The global ripper tool market is experiencing steady growth, driven by rising demand from the construction, mining, and agriculture sectors for efficient soil-loosening equipment. According to Grand View Research, the global ground engaging tools (GET) market—of which ripper tools are a critical component—was valued at USD 8.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increasing infrastructure development, especially in emerging economies, and the ongoing need to enhance the durability and performance of heavy equipment attachments. Mordor Intelligence also highlights a CAGR of approximately 5.3% for the GET market through 2028, citing advancements in wear-resistant materials and the integration of smart monitoring systems in ripper assemblies. Against this backdrop, manufacturers that prioritize innovation, material quality, and application-specific design are emerging as leaders in the ripper tool sector. The following list highlights the top 9 ripper tool manufacturers shaping the industry through technological advancement, global reach, and strong performance metrics.

Top 9 Ripper Tool Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

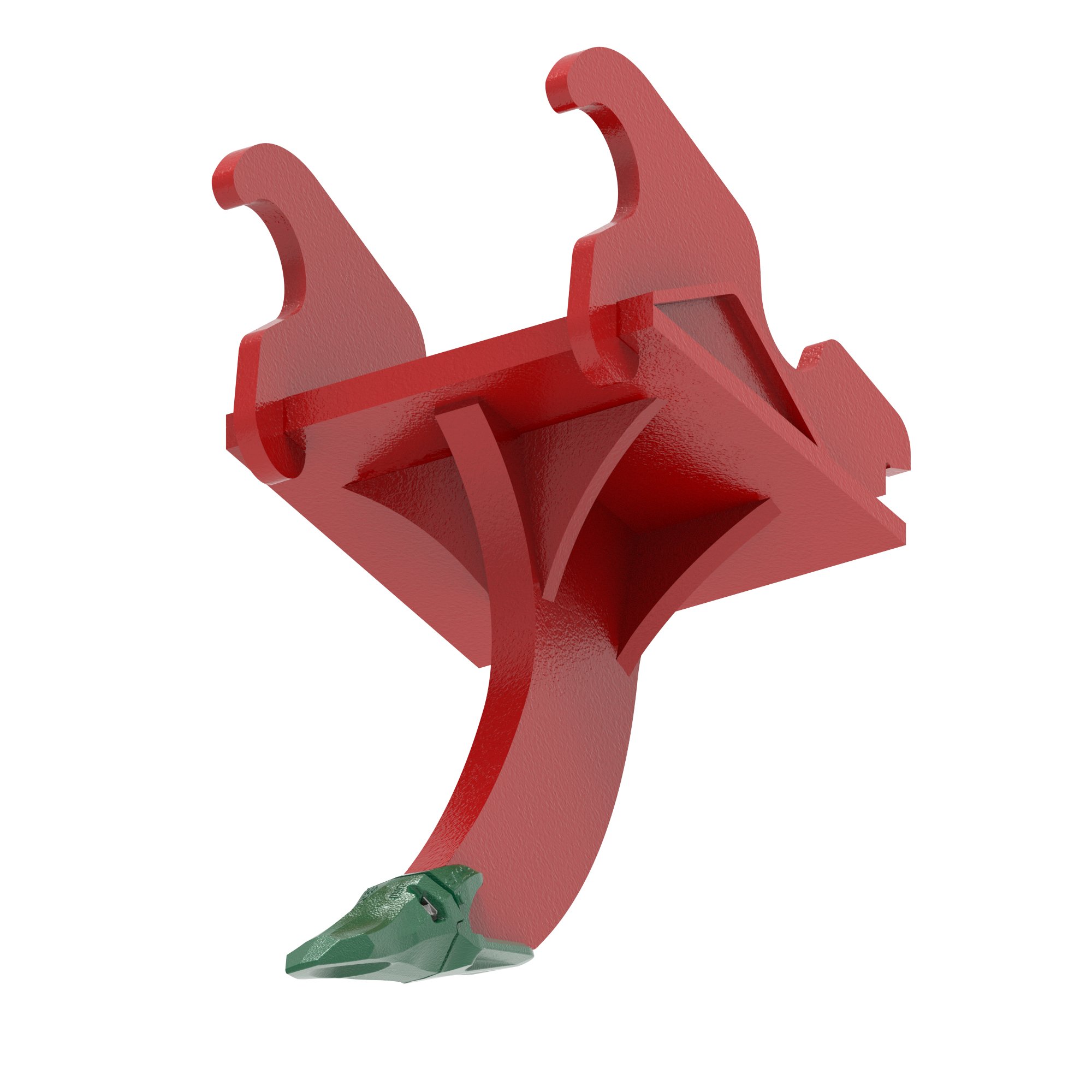

#1 Ripper and components

Domain Est. 1998

Website: byg.com

Key Highlights: BYG is one of the few manufacturers worldwide that produces ripper arms manufactured in one piece, without welding, thus avoiding the risk of premature breakage ……

#2 impact ripper for excavators

Domain Est. 2010

Website: xcentricripper.com

Key Highlights: The Xcentric Ripper is a hydraulic attachment for excavators, developed with a patented system of “Impact Technology by accumulation of energy”….

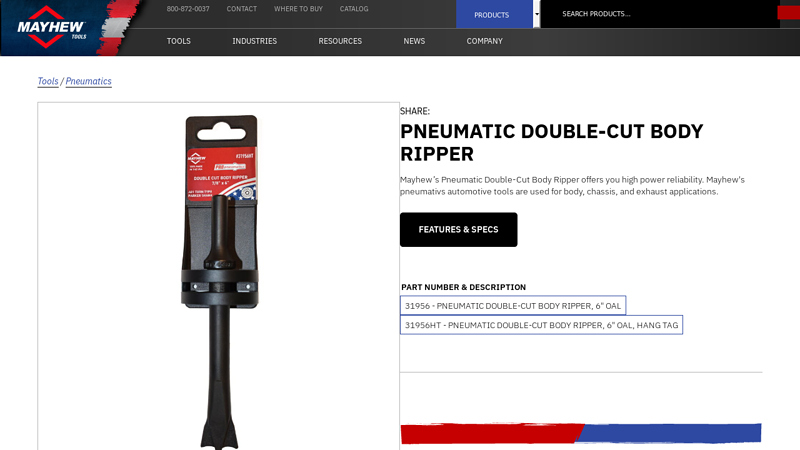

#3 Pneumatic Double

Domain Est. 1996

Website: mayhew.com

Key Highlights: Mayhew’s Pneumatic Double-Cut Body Ripper offers you high power reliability. Mayhew’s pneumativs automotive tools are used for body, chassis, ……

#4 Ripper Attachment for Compact (Mini) Excavators

Domain Est. 1997

Website: bobcat.com

Key Highlights: Free delivery over $99 30-day returnsThe ripper attachment tears through tough soil and frozen ground with rugged force. Gussets provide heavy-duty ripping power….

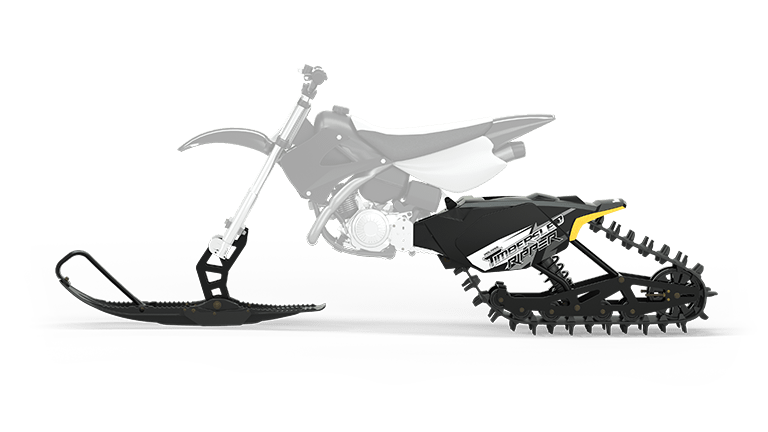

#5 2022 Timbersled Ripper

Domain Est. 2002

Website: timbersled.com

Key Highlights: Find specifications for the 2022 Timbersled Ripper such as engine, drivetrain, features, dimensions and suspension….

#6 Slate Ripper

Domain Est. 2002

#7 Ripper

Domain Est. 2005

Website: steelwrist.com

Key Highlights: The ripper provides best tear and break out of the material. The design allows for optimal breakout force and suited for frozen ground, stumps and stones….

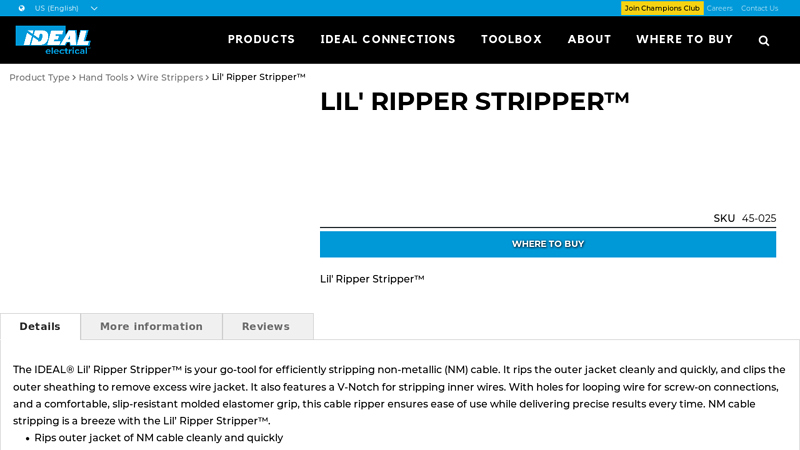

#8 Lil Ripper Stripper

Domain Est. 2012

Website: idealind.com

Key Highlights: 30-day returnsIt rips the outer jacket cleanly and quickly, and clips the outer sheathing to remove excess wire jacket. It also features a V-Notch for stripping inner wires….

#9 ESCO Standard Rippers for Hydraulic Excavators

Domain Est. 2016

Website: global.weir

Key Highlights: We offer a full line of standard ripper attachments for excavators from 7 metric tons to 75 metric tons. Ripper attachments are the best option when heavy-duty ……

Expert Sourcing Insights for Ripper Tool

2026 Market Trends for Ripper Tool

As we approach 2026, the market for ripper tools—specialized attachments used in construction, mining, agriculture, and land clearing—is poised for significant evolution driven by technological innovation, sustainability mandates, and shifting global infrastructure demands. This analysis explores key trends expected to shape the ripper tool industry in 2026, focusing on technological advancements, market dynamics, regulatory influences, and competitive positioning.

Technological Advancements and Smart Equipment Integration

One of the most defining trends for ripper tools in 2026 is the integration of smart technologies. Equipment manufacturers are increasingly embedding IoT sensors, telematics, and AI-driven diagnostics into ripper tools and their host machinery. These technologies enable real-time monitoring of wear, stress levels, and operational efficiency, allowing for predictive maintenance and optimized performance. In 2026, leading ripper tool providers will likely offer data-enabled attachments that sync with fleet management systems, improving uptime and reducing operational costs for contractors.

Additionally, advancements in material science—such as hardened wear-resistant alloys and composite coatings—are expected to extend tool lifespan and reduce replacement frequency. This trend aligns with the industry’s growing focus on total cost of ownership (TCO) rather than initial purchase price.

Growth in Infrastructure and Mining Sectors

Global infrastructure development, particularly in emerging economies across Asia, Africa, and Latin America, will remain a key driver of demand for ripper tools in 2026. Government-led investments in roads, railways, and urban development projects will require heavy-duty earthmoving equipment, including rippers used for breaking compacted soil and rock.

Simultaneously, the mining industry’s resurgence—fueled by demand for critical minerals like lithium, cobalt, and rare earth elements—will boost the need for robust ripper tools capable of handling extreme conditions. As mines expand into harder terrains, high-penetration rippers with enhanced hydraulic or mechanical force will be in high demand.

Sustainability and Emission Regulations

Environmental regulations are becoming more stringent worldwide, particularly in North America and the European Union. By 2026, emissions standards such as Tier 5 and upcoming EU Stage V compliance will influence not only prime movers (excavators, dozers) but also the design and application of attachments like ripper tools. Manufacturers are responding by designing lighter, more efficient rippers that reduce fuel consumption and carbon footprint.

Moreover, the circular economy is gaining traction. In 2026, expect increased offerings in remanufactured or refurbished ripper tools, supported by take-back programs and lifecycle extension services. These initiatives align with corporate sustainability goals and appeal to cost-conscious operators.

Customization and Modular Design

The demand for customization is rising as operators face diverse geologies and project-specific challenges. In 2026, ripper tool manufacturers will increasingly adopt modular designs that allow quick changes in shank configuration, tip geometry, and mounting systems. This flexibility enables contractors to adapt tools for varying soil conditions—whether breaking through clay, fractured rock, or frozen ground—without investing in multiple dedicated units.

Customization will be supported by digital configurators and 3D modeling tools, enabling customers to co-design rippers with manufacturers for optimal performance.

Competitive Landscape and Market Consolidation

The ripper tool market in 2026 is expected to see continued consolidation, as larger equipment manufacturers acquire niche attachment specialists to expand their product ecosystems. Companies like Caterpillar, Komatsu, and Volvo CE may deepen vertical integration by offering proprietary ripper systems that are fully compatible with their machinery.

At the same time, independent aftermarket providers will compete on innovation, price, and service agility. These players will focus on retrofit solutions and compatibility across multiple OEM platforms, capturing market share from budget-conscious and independent operators.

Conclusion

The 2026 market for ripper tools will be shaped by digitalization, sustainability, and infrastructure growth. Manufacturers that invest in smart, durable, and adaptable solutions will lead the market, while those slow to innovate may struggle. For stakeholders, understanding these trends is crucial for strategic planning, product development, and positioning in an increasingly competitive and technologically driven landscape.

Common Pitfalls When Sourcing Ripper Tools (Quality, IP)

Sourcing ripper tools—whether for construction, mining, or demolition—requires careful attention to quality standards and intellectual property (IP) considerations. Overlooking these aspects can lead to operational inefficiencies, legal liabilities, and financial losses. Below are key pitfalls to avoid:

Poor Quality Control and Substandard Materials

One of the most frequent issues when sourcing ripper tools is receiving products made from inferior materials or with inconsistent manufacturing processes. Low-quality steel or improper heat treatment can result in rapid wear, breakage under stress, and reduced equipment lifespan. This not only increases maintenance and replacement costs but can also cause downtime and safety hazards.

To mitigate this risk, buyers should demand material certifications (e.g., mill test reports), conduct third-party inspections, and prioritize suppliers with recognized quality management systems such as ISO 9001.

Lack of Compatibility and Dimensional Accuracy

Ripper tools must precisely match the make and model of the host machine (e.g., excavator or dozer). Poorly dimensioned or non-standardized tools can lead to improper fitment, reduced performance, and accelerated wear on both the tool and machine components. Generic or counterfeit parts often fail to meet OEM specifications.

Always verify compatibility using OEM part numbers and request dimensional drawings or samples before bulk ordering. Conduct fitment tests during pilot procurement.

Intellectual Property Infringement

Sourcing ripper tools from unauthorized manufacturers or suppliers may result in IP violations, particularly when tools replicate patented designs (e.g., unique tooth geometry, locking mechanisms, or adapter systems). Using counterfeit or cloned products can expose the buyer to legal action from OEMs, especially in regions with strict IP enforcement.

Ensure suppliers have proper licensing agreements or offer legally compliant aftermarket designs. Request documentation proving the legitimacy of the design and avoid suppliers offering “OEM-equivalent” tools at suspiciously low prices, as these are often infringing products.

Inadequate Testing and Performance Validation

Some suppliers claim high durability or longer service life without providing test data or field performance records. Without real-world validation, buyers risk investing in tools that underperform in actual operating conditions.

Request performance reports, wear-test data, or trial programs. Consider conducting side-by-side comparisons with known OEM or reputable aftermarket products.

Supply Chain Transparency and Traceability Issues

Opaque supply chains make it difficult to trace the origin of materials and manufacturing processes. This lack of transparency increases the risk of receiving goods produced under unethical conditions or with inconsistent quality control.

Work with suppliers who provide full traceability, from raw material sourcing to final assembly, and consider on-site audits when sourcing in high-risk regions.

Short-Term Cost Focus Over Total Cost of Ownership

Choosing the cheapest available ripper tool often leads to higher long-term costs due to frequent replacements, downtime, and machine damage. A low initial price rarely reflects true value if the tool fails prematurely.

Evaluate sourcing decisions based on total cost of ownership, including wear life, maintenance needs, and operational efficiency—not just unit price.

By addressing these common pitfalls proactively, businesses can ensure they source ripper tools that deliver reliable performance, comply with legal standards, and offer sustainable value.

Logistics & Compliance Guide for Ripper Tool

This guide outlines the essential logistics procedures and compliance requirements for handling, transporting, storing, and maintaining the Ripper Tool. Adherence to these guidelines ensures operational efficiency, regulatory compliance, and workplace safety.

Product Overview and Specifications

The Ripper Tool is a heavy-duty industrial implement designed for soil penetration, rock fracturing, and ground loosening applications. Key specifications include:

– Weight: [Insert weight in lbs/kg]

– Dimensions: [Length x Width x Height]

– Material: High-strength alloy steel with reinforced tip

– Compatibility: Designed for use with [Specify machinery models, e.g., excavators XYZ-200/300]

– Operating Temperature Range: -20°C to 60°C

Ensure all logistics and operational personnel are familiar with these specifications to prevent misuse or improper handling.

Shipping and Transportation Requirements

All shipments of Ripper Tools must comply with domestic and international freight regulations. Key shipping guidelines include:

– Packaging: Secure the tool in a wooden crate with internal cushioning to prevent movement. Label crate with “Fragile,” “This Side Up,” and “Heavy Equipment.”

– Weight Distribution: When loaded on transport vehicles, the Ripper Tool must be centered and secured using industrial-grade chains or straps rated for at least 150% of the tool’s weight.

– Documentation: Include a commercial invoice, packing list, and bill of lading. For international shipments, provide a Material Safety Data Sheet (MSDS) and export declaration if applicable.

– Carrier Compliance: Use certified freight carriers experienced in handling heavy industrial equipment. Confirm carrier adherence to DOT (Department of Transportation) or equivalent regional safety standards.

Storage and Handling Procedures

Proper storage and handling preserve the integrity of the Ripper Tool and reduce wear:

– Indoor Storage: Store in a dry, covered facility with low humidity to prevent corrosion. Use protective covers if long-term storage is required.

– Orientation: Store horizontally on padded racks. Avoid stacking unless specifically designed for it.

– Handling Equipment: Use forklifts or cranes with appropriate lifting capacity. Never drag or drop the tool.

– Inspection: Conduct monthly visual checks for rust, cracks, or deformation, especially on the tip and mounting points.

Regulatory Compliance

The Ripper Tool must meet the following regulatory standards:

– OSHA (Occupational Safety and Health Administration): All handling and operational procedures must align with OSHA 29 CFR 1910 for general industry and 1926 for construction.

– ISO Standards: Compliant with ISO 9001 (Quality Management) and ISO 14001 (Environmental Management) where applicable.

– Customs Regulations: For cross-border shipments, ensure compliance with local customs codes (e.g., HTS code [Insert code]) and obtain necessary import permits.

– Environmental Compliance: No hazardous materials are used in the tool’s construction. However, disposal must follow local scrap metal recycling regulations (e.g., EPA guidelines in the U.S.).

Maintenance and Inspection Logs

Maintain detailed records to ensure traceability and compliance:

– Pre-Use Inspection: Operators must check for visible damage before each use.

– Scheduled Maintenance: Conduct preventive maintenance every [X] operating hours. Record lubrication, bolt tightness, and wear measurements.

– Log Retention: Keep inspection and maintenance logs for a minimum of 5 years. Digital records should be backed up and password-protected.

Training and Personnel Certification

Only trained personnel may handle or operate machinery equipped with the Ripper Tool:

– Initial Training: Includes safe handling, mounting/dismounting procedures, and hazard awareness.

– Refresher Courses: Required annually or after any safety incident.

– Certification: Issue certificates upon successful completion. Maintain a central training database.

Incident Reporting and Non-Compliance Procedures

In the event of damage, loss, or regulatory non-compliance:

– Immediate Action: Isolate the affected tool and notify the Logistics Manager and Safety Officer.

– Reporting: File an Incident Report within 24 hours using Form RT-INC-01.

– Root Cause Analysis: Conduct an internal review and implement corrective actions.

– Regulatory Notification: Report incidents to relevant authorities if required by law (e.g., OSHA for workplace injuries).

Contact Information

For logistics or compliance inquiries, contact:

– Logistics Coordinator: [Name], [Email], [Phone]

– Compliance Officer: [Name], [Email], [Phone]

– Emergency Line: [24/7 Contact Number]

Ensure all team members have access to this guide and updated contact information at all times.

Conclusion for Sourcing a Ripper Tool

After a thorough evaluation of available options, it is evident that sourcing a high-quality ripper tool is essential for maximizing excavation efficiency, durability, and overall project performance. The decision should be guided by key factors such as compatibility with existing machinery, material strength, intended application (e.g., rocky soil, compacted earth), and long-term maintenance requirements.

Sourcing from reputable manufacturers or suppliers ensures reliability, adherence to industry standards, and access to technical support and warranties. Additionally, considering total cost of ownership—factoring in durability, wear resistance, and replacement frequency—leads to more cost-effective outcomes over time.

In conclusion, a well-sourced ripper tool not only enhances equipment productivity but also reduces downtime and operational costs. Prioritizing quality, proper fit, and supplier credibility will ensure optimal performance and longevity, making it a valuable investment for any earthmoving or construction operation.