage for color retention, corrosion, or workmanship. A robust warranty from a reputable manufacturer is a strong indicator of product confidence. Ensure warranty terms are clear, transferable, and backed by reliable customer support.

Avoiding these pitfalls requires due diligence in vetting suppliers, requesting physical samples, and verifying both quality standards and IP legitimacy before finalizing procurement.

Logistics & Compliance Guide for Siding Aluminum Trim

Overview and Product Classification

Siding aluminum trim is a lightweight, durable component used in exterior building applications to finish edges, corners, and transitions between different materials. Typically made from coil-coated aluminum alloys (such as 3003 or 5052), it is corrosion-resistant and designed for long-term exposure to weather. Proper logistics and regulatory compliance are essential for safe, efficient distribution and legal market access.

International Shipping and Packaging Standards

Aluminum trim must be securely packaged to prevent damage during transit. Standard practices include:

– Bundling lengths with protective corner guards and moisture-resistant wrapping.

– Securing bundles on wooden or composite pallets to prevent shifting.

– Using waterproof covers or shrink-wrapping to protect against humidity and precipitation.

– Labeling packages with handling instructions (e.g., “Fragile,” “This Side Up”) and product details (length, finish, alloy type).

For international shipments, compliance with ISPM 15 regulations for wooden packaging materials is required. Documentation must include commercial invoices, packing lists, and a bill of lading, all accurately describing the product under the appropriate HS code.

Customs Classification and Tariff Codes

Siding aluminum trim is typically classified under the Harmonized System (HS) code 7606.12.00 (Flat-Rolled Aluminum, not alloyed, over 0.2mm thick) or 7606.91.00 (Alloyed). Accurate classification is critical for determining import duties and regulatory requirements. Importers must verify country-specific tariff schedules, as rates vary by destination. For example, under US Harmonized Tariff Schedule (HTS), aluminum trim may fall under 7606.12.00.60 with applicable duties based on trade agreements or anti-dumping measures.

Regulatory Compliance – Building Codes and Standards

Siding aluminum trim must meet local and international building performance standards, including:

– ASTM B209: Standard specification for aluminum and aluminum-alloy sheet and plate.

– ASTM D3359: Adhesion testing for coil coatings.

– NFPA 285 or IBC Chapter 26: Fire performance requirements for exterior wall assemblies in high-rise or commercial buildings.

– Regional energy codes (e.g., IECC in the U.S.) may require thermal break integration or compatibility with insulation systems.

Manufacturers and suppliers should provide test reports and product data sheets confirming compliance with relevant standards.

Environmental and Safety Regulations

Aluminum trim production and distribution must adhere to environmental and worker safety regulations:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals – applicable to coatings and surface treatments.

– RoHS (EU): Restriction of Hazardous Substances – generally not applicable to raw aluminum but relevant if electronic components are integrated.

– OSHA (USA): Guidelines for safe handling, including protection against sharp edges and dust during cutting.

End-of-life recyclability should be communicated; aluminum is 100% recyclable, and suppliers should support circular economy principles.

Import/Export Documentation and Duties

Complete and accurate documentation is essential for customs clearance:

– Commercial Invoice (with value, quantity, and HS code)

– Packing List

– Certificate of Origin (to claim preferential tariffs under agreements like USMCA or CETA)

– Bill of Lading or Air Waybill

– Material Test Reports (MTRs) upon request

Importers must be aware of potential anti-dumping or countervailing duties, particularly on aluminum products from certain countries. Regular monitoring of U.S. DOC and CBP notices or EU Commission regulations is advised.

Transportation and Handling Best Practices

During transport and storage:

– Store in dry, ventilated areas off the ground to prevent moisture accumulation and staining.

– Avoid contact with dissimilar metals (e.g., steel) to prevent galvanic corrosion.

– Handle with gloves to minimize surface contamination and coating damage.

– Use appropriate lifting equipment for heavy pallets (typically 1,000–2,000 lbs per unit load).

Ground, sea, and air freight options depend on urgency, volume, and destination. Sea freight is most common for bulk shipments due to cost efficiency.

Certification and Quality Assurance

Reputable suppliers provide:

– Mill test certificates confirming alloy composition and mechanical properties.

– AAMA 2605 or AAMA 2604 compliance for high-performance organic coatings (excellent chalk resistance, color retention).

– Third-party inspection reports when required by project specifications.

Quality assurance programs should include in-process inspections and final verification before shipment.

Conclusion

Successful logistics and compliance for siding aluminum trim require attention to packaging, accurate classification, adherence to building and environmental standards, and thorough documentation. Proactive engagement with customs authorities and staying updated on trade regulations ensures smooth cross-border movement and market access.

In conclusion, sourcing aluminum siding trim requires careful consideration of quality, durability, aesthetics, cost, and supplier reliability. Aluminum trim offers numerous advantages, including resistance to corrosion, low maintenance, lightweight versatility, and a wide range of finishes and colors to complement various architectural styles. When selecting a supplier, it is essential to evaluate their reputation, product certifications, customization options, and availability of technical support. Additionally, comparing pricing, lead times, and sustainability practices can help ensure a cost-effective and environmentally responsible choice. By conducting thorough research and partnering with reputable manufacturers or distributors, builders and contractors can secure high-performance aluminum trim that enhances the longevity and visual appeal of exterior siding systems.