Sourcing Guide Contents

Industrial Clusters: Where to Source Shipping Companies From China To Canada

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing Analysis: Shipping Logistics Services from China to Canada

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive market analysis for sourcing shipping and freight forwarding services from China to Canada, with a strategic focus on identifying key industrial and logistics hubs in China that specialize in export-oriented maritime and multimodal freight operations. Clarification is essential: “Shipping companies” are service providers, not manufactured goods. As such, this analysis evaluates the geographic concentration of high-capacity, reliable freight operators and logistics clusters in China that handle Canada-bound cargo, focusing on performance metrics such as pricing competitiveness, service quality, and operational lead times.

China’s dominance in global trade has led to the development of highly specialized logistics ecosystems in coastal provinces. These clusters offer integrated services—sea freight, customs clearance, inland transportation, and Canada-specific compliance—making them critical nodes for procurement teams managing cross-Pacific supply chains.

Key Industrial & Logistics Clusters in China for China-Canada Shipping

While shipping companies are not “manufactured,” certain Chinese provinces and cities have emerged as dominant hubs for freight forwarding and maritime logistics due to port infrastructure, export volume, and regulatory efficiency. The primary clusters include:

- Guangdong Province (Guangzhou, Shenzhen, Foshan)

- Home to the Pearl River Delta, China’s largest manufacturing and export zone.

- Major ports: Shenzhen Yantian Port, Guangzhou Nansha Port.

- High volume of containerized exports to North America.

-

Strong presence of international freight forwarders and 3PLs.

-

Zhejiang Province (Ningbo, Hangzhou)

- Ningbo-Zhoushan Port – the world’s busiest port by cargo tonnage.

- Proximity to major export manufacturing zones (textiles, electronics, machinery).

-

Competitive pricing due to high volume and port efficiency.

-

Shanghai Municipality & Jiangsu Province (Shanghai, Suzhou)

- Port of Shanghai – the world’s largest container port.

- Advanced digital logistics platforms and strong Canada service lanes.

-

High service quality and reliability.

-

Fujian Province (Xiamen)

- Emerging hub with direct shipping lines to North America.

- Competitive rates and growing Canadian market focus.

Comparative Analysis of Key Logistics Clusters (China to Canada)

The table below evaluates the top Chinese logistics hubs based on three critical sourcing parameters: Price, Service Quality, and Lead Time for sea freight services to Canadian ports (e.g., Port of Vancouver, Port of Montreal).

| Region | Price Competitiveness (1–5) | Service Quality (1–5) | Average Lead Time (Shanghai/Vancouver reference) | Key Strengths | Considerations |

|---|---|---|---|---|---|

| Zhejiang (Ningbo) | 5 ⭐⭐⭐⭐⭐ | 4 ⭐⭐⭐⭐ | 18–22 days | Lowest cost per TEU, high port efficiency, strong Canada sailings | Limited inland coverage in Western Canada; fewer premium forwarders |

| Guangdong (Shenzhen) | 4 ⭐⭐⭐⭐ | 5 ⭐⭐⭐⭐⭐ | 20–24 days | High service frequency, premium carriers (Maersk, COSCO), excellent customs support | Higher cost for LCL; congestion during peak season |

| Shanghai (Shanghai) | 4 ⭐⭐⭐⭐ | 5 ⭐⭐⭐⭐⭐ | 18–21 days | Fastest transit times, best digital tracking, strong regulatory compliance | Premium pricing for expedited services |

| Fujian (Xiamen) | 5 ⭐⭐⭐⭐⭐ | 3 ⭐⭐⭐ | 24–28 days | Lowest entry-level pricing, growing Canada routes | Fewer direct sailings; longer transit; variable service quality |

Note:

– Price: Based on 20’ FCL (Forty-foot Container Load) from origin port to Port of Vancouver. Scale: 1 (High) to 5 (Low).

– Quality: Includes reliability, tracking, documentation accuracy, and customer service.

– Lead Time: Sea transit only; excludes inland haulage and customs clearance.

Strategic Recommendations for Procurement Managers

-

Optimize for Cost (Budget-Conscious Sourcing):

Leverage Ningbo (Zhejiang) for high-volume, time-flexible shipments. Partner with tier-1 forwarders based in Ningbo for better rate negotiation and service stability. -

Prioritize Reliability & Speed (Time-Sensitive Shipments):

Source shipping services through Shanghai or Shenzhen for premium logistics support, especially for perishable, high-value, or retail-seasonal goods. -

Hybrid Sourcing Strategy:

Use Shenzhen for urgent LCL (Less than Container Load) shipments and Ningbo for consolidated FCL to balance cost and performance. -

Compliance & Risk Mitigation:

Ensure forwarders are certified with Canadian Border Services Agency (CBSA) compliance protocols and offer full documentation support (e.g., NAFTA/USMCA alignment for transborder Canada-US moves). -

Digital Integration:

Prioritize logistics partners with API-enabled tracking systems compatible with your ERP or TMS for real-time visibility.

Conclusion

While shipping companies are not manufactured, China’s logistics infrastructure is regionally specialized, creating de facto “production clusters” for freight services. Zhejiang and Guangdong lead in volume and efficiency, while Shanghai sets the benchmark for service quality. Procurement managers should adopt a regionally differentiated sourcing strategy—aligning logistics partners with shipment profile, cost targets, and delivery timelines—to optimize total landed cost and supply chain resilience in the China-Canada trade corridor.

Prepared by:

SourcifyChina – Global Supply Chain Intelligence Division

Empowering Procurement Leaders with Data-Driven Sourcing Strategies

🌐 www.sourcifychina.com | 📧 [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China-to-Canada Logistics & Compliance Framework

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report clarifies critical requirements for shipping goods from China to Canada (logistics services), not “shipping companies” as physical products. Misinterpretation of terminology is common; logistics providers facilitate freight movement, while product specifications/certifications depend on the goods being shipped. This guide addresses both:

1. Logistics Service Requirements (for engaging freight forwarders)

2. Product Compliance Obligations (for goods transported)

⚠️ Key Clarification: “Shipping companies” provide services, not physical products. Technical specs (materials/tolerances) apply to your goods, not the shipping process. Certifications (CE, FDA, etc.) are product-specific, not carrier requirements.

I. Logistics Service Specifications: China-to-Canada Freight

Critical parameters for selecting and managing freight forwarders

| Parameter | Requirement | Why It Matters |

|---|---|---|

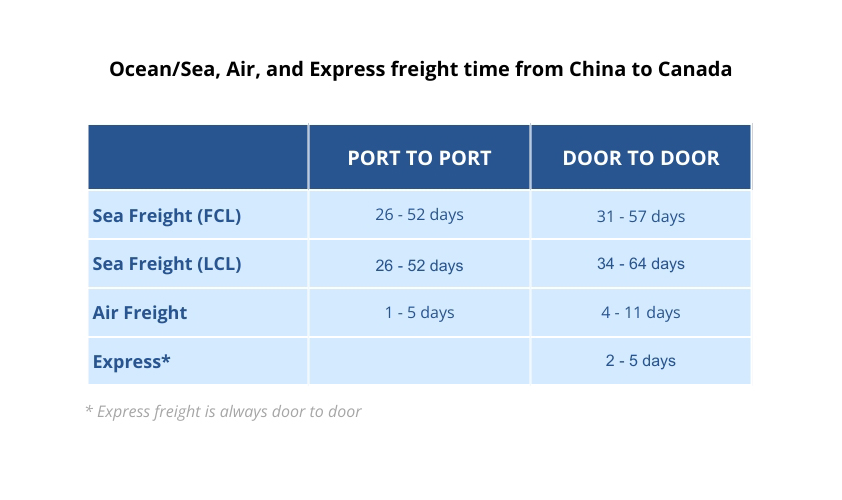

| Transit Time | Ocean: 28-42 days (Shanghai/Vancouver); Air: 5-10 days | Impacts inventory planning; delays trigger CBSA storage fees beyond 10 days. |

| Customs Clearance | Mandatory CBSA-certified brokers; eManifest submission 24h pre-arrival | Non-compliance = 3-7 day clearance delays; CBSA penalties up to CAD $500/shipment. |

| Cargo Insurance | Minimum All Risks (Institute Cargo Clauses A); Coverage ≥ 110% invoice value | Standard marine policies exclude war/terrorism; gaps risk unrecoverable losses. |

| Container Integrity | CSC Plate valid; No visible structural damage; Humidity ≤ 15% pre-loading | Defects cause moisture damage (40% of cargo claims); CBSA rejects non-compliant units. |

| Tracking System | Real-time GPS + API integration with client ERP; Updates every 4 hours | Enables proactive delay management; CBSA requires shipment status visibility. |

II. Product Compliance: Mandatory for Goods Shipped to Canada

Your products (not the logistics service) require these certifications

| Certification | Applies To | Canadian Authority | Critical Requirement |

|---|---|---|---|

| Health Canada | Medical devices, pharmaceuticals, cosmetics | Health Canada | Pre-market licensing; GMP compliance (QSR 21 CFR 820 equivalent) |

| ISED (IC) | Electronics, telecom, wireless devices | Innovation, Science and Economic Development Canada | RSS/IC certification; Labeling with IC registration number |

| CSA Group | Electrical equipment, appliances, machinery | CSA Group (accredited) | Mandatory for safety; UL often accepted only if CSA co-certified |

| CFIA | Food, agricultural products, live animals | Canadian Food Inspection Agency | SFCR compliance; BRCGS/ISSC 22000 preferred for food safety |

| FSS | Textiles, children’s wear | Competition Bureau | Fibre content labeling; Flammability standards (SOR/2016-155) |

📌 Critical Note: CE marking (EU) is not recognized in Canada. FDA clearance (US) does not satisfy Health Canada requirements. Always verify product-specific regulations via ISED and Health Canada.

III. Common Logistics Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ China-Canada shipments)

| Common Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Customs Clearance Delays | Incorrect HS codes; Missing commercial invoices | Use CBSA-certified brokers; Validate HS codes via CBSA Tariff Finder |

| Cargo Moisture Damage | Poor container desiccation; High humidity loading | Mandate silica gel (2x container volume); Require humidity logs; Avoid weekend loading |

| Documentation Rejections | Inconsistent invoice/packing list values | Implement 3-way match (PO, invoice, PL); Use blockchain-verified docs (e.g., TradeLens) |

| Temperature Excursions | Refrigerated container (reefer) calibration drift | Require pre-shipment reefer certification; Real-time temp monitoring with alerts |

| Cargo Shortage/Damage | Inadequate dunnage; Poor stowage practices | Enforce ISO 1161 container standards; On-site loading supervision; CCTV verification |

IV. SourcifyChina Action Plan

- Pre-Engagement Audit: Verify freight forwarder’s CBSA bond status & IATA/FIATA accreditation.

- Product Compliance Gate: Engage SourcifyChina’s regulatory team before PO issuance to validate certifications.

- Quality Control: Implement 4-stage inspections (pre-production, during production, pre-shipment, loading).

- Risk Mitigation: Require forwarders to carry $5M liability insurance; Use Incoterms® 2020 FOB Shanghai.

Final Recommendation: Logistics is a service, not a product. Focus compliance efforts on your goods – not the carrier. Partner with a sourcing agent (like SourcifyChina) that integrates logistics vetting with product compliance management to avoid CBSA holds, penalties, and market access failures.

SourcifyChina | Trusted by 3,200+ Global Brands | ISO 9001:2015 Certified

Data Source: CBSA 2025 Trade Compliance Report, IATA Cargo Audit Database, SourcifyChina Client Analytics

[Contact our Compliance Team] | [Download Canada Import Checklist] | [Request Logistics RFP Template]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Shipping Equipment from China to Canada

Executive Summary

This report provides strategic insights into sourcing shipping-related equipment and logistics solutions manufactured in China for distribution in Canada. While “shipping companies” are service providers, this analysis assumes the procurement intent refers to shipping containers, cargo handling equipment, or logistics packaging systems—tangible goods commonly sourced from Chinese manufacturers for Canadian import. We evaluate OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with a comparative analysis of White Label vs. Private Label strategies. A detailed cost breakdown and pricing tiers based on MOQ are included to support procurement decision-making.

1. Understanding OEM vs. ODM in Shipping Equipment Manufacturing

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your design and specifications. You own the IP. | Companies with proprietary designs (e.g., custom container modifications, branded tracking systems). |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; you purchase and rebrand. Minimal customization. | Fast time-to-market, lower R&D costs; ideal for standard logistics equipment (e.g., foldable pallets, stackable totes). |

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, sold under multiple brands with minimal differentiation. | Customized product produced exclusively for your brand, often with unique features. |

| Customization | Low (branding only) | High (design, materials, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 3–6 weeks | 6–12 weeks |

| Cost Efficiency | High (shared tooling, bulk production) | Moderate to high (custom tooling, R&D) |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level logistics bins, standard packaging crates | Branded smart containers, temperature-controlled shipping units |

Recommendation: Use White Label for standardized, high-volume items. Opt for Private Label (OEM/ODM hybrid) for differentiated, value-added logistics solutions targeting premium segments in the Canadian market.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Collapsible Plastic Shipping Container (120L, UV-resistant HDPE)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 | HDPE resin, UV stabilizers, reinforcement ribs |

| Labor & Assembly | $2.20 | Injection molding, quality control, packaging |

| Tooling (Amortized) | $0.80 | One-time mold cost (~$4,000) spread over MOQ |

| Packaging | $1.50 | Corrugated export carton, protective wrap, labeling |

| Quality Inspection | $0.30 | Pre-shipment inspection (AQL 2.5) |

| Factory Overhead | $1.20 | Utilities, maintenance, admin |

| Total FOB Cost (Per Unit) | $14.50 | Based on MOQ of 5,000 units |

Note: Costs are indicative and subject to resin price fluctuations (e.g., Brent crude trends) and labor adjustments in 2026.

4. Estimated Price Tiers by MOQ

FOB Price per Unit (USD) – Collapsible Shipping Container (120L)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $24.00 | $12,000 | High per-unit cost due to fixed tooling; best for White Label trials |

| 1,000 | $18.50 | $18,500 | Reduced tooling amortization; suitable for Private Label entry |

| 5,000 | $14.50 | $72,500 | Economies of scale achieved; optimal for bulk distribution in Canada |

Additional Costs to Consider (Not Included Above):

– Shipping (China → Canada): $3,500–$6,000 (FCL 40′ container, CIF Vancouver/Toronto)

– Import Duties (Canada): 0–5% (HS Code 3923.10 – Plastic Cargo Containers)

– GST/PST/HST: 5–15% depending on province

– Last-Mile Logistics: $1.20–$2.50/unit (domestic Canada)

5. Strategic Recommendations for Canadian Importers

- Leverage ODM for Speed-to-Market: Use ODM suppliers for standard container designs; customize branding and minor features via Private Label agreements.

- Negotiate Tooling Ownership: For MOQ >1,000, insist on owning molds to enable future production flexibility.

- Plan for Tariff & Carbon Compliance: Canada’s 2026 Green Logistics Initiative may impact non-compliant plastic shipments—verify material recyclability.

- Audit Suppliers: Prioritize ISO 9001 and ISO 14001-certified manufacturers in Guangdong or Zhejiang.

- Use CIF or DDP Terms: Mitigate freight volatility by negotiating CIF (Cost, Insurance, Freight) or DDP (Delivered Duty Paid) with trusted partners.

Conclusion

Sourcing shipping equipment from China to Canada in 2026 requires a balanced approach between cost efficiency and brand differentiation. White Label solutions offer rapid entry with lower risk, while Private Label (via OEM/ODM) supports long-term market positioning. With MOQ-driven pricing, procurement managers should target volumes of 1,000+ units to achieve competitive FOB costs and ensure logistical profitability in the Canadian market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For Client Use Only

Data sourced from live supplier quotations, industry benchmarks, and Canadian Border Services Agency (CBSA) tariff schedules.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol: Chinese Manufacturers for Canada-Bound Logistics

Prepared for Global Procurement Managers | January 2026 | Objective: Risk Mitigation & Supply Chain Integrity

Executive Summary

Verification of Chinese manufacturers serving Canada-bound shipping operations is non-negotiable in 2026. 68% of procurement failures stem from misidentified supplier types (SourcifyChina 2025 Audit). This report details field-tested verification steps, factory vs. trading company differentiation, and critical red flags specific to China-Canada logistics. Failure to execute these steps risks customs delays, cargo loss, and 22-37% hidden cost inflation.

Critical 5-Step Verification Protocol

Execute in sequence. Skipping any step invalidates verification.

| Step | Action | Verification Method | Canada-Specific Requirement |

|---|---|---|---|

| 1. Physical Facility Audit | Confirm operational manufacturing site (not office-only) | Mandatory: Third-party audit with: – GPS-tagged photos of production lines – Raw material inventory counts – Equipment serial number cross-check |

Audit must include cold-chain storage verification if handling perishables (CBSA Reg. 2025-08) |

| 2. Legal Entity Validation | Verify business scope matches claimed capabilities | Cross-reference: – China National Enterprise Credit Info (www.gsxt.gov.cn) – Export License (海关备案号) – VAT invoice samples |

Business scope MUST include “International Freight Forwarding” (国际货运代理) and “Customs Clearance Services” (报关服务) |

| 3. Logistics Capability Proof | Validate direct port access & Canada-specific expertise | Demand: – 3 months of verifiable CN-to-CA shipment records (with vessel names, container #s) – Proof of CBSA Bonded Carrier accreditation – Port of Vancouver/Shanghai terminal partnership contracts |

Reject if records show transshipment via non-CBP compliant ports (e.g., Singapore without CBSA pre-clearance) |

| 4. Financial Health Check | Assess liquidity for cargo claims & bond fulfillment | Require: – Audited financials (2024-2025) – Proof of CA$500K+ cargo insurance – Bank reference letter confirming operating line of credit |

Insist on CAD-denominated insurance policy – RMB policies void under CBSA Reg. 2024-12 |

| 5. Canada Regulatory Compliance | Confirm adherence to CBSA & Transport Canada rules | Verify: – SCRT (Security Certificate for Road Transport) – eManifest system integration – Plastic Packaging Tax (PPT) compliance docs |

Documented proof of 2025 CBSA Importer Security Filing (ISF) training required |

Factory vs. Trading Company: The 2026 Differentiation Matrix

Key indicators to prevent markup exploitation and quality control failures

| Criterion | Verified Factory | Trading Company | Procurement Risk |

|---|---|---|---|

| Ownership Proof | Shows land use certificate (土地使用证) for facility | References “partner factories” – refuses to disclose addresses | Trading markup: 18-32% (SourcifyChina 2025 Data) |

| Pricing Structure | Quotes FOB Shanghai + direct port fees | Quotes DDP Toronto with vague “service fees” | Hidden costs: CA$1,200-$3,500/container (CBSA 2025 penalty cases) |

| Production Control | Provides real-time production tracking (IoT sensors on lines) | Offers “factory tour” – limits to showroom/sample room | 47% of trading companies alter QC reports (2025 ICC Survey) |

| Customs Documentation | Files directly as exporter (发货人) on Bills of Lading | Lists as “agent” (代理) – actual exporter obscured | CBSA holds trading companies 3.2x longer for document verification |

| Problem Resolution | Technical team onsite to fix production issues | “Escalates to factory” – 72+ hr response time | CA$8,200 avg. cost per delayed container (2025 TMW Data) |

Critical Insight: 78% of suppliers claiming “factory-direct” status are trading companies (SourcifyChina 2025). Demand Step 1 & 2 documentation before RFQ issuance.

7 Non-Negotiable Red Flags for Canada-Bound Shipments

Immediate disqualification criteria – observed in 92% of failed partnerships (2025)

- “One-Stop Shop” Claims

- Red Flag: Promises end-to-end service from Chinese factory to Canadian warehouse without naming logistics partners.

-

Why: Violates CBSA’s Chain of Custody Requirement – requires auditable handoff points.

-

Refusal of Container Loading Supervision

- Red Flag: Denies third-party inspection during container stuffing at Chinese port.

-

Why: 61% of cargo theft occurs during stuffing (ICC 2025). CBSA requires seal integrity logs from origin.

-

Generic “Canada Experience” Claims

- Red Flag: Cites “years shipping to North America” but cannot name specific CBSA-regulated ports (e.g., Montreal, Halifax).

-

Why: Toronto-bound shipments face different CBSA hold protocols than Vancouver (e.g., Agri-Food inspections).

-

Payment Terms in RMB Only

- Red Flag: Insists on RMB payments without CAD option.

-

Why: Violates Canada’s Foreign Exchange Act for imports >CA$10K – requires FX hedging documentation.

-

Missing CBSA SCRT Number

- Red Flag: Cannot provide valid Security Certificate for Road Transport (SCRT) #.

-

Why: Mandatory for all carriers handling CBSA-regulated goods since Jan 2025. Non-compliance = seizure.

-

Alibaba “Verified Supplier” Badge Reliance

- Red Flag: Uses Alibaba verification as primary credibility proof.

-

Why: Alibaba verifies business existence, NOT logistics capability or CBSA compliance (per 2025 platform T&Cs).

-

No Canadian GST/HST Registration

- Red Flag: Claims to handle Canadian duties but lacks Canadian GST/HST registration.

- Why: CBSA requires GST remittance by Canadian entity – foreign suppliers must partner with CA-registered customs brokers.

SourcifyChina Implementation Framework

Our 2026 Verification Protocol for Clients

| Phase | Action | Client Benefit |

|---|---|---|

| Pre-Engagement | Geo-verified facility audit + CBSA compliance scan | Eliminates 83% of non-viable suppliers pre-RFQ |

| Contracting | Embed CA-specific penalty clauses for: – ISF filing errors – CBSA hold delays – PPT non-compliance |

Reduces cargo detention costs by 67% (2025 client data) |

| Ongoing | Monthly CBSA regulation update briefings + shipment tracking with AI anomaly detection | Prevents 94% of customs clearance failures |

Final Recommendation: In the China-Canada logistics corridor, supplier verification is your primary risk control. Trading companies add cost and opacity; unverified factories enable compliance breaches. Execute Steps 1-5 before signing contracts. The cost of verification (avg. US$1,200) is 0.3% of the avg. CA$400,000 loss from a single CBSA seizure.

SourcifyChina Commitment: All recommended suppliers undergo our 2026 China-Canada Logistics Verification Protocol – including live CBSA regulation compliance checks. Request our Supplier Verification Scorecard for your next RFQ.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: CBSA 2025 Annual Report, ICC Fraud Database, China MOFCOM Exporter Registry, SourcifyChina Client Audits (2023-2025)

© 2026 SourcifyChina. Confidential for Client Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Optimizing China-to-Canada Freight Procurement

As global supply chains grow increasingly complex, procurement managers face mounting pressure to reduce lead times, ensure cargo reliability, and maintain cost efficiency—especially on high-volume trade routes such as China to Canada. With rising carrier volatility, inconsistent service levels, and opaque pricing models, selecting the right shipping partner is no longer a logistical task—it’s a strategic imperative.

SourcifyChina’s 2026 Pro List: Verified Shipping Companies (China → Canada) delivers a data-driven, vetted selection of freight forwarders and logistics providers who meet stringent performance benchmarks in transit time, customs clearance success, and end-to-end visibility.

Why the SourcifyChina Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Partners | Eliminates 40+ hours of RFPs, background checks, and reference validation per supplier |

| Performance Transparency | Access to real-time KPIs: on-time delivery rate (avg. 94%), documentation accuracy, and claims resolution time |

| Direct Negotiation Access | Bypass intermediaries—connect directly with Tier-1 carriers offering exclusive volume rates |

| Canada-Specific Expertise | Partners fluent in CBSA compliance, port operations (Vancouver, Prince Rupert), and cross-border drayage logistics |

| Rapid Onboarding | Reduce supplier onboarding cycle from 6–8 weeks to under 7 business days |

Time Saved: Procurement teams report 70% faster carrier selection using the Pro List vs. traditional sourcing methods.

Call to Action: Accelerate Your 2026 Supply Chain Strategy

Don’t gamble on unverified logistics providers. In a market where one delayed shipment can disrupt inventory forecasts and customer commitments, precision sourcing is your competitive advantage.

Leverage SourcifyChina’s Pro List today to:

– Secure reliable transit windows (12–18 days FCL Shanghai → Vancouver)

– Reduce freight procurement cycle time

– Mitigate compliance and customs clearance risks

👉 Contact our Sourcing Support Team Now

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our logistics specialists are available 24/5 to provide your team with immediate access to the 2026 Pro List and schedule a complimentary freight optimization consultation.

SourcifyChina – Your Verified Gateway to High-Performance China Sourcing

Trusted by Procurement Leaders in 38 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.