The global screen printing machine market is experiencing steady growth, driven by rising demand across key industries such as textiles, electronics, and signage. According to Mordor Intelligence, the market was valued at USD 1.78 billion in 2023 and is projected to reach USD 2.26 billion by 2029, growing at a CAGR of 4.0% during the forecast period. This expansion is fueled by advancements in automation, increasing customization in apparel, and the proliferation of printed electronics. As manufacturers seek higher precision, efficiency, and integration with digital workflows, the competitive landscape has intensified. In this evolving environment, leading screen printing machine manufacturers are investing in innovation to meet the diverse needs of printers worldwide. Based on market presence, technological capabilities, and customer reach, the following nine companies stand out as the top players shaping the future of screen printing technology.

Top 9 Screenprinting Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

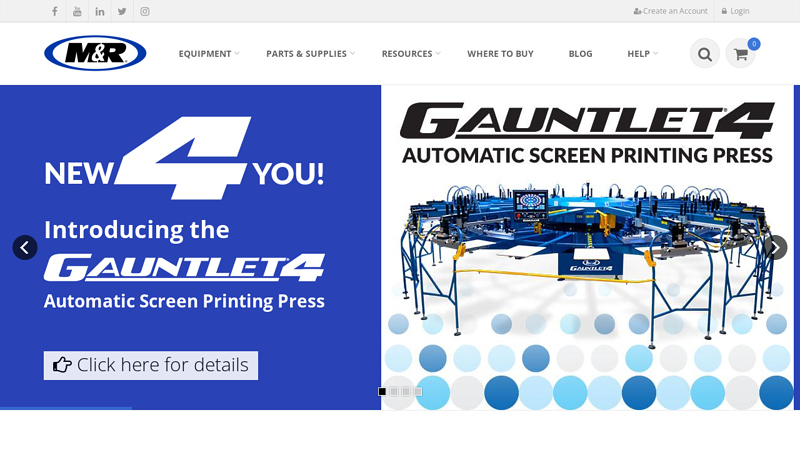

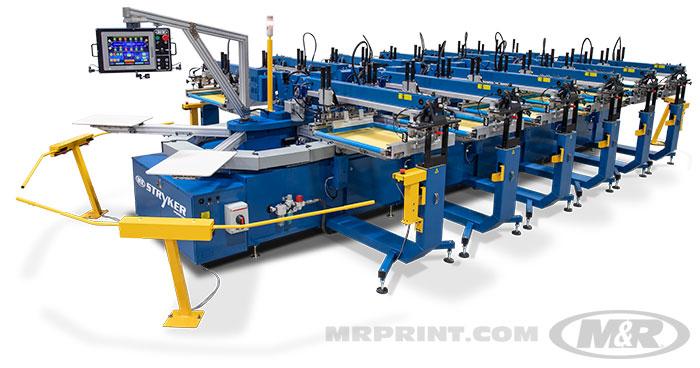

#1 M&R Printing Equipment Inc. :: DTF

Domain Est. 1996

Website: mrprint.com

Key Highlights: M&R is the world’s largest manufacturer of screen printing equipment for the graphic and textile industries, setting the standard for innovation, quality, and ……

#2 AWT World Trade, Inc.

Domain Est. 1997

Website: awt-gpi.com

Key Highlights: AWT, leading manufacturer of silk screen printing equipment, graphic and textile screen printing machines, manual t-shirt printing presses, ……

#3 Workhorse Products Screen Printing Equipment Manufacturer

Domain Est. 1997

Website: workhorseproducts.com

Key Highlights: Workhorse Products with its line of Precision Screen Printing Machine Equipment has been a dominant player in the textile screen printing industry for decades….

#4 Ryonet Corporation

Domain Est. 2006 | Founded: 2004

Website: ryonet.com

Key Highlights: Ryonet started off as a screen print manufacturer and supplier, but that was just the beginning. Since 2004, Ryonet has established the foundation to allow ……

#5 ROQ International

Domain Est. 2014

Website: roqinternational.com

Key Highlights: ROQ is a European industrial company producing silkscreen and digital printing, folding and packaging machines for textile and other industries….

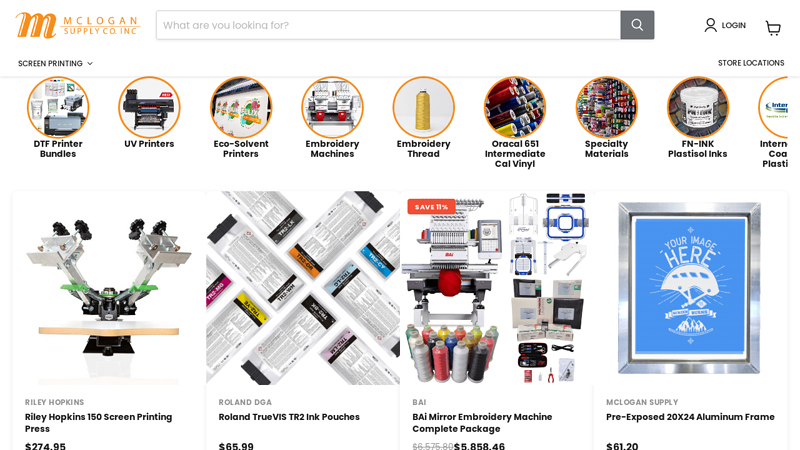

#6 Screen Printing, Heat Transfer, and DTG Supplies & Equipment

Domain Est. 1998

Website: mclogan.com

Key Highlights: Free delivery over $250 20-day returnsOct 8, 2025 · McLogan Supply is the leading supplier of low-cost, high-quality screen printing, heat transfer & signage supplies & equipment, …

#7 Screen Printing Presses and Accessories

Domain Est. 1998

Website: vastex.com

Key Highlights: Heavy, medium and light duty screen printing presses, low-cost craft/hobby tabletop presses and easy-to-use numbering systems….

#8 Automatic Screen Printing Machines

Domain Est. 2004

Website: roq.us

Key Highlights: ROQ.US provides the global digital and screen printing industry with unstoppable automation and resources for unmatched ROI. Press Onward with Your Partner ……

#9 Digital Inkjet Production Solutions

Domain Est. 2015

Website: screenamericas.com

Key Highlights: From high-speed inkjet to label and packaging to wide format and more, SCREEN Digital Inkjet Production Solutions help professional print operations grow to ……

Expert Sourcing Insights for Screenprinting Machine

H2: 2026 Market Trends for Screen Printing Machines

The global screen printing machine market is poised for significant transformation by 2026, driven by technological innovation, evolving consumer demands, and shifts in manufacturing practices across key industries such as textiles, packaging, and promotional goods. Below are the major trends expected to shape the screen printing machine landscape in 2026:

-

Increased Automation and Smart Manufacturing Integration

By 2026, automation will be a cornerstone of screen printing operations. Advanced screen printing machines will increasingly integrate with Industry 4.0 technologies, including IoT-enabled devices, AI-driven predictive maintenance, and cloud-based production management systems. These features will enhance precision, reduce downtime, and improve overall operational efficiency, particularly in high-volume production environments. -

Growth in Digital Hybrid Systems

The convergence of digital printing and traditional screen printing is accelerating. Hybrid machines that combine the high-speed, durable output of screen printing with the customization capabilities of digital printing are expected to gain traction. These systems allow printers to efficiently handle short to medium runs with variable data, meeting the rising demand for personalized apparel and packaging. -

Sustainability and Eco-Friendly Innovations

Environmental regulations and consumer preferences are pushing manufacturers toward greener solutions. In 2026, screen printing machines will increasingly feature water-based ink compatibility, reduced solvent emissions, and energy-efficient designs. Additionally, equipment with automatic cleaning systems that minimize water and chemical usage will become standard, supporting sustainable production goals. -

Rise in Demand from Emerging Markets

Asia-Pacific, Latin America, and Africa are expected to see robust growth in screen printing adoption, fueled by expanding textile industries, rising disposable incomes, and localization of manufacturing. Countries like India, Vietnam, and Brazil will emerge as key markets, driving demand for cost-effective, durable screen printing solutions tailored to local production scales. -

Advancements in Precision and Registration Technology

Improved micro-registration systems and servo-driven alignment mechanisms will enable higher print accuracy, especially for intricate designs and multi-color applications. These advancements will be critical in high-end fashion, technical textiles, and electronics printing, where consistency and detail are paramount. -

Customization and On-Demand Production

The trend toward mass customization will influence machine design, with more compact, user-friendly models entering the market to support small-batch and on-demand production. Desktop and semi-automatic screen printing machines will become popular among startups, e-commerce brands, and print-on-demand services. -

Impact of E-Commerce and Direct-to-Consumer Models

The growth of online retail and direct-to-consumer (DTC) brands will drive demand for agile printing solutions. Screen printing machines capable of fast changeovers, low setup times, and integration with e-commerce platforms will be highly sought after, enabling rapid fulfillment of customized products. -

Consolidation and Strategic Partnerships Among Manufacturers

Anticipating increased competition, major screen printing machine manufacturers are expected to form strategic alliances, acquire software firms, or expand into complementary technologies (e.g., digital cutters, curing systems) to offer end-to-end printing solutions. This will enhance customer value and strengthen market positioning.

In summary, the 2026 screen printing machine market will be defined by smarter, more sustainable, and highly adaptable systems that cater to both industrial-scale operations and niche customization needs. Companies that invest in innovation, sustainability, and digital integration will be best positioned to capitalize on these emerging opportunities.

Common Pitfalls When Sourcing Screenprinting Machines (Quality & IP)

Sourcing screenprinting machines, especially from overseas suppliers, presents several risks related to quality control and intellectual property (IP) protection. Being aware of these pitfalls can help buyers make informed decisions and avoid costly mistakes.

Poor Build Quality and Material Standards

Many low-cost screenprinting machines, particularly from less-regulated manufacturers, use substandard materials such as thin-gauge steel, low-grade aluminum, or inferior bearings and motors. This can lead to misalignment, excessive vibration, and premature wear, resulting in inconsistent print quality and frequent breakdowns.

Inadequate Calibration and Precision Engineering

High-quality screenprinting requires precise registration and consistent squeegee pressure. Machines that lack proper calibration during manufacturing often suffer from registration drift and uneven ink deposition. Buyers may overlook the importance of precision engineering, only discovering these flaws after installation and operation.

Lack of Compliance with International Safety and Electrical Standards

Some machines do not comply with regional safety standards (e.g., CE, UL, or RoHS). This can pose safety hazards and lead to import restrictions or legal liability. Always verify that the machine meets the required certifications for your market.

Hidden Costs from Incomplete or Non-Standard Components

Suppliers may quote a low base price but exclude essential components such as drying units, flash cure systems, or software. Additionally, non-standard parts can make maintenance difficult and increase long-term operational costs due to limited availability and higher replacement prices.

Inadequate After-Sales Support and Spare Parts Availability

Many manufacturers, particularly smaller or distant ones, offer limited technical support, training, or spare parts. This can lead to prolonged downtime when repairs are needed. Verify the supplier’s service network and the availability of critical components before purchase.

Intellectual Property Infringement Risks

Some screenprinting machines replicate patented designs, control systems, or software from established brands. Purchasing such machines may expose the buyer to legal risk, especially in jurisdictions with strong IP enforcement. Always ensure the machine does not infringe on existing patents or trademarks.

Use of Unlicensed Software or Control Systems

Machines may come with pirated or unlicensed software for automation and control. This not only violates copyright laws but can also lead to instability, lack of updates, and security vulnerabilities. Confirm that all software is properly licensed and supported.

Insufficient Documentation and Language Barriers

Poorly translated manuals, missing technical documentation, or lack of English support can hinder installation, maintenance, and troubleshooting. This increases reliance on the supplier and reduces operational efficiency.

Failure to Verify Supplier Authenticity and Track Record

Some suppliers operate as intermediaries or resellers without direct manufacturing control, leading to inconsistencies in quality. Conduct due diligence by checking references, visiting facilities if possible, and reviewing third-party certifications.

Overlooking IP Ownership in Customized Machines

When commissioning custom features or automated upgrades, ensure contracts clearly define IP ownership. Without proper agreements, the buyer may not retain rights to modifications, limiting future scalability or protection against copying.

Logistics & Compliance Guide for Screenprinting Machine

Overview

This guide outlines the essential logistics and compliance considerations when shipping, importing, or operating a screenprinting machine. Whether you are a manufacturer, distributor, or end-user, understanding these requirements ensures smooth transit, legal compliance, and operational readiness.

International Shipping & Export Compliance

When transporting screenprinting machines across borders, several export regulations apply:

– Export Classification: Determine the Export Control Classification Number (ECCN) under the U.S. Commerce Control List (CCL) or equivalent in your country. Most industrial screenprinting machines fall under EAR99 (low-risk, general control), but verify based on technical specs.

– Documentation: Prepare commercial invoice, packing list, bill of lading/airway bill, and Certificate of Origin. Include detailed machine specifications (voltage, dimensions, weight, serial number).

– Incoterms: Clearly define responsibilities (e.g., FOB, DDP) in contracts to avoid disputes over shipping costs, insurance, and customs clearance.

– Restricted Destinations: Check for sanctions or embargoes on destination countries via government databases (e.g., U.S. Department of State or EU Sanctions Map).

Import Regulations & Duties

Importing a screenprinting machine requires adherence to local customs rules:

– Customs Tariff Code: Identify the correct HS (Harmonized System) code—commonly 8443.19 for printing machinery. This determines duty rates and import taxes.

– Duties and Taxes: Calculate applicable import duties, VAT, or GST based on the declared value and destination country. Some countries offer reduced rates for industrial machinery.

– Import Permits: Certain countries may require special permits or pre-approval for importing industrial equipment. Check with local customs authorities.

– Product Certification: Ensure the machine meets local electrical and safety standards (e.g., CE in the EU, UL in the U.S., CCC in China).

Transportation & Handling

Proper logistics planning ensures the machine arrives undamaged:

– Packaging: Use robust, export-grade wooden crates with internal bracing. Include moisture barriers and shock indicators.

– Forklift Access: Design crates with pallet bases and forklift entry points. Mark lifting points clearly.

– Weight & Dimensions: Confirm machine dimensions and gross weight for freight classification (LTL, FTL, air, or sea). Oversized shipments may require special permits.

– Mode of Transport: Choose sea freight for cost efficiency on heavy machinery; air freight for urgency, despite higher costs.

Safety & Regulatory Compliance

Operating a screenprinting machine must comply with occupational and environmental standards:

– Electrical Compliance: Machines must meet local voltage and grounding requirements (e.g., 110V/220V, three-phase compatibility). Include certifications like CE, UL, or ETL.

– Machine Guarding: Ensure moving parts (squeegees, platens, registration systems) are equipped with proper guards per OSHA (U.S.) or equivalent safety regulations.

– Noise & Ventilation: Comply with noise emission limits; install ventilation systems if solvents or inks are used to control VOCs and airborne particulates.

– CE Marking (EU): Affix CE marking if selling in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

Environmental & Chemical Regulations

Screenprinting involves inks, cleaners, and solvents subject to environmental rules:

– Hazardous Materials: If shipping with ink or solvents, classify under IMDG (sea), IATA (air), or ADR (road) regulations. Use certified hazmat packaging and labels.

– REACH & RoHS (EU): Ensure electronic components and materials comply with restrictions on hazardous substances. Maintain documentation for chemical composition.

– Waste Disposal: Follow local regulations for disposing of ink residues, used screens, and cleaning solvents. Partner with certified waste management services.

Installation & Operational Readiness

Ensure seamless integration upon delivery:

– Site Preparation: Confirm facility has adequate power supply, floor load capacity, and space for operation and maintenance.

– Commissioning: Schedule technician support for installation, calibration, and staff training. Retain manuals and warranty documents.

– Regulatory Registration: In some jurisdictions, industrial equipment must be registered with labor or safety authorities before use.

Conclusion

Successfully managing the logistics and compliance of a screenprinting machine involves careful planning across shipping, customs, safety, and environmental domains. Partner with experienced freight forwarders and legal advisors to ensure full compliance and minimize delays or penalties.

In conclusion, sourcing a screen printing machine requires careful consideration of several key factors, including production volume, printing quality, machine type (manual, semi-automatic, or automatic), budget, maintenance requirements, and available space. After evaluating various suppliers, comparing features, and assessing long-term operational needs, it is essential to select a machine that balances performance, reliability, and cost-effectiveness. Additionally, choosing a reputable supplier with strong technical support and after-sales service will ensure smooth integration into your production process and minimize downtime. Ultimately, investing in the right screen printing machine will enhance efficiency, improve print consistency, and support business growth in the competitive printing industry.