The global sewing machine market is experiencing steady growth, driven by rising demand in the apparel industry, increasing DIY and home sewing trends, and advancements in computerized and smart sewing technology. According to a report by Mordor Intelligence, the global sewing machine market was valued at USD 4.3 billion in 2023 and is projected to reach USD 5.8 billion by 2029, growing at a CAGR of approximately 5.1% during the forecast period. Similarly, Grand View Research highlights the influence of expanding garment manufacturing in Asia-Pacific and technological innovation in industrial sewing solutions as key market drivers. With this upward trajectory, identifying the leading manufacturers becomes crucial for consumers, businesses, and industry stakeholders. These top players not only dominate in terms of market share but also set benchmarks in innovation, durability, and smart integration. Below is a data-informed ranking of the top 10 sewing machine manufacturers shaping the future of stitching across domestic and industrial applications.

Top 10 Sewing Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Yamato Sewing Machine Mfg. Co., Ltd.

Domain Est. 2000

Website: yamato-sewing.com

Key Highlights: Yamato Sewing Machine is a leading Japanese manufacturer of industrial sewing machines pioneering with innovative “FIRSTs” in industry solutions in ……

#2 Industrial sewing machine

Website: pegasus.co.jp

Key Highlights: We are an industrial sewing machine manufacturer. Especially, we manufacture chainstitching (Kan-nui) machines. We introduce a wide variety of our lineup….

#3 Dürkopp Adler

Domain Est. 1997

Website: duerkopp-adler.com

Key Highlights: WELCOME TO THE WORLD OF SEWING TECHNOLOGY The Dürkopp Adler Group is a global innovation and technology leader in the field of industrial sewing….

#4 Techsew Sewing Machines

Domain Est. 2007

Website: techsew.com

Key Highlights: Techsew is a family-owned manufacturer and distributor of high-quality industrial sewing machines, cutting equipment and supplies located in Montreal, ……

#5 Juki America

Domain Est. 2010

Website: jukihome.com

Key Highlights: JUKI Quilting Machines. built with industrial sewing machine technology ; Mechanical. and Computerized Sewing Machines ; Serging. and Coverstitch Sewing Machines….

#6 JUKI Industrial Sewing Machines

Domain Est. 1995

Website: juki.com

Key Highlights: JUKI specializes in non-apparel industrial sewing machines that ensure high-quality seams suitable for sewing large and heavy-weight materials….

#7 Sewing and Embroidery Machines

Domain Est. 2000

Website: brother-usa.com

Key Highlights: Brother sewing machines have cutting-edge technology and features, all while being easy to learn and easy to use. Generous lighting, large touchscreen displays, ……

#8 Baby Lock Sewing Machines

Domain Est. 1996

Website: babylock.com

Key Highlights: Explore Baby Lock: where sewing meets innovation. Dive into reliable machines, free projects, and join our supportive community….

#9 SVP Worldwide

Domain Est. 2006

Website: svpworldwide.com

Key Highlights: Since 1851, SINGER® has been one of the leading brands of consumer and artisan sewing machines, and one of the world’s most trusted and recognizable brands….

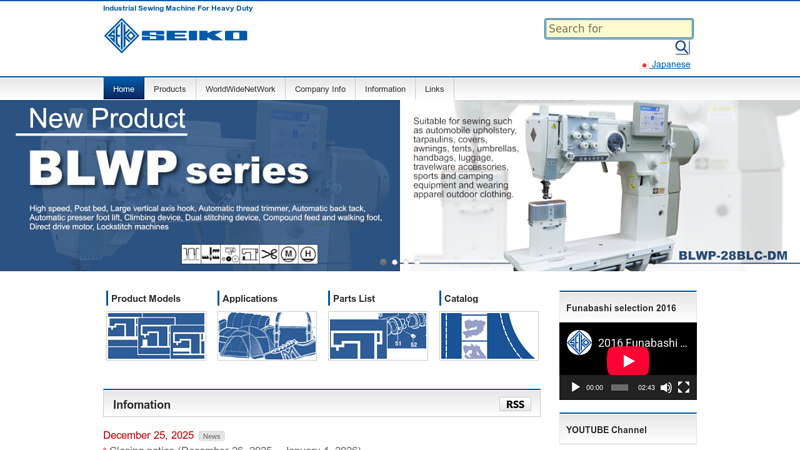

#10 Heavy Duty Sewing Machine / SEIKO SEWING MACHINE CO.,LTD.

Website: seiko-sewing.co.jp

Key Highlights: SEIKO SEWING MACHINE CO.,LTD. Home · Products · Product Models · Applications · Parts List · WorldWide Network · Company Info · Infomation · links….

Expert Sourcing Insights for Sewing Machine

H2: 2026 Market Trends for the Sewing Machine Industry

By 2026, the global sewing machine market is poised for significant transformation, driven by technological innovation, evolving consumer behaviors, and shifting industrial demands. Key trends shaping the landscape include:

1. Accelerated Smart & Connected Machine Adoption:

The integration of IoT, AI, and app connectivity will move from premium features to mainstream expectations. By 2026, over 40% of new consumer machines are projected to offer Wi-Fi/Bluetooth connectivity, enabling remote updates, cloud-based pattern libraries, AI-powered stitch optimization, and real-time troubleshooting via companion apps. Industrial smart machines will leverage predictive maintenance and production analytics to minimize downtime.

2. Sustainability as a Core Market Driver:

Environmental concerns will heavily influence design and purchasing decisions. Expect increased demand for:

Eco-Conscious Materials: Machines built with recycled plastics and sustainable composites.

Energy Efficiency: Low-power motors and “Eco-Mode” features becoming standard.

Longevity & Repairability: Brands emphasizing modular designs, accessible parts, and robust warranties to combat planned obsolescence, appealing to the circular economy.

Upcycling Focus: Marketing and features specifically targeting clothing repair and textile upcycling, fueled by the anti-fast-fashion movement.

3. Industrial Automation & Advanced Manufacturing:

The industrial segment will see rapid growth in:

Robotics & Cobots: Integration of sewing robots and collaborative robots (cobots) for handling, feeding, and complex stitching tasks, especially in apparel and technical textiles.

AI-Driven Pattern Making & Cutting: Seamless integration between design software, automated cutting systems, and sewing machines for end-to-end digital workflows.

On-Demand & Mass Customization:* Flexible automated lines enabling profitable small-batch production and personalized garments.

4. Consumer Market: Premiumization & Hobbyist Growth:

While basic models remain, the consumer market will bifurcate:

Premium Hobbyist Surge: Demand for high-end domestic/combo machines ($500+) with industrial-grade features (e.g., direct drive motors, advanced embroidery, quilting capabilities) will grow as skilled hobbyists and micro-entrepreneurs drive sales.

Subscription & Ecosystem Models: Brands will expand beyond hardware, offering subscription-based access to exclusive digital patterns, tutorials, and cloud storage, creating recurring revenue streams.

Educational Integration:* Partnerships with online learning platforms (e.g., Craftsy, Domestika) will bundle machines with courses, lowering the entry barrier.

5. E-Commerce & Direct-to-Consumer (DTC) Dominance:

Online sales will account for over 60% of consumer sewing machine purchases by 2026. Key shifts include:

Enhanced Online Experiences: AR/VR try-before-you-buy, detailed video demos, and AI chatbots for pre-sales support.

DTC Brand Expansion: Niche players (e.g., Janome’s online exclusives, Singer’s DTC push) will challenge traditional retailers, offering competitive pricing and community engagement.

Social Commerce:* Platforms like Instagram and TikTok will be crucial for influencer marketing and user-generated content showcasing projects.

6. Emerging Market Expansion:

Asia-Pacific (especially India, Southeast Asia) and Africa will see accelerated growth due to:

Rising Disposable Incomes: Increasing affordability of entry-level and mid-range machines.

Government Skill Development Initiatives: Vocational training programs boosting demand for training-grade machines.

Thriving Local Garment Sectors:* Support for small-scale manufacturers and artisans.

Conclusion:

The 2026 sewing machine market will be defined by intelligence, sustainability, and connectivity. Success will depend on manufacturers’ ability to innovate in smart technology, embrace circular economy principles, cater to the premium hobbyist and micro-business segments, dominate e-commerce channels, and penetrate high-growth emerging markets. The line between industrial automation and advanced domestic capabilities will continue to blur, creating a dynamic and competitive landscape.

Common Pitfalls When Sourcing Sewing Machines: Quality and Intellectual Property Risks

Sourcing sewing machines, especially from overseas manufacturers, can present significant challenges related to product quality and intellectual property (IP) protection. Being aware of these pitfalls is essential to ensure you receive reliable equipment and avoid legal or reputational damage.

Quality-Related Pitfalls

Inconsistent Build Quality and Materials

One of the most frequent issues is variability in the construction and materials used. Sourced machines may use substandard metals, inferior motors, or low-grade plastics to cut costs, leading to reduced durability, increased maintenance, and shorter lifespan. Without rigorous quality control oversight, batches can vary significantly in performance and reliability.

Misrepresentation of Technical Specifications

Suppliers may exaggerate key performance metrics such as stitch speed, motor power, or compatibility with different fabric types. These discrepancies can result in machines that fail to meet production demands, causing downtime and inefficiencies on the factory floor.

Lack of Standardized Quality Control Processes

Many manufacturers, especially smaller or less established ones, lack robust quality assurance systems. Without ISO certification or third-party inspections, defects—such as misaligned parts, poor electrical wiring, or faulty tension systems—may go undetected until after delivery.

Inadequate After-Sales Support and Spare Parts Availability

Even if the initial machine quality is acceptable, sourcing from unreliable suppliers often means limited access to technical support, training, or replacement parts. This can lead to prolonged machine downtime and increased total cost of ownership.

Intellectual Property (IP) Risks

Counterfeit or Clone Machines

A significant risk when sourcing from certain regions is receiving machines that mimic well-known brands (e.g., Juki, Brother, or Singer) without authorization. These clones often infringe on patents, trademarks, and design rights, potentially exposing the buyer to legal liability, especially in markets with strong IP enforcement.

Unauthorized Use of Proprietary Technology

Some suppliers integrate patented mechanisms—such as automated thread cutters, advanced feed systems, or digital controls—into their machines without licensing. Purchasing such machines can inadvertently involve your business in IP infringement disputes, particularly if the machines are imported into countries like the U.S. or EU.

Weak Contractual IP Clauses

Purchase agreements may lack clear terms regarding IP ownership, warranties against infringement, or liability in case of legal challenges. Without proper legal safeguards, buyers may have limited recourse if issues arise post-purchase.

Risk of Brand Damage

Using or distributing machines that violate IP rights can harm your company’s reputation, especially if customers or partners perceive your business as complicit in counterfeiting or unethical sourcing practices.

Mitigation Strategies

To avoid these pitfalls, conduct thorough due diligence on suppliers, request product certifications, perform factory audits, and engage third-party inspection services. Include strong IP indemnification clauses in contracts and consider working with legal counsel familiar with international trade and intellectual property law.

Logistics & Compliance Guide for Sewing Machines

Product Classification and HS Code

Sewing machines are typically classified under the Harmonized System (HS) Code 8452. This classification includes household and industrial sewing machines, as well as sewing machine heads and parts. Accurate classification is essential for determining import duties, taxes, and regulatory requirements in the destination country. Always verify the specific HS code with local customs authorities, as subcategories may vary.

Import/Export Documentation

Ensure all necessary documentation is prepared and compliant with international trade regulations. Required documents usually include:

– Commercial Invoice (detailing value, quantity, and description)

– Packing List (specifying weight, dimensions, and packaging type)

– Bill of Lading or Air Waybill

– Certificate of Origin (if claiming preferential tariffs under trade agreements)

– Import/Export License (if required by country)

– Product Conformity Certificates (e.g., CE, UL, or other regional marks)

Packaging and Labeling Requirements

Sewing machines must be securely packaged to prevent damage during transit. Use sturdy cartons with internal cushioning (e.g., foam or corrugated inserts). Label all packages with:

– Product name and model number

– HS code and country of origin

– Handling instructions (e.g., “Fragile,” “This Side Up”)

– Safety warnings and compliance marks (e.g., CE, FCC, RoHS)

– Barcode or SKU for inventory tracking

Ensure labeling complies with destination country standards, including language requirements.

Transportation and Freight Considerations

Sewing machines are generally shipped via ocean freight (FCL or LCL) for bulk orders or air freight for urgent or low-volume shipments. Consider the following:

– Weight and dimensions to calculate freight costs and space requirements

– Use of pallets for stability and ease of handling

– Insurance coverage for loss or damage

– Selection of Incoterms (e.g., FOB, CIF, DDP) to clarify responsibilities between buyer and seller

Handle with care to avoid misalignment of internal components.

Regulatory and Safety Compliance

Sewing machines must meet electrical and safety standards in the target market:

– CE Marking (EU): Complies with Low Voltage Directive (LVD) and Electromagnetic Compatibility (EMC) Directive

– UL/ETL Certification (USA/Canada): Required for electrical safety

– RoHS Compliance: Restriction of Hazardous Substances (lead, mercury, etc.)

– Energy Labeling (if applicable): Some regions require energy efficiency disclosures

– FCC Regulations (USA): For machines with electronic controls or motors

Maintain technical files and test reports to demonstrate compliance.

Customs Clearance and Duties

Work with a licensed customs broker to ensure smooth clearance. Provide complete and accurate documentation to avoid delays. Be aware of:

– Applicable import duties and VAT/GST rates based on HS code and origin

– Anti-dumping or safeguard measures (if applicable)

– Customs inspections or product sampling

Duties vary by country; check tariff schedules before shipping.

After-Sales and Warranty Logistics

Plan for spare parts distribution and repair services in the destination market. Ensure:

– Availability of service manuals and technical support

– Compliance with local warranty regulations

– Clear communication of warranty terms in local language

– Reverse logistics process for defective units or returns (RMA system)

Environmental and Disposal Regulations

Adhere to waste electrical and electronic equipment (WEEE) directives in regions like the EU. Provide take-back programs or recycling information for end-of-life products. Packaging materials should be recyclable and labeled accordingly.

Recordkeeping and Audits

Maintain complete records of shipments, compliance certifications, and correspondence for at least five years. Regular audits help ensure ongoing compliance with international trade laws and product standards.

In conclusion, sourcing a sewing machine requires careful consideration of several key factors, including intended use (domestic, small business, or industrial), machine type (mechanical, electronic, or computerized), essential features (stitch variety, speed, durability), and budget. It is important to evaluate reputable brands, compare warranties and after-sales support, and read user reviews to ensure reliability and performance. Whether purchasing locally or online, verifying the authenticity and availability of spare parts and service centers is crucial for long-term satisfaction. By aligning the machine’s specifications with specific sewing needs and conducting thorough research, one can make a cost-effective and efficient sourcing decision that enhances productivity and sewing quality.