The global rubber pipes market is experiencing steady expansion, driven by increasing demand across industries such as automotive, construction, oil & gas, and water management. According to a report by Mordor Intelligence, the global rubber hoses market was valued at USD 9.87 billion in 2023 and is projected to grow at a CAGR of over 4.5% from 2024 to 2029. This growth is fueled by rising infrastructure development, the need for durable fluid transfer solutions, and advancements in elastomer technology enhancing performance under extreme conditions. As industrialization accelerates in emerging economies and regulatory standards emphasize safety and efficiency, the demand for high-quality rubber piping systems continues to rise. In this evolving landscape, a select group of manufacturers have emerged as leaders, combining innovation, global reach, and product reliability to capture significant market share. Based on production capacity, technological expertise, and industry reputation, the following are the top 10 rubber pipes manufacturers shaping the future of fluid transfer solutions worldwide.

Top 10 Rubber Pipes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Crushproof Rubber Industrial Hoses and Custom Tubing …

Domain Est. 1997

Website: crushproof.com

Key Highlights: Crushproof Tubing provides high quality custom industrial rubber hoses, custom rubber tubing, industrial rubber bellows for every industry….

#2 Salem

Domain Est. 1997

Website: salem-republic.com

Key Highlights: World leader in large-bore industrial hose and calendered rubber products. Proudly Made in the USA1-877-425-5079….

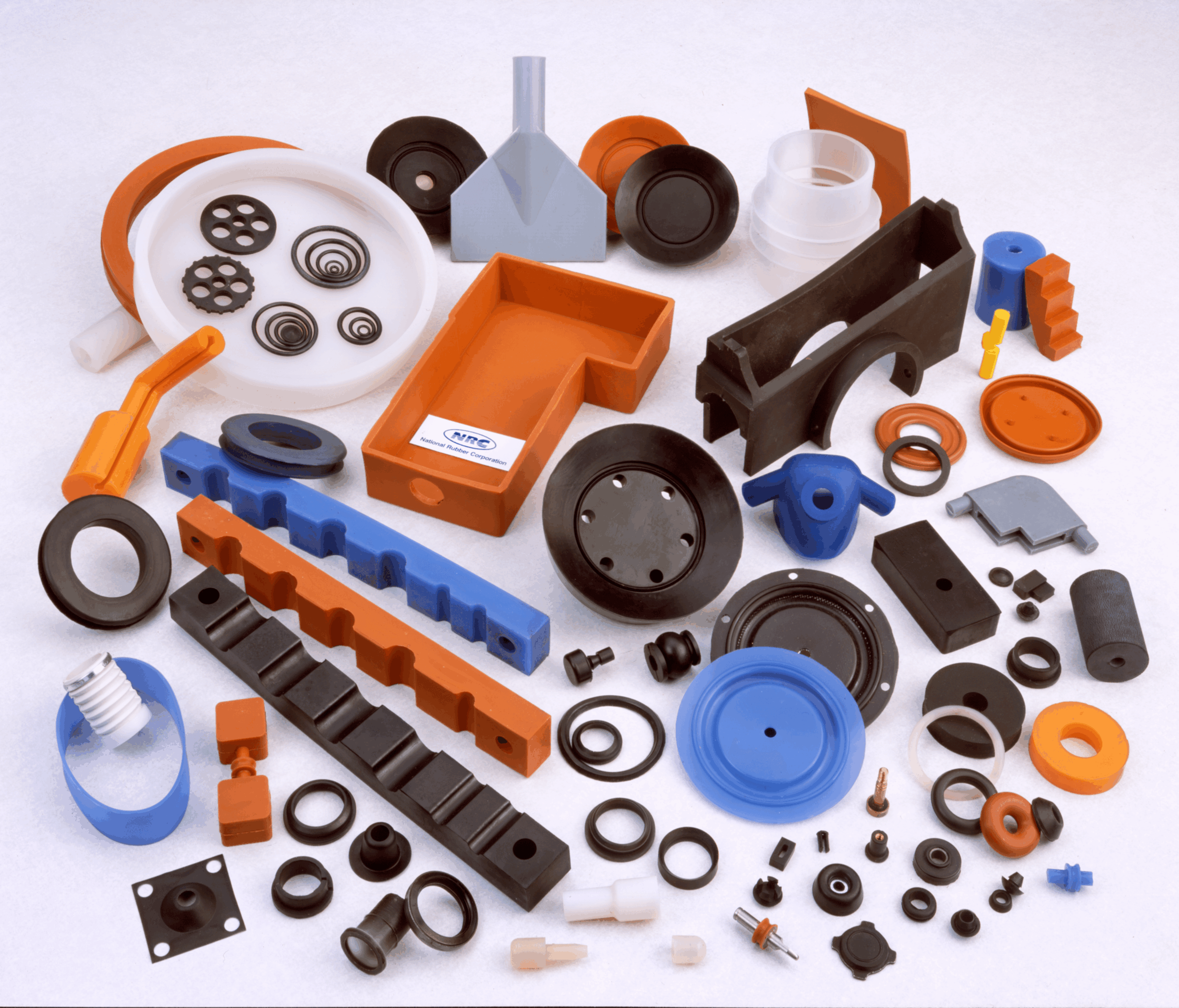

#3 National Rubber Corporation

Domain Est. 1998

Website: nationalrubber.com

Key Highlights: Leading manufacturer of custom rubber products, gaskets, seals, and molded components for aerospace, automotive, appliance, and chemical processing ……

#4 Southern Rubber

Domain Est. 1998

Website: southernrubber.com

Key Highlights: Southern Rubber is a distributor and fabricator of industrial rubber goods, but we are not limited to providing only these products. Learn about our full range ……

#5 The Rubber Company

Domain Est. 2013

Website: therubbercompany.com

Key Highlights: The Rubber Company are the leading manufacturer and supplier of rubber mouldings, extrusions, grass mats, fenders, gaskets, and seals….

#6 Thor Hoses

Domain Est. 2019

Website: thorhoses.com

Key Highlights: Design and production of high-quality rubber hoses for a wide variety of industrial applications, with standard and custom-made solutions….

#7 Mercer Rubber Company

Domain Est. 1996

Website: mercer-rubber.com

Key Highlights: Flanged Rubber Pipe. Flanged Rubber Pipes are engineered with superior materials and strict quality standards, ensuring outstanding performance and durability….

#8 ATCO Rubber Products

Domain Est. 1996

Website: atcoflex.com

Key Highlights: ATCO Rubber Products is the worldwide leader in flex duct systems. With a complete line for residential and light-commercial heating, ventilation and AC….

#9 Rubber Hoses

Domain Est. 1996

Website: trelleborg.com

Key Highlights: Hose construction gives excellent bending radius. · Good resistance to abrasion and chemicals. · Can be fitted with many types of couplings….

#10 Rubber Fab

Domain Est. 1997

Website: rubberfab.com

Key Highlights: Rubber Fab is an industry leader in sanitary seals and hoses for the Pharmaceutical, Food and Beverage, Brewing, Cannabis and Dairy Processing Industries….

Expert Sourcing Insights for Rubber Pipes

H2: 2026 Market Trends for Rubber Pipes

As the global industrial and infrastructure sectors evolve, the rubber pipes market is poised for significant transformation by 2026. Driven by technological advancements, environmental regulations, and shifting demand across end-use industries, several key trends are shaping the trajectory of the rubber pipes market.

1. Rising Demand in Construction and Infrastructure

Urbanization and government-led infrastructure projects—especially in Asia-Pacific, Latin America, and Africa—are boosting the need for durable piping solutions. Rubber pipes, known for their flexibility, vibration absorption, and resistance to corrosion, are increasingly preferred in water supply, sewage systems, and underground conduit applications. The expansion of smart cities and sustainable urban planning will further amplify this demand.

2. Growth in Industrial and Manufacturing Applications

Industries such as automotive, oil & gas, mining, and manufacturing rely on rubber hoses and pipes for fluid transfer, air compression, and hydraulic systems. With the recovery and expansion of global manufacturing post-pandemic, coupled with automation and Industry 4.0 integration, the need for high-performance, heat- and pressure-resistant rubber piping solutions is expected to grow steadily through 2026.

3. Shift Toward Sustainable and Eco-Friendly Materials

Environmental regulations are pushing manufacturers to adopt recyclable and bio-based rubber materials. Natural rubber and synthetic elastomers derived from sustainable sources are gaining traction. Additionally, companies are investing in closed-loop recycling processes to reduce waste and meet ESG (Environmental, Social, and Governance) goals. This trend is particularly strong in Europe and North America, where regulatory frameworks such as REACH and EPA standards influence material selection.

4. Technological Innovations in Material Science

Advancements in polymer technology are leading to the development of high-performance rubber compounds with enhanced durability, temperature resistance, and longevity. Nanocomposite rubber and reinforced elastomers are being integrated into pipes to improve efficiency and reduce maintenance costs. These innovations are especially beneficial in extreme environments such as offshore drilling or chemical processing plants.

5. Expansion of Oil & Gas and Petrochemical Sectors

Despite the global push toward renewable energy, oil & gas exploration and refining activities—particularly in the Middle East, North America, and parts of Africa—are sustaining demand for rubber-lined and flexible pipes capable of handling abrasive and corrosive fluids. The shale gas boom and deepwater drilling projects are expected to maintain this need through 2026.

6. Regional Market Dynamics

Asia-Pacific is projected to dominate the rubber pipes market by 2026, driven by rapid industrialization in China, India, and Southeast Asian nations. North America and Europe will see steady growth fueled by replacement cycles, infrastructure upgrades, and stringent safety standards. Meanwhile, Africa and the Middle East offer emerging opportunities due to increasing investments in water management and energy infrastructure.

7. Supply Chain Resilience and Localization

Post-pandemic disruptions have prompted companies to reevaluate global supply chains. By 2026, we expect a rise in localized production of rubber pipes to reduce dependency on imports, minimize logistics costs, and enhance supply chain resilience—especially in critical sectors like healthcare (e.g., medical-grade tubing) and emergency services.

Conclusion

By 2026, the rubber pipes market will be characterized by innovation, sustainability, and regional diversification. Companies that invest in advanced materials, comply with environmental standards, and adapt to regional infrastructure needs will be best positioned to capitalize on emerging opportunities. As demand surges across multiple sectors, the rubber pipes industry is set for steady, resilient growth in the coming years.

Common Pitfalls When Sourcing Rubber Pipes: Quality and Intellectual Property (IP) Risks

Sourcing rubber pipes—used in industries ranging from automotive and construction to oil and gas—can present significant challenges, particularly concerning product quality and intellectual property (IP) protection. Avoiding these common pitfalls is essential to ensure performance, compliance, and legal safety.

Poor Material Quality and Inconsistent Specifications

One of the most frequent issues is receiving rubber pipes made from substandard or non-compliant materials. Suppliers may use inferior rubber compounds (e.g., recycled or off-spec elastomers) that degrade quickly under pressure, temperature, or chemical exposure. This can lead to premature failure, safety hazards, and costly downtime. Additionally, inconsistent wall thickness, poor curing, or dimensional inaccuracies compromise performance and system integrity.

Mitigation: Require material certifications (e.g., ASTM, ISO), conduct third-party testing, and perform regular factory audits. Clearly define technical specifications in purchase agreements.

Lack of Compliance with Industry Standards

Rubber pipes must often meet specific regulatory and industry standards (e.g., FDA for food-grade, UL for fire resistance, or ISO 1307 for dimensions). Sourcing from suppliers who do not adhere to these standards can result in rejected shipments, regulatory fines, or liability in case of failure.

Mitigation: Verify supplier compliance with relevant standards and request test reports or conformity certificates. Include compliance clauses in contracts.

Counterfeit or IP-Infringing Products

Some suppliers—especially in regions with weak IP enforcement—may produce rubber pipes that mimic patented designs, logos, or proprietary formulations. These counterfeit products not only violate intellectual property rights but also often underperform due to reverse-engineered, non-optimized designs.

Mitigation: Work only with reputable, vetted suppliers. Conduct IP due diligence and include IP indemnification clauses in supply agreements. Monitor for trademark or design infringement.

Inadequate Traceability and Documentation

Poor record-keeping from suppliers can make it difficult to trace the origin of materials or verify production batches. This becomes critical during quality audits, recalls, or failure investigations. Lack of batch traceability may also implicate IP disputes, especially if patented technologies are involved.

Mitigation: Demand full traceability documentation, including batch numbers, material sources, and production dates. Use digital supply chain tools where possible.

Weak Contractual Protections

Many procurement contracts fail to adequately address quality assurance, IP ownership, or liability for infringement. This leaves buyers exposed if a supplier delivers non-conforming or infringing products.

Mitigation: Draft comprehensive contracts that specify quality metrics, IP warranties, indemnification for IP violations, and rights to audit and inspect.

Avoiding these pitfalls requires due diligence, robust supplier qualification processes, and clear legal and technical agreements. Proactive management of both quality and IP risks ensures reliable performance and protects your business from legal and operational setbacks.

Logistics & Compliance Guide for Rubber Pipes

Overview

Rubber pipes are widely used across industries such as automotive, construction, HVAC, and manufacturing due to their flexibility, durability, and resistance to vibration and certain chemicals. However, transporting and importing/exporting rubber pipes require adherence to specific logistics and compliance standards to ensure safety, regulatory conformity, and efficient supply chain operations.

Product Classification and HS Code

Correct classification is essential for international trade. Rubber pipes are typically categorized under the Harmonized System (HS) Code:

– 4009.21 to 4009.22: For new pneumatic or hydraulic hoses and tubing made of vulcanized rubber.

– 4009.31 to 4009.32: For hose fittings and reinforced rubber tubing.

Verify the exact HS code based on material composition (e.g., synthetic vs. natural rubber), reinforcement type (e.g., steel braided), and intended use, as this affects tariffs, quotas, and import regulations.

Regulatory Compliance

International Standards

Rubber pipes may need to comply with various international standards depending on application:

– ISO 1307: Specifies dimensional requirements for rubber and plastics hoses.

– ISO 1436: For oil-resistant hydraulic hoses.

– SAE J517: Common in North America for hydraulic hose performance.

– DIN 20022 / EN 853: European standards for hydraulic hose specifications.

Ensure product certification (e.g., CE marking in the EU, NSF for potable water applications) is obtained where applicable.

Chemical and Environmental Regulations

- REACH (EU): Register and evaluate chemical substances used in rubber compounds (e.g., phthalates, accelerators).

- RoHS (EU): Restricts hazardous substances if used in electrical or electronic assemblies.

- TSCA (USA): Comply with Toxic Substances Control Act for chemical components.

- Proposition 65 (California): Requires warning labels if products contain listed carcinogens or reproductive toxins.

Packaging and Handling

- Use moisture-resistant wrapping (e.g., polyethylene film) to prevent degradation.

- Coil or bundle pipes based on diameter and length; avoid sharp bends to prevent permanent deformation.

- Use wooden pallets or crates for bulk shipments; secure with strapping or stretch wrap.

- Label packages with product details, HS code, country of origin, and handling instructions (e.g., “Do Not Crush,” “Keep Dry”).

Transportation and Storage

Modes of Transport

- Sea Freight: Most cost-effective for bulk shipments. Use dry containers; ensure ventilation to prevent condensation.

- Air Freight: Suitable for urgent, high-value, or small-volume shipments.

- Road/Rail: Ideal for regional distribution. Use covered trailers to protect from weather.

Storage Conditions

- Store in a cool, dry, and well-ventilated area away from direct sunlight.

- Maintain temperatures between 5°C and 35°C to prevent hardening or softening.

- Keep away from ozone sources (e.g., electric motors, welding equipment) to reduce cracking.

Import/Export Documentation

Ensure the following documents are prepared:

– Commercial Invoice

– Packing List

– Bill of Lading / Air Waybill

– Certificate of Origin

– Product Compliance Certificates (e.g., ISO, CE)

– Material Safety Data Sheet (MSDS) if requested

– Phytosanitary Certificate (if applicable for natural rubber origin)

Customs Clearance

- Provide accurate product descriptions and HS codes to avoid delays.

- Declare any rubber origin (e.g., natural rubber from specific countries may face tariffs or anti-dumping measures).

- Be aware of import duties and VAT requirements in the destination country.

- Some countries may require pre-shipment inspections (e.g., SPS measures).

Special Considerations

- Temperature-Sensitive Materials: Monitor cold chain logistics if transporting specialty rubber pipes (e.g., silicone) in extreme climates.

- Hazardous Goods Classification: While most rubber pipes are non-hazardous, check if additives or packaging materials require special handling.

- Recycling and Disposal Compliance: Follow local waste regulations (e.g., WEEE, ELV) if pipes are part of end-of-life equipment.

Conclusion

Effective logistics and compliance management for rubber pipes involves accurate classification, adherence to international standards, proper packaging, and complete documentation. Proactive planning ensures smooth customs clearance, reduces risk of shipment rejection, and supports sustainable and legal trade operations. Always consult with local regulatory authorities and freight forwarders to stay current with evolving requirements.

Conclusion for Sourcing Rubber Pipes

Sourcing rubber pipes requires a strategic approach that balances quality, cost, reliability, and compliance. After evaluating potential suppliers, material specifications, performance requirements, and industry standards, it is clear that selecting the right source involves more than just competitive pricing. The durability, flexibility, temperature, and chemical resistance of rubber pipes are critical factors that must align with the intended application—whether in automotive, industrial, plumbing, or manufacturing settings.

Establishing long-term partnerships with reputable suppliers who adhere to international quality standards (such as ISO certifications) ensures consistent product performance and reduces the risk of operational downtime. Additionally, considering sustainability, lead times, and logistical efficiency further enhances supply chain resilience.

In conclusion, successful sourcing of rubber pipes hinges on a comprehensive evaluation of technical specifications, supplier reliability, and total cost of ownership. By prioritizing quality and supplier collaboration, organizations can secure a dependable supply of rubber pipes that meet operational demands and contribute to long-term efficiency and safety.