The global shell and tube heat exchangers market is experiencing steady growth, driven by rising demand across key industries such as oil & gas, power generation, chemical processing, and HVAC. According to Grand View Research, the global heat exchangers market size was valued at USD 24.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030, with shell and tube configurations maintaining a significant share due to their durability, efficiency, and adaptability to high-pressure applications. Similarly, Mordor Intelligence projects a CAGR of approximately 5.8% for the global heat exchanger market during the forecast period of 2023–2028, citing increased industrialization and energy infrastructure investments as key drivers. As demand for energy-efficient and reliable thermal management solutions intensifies, leading manufacturers are innovating in design, materials, and customization to meet stringent industry standards. In this competitive landscape, a select group of global manufacturers have emerged as leaders, setting benchmarks in performance, scalability, and technological advancement.

Top 10 Shell And Tube Heat Exchangers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Tranter: Responsive Heat Exchangers

Domain Est. 1995

Website: tranter.com

Key Highlights: At Tranter, we specialize in advanced gasketed and welded plate heat exchangers. As a global manufacturer, we are committed to precision and localized service….

#2 Heat Exchangers for Industrial & Mobile Applications

Domain Est. 1997

Website: thermaltransfer.com

Key Highlights: We offer the industry’s most complete lineup of air- and water-cooled heat exchangers; from brazed aluminum and copper tube designs to shell-and-tube and brazed ……

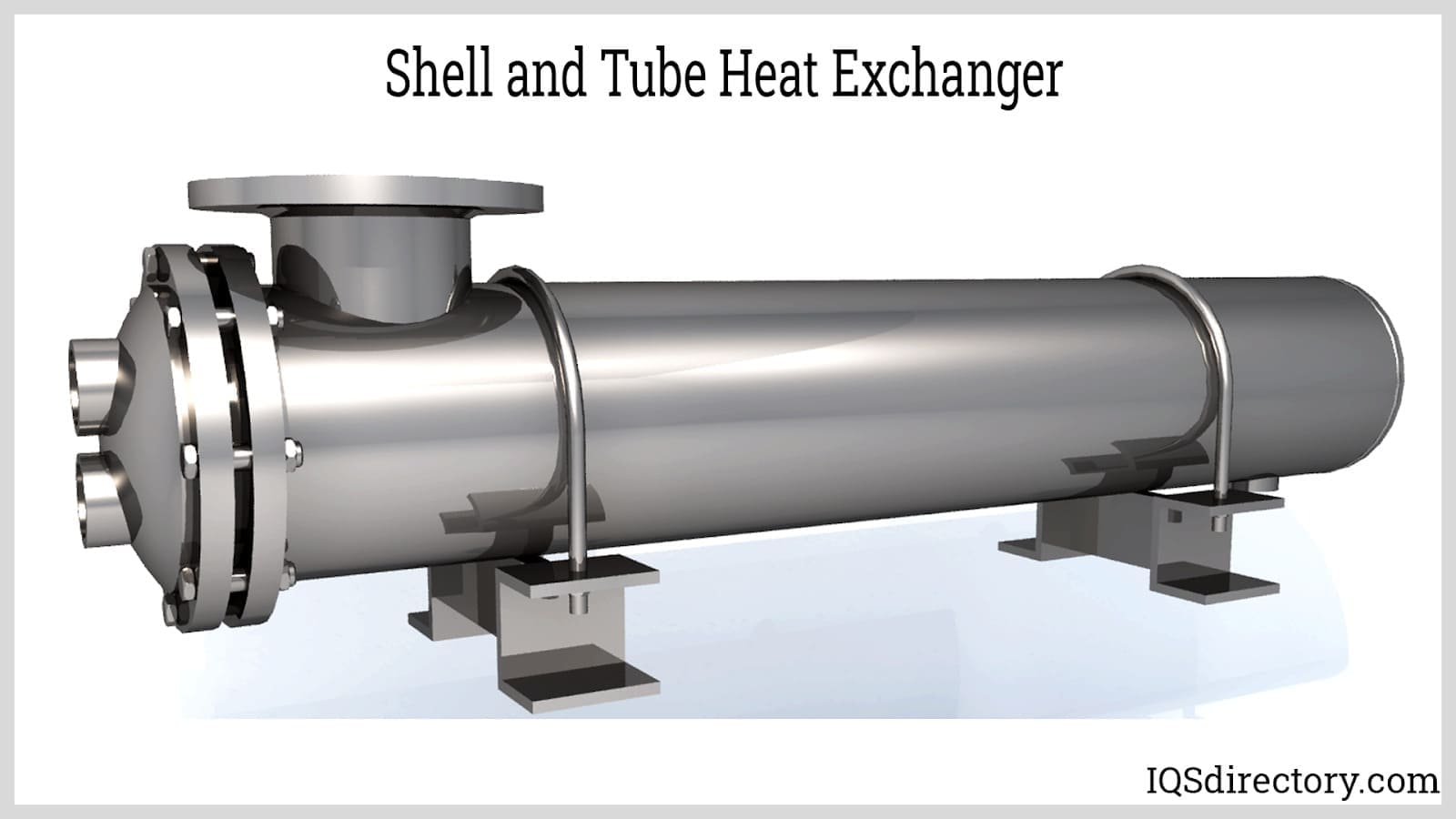

#3 Shell & Tube Heat Exchangers

Domain Est. 2008

Website: braskinc.com

Key Highlights: Brask, Inc. is a leader in the design, manufacturing, and repair of Shell & Tube Heat Exchangers, Helixchangers, and related equipment….

#4 FUNKE

Website: funke.de

Key Highlights: FUNKE shell-and-tube heat exchangers for all thermodynamic requirements in mechanical and system engineering, from series model to custom solution. More ……

#5 Shell and tube heat exchanger

Domain Est. 1997

Website: barriquand.com

Key Highlights: Shell and tube heat exchangers are designed and manufactured in France to meet diverse energy needs with duties up to over 70 MW….

#6 Shell and Tube Heat Exchangers

Domain Est. 1998

Website: onda-it.com

Key Highlights: Wieland Onda produces shell and tube heat exchangers for various fields: from the refrigeration field (evaporators and condensers suitable for different ……

#7 Shell & Tube Heat Exchangers

Domain Est. 1998

Website: dhtnet.com

Key Highlights: DHT’s shell and tube heat exchangers are custom designed and manufactured in conformance with the latest ASME Section VIII-1 and TEMA standards….

#8 Shell and Tube Heat Exchangers

Domain Est. 1999

Website: xylem.com

Key Highlights: Custom Shell and Tube Heat Exchangers, CPK – TEMA type AEW or BEW, removable bundle, packed floating tubesheet shell & tube heat exchanger….

#9 Polytube

Domain Est. 2006

Website: us.mersen.com

Key Highlights: Mersen is the global leader in designing and manufacturing graphite shell and tube heat exchangers, offering exceptional corrosion resistance, high thermal ……

#10 Shell and Tube Heat Exchangers

Domain Est. 2009

Website: shell-tube.com

Key Highlights: A shell and tube heat exchanger is a type of heat transfer device that can be used to efficiently transfer thermal energy from one medium to another….

Expert Sourcing Insights for Shell And Tube Heat Exchangers

H2: 2026 Market Trends for Shell and Tube Heat Exchangers

The global market for shell and tube heat exchangers is poised for steady growth through 2026, driven by increasing energy demands, industrial modernization, and a growing focus on energy efficiency and sustainability. As one of the most widely used heat transfer equipment in industrial applications, shell and tube heat exchangers are critical in sectors such as oil & gas, power generation, chemical processing, and petrochemicals. The following key trends are expected to shape the market landscape in 2026:

-

Rising Demand in Oil & Gas and Petrochemical Industries: Despite the global shift toward renewable energy, the oil & gas and petrochemical sectors remain primary drivers of demand for shell and tube heat exchangers. Upstream, midstream, and downstream operations continue to rely on these robust systems for heating, cooling, condensation, and evaporation processes. Expansion of LNG (liquefied natural gas) infrastructure, especially in the Middle East, Asia-Pacific, and North America, is expected to boost procurement of high-performance heat exchangers.

-

Energy Efficiency and Regulatory Compliance: Governments and industry regulators worldwide are enforcing stricter energy efficiency standards and emissions controls. This has led to increased adoption of optimized, high-efficiency shell and tube designs that reduce energy consumption and thermal losses. Manufacturers are investing in advanced computational fluid dynamics (CFD) and thermal modeling to enhance performance while maintaining compliance with environmental regulations such as the EU Emissions Trading System (ETS) and U.S. EPA guidelines.

-

Technological Advancements and Material Innovation: The integration of smart monitoring systems, predictive maintenance technologies, and digital twins is transforming the operational efficiency of heat exchangers. Additionally, the use of advanced materials such as titanium, duplex stainless steel, and high-nickel alloys is increasing to improve corrosion resistance and extend equipment lifespan—especially in harsh operating environments like offshore platforms and chemical plants.

-

Growth in Emerging Markets: Asia-Pacific is expected to dominate market growth by 2026, led by rapid industrialization in countries such as India, China, and Vietnam. Increased investments in power generation—including nuclear and thermal plants—and expanding chemical manufacturing hubs are creating strong demand for reliable heat transfer solutions. Similarly, infrastructure development in the Middle East and Africa supports regional market expansion.

-

Sustainability and Circular Economy Initiatives: The push toward sustainable manufacturing is influencing design and maintenance practices. Reconditioning and retrofitting of existing heat exchangers are gaining popularity as cost-effective and eco-friendly alternatives to full replacements. Moreover, manufacturers are exploring modular and compact designs that reduce material use and improve recyclability.

-

Supply Chain Resilience and Localization: Geopolitical uncertainties and supply chain disruptions observed in recent years have prompted companies to localize production and diversify sourcing. By 2026, more OEMs are expected to establish regional manufacturing hubs to reduce lead times, mitigate risks, and comply with local content requirements in key markets.

-

Integration with Renewable Energy Systems: While traditionally associated with fossil fuel-based industries, shell and tube heat exchangers are finding new applications in renewable energy, particularly in concentrated solar power (CSP) plants and geothermal systems. Their ability to handle high-pressure and high-temperature fluids makes them suitable for next-generation clean energy infrastructure.

In conclusion, the shell and tube heat exchanger market in 2026 will be shaped by a confluence of industrial demand, technological innovation, and sustainability imperatives. Companies that prioritize energy efficiency, digital integration, and regional adaptability are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Shell and Tube Heat Exchangers (Quality, IP)

Sourcing Shell and Tube Heat Exchangers (STHEs) involves significant technical, quality, and commercial risks. Overlooking key aspects can lead to performance failures, safety hazards, project delays, and intellectual property (IP) exposure. Below are critical pitfalls related to quality and intellectual property that buyers must address.

Poor Material and Manufacturing Quality

One of the most frequent issues is receiving equipment that does not meet specified material or fabrication standards. This includes:

- Incorrect material grades: Suppliers may substitute lower-grade alloys (e.g., carbon steel instead of stainless or duplex stainless) to cut costs, compromising corrosion resistance and longevity.

- Deficient welding practices: Poor weld quality, lack of proper certification (e.g., ASME Section IX), or inadequate Non-Destructive Testing (NDT) can lead to leaks and structural failures under pressure or thermal cycling.

- Tolerance and dimensional inaccuracies: Deviations in tube alignment, baffle spacing, or shell diameter affect heat transfer efficiency and increase vibration or fouling risks.

Ensure quality by specifying adherence to recognized codes (ASME, TEMA, PED) and requiring full documentation, including Material Test Reports (MTRs), weld maps, and inspection records.

Inadequate Design Verification and Testing

Many suppliers provide designs without sufficient validation, leading to underperformance or operational issues.

- Lack of thermal and hydraulic modeling: Some vendors offer generic designs without customized simulations, resulting in inefficient heat transfer or excessive pressure drop.

- Insufficient mechanical analysis: Failure to perform proper stress analysis under operational loads (thermal expansion, pressure, vibration) can compromise integrity.

- Limited factory acceptance testing (FAT): Skipping hydrostatic tests, pneumatic leak tests, or performance checks at the supplier’s facility increases the risk of field failures.

Insist on detailed design calculations, third-party review where applicable, and comprehensive FAT protocols before shipment.

Intellectual Property (IP) Exposure and Misuse

Sharing detailed process data and design specifications with suppliers can expose sensitive IP. Common risks include:

- Unprotected design information: Providing tube layouts, material specifications, or performance requirements without Non-Disclosure Agreements (NDAs) or clear IP ownership clauses can allow suppliers to reuse or disclose your designs.

- Reverse engineering by suppliers: Some manufacturers, especially in low-cost regions, may use purchased designs to replicate equipment for other clients.

- Lack of contractual IP safeguards: Contracts that fail to specify IP ownership, usage rights, and confidentiality obligations leave buyers vulnerable.

Mitigate IP risks by:

– Executing robust NDAs before technical discussions.

– Limiting data disclosure to only what is necessary.

– Including explicit IP ownership clauses in procurement contracts (e.g., all design adaptations are the buyer’s property).

– Using third-party engineering firms to act as intermediaries when appropriate.

Non-Compliance with Industry Standards and Certifications

Accepting equipment without verified compliance can result in safety incidents or regulatory rejection.

- Falsified certifications: Some suppliers provide fake or outdated ASME, PED, or NACE certifications.

- Missing traceability: Lack of full material traceability (e.g., 3.1 or 3.2 EN 10204 documentation) complicates audits and quality investigations.

- Inadequate documentation package: Poorly organized or incomplete operation and maintenance manuals, P&IDs, and as-built drawings hinder commissioning and maintenance.

Require certified documentation packs and verify credentials through independent audits or notified bodies.

Overlooking Supply Chain and Subcontractor Risks

Many STHE manufacturers outsource key components (tubes, forgings, flanges) without adequate oversight.

- Substandard subcontractors: Use of uncertified or low-tier suppliers for critical parts undermines overall quality.

- Lack of visibility into sub-tier supply chain: Buyers may not know the origin of materials, increasing risk of counterfeit or subpar components.

Demand transparency in the supply chain and require approval of key subcontractors and material sources.

Conclusion

Avoiding these pitfalls requires a proactive sourcing strategy that emphasizes technical diligence, clear contractual terms, and continuous supplier oversight. Prioritize suppliers with proven quality management systems (e.g., ISO 9001), enforce strict documentation and testing requirements, and protect intellectual property through legal and operational safeguards.

Logistics & Compliance Guide for Shell and Tube Heat Exchangers

This guide outlines the key logistics and compliance considerations for the safe and efficient handling, transportation, installation, and operation of shell and tube heat exchangers across their lifecycle.

Design and Manufacturing Compliance

Ensure heat exchangers are designed and fabricated in accordance with recognized standards and regulatory requirements. Key compliance frameworks include:

- ASME Boiler and Pressure Vessel Code (Section VIII) – Mandatory for pressure-containing components in most jurisdictions. Certification (e.g., U-stamp) is required.

- Tema Standards (Tubular Exchanger Manufacturers Association) – Governs mechanical design, dimensions, and tolerances for shell and tube exchangers.

- PED (Pressure Equipment Directive 2014/68/EU) – Required for equipment placed on the European market. Involves CE marking and conformity assessment.

- API Standards (e.g., API 660, API 661) – Common in oil and gas industries for specific service conditions.

- Material Traceability & Certifications – Full material test reports (MTRs), including chemical composition and mechanical properties, must be maintained. Traceability to heat numbers is essential.

- Welding Procedures & Personnel Qualification – Welding must follow qualified WPS (Welding Procedure Specifications) with certified welders (e.g., ASME IX, ISO 9606).

Packaging and Handling

Proper packaging and handling prevent damage during storage and transit:

- End Protection – Seal tube sheets and nozzles with wooden or metal caps, sealed with plastic sheeting to prevent moisture, debris, and foreign object entry.

- Internal Protection – Use desiccants and nitrogen purging for long-term storage to prevent internal corrosion. Apply corrosion inhibitors if specified.

- Lifting Points – Use only designated lifting lugs or spreader bars. Never lift by tubes, baffles, or nozzles. Follow manufacturer-recommended rigging procedures.

- Surface Protection – Protect painted surfaces and flange faces with protective covers. Avoid dragging or rolling exchangers on the ground.

- Storage – Store horizontally on level, padded supports to avoid sagging or stress. Elevate off ground to prevent moisture accumulation. Cover with weatherproof tarp if stored outdoors.

Transportation Logistics

Plan transport carefully due to the size, weight, and fragility of heat exchangers:

- Route Survey – Conduct a pre-transport assessment for bridges, overhead obstructions, road conditions, and turning radii, especially for oversized units.

- Permits – Obtain necessary oversized/overweight transport permits from relevant authorities (DOT, state/provincial agencies).

- Securing the Load – Use chocks, chains, and binders to prevent shifting. Ensure tie-down points are rated and properly used. Monitor load during transit.

- Specialized Equipment – Utilize lowboy trailers, cranes, or SPMTs (Self-Propelled Modular Transporters) as needed. Coordinate with certified transport companies experienced in heavy industrial equipment.

- Documentation – Maintain shipping manifests, packing lists, certificates of compliance, and handling instructions with the shipment.

Import/Export and Customs Compliance

Ensure adherence to international trade regulations:

- HS Codes – Accurately classify the exchanger under the Harmonized System (e.g., 8419.89 for heat exchangers).

- Export Controls – Verify if components or technology are subject to export restrictions (e.g., dual-use items under EAR or ITAR).

- Certificates of Origin – Provide required documents (e.g., EUR.1, Form A) for preferential tariffs.

- Customs Declarations – Submit accurate documentation including commercial invoices, packing lists, and compliance certificates.

- Duties and Taxes – Calculate and prepare for applicable import duties, VAT, or GST.

On-Site Receiving and Inspection

Perform thorough checks upon delivery:

- Visual Inspection – Check for visible damage to shells, tubes, nozzles, supports, and lifting lugs.

- Documentation Review – Verify delivery against purchase order and packing list. Confirm receipt of all required certificates (ASME, MTRs, NDT reports).

- Dimensional Check – Confirm critical dimensions (nozzle locations, support centers) match drawings.

- Flange Face Inspection – Examine for nicks, scratches, or warping. Ensure protective covers are intact.

- Report Anomalies – Document and report any discrepancies or damage immediately to the supplier and carrier.

Installation and Commissioning Compliance

Follow manufacturer guidelines and site-specific procedures:

- Alignment – Ensure proper alignment with connected piping to avoid excessive stress on nozzles. Use laser alignment tools where necessary.

- Support Systems – Install saddles, supports, and anchors as per design. Allow for thermal expansion.

- Piping Stress – Confirm piping is free of strain before final bolting.

- Hydrostatic Testing – Perform pressure tests as per ASME or design specifications. Document test parameters and results.

- Leak Testing – Conduct leak tests (e.g., pneumatic, helium leak) if required by process or safety standards.

- Insulation and Cladding – Install insulation per specifications, ensuring access points for inspection and maintenance are preserved.

Operational and Maintenance Compliance

Maintain compliance throughout the operational life:

- Operating Within Design Limits – Monitor and control pressures, temperatures, and flow rates within allowable design conditions.

- Periodic Inspections – Follow RBI (Risk-Based Inspection) plans or jurisdictional requirements. Inspect for corrosion, erosion, fouling, and mechanical damage.

- NDT Testing – Conduct scheduled non-destructive testing (e.g., UT, RT, PT) as per inspection plans.

- Tube Integrity Testing – Perform eddy current or hydrostatic tube testing during maintenance outages.

- Record Keeping – Maintain logs of operations, inspections, repairs, modifications, and pressure test results for regulatory audits.

- Modifications – Any alterations to the exchanger must be re-evaluated for compliance with original codes (e.g., ASME rerating, new calculations).

Decommissioning and Disposal

Handle end-of-life units responsibly:

- Safe Depressurization and Cleaning – Purge and clean all fluids, including hazardous residues, in accordance with environmental regulations.

- Hazardous Material Handling – Manage contaminants (e.g., asbestos gaskets, heavy metals) per local waste disposal laws.

- Recycling – Maximize recovery of metals (carbon steel, stainless steel, copper alloys) through certified recycling facilities.

- Documentation – Maintain records of decommissioning, disposal methods, and recycling certificates.

Adherence to this logistics and compliance guide ensures the integrity, safety, and regulatory conformity of shell and tube heat exchangers from procurement to decommissioning.

Conclusion for Sourcing Shell and Tube Heat Exchangers

Sourcing shell and tube heat exchangers requires a strategic approach that balances technical specifications, cost-effectiveness, quality assurance, and long-term reliability. These critical components play a vital role in numerous industrial processes, and selecting the right supplier is essential to ensure optimal performance, energy efficiency, and operational safety.

After thorough evaluation of market options, engineering requirements, material compatibility, manufacturing standards (such as TEMA, ASME, and PED), and supplier capabilities, it becomes evident that partnering with experienced and certified manufacturers is paramount. Key considerations such as design customization, corrosion resistance, pressure and temperature ratings, maintenance accessibility, and lifecycle costs should guide the sourcing decision.

Additionally, engaging suppliers with a strong track record, robust quality control processes, and after-sales support helps mitigate risks associated with downtime and unexpected failures. Global sourcing offers competitive pricing and advanced technologies, but must be weighed against logistics, lead times, and compliance with regional regulations.

In conclusion, a well-informed sourcing strategy for shell and tube heat exchangers—grounded in technical due diligence, supplier assessment, and total cost of ownership analysis—ensures reliable operation, enhances process efficiency, and supports long-term project success across industries such as oil and gas, chemical processing, power generation, and HVAC.