The global shrink packaging market is experiencing robust growth, driven by increasing demand across food & beverage, pharmaceutical, and e-commerce sectors. According to Mordor Intelligence, the shrink wrapping machine market was valued at USD 3.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by the need for durable, tamper-evident, and space-efficient packaging solutions, particularly as supply chains prioritize automation and sustainability. As consumer expectations and regulatory standards evolve, manufacturers are investing in advanced shrinking technologies that offer precision, energy efficiency, and integration with smart production lines. Against this backdrop, a select group of machine builders has emerged as industry leaders—innovating at the intersection of speed, reliability, and adaptability. The following list highlights the top nine shrinking machine manufacturers shaping the future of packaging, based on market presence, technological advancement, and customer adoption.

Top 9 Shrinking Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mr. Shrinkwrap

Domain Est. 1997

Website: mrshrinkwrap.com

Key Highlights: Mr Shrinkwrap is the trusted source for shrink wrap, shrink wrap supplies and shrink wrapping equipment from top manufacturers including Ripack and Shrinkfast ……

#2 Shrink Wrap Packaging Machine Manufacturer

Domain Est. 1998

Website: apack.com

Key Highlights: This machine is an online automatic shrink packing machine with automatic conveyance, advance, seal and heat shrinkage….

#3 Heat Shrink Wrap Machines

Domain Est. 2011

Website: uspackagingandwrapping.com

Key Highlights: We stock heat shrink wrapping machines for every packaging project, from industrial shrink wrap machines for high-volume orders to portable shrink wrap machines ……

#4 Dr. Shrink

Domain Est. 1997

Website: dr-shrink.com

Key Highlights: Dr. Shrink is the global leader in shrink wrap, and it doesn’t stop at just the products to make it possible. Our extensive How-To library is always growing….

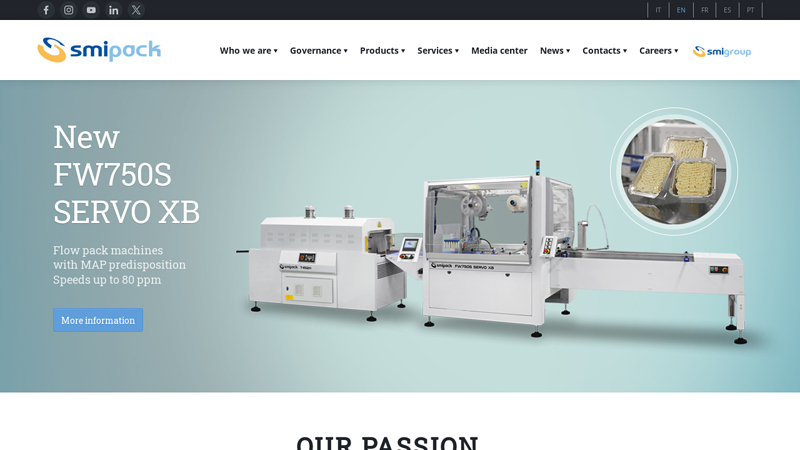

#5 Packaging machines – Shrinkwrappers – Smipack

Domain Est. 1998

Website: smipack.it

Key Highlights: The new shrink wrapper model that combines high performance and sustainability in a single packaging solution….

#6 DSG

Domain Est. 2000

Website: dsgcanusa.com

Key Highlights: DSG-Canusa has been developing and producing high-quality heat shrink tubing, cold-applied accessories and heat shrink equipment for over 50 years….

#7 All Shrink Packaging

Domain Est. 2006

Website: technopackcorp.com

Key Highlights: 4–9 day deliveryWe have a large selection of JORES TECHNOLOGIES® machinery for various packaging operations. Choose from hand-operated heat guns, manual shrink sealers, ……

#8 Shrink Wrapping & Packaging Machines and Equipment For Sale

Domain Est. 2019

Website: maripakusa.com

Key Highlights: Experience Maripak’s elite shrink wrapping solutions: semi-auto, high-speed, custom machines. From shrink film bundling to POF machines, we’ve got you ……

#9 Shrink Wrapping Machines Made in Italy

Website: pactur.eu

Key Highlights: 100% Made in Italy. Pactur offers a range of shrink wrapping machines and equipment to help businesses increase production and efficiency….

Expert Sourcing Insights for Shrinking Machine

H2: 2026 Market Trends for Shrinking Machines

The global shrinking machine market is poised for substantial evolution by 2026, driven by advancements in automation, sustainability demands, and shifting packaging needs across industries. Below are the key trends expected to shape the shrinking machine landscape in 2026:

-

Increased Demand from E-Commerce and Food & Beverage Sectors

The exponential growth of e-commerce continues to fuel demand for durable, compact, and visually appealing packaging. Shrinking machines offer efficient solutions for product bundling, tamper evidence, and moisture protection—critical for online shipments. Simultaneously, the food and beverage industry remains the largest end-user, with rising consumer preference for ready-to-eat meals and single-serve packaging driving investment in high-speed shrink packaging lines. -

Adoption of Energy-Efficient and Eco-Friendly Technologies

Sustainability is a major driver. By 2026, manufacturers are expected to prioritize energy-efficient shrinking machines that consume less power and heat, reducing both operational costs and environmental impact. Additionally, there is a growing shift toward recyclable and biodegradable shrink films (e.g., polyolefin and PLA-based materials), prompting machine redesigns to accommodate lower-temperature sealing and compatibility with eco-friendly films. -

Integration of Automation and IoT (Industry 4.0)

Smart manufacturing trends are transforming shrinking machine operations. By 2026, an increasing number of systems will be equipped with IoT sensors, predictive maintenance features, and real-time monitoring capabilities. This enables remote diagnostics, reduced downtime, and seamless integration into fully automated packaging lines, enhancing overall operational efficiency. -

Miniaturization and Customization for SMEs

While large manufacturers dominate the market, small and medium-sized enterprises (SMEs) are increasingly adopting compact, modular shrinking machines. These units offer lower entry costs, space efficiency, and flexibility for custom-sized packages—catering to niche markets and personalized consumer products. This trend supports the democratization of advanced packaging technology. -

Geographic Shifts and Emerging Market Growth

Asia-Pacific, particularly countries like China, India, and Vietnam, is expected to witness the highest growth in shrinking machine adoption due to rising industrialization, urbanization, and local manufacturing incentives. Latin America and Africa are also emerging as promising markets, driven by expanding food processing industries and modern retail infrastructure. -

Focus on Hygiene and Safety in Medical and Pharmaceutical Packaging

The medical and pharmaceutical sectors are increasingly utilizing shrink-wrapping for sterile barrier systems. By 2026, shrinking machines designed for cleanroom environments with high hygiene standards—featuring stainless steel construction, easy cleanability, and compliance with FDA and ISO regulations—will see increased demand. -

Technological Innovation in Shrink Tunnel Design

Innovations such as variable frequency drives (VFD), adjustable conveyor speeds, and precise temperature control are enhancing shrink tunnel performance. Additionally, hybrid systems combining shrinking with labeling or coding are gaining popularity, enabling all-in-one packaging solutions.

In conclusion, the shrinking machine market in 2026 will be defined by smart, sustainable, and adaptable solutions. Companies that invest in energy efficiency, digital integration, and customization will be best positioned to capitalize on evolving consumer and industrial needs.

Common Pitfalls When Sourcing a Shrinking Machine (Quality and Intellectual Property)

Sourcing a shrinking machine, especially from international or unfamiliar suppliers, can present several risks related to product quality and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, increased costs, legal disputes, and reputational damage. Below are key areas to watch for:

Poor Build Quality and Material Standards

One of the most frequent issues is receiving a shrinking machine constructed with substandard materials or poor workmanship. Low-cost suppliers may use inferior stainless steel, weak frame structures, or low-grade electrical components to cut costs. This compromises the machine’s durability, safety, and performance, leading to frequent breakdowns, higher maintenance costs, and potential downtime in production lines.

Inaccurate Performance Specifications

Suppliers may exaggerate machine capabilities—such as shrink tunnel temperature ranges, conveyor speed, or energy efficiency—on paper. Actual performance often falls short, especially under continuous operation. Without third-party verification or on-site testing, buyers may end up with equipment that fails to meet production requirements, impacting throughput and product quality.

Lack of Compliance with Safety and Industry Standards

Especially when sourcing from regions with less stringent regulations, shrinking machines may not comply with essential safety certifications (e.g., CE, UL, or ISO standards). Non-compliant machines pose safety risks to operators and may not be legally permitted for use in certain markets, resulting in costly delays or forced modifications.

Inadequate After-Sales Support and Spare Parts Availability

Many suppliers, particularly smaller or offshore manufacturers, offer limited technical support, training, or access to spare parts. When a machine breaks down, delays in obtaining replacements or expert assistance can halt production. This pitfall is often overlooked during procurement but becomes critical during long-term operation.

Intellectual Property Infringement Risks

Sourcing from manufacturers who replicate patented designs or use proprietary technology without authorization exposes buyers to legal liability. Even if unintentional, purchasing an infringing machine can result in cease-and-desist orders, fines, or forced equipment replacement. This is especially common with “copycat” machines that closely resemble branded models but lack proper licensing.

Use of Counterfeit or Unauthorized Components

Some machines incorporate counterfeit or unlicensed control systems, sensors, or drive motors (e.g., fake Siemens or Mitsubishi parts). These components are unreliable and can void warranties on other integrated equipment. They also pose cybersecurity and safety risks, particularly in automated or networked production environments.

Absence of Clear IP Ownership and Documentation

Contracts may fail to specify who owns customizations, software, or modifications made to the machine. This ambiguity can lead to disputes if the buyer wants to replicate the design or switch suppliers. Additionally, missing technical documentation (e.g., CAD files, schematics) limits the buyer’s ability to service or upgrade the machine independently.

Insufficient Verification and Due Diligence

Relying solely on promotional materials or supplier claims without independent audits, factory inspections, or reference checks increases the risk of encountering the above issues. Buyers who skip due diligence often discover quality or IP problems only after the machine is delivered and installed.

To mitigate these risks, conduct thorough supplier vetting, require compliance certifications, include IP clauses in contracts, and consider third-party inspections before shipment.

Logistics & Compliance Guide for Shrinking Machine

Product Overview and Specifications

Before initiating logistics and compliance procedures, ensure detailed knowledge of the shrinking machine’s technical specifications, including dimensions, weight, power requirements, and operational components. This information is crucial for transportation planning, customs documentation, and regulatory compliance.

International Shipping Requirements

When shipping a shrinking machine internationally, prepare commercial invoices, packing lists, and a bill of lading or air waybill. Include the correct HS (Harmonized System) code—typically under heading 8422 (machines for cleaning, filling, sealing, capping, etc.)—to ensure accurate tariff classification and customs clearance.

Export Controls and Permits

Verify whether the shrinking machine contains controlled components or technology subject to export regulations such as EAR (Export Administration Regulations) in the U.S. or similar frameworks in other countries. Most standard industrial shrinking machines do not require special licenses, but automated or high-tech models may need an export license.

Packaging and Handling Instructions

Securely package the shrinking machine using wooden crates or heavy-duty pallets to prevent damage during transit. Include shock and tilt indicators if shipping sensitive models. Clearly label packages with handling instructions such as “Fragile,” “This Side Up,” and “Do Not Stack.”

Import Compliance and Duties

Upon arrival in the destination country, the importer must comply with local regulations. This includes paying applicable import duties, VAT, and any product conformity assessments. Some countries may require conformity to local electrical safety standards (e.g., CE in Europe, UKCA in the UK, or CCC in China).

Electrical and Safety Compliance

Ensure the shrinking machine meets the electrical standards of the destination market. Voltage, plug type, and frequency must align with local requirements. Machines should carry recognized safety certifications (e.g., CE, UL, CSA) as required by the importing country.

Installation and On-Site Compliance

Coordinate with the end user or local agent for proper installation. Verify that the machine operates in compliance with local occupational health and safety regulations. Provide technical documentation, user manuals, and safety warnings in the local language if required.

Warranty and After-Sales Support Logistics

Include information on warranty terms, spare parts availability, and service support. Establish a logistics plan for delivering replacement parts and servicing equipment, especially for international customers, to ensure compliance with service-level agreements.

Disposal and Environmental Regulations

Advise customers on proper end-of-life disposal in accordance with local environmental laws. Shrinking machines may contain recyclable materials or components subject to WEEE (Waste Electrical and Electronic Equipment) directives in certain regions.

Documentation and Recordkeeping

Maintain comprehensive records of all shipping documents, compliance certifications, export licenses (if applicable), and customer communications for a minimum of five years to satisfy audit and regulatory requirements.

In conclusion, sourcing a shrinking machine requires careful consideration of various factors such as production needs, product specifications, operational efficiency, and budget constraints. It is essential to evaluate different types of shrinking machines—such as L-bar sealers, chamber sealers, and automatic shrink tunnels—based on the volume and nature of packaging operations. Additionally, assessing the machine’s durability, ease of maintenance, energy efficiency, and compatibility with existing production lines ensures long-term reliability and cost-effectiveness.

Supplier credibility, after-sales support, warranty terms, and availability of spare parts also play a crucial role in making a sound investment. By conducting thorough market research, comparing multiple vendors, and possibly testing equipment through samples or trials, businesses can select a shrinking machine that enhances packaging quality, improves throughput, and supports sustainable operational growth. Ultimately, a well-sourced shrinking machine contributes significantly to product presentation, shelf life, and overall customer satisfaction.