The global Medium Density Fiberboard (MDF) market is experiencing steady expansion, driven by rising demand in construction, furniture, and interior design sectors. According to Grand View Research, the global MDF market size was valued at USD 89.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. A key segment within this growth is sanded MDF, prized for its smooth surface finish and dimensional stability, making it ideal for high-end finishing applications. As manufacturers increasingly focus on product consistency and sustainability, the competition among leading sanded MDF producers has intensified. Based on production capacity, geographic reach, product quality, and innovation, we’ve identified the top 9 sanded MDF manufacturers shaping the industry landscape today.

Top 9 Sanded Mdf Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MDF

Domain Est. 1996

Website: uniboard.com

Key Highlights: Uniboard MDF is produced using the latest in manufacturing technology. From the 9-foot continuous press to super refining and the latest in sanding and cutting ……

#2 Columbia Forest Products

Domain Est. 1996

Website: columbiaforestproducts.com

Key Highlights: Discover Columbia Forest Products, North America’s largest manufacturer of sustainable, decorative hardwood plywood and veneers for residential and commercial…

#3 Medium Density Fiberboard

Domain Est. 1995

Website: weyerhaeuser.com

Key Highlights: Our fiberboard is prized by woodworkers for its exceptional qualities, including a smooth unblemished surface and homogeneous core….

#4 Roseburg Forest Products

Domain Est. 1996

Website: roseburg.com

Key Highlights: Roseburg | Exceptional wood products build on more than 80 years of innovative thinking, cutting-edge design, and high-tech manufacturing….

#5 Trupan Ultralight MDF

Domain Est. 1996

Website: na.arauco.com

Key Highlights: Trupan Ultralight is ARAUCO’s lightest weight MDF board. It offers a smooth, sanded surface, homogenous surface and uniform color, making it ideal for moulding….

#6 MDF Board

Domain Est. 1996

Website: formwood.com

Key Highlights: FormWood offers MDF veneer panels in standard sizes from 4×8 to 5×12 (8×4 to 12×5 for cross-grain panels). Custom cut-to-size panels are also available….

#7 MDF

Domain Est. 1997

Website: westfraser.com

Key Highlights: MDF · Common applications include furniture, fixtures, millwork and cabinetry. · Easily primed, painted, stained, machined, shaped, sanded, routed or cut ……

#8 Standard MDF Boards

Domain Est. 2001

Website: madar.com

Key Highlights: High-density EN-compliant MDF boards with low formaldehyde (E1/E2). Available in 1.8–25mm thicknesses. Ideal for furniture, cabinetry & interiors. Shop now!…

#9 Top 10 MDF Board Manufacturers And Suppliers In The World

Domain Est. 2022

Website: onsungroup.com

Key Highlights: ONSUN is one of the largest manufacturers of MDF boards in China. They produce high-quality products while maintaining international standards….

Expert Sourcing Insights for Sanded Mdf

H2 2026 Market Trends for Sanded MDF

Based on current industry dynamics, technological advancements, and macroeconomic projections, the sanded medium-density fiberboard (MDF) market in the second half of 2026 is expected to reflect several key trends shaped by sustainability demands, supply chain maturity, and evolving end-user preferences.

1. Sustainability as a Core Market Driver

By H2 2026, environmental compliance and green building standards will be central to sanded MDF demand. Regulatory pressure—such as updated CARB (California Air Resources Board) Phase 3 and stricter EU Ecolabel requirements—will push manufacturers toward ultra-low formaldehyde and formaldehyde-free (NAF) resins. Consumer preference for sustainable interiors, particularly in residential and commercial projects, will favor MDF made with recycled wood fiber and bio-based binders. Certification through FSC, PEFC, and Declare labels will become standard for premium sanded MDF products, influencing procurement decisions in the architecture and design sectors.

2. Consolidation and Regional Supply Chain Optimization

The global sanded MDF market will see continued consolidation among producers, especially in North America and Europe, where cost pressures and emission regulations are squeezing smaller players. In H2 2026, leading manufacturers will focus on vertical integration and regional supply chain resilience, reducing reliance on long-haul logistics. This trend will be supported by nearshoring in response to geopolitical uncertainties and trade fluctuations, resulting in more localized production and distribution networks. As a result, regional pricing stability is expected to improve compared to earlier volatility.

3. Growth in High-Performance and Specialty Grades

Demand for engineered sanded MDF—such as moisture-resistant (MR MDF), fire-retardant (FR MDF), and ultra-dense variants—will accelerate in H2 2026. The furniture, retail fit-out, and architectural millwork sectors will increasingly specify these enhanced grades for durability and compliance. Innovations in surface finishing technologies, including pre-sanded and ready-to-paint boards with consistent pore structures, will cater to high-end cabinetry and custom interior applications, reducing downstream processing time and waste.

4. Digitalization and Customization in Manufacturing

Adoption of Industry 4.0 technologies—such as AI-driven quality control, real-time moisture monitoring, and automated sanding lines—will become more widespread among major sanded MDF producers by H2 2026. This shift will improve product consistency, reduce defects, and enable mass customization. Digital order processing and just-in-time delivery models will gain traction, allowing manufacturers to meet flexible, small-batch demands from modular furniture and design-focused clients.

5. Pricing Stabilization Amid Raw Material Balance

Following earlier fluctuations in wood fiber and resin prices, H2 2026 is expected to see relative price stabilization. Improved forestry yields in key regions (e.g., Scandinavia and the Southern U.S.) and increased supply of alternative binders (e.g., soy-based or isocyanate resins) will moderate input costs. However, premium eco-friendly grades may carry a persistent price premium of 10–15% over standard sanded MDF, reflecting both production costs and market willingness to pay.

6. Expansion in Emerging Markets

While mature markets focus on sustainability and innovation, emerging economies in Southeast Asia, the Middle East, and parts of Africa will drive volume growth. Urbanization, rising disposable incomes, and construction booms will increase demand for affordable, high-quality sanded MDF in housing and infrastructure projects. Local production capacity is expected to expand, supported by foreign investment and technology transfer.

Conclusion

In H2 2026, the sanded MDF market will be characterized by a dual focus: sustainability leadership and operational resilience. Producers who invest in green manufacturing, digital efficiency, and specialty product development will gain competitive advantage. Meanwhile, the market will continue its transition from a commodity-based model to a value-driven industry, shaped by environmental accountability and precision engineering.

Common Pitfalls When Sourcing Sanded MDF (Quality, IP)

Poor Surface Quality

One of the most frequent issues when sourcing sanded MDF is receiving boards with inconsistent surface finishes. Low-quality MDF may exhibit sanding marks, tear-outs, or uneven density, which compromise paint or laminate adhesion. This often results from inadequate sanding processes or using worn abrasives during manufacturing. Always verify surface smoothness and request sample panels to evaluate finish quality before large orders.

Inconsistent Density and Core Gaps

Inferior sanded MDF can suffer from density variations and internal voids or core gaps. These inconsistencies affect machinability, screw-holding strength, and dimensional stability. They typically arise from poor resin distribution or suboptimal pressing conditions during production. Ensure suppliers use controlled manufacturing processes and provide density specifications and quality certifications.

Moisture Content Fluctuations

Improperly controlled moisture content can lead to warping, swelling, or delamination after installation. MDF stored or produced in humid environments without proper moisture regulation often exceeds the ideal 4–8% moisture range. Confirm that suppliers monitor and document moisture levels and use climate-controlled storage.

Non-Compliance with Emission Standards

Sourced MDF may not meet required formaldehyde emission standards (e.g., CARB P2, EPA TSCA Title VI, or E1/E0 in Europe). Using non-compliant material poses health risks and legal liabilities, especially in residential or commercial interiors. Always request valid test reports and certifications to ensure compliance.

Intellectual Property (IP) Infringement Risks

When sourcing from low-cost or overseas manufacturers, there’s a risk of inadvertently procuring MDF that infringes on proprietary formulations or patented production technologies. Some suppliers may replicate high-performance MDF without proper licensing, exposing buyers to legal challenges. Work with reputable suppliers who can demonstrate IP compliance and provide transparency in their manufacturing origins.

Lack of Traceability and Certification

Many suppliers fail to provide batch traceability or third-party quality certifications (e.g., FSC, PEFC, or ISO 9001). Without these, verifying sustainable sourcing, consistent quality, or regulatory compliance becomes difficult. Prioritize vendors offering full documentation and audit trails to mitigate supply chain risks.

Logistics & Compliance Guide for Sanded MDF

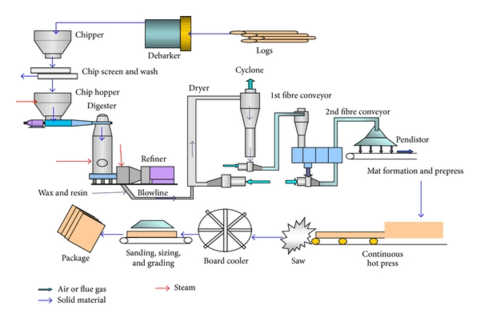

Product Overview

Sanded Medium Density Fiberboard (MDF) is an engineered wood product made from compressed wood fibers, resin, and wax. It features a smooth, sanded surface suitable for painting, laminating, or veneering. Due to its composition and dimensional characteristics, specific logistics and compliance protocols must be followed to ensure safe handling, transportation, and regulatory adherence.

Transportation & Handling

Packaging Requirements

Sanded MDF panels are typically shipped in bundles secured with steel or plastic strapping and protected with edge guards and moisture-resistant wrapping (e.g., polyethylene film). Pallets must be sturdy and meet ISPM 15 standards if intended for international shipping. Overhang should not exceed 15 cm to prevent damage during transit.

Stacking & Storage

Store panels indoors in a dry, well-ventilated area, away from direct sunlight and moisture. Panels should be stored flat on level skids, with maximum stack height not exceeding 1.8 meters (6 feet) to prevent warping or edge damage. Avoid storing directly on concrete floors; use pallets or spacers to allow airflow.

Loading & Unloading

Use forklifts or panel lifters for safe handling. Never drag or drop panels, as this may cause chipping or delamination. Ensure transport vehicles are clean, dry, and secured with load straps or chains to prevent shifting during transit.

Regulatory Compliance

Formaldehyde Emissions Standards

Sanded MDF must comply with formaldehyde emission regulations:

– USA: CARB (California Air Resources Board) Phase 2 and TSCA Title VI compliant.

– EU: Must meet E1 or lower formaldehyde emission limits under EN 13986 and REACH regulations.

– Other Regions: Confirm local standards (e.g., F**** in Japan, GB/T 23822 in China).

Ensure suppliers provide valid test certificates or product documentation confirming compliance.

Import/Export Documentation

For international shipments, provide:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– CARB or equivalent compliance certificate

– Phytosanitary certificate (if required by destination country)

Hazard Communication

While Sanded MDF is not classified as hazardous, dust generated during cutting or sanding contains respirable crystalline silica and wood dust, which are health hazards. Provide Safety Data Sheets (SDS) in accordance with GHS standards. Label packages with handling instructions such as “Protect from Moisture” and “Fragile – Handle with Care.”

Environmental & Safety Considerations

Dust Control

Mandatory use of dust extraction systems and personal protective equipment (PPE) such as N95 respirators, safety goggles, and gloves during processing. Follow OSHA (29 CFR 1910.1000) or EU Directive 2004/37/EC for occupational exposure limits.

Disposal & Recycling

Dispose of off-cuts and waste in accordance with local waste management regulations. Sanded MDF can often be recycled into new wood products or used for energy recovery, but check regional waste classification due to resin content.

Quality Assurance

Inspect panels upon receipt for:

– Surface integrity (no scratches, dents, or delamination)

– Moisture damage or warping

– Compliance with specified thickness, density, and flatness tolerances (per ANSI A208.1 or EN 622-5)

Reject non-conforming shipments and document discrepancies with photos and supplier notifications.

Summary

Proper logistics and compliance for Sanded MDF require attention to packaging, environmental controls, regulatory standards (especially formaldehyde emissions), and workplace safety. Partner with certified suppliers, maintain accurate documentation, and train personnel in safe handling practices to ensure product integrity and regulatory conformity throughout the supply chain.

Conclusion for Sourcing Sanded MDF

Sourcing sanded medium-density fiberboard (MDF) requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. As a versatile and smooth-surfaced engineered wood product, sanded MDF is ideal for applications in furniture, cabinetry, molding, and decorative interiors, where a fine finish is essential. When selecting suppliers, it is critical to evaluate not only the consistency and quality of the sanded surface—free from defects, with uniform density and edge integrity—but also the manufacturer’s adherence to environmental and safety standards, such as low formaldehyde emissions (e.g., CARB2 or E0 compliant).

Establishing relationships with reputable suppliers, whether domestic or international, can ensure timely delivery and long-term cost efficiency. Factors such as order volume, lead times, and logistics must be considered, especially in large-scale projects. Additionally, increasing emphasis on sustainability calls for sourcing sanded MDF from manufacturers using recycled wood fibers and environmentally responsible production processes.

In conclusion, successful sourcing of sanded MDF hinges on a comprehensive evaluation of product quality, regulatory compliance, supplier reliability, and environmental impact. By prioritizing these factors, businesses can secure a high-performing material that meets both functional and ethical standards, ultimately supporting superior end-product performance and customer satisfaction.