The global servo actuator market is experiencing robust growth, driven by increasing demand for precision motion control across industries such as robotics, aerospace, automotive, and industrial automation. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 16.5 billion in 2022 and is projected to grow at a CAGR of over 5.8% from 2023 to 2028, reaching an estimated USD 23.1 billion by the end of the forecast period. This expansion is fueled by the rising adoption of automation technologies, advancements in servo control systems, and the integration of Industry 4.0 principles in manufacturing. As demand intensifies, manufacturers are investing heavily in R&D to enhance efficiency, accuracy, and responsiveness of servo actuators. In this competitive landscape, a select group of leading companies have emerged as key innovators and suppliers. Based on market share, technological capabilities, global reach, and product performance metrics, the following are the top 10 servo actuator manufacturers shaping the future of motion control.

Top 10 Servo Actuator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

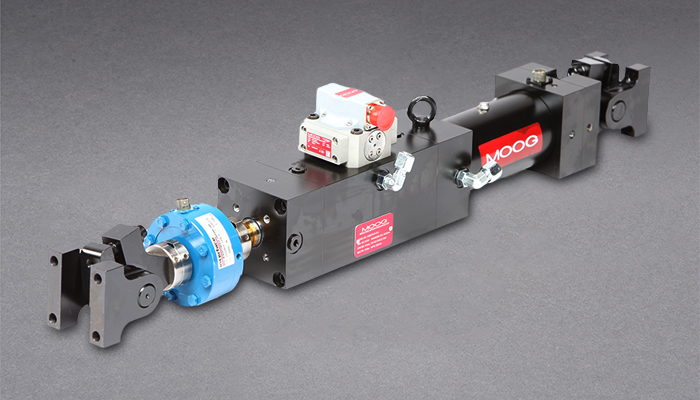

#1 Moog Electrohydraulic Servo Actuators

Domain Est. 1990

Website: moog.com

Key Highlights: Moog is the premier manufacturer of electrohydraulic actuators for Industrial, Aerospace, and Defense applications….

#2 Tolomatic

Domain Est. 1996

Website: tolomatic.com

Key Highlights: Tolomatic is a US manufacturer of linear motion solutions made to last. Design engineers rely on us for mission-critical automation….

#3 Premier Manufacturer of Electromechanical Actuators • Volz Servos

Domain Est. 1997

Website: volz-servos.com

Key Highlights: Volz Servos: The benchmark for cutting edge actuator technology · Made in Germany · Designed to control · Tried and tested · EASA certification….

#4 Electric Linear Actuators & Cylinders

Domain Est. 1998

Website: intelligentactuator.com

Key Highlights: Electric Actuator, Cylinder, Linear Actuators and Robot Manufacturer site for North America including United States, USA, Canada, Mexico….

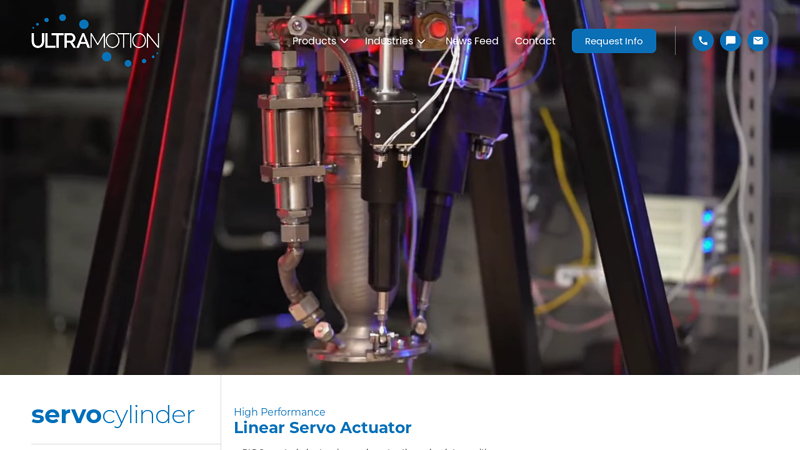

#5 Ultra Motion

Domain Est. 1996

Website: ultramotion.com

Key Highlights: The T3 Series Rotary Servo Actuator is an advanced electromechanical actuator equipped with integrated brushless DC control electronics and contactless ……

#6 Exlar Electric Linear & Rotary Actuator Products

Domain Est. 1996

Website: actuation.curtisswright.com

Key Highlights: Exlar ® electric actuators from Curtiss-Wright deliver a broad range of capabilities, power and performance in both linear and rotary configurations. Select ……

#7 Servomech S.p.a.

Domain Est. 2003

Website: servomech.com

Key Highlights: SERVOMECH Spa designs and manufactures acme and ball screw linear actuators, ball screw jacks, acme screw jacks, bevel gears, ball screws and nuts….

#8 Servo actuators

Domain Est. 2007

Website: wittenstein-us.com

Key Highlights: Our servo actuators are distinguished by high power density, a low mass moment of inertia, high stiffness and low torsional backlash….

#9 Hitec Commercial Solutions

Domain Est. 2018

Website: hiteccs.com

Key Highlights: With 50 years of expertise, Hitec Commercial Solutions leads in servo engineering. Customizable, high-quality servo actuators for every need….

#10 Micro Electric Linear (Servo) Actuator

Domain Est. 2020

Website: mightyzap.com

Key Highlights: Micro size mightyZAP linear servo actuators, limit switch linear actuators, and its accessories. See our various products & technical information….

Expert Sourcing Insights for Servo Actuator

H2: 2026 Market Trends for Servo Actuators

The global servo actuator market is poised for significant evolution by 2026, driven by technological advancements, shifting industrial demands, and the accelerating adoption of automation across diverse sectors. Key trends shaping the market landscape include:

-

Accelerated Integration of Industry 4.0 and IoT: Servo actuators are becoming increasingly “smart,” embedded with sensors and communication capabilities (e.g., Ethernet/IP, PROFINET, OPC UA). This enables real-time monitoring of position, torque, temperature, and vibration, facilitating predictive maintenance, optimizing performance, and enabling seamless integration into IIoT platforms and centralized control systems.

-

Demand for Miniaturization and Higher Power Density: Applications in robotics (especially collaborative and mobile robots), medical devices, and consumer electronics are driving demand for smaller, lighter actuators that deliver high torque and precision in compact footprints. Advances in materials (e.g., high-energy magnets) and design are enabling this trend.

-

Rise of Direct-Drive and Frameless Motors: Traditional gearboxes are being replaced by direct-drive rotary and linear servo actuators, eliminating backlash, reducing maintenance, and improving efficiency and precision. Frameless motors (rotor and stator only) are gaining traction, offering greater design flexibility and integration into custom mechanical systems, particularly in aerospace and high-end automation.

-

Focus on Energy Efficiency and Sustainability: Stricter regulations and rising energy costs are pushing demand for highly efficient servo systems. This includes advancements in motor design, regenerative braking capabilities (feeding energy back to the grid), and the development of eco-friendly manufacturing processes and materials.

-

Growth in High-Precision Applications: Industries like semiconductor manufacturing, photonics, life sciences, and advanced electronics assembly require nanometer-level precision and ultra-smooth motion control. This drives innovation in servo actuator design, feedback systems (e.g., high-resolution encoders), and control algorithms.

-

Expansion into New and Emerging Markets:

- Electrification of Mobility: Increased use in electric vehicles (EVs) for applications like active suspension, throttle control, and automated charging systems.

- Renewable Energy: Deployment in solar tracking systems and wind turbine pitch/yaw control for optimized energy capture.

- Agriculture Automation: Use in precision farming equipment (planters, sprayers, harvesters) and autonomous tractors.

- Logistics and Warehousing: Critical for high-speed, high-precision automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and sorting systems.

-

Increased Competition and Price Pressure: As the market grows, competition intensifies, particularly in standard applications. This drives innovation in cost-effective manufacturing (e.g., automation of actuator assembly) and the development of standardized, modular platforms to reduce complexity and price.

-

Software and Control System Integration: The value proposition is shifting beyond hardware. Seamless integration with advanced motion control software, simulation tools (digital twins), and machine learning algorithms for adaptive control and optimization is becoming a key differentiator.

Conclusion: By 2026, the servo actuator market will be characterized by smarter, smaller, more efficient, and more integrated solutions. Success will depend on manufacturers’ ability to leverage digitalization, meet the demands of high-growth sectors like robotics and EVs, and provide comprehensive solutions that combine advanced hardware with sophisticated software and connectivity, moving towards predictive and adaptive automation.

Common Pitfalls When Sourcing Servo Actuators (Quality, IP)

When sourcing servo actuators, overlooking critical quality and intellectual property (IP) aspects can lead to performance failures, legal risks, and increased costs. Below are key pitfalls to avoid:

Inadequate Quality Verification

Relying solely on supplier claims without independent quality validation is a major risk. Many low-cost manufacturers exaggerate performance metrics such as torque, speed, and lifespan. Without third-party testing or certifications (e.g., ISO 9001), there’s a high chance of receiving substandard components prone to premature failure, especially under continuous or high-load operation.

Ignoring IP Infringement Risks

Sourcing from regions with weak IP enforcement may expose your business to counterfeit or cloned servo actuators. These products often replicate patented designs or firmware without authorization, leading to potential legal liability, customs seizures, or product recalls. Always verify the supplier’s legitimacy and request documentation proving original design and manufacturing rights.

Misunderstanding IP Ratings

Many buyers assume a high IP (Ingress Protection) rating guarantees suitability for harsh environments, but context matters. For example, an IP67-rated actuator is dust-tight and withstands temporary immersion, but may not be suitable for continuous submersion or high-pressure washdowns (requiring IP69K). Confusing these ratings can result in equipment failure in industrial or outdoor applications.

Overlooking Firmware and Software IP

Modern servo actuators often include proprietary control algorithms or embedded software. Sourcing units with unlicensed or reverse-engineered firmware can introduce security vulnerabilities, compatibility issues, and breach software licensing agreements. Ensure firmware is genuine and updates are supported by the original manufacturer.

Failing to Audit the Supply Chain

Using intermediaries or brokers without transparency into the actual manufacturer increases the risk of receiving refurbished, counterfeit, or non-compliant units. Conduct on-site audits or require supply chain traceability documentation to confirm authenticity and production standards.

Avoiding these pitfalls requires due diligence in supplier evaluation, technical validation, and legal compliance—ensuring long-term reliability and avoiding costly disruptions.

Logistics & Compliance Guide for Servo Actuator

This guide outlines key considerations for the safe, efficient, and compliant logistics handling and regulatory adherence of servo actuators throughout the supply chain.

Packaging & Handling

- Use anti-static packaging materials to protect sensitive electronic components.

- Secure actuators in rigid, shock-absorbent containers to prevent physical damage during transit.

- Clearly label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” indicators.

- Avoid dropping or applying excessive force during handling; servo actuators contain precision gears and sensors.

- Store in a dry, temperature-controlled environment (typically 5°C to 40°C) when not in transit.

Transportation Requirements

- Comply with IATA/ICAO regulations if shipping lithium batteries (if applicable).

- Use carriers experienced in handling industrial automation components.

- Ensure proper securing of cargo on pallets or in containers to prevent shifting.

- For international shipments, provide accurate commodity codes (HS codes) such as 8537.10 or 8501.31, depending on actuator type.

- Consider climate-controlled transport for extreme environments.

Import/Export Compliance

- Verify export control classifications (ECCN) under the EAR (Export Administration Regulations); most servo actuators fall under 3A002 or 3A999.

- Obtain necessary export licenses for restricted destinations or end-uses.

- Complete accurate commercial invoices, packing lists, and certificates of origin.

- Confirm compliance with destination country’s import regulations (e.g., CE in Europe, UKCA in the UK, CCC in China).

- Maintain records for audit purposes per local customs requirements.

Regulatory & Safety Standards

- Ensure servo actuators meet relevant safety standards such as:

- IEC 61800-5-1 (functional safety of adjustable speed electrical power drive systems)

- IEC 60204-1 (safety of machinery – electrical equipment)

- CE Marking (EU), UL/CSA (North America), or PSE (Japan), as applicable.

- Confirm electromagnetic compatibility (EMC) compliance with standards like IEC 61800-3.

- Provide user documentation including installation manuals, safety warnings, and compliance declarations.

Documentation & Traceability

- Maintain a bill of materials (BOM) with RoHS, REACH, and conflict minerals declarations.

- Include unique serial numbers or batch codes on each unit for traceability.

- Provide a Declaration of Conformity (DoC) with each shipment.

- Keep digital records of compliance certificates, test reports, and shipping documents for a minimum of 10 years.

End-of-Life & Environmental Compliance

- Follow WEEE (Waste Electrical and Electronic Equipment) directives for returns and recycling in applicable regions.

- Label products with appropriate recycling symbols.

- Partner with certified e-waste recyclers for proper disposal.

- Ensure compliance with local environmental regulations regarding hazardous substances.

Adhering to this guide ensures smooth logistics operations and full regulatory compliance for servo actuator distribution worldwide.

Conclusion for Sourcing Servo Actuator:

After a thorough evaluation of technical specifications, performance requirements, supplier capabilities, and cost considerations, the sourcing of servo actuators should prioritize precision, reliability, and compatibility with the intended application. Key factors such as torque, speed, control accuracy, environmental resilience, and integration with existing control systems must align with operational needs. Additionally, selecting suppliers with a proven track record, strong technical support, and competitive lead times ensures long-term system performance and maintenance efficiency. Ultimately, a balanced decision that weighs quality, cost, and serviceability will lead to optimal performance, reduced downtime, and improved return on investment in automation and motion control systems.