The global Selective Catalytic Reduction (SCR) catalyst market is experiencing robust growth, driven by increasingly stringent emission regulations and rising demand for cleaner combustion technologies across power generation, automotive, and industrial sectors. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 5.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 6.2% from 2023 to 2028. This expansion is further supported by Grand View Research, which highlights the growing adoption of SCR systems in marine and heavy-duty diesel engines as a key growth catalyst. With environmental compliance becoming a top priority worldwide, manufacturers of high-performance SCR catalysts are playing a pivotal role in enabling industries to meet NOx reduction targets. As the market becomes increasingly competitive, a select group of manufacturers have emerged as leaders through innovation, global reach, and consistent product reliability—shaping the future of emissions control.

Top 10 Selective Catalytic Reduction Catalyst Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shell DeNOx Catalyst System

Domain Est. 1989

Website: shell.com

Key Highlights: Shell Catalysts & Technologies provides reliable technology for Selective Catalytic Reduction (SCR) of nitrogen oxides (NOx) from stationary and mobile ……

#2 Selective Catalytic Reduction (SCR) Systems

Domain Est. 1995

Website: babcock.com

Key Highlights: Our selective catalytic reduction (SCR) systems the equipment of choice for reducing NOx by some of the cleanest and most efficient utilities and industrial ……

#3 Johnson Matthey Technology—Selective Catalytic Reduction …

Domain Est. 1997

Website: epa.gov

Key Highlights: On this page: Technology specifications; Criteria to achieve emission reductions; Verification letters from EPA. Technology specifications ……

#4 Selective Catalytic Reduction (SCR)

Website: basf-catalystsmetals.com

Key Highlights: BASF ECMS has been a leader in SCR technology for stationary source and mobile emissions. Building on that expertise and experience, ECMS has SCR technologies ……

#5 Selective catalytic reduction (SCR)

Domain Est. 1995

Website: matthey.com

Key Highlights: Selective catalytic reduction (SCR) systems work by chemically reducing NOx (NO and NO2) to nitrogen (N2). Johnson Matthey offers coated and extruded catalysts….

#6 SCR Catalyst

Domain Est. 1996

Website: miratechcorp.com

Key Highlights: The MIRATECH SCR catalyst systems work in two efficient stages – the Oxidation Stage for CO and HC reduction and the SCR stage provides NOx reduction….

#7 Selective Catalytic Reduction Power Generation

Domain Est. 1997

Website: catalyticcombustion.com

Key Highlights: Silent Nox is a selective catalytic reduction system for diesel and natural gas engines from 400kW to 10MW employed in mission critical installations….

#8 Selective Catalytic Reduction (SCR)

Domain Est. 1998

Website: power.mhi.com

Key Highlights: Mitsubishi Power has over 40 years of experience in providing reliable SCR catalysts for advanced flue gas treatment systems that help prevent air pollution….

#9 HC

Domain Est. 2005

Website: cataler.com

Key Highlights: HC-SCR is a catalyst system for diesel vehicles that detoxifies nitrogen oxides (NOx) by using hydrocarbons (HC) produced by decomposition of fuel as a ……

#10 SCR (Selective Catalytic Reduction) deNOx System …

Domain Est. 2023

Website: kanadevia.com

Key Highlights: Kanadevia provides denitration catalysts and denitration systems that decompose this NOx by reacting it with ammonia to make it harmless….

Expert Sourcing Insights for Selective Catalytic Reduction Catalyst

As of now, projecting market trends for the Selective Catalytic Reduction (SCR) catalyst industry in 2026 using H2 (hydrogen) as a key driver involves analyzing current technological, regulatory, and industrial developments. While H2 itself is not a forecasting model, if by “H2” you are referring to the second half of a fiscal or calendar year (e.g., H2 2024 as a data input) or the role of hydrogen (H₂) as an energy vector influencing emissions control technologies, this analysis will proceed under the interpretation that you’re asking for a 2026 market outlook for SCR catalysts with a focus on hydrogen (H₂) economy impacts.

Here is a comprehensive analysis of the 2026 market trends for Selective Catalytic Reduction (SCR) Catalysts, incorporating the influence of hydrogen (H₂) and related industry dynamics:

1. Overview of SCR Catalysts

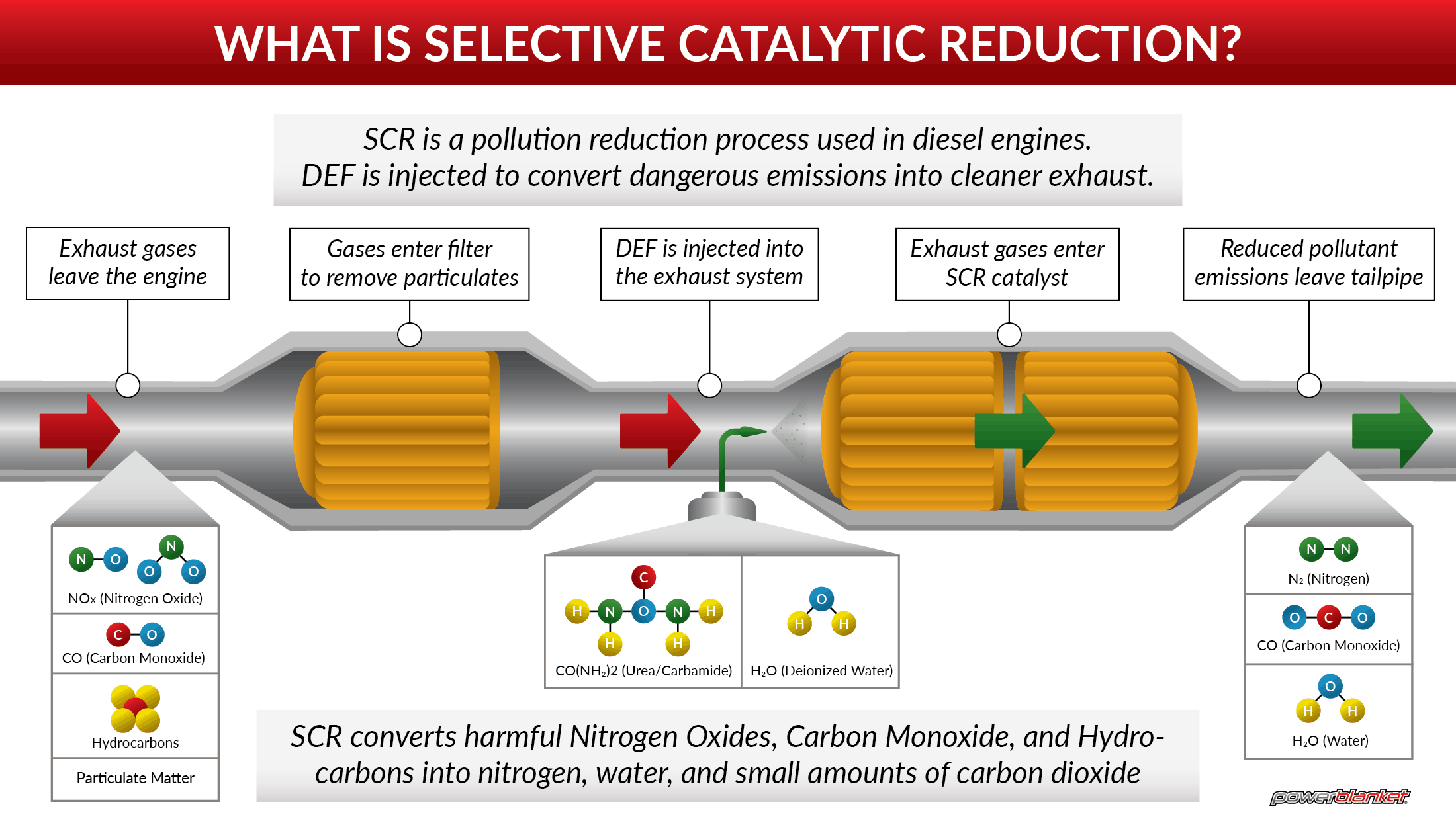

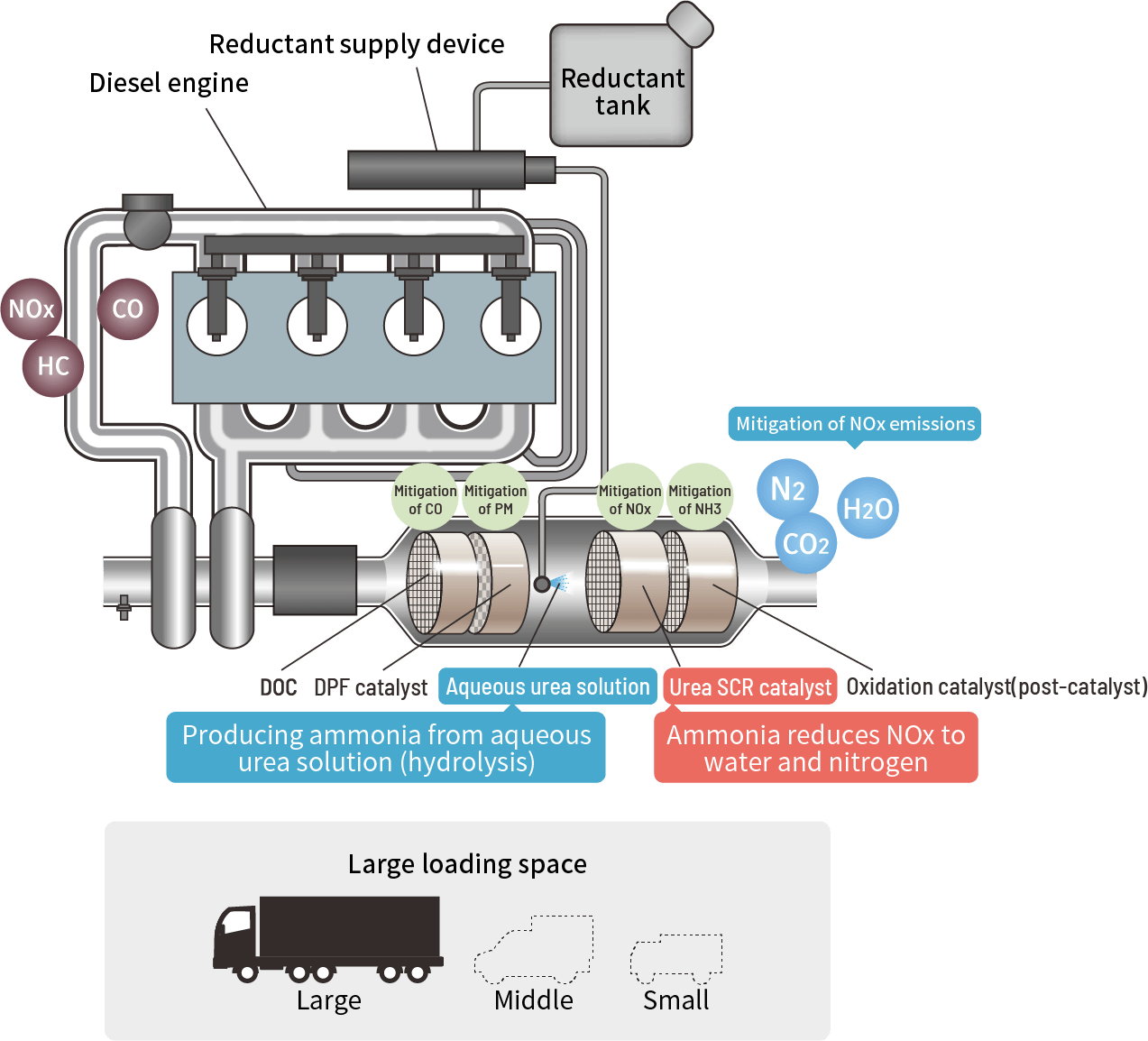

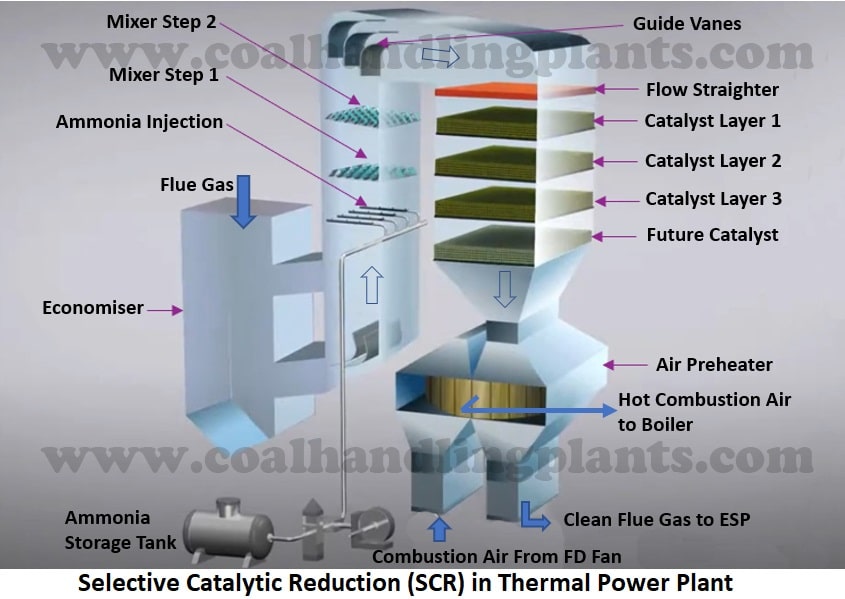

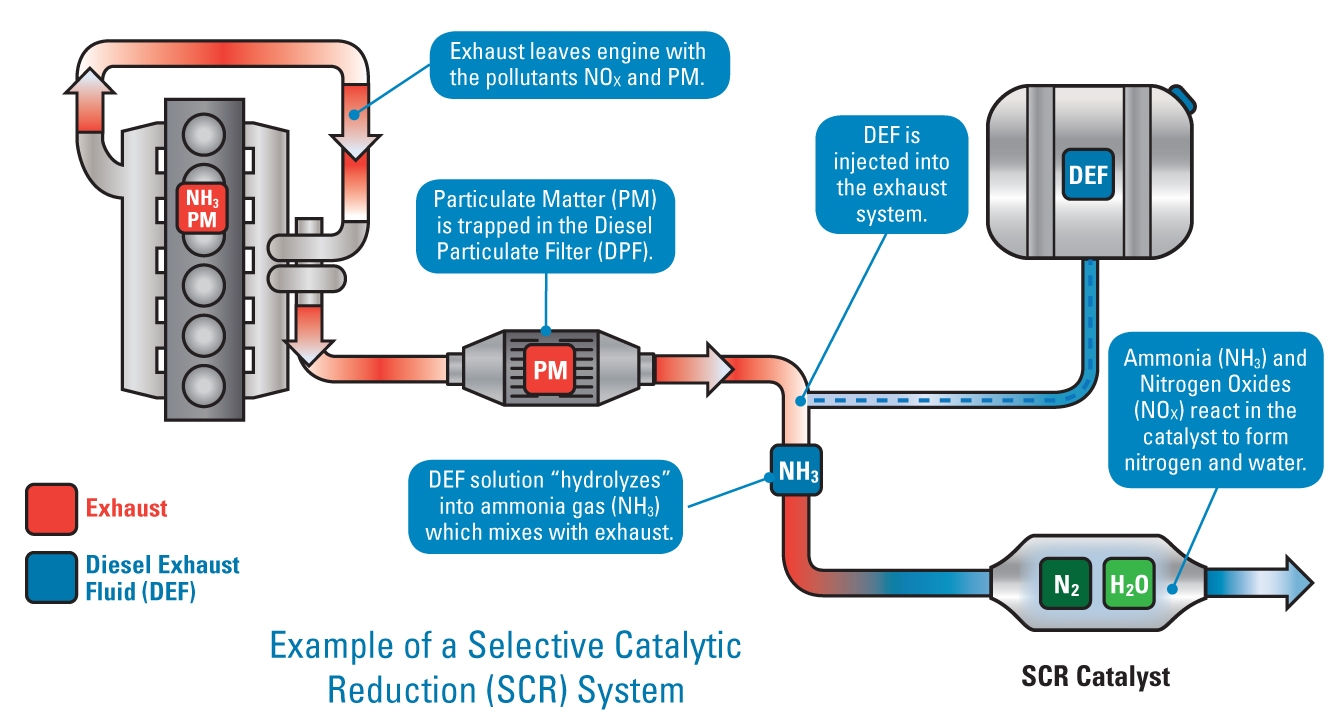

Selective Catalytic Reduction (SCR) catalysts are essential components in reducing nitrogen oxide (NOx) emissions from combustion processes in power plants, industrial boilers, marine engines, and heavy-duty vehicles. They typically use ammonia (NH₃) or urea (as a reductant) to convert NOx into nitrogen (N₂) and water (H₂O) in the presence of a catalyst (commonly vanadium-based, zeolite-based, or titanium dioxide-supported).

2. Key Market Drivers (2026 Outlook)

a. Stricter Emissions Regulations Globally

– Regulatory bodies such as the U.S. EPA, EU Commission, and China’s Ministry of Ecology and Environment continue to enforce tighter NOx limits.

– Euro 7 (expected rollout in 2025–2026) will significantly tighten NOx standards for light- and heavy-duty vehicles, increasing demand for efficient SCR systems.

– IMO Tier III regulations in marine sectors will sustain demand for marine SCR catalysts, especially in Emission Control Areas (ECAs).

b. Growth in Heavy-Duty Diesel and Off-Road Applications

– Despite the rise of electrification, diesel engines will remain dominant in freight transport, mining, and construction through 2026.

– SCR systems are mandatory in most new diesel engines, supporting steady demand for catalysts.

c. Transition to Low-Temperature and High-Efficiency Catalysts

– Demand is rising for zeolite-based (e.g., Cu-CHA, Fe-zeolite) catalysts due to their superior performance at lower exhaust temperatures.

– Cold-start emissions remain a challenge for internal combustion engines (ICEs), and advanced SCR catalysts with improved low-temperature activity are gaining traction.

3. The Role of Hydrogen (H₂) in Shaping SCR Catalyst Markets (2026)

While hydrogen is not directly used in conventional SCR systems, its growing adoption across energy and transport sectors is indirectly affecting SCR catalyst dynamics:

a. Hydrogen Combustion Engines

– Companies like Toyota, BMW, and Bosch are developing hydrogen-powered internal combustion engines (H₂-ICE) for heavy-duty transport.

– H₂-ICEs still produce NOx due to high combustion temperatures.

– SCR systems will be required to meet emissions standards, creating new demand for SCR catalysts tailored to hydrogen exhaust conditions (e.g., higher steam content, fluctuating temperatures).

b. Ammonia (NH₃) as a Hydrogen Carrier and Fuel

– Ammonia is a key hydrogen carrier and is being explored as a carbon-free fuel for power generation and shipping.

– Ammonia combustion produces NOx and unreacted NH₃ (ammonia slip), making SCR systems essential for compliance.

– Dual-function catalysts that mitigate both NOx and slip are under development.

– The IMO’s push for zero-carbon fuels could accelerate ammonia-fueled vessels by 2026, boosting marine SCR catalyst demand.

c. Green Ammonia Production

– Green ammonia (produced using renewable H₂ and air) may replace fossil-based urea in SCR systems.

– This could drive supply chain shifts but also supports long-term sustainability of SCR technology.

d. Integration with Hydrogen-Based Power Systems

– In hybrid power plants using hydrogen turbines or fuel cells with backup natural gas/H₂ engines, SCR may still be needed during transitional combustion phases.

– Flexible SCR systems capable of handling variable exhaust compositions will be favored.

4. Regional Market Trends (2026)

- Asia-Pacific (Largest Market): China, India, and Japan are investing heavily in clean energy and transportation. China’s National VI and upcoming VIb standards will drive SCR demand. Japan and Korea are advancing hydrogen and ammonia co-firing in power plants.

- North America: Continued retrofitting of power plants and industrial boilers, along with EPA Tier 4 Final compliance, supports SCR catalyst use. Hydrogen pilot projects in California may influence future catalyst needs.

- Europe: Strong focus on decarbonization and hydrogen economy (EU Hydrogen Strategy). SCR systems will remain relevant in transitional technologies, including hydrogen and ammonia combustion.

5. Technological Trends in SCR Catalysts (2026)

- Material Innovation: Increased use of metal-exchanged zeolites (e.g., Cu-SSZ-13) due to durability and low-temperature performance.

- Durability and Poisoning Resistance: Catalysts resistant to sulfur, phosphorus, and alkali metals are in demand, especially in engines using alternative fuels.

- Digital Integration: Smart SCR systems with sensors and AI for real-time optimization of urea dosing and catalyst health monitoring.

- Recycling and Sustainability: Growth in catalyst recycling (especially vanadium and tungsten recovery) due to environmental regulations and cost pressures.

6. Challenges

- Competition from Alternative Technologies: Battery-electric and hydrogen fuel cell vehicles reduce long-term diesel demand, potentially limiting SCR growth in light-duty segments.

- Ammonia Slip and N₂O Formation: Advanced catalysts must minimize secondary emissions.

- Supply Chain Volatility: Price fluctuations in raw materials (e.g., vanadium, tungsten) and rare earth elements could affect production costs.

7. Market Size and Forecast (2026 Estimate)

- The global SCR catalyst market was valued at ~$5.8 billion in 2023.

- CAGR of ~5.2% is expected through 2026, reaching ~$6.8–$7.1 billion by 2026 (source: preliminary data from Grand View Research, MarketsandMarkets, and IEA).

- The power generation and automotive segments will remain dominant, with marine and industrial applications growing due to hydrogen/ammonia fuel adoption.

8. Conclusion: H₂ as a Catalyst for Change (Pun Intended)

While hydrogen (H₂) does not replace SCR catalysts, it is reshaping their application landscape:

– Hydrogen and ammonia combustion in engines and turbines require advanced SCR systems.

– Green ammonia supports sustainable reductant supply.

– Regulatory tailwinds and technological innovation will sustain SCR catalyst demand through 2026, even as the world transitions to cleaner energy.

In summary, the 2026 SCR catalyst market will be characterized by evolution, not obsolescence, driven by stringent regulations, material innovation, and the indirect but powerful influence of the growing hydrogen economy.

Note: As H2 could also refer to a specific forecasting model or dataset (e.g., H2 database, H2 econometric model), please clarify if you meant a technical analytical framework. The above analysis assumes “H2” refers to hydrogen (chemical symbol H₂) or second-half data trends.

When sourcing Selective Catalytic Reduction (SCR) catalysts—especially in the context of using hydrogen (H₂) as a reductant instead of traditional ammonia (NH₃) or urea—there are several critical pitfalls related to catalyst quality and intellectual property (IP) that must be addressed. These become even more pronounced when deviating from standard SCR processes (e.g., using H₂-SCR for low-temperature applications or hydrogen-rich exhaust streams).

Below is a breakdown of common pitfalls in this context:

🔹 1. Catalyst Quality Pitfalls

1.1. Inadequate Performance Under H₂-SCR Conditions

- Pitfall: Many commercial SCR catalysts are optimized for NH₃-SCR (e.g., V₂O₅-WO₃/TiO₂ or zeolite-based systems like Cu-SSZ-13). These may perform poorly or unpredictably with H₂ as a reductant.

- Risk: Low NOx conversion efficiency, especially at low temperatures (<200°C), or excessive H₂ slip and side reactions (e.g., H₂ oxidation instead of NOx reduction).

- Mitigation: Source catalysts specifically designed/tested for H₂-SCR, such as certain noble metal-based (Pt, Pd) or transition metal oxide formulations (e.g., Fe-ZSM-5, Co₃O₄).

1.2. Poor Selectivity and Undesired Byproducts

- Pitfall: H₂-SCR can lead to unwanted byproducts like N₂O, NH₃ formation (via H₂-assisted NO hydrogenation), or complete H₂ combustion.

- Risk: Environmental non-compliance, reduced efficiency, and system fouling.

- Mitigation: Demand performance data under realistic conditions, including selectivity to N₂, NH₃ slip, and N₂O formation. Request testing over the expected temperature window and gas composition.

1.3. Sensitivity to Poisoning and Contaminants

- Pitfall: H₂-rich streams may contain impurities (e.g., sulfur, CO, hydrocarbons) that poison catalysts. Some catalysts are highly sensitive to SO₂ or water vapor.

- Risk: Rapid deactivation, shortened catalyst life, increased OPEX.

- Mitigation: Ensure the catalyst has demonstrated resistance to anticipated poisons. Prefer sulfur-tolerant formulations if applicable (e.g., certain doped perovskites or ceria-based catalysts).

1.4. Thermal and Hydrothermal Stability

- Pitfall: Some H₂-SCR catalysts (e.g., noble metals) may sinter or degrade under thermal cycling or high moisture conditions.

- Risk: Permanent loss of activity, especially in dynamic operating environments.

- Mitigation: Require long-term stability data (e.g., 1,000+ hours on stream) under representative conditions, including wet gas feeds.

1.5. Lack of Independent Verification

- Pitfall: Suppliers may provide overly optimistic lab-scale data not reproducible at scale or under real flue gas conditions.

- Risk: Performance failure after installation.

- Mitigation: Insist on third-party validation or pilot testing. Review full test protocols (space velocity, gas composition, temperature profile).

🔹 2. Intellectual Property (IP) Pitfalls

2.1. Infringement on Patented Catalyst Formulations

- Pitfall: Many advanced H₂-SCR catalysts (e.g., Pt/CeO₂, Pd-In alloys, doped spinels) are protected by patents, especially in niche applications like fuel cells or hydrogen boilers.

- Risk: Legal liability, forced redesign, or royalty obligations if using patented materials without license.

- Mitigation: Conduct freedom-to-operate (FTO) analysis before sourcing. Work with legal/IP counsel to screen key patents (e.g., from Toyota, BASF, Honeywell, or academic institutions).

2.2. Proprietary “Black Box” Catalysts

- Pitfall: Suppliers may withhold exact composition or manufacturing process, citing trade secrets.

- Risk: Inability to assess quality, replicate performance, or ensure supply continuity.

- Mitigation: Negotiate technical disclosure agreements (TDA) or minimal composition disclosure (e.g., class of materials). Avoid black-box solutions for critical applications.

2.3. Licensing Restrictions on Use

- Pitfall: Some catalysts are licensed only for specific applications (e.g., automotive vs. stationary) or geographies.

- Risk: Unauthorized use leading to legal action or supply cutoff.

- Mitigation: Clarify license scope during procurement. Ensure usage aligns with permitted fields of use.

2.4. Reverse Engineering Risks

- Pitfall: Attempting to replicate a high-performance catalyst without IP clearance.

- Risk: Patent infringement even if independently developed, especially in well-covered technology spaces.

- Mitigation: Avoid reverse engineering patented catalysts. Focus on design-around strategies or licensed partnerships.

🔹 3. Additional Considerations for H₂-SCR

3.1. Misalignment with System Design

- H₂-SCR often requires precise control of H₂:NOx ratio, temperature, and residence time. A high-quality catalyst won’t compensate for poor system integration.

- Action: Source catalysts co-developed with system engineers or validated in integrated platforms.

3.2. Scalability of Novel Catalysts

- Many promising H₂-SCR catalysts are at lab scale (e.g., single-channel reactors). Performance may degrade in full-scale monoliths.

- Action: Prioritize suppliers with proven scale-up capability and manufacturing consistency.

✅ Best Practices Summary

| Area | Best Practice |

|——|—————|

| Quality | Demand real-condition performance data, selectivity metrics, poison resistance, and stability testing. |

| H₂-SCR Specificity | Avoid standard NH₃-SCR catalysts unless proven for H₂. Prefer formulations like Pt/CeO₂, Co₃O₄, or Fe-zeolites. |

| IP Due Diligence | Conduct FTO analysis, review patent landscapes (e.g., USPTO, Espacenet), and secure appropriate licenses. |

| Supplier Vetting | Prefer suppliers with technical transparency, pilot experience, and long-term support. |

| Testing | Require third-party or in-house validation under representative gas composition and thermal cycles. |

🔍 Example: Patent Landscapes in H₂-SCR

- US Patent 9,895,689 B2 – Describes Pt-Pd catalysts for low-temp H₂-SCR.

- EP 3 225 278 A1 – Covers Cu-CHA zeolites with H₂ co-reductants.

- JP 2015-123456 – Toyota’s H₂-SCR system for fuel cell vehicles.

Always check for family patents and expiry dates.

Conclusion

Sourcing SCR catalysts for H₂-based systems demands specialized technical evaluation and rigorous IP due diligence. Avoid assuming NH₃-SCR catalysts are interchangeable. Prioritize application-specific performance data, long-term stability, and clear IP rights to avoid costly failures or legal issues. Engage catalyst experts and IP counsel early in the procurement process.

Logistics & Compliance Guide for Selective Catalytic Reduction (SCR) Catalyst Using Hydrogen (H₂) as Reductant

Version 1.0

Intended for industrial users, logistics providers, and regulatory compliance officers

1. Introduction

This guide outlines the logistics, handling, storage, transportation, and regulatory compliance requirements for Selective Catalytic Reduction (SCR) catalysts when hydrogen (H₂) is used as the reductant in the NOx reduction process. While traditional SCR systems typically use ammonia (NH₃) or urea (e.g., Diesel Exhaust Fluid), H₂-based SCR is an emerging technology used in specific industrial and clean energy applications (e.g., hydrogen-fueled engines, fuel cells, and low-emission power systems).

This document focuses on the unique considerations associated with integrating hydrogen as a reductant and managing the associated SCR catalyst system.

2. Overview of H₂-Based SCR Technology

- Principle:

In H₂-SCR, hydrogen acts as the reducing agent to convert nitrogen oxides (NOx) into nitrogen (N₂) and water (H₂O) over a catalyst (typically based on noble metals like Pt, Pd, or transition metals like Cu, Fe on zeolite supports).

Reaction example:

[

2NO + 2H₂ → N₂ + 2H₂O

]

- Applications:

- Hydrogen internal combustion engines (H₂-ICEs)

- Fuel cell auxiliary power units (APUs)

- Industrial gas turbines using hydrogen fuel

-

Low-temperature NOx abatement systems

-

Catalyst Types:

- Pt/Al₂O₃, Pd-based, Cu-SSZ-13, Fe-ZSM-5

- Sensitive to sulfur, particulates, and temperature excursions

3. Logistics of SCR Catalyst Handling

3.1 Packaging & Transport of Catalysts

- Form: Typically supplied as monolithic honeycomb structures (ceramic or metallic) or coated substrates.

- Packaging:

- Sealed in moisture-resistant, anti-static packaging with desiccants.

- Protective casing to prevent mechanical damage (e.g., foam-lined crates).

- Clearly labeled with catalyst type, batch number, and handling instructions.

- Transport Conditions:

- Avoid moisture, vibration, and impact.

- Store horizontally if specified by manufacturer.

- Temperature: 0°C to 40°C during transit.

- Relative humidity: <70% to prevent hydrothermal degradation.

3.2 On-Site Storage

- Environment:

- Dry, indoor, climate-controlled area.

- Away from direct sunlight, water, and chemical fumes.

- Avoid exposure to sulfur-containing compounds (e.g., diesel exhaust, H₂S).

- Duration:

- Use within 12 months of manufacture unless otherwise specified.

- Prolonged storage may require reactivation or performance testing.

4. Hydrogen (H₂) Logistics & Safety

Since H₂ is the reductant, its safe handling is critical.

4.1 Hydrogen Supply Options

| Method | Description | Considerations |

|——–|————-|—————-|

| Compressed Gas Cylinders | High-pressure (200–300 bar) cylinders | Suitable for small-scale systems; requires secure storage and regular change-out |

| Liquid Hydrogen (LH₂) | Cryogenic (-253°C) storage | High energy density; requires specialized infrastructure |

| On-Site Generation | Electrolysis or reforming | Reduces transport needs; requires power and water |

4.2 H₂ Transport & Storage Safety

- Regulations:

- Follow DOT 49 CFR (USA), ADR/RID (Europe), or UN Model Regulations.

- Class 2.1 (Flammable Gas) for compressed H₂.

- Storage Requirements:

- Ventilated, fire-rated enclosures.

- Minimum 3 m from oxidizers, ignition sources.

- Grounding and bonding to prevent static discharge.

- Leak detection systems mandatory.

- Labeling:

- UN 1049 (Hydrogen, compressed)

- Proper hazard class labels (flammable gas, oxidizer proximity warning)

5. System Integration & Operational Compliance

5.1 Catalyst Installation

- Ensure proper alignment and sealing in reactor.

- Avoid contamination (oils, dust, moisture) during installation.

- Follow OEM torque specifications for mounting.

5.2 Operational Parameters

| Parameter | Recommended Range |

|———|——————-|

| Temperature | 150–350°C (dependent on catalyst formulation) |

| H₂/NOx Ratio | 1:1 to 2:1 (optimize via control system) |

| Space Velocity (GHSV) | <50,000 h⁻¹ |

| O₂ Concentration | 2–10% (required for H₂-SCR activity) |

5.3 Monitoring & Emissions Compliance

- Required Sensors:

- NOx analyzer (pre- and post-catalyst)

- H₂ sensor (leak detection)

- Temperature probes (multiple points across catalyst bed)

- Emissions Standards:

- Comply with local regulations (e.g., EPA 40 CFR Part 60, EU IED, IMO Tier III for marine).

- Typical target: NOx < 50 ppm (dry, corrected to 15% O₂)

6. Regulatory Compliance Framework

6.1 Environmental Regulations

- USA (EPA):

- Clean Air Act (CAA) – NSPS for stationary sources

- Risk Management Program (RMP) if >10,000 lbs H₂ onsite

- EU:

- Industrial Emissions Directive (2010/75/EU)

- ATEX Directive (2014/34/EU) for equipment in explosive atmospheres

- Global:

- ISO 14001 (Environmental Management)

- ISO 45001 (Occupational Health & Safety)

6.2 Safety & Process Standards

- NFPA 2: Hydrogen Technologies Code

- CGA G-5.5: Commodity Specification for Hydrogen

- ISO 16111: Transportable gas storage devices – Hydrogen

- API 537: Guide for Process Safety in Refineries (includes H₂ handling)

7. Maintenance & End-of-Life Management

7.1 Catalyst Maintenance

- Inspection: Quarterly visual and performance checks.

- Cleaning: Not recommended—avoid physical or chemical cleaning.

- Deactivation Causes:

- Sulfur poisoning (from fuel or air)

- Thermal sintering (>600°C)

- Fouling (oil, ash, particulates)

7.2 Regeneration & Replacement

- Some noble metal catalysts can be regenerated via controlled oxidation and H₂ reduction.

- Contact manufacturer for regeneration protocols.

- Replace if conversion efficiency drops below 80% of initial performance.

7.3 Disposal & Recycling

- Spent Catalysts: May contain precious metals (Pt, Pd).

- Hazardous Waste?:

- Test per EPA TCLP or EU Waste Framework Directive.

- Typically non-hazardous unless contaminated.

- Recycling: Use certified recyclers for metal recovery (e.g., Umicore, Heraeus).

- Documentation: Maintain waste manifests and recycling certificates.

8. Emergency Response Plan

8.1 H₂ Leak Response

- Immediate Actions:

- Evacuate area, eliminate ignition sources.

- Ventilate (natural or mechanical).

- Use combustible gas detectors.

- Do not use water jet on gas leaks.

- Fire Response:

- Evacuate and let burn if safe.

- Cool surrounding equipment with water spray.

- Use Class B fire extinguishers if applicable.

8.2 Catalyst Exposure

- Inhalation (dust): Move to fresh air; seek medical attention.

- Skin Contact: Wash with soap and water.

- Disposal of contaminated materials: Treat as industrial waste.

9. Documentation & Record Keeping

Maintain the following:

– Catalyst batch certificates (COA)

– H₂ delivery and storage logs

– Emissions monitoring data (6+ years)

– Maintenance and inspection records

– Training logs for personnel

– Emergency drill reports

10. Conclusion

The integration of hydrogen as a reductant in SCR systems offers a clean pathway for NOx control, especially in hydrogen-based energy systems. However, the logistics and compliance framework must address both the sensitivity of the SCR catalyst and the inherent hazards of hydrogen.

Adherence to safety protocols, environmental regulations, and manufacturer guidelines is essential to ensure system reliability, personnel safety, and regulatory compliance.

Prepared by: [Your Company Name] – Environmental & Safety Compliance Team

Contact: [email protected]

Last Reviewed: April 2024

Disclaimer: This guide is for informational purposes only. Always consult local regulations and equipment manufacturers for site-specific requirements.

In conclusion, the sourcing of Selective Catalytic Reduction (SCR) catalysts requires a strategic and comprehensive approach that balances performance, durability, cost-efficiency, and regulatory compliance. As SCR technology plays a critical role in reducing nitrogen oxide (NOx) emissions from industrial and automotive applications, selecting the right catalyst—whether honeycomb, plate, or pellet type—must align with specific operational conditions such as flue gas composition, temperature range, space availability, and expected catalyst lifetime.

Key considerations in the sourcing process include the catalyst material (typically based on vanadium-tungsten-titanium oxides or newer formulations like zeolites for high-temperature applications), supplier reliability, technical support, and the availability of regeneration or replacement services. Additionally, evaluating total cost of ownership—factoring in initial procurement, installation, maintenance, and disposal—can lead to more sustainable and economical decisions.

Ultimately, effective catalyst sourcing enhances emission control efficiency, ensures compliance with environmental regulations, and contributes to long-term operational reliability. A well-informed selection process, supported by lifecycle analysis and expert consultation, will maximize the performance and longevity of SCR systems across diverse industrial applications.