The global foundry equipment market, driven by increasing demand for precision casting in automotive and industrial applications, is projected to grow at a CAGR of 5.2% from 2023 to 2028, according to Mordor Intelligence. A critical component within this ecosystem is the sand compactor—a key machine used to prepare molding sand with consistent density and strength, ensuring high-quality metal castings. As foundries modernize operations to improve efficiency and reduce defects, investment in advanced sand compaction technology has surged. Fueled by rising automotive production, particularly in Asia-Pacific, and the need for automation in foundry processes, the market for sand compactors is expanding in tandem. With numerous manufacturers offering innovative solutions in compaction force, control systems, and integration capabilities, selecting the right supplier has become pivotal for operational excellence. Based on market presence, technological advancement, and customer reviews, here are the top 8 sand compactor manufacturers shaping the future of modern foundries.

Top 8 Sand Compactor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

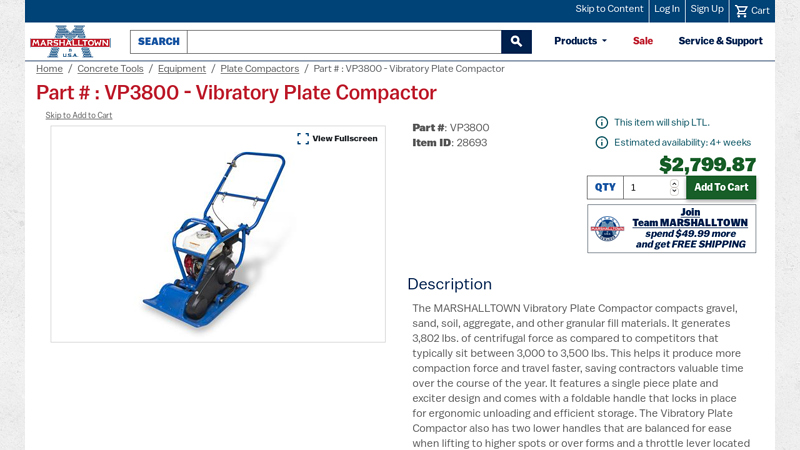

#1 Part # : VP3800

Domain Est. 1996

#2 Light Compaction (Compactors) Equipment

Domain Est. 1997

Website: bobcat.com

Key Highlights: These high-powered pounders are ideal for compacting granular materials such as sand, gravel and asphalt. View Reversible Plate Compactor Models · Trench ……

#3 Mechanical Compactors for Lab Soil Testing

Domain Est. 1999

Website: humboldtmfg.com

Key Highlights: 3-day delivery 30-day returnsMechanical compactors for soil testing and vibration compaction hammer sets are in-stock and available from….

#4 Compactors

Domain Est. 2000

Website: store.evolutionpowertools.com

Key Highlights: Free delivery · Free 45-day returns…

#5 Vibratory Plate Compactors for Soil, Asphalt

Domain Est. 2012

#6 Compaction

Domain Est. 2014

Website: bartellglobal.com

Key Highlights: Compaction is the process of using vibration to remove air from the base material. This improves the density of the base, which gives your project a solid ……

#7 All about Husqvarna compactors

Domain Est. 2019

Website: husqvarnaconstruction.com

Key Highlights: With our wide range of compactors you can handle all kinds of compaction jobs – from clay, silt and sand, gravel to rockfill and asphalt….

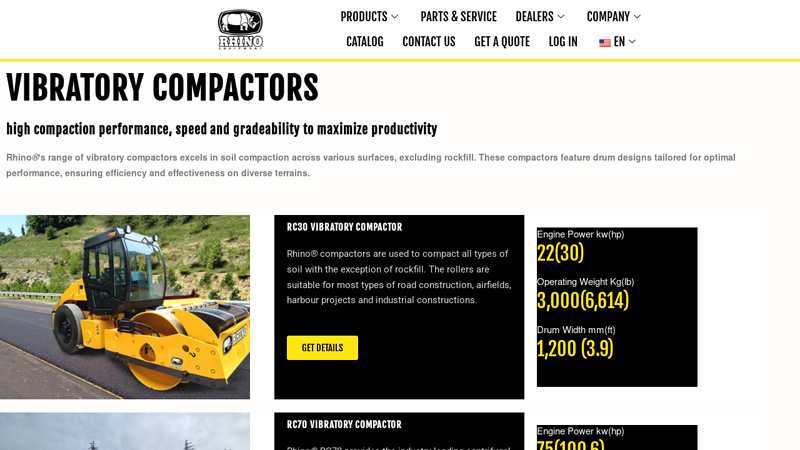

#8 Vibratory Compactors

Domain Est. 2022

Website: rhinoequipment.us

Key Highlights: Rhino®’s range of vibratory compactors excels in soil compaction across various surfaces, excluding rockfill. These compactors feature drum designs tailored ……

Expert Sourcing Insights for Sand Compactor

H2: Projected Market Trends for Sand Compactors in 2026

The global sand compactor market in 2026 is expected to experience steady growth, driven by increasing construction activity, infrastructure development, and technological advancements, albeit influenced by broader economic and sustainability trends. Key developments anticipated by the second half of 2026 include:

-

Infrastructure Boom as Primary Driver: Major government-led infrastructure projects in North America, Europe, and Asia-Pacific (especially China and India) will remain the dominant demand catalyst. Investments in highways, bridges, railways, and urban development will require significant earthwork, where efficient sand compaction is crucial for stable foundations. Public-private partnerships (PPPs) are expected to accelerate project timelines, boosting equipment utilization.

-

Sustainability and Green Construction Pressures: Environmental regulations and a growing focus on sustainable construction will increasingly influence the market. Demand will shift towards:

- Low-Emission and Electric Models: Stricter emissions standards (like Tier 5/Stage V) will push adoption of cleaner diesel engines. Small-scale electric or hybrid sand compactors, particularly for indoor or sensitive urban environments, will see niche growth, driven by zero emissions and reduced noise.

- Recycled Materials: Increased use of recycled aggregates and sand (e.g., from C&D waste) in construction may require adjustments in compaction techniques and potentially influence machine specifications or accessory needs.

-

Technology Integration and Smart Compaction: The integration of telematics, GPS, and basic IoT sensors into sand compactors will become more widespread by 2026. Key trends include:

- Remote Monitoring & Fleet Management: Real-time tracking of machine location, operating hours, fuel consumption, and basic health will optimize fleet utilization, maintenance scheduling, and reduce downtime.

- Basic Compaction Feedback: While advanced Intelligent Compaction (IC) is more common in large rollers, simpler systems providing basic feedback on pass count or vibration consistency may become more accessible on mid-range compaction equipment, improving quality control.

- Enhanced Operator Assistance: Features like automated vibration control based on speed or load and improved ergonomics will focus on boosting operator productivity and reducing fatigue.

-

Focus on Efficiency and Total Cost of Ownership (TCO): Contractors will prioritize machines offering lower operating costs (fuel efficiency, reduced maintenance) and higher uptime. This will drive demand for:

- Durable, Low-Maintenance Designs: Robust construction, simplified maintenance access, and longer service intervals.

- Fuel Efficiency: Continued optimization of engines and hydraulic systems.

- Multi-Functionality: Compactors that can handle a wider range of soil types and site conditions efficiently.

-

Regional Market Dynamics:

- Asia-Pacific: Expected to remain the largest and fastest-growing market, fueled by rapid urbanization and massive infrastructure investments in developing economies.

- North America & Europe: Steady growth driven by infrastructure renewal, repair, and smart city projects. Higher regulatory pressure for emissions and noise will be prominent here.

- Middle East & Africa: Growth linked to specific large-scale development projects (e.g., NEOM, urban expansion) and resource extraction activities.

-

Supply Chain Resilience: Lessons learned from recent disruptions will lead manufacturers to diversify supply chains and increase local/regional component sourcing where feasible, aiming for greater resilience and shorter lead times.

In summary, the 2026 sand compactor market will be characterized by steady demand from global infrastructure, a growing emphasis on sustainability and emissions reduction, the gradual adoption of connectivity and smart features to improve efficiency, and a strong focus on lowering operational costs. While revolutionary changes may be limited, incremental technological improvements and responsiveness to environmental and economic pressures will shape competitive positioning.

Common Pitfalls When Sourcing a Sand Compactor (Quality and Intellectual Property)

Sourcing a sand compactor, especially from international or low-cost manufacturers, can present several challenges related to product quality and intellectual property (IP) protection. Being aware of these pitfalls is crucial to ensuring long-term operational efficiency and safeguarding business interests.

Poor Build Quality and Material Standards

One of the most frequent issues when sourcing sand compactors is substandard build quality. Some suppliers may use inferior materials or cut corners in manufacturing to reduce costs. This can lead to premature wear, frequent breakdowns, and increased maintenance costs. Always verify material specifications, conduct factory audits, and request third-party quality inspections before shipment.

Lack of Compliance with Industry Standards

Not all sand compactors meet international safety and performance standards (e.g., CE, ISO, or ANSI). Using non-compliant equipment can pose safety risks, lead to regulatory fines, or void insurance coverage. Ensure the supplier provides certification documentation and adheres to applicable standards in your region.

Inadequate After-Sales Support and Spare Parts Availability

Many low-cost suppliers fail to offer reliable technical support, training, or spare parts. This can result in prolonged downtime when repairs are needed. Confirm the availability of spare parts, warranty terms, and whether the supplier has local service partners before finalizing a purchase.

Misrepresentation of Technical Specifications

Some suppliers exaggerate performance metrics such as compaction force, cycle time, or automation capabilities. This misrepresentation can lead to equipment that doesn’t meet production requirements. Request test reports, conduct live demonstrations, or review references from existing customers to validate claims.

Intellectual Property Infringement Risks

Sourcing from manufacturers that replicate patented designs or use unauthorized software/control systems exposes your company to IP litigation. Ensure the supplier has legitimate rights to the technology used and can provide proof of IP ownership or licensing agreements. Avoid “copycat” models that closely resemble branded machines.

Limited Customization and Scalability

Off-the-shelf sand compactors may not integrate well with existing foundry lines or meet specific production needs. Suppliers offering little to no customization can limit your operational flexibility. Choose vendors capable of tailoring machine specifications to your process requirements.

Hidden Costs and Unclear Contracts

Initial price quotes may exclude shipping, import duties, installation, or training. Ambiguous contracts can also lead to disputes over warranty, delivery timelines, or performance guarantees. Work with legal and procurement experts to draft clear, comprehensive agreements.

By addressing these pitfalls proactively—through due diligence, supplier vetting, and contractual safeguards—companies can source sand compactors that deliver reliable performance while minimizing quality and IP risks.

Logistics & Compliance Guide for Sand Compactor

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, handling, operation, and maintenance of a sand compactor. Adherence to these guidelines ensures safety, regulatory compliance, and operational efficiency.

Transportation & Handling

- Ensure the sand compactor is securely fastened during transport using straps or chains compatible with its weight and dimensions.

- Use appropriate lifting equipment (e.g., forklifts or cranes with spreader bars) when loading or unloading.

- Confirm road and site access routes can support the machine’s weight and size, especially on soft or uneven terrain.

- Remove loose parts or attachments before shipment to prevent damage or loss.

Regulatory Compliance

- Verify that the sand compactor meets local and international standards such as OSHA (Occupational Safety and Health Administration), ISO, or CE marking requirements.

- Ensure all safety guards, warning labels, and emergency stop mechanisms are in place and compliant with machine safety directives.

- Confirm noise and emissions levels align with environmental regulations in the operating region.

Operator Certification & Training

- Only trained and certified personnel should operate the sand compactor.

- Provide documented training covering startup/shutdown procedures, emergency response, and routine inspections.

- Maintain training records to demonstrate compliance during audits or inspections.

Site Safety & Operational Requirements

- Conduct a pre-operation site assessment to identify hazards such as underground utilities, overhead lines, or unstable ground.

- Establish exclusion zones during operation to protect bystanders.

- Equip the machine with functional roll-over protection (ROPS) and falling object protection (FOPS) where applicable.

- Implement lockout/tagout (LOTO) procedures during maintenance.

Maintenance & Documentation

- Follow the manufacturer’s maintenance schedule for inspections, lubrication, and parts replacement.

- Keep detailed logs of maintenance, repairs, and operational hours.

- Retain compliance documentation, including equipment certifications, inspection reports, and operator training records.

Environmental & Waste Management

- Prevent soil and sand contamination by containing lubricants and hydraulic fluids.

- Dispose of worn components (e.g., filters, seals) according to local environmental regulations.

- Minimize dust emissions during compaction using water sprays or dust control systems where required.

Import & Export Considerations (if applicable)

- Verify customs documentation, including certificates of origin, commercial invoices, and packing lists.

- Comply with import/export regulations related to machinery, such as EPA or DOT requirements.

- Confirm voltage and power compatibility if operating in a different region.

Adhering to this guide ensures safe, legal, and efficient deployment of sand compactors across various project environments.

Conclusion for Sourcing a Sand Compactor

Sourcing a sand compactor is a critical decision that directly impacts the efficiency, quality, and safety of construction or foundry operations. After evaluating key factors such as compaction method (e.g., plate, roller, or vibratory), power source (gasoline, electric, or pneumatic), compaction force, frequency, operating weight, and ease of maintenance, it is evident that selecting the right equipment requires a balance between performance requirements and operational constraints.

Additionally, considerations such as supplier reliability, after-sales service, cost-effectiveness, and compliance with safety and environmental standards play a significant role in long-term value. Opting for reputable manufacturers or suppliers with proven track records ensures durability, technical support, and availability of spare parts.

In conclusion, a well-informed sourcing decision—based on thorough need assessment, site-specific requirements, and total cost of ownership—will lead to improved productivity, reduced downtime, and optimal compaction results. Investing in the right sand compactor not only enhances project outcomes but also contributes to operational sustainability and cost efficiency over time.