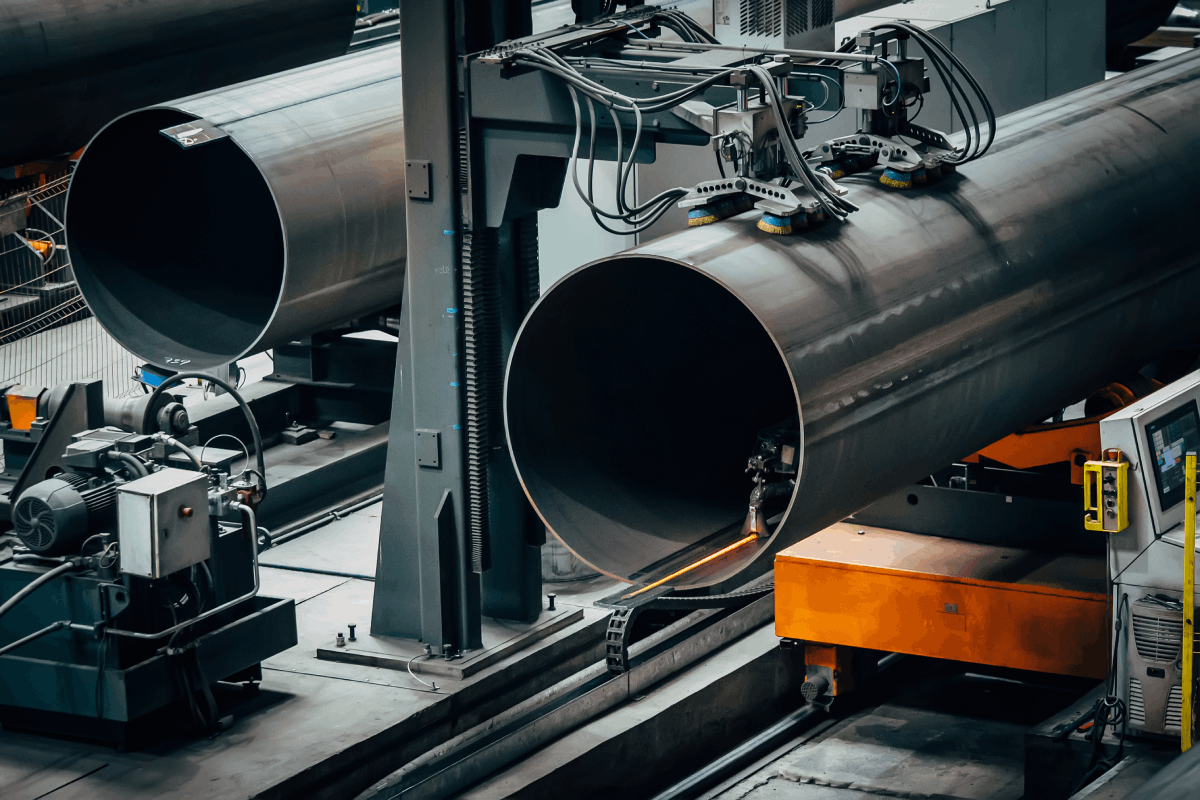

The global shaped pipe market is experiencing robust growth, driven by rising demand across construction, automotive, and industrial sectors. According to a report by Grand View Research, the global steel pipes market size was valued at USD 127.6 billion in 2023 and is expected to expand at a CAGR of 5.8% from 2024 to 2030, fueled by infrastructure development and energy transportation projects. Similarly, Mordor Intelligence projects steady growth in the shaped steel tubes and pipes segment, with increased adoption in structural applications and machinery due to their superior strength-to-weight ratio. As demand for precision-engineered, high-performance piping solutions rises, manufacturers specializing in shaped pipes—such as square, rectangular, and oval profiles—are gaining strategic importance. This growing market landscape underscores the need to identify the leading players driving innovation, scalability, and quality in shaped pipe production.

Top 10 Shaped Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Special

Domain Est. 2022

Website: sdzhongaosteel.com

Key Highlights: Special-shaped Pipe Manufacturers, Factory, Suppliers From China, We, with open arms, invite all interested buyers to visit our website or contact us directly…

#2

Domain Est. 1996

Website: lane-enterprises.com

Key Highlights: Lane Enterprises specializes and provides highly engineered products for every stormwater management, water quality and small bridge application….

#3

Domain Est. 1998

Website: consolidatedpipe.com

Key Highlights: For more than 60 years, Consolidated Pipe & Supply has been a full line supplier, fabricator and manufacturer of pipe, valve, and fitting ……

#4 Asian Steels

Domain Est. 2008 | Founded: 1985

Website: asiansteels.com

Key Highlights: Asian Steels, established in 1985, is India’s leading manufacturer of GI, GP, MS Pipes, GP/GC Coils & Sheets and durable SAW Pipes for diverse industries….

#5 Hdpe Pipe,Hdpe Pipe Fittings,HDPE Butt Fusion Fittings,Multilayer …

Domain Est. 2016

Website: sunplastpipe.com

Key Highlights: SUNPLAST has been one of the leading manufacturer & provider of plastic piping systems in China, such as HDPE pipe, HDPE pipe fittings….

#6 Pexco

Domain Est. 1997

Website: pexco.com

Key Highlights: The North American leader in custom plastic extrusion, injection molding, and high-performance polymers. We are where ideas take shape….

#7 Plastitalia

Domain Est. 1999

Website: plastitaliaspa.com

Key Highlights: European leader in the production of polyethylene fittings. Electrofusion, transition and spigot fittings for water and gas systems….

#8 Products

Domain Est. 2003

Website: hobaspipe.com

Key Highlights: In addition to classic cross sections, such as circular, egg, jaw, or kiteshaped pipes, we manufacture additional combinations of shapes to customer request….

#9 Ductwork Products

Domain Est. 2006

Website: shapemfg.com

Key Highlights: At Shape Manufacturing, we’re your ductwork experts, backed by over 30 years of experience in building many types of ducting. We’re here to supply you with ……

#10 Contech Engineered Solutions

Domain Est. 2012

Website: conteches.com

Key Highlights: We manufacture engineered solutions for complex civil infrastructure challenges and create lasting value for project stakeholders through unrivaled expertise, ……

Expert Sourcing Insights for Shaped Pipe

H2: Market Trends for Shaped Pipes in 2026

The shaped pipe market in 2026 is poised for significant transformation, driven by evolving industrial demands, technological advancements, sustainability imperatives, and regional economic shifts. While precise 2026 forecasts require real-time data, analysis based on current trajectories and emerging patterns points to several key trends shaping the industry under the second half of the year (H2 2026):

1. Accelerated Adoption of High-Strength and Lightweight Alloys

- Trend: Growing demand from automotive (especially electric vehicles – EVs) and aerospace sectors will drive the shift towards advanced materials like high-strength low-alloy (HSLA) steels, advanced high-strength steels (AHSS), aluminum alloys (6000, 7000 series), and titanium alloys.

- H2 2026 Impact: By the second half of 2026, suppliers will have optimized production for complex cross-sections (e.g., tailored tubes for EV battery frames, crash structures) using these materials. Expect increased competition and price pressure as technology matures, but also higher margins for specialized, precision-engineered products meeting stringent weight and safety standards.

2. Deepening Integration of Automation and Industry 4.0

- Trend: Smart manufacturing technologies (IoT sensors, AI-driven process control, digital twins) are becoming standard for precision, consistency, and efficiency in tube forming (roll forming, hydroforming, welding).

- H2 2026 Impact: Leading producers will leverage real-time data analytics for predictive maintenance, quality assurance, and dynamic process optimization. This will reduce scrap rates, improve dimensional accuracy for complex shapes, and enable faster changeovers. “Lights-out” manufacturing for high-volume standard sections will become more common, while flexible automation handles complex custom shapes.

3. Sustainability as a Core Competitive Advantage

- Trend: Environmental regulations (carbon taxes, ESG reporting) and customer demands (especially OEMs) are forcing a focus on reducing the carbon footprint of shaped pipe production.

- H2 2026 Impact: Key developments will include:

- Increased Scrap Utilization: Higher use of recycled steel and aluminum in production, driven by cost and sustainability goals.

- Green Energy: More mills transitioning to renewable energy sources for melting and rolling.

- Circular Economy Models: Growth in take-back schemes and closed-loop recycling for end-of-life products (e.g., automotive tubes).

- “Green Premium”: Customers increasingly willing to pay a premium for low-carbon footprint shaped pipes, particularly in construction and automotive.

4. Geopolitical Reshoring and Supply Chain Diversification

- Trend: Ongoing geopolitical tensions and lessons from recent disruptions are accelerating efforts to shorten supply chains and reduce dependency on single regions (e.g., China).

- H2 2026 Impact: Significant investment in manufacturing capacity in North America (driven by US IRA incentives), Europe (Nearshoring), and India (PLI schemes). This will benefit regional shaped pipe producers supplying local automotive, energy, and infrastructure projects, though potentially increasing regional price variations. Supply chains will focus on resilience over pure cost minimization.

5. Growth in Renewable Energy and EV Infrastructure

- Trend: The global push for decarbonization fuels massive investments in renewable energy (solar, wind, hydrogen) and EV charging infrastructure.

- H2 2026 Impact: Shaped pipes (square, rectangular, custom profiles) are critical for:

- Solar: Mounting structures and tracker systems.

- Wind: Tower sections (increasingly using high-strength steel for taller towers) and nacelle components.

- Hydrogen: Piping for production, storage, and transport (requiring compatibility with hydrogen embrittlement).

- EV Charging: Structural supports and enclosures for charging stations.

- Demand for corrosion-resistant and high-strength profiles in these sectors will surge in H2 2026.

6. Consolidation and Strategic Partnerships

- Trend: The need for scale, technological investment, and global reach is driving M&A activity and strategic alliances.

- H2 2026 Impact: Expect further consolidation among mid-tier tube producers. Partnerships between shaped pipe manufacturers and end-users (e.g., automakers, construction firms) for co-development of optimized components will become more frequent, moving towards a “solution provider” model rather than just a component supplier.

Conclusion for H2 2026:

The shaped pipe market in the second half of 2026 will be characterized by innovation, sustainability, and regionalization. Success will depend on a manufacturer’s ability to:

* Master advanced materials and complex geometries efficiently.

* Leverage digitalization for superior quality and cost control.

* Demonstrate a verifiable low environmental impact.

* Offer resilient, regionally-anchored supply chains.

* Focus on high-growth end-markets like EVs, renewables, and infrastructure.

Producers failing to adapt to these converging trends will face intense competition and margin pressure, while those embracing them will capture significant market share in the evolving industrial landscape.

Common Pitfalls in Sourcing Shaped Pipe: Quality and Intellectual Property Concerns

Sourcing shaped pipe—whether square, rectangular, oval, or custom profiles—can present unique challenges, particularly in the areas of quality assurance and intellectual property (IP) protection. Buyers, especially those working with offshore suppliers or custom fabricators, must be vigilant to avoid common pitfalls that can lead to project delays, increased costs, or legal complications.

Quality-Related Pitfalls

Inconsistent Material Specifications

One of the most frequent quality issues arises when suppliers do not adhere strictly to specified material standards (e.g., ASTM, EN, or ISO). Variations in alloy composition, tensile strength, or wall thickness can compromise structural integrity, especially in critical applications such as construction or transportation.

Poor Dimensional Accuracy

Shaped pipes require precise tolerances to ensure proper fit and function. Suppliers with inadequate tooling or process controls may deliver products with warping, out-of-round profiles, or inconsistent bending radii, leading to assembly problems on-site.

Inadequate Surface Finish and Coating

Defects such as scale, pitting, or uneven galvanization are common when surface treatments are poorly executed. These flaws not only affect aesthetics but can accelerate corrosion and reduce the service life of the pipe.

Lack of Traceability and Certification

Some suppliers fail to provide full material test reports (MTRs) or mill certifications. Without proper documentation, it’s difficult to verify compliance with project specifications or industry regulations, increasing risk in regulated environments.

Intellectual Property-Related Pitfalls

Unauthorized Use of Design or Profiles

When sourcing custom-shaped pipes, especially for proprietary products, there is a risk that suppliers may replicate or resell your design to competitors. This is particularly prevalent in regions with weak IP enforcement.

Inadequate IP Clauses in Contracts

Many procurement agreements lack clear language assigning ownership of custom tooling, dies, or engineered profiles. Without explicit contractual terms, suppliers may claim partial rights or reuse tooling for other clients.

Reverse Engineering by Suppliers

Some manufacturers may analyze supplied samples or drawings to reverse engineer the design, enabling them to produce similar products independently. This undermines competitive advantage and may lead to market dilution.

Insufficient Protection in International Sourcing

When sourcing from countries with different IP laws, enforcement can be difficult and costly. Patents or design rights registered in one jurisdiction may not be recognized elsewhere, leaving shaped pipe designs vulnerable to imitation.

Mitigation Strategies

- Conduct thorough supplier audits and request third-party quality inspections.

- Require full material certification and dimensional reports with each shipment.

- Use non-disclosure agreements (NDAs) and include robust IP ownership clauses in contracts.

- Register designs and patents in key markets where sourcing or products will be used.

- Maintain control over tooling and dies, preferably storing them in secure, neutral locations.

Avoiding these pitfalls requires due diligence, clear contractual terms, and ongoing quality monitoring throughout the supply chain.

Logistics & Compliance Guide for Shaped Pipe

Overview

Shaped pipe—such as rectangular, square, oval, or custom-profiled steel or metal tubing—requires specialized handling, transportation, and regulatory compliance due to its structural form, weight, and application in industries like construction, automotive, and manufacturing. This guide outlines key logistics and compliance considerations to ensure safe, efficient, and legal movement of shaped pipe from manufacturer to end user.

Packaging & Handling

Proper packaging prevents damage during transit and ensures worker safety.

– Bundling: Secure pipes into tight bundles using steel or synthetic strapping; apply edge protectors at contact points to prevent deformation.

– Palletization: Use wooden or steel pallets rated for the load; ensure overhang does not exceed 150 mm to avoid damage.

– Coating Protection: Apply anti-corrosion coatings or VCI (Vapor Corrosion Inhibitor) paper for long-term storage or overseas shipping.

– Lifting: Use spreader bars or lifting cradles during crane operations to avoid bending or crushing.

Transportation Requirements

Shaped pipe often exceeds standard freight dimensions and must comply with transport regulations.

– Mode Selection:

– Road: Use flatbed or step-deck trailers for oversized loads; secure with chains or load bars.

– Rail: Confirm compatibility with railcar dimensions and coupling systems.

– Sea: Containerize smaller bundles or use break-bulk shipping for large consignments; ensure seaworthy packaging.

– Weight Distribution: Evenly distribute load across axles and within containers to meet axle weight limits.

– Marking & Labeling: Clearly label bundles with product specs, batch numbers, handling instructions (e.g., “Do Not Stack”), and hazard symbols if applicable.

International Compliance & Documentation

Exporting shaped pipe involves adherence to international standards and customs procedures.

– Certifications: Ensure compliance with standards such as ASTM, EN, ISO, or JIS, depending on the destination market.

– Mill Test Certificates (MTC): Provide MTCs (e.g., EN 10204 3.1 or 3.2) verifying material composition and mechanical properties.

– Customs Documentation: Prepare commercial invoice, packing list, bill of lading, and certificate of origin. Include HS code (e.g., 7306.61 for hollow sections of iron or steel).

– Anti-Dumping & Safeguards: Monitor trade regulations; shaped steel products are often subject to tariffs or quotas in markets like the EU and U.S.

Regulatory & Safety Standards

Compliance with regional and industry-specific regulations is mandatory.

– DOT & ADR Regulations: For road transport in North America and Europe, adhere to hazardous materials rules if pipes are coated with flammable substances.

– OSHA & WHMIS: Ensure workplace handling complies with safety standards; train staff on lifting procedures and PPE usage.

– REACH & RoHS: Confirm that coatings or surface treatments comply with chemical restrictions in the EU or other jurisdictions.

Storage & Inventory Management

Improper storage can lead to deformation or corrosion.

– Indoor vs. Outdoor: Store indoors when possible; if outdoors, elevate bundles on sleepers and cover with UV-resistant tarpaulins.

– Stacking Limits: Follow manufacturer recommendations for max stack height to prevent bottom-layer deformation.

– Inventory Tracking: Use barcodes or RFID tags linked to ERP systems for lot traceability and quality control.

Environmental & Sustainability Considerations

- Recyclability: Document recyclability of materials (e.g., carbon steel, aluminum) to support customer ESG reporting.

- Waste Minimization: Optimize cutting and packaging processes to reduce scrap and excess materials.

- Emissions Reporting: For large shipments, calculate and report carbon footprint using tools like the GLEC Framework.

Incident Response & Contingency Planning

- Damage Protocol: Establish procedures for inspecting and documenting transit damage; retain photos and shipping logs for insurance claims.

- Delay Mitigation: Maintain alternative routing options and buffer stock for time-sensitive projects.

- Regulatory Audits: Prepare for periodic audits by customs, safety, or environmental agencies with up-to-date compliance records.

Conclusion

Effective logistics and compliance for shaped pipe demand a proactive approach that integrates secure handling, regulatory alignment, and clear documentation. By adhering to this guide, stakeholders can minimize risk, ensure product integrity, and maintain smooth operations across global supply chains.

Conclusion for Sourcing Shaped Pipe:

Sourcing shaped pipe requires a strategic approach that balances quality, cost, lead time, and supplier reliability. After evaluating potential suppliers, material specifications, manufacturing capabilities, and market availability, it is evident that selecting the right supplier is critical to ensuring project success and long-term operational efficiency. Custom-shaped pipes, whether rectangular, oval, or other profiles, must meet specific engineering and application requirements, making adherence to international standards (such as ASTM, ISO, or EN) essential.

Engaging with suppliers who demonstrate technical expertise, consistent quality control, and the ability to accommodate customization is paramount. Additionally, considering factors such as logistics, minimum order quantities, and scalability supports sustainable procurement. Long-term partnerships with trusted manufacturers—especially those offering value-added services like fabrication, coating, or precision cutting—can significantly enhance supply chain performance.

In conclusion, effective sourcing of shaped pipe hinges on thorough due diligence, clear communication of technical needs, and ongoing supplier relationship management. By prioritizing these elements, organizations can secure reliable, high-quality supply solutions that support project timelines, reduce risk, and deliver optimal value.