The global RF shielding materials market is experiencing robust growth, driven by increasing demand for electromagnetic interference (EMI) protection across industries such as telecommunications, aerospace, defense, and consumer electronics. According to a report by Mordor Intelligence, the RF shielding market was valued at USD 10.3 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2029, reaching an estimated USD 15.6 billion by the end of the forecast period. This expansion is fueled by the proliferation of 5G infrastructure, rising adoption of IoT devices, and stringent regulatory standards for signal integrity and device performance. As the need for reliable RF shielding sleeves intensifies—particularly for cable and connector protection—a select group of manufacturers has emerged as industry leaders, combining material innovation, scalability, and technical expertise to meet evolving global demands. These top seven RF sleeve manufacturers represent a blend of advanced engineering and market responsiveness, positioning them at the forefront of a rapidly advancing technological landscape.

Top 7 Rf Sleeve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ArmorShield RFID Blocking Sleeves and Envelopes

Domain Est. 1998

Website: infopkg.com

Key Highlights: We are the leading manufacturer of packaging for storage and protection of CDs/DVDs, Envelopes for Plastic Cards and RFID applications. Call 800-776-7633! Call ……

#2 RFID Blocking Card Sleeves

Domain Est. 2012

Website: rfidfs.com

Key Highlights: Made from special RFID blocking material aluminium-foil paper, state of the art RFID shielding inside the lining, and has the potential to shield your identity….

#3 George Schmitt & Co.

Domain Est. 1997

Website: georgeschmitt.com

Key Highlights: George Schmitt offers innovative RFID label printing solutions with 100% readability, ensuring security, traceability, and superior quality….

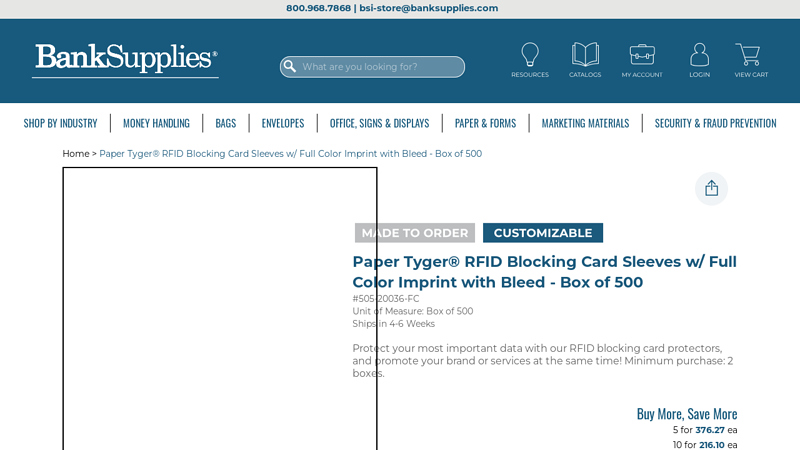

#4 Paper Tyger® RFID Blocking Card Sleeves w/ Full Color Imprint with …

Domain Est. 1997

Website: banksupplies.com

Key Highlights: In stock $25.21 deliveryProtect your cards from electronic theft with RFID blocking card sleeves. Secure, durable, and perfect for credit, debit, and ID cards….

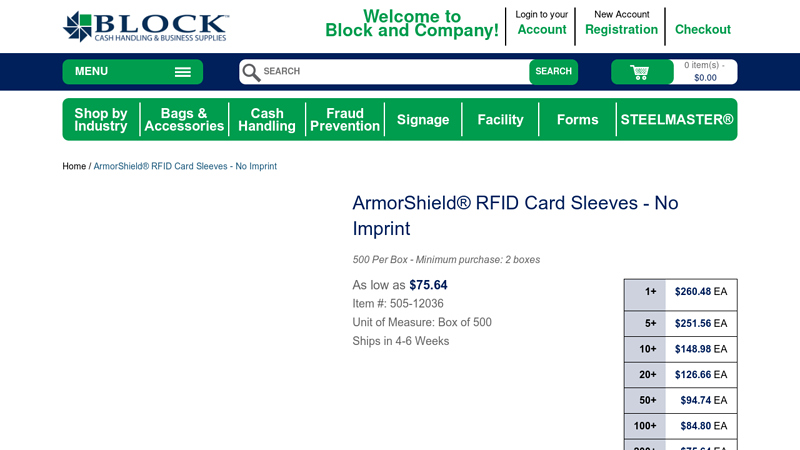

#5 ArmorShield RFID Card Sleeves

Domain Est. 1999

Website: blockandcompany.com

Key Highlights: In stock $28.14 deliveryProtect ATM, debit/credit cards from identity theft with RFID blocking sleeves · Water, chemical & puncture resistant, and tear-proof · Dust-free and provid…

#6 RFID Blocking Sleeves

Domain Est. 2012

Website: rogue-industries.com

Key Highlights: Free delivery over $75 Free 30-day returns…

#7 Custom Hotel Key Card Sleeves

Domain Est. 2016

Website: tjnfctag.com

Key Highlights: Explore how custom hotel key card sleeves protect against RFID skimming while boosting your hotel’s brand presence….

Expert Sourcing Insights for Rf Sleeve

H2: Projected 2026 Market Trends for RF Sleeve Technology

The market for Radio Frequency (RF) Sleeve technology is poised for significant transformation by 2026, driven by advancements in wireless communication, the proliferation of 5G and emerging 6G networks, and rising demand for compact, high-performance RF components in consumer electronics, defense, and industrial applications. RF Sleeves—shielding or coupling components used in RF systems to manage signal integrity, reduce electromagnetic interference (EMI), and improve connector performance—are becoming increasingly critical in densely packed electronic environments.

1. Growth in 5G and IoT Infrastructure

By 2026, the global rollout of 5G networks will have matured significantly, with increased deployment of small cells, base stations, and edge computing infrastructure. RF Sleeves are essential in maintaining signal quality and EMI shielding in these high-frequency environments. The expanding Internet of Things (IoT) ecosystem, especially in smart cities and industrial IoT (IIoT), will further drive demand for reliable RF interconnect solutions, including optimized sleeve designs that support miniaturization and thermal stability.

2. Miniaturization and High-Frequency Performance

As electronic devices become smaller and operate at higher frequencies (above 20 GHz), RF Sleeve designs must evolve to ensure signal integrity without compromising size or efficiency. The trend toward higher-frequency mmWave applications—common in 5G, automotive radar, and satellite communications—will demand RF Sleeves with improved material properties, such as low dielectric loss and enhanced conductivity. Manufacturers are expected to invest in advanced materials like engineered polymers and composite metals to meet these requirements.

3. Rising Demand in Automotive and Aerospace Sectors

The automotive sector, particularly in electric and autonomous vehicles, will be a key growth driver. Vehicles are increasingly reliant on RF systems for V2X (vehicle-to-everything) communication, radar, and telematics. RF Sleeves help ensure reliable signal transmission in harsh environments, making them vital for safety-critical applications. Similarly, aerospace and defense applications—including UAVs, satellite systems, and secure communication platforms—will prioritize RF components with military-grade durability and EMI shielding, boosting demand for high-specification RF Sleeves.

4. Regional Market Dynamics

Asia-Pacific is expected to lead the global RF Sleeve market by 2026, driven by robust electronics manufacturing in China, South Korea, and Japan, along with strong government support for 5G and smart infrastructure. North America will remain a key innovator, particularly in defense and aerospace applications, while Europe focuses on green tech and automotive electrification, both of which rely on advanced RF systems.

5. Sustainability and Supply Chain Resilience

By 2026, environmental regulations and sustainability goals will influence material selection and manufacturing processes. Companies will prioritize recyclable or low-impact materials in RF Sleeve production. Additionally, ongoing efforts to diversify supply chains—especially post-pandemic and amid geopolitical tensions—will encourage regional production and partnerships to ensure consistent component availability.

6. Technological Integration and Smart Features

Emerging trends include the integration of sensors or monitoring capabilities within RF Sleeves for real-time diagnostics (e.g., temperature, signal loss). This “smart sleeve” concept could gain traction in critical infrastructure, enabling predictive maintenance and improved system reliability.

Conclusion

By 2026, the RF Sleeve market will be shaped by the convergence of higher-frequency communication systems, miniaturization, and increased reliance on wireless connectivity across industries. Companies that innovate in materials science, design efficiency, and sustainable manufacturing will be best positioned to capitalize on these trends. The market is expected to grow at a CAGR of approximately 7–9% from 2023 to 2026, reaching a valuation of over $1.8 billion, with significant opportunities in telecommunications, automotive, and defense sectors.

Common Pitfalls Sourcing RF Sleeves (Quality, IP)

Sourcing RF (Radio Frequency) sleeves for medical, industrial, or scientific applications requires careful consideration to ensure performance, safety, and regulatory compliance. Overlooking key aspects can lead to significant issues. Below are common pitfalls related to quality and Ingress Protection (IP) ratings.

Poor Material Quality and Manufacturing Standards

Low-cost RF sleeves may use substandard materials or inconsistent manufacturing processes, leading to premature failure, inconsistent RF performance, or compromised biocompatibility in medical settings. Variability in wall thickness or dielectric properties can disrupt signal integrity. Always verify that suppliers adhere to recognized quality management systems (e.g., ISO 13485 for medical devices) and provide material certifications.

Inadequate or Misrepresented IP Ratings

The IP (Ingress Protection) rating indicates resistance to dust and moisture, which is critical in environments like operating rooms or industrial settings. A common pitfall is assuming an RF sleeve has a high IP rating without documentation. Some suppliers may provide misleading or unverified claims. Always request independent test reports (e.g., IEC 60529 compliance) and ensure the IP rating matches the intended use—such as IP67 for full dust protection and temporary water immersion.

Lack of Compatibility Testing

RF sleeves must maintain signal transparency while providing physical protection. Poor quality sleeves can attenuate or distort RF signals, impacting device functionality. Ensure the sleeve has been tested with your specific RF equipment and frequencies. Request performance data under real-world conditions to avoid interference issues post-deployment.

Insufficient Environmental and Durability Testing

Beyond IP ratings, RF sleeves may be exposed to chemicals, repeated sterilization (in medical use), UV light, or mechanical stress. Sourcing sleeves without documented resistance to these factors can lead to cracking, delamination, or loss of protective qualities. Confirm that the product has undergone relevant lifecycle and environmental testing.

Non-Compliance with Regulatory Requirements

Depending on the application, RF sleeves may need to meet regulatory standards (e.g., FDA, CE marking, RoHS). Overlooking compliance can result in deployment delays or legal issues. Verify that the supplier provides full regulatory documentation and that the product is certified for your target market.

Inconsistent Batch-to-Batch Quality

Without strict quality control, there can be significant variation between production batches, affecting fit, sealing, or electrical performance. Establish clear quality agreements with suppliers and conduct incoming inspections or periodic audits to ensure consistency.

Logistics & Compliance Guide for RF Sleeve

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence of RF (Radio Frequency) Sleeves. These devices are often used in access control, asset tracking, or personnel monitoring and may be subject to specific technical and legal requirements.

Product Overview

RF Sleeves are wearable electronic devices embedded with RFID (Radio-Frequency Identification) technology. They typically operate in LF (Low Frequency), HF (High Frequency), or UHF (Ultra-High Frequency) bands and may be passive (no internal power source) or active (with battery). Understanding the technical specifications of the specific sleeve model is critical for compliance and logistics planning.

Regulatory Compliance

Radio Frequency Regulations

RF Sleeves must comply with radio emission standards set by national and international regulatory bodies. Key authorities include:

– FCC (Federal Communications Commission) – Required for devices sold or used in the United States.

– CE Marking (RED Directive) – Mandatory for devices placed on the market in the European Economic Area.

– ISED (Innovation, Science and Economic Development Canada) – Required for Canadian market entry.

– Other Regional Regulators – Such as MIC (Japan), SRRC (China), and ACMA (Australia).

Ensure that each RF Sleeve model has the appropriate certification for the target market and that documentation (e.g., Declaration of Conformity) is maintained.

Electromagnetic Compatibility (EMC)

RF Sleeves must not interfere with other electronic equipment and must operate reliably in electromagnetic environments. Compliance with EMC standards (e.g., FCC Part 15, EN 301 489) is mandatory in most jurisdictions.

Environmental & Safety Standards

- RoHS (Restriction of Hazardous Substances) – Prohibits the use of specific hazardous materials (e.g., lead, mercury) in electrical equipment.

- REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) – Applies in the EU and regulates chemical substances.

- Battery Safety – If the RF Sleeve contains a battery, it must comply with IEC 62133 (for secondary cells) or IEC 60086 (for primary cells), and transportation regulations for lithium batteries may apply.

Logistics Considerations

Packaging & Labeling

- Use anti-static packaging for RF Sleeves to protect sensitive electronics.

- Clearly label packages with compliance marks (FCC ID, CE, etc.), product identification, and handling instructions (e.g., “Fragile,” “Do Not Bend”).

- Include multilingual labels if shipping internationally.

Storage Conditions

- Store in a dry, temperature-controlled environment (typically 0°C to 40°C).

- Avoid exposure to moisture, direct sunlight, and strong electromagnetic fields.

- Keep away from materials that may demagnetize or interfere with RFID functionality (e.g., metal surfaces, strong magnets).

Transportation

- Ground & Air Shipping: Comply with IATA/ICAO regulations if shipping lithium batteries. Classify and document accordingly.

- International Shipments: Prepare accurate commercial invoices, packing lists, and certificates of origin. Include FCC ID or CE declaration as needed.

- Customs Clearance: Ensure Harmonized System (HS) codes are correctly assigned (e.g., 8523.51 or 8526.10 for RFID devices). Duty rates and import restrictions vary by country.

Supply Chain Security

- Implement tamper-evident packaging where security is a concern (e.g., for access control applications).

- Track shipments using serialized identifiers to maintain chain of custody.

- Conduct supplier audits to ensure compliance with logistics and environmental standards.

End-of-Life & Recycling

- Follow WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions for proper disposal.

- Provide customers with information on recycling options.

- Partner with certified e-waste recyclers to handle returns and end-of-life products responsibly.

Documentation & Recordkeeping

Maintain the following records for compliance and traceability:

– Technical specifications and test reports

– Certifications (FCC, CE, ISED, etc.)

– Safety data sheets (if applicable)

– Shipping and customs documentation

– Recalls or non-conformance reports

Summary

Adhering to logistics and compliance requirements for RF Sleeves ensures legal market access, operational reliability, and environmental responsibility. Proactive management of regulatory certifications, safe transportation practices, and proper documentation is essential for global deployment and customer trust.

Conclusion for Sourcing RF Shielding Sleeves:

Sourcing RF (Radio Frequency) shielding sleeves requires a strategic approach that balances technical performance, cost-efficiency, and reliable supply. Based on the evaluation of potential suppliers, material specifications, shielding effectiveness (typically measured in decibels), durability, and compliance with industry standards (such as MIL-STD, RoHS, or REACH), it is clear that selecting the right supplier involves more than just pricing considerations.

The ideal supplier should offer customizable solutions to meet specific application requirements—such as flexibility, temperature resistance, and ease of installation—while maintaining consistent quality and providing technical support. Verified manufacturers with proven experience in aerospace, defense, telecommunications, or medical device sectors tend to deliver superior performance and reliability.

In conclusion, the recommended sourcing strategy includes partnering with pre-qualified suppliers who demonstrate technical expertise, regulatory compliance, and strong track records in delivering EMI/RF shielding solutions. Conducting periodic performance reviews and maintaining dual-source options can further mitigate supply chain risks. By prioritizing quality and long-term reliability, the organization can ensure optimal electromagnetic compatibility and system performance across its applications.