The global safety cones and barriers market is experiencing robust growth, driven by increasing emphasis on workplace safety, rising infrastructure development, and stringent government regulations across construction, transportation, and industrial sectors. According to Grand View Research, the global traffic safety equipment market was valued at USD 14.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Similarly, Mordor Intelligence forecasts sustained demand for safety signaling products, attributing growth to urbanization, road safety initiatives, and the expansion of smart city projects worldwide. With the rising adoption of high-visibility, durable, and impact-resistant safety barriers and cones, manufacturers are innovating to meet evolving safety standards and environmental conditions. In this competitive landscape, nine key players have emerged as leaders, combining technological advancement, global reach, and product reliability to dominate the market.

Top 9 Safety Cones And Barriers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 to JBC Safety Plastic

Domain Est. 2017

Website: jbcsafetyplastic.com

Key Highlights: JBC Safety Plastic, Inc. is a leading manufacturer of premium traffic control and highway safety products….

#2 Traffic Cones and Delineator Posts

Domain Est. 1997

Website: emedco.com

Key Highlights: 1–7 day deliveryShop high-visibility traffic cones and delineator posts. Available in various sizes, colors, and custom options for maximum control….

#3 Cones And Barriers

Domain Est. 1998

Website: tallmanequipment.com

Key Highlights: Cones and Barriers · Florida DOT Traffic Cone 36 IN · 28″ Traffic Cone · Collapsible Traffic Cone, 2 Pack · Safety Cone Hanger · Traffic Cone Adapter · Retractable ……

#4 Safety Cones

Domain Est. 1998

Website: acpinternational.com

Key Highlights: ACP’s safety and traffic cones are 100% PVC injection molded, stack well, and have specially designed cleated bases that grip the road….

#5 Traffic Cones (TC)

Domain Est. 1998

Website: vestil.com

Key Highlights: These durable all weather cones are constructed from 100% PVC for long life. Their construction prohibits fading, cracking. Will retain its shape for years ……

#6 Cortina Safety Products

Domain Est. 1999

Website: cortinaco.com

Key Highlights: Cortina Safety Products Group (CSPG) offers the most dependable safety products manufactured for today’s demanding needs….

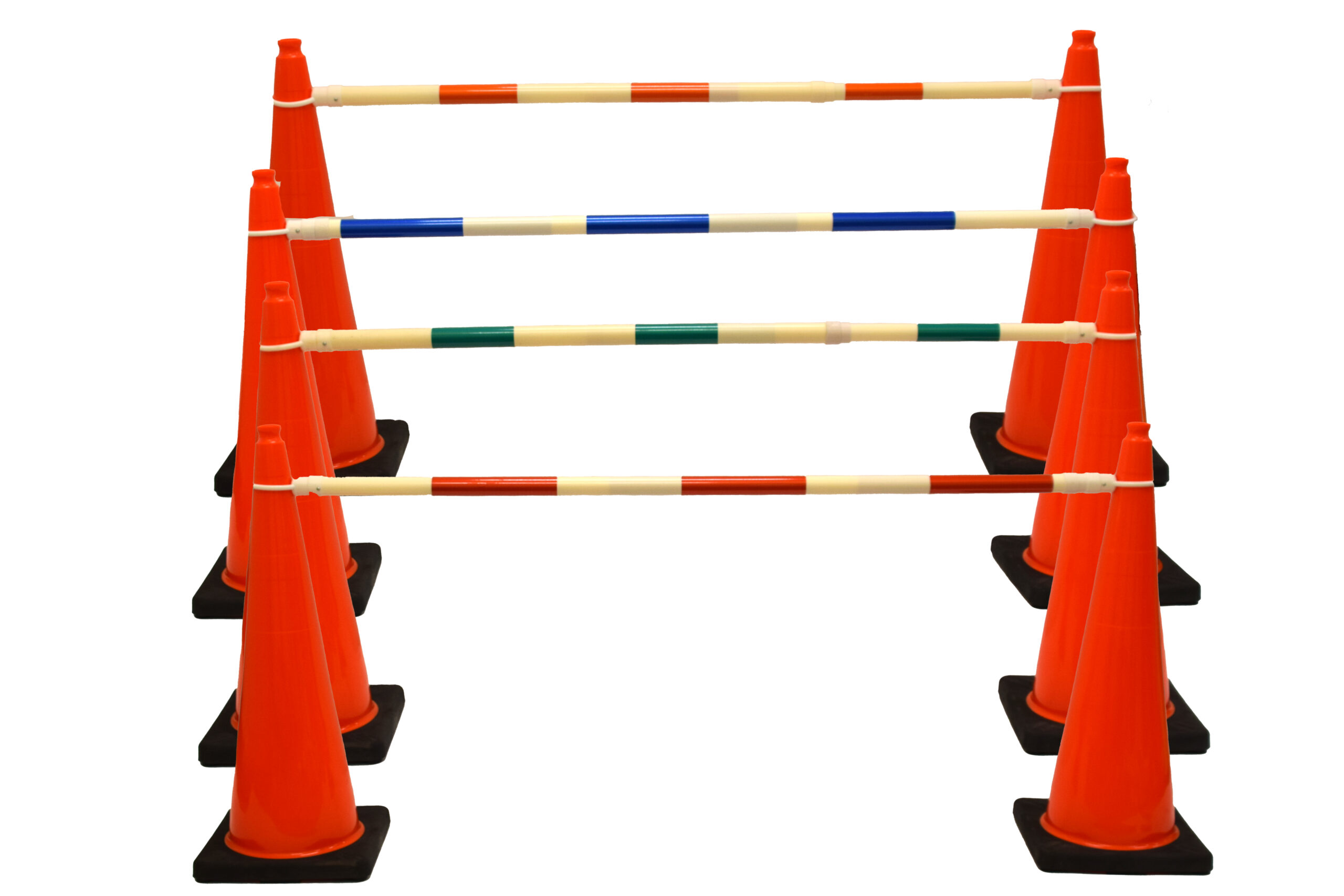

#7 Cone Bars

Domain Est. 2002

#8 RoadSafe Traffic Systems

Domain Est. 2006

Website: roadsafetraffic.com

Key Highlights: RoadSafe Traffic Systems offers work zone safety and traffic control services like flaggers, barriers and glare screen rentals….

#9 Traffic Safety Barriers

Domain Est. 2014

Website: crowdcontrolcompany.com

Key Highlights: Free deliveryEasily set up effective and durable barriers to guide and divert traffic. Whether it’s the classic Traffic Cone or the innovative Cone Top Belt Barrier….

Expert Sourcing Insights for Safety Cones And Barriers

2026 Market Trends for Safety Cones and Barriers: Navigating Growth, Innovation, and Regulation

The global market for safety cones and barriers is poised for significant evolution by 2026, driven by heightened safety awareness, urbanization, technological advancements, and stringent regulations. This analysis explores the key trends shaping the industry landscape over the next few years.

Rising Demand Across Key Sectors

The primary driver for the safety cones and barriers market remains robust growth in construction and infrastructure development globally. Major government initiatives for road expansion, urban renewal, and smart city projects (particularly in Asia-Pacific, North America, and Europe) will necessitate extensive temporary traffic control, directly boosting demand for high-visibility cones and modular barriers. Simultaneously, the booming events and entertainment sector, alongside increasing focus on crowd management in public spaces, will expand the need for specialized crowd control barriers and pedestrian safety solutions. The logistics and warehousing industry’s growth, fueled by e-commerce, also increases demand for interior safety cones and barriers for forklift pathways and hazardous area demarcation.

Technological Integration and Smart Solutions

A defining trend by 2026 will be the integration of technology into passive safety equipment. “Smart” safety cones and barriers equipped with IoT sensors, GPS tracking, and LED lighting are moving from niche to mainstream. These innovations enable real-time monitoring of work zone activity, asset tracking to prevent theft and loss, automated alerts for displacement or impact, and enhanced visibility through programmable lighting patterns (e.g., flashing warnings, directional arrows). While cost remains a barrier, the demonstrable ROI in improved safety, reduced liability, and operational efficiency will drive wider adoption, especially by large contractors and government agencies.

Sustainability and Eco-Friendly Materials

Environmental regulations and corporate sustainability goals are pushing manufacturers towards greener solutions. By 2026, expect increased demand for cones and barriers made from recycled plastics (especially post-consumer content), bio-based polymers, and materials designed for easier recycling at end-of-life. Lightweight designs, reducing material use and transportation emissions, will also gain favor. Reusable and highly durable barrier systems will be preferred over single-use options, aligning with circular economy principles. Transparency in the supply chain regarding material sourcing and recyclability will become a competitive advantage.

Regulatory Stringency and Standardization

Safety standards (like MUTCD in the US, EN standards in Europe, and similar regulations globally) will continue to evolve, mandating higher performance criteria for visibility (day and night), durability, and stability. Compliance will be non-negotiable. Regulations concerning worker safety (OSHA, etc.) and public safety in dynamic environments will drive the need for more sophisticated and reliable temporary barriers, particularly impact-absorbing systems for high-risk zones. Harmonization of standards across regions could simplify international trade but may also raise the bar for global manufacturers.

Material and Design Innovation

Beyond sustainability, material science will focus on enhancing performance. Development of more resilient, weather-resistant, and UV-stable polymers will extend product lifespan, especially in harsh environments. Innovations in design will prioritize ease of deployment, transport (e.g., nesting cones, collapsible barriers), stability in high winds, and improved interlock mechanisms for modular systems. High-visibility color schemes, enhanced reflective sheeting (wider angles, longer range), and integrated base weights will be standard features.

Market Consolidation and Competitive Landscape

The market is expected to see continued consolidation, with larger players acquiring niche innovators, particularly those specializing in smart technology or sustainable materials. Competition will intensify, focusing on value-added services like fleet management software for smart assets, comprehensive safety consulting, and bundling solutions. Price pressure in the commoditized segment (standard plastic cones) will persist, pushing manufacturers towards differentiation through innovation, durability, and service.

Geographic Shifts

While North America and Europe remain large markets due to mature infrastructure and strict regulations, the fastest growth is anticipated in the Asia-Pacific region, driven by massive infrastructure investments in countries like China and India. Latin America and the Middle East & Africa also present significant growth opportunities linked to urbanization and development projects, though economic volatility can be a factor.

In conclusion, the 2026 safety cones and barriers market will be characterized by a shift from basic passive devices towards intelligent, sustainable, and high-performance solutions. Success will belong to companies that embrace technological integration, prioritize environmental responsibility, ensure strict regulatory compliance, and offer innovative designs that enhance safety and operational efficiency across diverse applications.

Common Pitfalls When Sourcing Safety Cones and Barriers

Sourcing safety cones and barriers is a critical task for organizations focused on worksite safety, traffic control, and public protection. However, buyers often encounter several pitfalls—particularly related to quality and intellectual property (IP)—that can compromise safety, lead to legal issues, or increase long-term costs. Being aware of these challenges helps ensure the procurement of reliable, compliant, and legally sound products.

Poor Material Quality and Durability

One of the most common issues is selecting safety cones and barriers made from substandard materials. Low-quality PVC or recycled plastics may degrade quickly when exposed to UV light, extreme temperatures, or heavy impacts. This reduces visibility and structural integrity, increasing the risk of accidents. Buyers should verify material specifications and demand third-party test reports for UV resistance, flexibility, and impact strength.

Inadequate Reflectivity and Visibility

Many budget-friendly cones fail to meet required visibility standards due to poor or non-compliant reflective sheeting. Inferior retroreflective materials fade or delaminate quickly, especially outdoors. Ensure that products meet recognized standards such as MUTCD (Manual on Uniform Traffic Control Devices) or EN 13422, and request samples for real-world visibility testing.

Non-Compliance with Safety Standards

Safety cones and barriers must comply with regional or industry-specific regulations. Sourcing from suppliers who do not adhere to standards like OSHA, ANSI, or ISO can lead to non-compliant installations, fines, or liability in the event of an accident. Always confirm certifications and ask for documentation proving compliance.

Counterfeit or IP-Infringing Products

A growing concern in global sourcing is the risk of purchasing counterfeit safety equipment that mimics branded designs. Some manufacturers copy patented shapes, bases, or reflective patterns, exposing buyers to intellectual property (IP) infringement claims. Using such products—even unknowingly—can result in legal action, supply chain disruptions, or reputational damage.

Lack of Supplier Verification

Working with unverified suppliers, especially in international markets, increases the risk of receiving off-spec or counterfeit goods. Without proper due diligence, buyers may face misleading product claims or inconsistent quality across shipments. Conduct supplier audits, request references, and use third-party inspection services when sourcing in bulk.

Hidden Costs from Short Product Lifespan

While low-cost cones may appear economical upfront, their shorter lifespan due to cracking, fading, or instability leads to frequent replacements. This increases total cost of ownership and operational downtime. Investing in higher-quality, durable products often provides better long-term value.

Insufficient Customization and Branding Protection

When custom branding or logos are required, unclear IP agreements with suppliers can lead to unauthorized use or reproduction of your designs. Ensure contracts specify that your branding materials are your intellectual property and restrict the supplier from using them for other clients.

Conclusion

To avoid these pitfalls, prioritize suppliers with proven quality management systems, clear compliance documentation, and transparent IP policies. Conduct thorough due diligence and product testing before committing to large orders. By focusing on quality and legal compliance, organizations can ensure their safety equipment performs reliably and avoids unnecessary risks.

Logistics & Compliance Guide for Safety Cones and Barriers

Overview

Safety cones and barriers are essential traffic control and hazard management tools used across construction, roadwork, event management, and industrial environments. Proper logistics and compliance ensure these devices are effective, safe, and legally compliant. This guide outlines key considerations for the transportation, storage, use, and regulatory adherence related to safety cones and barriers.

Regulatory Compliance Standards

Safety cones and barriers must comply with national and international safety standards to ensure visibility, durability, and performance. Key regulations include:

-

U.S. – MUTCD (Manual on Uniform Traffic Control Devices):

Specifies requirements for size, color, retroreflectivity, and placement of traffic control devices. Cones must be orange and at least 28 inches tall for most roadway applications. -

Europe – EN 13422 (Road Traffic Calming Devices):

Covers design, performance, and testing requirements for temporary traffic control devices, including cones and barriers. -

OSHA (Occupational Safety and Health Administration):

Requires clear demarcation of hazardous areas in workplaces using visible barriers or cones, especially in construction and industrial settings. -

ANSI/ISEA 107 (High-Visibility Safety Apparel and Accessories):

While primarily for clothing, it influences retroreflective tape standards used on barriers for low-light visibility.

Ensure all equipment meets applicable standards for your region and application.

Transportation & Logistics

Efficient and safe transportation of safety cones and barriers is critical to prevent damage and ensure readiness.

-

Packaging & Stacking:

Use stackable cones or barrier-specific transport racks to minimize space and prevent deformation. Nest cones when possible to reduce volume. -

Vehicle Requirements:

Transport in enclosed trailers or covered trucks to protect from weather and debris. Secure loads with straps or nets to prevent shifting during transit. -

Load Planning:

Group cones and barriers by size, weight, and application to streamline deployment. Maintain an inventory log to track equipment movement. -

Handling Procedures:

Train staff in proper lifting techniques and use material handling aids (e.g., dollies) for heavy or stacked barriers to prevent injury.

Storage Guidelines

Proper storage extends product lifespan and ensures equipment is ready for immediate use.

-

Environment:

Store indoors or under cover to prevent UV degradation, fading, and cracking from prolonged sun exposure. -

Organization:

Keep cones nested and barriers stacked flat. Avoid placing heavy objects on top to prevent warping or damage. -

Inspection & Maintenance:

Conduct regular checks for cracks, fading, missing retroreflective strips, or base damage. Repair or replace non-compliant units promptly.

Deployment & Usage Best Practices

Correct deployment ensures maximum visibility and compliance with safety regulations.

-

Placement:

Position cones and barriers according to MUTCD or local guidelines—typically in advance of hazards, with adequate spacing (e.g., 10–20 feet apart depending on speed zone). -

Stability:

Use weighted bases or sandbags in windy areas to prevent tipping. Avoid placing on uneven or sloped surfaces without stabilization. -

Visibility:

Use reflective collars, chevron markings, or lighted barriers in low-light or nighttime operations. -

Temporary Use Only:

Safety cones and barriers are not substitutes for permanent traffic control. Remove when work is complete to avoid public confusion.

Inspection & Compliance Audits

Regular audits help maintain compliance and identify deteriorating equipment.

-

Frequency:

Inspect before and after each use; conduct formal audits quarterly. -

Checklist Items:

- Color brightness and retroreflectivity

- Structural integrity (no cracks, warping)

- Correct size and type for application

-

Compliance with site-specific safety plans

-

Documentation:

Maintain logs of inspections, repairs, replacements, and compliance certifications.

Environmental & Sustainability Considerations

-

Recycling:

Many plastic cones and barriers can be recycled at end-of-life. Partner with vendors offering take-back programs. -

Durability:

Invest in high-quality, UV-resistant materials to reduce replacement frequency and environmental impact. -

Eco-Friendly Options:

Explore barriers made from recycled content or biodegradable materials where performance allows.

Training & Worker Responsibility

All personnel deploying safety cones and barriers should be trained in:

- Relevant safety standards and site-specific requirements

- Proper handling, placement, and retrieval

- Reporting damaged or missing equipment

- Emergency procedures for dislodged or misplaced barriers

Conclusion

Effective logistics and compliance for safety cones and barriers involve a combination of regulatory knowledge, proper handling, regular maintenance, and worker training. Adhering to this guide ensures operational safety, legal compliance, and cost-efficiency in managing traffic control equipment.

In conclusion, sourcing safety cones and barriers requires careful consideration of quality, durability, visibility, compliance with safety standards, and cost-effectiveness. Selecting reliable suppliers who provide products that meet regulatory requirements—such as those set by OSHA, MUTCD, or local authorities—ensures the effectiveness of traffic control and enhances overall worksite safety. Additionally, evaluating customization options, scalability, and delivery timelines contributes to efficient project management and long-term operational success. By prioritizing these factors, organizations can secure dependable safety equipment that not only protects workers and the public but also supports compliance and operational efficiency across various environments.