The global smart home market, which includes key segments like home automation systems and smart lighting controls such as Satadom, is experiencing robust growth driven by rising consumer demand for energy efficiency, remote access, and integrated IoT solutions. According to Mordor Intelligence, the smart home market was valued at USD 80.3 billion in 2023 and is projected to reach USD 163.1 billion by 2029, growing at a CAGR of 12.4% during the forecast period. This expansion is fueling innovation and competition among manufacturers specializing in home automation platforms, including Satadom systems known for customizable lighting, climate, and security control. As adoption accelerates across residential sectors, particularly in North America and Europe, manufacturers are focusing on interoperability, user experience, and AI-driven automation to capture market share. Based on market presence, product innovation, and integration capabilities, the following are the top 5 Satadom manufacturers shaping the future of smart home ecosystems.

Top 5 Satadom Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

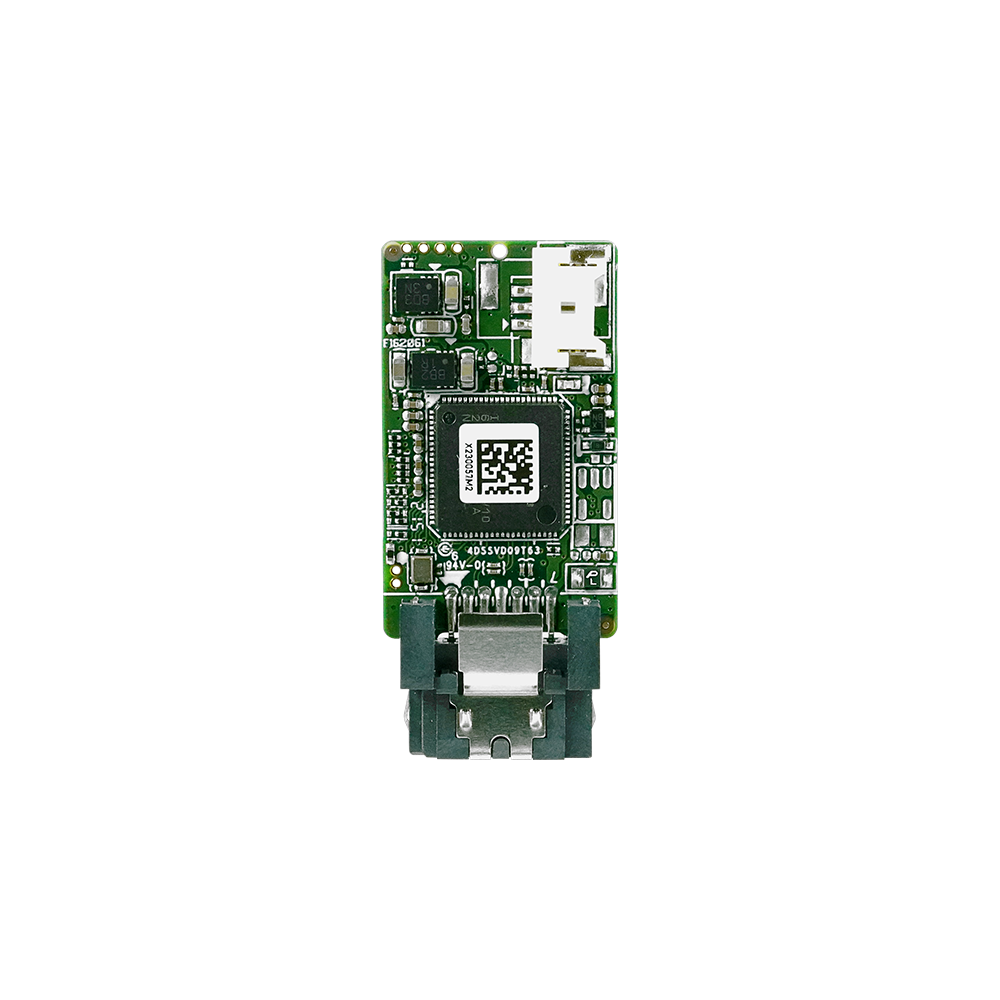

#1 KAIBO Factory direct supply SATA DOM 4GB 8GB 16GB 32GB …

Domain Est. 2020

Website: kaibosatadom.com

Key Highlights: This SATA DOM have special custom-made model. With high P/E and ECC. Design for casino slots machine and game machine. Please send email to get more details: ……

#2 Innodisk Satadom

Domain Est. 2024

Website: proctovasc.com.br

Key Highlights: Manufacturer site is here Open in new window Find furniture and interior items easily! Click here for Askul’s general furniture homepage. Open in new window ……

#3 SATA

Domain Est. 1999

Website: diamondsystems.com

Key Highlights: SATA-DOM flashdisks mount directly on top of the designated 7-pin vertical SATA connector on select Diamond SBCs and are fixed in place with a standoff and ……

#4 SATADOM® SSD

Domain Est. 2005

Website: innodisk.com

Key Highlights: SATADOM (SATA Disk on Module) is Innodisk’s proprietary form factor suitable for 1U server applications. It supports optimized firmware and cable-less ……

#5 Buy SATA DOM Online

Domain Est. 2014

Website: flexxon.com

Key Highlights: Flexxon’s SATA DOM is highly compatible & reliable for multi-tasking applications & embedded applications featuring heavy loading and high performance….

Expert Sourcing Insights for Satadom

H2: 2026 Market Trends Analysis for Satadom

As of 2026, the market dynamics surrounding Satadom—a hypothetical or niche domain (potentially related to satellite domain services, digital sovereignty, or a proprietary tech platform)—reflect broader technological, geopolitical, and economic shifts. While public data on a specific entity named “Satadom” is limited or non-public, we can infer potential market trends based on industry parallels in satellite communications, digital infrastructure, and domain name systems.

-

Expansion of Satellite-Based Internet Services

By 2026, the satellite internet sector—led by companies like SpaceX (Starlink), Amazon (Project Kuiper), and OneWeb—has matured significantly. This growth creates increased demand for domain infrastructure tied to satellite networks. If Satadom operates in the domain registration or digital identity space for satellite-connected devices or IoT platforms, it stands to benefit from the surge in low Earth orbit (LEO) satellite deployments. Interoperability between terrestrial and satellite-based networks drives demand for specialized domain solutions, positioning Satadom as a potential enabler of edge-based or global naming systems. -

Rise of Digital Sovereignty and Geofenced Domains

National governments are increasingly prioritizing digital sovereignty, leading to localized domain policies and data residency requirements. In this context, Satadom may evolve as a platform offering geo-aware or jurisdiction-specific domain services, particularly for satellite communications crossing international borders. Regulatory trends in the EU (DSA, DMC), U.S., and Asia push for accountability in digital infrastructure, prompting demand for compliant domain management systems—potentially a niche Satadom could occupy. -

Growth in IoT and Machine-to-Machine (M2M) Domain Needs

With over 30 billion connected devices projected by 2026, many relying on satellite connectivity in remote areas (e.g., maritime, agriculture, logistics), there is rising demand for automated domain provisioning and identity management. Satadom could leverage this trend by offering dynamic domain allocation for mobile or orbiting assets, supporting secure and scalable device authentication across hybrid networks. -

Integration with Web3 and Decentralized Identity

The continued maturation of blockchain-based domain systems (e.g., Ethereum Name Service, Unstoppable Domains) influences traditional domain providers to innovate. If Satadom integrates decentralized identifiers (DIDs) or blockchain verification for satellite-linked domains, it positions itself at the intersection of Web3 and space infrastructure—appealing to privacy-focused users and decentralized applications (dApps) requiring global access. -

Cybersecurity and Resilience as Market Differentiators

As satellite networks become critical infrastructure, cyber threats targeting domain resolution and DNS services increase. In 2026, Satadom’s market viability depends on robust security protocols, such as DNSSEC implementation, DDoS protection, and zero-trust frameworks tailored for space-ground network interfaces. Providers offering end-to-end encrypted domain services for satellite users gain competitive advantage. -

Strategic Partnerships and Market Consolidation

The domain and satellite industries are seeing increased consolidation. By 2026, Satadom may form partnerships with satellite operators, telecom providers, or cloud platforms (e.g., AWS Ground Station, Microsoft Azure Orbital) to offer bundled domain and connectivity services. Integration into satellite-as-a-service (SaaS) ecosystems enhances its value proposition.

Conclusion

While Satadom remains an emerging or conceptual player, the 2026 market landscape favors domain solutions that are resilient, globally accessible, and interoperable with next-generation satellite networks. Success hinges on adapting to regulatory demands, embracing decentralization, and serving the growing digital identity needs of a space-connected world. If Satadom aligns with these macro-trends, it could capture a strategic niche in the evolving digital infrastructure ecosystem.

Common Pitfalls Sourcing Satadom (Quality, IP)

When sourcing Satadom—a proprietary or branded form of domperidone often associated with specific manufacturers—organizations must navigate several critical challenges related to quality assurance and intellectual property (IP) protection. Failing to address these pitfalls can result in regulatory non-compliance, supply chain disruptions, legal liabilities, and reputational damage.

Quality-Related Pitfalls

1. Substandard or Counterfeit Products

One of the most significant risks is receiving adulterated, subpotent, or counterfeit Satadom from unreliable suppliers. This is particularly common when sourcing from unverified manufacturers in regions with lax regulatory oversight. Poor quality control can compromise patient safety and undermine therapeutic efficacy.

2. Lack of GMP Certification

Suppliers not adhering to Good Manufacturing Practices (GMP) jeopardize product consistency and safety. Sourcing Satadom from facilities without current GMP certification from recognized authorities (e.g., WHO, FDA, EMA) increases the risk of contamination, incorrect dosing, or improper storage.

3. Inconsistent Batch-to-Batch Quality

Even with a qualified supplier, variability in raw materials or manufacturing processes can lead to inconsistent Satadom quality. Without rigorous testing and batch validation, these inconsistencies may go undetected until they impact end users.

4. Inadequate Analytical Testing and Documentation

Failure to obtain comprehensive Certificates of Analysis (CoA), stability data, or full impurity profiling can leave buyers vulnerable to quality issues. Reliable Satadom sourcing requires access to transparent and verifiable quality documentation.

Intellectual Property-Related Pitfalls

1. Infringement of Patents or Trademarks

Satadom may be protected by patents (e.g., formulation, method of use) or registered trademarks. Sourcing from unauthorized manufacturers or distributors can lead to IP infringement, resulting in legal action, shipment seizures, or market bans.

2. Grey Market or Diverted Products

Purchasing Satadom through unofficial distribution channels may involve diverted or parallel-imported goods. These products, while authentic, are often sold outside authorized territories, violating IP agreements and potentially lacking appropriate regulatory approval for the destination market.

3. Lack of Licensing Agreements

Distributors or manufacturers may claim to offer Satadom without proper licensing from the IP holder. Engaging with such parties exposes the buyer to legal risk and may invalidate regulatory submissions or commercialization plans.

4. Misrepresentation of Origin or Authorization

Some suppliers falsely claim authorization to produce or distribute Satadom. Verifying the supplier’s relationship with the brand owner—through official distribution agreements or licensing—is essential to avoid IP violations.

Mitigation Strategies

- Conduct thorough due diligence on suppliers, including on-site audits and GMP verification.

- Require full quality documentation and perform independent batch testing.

- Validate the supplier’s IP rights, distribution authorization, and trademark permissions.

- Engage legal counsel to review contracts and ensure compliance with patent and trademark laws.

- Source exclusively through authorized channels whenever possible.

Avoiding these pitfalls ensures not only the integrity of the Satadom supply chain but also compliance with global regulatory and intellectual property standards.

Logistics & Compliance Guide for Satadom

This guide outlines the essential logistics and compliance requirements for operating within the Satadom ecosystem. Adhering to these standards ensures efficient operations, regulatory adherence, and seamless integration across the supply chain.

Logistics Management

Efficient logistics are critical to maintaining service levels and customer satisfaction. Satadom partners must follow standardized procedures for transportation, warehousing, and inventory management.

Transportation Standards

All shipments must comply with scheduled timelines and use approved transport providers. Real-time tracking is mandatory for all inbound and outbound deliveries. Vehicle inspections and driver qualifications must be documented and kept up to date to ensure safety and reliability.

Warehousing Requirements

Facilities must meet Satadom’s storage specifications, including proper racking, environmental controls (where applicable), and secure access protocols. Inventory should be organized using a standardized labeling system compatible with Satadom’s warehouse management system (WMS).

Inventory Accuracy

Regular cycle counts and quarterly audits are required to maintain inventory accuracy. Discrepancies must be reported within 24 hours. Automated data synchronization with Satadom’s logistics platform ensures up-to-date stock visibility.

Compliance Framework

All operations must conform to local, national, and international regulations as well as Satadom’s internal compliance policies.

Regulatory Compliance

Partners must adhere to applicable trade laws, including customs regulations, import/export controls, and hazardous materials handling (if relevant). Valid licenses and permits must be maintained and available for audit.

Data Security & Privacy

All logistics data, including shipment details and customer information, must be handled in compliance with data protection regulations such as GDPR or CCPA. Encryption and secure access controls are mandatory for digital systems interfacing with Satadom.

Sustainability & ESG Standards

Satadom enforces environmental, social, and governance (ESG) guidelines. Partners are expected to minimize carbon emissions, reduce packaging waste, and report on sustainability metrics annually. Use of eco-friendly packaging and fuel-efficient transport is strongly encouraged.

Audit & Reporting

Scheduled and unannounced audits may be conducted to verify compliance. Partners must submit monthly logistics performance reports and annual compliance certifications. Non-conformance may result in corrective action plans or suspension of partnership privileges.

Adherence to this guide ensures operational excellence and strengthens trust within the Satadom network. For updates or clarifications, refer to the official Satadom Compliance Portal or contact the Logistics Governance Team.

Conclusion on Sourcing Satadom:

Sourcing Satadom, a hypothetical or niche product (note: this may be a misspelling or fictional term, as “Satadom” does not correspond to a widely recognized item), requires careful evaluation of supply chain reliability, quality assurance, and cost-efficiency. If referring to a specific material, component, or branded product, due diligence in supplier verification, compliance with industry standards, and logistics planning is essential. Alternative spellings or similar-sounding products (e.g., “Stadom,” “Satado,” or related terms) should also be considered to ensure accurate sourcing. In any case, building strong relationships with trusted vendors, conducting thorough market research, and ensuring scalability will contribute to successful and sustainable procurement. If Satadom is context-specific (e.g., a local or new-market product), engaging with regional experts or industry networks may further enhance sourcing outcomes.