The global roll-your-own (RYO) cigarette market has seen steady growth, driven by consumer preference for customizable smoking experiences and cost-effectiveness. According to Grand View Research, the global tobacco market was valued at USD 895.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.2% from 2023 to 2030, with the RYO segment contributing significantly to this growth due to rising demand in emerging economies and sustained popularity in Europe. Additionally, Mordor Intelligence projects increased consumer focus on premiumization and natural ingredients, prompting manufacturers to innovate in rolling paper materials—such as hemp, rice, and bamboo—to align with health and sustainability trends. As competition intensifies, a select group of roll paper manufacturers has risen to prominence through product quality, brand recognition, and global distribution networks. Here are the top 10 cigarette rolling paper manufacturers shaping the industry in 2024.

Top 10 Roll Paper For Cigarettes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

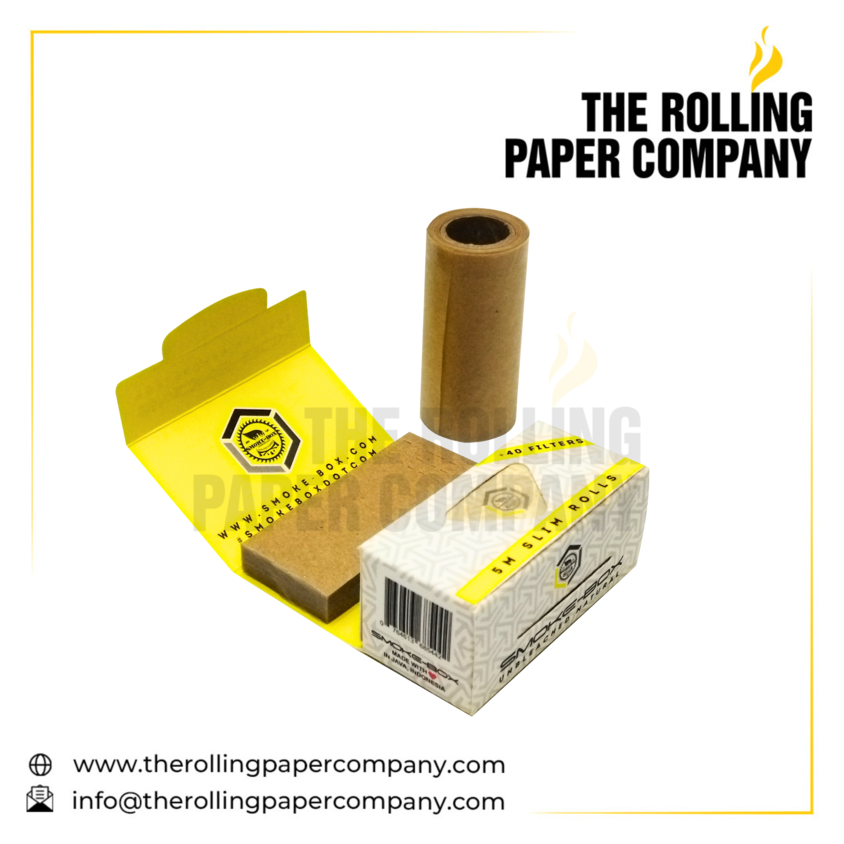

#1 The Rolling Paper Company

Domain Est. 2012

Website: therollingpapercompany.com

Key Highlights: We are the only manufacturer in the world to have both Rolling Paper and Pre Rolled Cone production under one roof where EVERYTHING is made in-house….

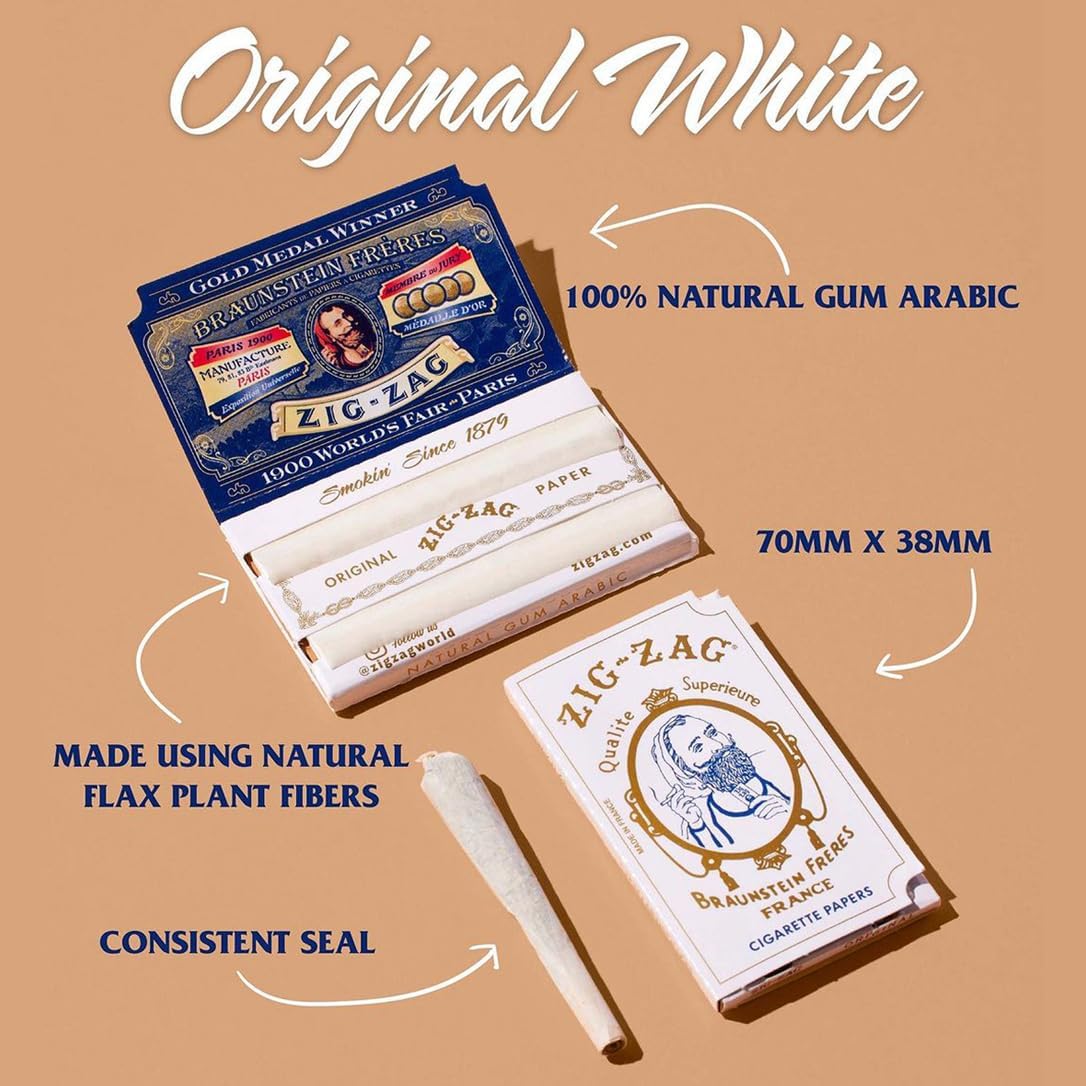

#2 24 Pack Original White Papers

Domain Est. 1995

Website: zigzag.com

Key Highlights: Discover the perfect white cigarette rolling papers made with gum arabic to provide a consistent seal. Great for on-the-go or at home….

#3

Domain Est. 1996

Website: rizla.com

Key Highlights: Official site for Rizla the Number 1 Rolling Paper brand. Rizla is sold in more than 120 countries globally and has more than 200 years of heritage….

#4 Smoking

Domain Est. 1997

Website: smokingpaper.com

Key Highlights: Smoking, rolling papers since 1879, for all types of tobacco and different sizes of papers adapted to different smokers. Take a look around!…

#5 PDL

Domain Est. 1998

Website: pdl.fr

Key Highlights: Rolling & Cone papers PDL is a top supplier of cellulose-based papers for the smoking industry, offering an extensive range of hemp, textile, and wood pulp ……

#6 RAW Cigarette Filter • RAWthentic

Domain Est. 2004

Website: rawthentic.com

Key Highlights: Products on rawthentic.com are for informational purposes only. Visit the Buy RAW page to find a recommended retailer near you….

#7 Cigarette Papers & Tobacco Solutions

Domain Est. 2006

Website: delfortgroup.com

Key Highlights: Our cigarette papers cater to both classic and highly innovative products within the tobacco industry, ensuring creative solutions!…

#8 OCB USA Rolling Paper Store

Domain Est. 2010

Website: ocbusa.com

Key Highlights: Our 100% bamboo papers burn smooth and slow, with a crisp mouthfeel so every nuance of your herb’s flavor shines every time….

#9 Papers, Cones, Wraps & Tips

Domain Est. 2011

Website: afgdistribution.com

Key Highlights: Papers, Cones, Wraps & Tips · King Palm Hand-Rolled Leaf Wraps | Slim | 25pc | 8pk Display | Updated · Hempire Hemp Rolling Papers – One And A ……

#10 Republic Brands

Domain Est. 2017

Website: republicbrands.com

Key Highlights: With a 200-year-old cultural legacy, the family-owned company is known for innovations such as sustainable bamboo, hemp and flax fiber papers and cones….

Expert Sourcing Insights for Roll Paper For Cigarettes

H2: 2026 Market Trends for Roll-Your-Own (RYO) Cigarette Roll Paper

The global market for roll paper used in roll-your-own (RYO) cigarettes is poised for notable shifts and growth by 2026, influenced by evolving consumer behaviors, regulatory environments, and innovations in product offerings. Below is an analysis of key trends shaping the roll paper market in 2026 under the H2 category:

1. Rising Demand for Natural and Organic Roll Papers

Consumers are increasingly health-conscious and environmentally aware, driving demand for roll papers made from organic materials such as hemp, rice, and flax. By 2026, brands emphasizing chemical-free, unbleached, and biodegradable papers are expected to capture a larger market share. This trend aligns with the broader wellness movement and clean-label preferences, particularly among younger demographics in North America and Western Europe.

2. Expansion of Premium and Flavored Variants

The roll paper market is witnessing a shift toward premiumization. In 2026, expect increased availability of flavored roll papers (e.g., menthol, fruit, and spice-infused) and customizable options in terms of burn rate, thickness, and size. Companies are investing in R&D to enhance user experience, contributing to higher price points and improved profit margins.

3. Regulatory Pressures and Taxation Impacts

Tightening global tobacco regulations are influencing the RYO segment. In regions like the EU and Australia, higher taxes on traditional cigarettes have historically driven consumers toward RYO alternatives, benefiting roll paper sales. However, some governments are beginning to extend excise duties to include RYO tobacco and accessories. By 2026, ongoing regulatory scrutiny may constrain market expansion in certain regions, especially where roll papers are classified under tobacco control legislation.

4. E-Commerce and Direct-to-Consumer Sales Growth

Online sales channels are becoming the primary distribution method for roll papers. The convenience, privacy, and wide product selection offered by e-commerce platforms appeal to RYO users. By 2026, digital marketplaces and brand-owned websites are expected to dominate, supported by targeted digital marketing and subscription models. This trend is especially strong in the U.S., Canada, and parts of Southeast Asia.

5. Market Penetration in Emerging Economies

While mature markets like the U.S. and Germany remain dominant, emerging regions such as Southeast Asia, Latin America, and parts of Africa are showing rising interest in RYO products due to cost savings and cultural smoking habits. Localized branding and affordable pricing strategies will be crucial for roll paper manufacturers aiming to capitalize on this growth by 2026.

6. Sustainability and Packaging Innovation

Environmental concerns are pushing brands to adopt sustainable packaging—such as recyclable tins, compostable wrappers, and reduced plastic use. By 2026, eco-conscious packaging will be a key differentiator, helping brands appeal to environmentally responsible consumers and comply with tightening global packaging regulations.

7. Competitive Landscape and Brand Consolidation

The market is seeing increased competition between established players (e.g., Raw, OCB, Zig-Zag) and niche startups. Mergers, acquisitions, and strategic partnerships are expected to rise as larger companies seek to expand their portfolios. Innovation in product design—like slow-burn papers and humidity-controlled packaging—will be central to maintaining a competitive edge.

In conclusion, the 2026 roll paper market for cigarettes will be shaped by a blend of consumer-driven innovation, regulatory adaptation, and digital transformation. While challenges remain, particularly in regulation-heavy regions, the overall trend points toward a resilient and evolving market with strong opportunities for agile and sustainability-focused brands.

Common Pitfalls When Sourcing Roll-Your-Own Cigarette Paper (Quality and Intellectual Property Risks)

Sourcing rolling paper for cigarettes—especially for private label, resale, or manufacturing purposes—can be fraught with quality inconsistencies and intellectual property (IP) challenges. Being aware of these pitfalls is crucial to maintaining product integrity and avoiding legal complications.

Poor or Inconsistent Material Quality

One of the most frequent issues is receiving rolling papers made from substandard materials. Low-quality papers may contain excessive fillers, use non-pure wood or flax pulp, or include harmful chemicals like bleaches or burn accelerants. This leads to uneven burns, harsh taste, or undesirable aftertaste, damaging brand reputation.

Inaccurate Weight and Thickness Specifications

Suppliers may advertise papers as “ultra-thin” or “lightweight” (e.g., 11–13gsm), but delivered batches often vary significantly in thickness and weight. Inconsistent GSM (grams per square meter) affects burn rate and user experience, resulting in customer dissatisfaction and potential returns.

Inadequate Burn Performance

Poorly manufactured papers may tunnel (burn unevenly), go out prematurely, or burn too quickly. These performance flaws are often due to inconsistent glue strips, improper paper sizing, or poor combustion additives. Reliable burn characteristics are essential for consumer satisfaction.

Misleading or Non-Compliant Packaging Claims

Some suppliers misrepresent product attributes such as “100% organic,” “vegan,” or “additive-free” without certification or verification. This not only misleads consumers but can expose buyers to regulatory scrutiny or false advertising claims, especially in markets with strict labeling laws.

Intellectual Property Infringement Risks

Sourcing generic or unbranded papers can still pose IP risks. Some manufacturers replicate the design, packaging, or branding elements (e.g., logos, color schemes, rolling paper shapes) of well-known brands like RAW, Juicy Jay’s, or Zig-Zag. Distributing such products—even unknowingly—can lead to cease-and-desist letters, customs seizures, or litigation.

Counterfeit or Grey Market Goods

Suppliers may offer “branded” rolling papers at suspiciously low prices, which are often counterfeit or diverted from authorized distribution channels. These products may have been produced without brand owner consent, leading to legal liability for importers and distributors.

Lack of Traceability and Certifications

Reputable rolling papers should come with documentation verifying sourcing, manufacturing standards, and compliance (e.g., ISO, FDA, EU regulations). Many low-cost suppliers lack transparency, making it difficult to verify claims about material origin, sustainability, or food-grade safety.

Inconsistent Sizing and Perforations

Rolling papers must be uniformly sized and perforated for ease of use. Poor manufacturing can result in irregular tear lines, inconsistent sheet dimensions, or misaligned glue strips, leading to user frustration and product returns.

Failure to Meet Regional Regulatory Standards

Different countries have specific requirements for tobacco accessories, including fire safety, labeling, and child-resistant packaging. Sourcing papers without verifying compliance can lead to import denials, fines, or recalls.

Overreliance on Unverified Suppliers

Using suppliers found through general marketplaces (e.g., Alibaba) without proper vetting increases the risk of fraud, poor quality, and IP violations. Due diligence—such as requesting samples, checking business licenses, and validating trademarks—is essential to mitigate these risks.

Avoiding these pitfalls requires thorough supplier vetting, clear quality agreements, and legal review of branding and packaging to ensure both product excellence and IP compliance.

Logistics & Compliance Guide for Roll-Your-Own (RYO) Cigarette Paper

Overview

Roll paper for cigarettes, often referred to as rolling paper or RYO paper, is a regulated consumer product subject to specific logistics and compliance requirements due to its association with tobacco use. This guide outlines key considerations for the legal import, export, transportation, labeling, and distribution of rolling papers across jurisdictions.

Regulatory Classification

Rolling papers are typically classified as tobacco accessories rather than tobacco products in many countries. However, their legal status varies significantly by region. In some jurisdictions, they are regulated under tobacco control laws (e.g., U.S. Family Smoking Prevention and Tobacco Control Act), while in others they may fall under general consumer goods or drug paraphernalia statutes. It is essential to verify the classification in each target market.

Import and Export Compliance

- Customs Documentation: Accurate harmonized system (HS) codes must be used. Common codes include 4813.00 (tissues, napkins, and similar articles of paper) or 4802.61 (cigarette paper), depending on composition and use.

- Licensing: Some countries require import/export licenses for tobacco-related accessories. For example, the U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB) may require registration for manufacturers or importers.

- Prohibited Jurisdictions: Certain countries ban rolling papers entirely or restrict them under drug paraphernalia laws (e.g., some Middle Eastern and Southeast Asian nations). Conduct thorough market research before shipping.

Age Verification and Sales Restrictions

- Minimum Age Laws: Many countries enforce age restrictions (typically 18 or 21) for the sale of rolling papers. Retailers and distributors must implement age verification processes, especially for e-commerce.

- Sales Channels: Restrict sales to licensed tobacco retailers or adult-only establishments where required. Avoid distribution through convenience stores or outlets accessible to minors in regulated markets.

Packaging and Labeling Requirements

- Health Warnings: In countries like Canada and members of the European Union, rolling papers may require health warnings or toxic constituent disclosures.

- Ingredient Disclosure: Some jurisdictions mandate disclosure of paper composition (e.g., hemp, rice, flax) and chemical additives.

- Brand and Origin Labeling: Clearly indicate manufacturer, country of origin, and batch/lot numbers for traceability.

- Tamper-Evident Seals: Use tamper-proof packaging to meet safety and regulatory expectations.

Transportation and Storage

- Temperature and Humidity Control: Store in dry, cool environments to prevent moisture damage, which can degrade paper quality.

- Separation from Tobacco and Cannabis: Where regulations require, rolling papers should be stored and transported separately from actual tobacco or cannabis products to avoid classification issues.

- Documentation in Transit: Maintain commercial invoices, certificates of origin, and compliance declarations during shipping for customs inspections.

Taxation and Duties

- Excise Taxes: In some regions (e.g., certain U.S. states), rolling papers are subject to excise taxes. Confirm local tax obligations and ensure proper collection and remittance.

- VAT/GST: Apply appropriate value-added or goods and services taxes based on destination country rules.

Advertising and Marketing Restrictions

- Promotional Content: Avoid marketing that implies health benefits or targets minors. Many countries prohibit branding that appeals to youth (e.g., cartoon characters, fruit flavors).

- Online Advertising: Comply with digital advertising laws, including geotargeting restrictions and age-gating on websites.

Recordkeeping and Audits

Maintain detailed records of suppliers, shipments, sales, and compliance certifications for a minimum of 5–7 years, depending on jurisdiction. Regulatory bodies may conduct audits to verify adherence to tobacco accessory laws.

Environmental and Sustainability Standards

- Biodegradable Materials: Increasingly, regulations and consumer demand favor eco-friendly rolling papers. Use sustainable sourcing and recyclable packaging where possible.

- Chemical Restrictions: Avoid chlorine-bleached papers or those containing harmful additives if restricted by local laws (e.g., REACH in the EU).

Conclusion

Compliance for roll paper for cigarettes requires careful attention to evolving tobacco and consumer product regulations globally. Engage legal counsel or compliance experts familiar with tobacco accessory laws in each market. Regularly review regulatory updates from agencies such as the FDA (U.S.), MHRA (UK), Health Canada, and the European Commission to ensure ongoing adherence.

Conclusion: Sourcing Roll-Your-Own (RYO) Cigarette Paper

Sourcing roll-your-own (RYO) cigarette paper requires careful consideration of quality, cost, availability, and regulatory compliance. After evaluating various suppliers, regions, and product types, it is evident that factors such as material composition (e.g., rice, flax, or wood pulp), burn rate, flavor neutrality, and environmental sustainability significantly influence the end-user experience. Reliable sourcing involves partnering with reputable manufacturers or distributors that adhere to international standards and offer consistent product quality.

Asia, particularly China and Indonesia, remains a key production hub due to competitive pricing and large-scale manufacturing capacity. However, import regulations, tobacco control laws, and duty structures in target markets must be thoroughly understood to ensure compliance and avoid supply chain disruptions.

Ultimately, successful sourcing of cigarette rolling paper balances affordability with performance and regulatory adherence. Building long-term relationships with ethical suppliers, verifying product certifications, and staying informed about market trends and legislative changes will support a sustainable and compliant supply chain. As consumer preferences shift toward organic and additive-free options, adapting sourcing strategies to meet these demands will be crucial for continued competitiveness in the RYO tobacco market.