The global rocker arms and lifters market is experiencing steady growth, driven by increasing demand for high-performance internal combustion engines and continuous advancements in engine technology. According to a report by Mordor Intelligence, the global valve train components market—which includes rocker arms and lifters—is projected to grow at a CAGR of over 4.5% from 2023 to 2028. This growth is further supported by Grand View Research, which highlights rising automotive production, especially in emerging economies, and the growing need for fuel-efficient and low-emission engines. As vehicle manufacturers focus on improving engine efficiency and performance, the demand for precision-engineered rocker arms and lifters has surged. This has paved the way for leading manufacturers to innovate and expand their product portfolios. In this landscape, the top 10 rocker arms and lifters manufacturers have distinguished themselves through advanced manufacturing capabilities, stringent quality standards, and strong global supply chains—positioning them at the forefront of a competitive and evolving market.

Top 10 Rocker Arms And Lifters Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 T&D Machine Products

Domain Est. 2001

Website: tdmach.com

Key Highlights: T&D Machine is the leading manufacturer of high performance shaft mount rocker arm systems. OEM and racing applications available….

#2 Jesel Valvetrain

Domain Est. 1997

Website: jesel.com

Key Highlights: The Great American Valvetrain Company. Jesel is a premium valvetrain parts manufacturer specializing in Rocker Arms, Roller Lifters, Belt Drives, OHC Followers…

#3

Domain Est. 1999

Website: mantonpushrods.com

Key Highlights: Manton Pushrods & Rockerarms Automotive Manufacturer. The Highest quality and Best Performing Pushrods , Custom Built For Every Application!…

#4 Camshafts

Domain Est. 1995

Website: crower.com

Key Highlights: Free delivery over $150 365-day returnsCrower builds performance racing parts from camshafts to crankshafts. Crower has worked hard to serve the performance parts needs of the raci…

#5 Valve Train

Domain Est. 1996

Website: melling.com

Key Highlights: Melling stocks a full line of valve train components including valves, springs, rocker arms, and rocker arm kits for both domestic and import applications, as ……

#6 Johnson Lifters

Domain Est. 2003

Website: johnsonlifters.com

Key Highlights: Welcome to the official Johnson Lifters® web page. At Johnson Lifters® we continuously use research and development with tooling and techniques for innovative ……

#7 Reid Rocker Arms

Domain Est. 2007

Website: reidmachine.com

Key Highlights: We design and manufacture our own line of racing products. The design of our rockerarms provides the stability required in the Top Fuel, Blown Alcohol, ……

#8 Performance Rocker Arms by Scorpion Racing Products

Domain Est. 2008

Website: scorpionracingproducts.com

Key Highlights: American made aluminum rocker arms. Scorpion Rocker Arms feature our exclusive lifetime warranty. Shop Scorpion Racing. Shop the latest products from the most ……

#9 Yella Terra Roller Rockers

Domain Est. 2015

Website: yellaterragroup.com

Key Highlights: Yella Terra Roller Rockers are arguably the strongest aluminum rocker arms in the world. Deflection and bend test prove their aircraft grade extruded ……

#10 PRW Power

Domain Est. 2023

Website: prwpower.com

Key Highlights: PRW has been recognized in the industry as a leader in high-performance aftermarket parts that are value priced and readily available on an in-stock basis….

Expert Sourcing Insights for Rocker Arms And Lifters

2026 Market Trends for Rocker Arms and Lifters

The global market for rocker arms and lifters is poised for significant transformation by 2026, driven by advancements in engine technology, stringent emissions regulations, and the evolving automotive landscape. As critical components of internal combustion engines (ICEs), rocker arms and lifters play a pivotal role in valve actuation, directly influencing engine performance, fuel efficiency, and reliability. This analysis explores key trends expected to shape the rocker arms and lifters market through 2026.

Increasing Demand for Lightweight and Durable Materials

A major trend shaping the 2026 market is the shift toward lightweight, high-strength materials such as powdered metal alloys, advanced aluminum composites, and reinforced polymers. Manufacturers are prioritizing weight reduction to improve fuel economy and reduce emissions. Powdered metal components, in particular, are gaining traction due to their precision engineering, cost-efficiency, and enhanced durability under high-stress conditions. This material evolution supports the production of compact, high-performance engines, especially in passenger vehicles and light-duty trucks.

Integration with Variable Valve Timing (VVT) Systems

The widespread adoption of Variable Valve Timing (VVT) and advanced valvetrain technologies is driving innovation in lifter design. Hydraulic roller lifters and finger followers are being increasingly integrated into VVT systems to enable precise control of valve lift and timing. By 2026, demand for lifters compatible with electronically controlled VVT systems is expected to grow significantly, especially in Asia-Pacific and North America, where automakers are focused on optimizing engine efficiency and reducing carbon footprints.

Electrification Impact and ICE Resilience

While the rise of electric vehicles (EVs) is reducing the long-term reliance on internal combustion engines, the transition will be gradual. Through 2026, ICE vehicles—particularly hybrids and performance-oriented models—will continue to dominate certain segments. This ensures sustained demand for high-performance rocker arms and lifters. Additionally, emerging markets with growing vehicle ownership and less EV infrastructure will maintain strong ICE demand, supporting continued investment in valvetrain components.

Growth in Aftermarket and Replacement Demand

The global aftermarket for rocker arms and lifters is anticipated to expand by 2026, fueled by aging vehicle fleets and increased maintenance cycles. As vehicles accumulate mileage, wear on valvetrain components necessitates replacement, creating opportunities for OEMs and aftermarket suppliers. Regions like Latin America, Africa, and parts of Southeast Asia are expected to see robust aftermarket growth due to extended vehicle lifespans and cost-conscious consumers opting for repairs over replacements.

Regional Market Dynamics

North America and Europe will remain key markets due to the presence of established automotive manufacturers and stringent emission norms pushing for engine optimization. Meanwhile, the Asia-Pacific region—led by China, India, and Japan—is expected to witness the highest growth rate, driven by rising automotive production, urbanization, and government support for efficient engine technologies.

Technological Advancements and Automation in Manufacturing

By 2026, advanced manufacturing techniques such as precision forging, CNC machining, and automated quality control systems will enhance production efficiency and component consistency. Digital twin technology and AI-driven predictive maintenance in manufacturing plants are expected to reduce defects and improve lifespan, meeting the automotive industry’s demand for reliability and performance.

Conclusion

The rocker arms and lifters market in 2026 will be characterized by innovation, material advancements, and adaptation to regulatory and technological shifts. While electrification poses a long-term challenge, the continued relevance of ICEs—especially in hybrids and emerging economies—ensures robust demand. Companies that invest in lightweight materials, compatibility with advanced valvetrain systems, and efficient manufacturing will be best positioned to capitalize on these evolving trends.

Common Pitfalls Sourcing Rocker Arms and Lifters: Quality and Intellectual Property Concerns

Sourcing rocker arms and lifters—critical components in internal combustion engines—requires careful attention to both quality and intellectual property (IP) risks. Overlooking these factors can lead to performance issues, engine failure, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Material Quality and Manufacturing Tolerances

Low-cost suppliers may use substandard materials or inadequate heat treatment processes, resulting in premature wear, cracking, or deformation under high stress and temperature. Inconsistent machining tolerances can cause improper valve timing, reduced engine efficiency, and increased noise. Always verify material certifications (e.g., ASTM, SAE) and insist on dimensional inspection reports and quality control documentation.

Inadequate Surface Finishes and Coatings

Rocker arms and lifters rely on precise surface finishes to minimize friction and resist wear. Poorly finished components or missing anti-friction coatings (e.g., DLC, PTFE, or phosphate coatings) accelerate wear and increase the risk of scuffing or galling. Ensure suppliers specify surface roughness (Ra values) and coating specifications, and validate performance through independent testing.

Lack of Traceability and Certification

Reputable OEMs and Tier 1 suppliers require full traceability for engine components. Sourcing from suppliers without lot tracking, material test reports, or ISO/TS 16949 (or IATF 16949) certification increases the risk of receiving counterfeit or non-conforming parts. Always demand full documentation and audit supplier quality systems before placing orders.

Intellectual Property Infringement Risks

Many high-performance rocker arms and lifters are protected by design patents, utility models, or trade secrets. Sourcing generic or “compatible” versions from unlicensed manufacturers may infringe on IP rights, exposing your company to legal action, product seizures, or costly litigation. Conduct due diligence to ensure parts are either licensed, in the public domain, or designed independently without copying protected features.

Counterfeit or Reverse-Engineered Components

The aftermarket is rife with counterfeit parts that mimic OEM designs but fail to meet performance standards. These may be reverse-engineered without proper validation, leading to reliability issues. Verify supplier authenticity through direct OEM partnerships or authorized distributors, and avoid unusually low prices that may signal IP or quality violations.

Inconsistent Performance and Durability Testing

Reliable rocker arms and lifters undergo rigorous testing (e.g., cycle testing, load testing, fatigue analysis). Suppliers that skip or falsify test data pose a significant risk. Require access to test reports, including duration and results of endurance and stress tests, and consider third-party validation for critical applications.

Non-Compliance with OEM Specifications

Even if a part fits, it may not meet OEM performance criteria for hardness, geometry, or dynamic behavior. Using non-OEM-compliant parts can void warranties and lead to engine failure. Always cross-reference part specifications with OEM service manuals and validate compliance before integration.

By addressing these quality and IP pitfalls proactively, companies can ensure the reliability, legality, and performance of sourced rocker arms and lifters while protecting their supply chain integrity.

Logistics & Compliance Guide for Rocker Arms and Lifters

This guide provides essential information for the safe, efficient, and compliant handling, transportation, and documentation of rocker arms and lifters—critical engine components used in automotive and industrial applications.

Product Classification and HS Codes

Rocker arms and lifters are typically classified under Harmonized System (HS) codes related to engine parts. Common classifications include:

- 8409 91 90: Parts suitable for use solely or principally with internal combustion piston engines, for engines of heading 8407 or 8408 – Other – Other.

- 8483 40 90: Transmission shafts (including camshafts and crankshafts) and cranks, bearing boxes, pulleys, and gears – Other.

- 8483 60 90: Other engine parts, including valves, tappets, and rocker arms.

Note: HS code accuracy depends on material composition, design, and end-use. Verify with local customs authorities or a licensed customs broker to ensure proper classification and avoid delays or penalties.

Packaging and Handling Requirements

Proper packaging is critical to prevent damage during transit and ensure compliance with carrier and import regulations.

- Material Protection: Package parts in anti-corrosion materials (e.g., VCI paper or rust-inhibiting coatings) to prevent oxidation.

- Secure Packaging: Use rigid containers (corrugated boxes or wooden crates) with foam inserts or dividers to prevent movement and surface damage.

- Labeling: Clearly label packages with:

- Product name (e.g., “Hydraulic Lifters – Do Not Drop”)

- Net and gross weight

- Handling instructions (e.g., “Fragile,” “This Side Up”)

- Lot or serial numbers for traceability

- Hazardous Materials: Standard rocker arms and lifters are generally non-hazardous. However, if shipped with lubricants or cleaning agents, ensure compliance with IATA/IMDG regulations.

Transportation Regulations

Ensure compliance with domestic and international shipping standards.

- Freight Class (NMFC): Classify shipments based on density, dimensions, and handling. Typical freight class for engine components ranges from 70–92.

- International Shipping: For air freight, comply with IATA Dangerous Goods Regulations (if applicable). For ocean freight, follow IMDG Code requirements.

- Temperature & Environment: Avoid exposure to extreme temperatures and humidity during transport to prevent dimensional changes or corrosion.

Import/Export Documentation

Accurate documentation is essential for customs clearance.

- Commercial Invoice: Must include detailed product description, HS code, country of origin, unit price, total value, and terms of sale (e.g., FOB, DDP).

- Packing List: Itemize contents per package, including weights and dimensions.

- Certificate of Origin: Required by some countries to determine tariff eligibility (e.g., under USMCA, EU trade agreements).

- Bill of Lading (BOL) or Air Waybill (AWB): Legal receipt of goods and contract of carriage.

- Export Declarations: Required for shipments above certain value thresholds (e.g., AES filing for U.S. exports over $2,500).

Regulatory Compliance

Adhere to regional and international regulatory standards.

- RoHS/REACH (EU): Ensure materials comply with restrictions on hazardous substances. Most steel and iron-based components are typically compliant, but verify coatings and lubricants.

- EPA & CARB (USA): While rocker arms and lifters are not emission-controlled parts themselves, ensure they meet specifications for use in certified engines.

- ITAR/EAR (USA): Generally not applicable, unless components are designed for military or aerospace applications. Verify if export controls apply.

- Country-Specific Standards: Some markets (e.g., China, India) may require BIS, CCC, or other certifications for automotive parts.

Quality and Traceability

Maintain documentation to support quality assurance and recalls, if necessary.

- Batch/Serial Tracking: Assign unique identifiers to batches or units for traceability.

- Quality Certifications: Provide ISO 9001 or IATF 16949 certificates upon request.

- Inspection Reports: Include material test reports (MTRs) or conformity certificates when required by customers or regulators.

Storage and Inventory Management

Optimize warehouse practices to maintain product integrity.

- Environment: Store in dry, temperature-controlled areas to prevent rust and contamination.

- Shelf Life: While metal components have long shelf lives, monitor for corrosion, especially if stored with residual oils or in high-humidity areas.

- Inventory Rotation: Use FIFO (First In, First Out) to manage stock and prevent obsolescence.

Returns and Reverse Logistics

Establish clear procedures for handling returns.

- Defective Goods: Inspect returned items for damage, wear, or misuse. Document findings for warranty claims.

- Packaging Requirements: Require original or equivalent protective packaging for returns.

- Compliance with Import Rules: Returned goods may require customs processing; use a Returned Goods Authorization (RGA) system to track and manage.

Summary

Compliance and efficient logistics for rocker arms and lifters require attention to classification, packaging, documentation, and regulatory standards. Partnering with experienced freight forwarders and customs brokers, maintaining accurate records, and implementing quality controls will ensure smooth global distribution and customer satisfaction.

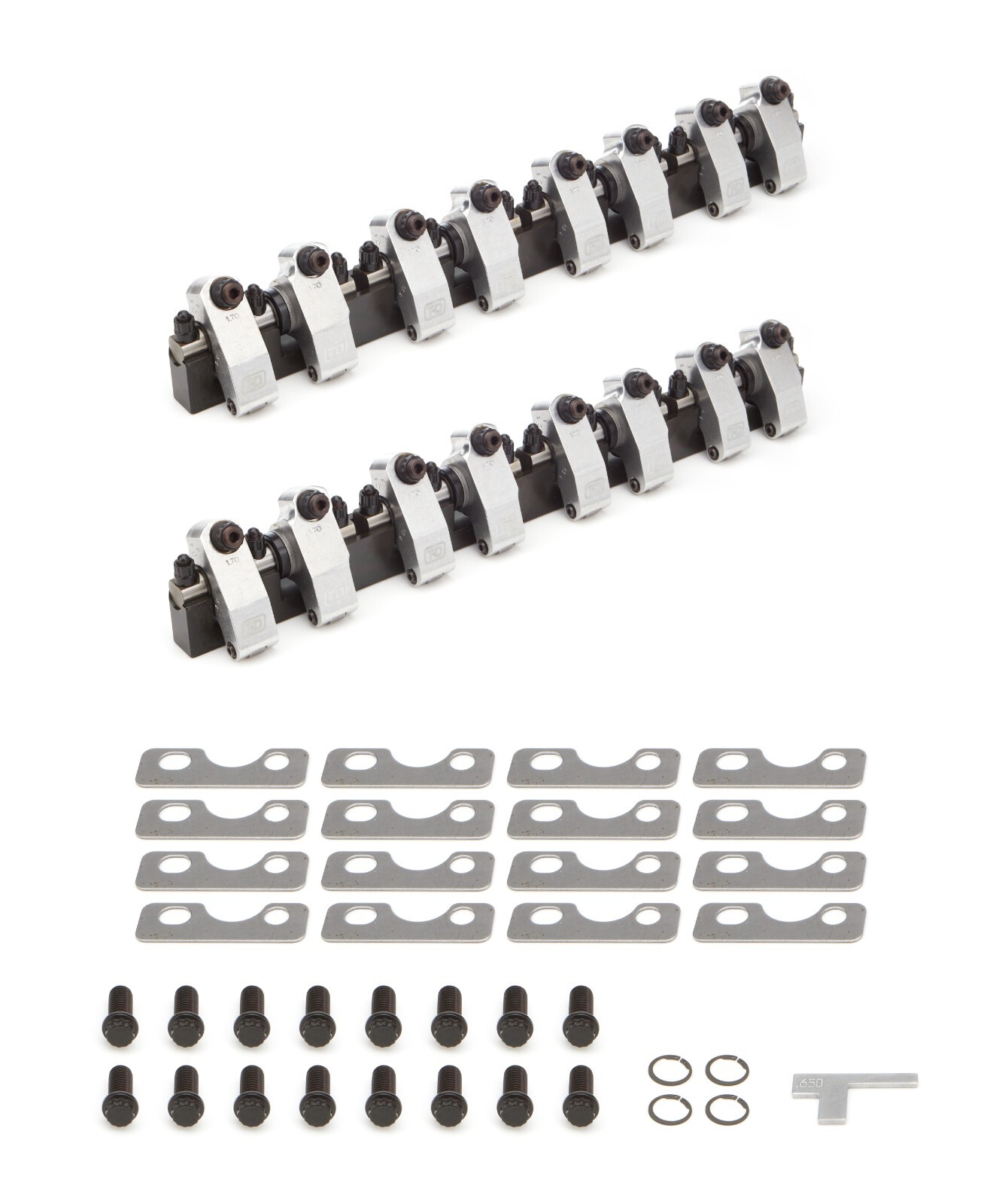

In conclusion, sourcing rocker arms and lifters requires careful consideration of engine specifications, material quality, compatibility, and performance requirements. Whether for stock replacement, high-performance builds, or restoration projects, selecting components from reputable manufacturers ensures reliability, durability, and optimal valve train operation. Evaluating factors such as material composition (e.g., stamped steel, forged, or roller lifters), lift ratio, weight, and application-specific design will contribute to improved engine efficiency and longevity. Additionally, verifying supplier credibility, availability, and cost-effectiveness supports a successful procurement process. Ultimately, investing time in sourcing the right rocker arms and lifters pays dividends in engine performance, reduced maintenance, and overall drivability.