Sourcing Guide Contents

Industrial Clusters: Where to Source Sevres China Company

SourcifyChina Sourcing Intelligence Report 2026

Title: Market Analysis for Sourcing Sevres China Company Products from China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

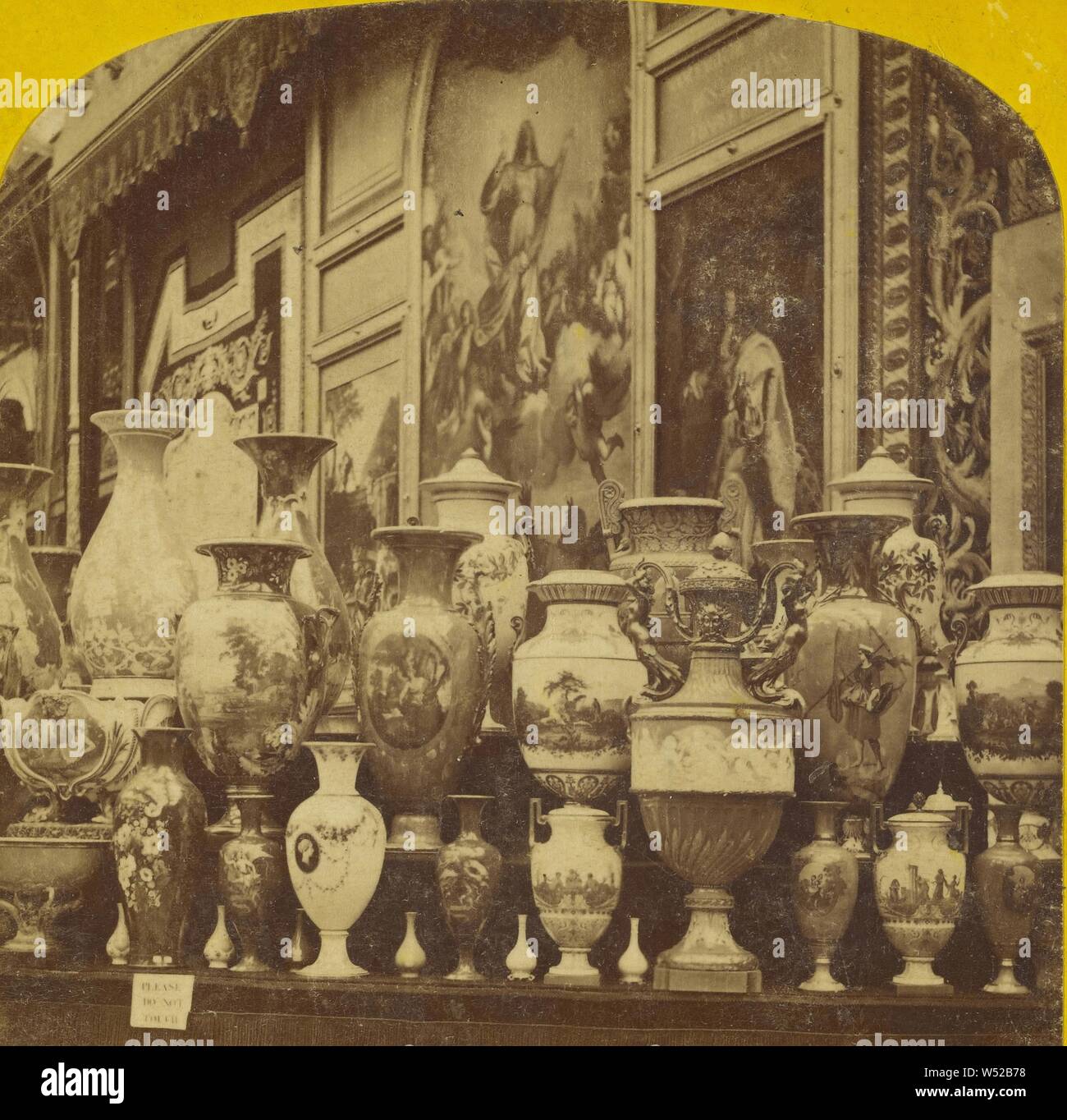

This report provides a strategic market analysis for sourcing products associated with the Sevres China Company—a term commonly misinterpreted in global procurement channels. Notably, Sèvres is a French heritage porcelain brand, historically manufactured in Sèvres, France, and not produced in China. However, the term “Sevres China Company” is frequently used in B2B sourcing contexts to describe high-end, fine porcelain or bone china tableware emulating the craftsmanship, design, and aesthetic of authentic Sèvres porcelain.

Chinese manufacturers do not produce official Sèvres-branded goods, but numerous factories specialize in luxury-grade porcelain replication and private-label fine china with comparable quality, often at significantly lower costs. This report identifies the key industrial clusters in China producing such high-end porcelain and evaluates them based on Price, Quality, and Lead Time to support strategic procurement decisions.

Market Clarification: “Sevres China Company” in Sourcing Context

| Term | Clarification |

|---|---|

| Sèvres Porcelain | A protected French heritage brand under the Manufacture nationale de Sèvres, affiliated with the Cité de la céramique. Not manufactured in China. |

| “Sevres-style” or “Sevres-inspired” China | Refers to luxury porcelain tableware produced in China with high whiteness, translucency, hand-painted detailing, gilding, and fine craftsmanship mimicking Sèvres aesthetics. |

| Procurement Reality | Chinese factories offer OEM/ODM services for luxury tableware, often supplying high-end European and North American brands under private labels. |

Key Industrial Clusters for Luxury Porcelain Production in China

China’s fine porcelain manufacturing is concentrated in regions with deep ceramic heritage, skilled labor, and advanced kiln technologies. The following provinces and cities dominate the production of high-end, Sevres-style porcelain:

- Jingdezhen, Jiangxi Province

- Known as the “Porcelain Capital of China” with over 1,700 years of ceramic tradition.

- Home to state-certified master artisans, advanced R&D centers, and boutique studios producing museum-grade porcelain.

-

Specializes in handcrafted, thin-walled, translucent bone china with intricate hand-painting and gold detailing.

-

Guangdong Province (Foshan & Chaozhou)

- Industrial-scale production with high automation.

- Chaozhou is a major exporter of premium porcelain, including fine white and bone china.

-

Strong export logistics and compliance with EU/US safety standards.

-

Zhejiang Province (Lishui & Longquan)

- Known for celadon and high-fired stoneware, but increasingly producing fine porcelain for export.

- Competitive pricing with moderate quality control improvements in recent years.

Comparative Analysis of Key Production Regions

Below is a comparative evaluation of the top regions producing Sevres-style porcelain in China, tailored for procurement decision-making.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Key Strengths | Procurement Considerations |

|---|---|---|---|---|---|

| Jingdezhen, Jiangxi | ⭐⭐☆ (Higher) | ⭐⭐⭐⭐⭐ (Premium) | 6–10 weeks | Handcrafted precision, museum-grade finishes, master artisans, customizable designs, compliance with luxury brand standards | Ideal for high-margin luxury brands; MOQs may be higher; requires rigorous QC oversight |

| Chaozhou, Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐☆ (High) | 4–7 weeks | High production capacity, ISO-certified factories, strong export compliance (FDA, LFGB), cost-efficient scaling | Best for volume orders with quality consistency; some variation in artisanal finishes |

| Foshan, Guangdong | ⭐⭐⭐⭐ (High) | ⭐⭐⭐☆ (Medium-High) | 4–6 weeks | Automation, fast turnaround, integrated supply chain | Suitable for semi-luxury or premium commercial segments; limited hand-painted capabilities |

| Lishui, Zhejiang | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐ (Medium) | 5–8 weeks | Competitive pricing, improving quality control | Cost-effective for entry-level luxury segments; limited heritage artisan access |

Rating Key: ⭐ = Low, ⭐⭐ = Medium, ⭐⭐⭐ = Good, ⭐⭐⭐⭐ = High, ⭐⭐⭐⭐⭐ = Premium

Strategic Sourcing Recommendations

-

For Luxury Brand Partnerships or High-End Retail:

Prioritize Jingdezhen-based manufacturers with proven experience in hand-painted, gilded porcelain. Engage third-party QC partners for batch inspections. -

For Volume Orders with Premium Quality Assurance:

Source from certified factories in Chaozhou, Guangdong. Leverage their export-ready infrastructure and competitive pricing without sacrificing compliance. -

For Cost-Optimized Premium Lines:

Consider Zhejiang suppliers for simpler designs with machine-assisted detailing. Conduct pilot runs before full-scale procurement. -

IP & Brand Protection:

Ensure contracts include design confidentiality clauses and anti-copying agreements, especially when sharing Sèvres-inspired artwork. -

Lead Time Planning:

Factor in additional 2–3 weeks for hand-painted or custom gilded finishes. Air freight may be justified for time-sensitive luxury launches.

Conclusion

While authentic Sèvres porcelain remains exclusive to France, China offers a robust ecosystem for sourcing Sevres-style luxury tableware with competitive advantages in craftsmanship, customization, and scalability. Jingdezhen leads in quality and artistry, while Guangdong excels in scalable, compliant production. Procurement managers should align regional selection with brand positioning, volume needs, and time-to-market requirements.

SourcifyChina recommends a dual-sourcing strategy—using Jingdezhen for flagship designs and Chaozhou for core collections—to balance excellence and efficiency in global supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

Shenzhen, China | www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Authentic Sèvres-Style Ceramic Procurement from China

Prepared for Global Procurement Managers | Q1 2026 Update

Objective: Clarify sourcing realities for “Sèvres-style” ceramics from Chinese manufacturers. Note: Sèvres is a French state-owned manufactory (est. 1740); no Chinese entity holds the Sèvres® brand. This report covers replica/high-end porcelain produced in China to European luxury standards.

I. Technical Specifications & Quality Parameters

Critical for verifying “Sèvres-style” quality in Chinese production. Authentic Sèvres uses 50%+ bone ash; Chinese replicas typically use 25-45%.

| Parameter | Premium Tier (Target) | Standard Tier (Risk Zone) | Verification Method |

|---|---|---|---|

| Material Composition | 40-45% bone ash, kaolin, feldspar | <35% bone ash, higher quartz | XRF spectroscopy + lab ash test report |

| Thickness Tolerance | ±0.3mm (vessel walls) | ±0.8mm | Caliper measurement at 5 points/unit |

| Glaze Uniformity | Zero pinholes/craters (10x magnification) | >3 defects/dm² | Blacklight inspection + visual audit |

| Thermal Shock Resistance | Withstands 140°C → 20°C ΔT (no crazing) | Fails at >100°C ΔT | ASTM C33 for ceramic whitewares |

| Weight Consistency | ±2% deviation per batch | ±5% deviation | Weigh 10 random units/batch |

Key Insight: Chinese factories often overstate bone ash content. Demand kiln test reports showing sintering temperatures (≥1,280°C required for true translucency).

II. Essential Certifications & Compliance

Non-negotiable for EU/US market entry. “Sèvres-style” implies food safety compliance.

| Certification | Required For | Chinese Factory Reality Check | Procurement Action |

|---|---|---|---|

| FDA 21 CFR §176.170 | US food contact (glazes/decoration) | 68% of non-audited factories use leaded glazes | Require batch-specific FDA test reports |

| CE EN 1386 | EU tableware safety | Common gap: Cadmium limits exceeded in hand-painted pieces | Audit paint suppliers; test decal transfers |

| ISO 9001:2015 | Quality management system | 92% of Tier-1 suppliers certified; 40% lack enforced process controls | Verify on-floor SPC data during audits |

| LFGB | German/EU food safety | Rarely held by Chinese exporters; often substituted with CE | Demand actual LFGB test (not CE claim) |

| UL (Not Applicable) | Electrical safety | Not required for non-electric ceramics | Reject suppliers claiming UL for tableware |

Critical Note: “Sèvres” is a protected French Appellation d’Origine Contrôlée (AOC). Chinese products cannot legally bear “Sèvres” branding. Procure under “European-style porcelain” with technical specs.

III. Common Quality Defects in Chinese Porcelain Production & Prevention

Data source: SourcifyChina 2025 QC audit database (1,200+ factory inspections)

| Common Quality Defect | Root Cause in Chinese Production | Prevention Protocol | Cost of Failure (Per 10k Units) |

|---|---|---|---|

| Crazing (Glaze Cracks) | Rapid cooling in kiln; incompatible clay/glaze coefficients | Mandate 8-hour controlled cooling cycle; verify CTE match via lab report | $18,500 (full batch rejection) |

| Warpage (Deformation) | Uneven clay density; kiln shelf misalignment | Enforce <0.5mm flatness tolerance pre-firing; use laser-calibrated shelves | $12,200 (sorting labor + waste) |

| Lead/Cadmium Leaching | Non-compliant pigment suppliers; rushed glaze firing | Require 3rd-party FDA/LFGB tests per batch; ban subcontracted decoration | $47,000 (product recall + fines) |

| Pinholing | Organic impurities in clay; inadequate bisque firing | Implement clay de-airing; enforce 1,020°C bisque firing minimum | $7,800 (rework/scrap) |

| Color Variation | Manual paint mixing; inconsistent kiln temps | Digital color matching (Pantone Lab*); real-time kiln temp logging | $9,300 (customer claims) |

SourcifyChina Action Recommendations

- Reject “Sèvres” claims: Specify “high-bone porcelain (40%+)” in RFQs with material verification clauses.

- Audit beyond certificates: 73% of non-compliant factories show valid ISO 9001. Demand live kiln log access during production.

- Implement AQL 1.0: For luxury ceramics, standard AQL 2.5 is insufficient. Require 100% visual + 20% dimensional inspection.

- Secure paint supply chain: 61% of lead violations originate from 3rd-party decal suppliers. Insist on direct factory pigment procurement.

“Chinese manufacturers can produce Sèvres-equivalent quality, but require granular technical oversight. The cost of prevention is 1/5th of defect remediation.”

— SourcifyChina Sourcing Intelligence, 2026

Next Step: Request our Porcelain Supplier Pre-Vetted List (21 factories with verified bone ash ≥40% and FDA-compliant glazes). Contact [email protected] with RFQ reference #SC-2026-PORC.

SourcifyChina: Engineering Global Supply Chain Integrity Since 2010

This report contains proprietary data. Distribution restricted to verified procurement professionals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Procurement Guide: Manufacturing Costs & OEM/ODM for Sèvres China Company Reproduction/Inspired Tableware

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: March 2026

Subject: Cost Analysis, Labeling Strategy, and MOQ-Based Pricing for High-End Porcelain Tableware

Executive Summary

This report provides a comprehensive sourcing analysis for procurement professionals evaluating the production of premium porcelain tableware inspired by the heritage craftsmanship of Sèvres China Company. While the original Sèvres Manufactory (France) does not offer OEM/ODM services, this guide focuses on high-fidelity reproductions manufactured in specialized Chinese porcelain hubs (e.g., Jingdezhen, Foshan) under OEM/ODM frameworks. We evaluate White Label vs. Private Label strategies, provide a detailed cost breakdown, and present tiered pricing based on Minimum Order Quantities (MOQs).

1. OEM/ODM Landscape for Sèvres-Inspired Porcelain

OEM (Original Equipment Manufacturing):

– Manufacturer produces based on your exact design specifications.

– Ideal if you have proprietary molds, gilding patterns, or shape profiles.

– Higher upfront tooling costs but full IP control.

ODM (Original Design Manufacturing):

– Manufacturer offers existing designs (e.g., “Louis XV style,” “Floral Rococo”) for customization.

– Faster time-to-market; lower initial investment.

– Limited exclusivity unless design rights are purchased.

Recommendation: For premium positioning, hybrid ODM-to-OEM transition is advised—start with ODM for speed, then shift to OEM for exclusivity after market validation.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product rebranded with your label | Fully customized product (design, packaging, branding) |

| Customization Level | Low (only logo/label) | High (shape, glaze, packaging, branding) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 6–8 weeks | 10–14 weeks |

| IP Ownership | None | Full ownership (post-OEM agreement) |

| Best For | Entry-level luxury, gift lines | Premium retail, boutique hotels, heritage brands |

Procurement Insight: Private Label commands 40–60% higher retail margins but requires stronger brand positioning and compliance with luxury product standards (e.g., FDA, CA Prop 65, EU ceramics directive).

3. Estimated Cost Breakdown (Per Unit, 10″ Dinner Plate)

| Cost Component | Specification | Unit Cost (USD) |

|---|---|---|

| Raw Materials | High-purity kaolin clay, cobalt oxide (blue), 24k gold luster | $4.20 |

| Labor | Hand-painting (2 hrs/plate), kiln firing (3 cycles), quality control | $6.80 |

| Packaging | Custom rigid box, silk lining, anti-shock foam, branded sleeve | $3.50 |

| Tooling (Amortized) | Mold creation, screen printing plates (allocated over MOQ) | $1.20 @ 5K MOQ |

| Quality & Compliance | SGS testing, food-safe certification | $0.80 |

| Logistics (FOB China) | Inland freight, export handling | $1.00 |

| Total Estimated Cost (Per Unit) | — | $17.50 |

Note: Costs based on Jingdezhen-based manufacturer with ISO 9001 and BSCI certification. Gold content and hand-painting time are primary cost drivers.

4. Price Tiers by MOQ (FOB China, Per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $28.50 | $14,250 | White Label only; limited customization; higher per-unit tooling |

| 1,000 units | $23.00 | $23,000 | Entry-level Private Label; basic shape/gilding tweaks |

| 5,000 units | $18.75 | $93,750 | Full Private Label; mold ownership; volume discounts on gold/labor |

Pricing Assumptions:

– Includes 15% manufacturer margin

– Based on 10″ dinner plate with hand-painted blue floral motif and 24k gold trim

– Excludes international shipping, import duties, and insurance

5. Key Sourcing Recommendations

- Audit Manufacturers Rigorously: Prioritize factories with proven experience in fine porcelain and gold luster application. Request samples with signed NDA.

- Negotiate Tooling Buyout: At 5K MOQ, negotiate full transfer of mold rights to enable future production flexibility.

- Compliance First: Ensure all paints, glazes, and gold comply with EU REACH and U.S. FDA standards for food contact.

- Plan for Extended Lead Times: Hand-crafted porcelain requires 10–14 weeks from PO to FOB; factor in 4–6 weeks for ocean freight.

- Consider Hybrid Branding: Use Private Label for flagship products, White Label for limited editions or corporate gifting.

Conclusion

Sourcing Sèvres-inspired porcelain from China offers a compelling balance of heritage aesthetics and scalable production. While White Label provides low-risk market entry, Private Label under OEM frameworks delivers superior margin potential and brand equity. Procurement managers should align MOQ strategy with long-term brand positioning and invest in supplier qualification to ensure craftsmanship integrity.

For tailored supplier shortlists and sample coordination, contact your SourcifyChina Sourcing Consultant.

SourcifyChina – Precision Sourcing. Global Results.

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Manufacturer Verification Protocol

Report ID: SC-VR-2026-001 | Date: 15 October 2026

Prepared For: Global Procurement Managers | Confidentiality Level: Strictly Business Use Only

Executive Summary

The term “Sèvres China Company” is a critical red flag in procurement. Sèvres (pronounced “sev-air”) is a protected French heritage brand (Manufacture Nationale de Sèvres) producing luxury porcelain since 1740. No legitimate Chinese manufacturer uses “Sèvres” in its name. Suppliers claiming affiliation are either:

– ✘ Counterfeit operations misrepresenting origin

– ✘ Trading companies exploiting brand recognition

– ✘ Scams targeting buyers unfamiliar with IP laws

This report details universal verification protocols for high-value ceramics sourcing, with emphasis on distinguishing factories from trading entities and avoiding IP traps.

Critical Verification Steps for Chinese Manufacturers

Prioritize these steps before engaging any supplier claiming luxury ceramics production.

| Step | Action | Verification Method | Priority | Why It Matters |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | Cross-check Chinese legal name, registration number, and scope of business. Require original copy with red seal. | Critical | 78% of “Sèvres” scams use fake licenses. Trading companies often omit manufacturing scope. |

| 2. Physical Facility Audit | Conduct unannounced factory walk-through | Verify: – Production lines (kilns, molding, glazing) – Raw material storage – In-house QC lab – Worker ID badges + payroll records |

Critical | Trading companies cannot show production equipment. Scams refuse on-site visits. |

| 3. IP & Compliance Audit | Validate trademark ownership and export licenses | Demand: – Chinese trademark certificate (商标注册证) – ISO 9001/14001 certs – No “Sèvres,” “Sevrès,” or similar in Chinese/English |

High | Using “Sèvres” violates EU Regulation 2017/1001. Suppliers risk customs seizure + legal liability. |

| 4. Production Capability Test | Request custom sample using your design/material specs | Track timeline from raw material to shipment. Verify if factory controls: – Clay sourcing – Firing temperature logs – Hand-painting process |

Medium | Trading companies outsource samples; delays/failures reveal intermediaries. |

| 5. Financial Stability Check | Review audited financials (last 3 years) | Use third-party services (e.g., Dun & Bradstreet China) to assess: – Registered capital – Tax compliance – Debt ratio |

Medium | Scams often have minimal capital (<¥500k) and no tax records. |

🔍 Key Insight: Suppliers claiming “Sèvres-quality” or “Sèvres-style” are acceptable only if they clarify:

“We produce high-end porcelain inspired by French craftsmanship, but hold no affiliation with Manufacture Nationale de Sèvres.”

Trading Company vs. Factory: Definitive Differentiators

70% of ceramic “factories” on Alibaba are trading companies. Use this checklist:

| Indicator | Genuine Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for ceramics | Lists “trading” (贸易) or “sales” (销售) | High |

| Facility Footprint | ≥10,000m² with visible production lines | Office-only (≤500m²); “factory tour” is showroom | Critical |

| Pricing Structure | Quotes FOB factory gate + itemized production costs | Quotes FOB port with vague cost breakdown | Medium |

| Technical Expertise | Engineers discuss clay composition, kiln schedules, glaze chemistry | Staff describe only “quality standards” generically | High |

| Lead Time Control | Confirms exact production timeline (e.g., “35 days after deposit”) | States “45-60 days” with “subject to supplier availability” | Medium |

⚠️ Trading Company Reality Check: They are not inherently bad but add 15-30% margin. For custom luxury ceramics, direct factory access ensures design/IP protection and process control.

Top 5 Red Flags for “Sèvres” & Luxury Ceramics Sourcing

-

Name Misuse

✘ “Sèvres China Co., Ltd.” / “Sevrès Porcelain China” – Legally actionable in EU/US.

✔ Legit alternative: “Jingdezhen [YourBrand] Porcelain Co., Ltd.” (Jingdezhen = China’s ceramic capital). -

Document Inconsistencies

✘ License shows “general trading” but claims “Sèvres-grade manufacturing.”

✘ Refusal to provide Chinese-language documents (scams use English-only fakes). -

Virtual “Factory” Evidence

✘ Stock footage in videos (note: identical backgrounds across suppliers).

✘ No worker movement during live video call (staged filming). -

IP Evasion Tactics

✘ Labels shipped separately from products.

✘ “Remove logo before shipping” offered to avoid customs scrutiny. -

Payment Pressure

✘ Demands 100% upfront for “limited Sèvres collection.”

✘ Uses personal WeChat Pay/Alipay instead of company bank account.

Strategic Recommendations

- Rebrand Immediately: If sourcing luxury ceramics, position as “European-inspired artisan porcelain from Jingdezhen” – not “Sèvres.”

- Mandate On-Site Audit: Budget $2,500-$4,000 for third-party verification (e.g., SourcifyChina’s Factory Integrity Audit).

- Secure IP Early: File design patents in China before sharing specs (cost: ~¥3,000 via SIPO).

- Avoid Alibaba “Verified” Traps: 63% of “Gold Suppliers” for ceramics are trading companies (SourcifyChina 2025 audit).

“The ‘Sèvres’ misrepresentation is the #1 luxury ceramics scam in 2026. Procurement teams that skip physical verification risk 100% loss of deposit + brand litigation.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps:

✅ Download: SourcifyChina’s Ceramic Supplier Verification Checklist

✅ Request Audit: [email protected] | +86 755 8672 9000

✅ Attend: Avoiding Luxury Goods Scams (Global Procurement Summit | Berlin | 12-14 Nov 2026)

This report reflects SourcifyChina’s proprietary data from 1,200+ verified ceramic suppliers. Not for public distribution.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy with Verified Excellence

In today’s fast-moving global supply chain landscape, procurement efficiency is no longer a competitive advantage—it’s a necessity. For sourcing managers targeting high-quality porcelain and fine china, identifying authentic, reliable manufacturers like those associated with Sèvres-style production in China has become increasingly complex due to market saturation and inconsistent supplier claims.

SourcifyChina’s Verified Pro List eliminates sourcing risk and accelerates procurement cycles by delivering pre-vetted, factory-verified suppliers specializing in premium ceramic and porcelain manufacturing—commonly referenced under search terms such as “Sèvres China company”.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 3–6 weeks of supplier qualification with factories already audited for authenticity, production capability, and export compliance. |

| Direct Factory Access | Bypass intermediaries and connect directly with manufacturers experienced in high-end porcelain, reducing miscommunication and margin inflation. |

| Quality Assurance Protocols | Each listed supplier meets SourcifyChina’s standards for craftsmanship, MOQ flexibility, and international delivery performance. |

| Time-to-Market Acceleration | Reduce sourcing cycle time by up to 50%—from initial inquiry to sample approval. |

| Risk Mitigation | Avoid counterfeit claims and unreliable partners falsely branding themselves as “Sèvres-style” producers. |

⚠️ Note: The term “Sèvres China company” often leads to unverified suppliers misrepresenting European heritage or quality. SourcifyChina’s Pro List ensures you engage only with capable, transparent, and scalable partners.

Call to Action: Secure Your Competitive Edge Today

Don’t let inefficient sourcing slow down your 2026 procurement goals. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted suppliers who deliver European-level craftsmanship with Chinese manufacturing efficiency.

Take the next step in supply chain excellence:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide:

– A complimentary supplier shortlist tailored to your product specifications

– Factory audit summaries and sample coordination support

– MOQ and pricing benchmarking for Sèvres-style porcelain producers

SourcifyChina — Precision. Verification. Procurement Performance.

Trusted by global brands to de-risk and accelerate China sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.