The global demand for specialized heavy-duty transportation solutions has fueled significant growth in the rolling deck trailer manufacturing sector. According to a 2023 report by Mordor Intelligence, the global trailer market is projected to grow at a CAGR of over 5.8% from 2023 to 2028, driven by rising infrastructure development, increased logistics outsourcing, and expanding e-commerce supply chains. Rolling deck trailers—known for their hydraulic sliding decks that facilitate easy loading of heavy machinery and construction equipment—are witnessing heightened adoption across mining, oil & gas, and civil engineering industries. Grand View Research further supports this trend, noting that the North American flatbed and specialized trailer segment is expected to maintain steady expansion through 2030, underpinned by demand for versatile and durable hauling solutions. As fleet operators prioritize efficiency and equipment longevity, the competitive landscape among rolling deck trailer manufacturers continues to evolve, with innovation in materials, hydraulics, and weight distribution defining market leaders.

Top 10 Rolling Deck Trailer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

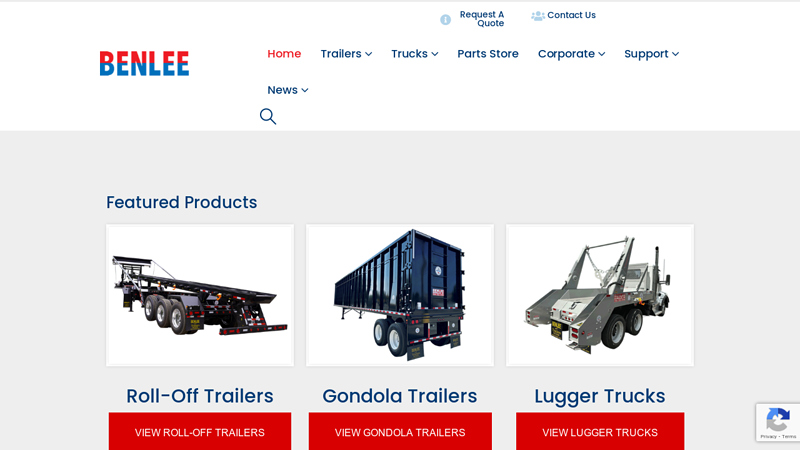

#1 Roll

Domain Est. 1996

Website: benlee.com

Key Highlights: BENLEE builds heavy-duty roll-off trailers, gondola trailers, lugger trucks, and dump trailers for maximum payload, durability, ……

#2 Felling Trailers

Domain Est. 1997

Website: felling.com

Key Highlights: Building standard and custom trailers for the long haul. Expansive line of Commercial, Construction, Utility, OEM & Government trailers….

#3 Utility Trailer

Domain Est. 1996

Website: utilitytrailer.com

Key Highlights: Reefers. The proven Utility 3000R and 3000R Multi-Temp refrigerated trailers are the industry’s strong light weight high payload performers. The Utility 3000R ……

#4 Landoll Trailers

Domain Est. 1996

Website: landoll.com

Key Highlights: Rolling Packers. TravAlong Trailers. View All; Livestock. Standard Gooseneck · Outside Skin Gooseneck · 7.5′ Wide Standard · Bumper Hitch ……

#5 Big Tex Trailers

Domain Est. 1997

Website: bigtextrailers.com

Key Highlights: Explore the Big Tex trailer lineup built for relentless professionals. Find a quality trailer for reliability, strength, and performance. Shop now!…

#6 PJ Trailers

Domain Est. 1999

Website: pjtrailers.com

Key Highlights: The #1 professional grade trailer company in the USA. Durable dump, gooseneck, tilt, equipment, and utility trailers. View our selection!…

#7 Diamond C Trailers

Domain Est. 2000

Website: diamondc.com

Key Highlights: We offer a robust lineup of premium grade trailers for sale: dump, gooseneck, equipment, tilt, step deck, and car hauler trailers….

#8 Rolland trailers

Domain Est. 2002 | Founded: 1946

Website: rollandtrailer.com

Key Highlights: Cropping, Livestock, construction, groundworks and environmental expertise. Since 1946, ROLLAND manufactures and develops machines to meet your needs….

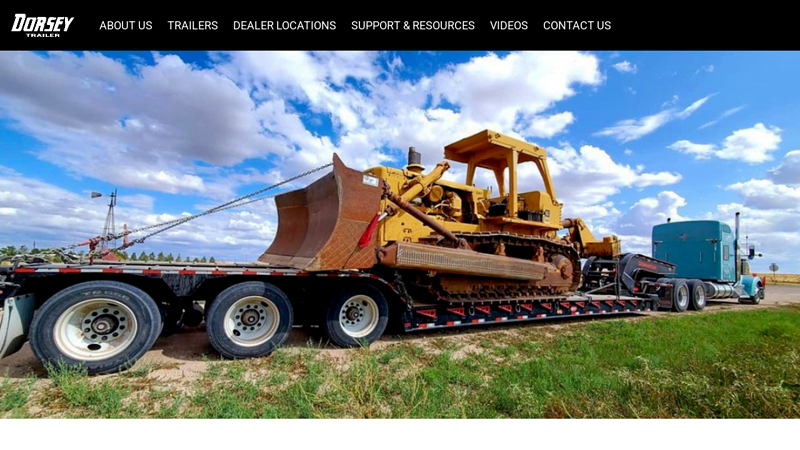

#9 Dorsey Trailer

Domain Est. 2007

Website: dorseytrailer.net

Key Highlights: For over 100 years, Dorsey has been committed to building the most durable trailers on the road. That commitment combined with a dedicated dealer network….

#10 MAXX-D Trailers

Domain Est. 2014

Website: maxxdtrailers.com

Key Highlights: We offer a wide variety of trailers that you can use to help grow your business: Dumps, tilts, flatbeds, roll-offs, and car/equipment haulers….

Expert Sourcing Insights for Rolling Deck Trailer

H2: 2026 Market Trends for Rolling Deck Trailers

The global market for rolling deck trailers is poised for significant transformation by 2026, driven by evolving logistics needs, technological advancements, regulatory changes, and shifting industrial demands. These specialized trailers, known for their telescoping or extendable decks used primarily in heavy equipment transport, are increasingly adapting to meet the requirements of infrastructure development, renewable energy projects, and efficient freight movement. This analysis outlines key trends expected to shape the rolling deck trailer market in 2026 under the broader context of H2 (second half) of the year, reflecting the culmination of annual developments.

1. Growth in Infrastructure and Renewable Energy Sectors

One of the primary drivers for rolling deck trailers in 2026 is the global push toward infrastructure modernization and renewable energy deployment. Governments in North America, Europe, and parts of Asia are investing heavily in road, rail, and energy projects, particularly wind and solar farms. Rolling deck trailers are essential for transporting oversized components such as wind turbine blades, towers, and transformers. By H2 2026, the demand for heavy-haul transport solutions is expected to peak due to accelerated project timelines ahead of policy deadlines and tax incentives.

2. Adoption of Lightweight and High-Strength Materials

Manufacturers are increasingly incorporating advanced materials such as high-tensile steel, aluminum alloys, and composite structures into rolling deck trailer designs. These materials enhance payload capacity while reducing overall trailer weight, leading to improved fuel efficiency and compliance with emissions regulations. By H2 2026, lightweight models are projected to constitute over 35% of new rolling deck trailer sales, particularly in regions with strict weight and emissions standards.

3. Integration of Smart Technology and Telematics

The integration of telematics, GPS tracking, load sensors, and predictive maintenance systems is becoming standard in premium rolling deck trailers. These technologies enable real-time monitoring of cargo stability, deck extension integrity, and axle load distribution—critical for safety and compliance when transporting high-value or sensitive equipment. In H2 2026, fleets operating across international borders will increasingly rely on IoT-enabled trailers to streamline cross-jurisdictional logistics and meet digital freight documentation requirements.

4. Regional Market Diversification

While North America remains the largest market for rolling deck trailers due to extensive oil & gas, construction, and mining activities, emerging markets in Southeast Asia, the Middle East, and Africa are gaining traction. Countries investing in large-scale infrastructure—such as Saudi Arabia’s NEOM project and India’s Bharatmala highway expansion—are driving demand. By H2 2026, international exports of rolling deck trailers are expected to grow by 12–15% year-over-year, supported by localized manufacturing partnerships.

5. Regulatory and Environmental Pressures

Emissions standards, particularly in the EU and California, are pushing transporters to adopt more sustainable practices. Rolling deck trailer manufacturers are responding by designing aerodynamic models and offering compatibility with electric and hydrogen-powered tractors. Additionally, stricter permitting rules for oversize loads are encouraging innovation in modular and retractable deck systems that reduce road footprint. Compliance with these regulations will be a key consideration for fleet operators in H2 2026.

6. Consolidation and Vertical Integration in Manufacturing

The rolling deck trailer industry is witnessing increased consolidation as larger manufacturers acquire niche players to expand product portfolios and service offerings. This trend is expected to accelerate in H2 2026, driven by the need for end-to-end solutions that include trailers, maintenance, and digital fleet management. Vertical integration allows companies to offer customized, turnkey transport systems tailored to sectors like mining, energy, and defense.

7. Rental and Fleet-as-a-Service Models

With capital costs rising and project-based demand fluctuating, many operators are turning to rental and leasing models. Equipment rental companies are expanding their rolling deck trailer fleets to serve short-term infrastructure and energy projects. By H2 2026, the rental segment is forecasted to grow by 10% annually, supported by flexible contracts and remote monitoring features that ensure asset utilization and maintenance compliance.

Conclusion

As H2 2026 approaches, the rolling deck trailer market will be characterized by innovation, sustainability, and global expansion. Driven by infrastructure growth, smart technology adoption, and regulatory evolution, the sector is transitioning from a niche heavy transport solution to a strategic component of modern logistics. Manufacturers and operators who embrace lightweight designs, digital integration, and flexible service models will be best positioned to capitalize on emerging opportunities in this dynamic market.

Common Pitfalls When Sourcing Rolling Deck Trailers (Quality and Intellectual Property)

Sourcing rolling deck trailers—especially from international suppliers—can present several challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to costly delays, legal disputes, safety issues, and reputational damage. Below are key areas to be aware of:

Quality Inconsistencies and Substandard Materials

One of the most frequent issues when sourcing rolling deck trailers is inconsistent build quality. Suppliers may use inferior materials—such as low-grade steel, subpar welding techniques, or inadequate corrosion protection—to cut costs. This can compromise the trailer’s load-bearing capacity, durability, and safety. Buyers should insist on material certifications (e.g., mill test reports), conduct third-party inspections, and verify compliance with industry standards (e.g., ISO, ASME, or regional safety codes).

Lack of Design and Engineering Validation

Many suppliers offer “custom” rolling deck trailers without proper engineering validation. Designs may not be stress-tested or compliant with transportation regulations, leading to structural failures under load. Ensure that technical drawings are reviewed by qualified engineers and that prototypes undergo performance testing before full-scale production.

Inadequate Quality Control Processes

Suppliers may lack robust quality management systems, resulting in inconsistent manufacturing practices. Without ISO 9001 certification or equivalent, there’s a higher risk of defects slipping through. Implementing staged inspections (during production, pre-shipment) and requiring documented QC procedures can mitigate this risk.

Intellectual Property Infringement Risks

Sourcing from regions with weak IP enforcement increases the risk of inadvertently obtaining trailers that infringe on patented designs, mechanisms, or proprietary features. Suppliers may copy patented deck movement systems, suspension designs, or hydraulic configurations. Conduct due diligence to confirm that the product design does not violate existing patents, and include IP indemnification clauses in supply contracts.

Unauthorized Reverse Engineering and Design Theft

When sharing technical specifications or custom designs with suppliers, there’s a risk they may reverse engineer your design for resale to competitors. Protect sensitive information through non-disclosure agreements (NDAs), limit access to critical design elements, and consider watermarking or segmenting technical documentation.

Weak Contractual Protections

Many sourcing agreements fail to clearly define quality benchmarks, IP ownership, or remedies for non-compliance. This leaves buyers vulnerable if the delivered trailers are defective or if the supplier reproduces the design. Contracts should explicitly state warranty terms, inspection rights, IP ownership, and penalties for breaches.

Supply Chain Transparency Gaps

Lack of visibility into subcontractors and component sourcing can hide quality and IP risks. A supplier might outsource critical parts to unvetted vendors, increasing the chance of counterfeit or non-compliant components. Require transparency in the supply chain and audit key sub-tier suppliers when possible.

By proactively addressing these pitfalls, businesses can secure reliable, high-quality rolling deck trailers while safeguarding their intellectual property and minimizing operational risks.

Logistics & Compliance Guide for Rolling Deck Trailers

Rolling Deck Trailers (also known as Extendable Flatbeds or Extendable Lowboys) are specialized trailers designed for transporting heavy, oversized, or irregularly shaped cargo such as construction equipment, industrial machinery, and large vehicles. Due to their unique design and the nature of loads they carry, strict attention to logistics planning and regulatory compliance is essential. This guide outlines key considerations for safe and lawful operations.

What Is a Rolling Deck Trailer?

A Rolling Deck Trailer features a hydraulic or mechanical system that allows the deck to extend or retract, increasing the usable length for longer loads. The trailer typically has a low deck height and may include a detachable gooseneck, enabling easier loading of heavy machinery via ramps. These trailers are commonly used in heavy haul and project logistics.

Load Securement Requirements

Proper load securement is critical to prevent shifting, falling, or accidents during transit. Compliance with the Federal Motor Carrier Safety Administration (FMCSA) guidelines under Part 393, Subpart I is mandatory.

- Use Appropriate Tie-Downs: Secure cargo with chains, binders, straps, or load bars rated for the weight and size of the load. The number and placement must meet WLL (Working Load Limit) requirements.

- Front, Rear, and Side Restraint: Ensure adequate blocking, bracing, or tiedowns to prevent forward, rearward, and lateral movement.

- Load Positioning: Center the load over the axles as much as possible to maintain balance and prevent overloading any one axle group.

Weight Distribution and Axle Compliance

Improper weight distribution can lead to mechanical failure, poor handling, and legal violations.

- Axle Weight Limits: Adhere to federal and state weight limits (e.g., 20,000 lbs per single axle, 34,000 lbs per tandem axle, 80,000 lbs gross vehicle weight federally).

- Use Weight Stations: Pre-trip and en route scale checks help ensure compliance and avoid fines.

- Adjustable Axle Systems: Utilize sliding tandem axles or multi-axle configurations to distribute weight correctly.

Oversize/Overweight Permits

Rolling Deck Trailers often transport loads exceeding standard legal dimensions or weights, requiring special permits.

- State & Interstate Permits: Obtain permits from each state the load will travel through. Some states require 7–14 days for processing.

- Escort Vehicles: Many jurisdictions require pilot cars (one or more) for wide, long, or tall loads. Requirements vary by state.

- Travel Restrictions: Be aware of route limitations, no-travel days (e.g., weekends, holidays), and time-of-day restrictions (often daylight hours only).

Route Planning and Infrastructure Clearance

Thorough route surveying is essential to avoid obstacles and ensure safe passage.

- Use Route Planning Software: Tools like PC*MILER, Route4Me, or specialized heavy haul software help identify low bridges, sharp turns, weight-restricted roads, and road conditions.

- Check Bridge & Overpass Heights: Confirm clearance for load height, including the trailer and any equipment.

- Avoid Restricted Roads: Many urban areas, tunnels, and certain highways prohibit oversized vehicles.

Licensing and Driver Qualifications

Drivers operating Rolling Deck Trailers hauling heavy or oversized loads must meet specific qualifications.

- Valid CDL with Appropriate Endorsements: Typically a Class A CDL; air brake endorsement may be required.

- Specialized Training: Drivers should be trained in heavy haul procedures, load dynamics, and emergency protocols.

- Medical Certification: Up-to-date DOT medical card is mandatory.

Inspection and Maintenance

Regular maintenance ensures reliability and compliance during transport.

- Pre-Trip Inspections: Conduct DOT-mandated Level 1 inspections before each journey, focusing on brakes, lights, tires, suspension, and securement points.

- Hydraulic System Checks: Inspect extension/retraction mechanisms, hoses, and controls for leaks or damage.

- Tire Maintenance: Ensure tires are rated for load and road conditions, with adequate tread and inflation.

Documentation and Recordkeeping

Maintain accurate records for compliance and operational efficiency.

- Permits and Routing Documents: Keep copies in the cab and accessible digitally.

- Bill of Lading & Freight Docs: Accurate shipment details, including weight, dimensions, and special handling instructions.

- Inspection Reports: Retain DVIRs (Driver Vehicle Inspection Reports) for at least 3 months (DOT requirement).

Safety and Emergency Procedures

Prepare for unexpected events during transit.

- Emergency Kits: Equip the vehicle with flares, reflective triangles, fire extinguisher, first aid kit, and communication devices.

- Spill & Hazard Response: For loads that pose environmental or safety risks, have a response plan and contact information for local authorities.

- Communication Plan: Maintain contact with dispatch or logistics coordinators throughout the trip.

Summary

Rolling Deck Trailers provide unmatched flexibility for transporting oversized and heavy cargo, but their operation demands meticulous planning and strict compliance with federal and state regulations. By adhering to securement standards, obtaining necessary permits, planning safe routes, and maintaining vehicles and records, operators can ensure safe, legal, and efficient transport operations. Always stay updated on regulatory changes and consult with state DOTs and industry experts when in doubt.

Conclusion for Sourcing a Roll Deck Trailer

Sourcing a roll deck trailer requires a comprehensive evaluation of operational needs, budget considerations, and long-term reliability. After assessing various suppliers, specifications, and pricing models, it is evident that selecting the right roll deck trailer involves more than just cost—it demands attention to quality, durability, compliance with safety standards, and after-sales support.

Key factors such as load capacity, trailer dimensions, axle configuration, and ease of loading/unloading must align with your transportation requirements. Additionally, choosing a reputable manufacturer or supplier with a proven track record ensures structural integrity and reduces long-term maintenance costs. Options such as new versus used units, customization capabilities, and lead times also play a crucial role in the decision-making process.

In conclusion, a well-informed sourcing strategy—grounded in clear operational objectives, thorough market research, and supplier vetting—will result in a roll deck trailer that enhances efficiency, ensures safety, and delivers optimal return on investment. Prioritizing value over initial cost will ultimately support smoother logistics operations and greater fleet reliability.