The global sachet packaging market is experiencing robust growth, driven by rising demand for portion-controlled, cost-effective, and portable packaging solutions across industries such as personal care, food & beverages, pharmaceuticals, and household products. According to Mordor Intelligence, the global sachet packaging market was valued at USD 15.2 billion in 2022 and is projected to grow at a CAGR of 5.8% from 2023 to 2028. This expansion is fueled by increasing urbanization, changing consumer lifestyles, and the proliferation of single-use packaging in emerging markets. Additionally, Grand View Research highlights that the shift toward sustainable packaging innovations and advancements in multilayer film technologies are further accelerating market evolution. As brands prioritize affordability and accessibility—especially in price-sensitive regions—the role of reliable sachet packet manufacturers has become more critical than ever. In this rapidly expanding landscape, identifying top-tier manufacturers with strong production capabilities, compliance standards, and innovation in materials is key to supply chain success.

Top 10 Sachet Packet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

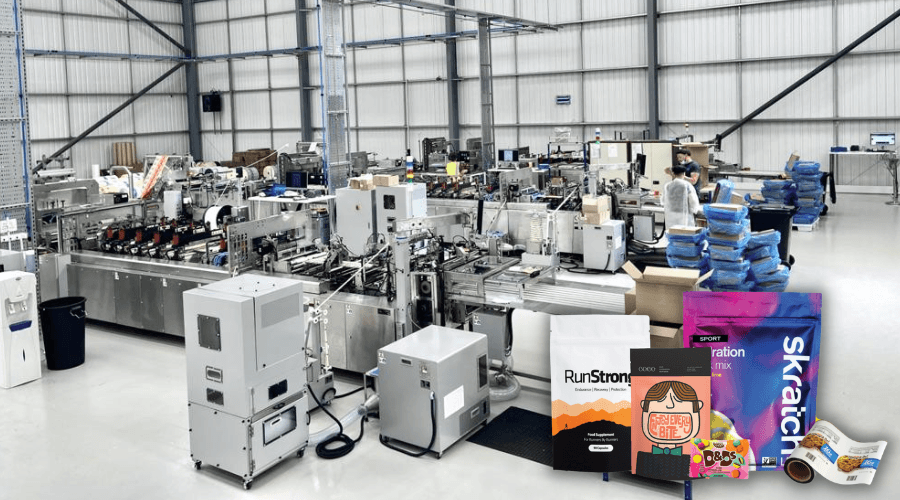

#1 Sachet Factory

Domain Est. 2023

Website: sachetfactory.com

Key Highlights: Sachet Factory is a UK-based stick-pack manufacturer specialising in turn-key solutions for formulation, blending & filling for supplement and beauty ……

#2 Cheer Pack North America

Domain Est. 1999

Website: cheerpack.com

Key Highlights: Cheer Pack North America (Cheer Pack NA) is the leading manufacturer of spouted flexible pouch and cap packaging in North America….

#3 Universal Pack. Packaging Technologies for Sachets & Stick

Domain Est. 2003

Website: universalpack.it

Key Highlights: Universal Pack is a REAL manufacturer, producing in-house over 90% of machine components. Our reliable machines for primary and secondary packaging are all ……

#4 V Shapes: Innovative Single

Domain Est. 2017

Website: v-shapes.com

Key Highlights: Discover V-Shapes’ patented single-portion packaging technology. Get eco-friendly, one-hand opening sachets & Alpha Prime filling machines for Food, ……

#5 Glenroy Flexible Packaging

Domain Est. 1996

Website: glenroy.com

Key Highlights: Glenroy excels in sustainable flexible packaging, offering custom laminations and stand-up pouches for leading brands in various industries….

#6 Stick pack vs. sachet pack flexible packaging

Domain Est. 1996

Website: taylor.com

Key Highlights: Stick packs and sachet packs are two forms of flexible packaging that are ideal for single-serve, on-the-go use of consumer packaged goods….

#7 Pouch and Sachet Materials

Domain Est. 1997

Website: graphicpkg.com

Key Highlights: We offer a comprehensive range of optimized materials for sachets, pouches, and flow wrapping using combinations of plastic films and paper-based materials….

#8 Custom Sachet Packaging for Liquids, Foods & Powders

Domain Est. 2018

Website: epacflexibles.com

Key Highlights: Our custom sachets are digitally printed using high-quality rollstock films, giving your brand a premium look and feel with best-in-class performance….

#9 Pouch Packaging Solutions & Cartoning Systems

Domain Est. 2020

Website: barteltpackaging.com

Key Highlights: Bartelt Packaging delivers best-in-class solutions for pouching and cartoning systems, serving the food, beverage, candy and confectionery, household……

#10 Custom Liquid Sachet Manufacturing

Domain Est. 2022

Website: nufacturing.com

Key Highlights: Revolutionize your brand with our liquid sachet manufacturing at Nufacturing. We specialize in innovative, practical solutions, crafting tailored sachets ……

Expert Sourcing Insights for Sachet Packet

2026 Market Trends for Sachet Packets

Economic Accessibility Drives Expansion in Emerging Markets

By 2026, sachet packets will continue to thrive in emerging economies due to their low-cost, single-use format. With inflationary pressures and income inequality persisting in regions like Southeast Asia, Africa, and Latin America, consumers will increasingly rely on affordable product access. Brands will expand sachet distribution for essentials such as personal care (shampoo, toothpaste), food condiments, and household cleaners, targeting price-sensitive demographics. This trend will incentivize multinational companies to localize production and packaging to reduce costs and improve shelf availability.

Sustainability Pressures Accelerate Eco-Friendly Packaging Innovation

Environmental concerns will intensify regulatory and consumer scrutiny on plastic sachets, known for contributing to non-recyclable waste. In response, 2026 will see accelerated adoption of biodegradable films, water-soluble materials, and post-consumer recycled (PCR) content in sachet manufacturing. Governments may enforce extended producer responsibility (EPR) schemes, pushing brands to invest in take-back programs and alternative delivery systems like refill stations. Innovations such as compostable laminate films and plant-based polymers will gain traction, particularly in environmentally conscious urban markets.

Premiumization and Niche Product Segmentation Rise

While traditionally associated with economy products, the sachet format will experience premiumization by 2026. Consumers will demand convenience and trial-size options for high-end skincare, gourmet foods, and dietary supplements. Travel-friendly, hygienic single servings will appeal to urban professionals and tourists. Brands will leverage sachets for product sampling and limited-edition launches, enhancing marketing agility. This shift will broaden the sachet’s appeal beyond low-income segments into the middle and upper classes.

E-Commerce Integration Fuels Multipack and Subscription Models

The growth of digital retail will reshape sachet consumption, with online platforms enabling bulk sachet packs and subscription services. By 2026, consumers will increasingly purchase curated sachet bundles—such as weekly skincare regimens or coffee sampler packs—through e-commerce channels. This shift will drive demand for durable, lightweight, and stackable sachet designs optimized for shipping. Data collected from online sales will allow brands to personalize offerings and improve inventory forecasting.

Regulatory Scrutiny and Standardization Increase

As sachet use grows, governments and regional bodies will implement stricter labeling, material safety, and waste management regulations. By 2026, markets like the EU and India are expected to enforce clearer disposal instructions and ban certain non-recyclable plastics used in sachets. Industry-wide standards for sustainable sachet design and recyclability will emerge, encouraging collaboration among manufacturers, brands, and waste processors to create a more circular packaging ecosystem.

Common Pitfalls When Sourcing Sachet Packets (Quality, IP)

Sourcing sachet packets—especially for products like food, pharmaceuticals, cosmetics, or consumer goods—can be deceptively complex. While they offer cost-effective packaging and portion control, businesses often encounter critical pitfalls related to quality and intellectual property (IP). Recognizing these early can prevent costly recalls, legal disputes, and reputational damage.

Quality-Related Pitfalls

1. Inconsistent Material Quality

Sachet films often use multi-layer laminates (e.g., PET/AL/PE), and substandard materials can compromise barrier properties. Poor-quality films may lead to leaks, oxidation, moisture ingress, or shortened shelf life. Suppliers may cut costs by using inferior resins or thinner layers, which aren’t always visible during inspection.

2. Poor Sealing Integrity

Weak or inconsistent heat seals are a frequent issue. This can result in product leakage, contamination, or tampering. Variability in sealing parameters (temperature, pressure, dwell time) across production batches often stems from poorly maintained machinery or inadequate process controls at the supplier’s facility.

3. Lack of Regulatory Compliance

Sachets used for food or medical products must comply with regional regulations (e.g., FDA, EU food contact materials, ISO standards). Sourcing from non-compliant suppliers can lead to failed audits, import bans, or product recalls. Ensure suppliers provide valid compliance documentation (e.g., FDA 21 CFR, EU 10/2011, or equivalent).

4. Inadequate Barrier Properties

For sensitive products (e.g., vitamins, coffee, or active ingredients), sachets must protect against oxygen, light, and moisture. Some suppliers use films with insufficient barrier performance to reduce costs, which accelerates product degradation. Always request barrier test data (e.g., MVTR, OTR) under real-world conditions.

5. Poor Print Quality and Legibility

Faded, misaligned, or smudged printing can affect brand image and regulatory compliance (e.g., illegible expiry dates or ingredients). Ink adhesion issues may also occur if non-food-grade or incompatible inks are used, especially on non-polar film surfaces.

Intellectual Property (IP)-Related Pitfalls

1. Unauthorized Use of Design or Branding

Suppliers may reuse custom-designed sachet artwork or molds for other clients unless explicitly prohibited. This risks brand dilution and potential IP infringement. Ensure your design is protected and include clear IP ownership clauses in the contract.

2. Lack of Design Protection

Unique sachet shapes, tear notches, or dispensing features may be patentable. If you develop a novel design, failing to file for design patents or utility models before sharing with suppliers can forfeit IP rights, especially in jurisdictions with “first-to-file” systems.

3. Reverse Engineering by Suppliers

Some packaging suppliers may reverse engineer your sachet design to offer similar products to competitors. This is particularly common in regions with weak IP enforcement. Use non-disclosure agreements (NDAs) and limit access to technical specifications.

4. Trademark Infringement on Packaging

Using branded logos, taglines, or distinctive color schemes without proper trademark clearance can lead to legal action. Even if your supplier prints them, you (as the brand owner) remain liable. Conduct a trademark search before finalizing artwork.

5. Unclear Ownership of Tooling and Molds

Custom dies, cutting tools, or printing plates used for your sachets are often paid for by the buyer but retained by the supplier. Without a clear agreement, you may lose control or be charged repeatedly for replacements. Specify in writing that tooling is your property and request return or secure storage.

Best Practices to Avoid Pitfalls

- Conduct on-site audits of packaging suppliers.

- Require material certifications and third-party test reports.

- Use legally binding contracts with explicit IP and quality clauses.

- Register designs and trademarks in relevant markets.

- Perform pre-shipment inspections and batch testing.

By proactively addressing these quality and IP risks, businesses can ensure reliable, compliant, and legally protected sachet packaging that supports brand integrity and customer safety.

Logistics & Compliance Guide for Sachet Packets

Overview

Sachet packets are small, sealed packages commonly used for single-use portions of liquids, powders, or semi-solids. They are widely used in industries such as food & beverage, pharmaceuticals, cosmetics, and household products. Due to their size and material composition, specific logistics and compliance considerations must be addressed to ensure product safety, regulatory adherence, and efficient distribution.

Packaging & Material Standards

Sachets must be constructed from materials that are appropriate for the product’s chemical nature and intended use. Common materials include laminated plastic films, aluminum foil, and biodegradable polymers. Packaging must meet relevant standards such as:

– ISO 22715 (Cosmetics – Packaging and labeling)

– FDA 21 CFR (for food and drug contact materials in the U.S.)

– EU Regulation (EC) No 1935/2004 (Materials and articles intended to come into contact with food)

Ensure the sachet material provides adequate barrier protection against moisture, oxygen, and light when required.

Labeling Requirements

Accurate and compliant labeling is critical. Required elements may include:

– Product name and description

– Net weight or volume

– Ingredient list (including allergens, if applicable)

– Manufacturer or distributor name and address

– Batch number and expiration date

– Usage instructions and safety warnings

– Country of origin

– Regulatory compliance marks (e.g., CE, FDA, FSSAI)

Labels must be legible, durable, and permanently affixed to the sachet or its outer packaging.

Regulatory Compliance

Sachet products are subject to sector-specific regulations depending on the product type:

– Food & Beverage: Comply with local food safety authorities (e.g., FDA, EFSA, FSSAI) including labeling, hygiene, and ingredient standards.

– Pharmaceuticals: Must adhere to Good Manufacturing Practices (GMP), require registration, and often need approval from health authorities (e.g., FDA, EMA).

– Cosmetics: Follow regulations such as the EU Cosmetics Regulation (EC) No 1223/2009, including safety assessments and ingredient disclosure.

– Household Chemicals: May require classification under GHS (Globally Harmonized System) for hazard communication.

Storage & Handling

Sachets should be stored in a clean, dry, temperature-controlled environment to prevent degradation. Avoid exposure to:

– Direct sunlight

– Excessive heat or cold

– High humidity

Stacking should follow manufacturer guidelines to prevent damage. Use first-in, first-out (FIFO) inventory practices to manage shelf life.

Transportation Logistics

- Use secure, tamper-evident outer packaging (e.g., corrugated boxes with void fill) to protect sachets during transit.

- Ensure compatibility with transportation modes (road, air, sea) and comply with IATA, IMDG, or ADR regulations if transporting hazardous materials.

- Monitor temperature and humidity during shipment if the product is sensitive.

- Include proper shipping labels, hazard symbols (if applicable), and documentation (e.g., MSDS, certificates of compliance).

Environmental & Sustainability Considerations

Many regions are restricting single-use plastics. Consider:

– Using recyclable or compostable materials where feasible.

– Complying with Extended Producer Responsibility (EPR) schemes.

– Providing end-of-life disposal instructions on packaging.

– Monitoring evolving regulations such as the EU Single-Use Plastics Directive.

Import/Export Compliance

When shipping internationally:

– Verify customs classifications (HS codes) for sachet products.

– Ensure compliance with import regulations in the destination country (e.g., labeling in local language, product registration).

– Prepare required documentation: commercial invoice, packing list, certificates of origin, and regulatory approvals.

– Be aware of restrictions on certain ingredients or packaging materials.

Quality Control & Traceability

Implement quality assurance processes including:

– Batch testing for integrity, seal strength, and content accuracy.

– Use of batch/lot numbers for full traceability.

– Documentation of manufacturing and testing records (minimum 3–5 years, depending on jurisdiction).

– Recall preparedness plan in case of non-compliance or contamination.

Disposal & End-of-Life

Educate consumers on proper disposal methods. If sachets contain hazardous substances, provide specific disposal instructions in accordance with local waste regulations.

Conclusion

Successfully managing the logistics and compliance of sachet packets requires attention to material selection, regulatory frameworks, labeling, transportation, and sustainability. Staying updated on regional and international regulations ensures market access and protects brand reputation.

Conclusion for Sourcing Sachet Packets:

Sourcing sachet packets presents a cost-effective, scalable, and convenient packaging solution for a wide range of products, including food, beverages, personal care, and pharmaceuticals. The lightweight nature, portion control benefits, and extended shelf life make sachets highly appealing to both manufacturers and consumers. Successful sourcing involves careful consideration of material quality, supplier reliability, regulatory compliance, and environmental sustainability. By partnering with reputable suppliers, conducting thorough due diligence, and aligning with market demands and eco-friendly practices, businesses can optimize their sachet packaging strategy to enhance product accessibility, reduce waste, and improve overall competitiveness in the market. Ultimately, effective sourcing of sachet packets supports operational efficiency and brand growth in an increasingly dynamic and environmentally conscious marketplace.