The global rope descender market is experiencing steady expansion, driven by increasing demand across industries such as construction, firefighting, rescue operations, and recreational climbing. According to Mordor Intelligence, the global fall protection equipment market—under which rope descenders fall—was valued at approximately USD 2.8 billion in 2022 and is projected to grow at a CAGR of over 6.5% from 2023 to 2028. This growth is fueled by stringent workplace safety regulations, rising high-rise construction activities, and greater awareness of personal protective equipment in emerging economies. With safety compliance becoming non-negotiable in vertical work environments, innovation in lightweight, durable, and reliable rope descender technology has become a critical differentiator among manufacturers. As the demand for efficient descent control systems intensifies, a select group of companies are leading the charge through engineering excellence, rigorous certification standards, and continuous product development. Below are the top 9 rope descender manufacturers shaping the future of vertical mobility and safety.

Top 9 Rope Descender Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CLIMBING TECHNOLOGY

Domain Est. 1998

Website: climbingtechnology.com

Key Highlights: CLIMBING TECHNOLOGY manufactures products for outdoor (climbing, mountaineering, etc.) and professional (rope access, rescue, etc.) activities….

#2 Fast Rope Descender

Domain Est. 1995

#3 Descenders – Petzl Other

Domain Est. 1996

Website: petzl.com

Key Highlights: Petzl Other. Descenders are designed to help regulate friction and control the descent on a fixed rope. They allow a worker to position himself at any point ……

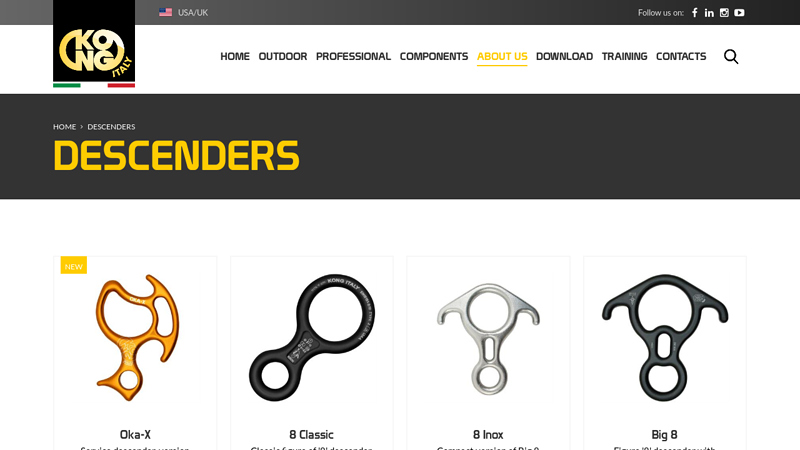

#4 Descenders

Domain Est. 1996

Website: kong.it

Key Highlights: Descender especially conceived for canyo.. Pirata. Descender designed for rope access. Rackong. Descender with stainless steel body and …..

#5 Descenders & Rope Adjusters

Domain Est. 1998

Website: iscwales.com

Key Highlights: ISC has a range of Descenders & Rope Adjusters, suitable for a variety of applications including Rope Access, Technical Rescue, Escape and Work Positioning….

#6 Powerful power ascenders for height access and rescue

Domain Est. 2004

Website: skylotec.com

Key Highlights: Discover high-performance power ascender for height access and rescue operations – compact, reliable and ready for any challenge with SKYLOTEC….

#7 EDELRID

Domain Est. 2007

Website: edelrid.com

Key Highlights: Climbing ropes and equipment for mountain sports and work safety. Climb Green; Belay devices; New Products Professional 2025….

#8 Descenders / Rappel – Belay

Domain Est. 2012

Website: cmcpro.com

Key Highlights: CMC, committed to providing rope descenders for rappelling, belay & vertical rescue maneuvers with rope rigging systems, pulleys, carabiners, and training ……

#9 RIG Self

Domain Est. 2015

Website: rigginginternationalgroup.com

Key Highlights: RIG is a compact self-braking descender for rope access, designed for experienced users. It has an ergonomic handle that allows comfortable descent control….

Expert Sourcing Insights for Rope Descender

H2: 2026 Market Trends for Rope Descenders

The global rope descender market is poised for significant transformation by 2026, driven by technological innovation, regulatory changes, and expanding end-user applications. Rope descenders—devices used for controlled descent along a rope—are essential in industries such as firefighting, rescue operations, industrial maintenance, defense, and recreational climbing. The following trends are expected to shape the market landscape in 2026:

-

Increased Demand for Personal Safety Equipment

Heightened awareness around occupational safety and stringent government regulations, especially in construction and high-rise maintenance sectors, are accelerating the adoption of advanced rope descenders. By 2026, compliance with international safety standards such as EN 12841 and OSHA will be a key purchasing factor, pushing manufacturers to innovate and certify their products accordingly. -

Technological Advancements in Materials and Design

Lightweight, high-strength materials such as aerospace-grade aluminum and composite alloys are being integrated into rope descender designs. These improvements enhance portability, reduce wear, and increase thermal resistance, especially during rapid descents. Additionally, smart features such as integrated sensors for speed monitoring and emergency lock mechanisms are expected to gain traction. -

Growth in Urban Search and Rescue (USAR) Operations

The rising frequency of natural disasters and urban emergencies is increasing the need for reliable descent systems in rescue missions. Fire departments and civil protection agencies are investing in compact, rapidly deployable rope descenders. By 2026, modular and multi-person descent systems are anticipated to become standard in emergency response kits. -

Expansion in Industrial and Wind Energy Applications

The global push toward renewable energy has led to increased construction and maintenance of offshore and onshore wind turbines. Rope descenders are critical for technician access and evacuation in these high-altitude environments. The industrial vertical access market is projected to drive significant demand, particularly in regions with aggressive green energy targets like Europe and China. -

Rise of Recreational and Adventure Tourism

Adventure sports such as canyoning, via ferrata, and urban rappelling are gaining popularity, creating a consumer-driven market for user-friendly, fail-safe rope descenders. By 2026, manufacturers are expected to focus on intuitive designs, enhanced ergonomics, and aesthetic customization to cater to recreational users. -

Regional Market Diversification

While North America and Europe currently dominate the rope descender market due to strict safety norms and mature rescue infrastructure, the Asia-Pacific region is expected to witness the highest growth rate by 2026. Rapid urbanization, infrastructure development, and increasing disaster preparedness initiatives in countries like India, Japan, and South Korea will fuel demand. -

Sustainability and Circular Economy Considerations

Environmental concerns are influencing product life cycles. Leading manufacturers are exploring recyclable materials and modular designs that allow part replacement instead of full-unit disposal. By 2026, eco-certifications and sustainable packaging may become differentiators in competitive bidding processes. -

Integration with Digital Platforms and IoT

The convergence of rope descenders with digital safety ecosystems is emerging. Some next-generation models are expected to offer Bluetooth connectivity for real-time descent data logging, GPS tracking, and remote diagnostics—especially valuable in industrial and military applications.

In conclusion, the 2026 rope descender market will be characterized by innovation, safety compliance, and diversification across sectors and geographies. Companies that invest in R&D, adhere to evolving standards, and anticipate user needs across professional and recreational domains will be best positioned for growth.

Common Pitfalls When Sourcing Rope Descenders (Quality and Intellectual Property)

Sourcing rope descenders—critical safety equipment used in rescue, climbing, industrial, and military applications—requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking key factors can lead to compromised safety, legal risks, and reputational damage. Below are the most common pitfalls to avoid.

Poor Manufacturing Quality and Material Standards

One of the most significant risks when sourcing rope descenders is substandard manufacturing. Low-quality materials (e.g., inferior alloys or plastics) or imprecise machining can result in device failure under load, endangering users. Many suppliers, particularly in low-cost regions, may cut corners on heat treatment, surface finishing, or quality control processes. Always verify that the manufacturer adheres to recognized standards such as EN 12841 (for industrial descenders) or UIAA 126 (for mountaineering devices).

Lack of Independent Certification and Testing

Relying solely on supplier claims without third-party certification is a critical mistake. Genuine rope descenders should be independently tested and certified by accredited bodies (e.g., TÜV, CE, or ANSI). Be cautious of counterfeit certifications or documentation that cannot be verified. Insist on test reports, batch certifications, and, if possible, conduct your own sample testing under load conditions.

Inadequate Quality Control Processes

Even if a manufacturer produces a certified prototype, inconsistent quality control during mass production can lead to defective units. Poor welding, inconsistent tolerances, or incorrect assembly can go unnoticed without rigorous in-process inspections. Implement a supplier audit program and require documented QC procedures, including statistical process control and final product inspections.

Intellectual Property Infringement

Sourcing from unauthorized manufacturers or suppliers increases the risk of IP violations. Many rope descender designs (e.g., Petzl I’D, Kong Duck) are protected by patents, trademarks, or design rights. Copying or reverse-engineering these devices—even with minor modifications—can result in legal action, product seizures, and reputational harm. Always verify IP ownership and obtain proper licensing if required.

Ambiguous or Misleading Product Specifications

Some suppliers may exaggerate device performance, such as load capacity, rope compatibility, or heat dissipation. For example, claiming compatibility with a wide range of rope diameters without proper testing can lead to slippage or jamming. Scrutinize technical documentation and request real-world performance data under relevant conditions.

Failure to Address After-Sales Support and Spare Parts

A reliable supply chain includes access to spare parts, technical support, and repair services. Sourcing from manufacturers without these capabilities can result in device downtime or unsafe field repairs. Confirm the availability of customer support, repair manuals, and replacement components before finalizing procurement.

Ignoring Traceability and Documentation

In safety-critical applications, full traceability—batch numbers, material certifications, test records—is essential. Poor documentation makes recalls difficult and can hinder incident investigations. Ensure suppliers provide complete traceability for each unit, especially for use in regulated industries.

By proactively addressing these pitfalls, organizations can ensure they source rope descenders that are both safe and compliant, protecting users and mitigating legal and operational risks.

Logistics & Compliance Guide for Rope Descender

Product Classification & Regulatory Compliance

Rope descenders are classified as personal protective equipment (PPE) under regulatory frameworks such as the EU’s Personal Protective Equipment Regulation (EU) 2016/425 and OSHA standards in the United States. Ensure all units comply with relevant safety standards, including EN 12841 (for rope access devices) and ANSI Z359.4 (for descent control devices). Certification documentation, including CE marking and test reports from notified bodies, must accompany each shipment. Products must also meet RoHS and REACH requirements if shipped into the European market.

Packaging & Shipping Requirements

Rope descenders must be individually packaged in durable, tamper-evident packaging to prevent damage during transit. Each package should include user instructions, safety warnings, and compliance labels in the destination country’s official language(s). Shipments must comply with IATA/ADR regulations if transported by air or road, particularly when accessories include metal components or batteries (in smart descenders). Use anti-static and moisture-resistant materials where applicable, and clearly label packages as “Fragile” and “Protect from Moisture.”

Import/Export Documentation

All international shipments require a commercial invoice, packing list, bill of lading or air waybill, and a Certificate of Conformity. For exports to the EU, include an EU Declaration of Conformity. Shipments to countries with specific PPE import regulations (e.g., Australia, Canada) may require additional certification such as SAA or CSA. Verify import tariffs and customs classifications (HS Code 8431.31 or 9020.00, depending on function) prior to dispatch.

Storage & Inventory Management

Store rope descenders in a dry, temperature-controlled environment (10°C–30°C), away from direct sunlight and corrosive substances. Implement a first-in, first-out (FIFO) inventory system to ensure product shelf-life integrity. Conduct routine inspections for signs of material degradation or packaging damage. Maintain records of storage conditions and inventory audits for traceability and compliance purposes.

Training & End-User Compliance

Distributors and end-users must receive certified training on proper use, inspection, and maintenance of rope descenders, in accordance with ANSI/ASSE Z490.1 and OSHA 1910.28. Provide training materials and documentation with each unit. Ensure all users understand limitations, load ratings, and compatibility with ropes and harnesses. Record training completion for audit and liability protection.

Recall & Incident Reporting Procedures

Establish a product traceability system using serial or batch numbers. In the event of a defect or safety incident, initiate a recall in compliance with local regulations (e.g., EU Rapid Information System (RAPEX) or U.S. Consumer Product Safety Commission (CPSC) guidelines). Report incidents to relevant authorities within required timeframes and communicate corrective actions to all stakeholders promptly.

Conclusion for Sourcing a Rope Descender:

In conclusion, sourcing a reliable and high-performance rope descender requires careful evaluation of safety standards, material quality, intended application, and user requirements. Whether for industrial rope access, rescue operations, recreational climbing, or firefighting, selecting a device that complies with relevant certifications (such as EN, UIAA, or NFPA) is critical to ensuring operational safety and durability. Additionally, factors such as ease of use, compatibility with rope diameter, heat dissipation, and resistance to wear should be prioritized during the procurement process. Engaging reputable suppliers with proven track records, comprehensive product support, and after-sales service further enhances reliability and long-term value. Ultimately, a well-informed sourcing decision not only ensures user safety and operational efficiency but also minimizes risks and maintenance costs over the equipment’s lifespan.