The global industrial vacuum cleaner market, which includes specialized systems like sawdust vacuum solutions, is experiencing steady growth driven by increasing demand for workplace safety, dust control regulations, and efficiency improvements in woodworking and manufacturing sectors. According to Grand View Research, the global industrial vacuum cleaners market was valued at USD 3.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This expansion is fueled by stringent occupational health standards and the rising adoption of automated cleaning systems in industrial environments. As wood processing facilities prioritize air quality and operational cleanliness, the need for high-performance sawdust vacuum systems has become critical. In this evolving landscape, selecting the right manufacturer is essential for ensuring reliability, compliance, and long-term cost efficiency. Based on market presence, innovation, product range, and customer reviews, the following nine companies have emerged as leading manufacturers of sawdust vacuum systems worldwide.

Top 9 Sawdust Vacuum System Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sawdust vacuum cleaners equipment

Domain Est. 2023

Website: rgsvacuumsusa.com

Key Highlights: We are a leading manufacturer of high-quality industrial vacuum cleaners, centralized vacuum systems, and pneumatic conveyors for powders and granules. Since ……

#2 Superior Filtration, Industrial Dust and Mist Collector

Domain Est. 1995

Website: parker.com

Key Highlights: We offer a range of efficient and cost-effective air pollution control solutions, including industrial DustHog dust and Smoghog mist collectors….

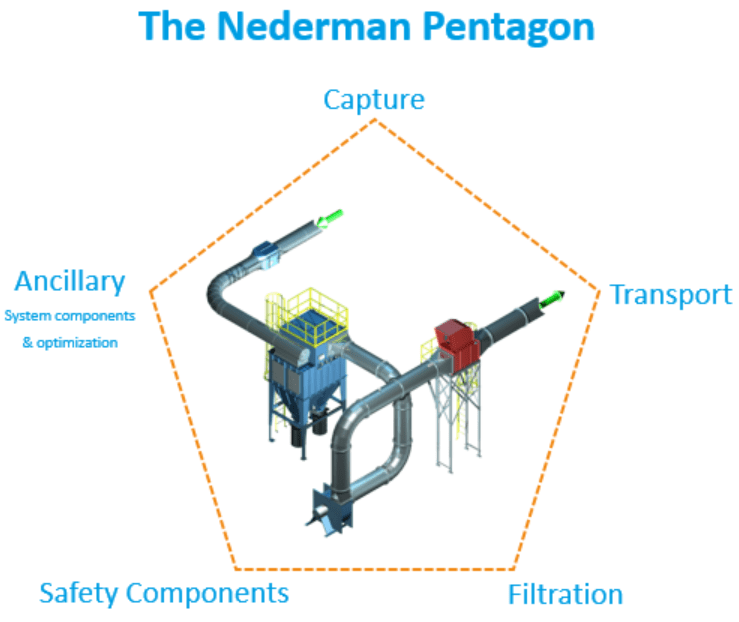

#3 Nederman

Domain Est. 1996

Website: nederman.com

Key Highlights: Nederman offers solutions for protecting people, planet and production from harmful effects of industrial processes. Your dust and fume extraction expert!…

#4 Industrial Dust Collection Systems for Every Application

Domain Est. 2005

Website: robovent.com

Key Highlights: At Robovent we are a leading provider of industrial dust collection systems. We design, manufacture, and installs world-class collector systems….

#5 DCE Limited

Domain Est. 2011

Website: dustcontrolenvironmental.com

Key Highlights: Dust Control Environmental (DCE) is the leading independent manufacturer and supplier of dust extraction systems boasting the largest range of dust collectors ……

#6 Dust Collectors

Domain Est. 1996

Website: lagunatools.com

Key Highlights: Free deliveryLaguna Tools offers a range of woodworking dust collectors that will minimize shop debris and keep your working space clean. Explore our selection today….

#7 Cyclone Dust Collectors Made in USA

Domain Est. 1998

Website: oneida-air.com

Key Highlights: Free delivery · 30-day returnsOneida Air Systems’ dust collectors are the industry leaders in airflow performance, filtration, and build quality….

#8 Enhance Your Table Saw’s Dust Collection Capability With SawStop …

Domain Est. 2000

Website: sawstop.com

Key Highlights: SawStop’s two types of saws—cast iron and portable—require different types of dust collection to maximize the effectiveness of each unit….

#9 Power Tool Dust Extraction Solutions and Equipment

Domain Est. 2000

Website: milwaukeetool.com

Key Highlights: Shop heavy duty power tool dust management equipment including OSHA certified vacuums, filters, extractors and more….

Expert Sourcing Insights for Sawdust Vacuum System

H2: 2026 Market Trends for Sawdust Vacuum Systems

The global market for sawdust vacuum systems is anticipated to experience steady growth and transformation by 2026, driven by rising industrial automation, increased focus on workplace safety, and stricter environmental regulations. These systems, essential in woodworking, furniture manufacturing, and construction sectors, are evolving to meet modern efficiency and sustainability demands. Below are key market trends expected to shape the sawdust vacuum system industry by 2026.

-

Increased Demand from Industrial Automation

Manufacturers are increasingly integrating automated production lines, where clean and debris-free environments are critical. Sawdust vacuum systems are being adopted not only for housekeeping but also to protect sensitive machinery from dust-related wear. The rise of smart factories is pushing demand for vacuum systems compatible with Industry 4.0 standards, including IoT-enabled monitoring and remote diagnostics. -

Emphasis on Worker Health and Safety

Regulatory bodies such as OSHA (Occupational Safety and Health Administration) and EU-OSHA continue to enforce strict air quality standards in industrial environments. Wood dust is classified as a carcinogen, prompting companies to invest in high-efficiency sawdust vacuum systems with advanced filtration (e.g., HEPA filters) to reduce airborne particulates and ensure compliance, thus driving market growth. -

Growth in Small and Medium-Sized Enterprises (SMEs)

Woodworking SMEs and custom furniture workshops are adopting compact, affordable, and portable sawdust vacuum systems. The availability of cost-effective, modular systems that integrate seamlessly into smaller workspaces is expanding market reach beyond large industrial facilities. -

Technological Advancements and Product Innovation

By 2026, manufacturers are expected to focus on innovations such as cyclonic separation technology, energy-efficient motors, and noise-reduction features. Additionally, cordless and battery-operated models are gaining traction, offering greater mobility and flexibility, especially in on-site construction and cabinetry work. -

Sustainability and Circular Economy Integration

There is a growing trend toward repurposing collected sawdust for biomass fuel, particleboard production, or composting. Vacuum systems with integrated collection and sorting capabilities are being developed to support circular economy initiatives, aligning with corporate sustainability goals and reducing waste disposal costs. -

Regional Market Expansion

Asia-Pacific, particularly China, India, and Southeast Asia, is projected to witness the highest growth due to expanding manufacturing sectors and urbanization. Europe remains a mature market with strong regulatory drivers, while North America sees growth fueled by residential construction and renovation activities. -

Rise of E-Commerce and Direct-to-Consumer Sales

Online platforms are enabling easier access to sawdust vacuum systems for both professional and DIY users. Manufacturers are leveraging digital marketing and e-commerce channels to offer customized solutions, real-time support, and faster delivery, reshaping traditional distribution models.

In conclusion, the sawdust vacuum system market in 2026 will be characterized by technological innovation, regulatory compliance, and a shift toward sustainability. Companies that invest in intelligent, efficient, and eco-friendly solutions are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing a Sawdust Vacuum System (Quality and IP)

When sourcing a sawdust vacuum system for woodworking operations, overlooking key quality and intellectual property (IP) aspects can lead to costly downtime, safety hazards, and legal risks. Below are critical pitfalls to avoid:

Poor Build Quality and Material Selection

Many low-cost sawdust vacuum systems use substandard materials such as thin-gauge steel or non-corrosion-resistant components, leading to rapid wear, leaks, and structural failure. Poor welding, inadequate sealing, and weak filtration housings compromise system integrity, resulting in dust escapes, reduced efficiency, and potential fire or explosion hazards in environments with combustible wood dust.

Inadequate Filtration Efficiency

A common quality oversight is insufficient filtration performance. Systems with low-grade filters (e.g., basic cloth bags instead of HEPA or cartridge filters) fail to capture fine particulates, endangering worker health and violating OSHA or local air quality regulations. Poor filter design also leads to frequent clogging, increased maintenance, and higher energy consumption due to reduced airflow.

Lack of Compliance with Safety Standards

Some imported or uncertified systems do not meet essential safety standards such as ATEX (for explosive atmospheres), UL, or CE. This poses serious safety risks, especially when handling fine, combustible sawdust. Non-compliant systems may lack proper grounding, explosion relief panels, or spark detection systems, increasing the risk of fire or explosion.

Insufficient IP Protection and Design Infringement

Sourcing from unverified suppliers may expose buyers to intellectual property risks. Some manufacturers copy patented designs, control systems, or filtration technologies without authorization. Purchasing such systems could inadvertently involve your business in IP infringement claims, especially in regulated markets. Always verify that the supplier holds proper certifications and rights to the technology used.

Hidden IP in Control Systems and Software

Modern vacuum systems often include proprietary control panels, monitoring software, or automation features. When IP in these components is not clearly licensed or documented, it can lead to operational restrictions, lack of support, or inability to integrate with existing infrastructure. Ensure software and control systems are legally licensed and support is guaranteed.

Lack of After-Sales Support and Spare Parts Availability

Low-quality suppliers—especially those without established IP or brand reputation—often fail to provide long-term technical support, spare parts, or documentation. This results in prolonged downtime when repairs are needed. Genuine IP-backed manufacturers typically offer better support and warranties, underpinned by their investment in R&D and product development.

Misrepresentation of Performance Claims

Some suppliers exaggerate airflow (CFM), static pressure, or dust collection efficiency without third-party testing or certification. These misleading claims can result in undersized or ineffective systems. Always request performance data backed by recognized testing standards (e.g., ISO 5167, AMCA certification) and verify IP-related claims through patents or technical documentation.

By prioritizing certified quality, regulatory compliance, and legitimate intellectual property, businesses can avoid these pitfalls and ensure reliable, safe, and legally sound operation of their sawdust vacuum systems.

Logistics & Compliance Guide for Sawdust Vacuum System

Introduction and Scope

This guide outlines the logistics procedures and compliance requirements for the safe and efficient handling, transportation, storage, and operation of a Sawdust Vacuum System. It is intended for manufacturers, distributors, installers, operators, and maintenance personnel involved in the lifecycle of the system. Adherence to this guide ensures regulatory compliance, operational safety, and environmental protection.

Regulatory Compliance Overview

Sawdust Vacuum Systems are subject to various national and international regulations due to fire hazards, dust explosion risks, and air quality concerns. Key compliance standards include:

- OSHA (Occupational Safety and Health Administration) – 29 CFR 1910 Subpart G (General Environmental Controls) and Subpart Z (Toxic and Hazardous Substances) for permissible exposure limits (PELs) to wood dust.

- NFPA 664 – Standard for the Prevention of Fires and Explosions in Wood Processing and Woodworking Facilities, which includes requirements for dust collection systems.

- ATEX Directive (EU) – Applicable for systems used in potentially explosive atmospheres; ensures equipment meets safety standards for dust ignition risks.

- IECEx (International Electrotechnical Commission System for Certification to Standards Relating to Equipment for Use in Explosive Atmospheres) – Global standard for equipment in explosive environments.

- EPA (Environmental Protection Agency) – Air emissions regulations under the Clean Air Act, particularly for facilities generating significant particulate matter.

- REACH & RoHS (EU) – Chemical compliance and restriction of hazardous substances in electrical and mechanical components.

Ensure the system is certified according to applicable standards prior to deployment. Documentation such as CE marking, test reports, and conformity declarations must be maintained.

Transportation and Handling Logistics

Proper logistics during shipment and handling are critical to avoid damage and ensure safe installation:

- Packaging: Units must be securely packaged with protective materials (e.g., foam inserts, wooden crates) to prevent impact damage. Clearly label packages as “Fragile” and “This Side Up.”

- Weight and Dimensions: Confirm system dimensions and weight for appropriate transport vehicle selection. Use forklifts or pallet jacks with adequate load capacity for unloading.

- Hazardous Material Classification: Sawdust Vacuum Systems are generally not classified as hazardous goods unless containing specific components (e.g., lithium batteries in sensors). Verify with manufacturer documentation.

- Documentation: Include packing lists, safety data sheets (SDS) for auxiliary components, compliance certificates, and installation manuals with shipments.

- Storage Conditions: Store in a dry, indoor environment with temperatures between 5°C and 40°C. Avoid exposure to moisture, direct sunlight, or corrosive atmospheres. Elevate units off the floor using pallets to prevent water damage.

Installation and Site Compliance

Installation must follow manufacturer guidelines and regulatory requirements:

- Ventilation and Exhaust: Exhaust outlets must be directed outside the workspace and away from air intakes, windows, or pedestrian areas. Comply with local air discharge regulations.

- Grounding and Bonding: Properly ground the system to prevent static discharge, a potential ignition source for combustible dust. Follow NFPA 77 for static electricity control.

- Clearance Requirements: Maintain minimum clearance (typically 0.5–1 meter) around the unit for maintenance access and heat dissipation.

- Ductwork Compliance: Use spark-resistant materials (e.g., stainless steel) for ducts. Ensure smooth interior surfaces and minimal horizontal runs to prevent dust accumulation. Slope ducts appropriately (minimum 45°) to promote self-cleaning.

- Explosion Protection: Install explosion venting, suppression systems, or isolation valves where required by NFPA 664 based on dust class and system design.

Operational Safety and Maintenance Compliance

Regular maintenance and operator training are essential for ongoing compliance:

- Training: Train personnel on proper use, emergency shutdown, and lockout/tagout (LOTO) procedures per OSHA 1910.147.

- Filter Cleaning and Replacement: Follow manufacturer schedule. Clean filters in a safe environment using approved methods (e.g., reverse pulse cleaning). Replace when damaged or clogged.

- Dust Disposal: Dispose of collected sawdust in sealed, non-combustible containers. Comply with local solid waste and fire codes. Avoid open dumping or burning unless permitted.

- Inspection Logs: Maintain logs for weekly visual inspections, monthly performance checks, and annual third-party audits. Document filter integrity, duct cleanliness, and electrical safety.

- Recordkeeping: Retain compliance records, maintenance logs, training certifications, and inspection reports for a minimum of five years.

Environmental and Waste Management

Sawdust is classified as combustible waste and may contain treated wood residues (e.g., arsenic in CCA-treated wood), which are regulated:

- Waste Classification: Test sawdust if processing treated wood; dispose of hazardous waste according to RCRA (Resource Conservation and Recovery Act) or equivalent local regulations.

- Recycling Options: Untreated wood dust may be suitable for biomass fuel, composting, or particleboard production. Verify recyclability with local facilities.

- Spill Response: In case of dust spillage, use ATEX-rated vacuum cleaners (not compressed air) to clean. Prevent ignition sources during cleanup.

Emergency Preparedness

Develop and implement an emergency response plan:

- Fire Response: Equip area with Class A fire extinguishers. Install smoke and heat detectors near the vacuum system.

- Dust Explosion Mitigation: Ensure explosion venting directs pressure safely outdoors. Train staff on evacuation procedures.

- System Shutdown: Clearly mark emergency stop buttons. Integrate system shutdown with facility fire alarm systems where possible.

Conclusion

Compliance with logistics and regulatory standards for Sawdust Vacuum Systems is essential to ensure workplace safety, environmental protection, and legal operation. Regular audits, staff training, and documentation are key components of a successful compliance program. Always consult the latest versions of applicable regulations and involve qualified safety professionals during system design and operation.

Conclusion on Sourcing a Sawdust Vacuum System

Sourcing a sawdust vacuum system is a critical investment for any woodworking or manufacturing operation aiming to maintain a clean, safe, and efficient working environment. After evaluating various options, it is clear that selecting the right system involves careful consideration of factors such as facility size, dust generation levels, system capacity, filtration efficiency, noise levels, energy consumption, and long-term maintenance requirements.

A centralized vacuum system offers superior performance for large-scale operations, providing consistent suction across multiple workstations and reducing manual cleanup time. Conversely, portable or downdraft table-integrated units may be more suitable for smaller shops or facilities with limited space and budget.

It is essential to partner with reputable suppliers who offer reliable equipment, technical support, and compliance with safety standards such as OSHA and NFPA regulations, particularly concerning combustible dust. Additionally, systems with advanced filtration—such as HEPA filters—help ensure air quality and worker health.

In conclusion, investing in the right sawdust vacuum system not only enhances workplace safety and productivity but also contributes to regulatory compliance and operational sustainability. A well-researched sourcing decision, aligned with specific operational needs, will deliver long-term cost savings and operational efficiency.