The global sausage making equipment market is experiencing steady growth, driven by rising demand for processed meat products and increasing automation in food processing facilities. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 2.1 billion in 2022 and is projected to grow at a CAGR of 5.8% through 2028. This expansion is fueled by advancements in food safety standards, the scalability needs of commercial meat processors, and growing consumer preference for consistent, high-quality sausages. As the industry evolves, manufacturers are investing in innovative machinery that enhances efficiency, hygiene, and throughput. In this landscape, a select group of equipment manufacturers have emerged as leaders, combining engineering excellence with compliance to international food safety regulations. Below, we spotlight the top 7 sausage making equipment manufacturers shaping the future of meat processing worldwide.

Top 7 Sausage Making Equipment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Get Premium Meat Processing Equipment

Domain Est. 1996

#2 Sausage Processing Equipment Solutions for your business

Domain Est. 1996

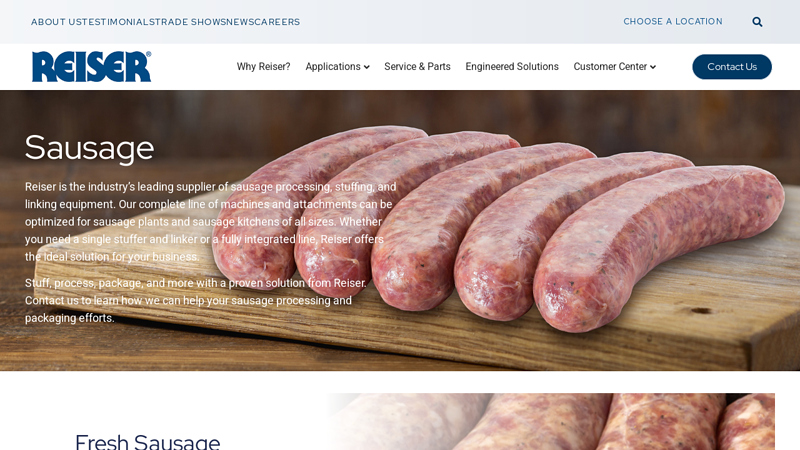

Website: reiser.com

Key Highlights: Reiser is the industry’s leading supplier of sausage processing equipment, including sausage processing, sausage stuffing, and sausage linking equipment….

#3 Burke Corporation

Domain Est. 1997

Website: burkecorp.com

Key Highlights: We have a robust selection of fully cooked meats: sizes, flavors, performance attributes. Brought to you by Burke and the Swiss American Sausage Company….

#4 Sausage Maker Supplies

Domain Est. 2012

Website: sausagemakersupplies.com

Key Highlights: 15-day returnsYour #1 internet stop for sausage making supplies!! Specialize in AC Leggs products. We also carry casings and all other necessary sausage making equipement ……

#5 Meat Processing Equipment, Grinders, Sausage & Jerky Making

Domain Est. 2017

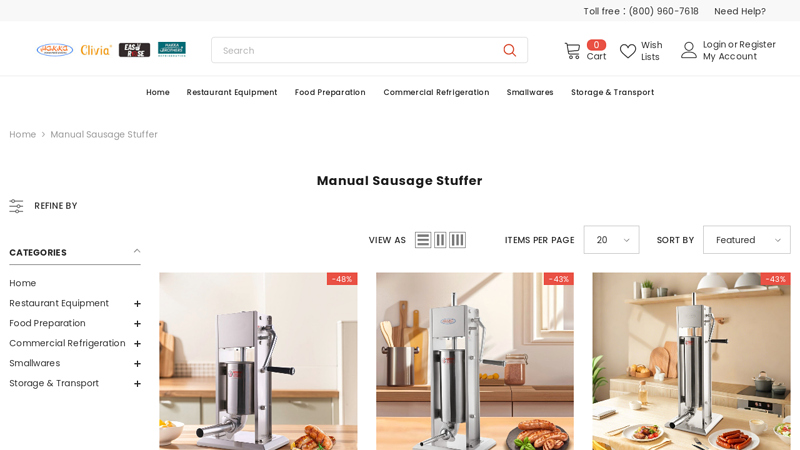

#6 Manual Sausage Stuffer 3L-15L

Domain Est. 2021

#7 Versatile GARVEE Stainless Steel Sausage Maker for and …

Domain Est. 2022

Expert Sourcing Insights for Sausage Making Equipment

H2: 2026 Market Trends for Sausage Making Equipment

The global sausage making equipment market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and shifts in food production practices. Key trends shaping this market include automation, demand for specialty and plant-based sausages, sustainability imperatives, and regional growth dynamics.

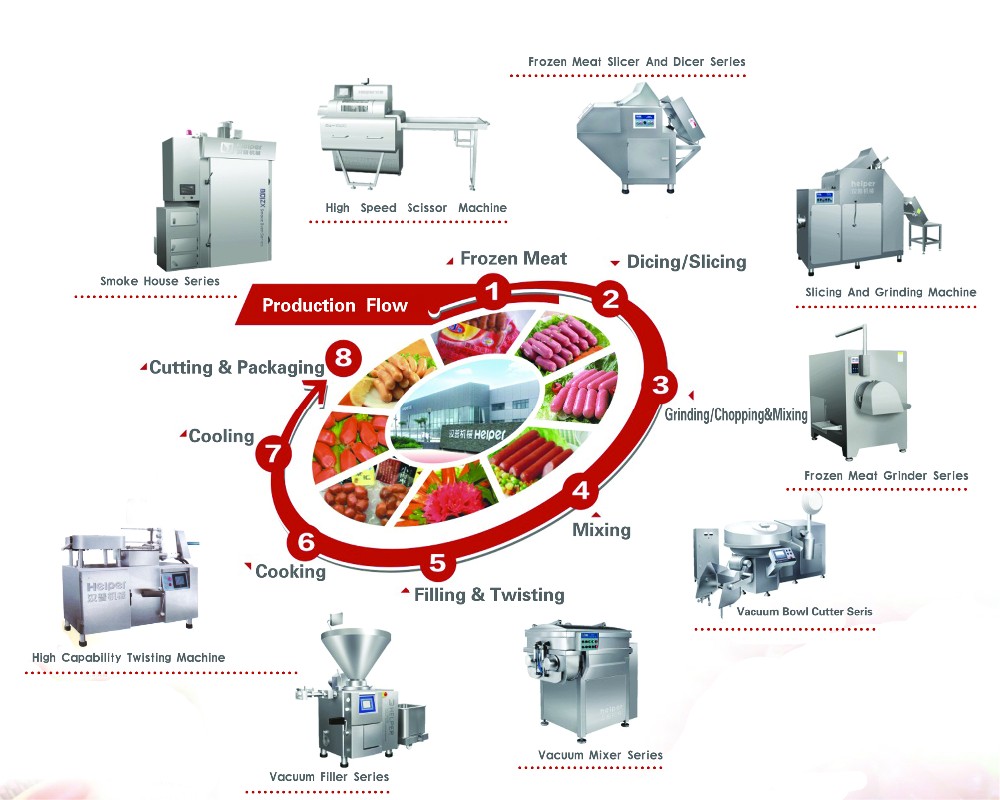

1. Increased Automation and Smart Technology Integration

By 2026, automation will be a dominant force in sausage making equipment. Manufacturers are increasingly investing in smart machinery equipped with IoT (Internet of Things) capabilities, enabling real-time monitoring, predictive maintenance, and enhanced operational efficiency. Fully automated stuffing, linking, and portioning systems will reduce labor costs and improve consistency, particularly in large-scale commercial operations. AI-driven control systems will also allow for precise recipe adjustments and quality control, meeting stringent food safety regulations.

2. Rising Demand for Plant-Based and Alternative Protein Sausages

The surge in plant-based diets and alternative proteins is reshaping equipment design. Traditional sausage fillers and stuffers are being adapted to handle viscous, non-meat formulations such as pea protein, mycoprotein, and soy-based mixtures. Equipment manufacturers are innovating to ensure consistent texture, reduced air entrapment, and efficient processing of these delicate blends. By 2026, dual-purpose machines capable of processing both meat and plant-based sausages will become standard in hybrid production facilities.

3. Focus on Hygiene, Cleanability, and Food Safety

As food safety regulations tighten globally, sausage making equipment will increasingly feature hygienic designs with smooth surfaces, minimal crevices, and corrosion-resistant materials (e.g., food-grade stainless steel). Quick-disassembly components and Clean-in-Place (CIP) systems will be prioritized to reduce downtime and contamination risks. This trend is especially critical in regions like North America and Europe, where regulatory compliance is strict.

4. Growth in Small-Scale and Artisanal Production

Alongside industrial demand, there is a rising market for compact, user-friendly sausage making equipment tailored to small processors, butchers, and artisanal food producers. These machines offer flexibility, ease of use, and lower entry barriers. In 2026, expect to see modular systems that allow scalability—from batch processing to semi-automated lines—catering to the booming craft food movement.

5. Regional Market Expansion and Localization

While North America and Europe remain key markets due to established meat processing industries, the Asia-Pacific region is expected to witness the highest growth rate by 2026. Increasing urbanization, rising disposable incomes, and Western dietary influences are boosting sausage consumption in countries like China, India, and Indonesia. Equipment suppliers will localize offerings to meet regional preferences—such as halal or spicy sausage varieties—and adapt to local infrastructure constraints.

6. Sustainability and Energy Efficiency

Environmental concerns are pushing manufacturers to develop energy-efficient, low-waste sausage making systems. Equipment with reduced water usage, lower carbon footprints, and recyclable components will gain favor. Additionally, companies are exploring closed-loop systems that minimize ingredient waste during stuffing and linking processes.

In conclusion, the 2026 sausage making equipment market will be characterized by innovation, adaptability, and a strong alignment with modern food industry demands. Manufacturers who invest in smart, versatile, and sustainable solutions will be best positioned to capture value in this dynamic landscape.

Common Pitfalls When Sourcing Sausage Making Equipment: Quality and Intellectual Property Concerns

Sourcing sausage making equipment requires careful consideration to ensure both product quality and legal compliance. Overlooking key aspects related to equipment quality and intellectual property (IP) can lead to operational inefficiencies, safety risks, and legal liabilities. Below are common pitfalls to avoid.

Poor Build Quality and Material Standards

One of the most frequent issues is selecting equipment constructed from substandard materials. Lower-cost machines may use non-food-grade stainless steel or inferior components that corrode, harbor bacteria, or degrade quickly under frequent cleaning. This compromises food safety and increases long-term maintenance costs. Always verify compliance with food safety standards such as FDA, NSF, or EU 1935/2004.

Inadequate Equipment Certification and Compliance

Equipment lacking proper certifications may not meet hygiene, electrical, or mechanical safety requirements. Sourcing from suppliers who cannot provide documentation for CE, UL, or other region-specific certifications risks non-compliance with local regulations, leading to production halts or fines.

Misrepresentation of Equipment Capabilities

Some suppliers exaggerate performance metrics such as output capacity, automation level, or ease of cleaning. This mismatch between advertised and actual capabilities can disrupt production planning and result in underperforming lines. Request third-party validation, user references, or on-site demos before purchasing.

Lack of After-Sales Support and Spare Parts Availability

Choosing suppliers without reliable technical support or accessible spare parts can lead to prolonged downtime. Equipment failure without timely service impacts productivity. Evaluate the supplier’s global service network and warranty terms before committing.

Intellectual Property Infringement Risks

Sourcing from manufacturers that replicate patented designs or use unlicensed technology exposes buyers to IP litigation. This is particularly common with automated stuffers, linking machines, or control systems. Always ensure the supplier owns or legally licenses the technology and request proof of IP compliance.

Use of Counterfeit or Clone Components

Some equipment incorporates counterfeit sensors, motors, or control units to cut costs. These components fail prematurely and may lack traceability, raising safety and compliance concerns. Insist on OEM component documentation and conduct supplier audits when feasible.

Inadequate Design for Cleanability and Sanitation

Poorly designed equipment with hard-to-reach crevices or non-drainable surfaces poses a contamination risk. Equipment not designed for Clean-in-Place (CIP) or without proper IP ratings for washdown environments increases sanitation challenges and violates hygiene standards.

By recognizing and addressing these pitfalls, buyers can select sausage making equipment that ensures food safety, operational efficiency, and legal security. Due diligence in supplier vetting, certification verification, and IP assessment is essential.

Logistics & Compliance Guide for Sausage Making Equipment

Equipment Classification and Regulatory Oversight

Sausage making equipment is classified as food contact machinery and falls under the jurisdiction of food safety and industrial equipment regulations. In the United States, the Food and Drug Administration (FDA) enforces compliance with the Food Safety Modernization Act (FSMA), requiring all equipment that contacts food to be constructed from non-toxic, corrosion-resistant materials (e.g., 304 or 316 stainless steel). The U.S. Department of Agriculture (USDA) may also regulate equipment used in federally inspected meat processing facilities. Internationally, compliance with EU Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food is mandatory, and CE marking may be required for machinery sold within the European Economic Area.

Design and Manufacturing Standards

Sausage making equipment must meet recognized industry standards for hygienic design. Adherence to 3-A Sanitary Standards (e.g., 3-A 03-01 for meat and poultry processing equipment) ensures cleanability, accessibility for inspection, and absence of harborage points for bacteria. Equipment should feature smooth, weld-free surfaces, sloped surfaces to prevent liquid pooling, and sealed motors or enclosures to prevent contamination. International standards such as ISO 14159 (hygiene requirements for machinery) and EHEDG (European Hygienic Engineering and Design Group) guidelines further support compliance in global markets.

Import/Export Documentation and Customs Clearance

When shipping sausage making equipment internationally, proper documentation is essential. Required documents typically include a commercial invoice, packing list, bill of lading or air waybill, and a certificate of origin. Equipment may require an Export Health Certificate if destined for regions with strict agri-food import regulations. Importers must verify compliance with local electrical standards (e.g., UL listing in North America, CE in Europe) and may need to submit conformity assessment documentation. Harmonized System (HS) Code 8438.80 (Machinery for the preparation of meat) should be used to classify the equipment for customs purposes.

Sanitation and Installation Compliance

Upon delivery, equipment must be inspected for damage and verified against purchase specifications. Prior to operation, a sanitation protocol aligned with HACCP (Hazard Analysis and Critical Control Points) principles should be implemented. Installation must follow manufacturer guidelines, including proper anchoring, connection to appropriate power and water supplies, and integration with facility drainage systems. A commissioning checklist should confirm that all safety guards, emergency stops, and interlocks are operational. Documentation of installation, sanitation, and operator training should be retained for audit purposes.

Maintenance and Ongoing Regulatory Compliance

Regular maintenance is critical for sustained compliance and equipment longevity. A preventive maintenance program should include lubrication of non-food-contact parts with food-grade lubricants (meeting NSF H1 standards), inspection of seals and gaskets, and calibration of temperature and pressure controls. Records of maintenance, cleaning schedules, and any equipment modifications must be maintained to demonstrate compliance during USDA, FDA, or third-party audits. Equipment used in certified organic processing must also adhere to NOP (National Organic Program) requirements regarding material compatibility and contamination prevention.

Training and Operational Safety

Personnel operating sausage making equipment must receive documented training on safe operation, cleaning procedures, and emergency response. Training should align with OSHA (Occupational Safety and Health Administration) standards in the U.S. or equivalent local regulations. Safety features such as lockout/tagout (LOTO) procedures, guarding on moving parts, and proper use of personal protective equipment (PPE) must be enforced. Training records and safety audits should be routinely reviewed to ensure ongoing compliance and workplace safety.

In conclusion, sourcing sausage making equipment requires careful consideration of several key factors, including production needs, equipment quality, supplier reliability, and long-term maintenance and support. By aligning the choice of equipment with your specific operational scale—whether artisanal, commercial, or industrial—you can ensure efficiency, consistency, and food safety in your sausage production. Evaluating suppliers based on reputation, certifications, after-sales service, and customer feedback further enhances the likelihood of a successful investment. Ultimately, selecting the right sausage making equipment not only optimizes productivity and product quality but also supports sustainable growth in a competitive market. A well-informed sourcing decision today lays the foundation for long-term success in the meat processing industry.