The global sandblasting equipment market has witnessed steady expansion, driven by growing demand across industries such as automotive, aerospace, construction, and metal fabrication. According to Grand View Research, the global surface preparation equipment market—of which sandblasting is a key component—was valued at USD 7.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increasing infrastructure development, stringent corrosion protection standards, and the rising need for efficient surface cleaning and coating adhesion. As manufacturers prioritize durability and surface integrity, the demand for high-performance sandblasting solutions continues to rise. In this evolving landscape, identifying leading sandblasting equipment manufacturers becomes critical for businesses seeking reliable, innovative, and scalable solutions. Based on market presence, product range, technological advancement, and customer reviews, the following are ten of the top sandblasting manufacturers shaping the industry today.

Top 10 Sand Sandblasting Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Quality Abrasive Blasting Cabinets

Domain Est. 1998 | Founded: 1978

Website: skatblast.com

Key Highlights: America’s leading manufacturer of affordable Made in USA abrasive sandblasting cabinets since 1978! Remove rust, paint & scale in minutes….

#2 SurfacePrep

Domain Est. 1995

Website: surfaceprep.com

Key Highlights: SurfacePrep is the largest network of distributors of blasting and vibratory media, specialty abrasives, and industrial blasting equipment….

#3 Sand, Abrasive, Wet and Vapor Blaster Cabinets

Domain Est. 1996

Website: mediablast.com

Key Highlights: Media Blast & Abrasive, Inc. provides sandblasting, abrasive blasting, and wet vapor blasting cabinet solutions made in the USA. Shop now!…

#4 MMLJ

Domain Est. 1997 | Founded: 1941

Website: mmlj.com

Key Highlights: The only manufacturer to offer a lifetime warranty on tank assemblies, MMLJ has been revolutionizing the abrasive blasting industry since 1941….

#5 JH Norton Company Inc.

Domain Est. 1998

#6 Econoline Abrasive Products

Domain Est. 1997

Website: sandblasting.com

Key Highlights: Econoline Abrasive Products is the leader in sandblasting equipment, abrasive blast equipment, blast cabinets, and sandblast dust collectors….

#7 Clemtex

Domain Est. 2001

Website: clemtex.com

Key Highlights: Discover top-quality abrasive blasting equipment, supplies, and services at Clemtex.com. Explore our wide range of sandblasting tools, media, and safety gear ……

#8 BlastOne USA

Domain Est. 2002

Website: blastone.com

Key Highlights: BlastOne USA | Blasting & Coating Equipment | Abrasives | Supplier. Inquire | Catalog | Call Us @ 1-800-999-1881 FREE SHIPPING ON ORDERS OVER $100!…

#9 Schmidt Abrasive Blasting Equipment

Domain Est. 2010

Website: schmidtabrasiveblasting.com

Key Highlights: Lightweight and most portable in the AmphiBlast family. Wet or dry blast with a single unit. Minimal water usage. Set and forget switching between machine ……

#10 Dustless Blasting®

Domain Est. 2011

Website: dustlessblasting.com

Key Highlights: Remove virtually any coating from any surface, with NO dust plume. Start your mobile blasting business or improve your existing one with Dustless Blasting….

Expert Sourcing Insights for Sand Sandblasting

H2: Projected Market Trends for Sand Sandblasting in 2026

As we approach 2026, the sand sandblasting market is poised for transformation driven by evolving industrial demands, environmental regulations, and technological advancements. While traditional applications remain vital, several key trends are reshaping the landscape:

1. Shift Toward Eco-Friendly Abrasives and Closed-Loop Systems

Environmental regulations are tightening globally, particularly concerning silica dust (respirable crystalline silica) and waste disposal. By 2026, demand is expected to surge for alternative abrasives like garnet, olivine, recycled glass, and plastic media. Concurrently, investments in closed-loop recycling systems and dust collection technologies will rise, enabling sustainable operations and compliance with OSHA and EU REACH standards. Sand-based blasting will increasingly be confined to controlled environments with advanced safety measures.

2. Automation and Robotic Integration Accelerates

Labor shortages and the need for precision are driving adoption of automated sandblasting systems. By 2026, robotic arms equipped with real-time monitoring and adaptive controls will be more prevalent in automotive, aerospace, and heavy manufacturing sectors. This trend enhances consistency, reduces human exposure to hazardous conditions, and improves throughput—making automated sandblasting a competitive necessity.

3. Growth in Maintenance and Refurbishment Sectors

With aging infrastructure and industrial equipment, the demand for surface preparation in maintenance, repair, and overhaul (MRO) is rising. The oil & gas, marine, and power generation industries will continue to rely on sand sandblasting for rust and coating removal. This sustained need supports market stability, especially in emerging economies investing in infrastructure renewal.

4. Regional Market Divergence

Growth will vary significantly by region. Asia-Pacific—led by China, India, and Southeast Asia—will dominate due to rapid industrialization and construction. North America and Europe will see moderate growth, focused on compliance-driven upgrades and niche high-precision applications. However, regulatory pressures in these regions may slow the use of traditional sand blasting unless paired with strict containment protocols.

5. Digitalization and Predictive Maintenance

Smart blasting systems with IoT sensors and data analytics will gain traction by 2026. These systems monitor abrasive consumption, equipment wear, and surface quality in real time, enabling predictive maintenance and optimizing operational efficiency. Digital twins may also be used to simulate blasting parameters, reducing trial-and-error and material waste.

6. Consolidation and Service-Oriented Business Models

Market players are expected to shift from selling only abrasives to offering integrated surface preparation solutions. Contract blasting services, equipment leasing, and full-cycle waste management will become key differentiators. Larger companies may consolidate smaller operators to enhance service reach and technological capabilities.

In summary, by 2026, the sand sandblasting market will balance legacy applications with a decisive pivot toward sustainability, automation, and digital innovation. Success will depend on adaptability to regulatory environments and the ability to deliver safer, more efficient, and environmentally responsible surface treatment solutions.

Common Pitfalls in Sourcing Sand for Sandblasting (Quality and Intellectual Property)

Sourcing sand for sandblasting applications involves more than just finding an affordable supplier. Quality inconsistencies and intellectual property (IP) concerns can lead to operational inefficiencies, safety hazards, and legal complications. Below are common pitfalls to watch for in both quality and IP aspects.

Quality-Related Pitfalls

Inconsistent Grain Size and Shape

One of the most frequent issues is inconsistent particle size and angularity. Sandblasting requires sand with specific grit characteristics to ensure effective surface preparation. Poorly graded sand—either too fine or too coarse—can lead to inadequate surface profiling or excessive substrate damage. Suppliers may provide variable batches due to lack of quality control, especially in regions with less stringent manufacturing standards.

High Levels of Silica Content and Health Risks

Many natural sands contain high levels of crystalline silica, which poses serious respiratory hazards (e.g., silicosis) when inhaled during blasting operations. Sourcing sand without verifying silica content or without considering safer alternatives (like slag or garnet) can expose workers to health risks and create compliance issues with OSHA or other regulatory bodies.

Contamination and Impurities

Impurities such as clay, salts, organic matter, or metal residues can compromise blasting efficiency and lead to surface contamination, especially in industrial applications like painting or coating. Low-quality sand often lacks proper washing and screening processes, increasing the risk of downstream defects.

Moisture Content Issues

Excess moisture in sand can clog blasting equipment, reduce efficiency, and lead to inconsistent performance. Some suppliers fail to properly dry sand before packaging, particularly in humid climates, which affects usability and storage life.

Intellectual Property and Compliance Pitfalls

Use of Proprietary Blasting Media Under Generic Labels

Some suppliers market proprietary abrasive blends (e.g., branded slag or engineered minerals) as generic “sand,” potentially infringing on trademarks or patents. Buyers may unknowingly use protected materials, exposing themselves to legal liability. It’s essential to verify the composition and origin of abrasive media and ensure it doesn’t violate existing IP rights.

Lack of Traceability and Certification

Reputable sandblasting media often comes with certification for composition, environmental safety, and performance standards (e.g., ISO 11126 for abrasives). Sourcing from vendors without proper documentation can result in non-compliance with project specifications or industry standards, particularly in regulated sectors like marine, aerospace, or infrastructure.

Counterfeit or Misrepresented Materials

In global supply chains, there are instances where lower-grade materials are falsely labeled as high-performance abrasives. For example, recycled or contaminated sand may be passed off as virgin or certified blasting sand. This misrepresentation not only affects quality but may also breach contractual or IP agreements, especially if a project specifies a particular branded abrasive.

Mitigation Strategies

- Require detailed material data sheets (MDS) and test reports from suppliers.

- Conduct independent batch testing for grain size, silica content, and moisture.

- Vet suppliers for compliance with environmental and safety regulations.

- Clarify IP rights and usage permissions when sourcing branded or patented abrasives.

- Establish long-term contracts with reliable, certified suppliers to ensure consistency.

Avoiding these pitfalls ensures safer operations, regulatory compliance, and protection against legal and financial risks associated with substandard or infringing materials.

Logistics & Compliance Guide for Sand Sandblasting

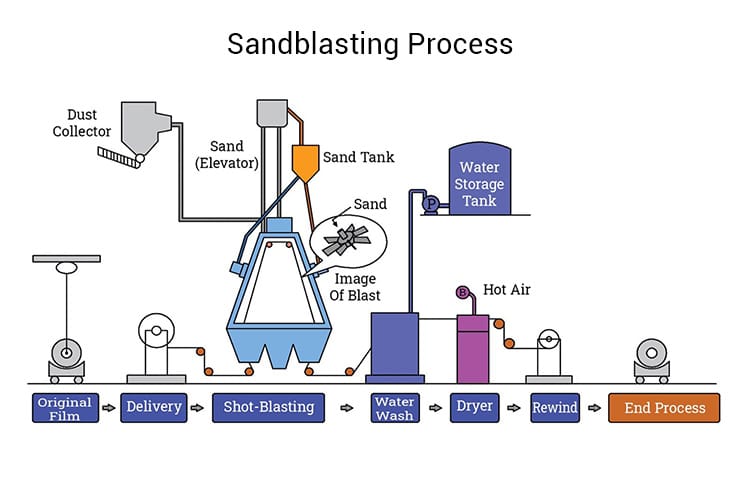

Overview of Sand Sandblasting Operations

Sand sandblasting, also known as abrasive blasting, involves propelling fine sand particles at high velocity to clean, smooth, or roughen surfaces. While effective, this process poses logistical and regulatory challenges due to the handling of abrasive materials, waste generation, and worker safety concerns. Proper logistics planning and regulatory compliance are essential to ensure operational efficiency, environmental protection, and employee well-being.

Regulatory Compliance Requirements

Environmental Regulations

Sand sandblasting operations must comply with environmental standards set by regulatory agencies such as the U.S. Environmental Protection Agency (EPA) and local environmental authorities. Key concerns include:

- Air Quality Control: Blasting releases silica dust, a known respiratory hazard. Operations must adhere to National Emission Standards for Hazardous Air Pollutants (NESHAP) and use dust collection systems or enclosures to minimize airborne particulates.

- Waste Management: Used sand (spent abrasive) may be classified as hazardous waste if contaminated with lead-based paint or other regulated substances. Proper characterization, storage, labeling, and disposal via licensed hazardous waste facilities are required under the Resource Conservation and Recovery Act (RCRA).

- Spill Prevention: Containment measures must prevent runoff of abrasive materials into storm drains or soil. Secondary containment and spill kits should be readily available.

Occupational Health and Safety Standards

The Occupational Safety and Health Administration (OSHA) regulates worker exposure and safety practices:

- Respiratory Protection: Workers must use NIOSH-approved respirators when silica exposure exceeds permissible exposure limits (PEL). A written Respiratory Protection Program is required.

- Silica Exposure Limits: OSHA’s Respirable Crystalline Silica Standard (29 CFR 1910.1053) sets a PEL of 50 µg/m³ over an 8-hour time-weighted average. Engineering controls, exposure monitoring, and medical surveillance are mandatory.

- Hearing Protection: High noise levels from blasting equipment necessitate hearing protection and routine audiometric testing.

- Personal Protective Equipment (PPE): Full-body protective suits, face shields, gloves, and safety boots must be worn to prevent injury from flying debris and chemical exposure.

Transportation and Handling Regulations

Transporting sand and spent abrasive materials must comply with Department of Transportation (DOT) and international shipping regulations:

- Hazard Classification: Spent abrasive containing hazardous contaminants must be classified, labeled, and shipped in accordance with DOT 49 CFR regulations.

- Manifesting and Documentation: Hazardous waste shipments require a Uniform Hazardous Waste Manifest, which must accompany the load and be retained for at least three years.

- Container Integrity: All materials must be stored and transported in leak-proof, UN-rated containers to prevent environmental contamination.

Logistics Planning and Best Practices

Material Procurement and Storage

- Source silica sand or alternative abrasives (e.g., garnet, steel grit) from certified suppliers who provide Safety Data Sheets (SDS).

- Store abrasive materials in dry, ventilated areas to prevent moisture absorption and caking.

- Segregate new and spent abrasives to avoid cross-contamination.

On-Site Operational Controls

- Use blast containment systems (e.g., blast rooms, cabinets, or tents) to control dust and debris.

- Implement a closed-loop recycling system where feasible to reuse abrasives and reduce waste volume.

- Conduct regular equipment maintenance to ensure blasting nozzles and dust collectors function efficiently.

Waste Management and Disposal

- Characterize waste through laboratory testing to determine hazardous status.

- Contract with licensed hazardous waste disposal facilities and maintain records of disposal.

- Explore recycling options such as abrasive reclamation or beneficial reuse in construction (where permitted).

Training and Documentation

- Train all personnel on hazard communication (HazCom), proper PPE use, emergency procedures, and waste handling.

- Maintain records of training, air monitoring, medical exams, and waste manifests for audit readiness.

- Develop a site-specific Health and Safety Plan (HASP) for compliance and incident prevention.

Conclusion

Effective logistics and compliance in sand sandblasting require adherence to environmental, safety, and transportation regulations. By implementing proper controls, training, and documentation practices, companies can mitigate risks, remain compliant, and promote a safe working environment. Regular audits and updates to procedures ensure continued alignment with evolving regulatory standards.

Conclusion for Sourcing Sand for Sandblasting:

Sourcing the appropriate sand for sandblasting is critical to achieving efficient, safe, and effective surface preparation. After evaluating available options, it is clear that not all sand is suitable for abrasive blasting—especially due to health risks associated with respirable crystalline silica, which can lead to silicosis and other respiratory diseases. As a result, many industries are shifting away from traditional silica sand toward safer, engineered abrasives such as garnet, aluminum oxide, steel grit, or recycled materials.

When sourcing sand or alternative abrasives, key considerations include blasting efficiency, reusability, environmental impact, worker safety, and regulatory compliance. While silica sand may be cheaper initially, the long-term costs related to health hazards, protective equipment, and regulatory fines often outweigh the savings. Therefore, sourcing abrasive media that aligns with safety standards—such as OSHA regulations and NIOSH recommendations—is essential.

In conclusion, the best approach to sourcing sandblasting media involves prioritizing worker health and operational efficiency by selecting a suitable, safer abrasive alternative to traditional sand. Investing in high-quality, compliant blasting materials not only ensures superior surface finishing but also promotes a safer work environment and regulatory adherence.