The global turbocharger market, particularly within the heavy-duty commercial vehicle sector, is experiencing robust expansion driven by stringent emission regulations and the growing demand for fuel-efficient transportation solutions. According to Grand View Research, the global turbocharger market size was valued at USD 23.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. A significant share of this growth is attributed to the rising adoption of turbocharged diesel engines in semi trucks, where performance, reliability, and compliance with environmental standards are paramount. As demand surges, manufacturers are focusing on advanced technologies such as variable geometry turbochargers (VGT) and electrically assisted turbocharging systems. In this evolving landscape, nine key players have emerged as leading semi truck turbocharger manufacturers, combining innovation, scalability, and global supply chain integration to dominate the market.

Top 9 Semi Truck Turbocharger Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Powertecturbo

Domain Est. 2014

Website: powertecturbo.com

Key Highlights: A professional turbocharger manufacturer and technology service company integrating R&D, design, production, marketing and service….

#2 Turbochargers

Domain Est. 1990

Website: cummins.com

Key Highlights: Learn more about turbochargers from Cummins, experts in medium- and heavy-duty diesel engine turbochargers for increased engine performance….

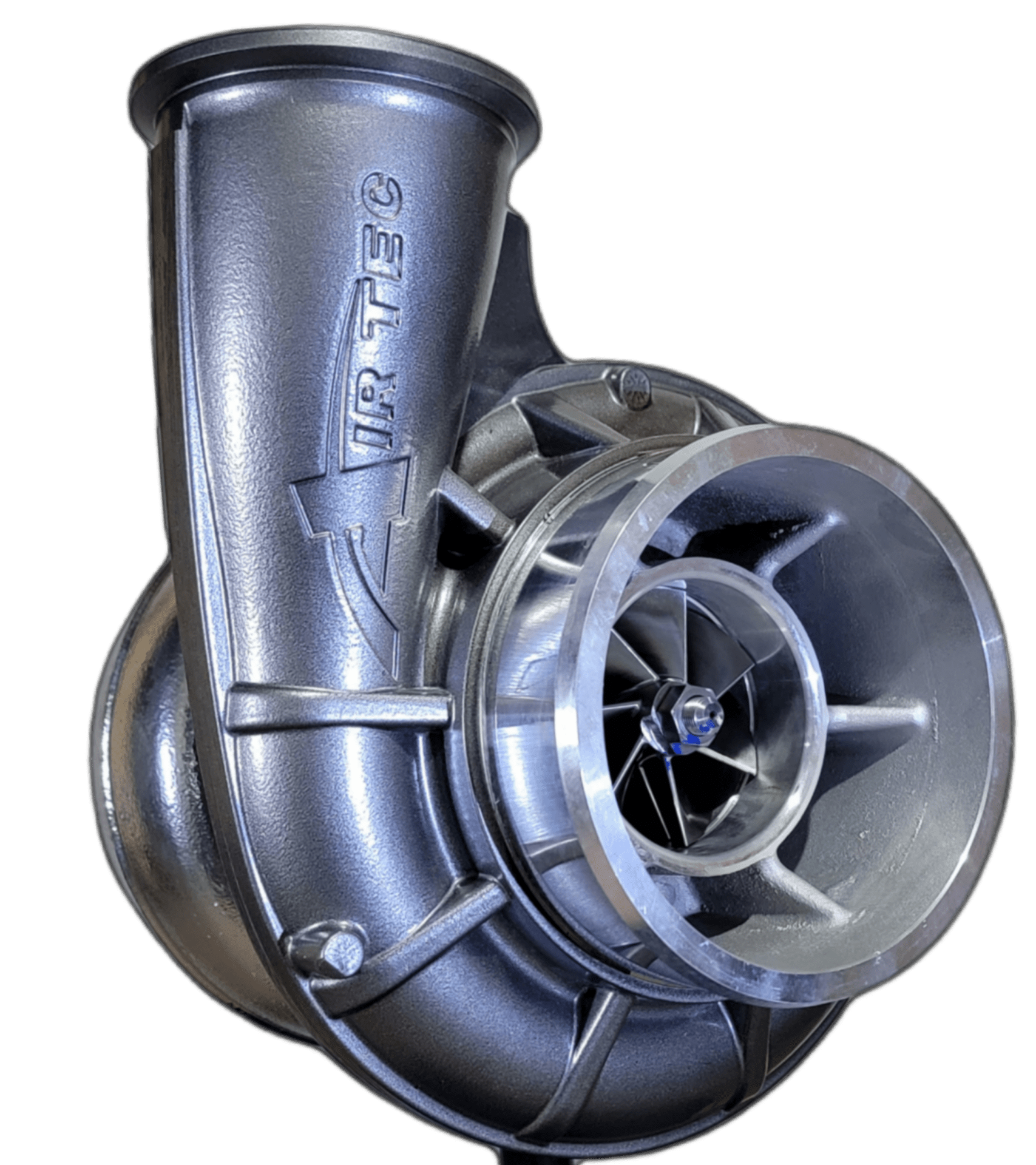

#3 Air Tec Innovations

Domain Est. 2017

Website: airtecinnovations.com

Key Highlights: Air Tec Innovations manufactures and distributes turbochargers for diesel pickups and heavy-duty trucks. Built with expertise for top performance….

#4 IHI Turbo America

Domain Est. 1998

Website: ihi-turbo.com

Key Highlights: IHI America is the US subsidiary of IHI Corporation serving both North and South America with exceptional turbocharger and supercharger products….

#5 Performance Turbochargers

Domain Est. 2002

Website: borgwarner.com

Key Highlights: AirWerks turbochargers cover a wide range of power ratings ranging from 220 HP all the way up to 1,875 HP per turbo. AirWerks is an excellent choice when it ……

#6 Turbo Solutions

Domain Est. 2015

Website: tsreman.com

Key Highlights: We have an extensive inventory of Turbochargers in stock and ready to ship the same day. We can service almost any application including: truck, bus, off- ……

#7 HD Turbo Official

Domain Est. 2016

Website: hdturbo.com

Key Highlights: HD Turbo is a Chicago-based turbocharger remanufacturing company focused on delivering the highest precision and quality turbochargers on the market….

#8 Garrett Original Equipment

Domain Est. 2018

Website: garrettmotion.com

Key Highlights: Aftermarket Original Turbos, 100% compatible with engine management systems, optimized for power, fuel efficiency and emissions compliance….

#9 Turbochargers

Domain Est. 2021

Website: terrepower.com

Key Highlights: Built on decades of experience, our turbochargers for commercial vehicles deliver the durability and performance required to keep fleets running smoothly….

Expert Sourcing Insights for Semi Truck Turbocharger

H2: 2026 Market Trends for Semi Truck Turbochargers

The semi truck turbocharger market is poised for significant transformation by 2026, driven by evolving emissions regulations, advancements in engine technology, and a growing emphasis on fuel efficiency and sustainability across the global transportation sector. As original equipment manufacturers (OEMs) and aftermarket suppliers adapt to these shifts, several key trends are expected to shape the trajectory of the turbocharger industry.

1. Stricter Emission Regulations Driving Turbocharger Innovation

Governments worldwide, particularly in North America, Europe, and China, are tightening emissions standards—such as the U.S. EPA’s Clean Trucks Plan and Euro VII—to reduce nitrogen oxides (NOx) and particulate matter (PM) from heavy-duty vehicles. These regulations are accelerating the adoption of advanced turbocharging technologies, including variable geometry turbochargers (VGTs) and two-stage turbo systems. These systems enhance combustion efficiency and improve exhaust gas recirculation (EGR) performance, enabling compliance without sacrificing engine power.

2. Electrification and Hybridization Impacting Turbocharger Demand

While full electrification of long-haul semi-trucks remains limited due to battery weight and range constraints, hybrid powertrains are gaining traction. In hybrid diesel-electric systems, turbochargers continue to play a critical role by optimizing internal combustion engine (ICE) efficiency during high-load operations. Additionally, electrically assisted turbochargers (e-Turbos), which use an electric motor to eliminate turbo lag and improve responsiveness, are expected to see increased integration by 2026, especially in premium and high-performance truck models.

3. Growth in the Aftermarket and Remanufactured Turbochargers

As the global fleet of semi-trucks ages and total cost of ownership becomes a priority, the aftermarket for turbochargers is expanding rapidly. Remanufactured and refurbished turbochargers offer cost-effective, sustainable alternatives to OEM parts, supported by improved quality standards and warranty offerings. By 2026, the aftermarket segment is projected to account for over 40% of total turbocharger sales, particularly in developing regions such as India, Southeast Asia, and Latin America.

4. Regional Market Divergence and Supply Chain Resilience

Market dynamics will vary by region. North America and Europe will focus on high-efficiency, low-emission turbo systems aligned with regulatory timelines, while Asia-Pacific—led by China and India—will experience robust growth due to increasing freight demand and infrastructure development. Supply chain localization, especially in response to geopolitical tensions and pandemic-related disruptions, will drive investments in regional manufacturing hubs to ensure component availability and reduce lead times.

5. Integration with Digital Monitoring and Predictive Maintenance

Smart turbochargers equipped with sensors and IoT connectivity are emerging as a trend by 2026. These systems enable real-time performance monitoring, fault detection, and predictive maintenance, reducing unplanned downtime and extending component life. Fleet operators are increasingly adopting telematics platforms that integrate turbocharger data with broader vehicle health analytics, improving operational efficiency and lowering maintenance costs.

In summary, the 2026 semi truck turbocharger market will be characterized by technological sophistication, regulatory compliance, and a balanced evolution between ICE optimization and electrification support. OEMs and suppliers that invest in innovation, sustainability, and digital integration will be best positioned to lead in this dynamic landscape.

Common Pitfalls When Sourcing Semi Truck Turbochargers (Quality & Intellectual Property)

Sourcing semi truck turbochargers involves significant risks, especially concerning quality assurance and intellectual property (IP) protection. Falling into these common pitfalls can lead to engine damage, downtime, safety issues, and legal complications.

Poor Quality Components and Counterfeit Products

One of the most prevalent risks in turbocharger sourcing is receiving substandard or counterfeit parts. These turbochargers may appear identical to OEM units but are manufactured using inferior materials and processes. Poor-quality bearings, imprecise turbine balancing, and weak housings can result in premature failure, reduced engine efficiency, and costly roadside breakdowns. Buyers often face misleading product descriptions, especially when sourcing from unverified suppliers or online marketplaces where counterfeit turbochargers are increasingly common.

Lack of Genuine OEM Certification

Many suppliers falsely claim their turbochargers are “OEM equivalent” or “OE quality” without providing verifiable certification. Genuine OEM turbochargers undergo rigorous testing and are traceable through serial numbers and manufacturer documentation. Sourcing parts without proper certification increases the risk of receiving remanufactured or knock-off units that do not meet original performance and durability standards, potentially voiding engine warranties and leading to compliance issues.

Intellectual Property Infringement

Turbocharger designs are protected by patents, trademarks, and copyrights held by major manufacturers such as Cummins, Holset (Cummins Turbo Technologies), BorgWarner, and Mitsubishi. Sourcing from suppliers that produce or distribute unlicensed replicas constitutes IP infringement. Companies that unknowingly purchase such products may face legal liability, customs seizures, or reputational damage. It is essential to verify that suppliers have proper licensing agreements or are authorized distributors.

Inadequate Traceability and Documentation

Reliable turbocharger sourcing requires full traceability, including manufacturing origin, date codes, and service history (for remanufactured units). Many low-cost suppliers fail to provide this documentation, making it difficult to verify authenticity or pursue warranty claims. Without proper paperwork, fleets and repair shops cannot ensure compliance with maintenance regulations or prove due diligence in case of failure investigations.

Misrepresentation of Remanufactured Units

Remanufactured turbochargers can be a cost-effective option when properly rebuilt to OEM specifications. However, some suppliers misrepresent used or poorly refurbished units as “remanufactured” or “like-new.” These units may not undergo full disassembly, inspection, or balancing, leading to unreliable performance. Buyers should ensure remanufacturers follow ISO standards and provide warranties equivalent to new units.

Choosing Suppliers Based Solely on Price

While cost is a major factor, prioritizing the lowest price often leads to compromised quality and hidden risks. Extremely low-priced turbochargers are frequently counterfeit or made with subpar components. Investing in verified, high-quality turbochargers from reputable sources reduces long-term costs by minimizing downtime, warranty claims, and collateral engine damage.

Inconsistent Warranty and Support

Low-tier suppliers may offer limited or ambiguous warranty terms, exclude labor costs, or require complex claim procedures. Some warranties are not honored internationally or lack responsive technical support. Reliable suppliers provide clear, comprehensive warranty coverage and accessible customer service to support fleet operations effectively.

By recognizing and avoiding these pitfalls—focusing on verified quality, authentic IP compliance, and trusted supply chains—fleets and distributors can ensure reliable performance, legal compliance, and long-term cost savings in their turbocharger procurement.

Logistics & Compliance Guide for Semi Truck Turbocharger

Overview

Semi truck turbochargers are critical performance components that require careful handling, documentation, and adherence to international and domestic regulations during shipping and distribution. This guide outlines key logistics considerations and compliance requirements for the safe and legal transport of turbochargers.

Classification & Harmonized System (HS) Code

Turbochargers for semi trucks are typically classified under the Harmonized System (HS) for international trade. The most common HS code is:

8414.30 – Turbochargers for internal combustion engines.

Accurate classification ensures proper customs clearance, duty assessment, and compliance with trade agreements. Always verify the specific code based on design and application with local customs authorities.

Packaging & Handling Requirements

- Protective Packaging: Turbochargers must be packed in sturdy, sealed containers with internal cushioning (e.g., foam inserts) to prevent vibration and impact damage.

- Moisture Protection: Include desiccants and moisture barrier wraps to avoid corrosion during transit, especially for ocean freight.

- Labeling: Packages must be clearly labeled with product identification, handling instructions (e.g., “Fragile,” “This Side Up”), and any hazardous material warnings if applicable (e.g., residual oil).

- Palletization: Secure units on pallets using stretch wrap or strapping for stability during storage and transport.

Transportation Modes & Considerations

- Ocean Freight: Most cost-effective for large volumes. Use containerized shipping (FCL or LCL) with climate-controlled options if transporting to humid regions.

- Air Freight: Ideal for urgent or low-volume shipments; higher cost but faster delivery. Ensure compliance with IATA regulations.

- Over-the-Road (Truck) Transport: Common for domestic distribution. Use enclosed trailers to protect against weather and road debris.

- Intermodal Transport: Combine rail and truck for long-distance, cost-efficient movement across continents (e.g., North America).

Import/Export Documentation

Ensure the following documents are prepared and accurate:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin

– Import/Export License (if required by country)

– Customs Declaration Form

– EPA or DOT Compliance Certificate (for U.S. imports)

Regulatory Compliance

- Emissions Standards: Turbochargers must comply with emissions regulations such as EPA (U.S.), Euro VI (EU), or equivalent standards in destination countries.

- DOT & FMVSS (U.S.): While turbochargers are not directly regulated under FMVSS, they must support compliance of the engine system with applicable standards.

- REACH & RoHS (EU): Ensure component materials comply with chemical and hazardous substance restrictions.

- Customs Bond & Duties: Use a licensed customs broker to calculate and pay applicable tariffs and fees. Duty rates vary by country and trade agreements.

Special Handling & Restrictions

- Hazardous Residues: Turbochargers may contain residual oil or cleaning agents. Declare any hazardous content per IMDG (sea), IATA (air), or ADR (road) regulations if thresholds are exceeded.

- Anti-Counterfeiting Measures: Implement serialization and tamper-evident packaging to prevent fraud and ensure traceability.

- Warranty & Recall Compliance: Maintain records of serial numbers and shipment data for potential recalls or warranty claims.

Storage & Inventory Management

- Store in a dry, temperature-controlled environment away from dust and corrosive agents.

- Follow FIFO (First In, First Out) inventory practices to prevent long-term storage degradation.

- Monitor for signs of corrosion or packaging damage during warehousing.

Reverse Logistics & Returns

- Establish a clear return authorization (RMA) process for defective or incorrect shipments.

- Package returned turbochargers using the same protective standards as outbound shipments.

- Inspect returned units for compliance and safety before refurbishment or disposal.

Conclusion

Proper logistics and compliance management are essential for the efficient and legal distribution of semi truck turbochargers. By adhering to packaging standards, regulatory requirements, and documentation protocols, businesses can minimize delays, avoid penalties, and ensure product integrity from factory to end-user.

In conclusion, sourcing a semi-truck turbocharger requires careful consideration of factors such as compatibility, quality, supplier reputation, and cost-effectiveness. Whether opting for OEM, aftermarket, or remanufactured units, it is crucial to ensure the turbocharger meets the performance and durability standards required for heavy-duty applications. Evaluating suppliers based on warranty offerings, technical support, and delivery reliability can significantly impact long-term operational efficiency. Additionally, considering total cost of ownership—not just upfront price—helps in making a sustainable and economically sound decision. With the right sourcing strategy, fleet operators and owner-operators can enhance engine performance, improve fuel economy, and minimize downtime, ultimately supporting optimal fleet productivity.