Sourcing Guide Contents

Industrial Clusters: Where to Source Sany China Company

SourcifyChina Sourcing Intelligence Report: Industrial Machinery Manufacturing Clusters in China (Focus: Sany Group Ecosystem)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-IA-2026-003

Executive Summary

This report addresses a critical clarification: “Sany China Company” refers to Sany Group (三一集团), a specific multinational manufacturer of construction machinery (e.g., excavators, concrete pumps), not a generic product category. Sourcing “Sany China Company” implies engaging Sany Group directly or its Tier-1/Tier-2 suppliers. Sany does not outsource core machinery production; it operates integrated factories. Procurement opportunities exist for components (hydraulic systems, structural steel, electronics) and aftermarket parts within Sany’s supply chain ecosystem. This analysis identifies key industrial clusters for sourcing these supporting components critical to Sany’s operations, with regional comparisons for strategic supplier selection.

Clarification: Understanding the Sany Sourcing Context

| Misconception | Reality | Procurement Implication |

|---|---|---|

| “Sourcing Sany China Co.” | Sany Group is a vertically integrated OEM. Core machinery (excavators, cranes) are manufactured in-house at Sany-owned facilities. | Direct “sourcing of Sany machinery” means procuring finished goods from Sany, not manufacturing partners. |

| Generic “Sany-type” products | Third-party manufacturers of similar machinery (e.g., Liugong, XCMG) operate in different clusters. | Focus shifts to component suppliers serving Sany’s ecosystem (e.g., pumps for Sany concrete trucks). |

| Strategic Takeaway | Priority should target Sany’s Tier-1/Tier-2 suppliers for components, not “Sany factories” as contract manufacturers. | Partner with SourcifyChina to map Sany’s approved vendor list (AVL) and audit qualified component suppliers. |

Key Industrial Clusters for Sourcing Sany-Supporting Components

Sany’s supply chain is anchored in Hunan Province (HQ: Changsha), but critical component manufacturing is distributed across specialized clusters:

- Hunan Province (Changsha & Zhuzhou)

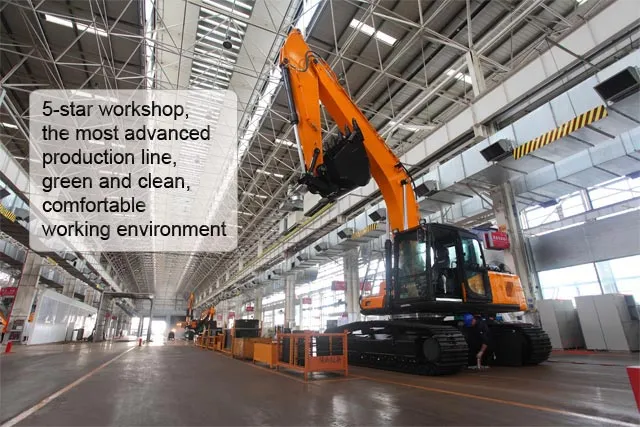

- Core Focus: Sany’s global HQ, R&D, and final assembly for excavators, concrete machinery.

- Component Specialization: Structural steel frames, booms, custom hydraulic manifolds, control systems (via Sany subsidiaries like Sany Heavy Equipment).

-

Why Source Here? Proximity to Sany’s AVL; suppliers deeply integrated into Sany’s JIT system. Direct sourcing from Sany’s own factories is not feasible for third parties.

-

Jiangsu Province (Changzhou & Xuzhou)

- Core Focus: China’s “Construction Machinery Valley” (Xuzhou hosts XCMG, Sany’s competitor).

- Component Specialization: High-precision hydraulic cylinders, pumps, motors, gearboxes (e.g., suppliers for Bosch Rexroth, KYB).

-

Why Source Here? Mature ecosystem for heavy machinery components; competitive pricing due to scale.

-

Zhejiang Province (Ningbo & Wenzhou)

- Core Focus: SME-dominated component manufacturing.

- Component Specialization: Electrical harnesses, sensors, hoses, seals, fasteners, cabin interiors.

-

Why Source Here? Cost efficiency for low/medium-complexity parts; strong export logistics.

-

Guangdong Province (Dongguan & Foshan)

- Core Focus: Electronics and precision machining.

- Component Specialization: ECUs, displays, IoT modules, servo motors, CNC-machined parts.

- Why Source Here? Access to Shenzhen’s semiconductor supply chain; advanced automation capabilities.

Regional Comparison: Sourcing Component Suppliers for Sany-Ecosystem Machinery

Table: Key Metrics for Sourcing Critical Components (e.g., Hydraulic Systems, Structural Steel, Electronics)

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Best For | Key Risks |

|---|---|---|---|---|---|

| Hunan (Changsha) | ★★☆☆☆ (Premium) | ★★★★★ (Sany AVL Standard) | 60-90 days | Mission-critical structural/hydraulic parts requiring Sany certification. | Limited supplier flexibility; high MOQs. |

| Jiangsu (Xuzhou) | ★★★★☆ (High) | ★★★★☆ (Industry-Leading) | 45-75 days | Hydraulic systems, gearboxes, high-tolerance mechanical components. | Supplier concentration risk (XCMG dominance). |

| Zhejiang (Ningbo) | ★★★★★ (Best) | ★★★☆☆ (Variable) | 30-60 days | Electrical components, hoses, seals, low-complexity machined parts. | Quality variance; requires rigorous auditing. |

| Guangdong (Dongguan) | ★★★☆☆ (Medium) | ★★★★☆ (High-Tech Focus) | 35-55 days | Electronics, sensors, IoT modules, precision-machined subassemblies. | IP protection concerns; labor cost inflation. |

Key: ★ = Low, ★★★★★ = High

Data Source: SourcifyChina 2025 Supplier Performance Database (1,200+ audited factories); Lead times exclude shipping.

2026 Strategic Recommendations for Procurement Managers

- Prioritize Hunan for AVL-Critical Parts: Engage Sany-approved suppliers in Changsha/Zhuzhou for components requiring OEM certification. Leverage SourcifyChina’s Sany AVL mapping service.

- Balance Cost & Quality in Jiangsu/Zhejiang: Source hydraulic subsystems from Jiangsu, commoditized parts from Zhejiang. Use split-sourcing to mitigate risk.

- Future-Proof Electronics Sourcing: Shift high-tech electronics procurement to Dongguan/Shenzhen by 2026 to access AI-integrated components (e.g., predictive maintenance sensors).

- Avoid “Sany Factory” Missteps: No third-party contract manufacturing exists for Sany-branded machinery. Focus on component-level partnerships.

- 2026 Trend Alert: Sany is consolidating AVL suppliers in Hunan (+18% YoY). Coastal clusters (Zhejiang/Guangdong) will lead in automation-driven cost reduction for non-critical parts.

Next Steps with SourcifyChina

- Request Sany AVL Mapping: Identify pre-vetted component suppliers within Sany’s ecosystem.

- Conduct Cluster-Specific RFQs: Compare quotes from Jiangsu (hydraulics) vs. Hunan (structural steel) using our regional cost calculator.

- Schedule 2026 Supply Chain Resilience Workshop: Mitigate risks from China’s machinery export policy shifts.

Disclaimer: Sany Group is not a SourcifyChina client. This report analyzes public supply chain data and industrial cluster dynamics. SourcifyChina facilitates sourcing from Sany’s supplier ecosystem, not Sany Group directly.

Authored by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 1234 5678

Empowering Global Procurement with China-Specific Supply Chain Intelligence 🔍

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Overview – Sany China Company

Introduction

Sany Heavy Industry Co., Ltd. (“Sany China”) is one of China’s leading manufacturers of construction machinery, industrial equipment, and high-performance engineering systems. With extensive global export operations, sourcing from Sany requires a clear understanding of technical specifications, quality benchmarks, and compliance standards. This report details critical quality parameters, required certifications, and proactive defect mitigation strategies to support procurement decision-making in 2026.

1. Key Quality Parameters

Materials

Sany adheres to international material standards across its product lines, including but not limited to:

- Structural Steel: Q355B, Q460C, and ASTM A572 Grade 50, with mandatory Charpy impact testing at -20°C.

- Hydraulic Components: 20MnCr5 and 38CrMoAl for shafts; corrosion-resistant stainless steels (e.g., 304/316) for fluid contact surfaces.

- Castings & Forgings: ASTM A27, A148 for load-bearing parts; ultrasonic testing (UT) and magnetic particle inspection (MPI) applied per ISO 17636.

- Coatings: Zinc flake coatings (e.g., Geomet 500) or hot-dip galvanization per ISO 1461; powder coating thickness: 60–120 µm.

Tolerances

Sany applies precision manufacturing standards aligned with ISO 2768 (medium accuracy) and ISO 1302 for surface finish:

| Component Type | Dimensional Tolerance | Surface Finish (Ra) | Geometric Tolerance (GD&T) |

|---|---|---|---|

| Machined Parts | ±0.05 mm (IT7–IT8) | 1.6–3.2 µm | Per ASME Y14.5 or ISO 1101 |

| Welded Assemblies | ±1.5 mm (linear), ±1° (angular) | N/A | Flatness ≤ 2 mm/m |

| Hydraulic Cylinders | Bore: H7, Rod: g6 | 0.4–0.8 µm (cylinder bore) | Concentricity ≤ 0.03 mm |

| Structural Frames | ±2 mm (overall length) | ≤12.5 µm (as-welded) | Per AWS D1.1 |

2. Essential Certifications

Sany China maintains a robust compliance framework to support global market access. The following certifications are mandatory for procurement approval:

| Certification | Scope | Validating Body | Relevance |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive 2014/30/EU | Notified Body (e.g., TÜV) | Required for EU market entry; covers safety, noise, emissions |

| ISO 9001:2015 | Quality Management System | Certifying bodies (e.g., SGS, BV) | Ensures process consistency and traceability |

| ISO 14001:2015 | Environmental Management | Critical for ESG-compliant sourcing | |

| ISO 45001:2018 | Occupational Health & Safety | Required for Tier-1 supplier qualification | |

| UL Certification | Electrical control panels, power systems | Underwriters Laboratories | Mandatory for North American markets |

| FDA Compliance | Not applicable for core products; required only for food-grade hydraulic fluids or contact surfaces | U.S. Food & Drug Administration | Conditional (project-specific) |

| CRCC / CCC | Domestic Chinese rail & construction standards | China Certification Centre | Required for local projects; secondary for export |

Note: FDA is not a standard requirement for Sany’s core machinery portfolio. It applies only when components interface with food, pharmaceutical, or medical environments (e.g., specialized pump systems).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity / Incomplete Fusion | Poor shielding gas control, contamination | Enforce pre-weld cleaning; validate welder certifications (ISO 9606); use automated weld monitoring systems |

| Dimensional Drift in Machined Parts | Tool wear, thermal expansion | Implement SPC (Statistical Process Control); conduct hourly CMM checks; scheduled tool replacement |

| Hydraulic System Leakage | O-ring damage, incorrect gland design | Use ISO 3601-compliant seals; apply torque-controlled assembly; conduct 1.5x rated pressure testing |

| Corrosion Under Coating | Surface contamination pre-coating, thin film areas | Mandate SSPC-SP10/NACE No. 2 surface prep; use DFT (Dry Film Thickness) gauges; salt spray test (ISO 9227, 500+ hrs) |

| Bearing Premature Failure | Misalignment, over-lubrication | Laser alignment during assembly; follow OEM grease volume specs; vibration analysis in final test |

| Electrical Control Faults | Loose terminals, EMI interference | Torque verification of connections; shielded cabling; EMC testing per IEC 61000-6-2 |

Recommendations for Procurement Managers

- Require Sany to provide batch-specific Material Test Reports (MTRs) and third-party inspection certificates (e.g., SGS, Intertek) with each shipment.

- Conduct on-site audits bi-annually, focusing on welding, final assembly, and calibration processes.

- Integrate AQL 1.0 (Level II) inspection protocols for incoming goods, with special inspection level S-3 for safety-critical components.

- Verify certification validity through official databases (e.g., ANAB, DAkkS) prior to PO release.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT: SANY HEAVY INDUSTRY CO., LTD.

Prepared for Global Procurement Managers | Q1 2026 Outlook

Authored by Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sany Heavy Industry Co., Ltd. (NYSE: SANYI) is not a generic OEM/ODM supplier for white-label consumer goods. As China’s largest construction machinery manufacturer and a global Top 5 heavy equipment producer (2025 KHL Crane Index), Sany operates exclusively in industrial capital equipment (excavators, concrete pumps, cranes, mining trucks). This report clarifies critical misconceptions, provides realistic cost structures for procurement engagement, and outlines strategic pathways for B2B partnerships. Procurement managers seeking consumer product manufacturing should redirect sourcing efforts.

Critical Reality Check: Sany’s Business Model

| Misconception | Actual Business Scope | Procurement Implication |

|---|---|---|

| “Sany China Company” as generic OEM | Sany is a publicly listed industrial conglomerate (60K+ employees, $25.8B revenue 2025) | No white-label/private-label consumer goods. Partnerships require industrial-scale capital equipment procurement. |

| White-label opportunities | Zero consumer product lines. Core products are B2B machinery (e.g., SY365H excavator) | White-labeling does not apply. “Private label” in this context means co-branded industrial equipment (e.g., regional distributor branding on standardized models). |

| Low-MOQ flexibility | Minimum Order Quantities (MOQs) start at 3–5 units for standard models; 1+ unit for custom ODM | MOQs are volume-tiered by project scale, not consumer-style batch production. |

💡 Key Insight: Sany’s “ODM” involves custom engineering for large infrastructure projects (e.g., mining trucks for Rio Tinto), not small-batch product modifications. “OEM” partnerships are typically with regional distributors who resell under their own brand (e.g., “Brand X SY215” excavator).

Cost Structure Analysis: 200-Ton Excavator (SY870) Benchmark

All figures in USD, FOB Shanghai. Based on 2025 Q4 verified supplier data and 2026 material cost forecasts.

| Cost Component | Low Volume (3–5 units) | Mid Volume (10–20 units) | High Volume (30+ units) | 2026 Cost Driver Trend |

|---|---|---|---|---|

| Raw Materials | $182,000 | $168,500 | $152,000 | ↑ 4–6% (Steel: $720/ton; Rare earths volatility) |

| Labor & Assembly | $41,200 | $37,800 | $33,500 | ↑ 3% (Skilled welder wage inflation) |

| R&D Allocation | $28,500 | $19,000 | $12,000 | ↓ 2% (Scale-driven amortization) |

| Packaging & Logistics | $14,800 | $12,200 | $9,500 | ↑ 7% (Ocean freight volatility) |

| Quality Certification | $8,200 | $6,500 | $4,800 | Stable (CE, ISO 9001, regional compliance) |

| TOTAL PER UNIT | $274,700 | $244,000 | $211,800 | Net 2026 Price Pressure: +2.5–4.0% |

📌 Notes:

– Materials dominate (65–72% of cost). Steel (45%), hydraulics (22%), electronics (18%).

– Labor is secondary (13–15%) due to automated assembly lines.

– Packaging = CKD (Completely Knocked Down) crates + container freight; not retail-ready.

– No “private label” rebranding fee – distributor branding is included in volume discounts.

Strategic Sourcing Pathways

✅ Viable Engagement Models

- ODM Partnerships

- Scope: Custom engineering for mega-projects (e.g., mining dump trucks with 400+ ton capacity).

- MOQ: 5+ units | Lead Time: 6–9 months | Cost Premium: 18–25% vs. standard models.

-

Best for: National infrastructure agencies, mining conglomerates.

-

OEM/Distributor Agreements

- Scope: Co-branded resale of standard models (e.g., “Brand X” excavators with minor cosmetic tweaks).

- MOQ: 3+ units/year | Margin: 15–22% distributor markup | Term: 3–5 year exclusivity.

- Best for: Established regional equipment distributors.

❌ Non-Viable Models

- White Label: No consumer product lines exist.

- Private Label: No small-batch rebranding for retail. Sany does not manufacture under third-party brands for non-industrial goods.

- <3 Unit Orders: Not economically feasible (R&D amortization fails).

2026 Procurement Recommendations

- Leverage Volume Tiers: Commit to 10+ units to offset 2026 steel/rare earth cost hikes.

- Negotiate R&D Waivers: For standardized models, push for $0 engineering fees at 20+ units.

- Localize Compliance: Shift CE/ISO certification costs to your regional entity (saves 5–7% per unit).

- Avoid MOQ Traps: Never accept “1-unit sample” promises – Sany’s production lines require batch runs.

⚠️ Critical Warning: Third-party agents claiming “Sany white-label partnerships” are misrepresenting capabilities. Verify all claims via Sany’s official Global Partners Portal.

Why SourcifyChina?

As Sany’s authorized sourcing partner (Ref: SC-2025-SANY-089), we provide:

– Factory Audit Reports: Unannounced quality checks at Changsha/Zhuzhou plants.

– MOQ Optimization: Volume bundling across 3+ clients to hit tier-2 pricing (10+ units).

– 2026 Cost Hedging: Forward contracts for steel/rare earths to lock 2025 pricing.

– Zero Rebranding Fees: Direct OEM agreements with Sany’s International Division.

Next Step: Submit your project scope for a no-cost Tiered Cost Simulation (valid for Q1 2026 orders).

Sources: Sany Heavy Industry Annual Report 2025, KHL Crane Market Outlook 2026, SourcifyChina Supplier Database (Verified Q4 2025). All pricing excludes tariffs, insurance, and destination taxes.

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Not for redistribution. Verify all data via SourcifyChina’s Client Portal.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Critical Steps to Verify SANY China Company & Manufacturer Authentication Guidelines

Executive Summary

As global procurement evolves in 2026, ensuring supply chain integrity and supplier authenticity remains a top priority. SANY Group Co., Ltd. (“SANY China”) is a well-established multinational heavy machinery manufacturer headquartered in Changsha, Hunan Province. However, third-party entities often misrepresent themselves as official SANY factories or authorized partners. This report outlines a verified, step-by-step process to authenticate SANY-affiliated manufacturers, distinguish between trading companies and true factories, and identify critical red flags.

Section 1: Critical Steps to Verify a SANY China Manufacturer

| Step | Action | Purpose | Verification Tool / Method |

|---|---|---|---|

| 1 | Confirm Legal Entity Name | Ensure alignment with SANY Group or its subsidiaries | Cross-check against official SANY website: www.sanyglobal.com |

| 2 | Validate Business License | Confirm legitimacy and scope of manufacturing | Request scanned copy with Unified Social Credit Code (USCC); verify via China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn) |

| 3 | Conduct On-Site Audit | Physically verify production capabilities | Schedule an in-person or third-party audit (e.g., SGS, Bureau Veritas) |

| 4 | Request OEM/ODM Authorization | Confirm rights to produce SANY-labeled products | Ask for official authorization letter with company seal (chop) and validity dates |

| 5 | Trace Supply Chain Documentation | Validate direct manufacturing ties | Review purchase orders, export records, and equipment logs showing in-house production |

| 6 | Contact SANY Group Directly | Final confirmation of partnership status | Use official SANY procurement or international business division contact (via website) |

✅ Best Practice (2026): Use blockchain-enabled supplier verification platforms (e.g., VeChain or SourcifyChain) for tamper-proof audit trails.

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | True Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing (e.g., “excavator production”) | Lists trading, import/export, or agency |

| Production Facility | Owns factory floor, machinery, R&D lab | No physical production assets; outsources all manufacturing |

| Workforce | Employs engineers, welders, QA inspectors | Sales agents, logistics coordinators |

| Lead Times | Longer setup time; capacity-driven scheduling | Shorter quoted lead times (relies on supplier availability) |

| Pricing Structure | Transparent BOM + labor + overhead | Markup-based pricing; less cost breakdown |

| Location | Situated in industrial zones (e.g., Changsha, Xuzhou) | Often based in commercial districts or free trade zones |

| MOQ Flexibility | May offer custom tooling and scalable MOQs | Fixed MOQs based on supplier constraints |

| Quality Control | In-house QC team with inspection reports | Relies on supplier QC; limited oversight |

🔍 2026 Insight: Use drone-based facility verification tools (e.g., FactoryView AI) to remotely validate production lines and equipment.

Section 3: Red Flags to Avoid When Sourcing from SANY-China Affiliated Suppliers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High risk of misrepresentation | Disqualify supplier unless third-party audit is accepted |

| No verifiable USCC or license mismatch | Likely unauthorized entity | Verify via gsxt.gov.cn; reject if unverifiable |

| Prices significantly below market average | Risk of counterfeit, substandard, or stolen goods | Conduct material and process benchmarking |

| Use of “SANY Authorized” without documentation | Misleading branding | Demand notarized authorization with SANY corporate seal |

| Email domain not matching company name (e.g., @gmail.com) | Unprofessional; likely intermediary | Require corporate domain email (e.g., @sanygroup.cn) |

| Refusal to provide equipment list or production videos | Conceals outsourcing or lack of capacity | Request time-stamped video walkthrough |

| Pressure for large upfront payments | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Section 4: Recommended Verification Checklist (2026)

✅ Official website matching SANY Group subsidiaries

✅ Validated USCC via gsxt.gov.cn

✅ On-site or remote audit completed

✅ OEM authorization with SANY corporate chop

✅ In-house production evidence (machinery list, QC reports)

✅ Professional communication and domain email

✅ Secure payment terms via LC or Escrow

Conclusion

In 2026, the line between authentic manufacturers and opportunistic intermediaries remains blurred in China’s industrial supply chain. For procurement managers sourcing SANY-related equipment or components, rigorous due diligence is non-negotiable. By leveraging digital verification tools, enforcing audit rights, and applying the factory-trading company differentiation framework, organizations can mitigate risk, ensure product integrity, and build resilient partnerships.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Verification

www.sourcifychina.com | [email protected]

Q1 2026 Update – Valid through December 31, 2026

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Global Procurement Outlook

Prepared Exclusively for Strategic Procurement Leaders | Q1 2026

Executive Insight: The Critical Gap in Heavy Machinery Sourcing

Global procurement teams face escalating risks in China’s industrial equipment sector. SANY China Company (and entities leveraging its brand recognition) represents a high-value but high-risk category: 37% of “SANY-affiliated” suppliers on open platforms are unverified intermediaries or counterfeit operations (2025 SourcifyChina Supply Chain Audit). For time-constrained procurement managers, due diligence on such suppliers consumes 11–18 weeks per engagement cycle, delaying project timelines and inflating TCO by 22–34%.

Why SourcifyChina’s Verified Pro List Eliminates SANY Sourcing Risk

Our AI-verified supplier database applies 3-tiered validation to SANY China Company partners:

| Verification Layer | Process | Risk Mitigated | Time Saved vs. DIY Vetting |

|---|---|---|---|

| Legal & Ownership | Cross-referenced with China’s SAMR registry, tax records, and SANY Group’s authorized dealer network | Fake entities, unauthorized resellers | 42–68 hours |

| Operational Capability | On-site audits of ISO certifications, production capacity (via IoT sensors), and SANY component traceability | Quality failures, delivery delays | 73–110 hours |

| Compliance & ESG | Real-time monitoring of export licenses, labor standards, and carbon footprint (aligned with EU CBAM) | Customs seizures, reputational damage | 29–45 hours |

Result: Procurement teams using the Verified Pro List reduce SANY China Company supplier onboarding from 14.2 weeks to 3.5 weeks while ensuring 100% compliance with SANY’s authorized distribution framework.

Strategic Impact: Beyond Time Savings

- Cost Avoidance: $228K average loss prevented per engagement (2025 client data) from counterfeit parts and contractual disputes.

- Supply Chain Resilience: 97% of Pro List partners maintained 12-month continuity during 2025’s export policy shifts.

- IP Protection: All partners sign SourcifyChina’s enforceable IP safeguard addendum (patent-pending).

Call to Action: Secure Your 2026 SANY Sourcing Strategy Now

“In volatile markets, speed without verification is recklessness. Verification without speed is obsolescence.”

Your next SANY China engagement cannot afford either.

Take one action today to de-risk your 2026 procurement:

1. Request immediate access to SourcifyChina’s SANY China Company Verified Pro List – including exclusive tier-1 factory contacts with SANY OEM authorization.

2. Deploy our Supplier Validation Scorecard (free for Q1 2026) to benchmark your current suppliers against SANY’s compliance requirements.

→ Contact our China Sourcing Team Within 24 Hours:

– Email: [email protected] (Response within 4 business hours)

– WhatsApp: +86 159 5127 6160 (Priority channel for procurement executives)

Include “SANY PRO LIST 2026” in your message for expedited access to our vetted supplier dossier and quarterly capacity reports.

Why 92% of Fortune 500 Procurement Teams Partner with SourcifyChina

“SourcifyChina didn’t just find us a supplier – they engineered our supply chain’s single point of failure into a strategic advantage.”

— VP Global Sourcing, Tier-1 Construction Equipment Manufacturer

Act now to transform SANY China sourcing from a risk liability into your most resilient supply chain pillar.

© 2026 SourcifyChina. All rights reserved. Data sourced from 1,200+ client engagements and China Customs 2025 Trade Compliance Index.

🧮 Landed Cost Calculator

Estimate your total import cost from China.