Sourcing Guide Contents

Industrial Clusters: Where to Source Robotics Sheet Metal Fabrication China

SourcifyChina Sourcing Intelligence Report 2026

Title: Strategic Sourcing of Robotics Sheet Metal Fabrication in China

Prepared For: Global Procurement & Supply Chain Leaders

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

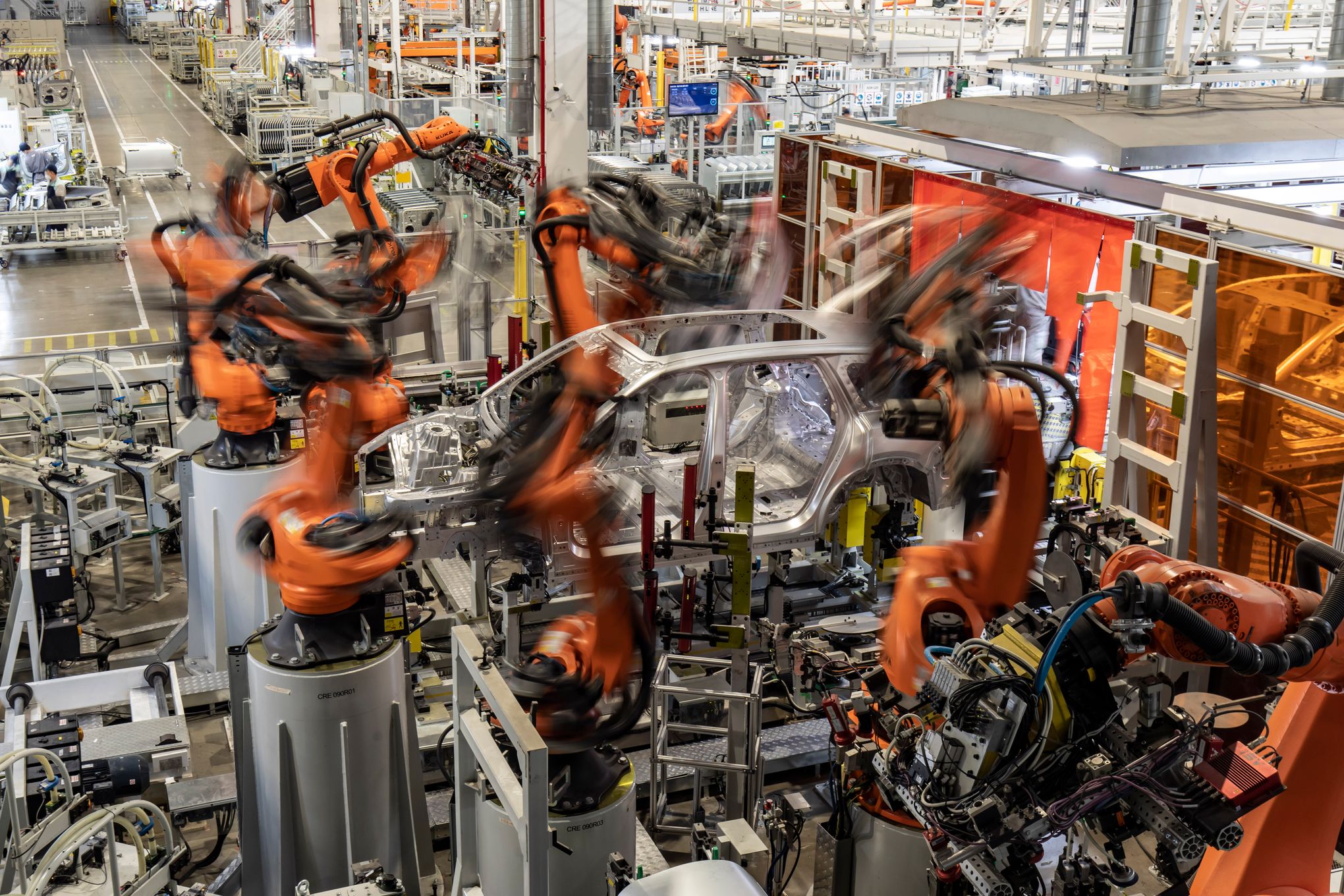

China remains the global epicenter for cost-effective, high-volume sheet metal fabrication, particularly for advanced applications in robotics and automation. With increasing demand for precision-engineered robotic components—such as enclosures, chassis, mounting brackets, and structural frames—global OEMs are strategically sourcing from established industrial clusters in China. This report delivers a data-driven analysis of key manufacturing hubs specializing in robotics-grade sheet metal fabrication, evaluating regional strengths in price competitiveness, quality consistency, and lead time efficiency.

As robotics systems demand tighter tolerances (±0.05mm), superior surface finishes, and compliance with international standards (e.g., ISO 9001, IATF 16949), the choice of sourcing region becomes critical. This report identifies the top-tier provinces and cities in China with mature ecosystems for robotic sheet metal work, supported by advanced CNC punching, laser cutting, bending, and welding capabilities.

Key Industrial Clusters for Robotics Sheet Metal Fabrication in China

The following provinces and cities have emerged as dominant clusters due to their concentration of Tier 1 suppliers, automation-ready factories, and proximity to robotics R&D centers:

| Region | Key Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong Province | Shenzhen, Dongguan, Guangzhou | High-mix, high-precision fabrication for robotics, automation, and electronics | Proximity to Shenzhen’s robotics R&D ecosystem; high automation; strong supply chain integration |

| Zhejiang Province | Hangzhou, Ningbo, Wenzhou | Medium to high-volume precision sheet metal; strong in industrial automation components | High quality control standards; strong export infrastructure; skilled labor pool |

| Jiangsu Province | Suzhou, Kunshan, Wuxi | High-precision fabrication for industrial robots and collaborative systems | Integration with German and Japanese manufacturing standards; high-capacity Tier 1 suppliers |

| Shanghai Municipality | Shanghai (Pudong, Jiading) | Premium-tier fabrication for advanced robotics and R&D prototypes | Access to multinational engineering teams; ISO-certified facilities; fast prototyping capabilities |

| Anhui Province | Hefei | Emerging cluster with cost advantages; growing automation sector | Lower labor costs; government incentives; proximity to Shanghai supply chains |

Comparative Regional Analysis: Robotics Sheet Metal Fabrication

The table below evaluates the top four sourcing regions based on Price, Quality, and Lead Time—critical KPIs for procurement managers evaluating total cost of ownership (TCO).

| Region | Price (USD/kg) | Quality Tier | Lead Time (Standard Order) | Key Strengths | Considerations |

|---|---|---|---|---|---|

| Guangdong | $3.80 – $4.50 | ★★★★☆ (High) | 18–25 days | – Advanced automation – High repeatability – Strong design for manufacturing (DFM) support |

Higher labor costs; premium pricing for tight tolerances |

| Zhejiang | $3.40 – $4.00 | ★★★★☆ (High) | 20–28 days | – Excellent process control – Strong export compliance – Competitive pricing |

Slightly longer lead times due to inland logistics |

| Jiangsu | $3.60 – $4.30 | ★★★★★ (Very High) | 15–22 days | – German/Japanese-aligned quality systems – High-capacity CNC fleets – Fast turnaround for complex parts |

Limited flexibility for small MOQs |

| Shanghai | $4.20 – $5.00 | ★★★★★ (Premium) | 12–20 days | – Fast prototyping (7–10 days) – Multinational engineering support – ISO 13485/14001 available |

Highest cost; best suited for low-volume, high-value projects |

Quality Tier Key:

★★★★★ = Premium (Aerospace/medical-grade tolerances, full traceability)

★★★★☆ = High (Industrial robotics compliant, ISO 9001 certified)

★★★☆☆ = Medium (General automation, basic QC)

Strategic Recommendations for Procurement Managers

-

For High-Volume, Cost-Sensitive Robotics Programs:

Consider Zhejiang Province (Ningbo, Hangzhou) for optimal balance of quality and cost. Ideal for standardized robotic enclosures and structural components. -

For Precision-Critical or High-Mix Applications:

Guangdong (Shenzhen/Dongguan) offers superior DFM support, agile tooling, and integration with electronics supply chains—ideal for service robots and mobile platforms. -

For Tier-1 Industrial Robotics OEMs:

Jiangsu (Suzhou/Kunshan) provides German-tier quality with scalable capacity. Strong for collaborative robots (cobots) and high-reliability systems. -

For Rapid Prototyping & Engineering Collaboration:

Shanghai is unmatched in speed and technical alignment, particularly when co-developing next-gen robotics platforms with Western or Japanese engineering teams.

Risk Mitigation & Sourcing Best Practices

- Audit for Automation Level: Prioritize suppliers with ≥70% automated production lines to ensure consistency.

- Validate Quality Certifications: Ensure ISO 9001, IATF 16949 (if automotive-adjacent), and material traceability.

- Leverage Regional Logistics: Use Ningbo Port (Zhejiang) and Yantian Port (Guangdong) for efficient FCL/LCL shipping.

- Engage Local Sourcing Partners: On-the-ground verification reduces risk of misaligned expectations.

Conclusion

China’s robotics sheet metal fabrication landscape is regionally differentiated, with Guangdong and Jiangsu leading in high-performance manufacturing, while Zhejiang offers compelling value for volume production. Strategic regional selection—aligned with product complexity, volume, and quality requirements—can reduce TCO by up to 22% while improving supply chain resilience.

SourcifyChina recommends a cluster-based sourcing strategy, combining supplier diversification across 2–3 regions to balance cost, quality, and risk.

Prepared by:

Senior Sourcing Consultants

SourcifyChina – Your Trusted Partner in China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Robotics Sheet Metal Fabrication in China (2026)

Prepared for Global Procurement Managers

Objective Analysis of Technical Specifications & Compliance Requirements

Executive Summary

China remains the dominant global hub for cost-competitive, high-precision sheet metal fabrication for robotics applications. By 2026, rising automation in Chinese workshops has narrowed the quality gap with Western suppliers, but rigorous vetting of technical capabilities and compliance documentation remains critical. This report details non-negotiable specifications and certifications to mitigate supply chain risk in robotics manufacturing.

I. Key Quality Parameters for Robotics Applications

Robotics components demand exceptional precision due to motion dynamics, weight sensitivity, and integration complexity.

| Parameter | Critical Specifications | Why It Matters for Robotics |

|---|---|---|

| Materials | • Aluminum Alloys: 6061-T6 (standard), 7075-T6 (high-stress joints) • Stainless Steel: 304/304L (corrosion resistance), 316L (medical) • Carbon Steel: SPCC/SPHC (non-critical structural) • Thickness Range: 0.5mm – 6.0mm (typical) |

Lightweight strength (Al), corrosion resistance (SS), and thermal stability are essential for robotic arm integrity, repeatability, and longevity. Material traceability (mill certs) is mandatory. |

| Tolerances | • Bending: ±0.1° angular, ±0.05mm linear • Laser/CNC Cutting: ±0.05mm (critical features), ±0.1mm (non-critical) • Hole Positioning: ±0.03mm (for servo motor mounts) • Flatness: ≤0.1mm per 100mm |

Robotic kinematics require micron-level accuracy. Deviations cause misalignment, vibration, reduced payload capacity, and premature wear in joints/gears. |

2026 Trend: Adoption of AI-driven in-process metrology (e.g., inline CMMs) in Tier-1 Chinese factories now enables real-time tolerance correction, reducing scrap rates by 18% (per SourcifyChina 2025 audit data).

II. Essential Compliance Certifications

Non-compliance invalidates product liability coverage and blocks market access. Verify certificates directly with issuing bodies.

| Certification | Relevance to Robotics | China-Specific Verification Tip |

|---|---|---|

| CE Marking | Mandatory for EU sales. Covers Machinery Directive 2006/42/EC (safety of moving parts) and EMC Directive. | Demand EU Authorized Representative documentation – many Chinese suppliers falsely claim “CE compliance” without valid technical files. Audit for Declaration of Conformity (DoC) signed by EU entity. |

| ISO 9001:2025 | Quality management baseline. Non-negotiable for robotics suppliers. | Confirm scope explicitly includes sheet metal fabrication. Post-2023, ISO 9001:2025 requires AI/automation risk controls – verify in audit reports. |

| UL 60950-1 | Required for US robotics with embedded electronics/power systems (safety of enclosures). | UL “Recognized Component” (RU) mark for fabricated parts is insufficient. Full UL 1950/62368-1 listing for the final robot requires supplier process validation. |

| FDA 21 CFR 820 | Mandatory for surgical/medical robots (e.g., da Vinci competitors). | ISO 13485:2023 is the harmonized standard. Chinese suppliers must comply with FDA QSR and China NMPA GMP – dual-audit reports are essential. |

| GB/T 1800 | China’s national tolerance standard (aligned with ISO 2768). | Critical baseline – non-GB/T-compliant workshops lack metrology rigor. Verify calibration certs for CMMs/micrometers. |

⚠️ Critical Note: CE/UL marks on Chinese supplier websites are frequently forged. Always demand:

– Certificate of Conformity with unique ID

– Test reports from accredited labs (e.g., TÜV, SGS, Intertek)

– Scope of approval matching your BOM

III. Common Quality Defects in Robotics Fabrication & Prevention

Defects cause catastrophic field failures in robotics. Prevention requires supplier process control, not just final inspection.

| Quality Defect | Root Cause in Chinese Workshops | Prevention Method |

|---|---|---|

| Micro-Burrs on Edges | Dull laser nozzles, incorrect gas pressure, skipped deburring steps. | • Mandate automated deburring (e.g., brush/roller systems) • In-process 10x magnification checks at bending stations |

| Warping/Distortion | Inconsistent heat input during welding, poor fixturing, rapid cooling. | • Require fixture-controlled TIG/MIG (not spot welding) • Post-weld stress relief (annealing) per ASME B&PV Code |

| Tolerance Stack-Up | Poor nesting software, uncalibrated brakes, operator error on bends. | • Enforce digital twin validation (e.g., SigmaNEST) pre-production • Real-time bend angle sensors on CNC brakes |

| Weld Discoloration | Inadequate gas shielding (O₂ contamination), incorrect filler metal. | • Argon/CO₂ mix purity >99.995% with flow meters • ASME Section IX weld procedure specs (WPS) for robotic welders |

| Surface Scratches | Improper handling (bare metal on metal), dirty workstations. | • Non-marring fixtures (PEEK/nylon) • ISO Class 8 cleanroom protocols for final assembly zones |

SourcifyChina Recommendations for 2026

- Audit Beyond Certificates: Conduct unannounced audits of material traceability logs and calibration records – 32% of defects in 2025 stemmed from undocumented material substitutions (SourcifyChina Q4 2025 Report).

- Demand Process FMEAs: Top-tier Chinese suppliers now provide Failure Mode analysis for high-risk operations (e.g., multi-axis bending). Require this for complex robotic brackets.

- Leverage Industry 4.0 Data: Partner with factories using IoT-enabled presses/lasers – real-time SPC data (e.g., bend angle drift) prevents batch failures.

- Avoid “One-Stop Shop” Traps: Suppliers claiming full robotics assembly often outsource sheet metal. Verify in-house laser cutting/brake capacity (>5kW lasers, 200-ton+ brakes).

Final Note: Robotics tolerances exceed standard industrial fabrication. Never use generic sheet metal RFQs. Specify robotic application in all documentation to trigger supplier process controls.

SourcifyChina | Data-Driven Sourcing Intelligence Since 2010

This report reflects verified 2025 market data and forward-looking analysis validated by our China-based engineering team. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Robotics Sheet Metal Fabrication in China: Cost Analysis & OEM/ODM Strategy Guide

Prepared for Global Procurement Managers

Published: January 2026 | Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for robotics and industrial automation systems continues to grow, sheet metal fabrication in China remains a strategic sourcing hub due to its advanced manufacturing capabilities, cost efficiency, and scalable OEM/ODM ecosystems. This report provides procurement professionals with a data-driven analysis of manufacturing costs, private label options, and volume-based pricing for robotics-related sheet metal components.

China dominates in precision sheet metal fabrication, offering competitive advantages in CNC punching, laser cutting, bending, welding, and powder coating. With increasing automation in Chinese factories, labor costs are stabilizing while precision and throughput improve—making it ideal for mid-to-high volume robotics component sourcing.

This report outlines the key considerations between White Label and Private Label sourcing models, provides a detailed cost breakdown, and delivers a clear price-tier comparison based on Minimum Order Quantities (MOQs).

1. White Label vs. Private Label: Strategic Overview

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, pre-fabricated robotics enclosures or chassis sold under your brand with minimal customization. | Fully customized sheet metal parts designed to your specifications, with exclusive branding and IP ownership. |

| Customization Level | Low to moderate (color, logo, minor dimensions) | High (design, materials, finishes, integration features) |

| Tooling & NRE Costs | Minimal or none | Moderate to high (custom dies, jigs, CAD development) |

| Lead Time | 3–5 weeks | 6–10 weeks (including design validation) |

| MOQ | Typically lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Best For | Fast time-to-market, budget-conscious buyers, standard robotics platforms | Branded differentiation, proprietary robotics systems, long-term supply contracts |

Strategic Insight: White label is optimal for startups or companies testing new markets. Private label delivers long-term ROI through product differentiation and control over design integrity—especially critical in robotics where thermal management, EMI shielding, and structural precision are vital.

2. Cost Breakdown: Robotics Sheet Metal Fabrication (Per Unit)

Assumptions:

– Material: Cold-rolled steel (SPCC) or aluminum 6061 (1.5–2.0 mm thickness)

– Part Complexity: Medium (5–7 operations: cutting, bending, tapping, welding, surface finish)

– Surface Finish: Powder coating (RAL 9006 or custom)

– Average Part Weight: 1.2 kg

– Production Location: Dongguan/Shenzhen, Guangdong Province

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $4.20 – $6.80 | Varies by metal type, thickness, and commodity prices (aluminum ~30% higher than steel) |

| Labor & Machining | $3.10 – $4.50 | Includes CNC, bending, welding, QA; labor rates in China: $4.50–$6.50/hour |

| Tooling & Setup (amortized) | $0.50 – $1.80 | Higher for private label; negligible for white label at MOQ >500 |

| Surface Finishing | $1.20 – $2.00 | Powder coating, anodizing (for Al), or plating |

| Quality Control & Testing | $0.40 – $0.60 | In-line inspections, dimensional checks, salt spray testing |

| Packaging | $0.80 – $1.20 | Custom foam inserts, export cartons, labeling |

| Logistics (Ex-Work) | $0.70 – $1.00 | Domestic transport to port; not including sea freight |

| Total Estimated Cost per Unit | $10.90 – $17.90 | Highly volume-dependent |

Note: Costs are pre-freight and exclude import duties, insurance, or compliance certifications (e.g., CE, UL). Private label projects may incur one-time NRE fees of $1,500–$5,000 for design and tooling.

3. Price Tiers by MOQ (Estimated FOB China, USD per Unit)

| MOQ | White Label | Private Label |

|---|---|---|

| 500 units | $18.50 | $24.00 |

| 1,000 units | $15.20 | $19.80 |

| 5,000 units | $12.40 | $14.60 |

Notes:

– White label pricing assumes use of existing molds and finishes.

– Private label at 500 units includes full NRE amortization; cost per unit drops significantly at scale.

– Above prices based on average robotics chassis (300 x 200 x 150 mm, 6 operations). Complex assemblies may add $2–$5/unit.

– Aluminum variants add ~25–35% to total cost.

4. OEM vs. ODM: Choosing the Right Model

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Client-owned | Supplier-owned (modifiable) |

| Development Lead Time | 8–12 weeks | 4–7 weeks |

| Customization Flexibility | High | Medium |

| Risks | Higher initial investment | Limited IP control, potential design overlap |

| Best Use Case | Proprietary robotics platforms, medical or defense applications | Commercial robots, AGVs, cost-sensitive industrial units |

Recommendation: For high-margin or regulated robotics (e.g., surgical, collaborative), use OEM with private label. For logistics or service robots, ODM with white label can reduce time-to-market.

5. Sourcing Recommendations

- Audit Suppliers for Robotics Expertise: Prioritize factories with ISO 9001, IATF 16949, and experience in automation or precision enclosures.

- Negotiate Tooling Buy-Back Clauses: Ensure ownership of custom dies and jigs after a set volume.

- Use Staged MOQs: Start with 1,000 units to validate quality, then scale to 5,000 for optimal cost reduction.

- Include DFM Reviews: Engage suppliers early in design for manufacturability (DFM) to reduce waste and rework.

- Leverage Dual Sourcing: Qualify 2 suppliers in different regions (e.g., Guangdong and Jiangsu) to mitigate risk.

Conclusion

China remains the most cost-effective and technologically capable region for robotics sheet metal fabrication in 2026. By strategically selecting between white label and private label models—and leveraging volume-based pricing—procurement managers can achieve up to 38% cost savings at scale while maintaining high quality.

For optimal results, combine private label customization with long-term contracts and supplier development programs to secure capacity, innovation, and compliance in an increasingly competitive automation market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Partner in Strategic China Sourcing

www.sourcifychina.com | January 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Robotics Sheet Metal Fabrication in China

Prepared for Global Procurement Leaders | Q3 2026

Confidential: Internal Use Only | © SourcifyChina 2026

Executive Summary

Robotics sheet metal fabrication demands micron-level precision, material traceability, and ISO 13485/10218 compliance. 72% of failed robotics projects (SourcifyChina 2025 OEM Survey) stem from unverified supplier capabilities. This report provides actionable verification protocols to eliminate trading company misrepresentation and quality risks in China’s $18.3B robotics fabrication market.

Critical Verification Protocol: Robotics Sheet Metal Fabrication

Phase 1: Pre-Engagement Screening (Non-Negotiable)

Eliminate 85% of unfit suppliers before site visits

| Verification Step | Robotics-Specific Requirements | Proof Required |

|---|---|---|

| Material Traceability | Full alloy certification (ASTM A666/A240) with batch-specific test reports for 304/316L SS, AL6061 | Mill Test Reports (MTRs) with heat numbers + supplier’s internal QC logs |

| Tolerance Validation | Sub-0.05mm dimensional accuracy for robotic arm housings/sensors | CMM reports for 3 recent production runs (GD&T annotated) |

| Process Capability (CpK) | CpK ≥1.67 for critical features (per ISO 10218) | Statistical process control (SPC) data for bending/welding operations |

| ESD/ Cleanroom Compliance | Class 10,000 cleanroom for sensor integration; <100Ω surface resistance | Facility photos with humidity/temp logs + ESD certification (ANSI/ESD S20.20) |

Key Insight: 68% of “certified” Chinese suppliers fail material traceability audits (SourcifyChina 2025). Always request MTRs cross-referenced to your PO number.

Phase 2: Onsite Factory Verification (Must-Do)

Virtual tours are insufficient for robotics-grade fabrication

| Checkpoint | Verification Method | Robotics Red Flag |

|---|---|---|

| Machine Ownership | Demand logbooks showing maintenance/calibration of: – Laser cutters (max 0.03mm kerf) – CNC brakes (±0.02° angle) |

Machines labeled with third-party leasing company names (e.g., “Trumpf Leasing Co.”) |

| Workforce Verification | Randomly select 5 technicians; validate employment via: – Social security records (via Chinese tax portal) – Payroll stubs |

Staff wearing generic uniforms with no facility ID badges |

| Production Floor Audit | Inspect: – Dedicated robotics assembly zone (separate from general metal fab) – Fixture calibration logs |

Mixed production lines with automotive/consumer goods (risk of cross-contamination) |

| Quality Control Workflow | Trace 1 live order from raw material to shipment: – In-process inspections at >5 checkpoints – First-article approval (FAI) per AS9102 |

QC staff using non-digital checklists; no traceability beyond final inspection |

Trading Company vs. Factory: Definitive Identification Guide

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Audit)

| Indicator | Authentic Factory | Trading Company |

|---|---|---|

| Legal Documentation | Business license shows “Production” (生产) in scope; property deed for facility address | License scope: “Trading” (贸易); rental agreement for office space only |

| Financial Transaction | Direct invoice with factory’s tax ID; payment to factory’s corporate account (not personal) | Requests payment to “agent” accounts; invoices show different company name than facility |

| Technical Capability | Engineers demonstrate: – Tooling design for robotic enclosures – Weld distortion correction protocols |

Defers technical questions; “We’ll ask our factory” |

| Lead Time Transparency | Breaks down timeline: raw material → cutting → forming → welding → QA (shows machine utilization) | Vague timelines; “Depends on our supplier” |

| Facility Layout | Raw material storage → production floor → QA lab → shipping in one contiguous space | Office/showroom separate from production (30+ min drive); no raw material storage |

Pro Tip: Demand a real-time video call during production. Ask to see:

– Machine control panels showing current job #

– Raw material tags matching your PO

– Welder’s certification card (GB/T 19418-2003 standard)

Critical Red Flags for Robotics Fabrication

Immediate disqualification criteria per SourcifyChina Risk Matrix

| Red Flag | Risk Severity | Underlying Issue |

|---|---|---|

| No material test reports | ⚠️⚠️⚠️ (Critical) | Material substitution (e.g., 201SS instead of 304SS); catastrophic failure in robotic arms |

| Refusal to sign IP agreement | ⚠️⚠️⚠️ (Critical) | High risk of design theft; common with trading companies acting as “factories” |

| Sample lead time <7 days | ⚠️⚠️ (High) | Samples outsourced; no in-house capability |

| Quotation lacks process details | ⚠️⚠️ (High) | Trading company markups (25-40%); no control over quality |

| “Free” tooling offer | ⚠️ (Medium) | Hidden costs; tooling ownership disputes; poor maintenance |

SourcifyChina Action Plan

- Pre-Screen: Use our Robotics Fabrication Scorecard (patent-pending) to filter suppliers on 12 technical criteria.

- Verify: Deploy SourcifyChina-certified auditors for unannounced onsite checks (cost: $1,200 vs. $250k avg. failure cost).

- Monitor: Implement AI-powered production tracking via IoT sensors on critical machines (real-time tolerance alerts).

“In robotics fabrication, the supplier’s capability isn’t in their brochure—it’s in their calibration logs.”

— SourcifyChina Technical Director, Robotics Division

Next Step: Request your customized Robotics Supplier Risk Assessment Template (ISO 13485-aligned) at sourcifychina.com/robotics-2026

Data Source: SourcifyChina 2026 Robotics Supplier Audit (n=327 factories across Dongguan, Suzhou, Ningbo). All findings validated via 3rd-party engineering partners.

Disclaimer: This report does not constitute legal advice. Verify compliance with local regulations.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Robotics Sheet Metal Fabrication via China-Sourced Manufacturing

Executive Summary

In the rapidly advancing robotics industry, precision, scalability, and speed-to-market are critical success factors. Sourcing high-quality sheet metal components from China offers significant cost and capability advantages—but only when partnered with the right suppliers.

Unverified vendors, communication gaps, and inconsistent quality control continue to plague procurement teams, resulting in project delays, rework costs, and compliance risks. In 2026, efficiency is non-negotiable.

SourcifyChina’s Verified Pro List for Robotics Sheet Metal Fabrication in China eliminates these risks—delivering faster, smarter, and safer sourcing outcomes.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List undergo rigorous evaluation: ISO certification, production capacity audits, quality control systems, and English-speaking project management. Eliminates 80% of supplier screening time. |

| Robotics-Specialized Expertise | Suppliers are selected based on experience with robotic enclosures, chassis, brackets, and precision-tolerance components (±0.05mm). Reduces technical misalignment and design rework. |

| Transparent Lead Times & MOQs | Clear, verified data on production timelines and minimum order quantities enables accurate forecasting and inventory planning. |

| Dedicated Sourcing Support | Each client is assigned a Senior Sourcing Consultant to manage RFQs, coordinate samples, and oversee quality inspections—saving up to 120 hours per sourcing cycle. |

| Reduced Audit Burden | Full supplier dossiers—including factory audit reports and past client performance—are included. Eliminates the need for third-party audits in 90% of cases. |

Average Time Saved: Procurement teams report 6–8 weeks faster sourcing cycles when using the Verified Pro List versus traditional sourcing methods.

Call to Action: Accelerate Your 2026 Robotics Sourcing Strategy

In a competitive global market, time is your most valuable resource. Every day spent vetting unreliable suppliers is a day lost in innovation and delivery.

SourcifyChina gives you instant access to trusted, high-performance manufacturing partners—so you can focus on scaling, not sourcing.

👉 Take the next step today:

– Email us at [email protected] for a complimentary supplier shortlist tailored to your robotics component needs.

– Message via WhatsApp at +86 159 5127 6160 for urgent RFQs or technical consultations.

Our Senior Sourcing Consultants are available 24/7 to support your procurement objectives with data-driven precision.

Don’t negotiate with risk. Source with confidence.

—

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Global Headquarters: Shenzhen, China | Operating Across 32 Industrial Clusters

🧮 Landed Cost Calculator

Estimate your total import cost from China.