The global reusable car oil filter market is gaining momentum as automotive manufacturers and environmentally conscious consumers increasingly prioritize sustainability and cost efficiency. According to Grand View Research, the global oil filter market was valued at USD 9.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030, driven by rising vehicle production, stringent emission regulations, and a growing aftermarket for performance and durable components. A segment of this expansion is attributed to reusable oil filters, which offer long-term savings, reduced waste, and enhanced engine protection compared to traditional disposable variants. As demand for eco-friendly automotive solutions rises, particularly in mature markets like North America and Western Europe, a select group of manufacturers has emerged at the forefront of innovation, scalability, and product reliability. Based on market presence, production capacity, material technology, and customer adoption trends, the following six companies represent the leading reusable car oil filter manufacturers shaping the future of sustainable vehicle maintenance.

Top 6 Reusable Car Oil Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Oil Filters

Domain Est. 2000

Website: challengeraviation.com

Key Highlights: Free deliveryFAA/STC Approved Re-Cleanable Oil Filters. Engines fitted previously with oil screen, must have a certified spin-on oil filter adapter to accept this assembly….

#2 Golan Products

Domain Est. 2000

Website: golanproducts.com

Key Highlights: Golan Products is a leading manufacturer of billet, reusable fuel filters, and reusable oil filters. We also manufacture motorcycle fuel tank valves ……

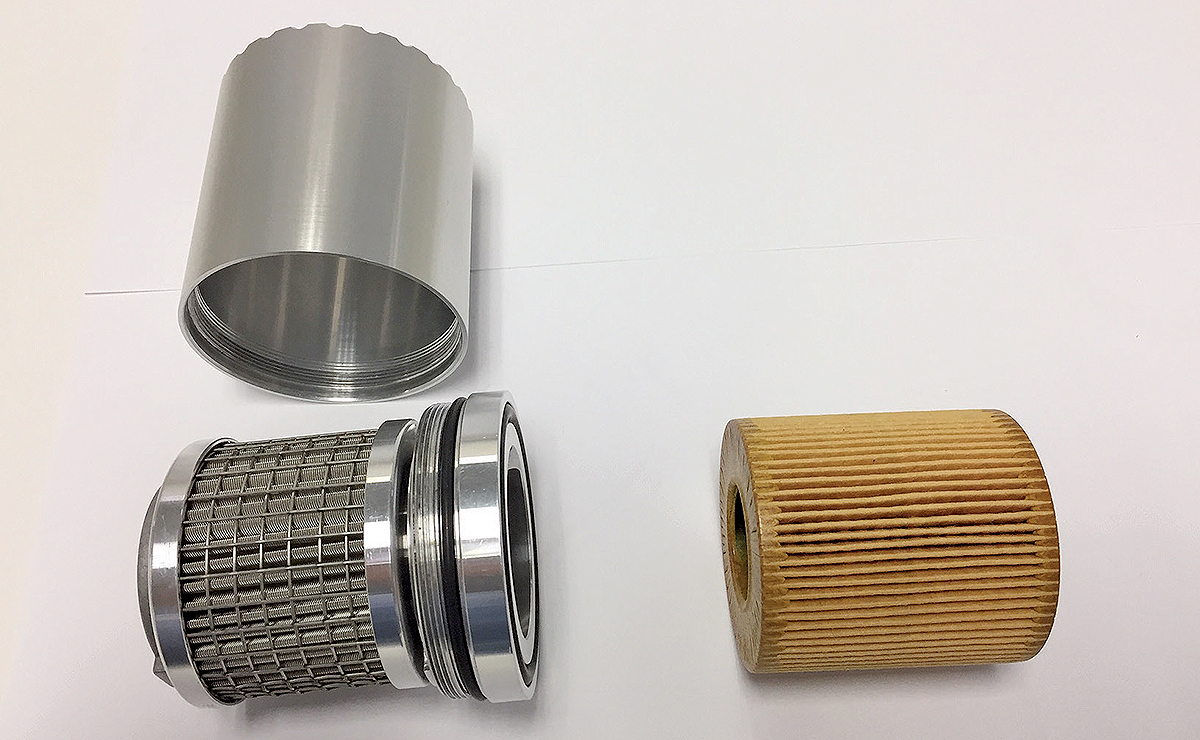

#3 BASF and Hengst develop reusable spin

Domain Est. 1995

Website: basf.com

Key Highlights: BASF and Hengst have developed the world’s first reusable plastic spin-on oil filter module for cars. Blue.on is the sustainable alternative ……

#4 PurePower!

Domain Est. 2000

#5 Automotive

Domain Est. 2003

Website: kandpengineering.com

Key Highlights: K&P Engineering’s reusable oil filters offer faster oil pressure at start-up. More filtered oil gives you longer asset life for your vehicles….

#6 HUBB Oil Filter

Domain Est. 2014

Website: hubbfilters.com

Key Highlights: HUBB Oil Filter · Made from surgical stainless steel and aircraft grade aluminum · Filter-in-a-filter design · Improves oil flow up to 5X, thereby reducing engine ……

Expert Sourcing Insights for Reusable Car Oil Filter

H2: Emerging Market Trends for Reusable Car Oil Filters in 2026

The global market for reusable car oil filters is poised for significant transformation by 2026, driven by technological advancements, environmental regulations, and shifting consumer preferences toward sustainable automotive solutions. This analysis explores the key trends shaping the reusable car oil filter industry in 2026 under the H2 framework—highlighting market drivers, technological innovation, regional dynamics, and competitive landscape shifts.

-

Growing Environmental Awareness and Regulatory Support

By 2026, stricter environmental regulations across North America, Europe, and parts of Asia-Pacific are expected to accelerate the adoption of reusable oil filters. Governments are increasingly targeting waste reduction in automotive maintenance, with policies promoting circular economy practices. Reusable filters, which reduce hazardous waste from disposable filter elements, align with emissions and sustainability goals. Incentives for eco-friendly vehicle maintenance and extended producer responsibility (EPR) schemes are likely to boost market penetration. -

Advancements in Filter Materials and Design

Technological innovations in filtration media—such as high-grade stainless steel mesh, magnetic particle capture systems, and self-cleaning mechanisms—are enhancing the efficiency and longevity of reusable filters. By 2026, next-generation reusable filters are expected to offer improved micron-level filtration, comparable to or exceeding disposable counterparts. Integration with onboard diagnostics (OBD) systems for real-time oil cleanliness monitoring may become a differentiating feature among premium products. -

Expansion in Electric and Hybrid Vehicle Applications

Although electric vehicles (EVs) require less frequent oil changes, hybrid models still rely on internal combustion engines and lubrication systems. As hybrid vehicle sales grow through 2026—particularly in emerging markets—demand for durable, low-maintenance components like reusable oil filters will rise. Manufacturers are adapting reusable filter designs for hybrid-specific oil formulations and thermal conditions, opening new application channels. -

Aftermarket Growth and DIY Consumer Adoption

The automotive aftermarket is a key growth vector. By 2026, increasing consumer interest in vehicle longevity, cost savings, and do-it-yourself (DIY) maintenance is expected to drive demand for reusable filters. Online retail platforms and video-based tutorials are lowering adoption barriers, enabling broader access to installation and cleaning procedures. Subscription-based cleaning services or filter exchange programs may emerge as complementary business models. -

Regional Market Divergence

Europe and North America are anticipated to lead adoption due to mature environmental policies and high consumer environmental consciousness. In contrast, Asia-Pacific—especially China and India—will see gradual growth, fueled by rising vehicle ownership and government push for green technologies. However, price sensitivity and lack of awareness may slow uptake in developing economies without targeted education and affordability initiatives. -

Competitive Landscape and Strategic Partnerships

By 2026, established automotive parts manufacturers are expected to enter or expand in the reusable filter space, competing with niche innovators. Strategic partnerships with fleet operators, ride-sharing companies, and car subscription services could provide scalable distribution channels. Brand differentiation will hinge on ease of maintenance, compatibility with diverse engine types, and lifecycle cost savings.

In conclusion, the 2026 reusable car oil filter market will be shaped by sustainability mandates, product innovation, and evolving consumer behavior. Companies that invest in durable design, user-friendly maintenance systems, and eco-certifications are likely to capture significant market share in this high-potential segment.

H2. Common Pitfalls When Sourcing Reusable Car Oil Filters (Quality and Intellectual Property)

Sourcing reusable car oil filters can offer long-term cost and environmental benefits, but it also presents several challenges related to quality assurance and intellectual property (IP) risks. Being aware of these pitfalls helps buyers and manufacturers make informed decisions and avoid legal or performance-related issues.

1. Inconsistent Quality and Performance Standards

Reusable oil filters vary significantly in build quality, filtration efficiency, and durability. Many suppliers—especially those from less-regulated markets—may not adhere to industry standards such as ISO 4548 or SAE J1113. Poor-quality filters can lead to inadequate oil filtration, engine wear, or even catastrophic engine failure. Buyers often face difficulties verifying claims about micron rating, burst pressure, and flow rate without third-party testing.

2. Lack of Certification and Testing Documentation

Reliable reusable filters should come with verifiable test reports and certifications. However, some suppliers provide falsified or generic documentation. Without access to real performance data or OEM compatibility reports, buyers risk integrating substandard components into their supply chain.

3. Material and Construction Deficiencies

The longevity of a reusable filter depends on high-grade materials such as stainless steel mesh, durable seals, and heat-resistant housings. Low-cost alternatives may use inferior materials that degrade quickly after a few cleaning cycles, compromising filtration and sealing integrity.

4. Inadequate Cleaning and Maintenance Guidance

Reusable filters require proper cleaning procedures to maintain efficiency. Some suppliers fail to provide clear maintenance instructions, leading to improper cleaning techniques that damage the filter or leave residue, reducing effectiveness over time.

5. Intellectual Property Infringement Risks

Many reusable oil filter designs are protected by patents, trademarks, or design rights. Sourcing from manufacturers that replicate OEM or branded designs (e.g., copying the thread pattern, housing shape, or filtration system of well-known brands) can expose buyers to IP litigation. This is especially common with suppliers offering “compatible” or “aftermarket replica” products.

6. Misrepresentation of Compatibility

Suppliers may claim universal fit or compatibility with major vehicle models without sufficient validation. This can result in installation issues, oil leaks, or bypass valve malfunctions. Ensuring dimensional accuracy and pressure specifications match OEM requirements is critical.

7. Hidden Costs from Short Lifespan or Poor Reusability

While marketed as cost-effective over time, poorly made reusable filters may not withstand repeated use. Frequent replacement or maintenance due to premature failure can erase any savings, making them less economical than disposable alternatives.

8. Limited Traceability and Supplier Accountability

In global sourcing, especially from less transparent supply chains, tracing the origin of components and holding suppliers accountable for defects or IP violations can be difficult. Lack of clear manufacturing records increases exposure to compliance and safety risks.

To mitigate these pitfalls, buyers should conduct thorough due diligence, including factory audits, third-party lab testing, IP clearance searches, and contractual quality guarantees. Partnering with reputable, legally compliant suppliers is essential for ensuring both product performance and legal safety.

Logistics & Compliance Guide for Reusable Car Oil Filters

Overview

Reusable car oil filters offer an eco-friendly alternative to traditional disposable filters, reducing waste and long-term costs for vehicle owners. However, their logistics and compliance requirements differ significantly due to material composition, handling, transportation, and regulatory considerations. This guide outlines key logistical and compliance aspects for manufacturers, distributors, and importers of reusable car oil filters.

Material & Product Specifications

Reusable oil filters are typically constructed from durable materials such as stainless steel, aluminum, or high-grade polymers designed to withstand high temperatures and pressure. Unlike disposable filters, they feature cleanable mesh or screen elements. Proper documentation of material composition (including REACH, RoHS, and conflict minerals compliance) is essential for international trade and environmental regulations.

Packaging & Labeling Requirements

- Protective Packaging: Due to their robust construction, reusable filters require less protective packaging than disposable counterparts. However, packaging must prevent surface damage and contamination during transit.

- Labeling: Each unit must be clearly labeled with:

- Manufacturer name and contact information

- Part number and compatible vehicle models

- Material composition

- Cleaning and maintenance instructions

- Country of origin

- CE marking (for EU sales), DOT compliance (if applicable), or other regional certifications

Transportation & Storage

- Weight and Volume: Reusable filters are generally heavier than disposable ones. Optimize palletization and container loading to minimize shipping costs.

- Storage Conditions: Store in dry, temperature-controlled environments to prevent corrosion (especially for metal components). Avoid exposure to oils, solvents, or moisture during warehousing.

- Hazard Classification: Reusable filters are typically non-hazardous when new and unused. However, if contaminated with oil, they may be classified as hazardous waste and subject to special handling. Ensure filters are shipped clean and dry.

Import/Export Regulations

- Customs Classification: Classify under the correct HS code. In most countries, reusable oil filters fall under:

- HS 8413.30 (Pumps for liquids, including oil filters as engine parts)

- Confirm with local customs authorities, as classification can vary by region.

- Duty Rates: Duty rates vary by country. For example:

- United States: Typically duty-free under HTSUS 8413.30.30

- European Union: Usually 2–4%, depending on member state

- Documentation: Provide commercial invoice, packing list, bill of lading/airway bill, and certificate of origin. Some markets (e.g., EU, Canada) require a completed declaration of conformity.

Environmental & Safety Compliance

- REACH (EU): Ensure all chemical substances used in manufacturing comply with REACH regulations. Register or notify if required.

- RoHS (EU): Comply with restrictions on hazardous substances in electrical and electronic components (if applicable, e.g., sensors in smart filters).

- WEEE (EU): Not typically applicable unless the filter includes electronic components.

- EPA (USA): No direct EPA regulation for reusable filters, but ensure manufacturing processes comply with environmental standards. If marketed as reducing waste, avoid unsubstantiated green claims (FTC Green Guides).

End-of-Life & Return Logistics

- Cleaning Responsibility: Unlike disposable filters, reusable units require consumer cleaning. Provide clear instructions and recommend proper disposal of used oil collected during cleaning.

- Take-Back Programs: Consider offering return or trade-in programs to encourage responsible end-of-life management. These may be subject to local extended producer responsibility (EPR) laws if implemented.

- Waste Classification: At end-of-life, reusable filters may be recyclable as metal scrap. Ensure disposal aligns with local recycling standards (e.g., EPA guidelines in the U.S., WEEE in the EU).

Regulatory Certifications & Market Access

- SAE Standards: While no SAE standard specifically for reusable filters, compliance with SAE J1239 (engine filter testing) may support performance claims.

- ISO 9001: Quality management certification enhances credibility and supports export compliance.

- Country-Specific Approvals:

- USA: No federal certification required, but state-level emissions regulations (e.g., California CARB) may apply if the filter affects engine performance.

- EU: May require CE marking under the Machinery Directive or General Product Safety Directive.

- Canada: Must meet Canadian Motor Vehicle Safety Standards (CMVSS) if impacting safety-related systems.

Conclusion

Successfully managing the logistics and compliance of reusable car oil filters requires attention to material safety, accurate classification, proper labeling, and adherence to regional environmental regulations. Proactive compliance not only ensures market access but also supports sustainability claims and builds consumer trust. Regularly review regulatory updates in target markets to maintain compliance.

In conclusion, sourcing reusable car oil filters presents a sustainable, cost-effective, and performance-enhancing alternative to traditional disposable filters. Their durable construction, typically from stainless steel or high-grade aluminum, allows for repeated use after proper cleaning, reducing waste and long-term maintenance expenses. When sourcing, it is essential to prioritize reputable suppliers offering high-quality materials, proper certifications, and compatibility with a wide range of vehicle makes and models. Additionally, considering factors such as filtration efficiency, ease of maintenance, and warranty support ensures optimal performance and longevity. As environmental awareness and demand for eco-friendly automotive solutions grow, reusable oil filters represent a forward-thinking investment for both individual consumers and fleet operators looking to reduce their environmental footprint while maintaining engine reliability.