The global satellite router market is experiencing robust growth, driven by rising demand for reliable connectivity in remote and mobile environments across industries such as maritime, defense, oil and gas, and aviation. According to a report by Mordor Intelligence, the satellite communication market was valued at USD 4.87 billion in 2023 and is projected to reach USD 7.43 billion by 2029, growing at a CAGR of 7.2% during the forecast period. This expansion is further fueled by advancements in low Earth orbit (LEO) satellite constellations, increased investment in broadband satellite networks, and the need for resilient communication infrastructure in underserved regions. As connectivity demands evolve, satellite router manufacturers are playing a pivotal role in enabling high-throughput, low-latency data transmission. In this competitive landscape, a select group of innovators are leading the charge in technology, scalability, and global reach—shaping the future of satellite-based networking.

Top 10 Satellite Router Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

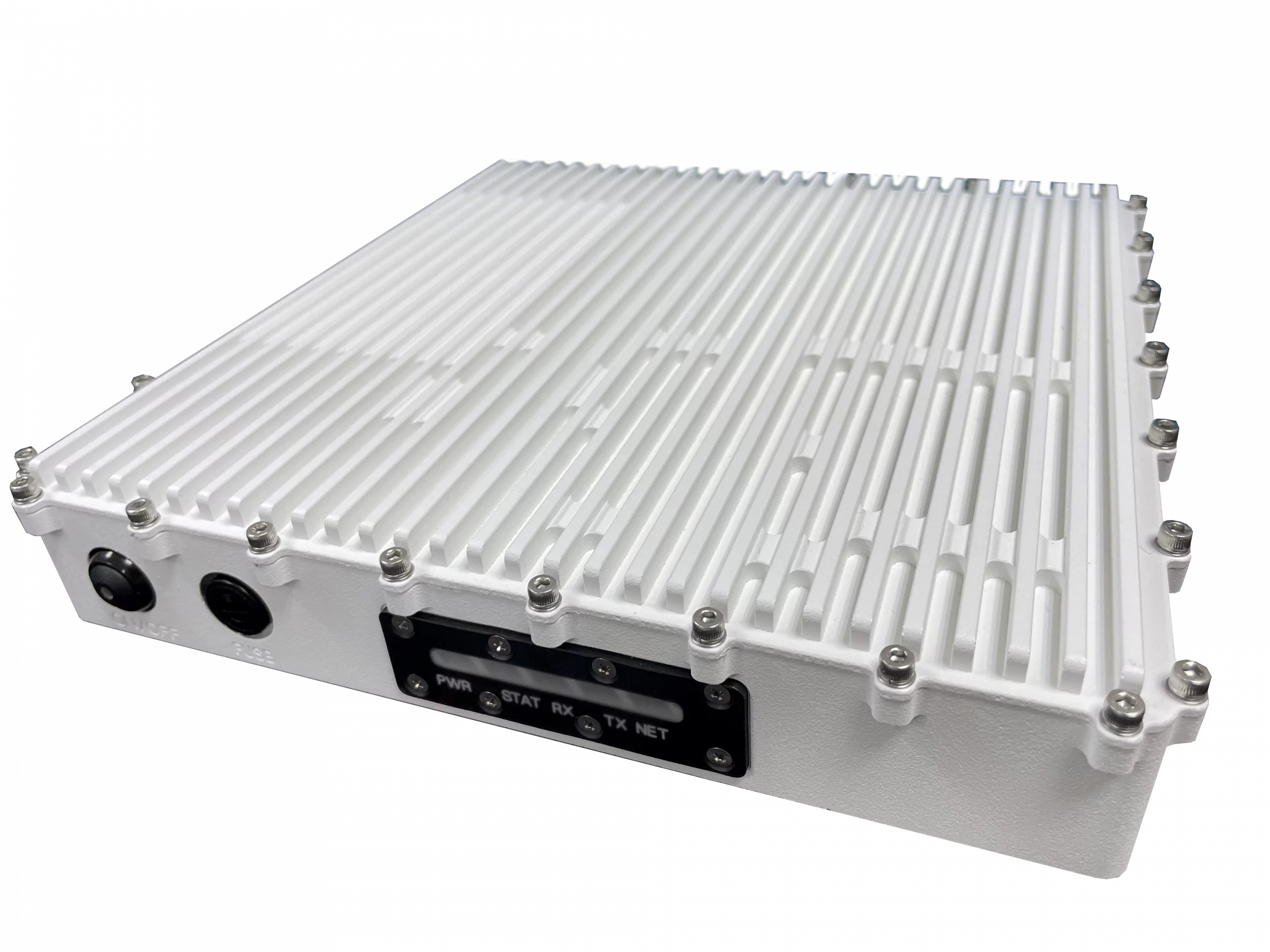

#1 Datum Systems

Domain Est. 1997

Website: datumsystems.com

Key Highlights: Datum Systems Inc. is a global leader in Satellite and Troposcatter communications modems. Datum is an OEM manufacturer that designs, manufactures and sells ……

#2 ST Engineering iDirect

Domain Est. 1995

Website: idirect.net

Key Highlights: ST Engineering iDirect is the global leader in satellite communications, providing satellite technology and communication solutions….

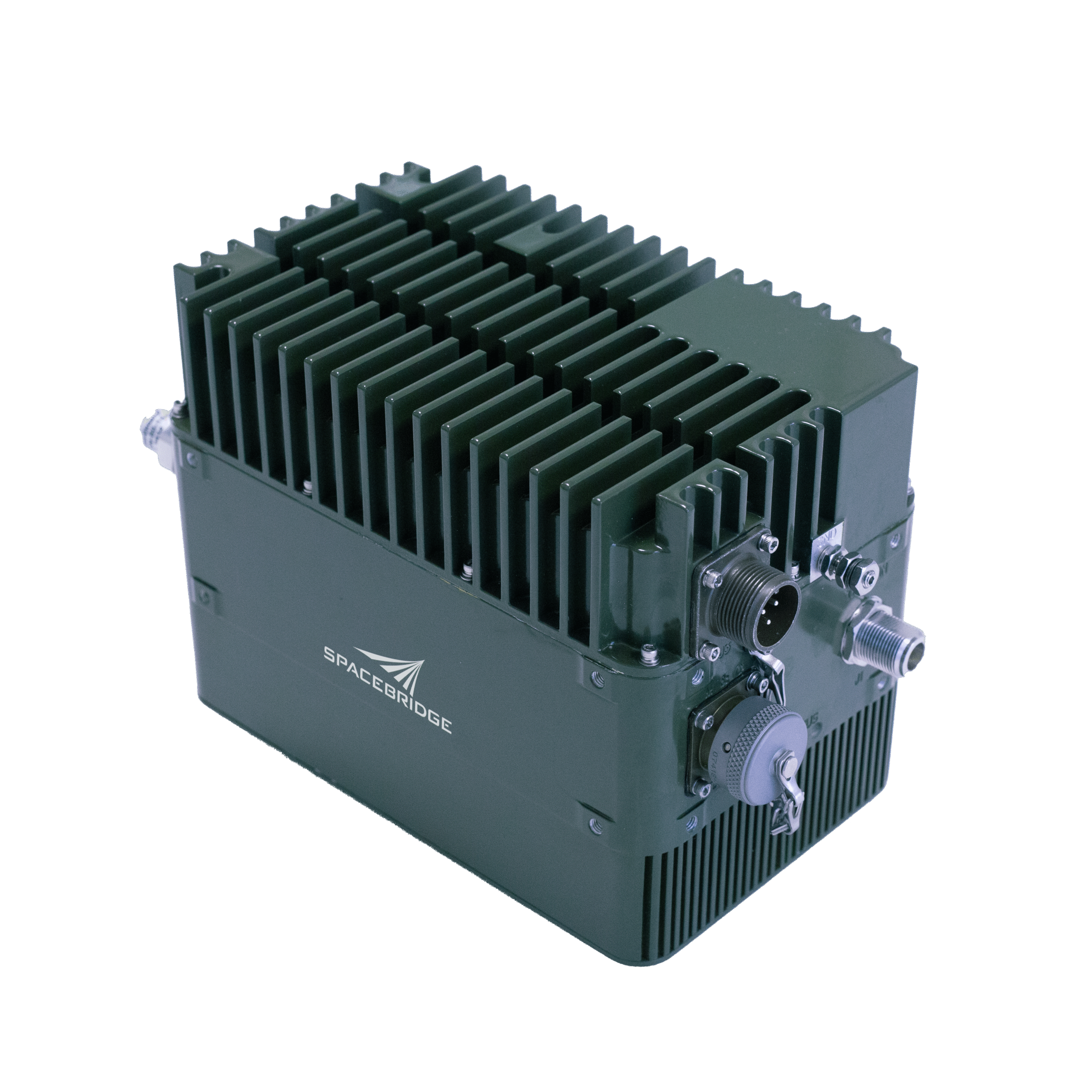

#3 SpaceBridge

Domain Est. 1997

Website: spacebridge.com

Key Highlights: SpaceBridge provides innovative satellite solutions for broadband interconnectivity, tactical defense, cellular backhaul and broadcasting segments….

#4 Satellite Connectivity and Managed Networks

Domain Est. 1992

Website: hughes.com

Key Highlights: Hughes provides LEO and GEO satellite broadband, 5G wireless, and managed network solutions for communities, businesses, and governments. Learn more today!…

#5 Viasat: Global Communications

Domain Est. 1993

Website: viasat.com

Key Highlights: Viasat is a global communications company connecting homes, businesses, governments & militaries with satellite internet, connectivity solutions, ……

#6 Sierra Wireless

Domain Est. 1995

Website: sierrawireless.com

Key Highlights: We simplify IoT with industry-leading wireless solutions: cellular modules, rugged routers, and global connectivity services to enable a smarter & more ……

#7 Residential

Domain Est. 1995

Website: starlink.com

Key Highlights: STARLINK FOR HOMES · Service starting at $40/mo. No upfront hardware cost. Select areas only. Enter your service address below to get started. · HIGH-SPEED ……

#8 KVH

Domain Est. 1995

Website: kvh.com

Key Highlights: KVH has over 40 years of experience creating innovative integrated connectivity solutions · Mobile satellite antennas fielded worldwide for satellite television ……

#9 SATCOM Services

Domain Est. 1998

Website: satcom-services.com

Key Highlights: SATCOM Services is a global satellite equipment distributor and integrator. Everything from military SATCOM products to VSAT Antenna parts….

#10 Speedcast

Domain Est. 1999

Website: speedcast.com

Key Highlights: Welcome to Speedcast, the leading provider of satellite communications and IT services. Our mission is to transform the way remote operations are conducted ……

Expert Sourcing Insights for Satellite Router

H2: 2026 Market Trends for Satellite Routers

By 2026, the satellite router market is poised for transformative growth, driven by technological advancements, increased demand for ubiquitous connectivity, and the deployment of next-generation satellite constellations. Key trends shaping the market include:

1. Proliferation of LEO Constellations: The continued expansion of Low Earth Orbit (LEO) mega-constellations—led by Starlink, OneWeb, Amazon’s Project Kuiper, and others—will dramatically enhance satellite broadband capacity and reduce latency. This shift enables satellite routers to support real-time applications (video conferencing, IoT, cloud services) previously limited to terrestrial networks, expanding their use cases beyond remote areas.

2. Demand for Ubiquitous Global Connectivity: As enterprises and governments prioritize digital inclusion, satellite routers are becoming essential for bridging the digital divide. By 2026, they will be increasingly deployed in underserved rural regions, maritime operations, aviation, and mobile environments (e.g., emergency response vehicles, mining, and agriculture), fueling market expansion.

3. Integration with 5G and Hybrid Networks: Satellite routers will evolve into hybrid communication hubs, seamlessly integrating with 5G, LTE, and Wi-Fi networks. This convergence allows for automatic failover and load balancing, offering resilient connectivity critical for industries like energy, transportation, and public safety.

4. Miniaturization and Cost Reduction: Advances in chipsets and manufacturing will lead to smaller, more energy-efficient, and affordable satellite routers. This democratization will open new consumer and SMB markets, particularly in mobile and portable applications (e.g., RVs, yachts, backpacking).

5. Enhanced Security and Edge Computing Features: With increased reliance on satellite links, cybersecurity will be paramount. Satellite routers in 2026 will incorporate advanced encryption, zero-trust architecture, and edge computing capabilities to process data locally, reducing latency and bandwidth usage.

6. Rise of IoT and M2M Applications: Satellite routers will play a pivotal role in enabling global IoT and machine-to-machine (M2M) communication, especially for asset tracking, environmental monitoring, and smart agriculture in remote locations where terrestrial infrastructure is absent.

7. Regulatory and Spectrum Developments: Governments and international bodies will continue to streamline licensing and spectrum allocation for non-geostationary satellite orbits, supporting market growth while addressing concerns around space debris and signal interference.

In conclusion, by 2026, satellite routers will transition from niche backup solutions to mainstream connectivity enablers, driven by improved performance, affordability, and integration with terrestrial networks. The market will see robust growth across consumer, enterprise, and government sectors, supported by a maturing satellite ecosystem.

Common Pitfalls When Sourcing Satellite Routers (Quality, IP)

Sourcing satellite routers requires careful evaluation to ensure reliable performance and compatibility with satellite networks. Overlooking key factors can lead to poor connectivity, security risks, and costly downtime. Below are common pitfalls related to quality and IP (Internet Protocol) considerations.

Poor Build Quality and Environmental Resistance

Many satellite routers are deployed in harsh environments—remote areas, maritime vessels, or extreme climates. A frequent pitfall is selecting routers with insufficient durability. Low-quality units may lack proper ingress protection (IP ratings), robust enclosures, or temperature tolerance, leading to early failure. Always verify IP65 or higher ratings for dust and water resistance, especially for outdoor installations.

Inadequate IP Performance and Throughput

Satellite links have high latency and variable bandwidth. A common mistake is choosing routers that don’t support efficient IP traffic management. Routers lacking Quality of Service (QoS), TCP acceleration, or compression may underperform, resulting in poor application responsiveness. Ensure the router supports satellite-optimized protocols and can handle real-world IP throughput—not just theoretical speeds.

Lack of IPv6 Support

As IPv4 addresses become scarce, many satellite networks are transitioning to IPv6. Sourcing a router without full IPv6 compatibility can future-proofing issues and limit integration with modern networks. Confirm dual-stack (IPv4/IPv6) support to avoid obsolescence and ensure seamless connectivity.

Weak Security Features for IP Networks

Satellite links are often targeted due to their remote nature. Routers with basic or outdated firewall capabilities, lack of IPsec/SSL VPN support, or unpatched firmware pose significant security risks. Always verify support for modern encryption standards, secure management interfaces (e.g., SSH, HTTPS), and regular firmware updates.

Incompatible Network Management and Monitoring

Many low-quality satellite routers lack standardized IP-based management (e.g., SNMP, TR-069), making remote monitoring and troubleshooting difficult. This can result in prolonged outages and increased operational costs. Choose routers with robust, standards-compliant management for better visibility and control over your IP network.

Overlooking Latency and Jitter Handling

Poorly designed routers may not handle the inherent latency and jitter of satellite connections effectively. This leads to dropped packets, failed VoIP calls, or disrupted video streams. Look for routers with built-in latency mitigation features such as jitter buffers, adaptive modulation support, and traffic prioritization.

Ignoring Firmware and Software Updates

Routers with infrequent or discontinued firmware updates can become security liabilities and lose compatibility with evolving IP standards. Source from vendors with a proven track record of ongoing support and timely patches to maintain performance and security over time.

Logistics & Compliance Guide for Satellite Router

This guide outlines the key logistics considerations and compliance requirements for the transportation, handling, and deployment of Satellite Routers. Adhering to these guidelines ensures regulatory compliance, product integrity, and operational efficiency.

Regulatory Compliance

Satellite Routers are subject to international and national regulations due to their communication capabilities and radio frequency emissions. Key compliance areas include:

- FCC (USA): Devices must meet Part 15 and Part 25 regulations for intentional radiators and satellite communications. Verify FCC ID is present and properly listed.

- CE Marking (EU): Compliance with the Radio Equipment Directive (RED) 2014/53/EU and EMC Directive 2014/30/EU is mandatory. Ensure routers have valid CE certification.

- ISED (Canada): Certification under RSS-247 and RSS-Gen is required for operation in Canadian airspace.

- ITU & National Frequency Allocations: Confirm the router operates within authorized satellite frequency bands (e.g., L-band, Ka-band) per country-specific allocations.

- Export Controls: Satellite communication equipment may be subject to export restrictions under regulations such as:

- ITAR (International Traffic in Arms Regulations) – If the device has military applications.

- EAR (Export Administration Regulations) – Most commercial satellite routers fall under ECCN 5A991 or similar.

Ensure proper documentation (certificates of conformity, technical specifications, and export licenses if applicable) accompanies each unit.

Packaging and Handling

Proper packaging ensures the satellite router arrives undamaged and ready for use:

- Shock-Resistant Packaging: Use double-walled corrugated boxes with internal foam or molded inserts to protect against vibration and impact.

- Moisture Protection: Include desiccant packs and moisture barrier bags, especially for maritime or humid environments.

- Labeling: Clearly label packages with:

- Fragile and electronic equipment indicators

- Regulatory compliance marks (FCC, CE, etc.)

- Handling orientation (e.g., “This Side Up”)

-

Serial number and IMEI (if applicable)

-

Temperature and Humidity: Store and transport within the operating range (typically -20°C to +60°C and 5% to 95% non-condensing humidity). Avoid prolonged exposure to extreme conditions.

Shipping and Transportation

- Mode of Transport: Satellite routers can be shipped via air, sea, or land. For air freight:

- Comply with IATA Dangerous Goods Regulations if batteries are included (typically lithium-ion).

- Use UN3481-compliant packaging for lithium batteries.

- Customs Documentation: Include:

- Commercial invoice with detailed product description

- Packing list

- Certificates of origin and conformity

- Export license (if required)

- Import Duties & Tariffs: Research Harmonized System (HS) codes (e.g., 8517.62 for wireless routers) and potential duties in destination countries.

Installation and Deployment Compliance

- Site Permits: Some jurisdictions require permits for satellite antenna installation, especially for fixed outdoor units.

- EMI/RFI Considerations: Install away from sensitive equipment to avoid interference. Follow manufacturer-recommended separation distances.

- Grounding and Lightning Protection: Adhere to local electrical codes (e.g., NEC in the U.S., IEC 62305 internationally) to protect equipment and personnel.

End-of-Life and Recycling

- WEEE Compliance (EU): Satellite routers are electronic waste. Follow WEEE Directive guidelines for collection, recycling, and disposal.

- RoHS Compliance: Ensure the device meets RoHS restrictions on hazardous substances (e.g., lead, mercury).

- Battery Disposal: Remove and recycle lithium batteries separately according to local regulations.

Documentation and Record Keeping

Maintain the following records for audit and compliance purposes:

- Product compliance certificates (FCC, CE, ISED, etc.)

- Export control classifications and licenses

- Shipping manifests and customs declarations

- Installation and maintenance logs

- End-of-life disposal records

Adherence to this guide ensures your satellite router operations remain lawful, safe, and efficient across global markets. Always consult local regulations and update procedures as standards evolve.

Conclusion for Sourcing a Satellite Router:

Sourcing a satellite router is a strategic decision that enhances communication capabilities, especially in remote or infrastructure-limited environments. After evaluating key factors such as performance, reliability, coverage, cost, and ease of integration, it is evident that selecting the right satellite router depends on specific operational needs—whether for maritime, terrestrial, or emergency response applications.

Partnering with reputable suppliers and leveraging established satellite networks ensures access to robust, secure, and scalable connectivity solutions. Additionally, considering future-proof features like support for multiple frequency bands, IP-based services, and integration with existing networks will maximize return on investment.

In conclusion, a well-sourced satellite router not only provides reliable connectivity beyond the reach of traditional networks but also supports business continuity, operational efficiency, and safety in critical situations. Proper due diligence in vendor selection, technical specifications, and total cost of ownership will lead to a successful and sustainable deployment.