The global market for surgical retractor systems is experiencing steady growth, driven by rising surgical volumes, technological advancements, and increasing demand for minimally invasive procedures. According to Mordor Intelligence, the Surgical Retractors Market was valued at approximately USD 3.1 billion in 2023 and is projected to grow at a CAGR of over 5.8% through 2029. This expansion reflects heightened investments in surgical simulation and training tools, including retractor simulation (Sims) platforms used for medical education and device testing. As healthcare institutions and medtech companies prioritize precision and safety in surgical training, the need for high-fidelity retractor Sims has surged. Based on market presence, innovation in haptic feedback and anatomical accuracy, and strategic partnerships with medical training centers, here are the top six retractor Sims manufacturers shaping this evolving landscape.

Top 6 Retractor Sims Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

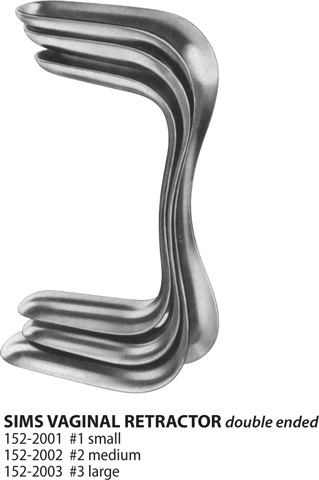

#1 Shop Sims, Vaginal Retractor

Domain Est. 1994

Website: mms.mckesson.com

Key Highlights: Shop Sims, Vaginal Retractor · Manufacturer Name. Sklar (2) · Brand or Series. Sklar® (2) · Material. Stainless Steel (2) · Size. Size 1 (1) · Size 3 (1) · Sterility….

#2 Sims Vaginal Retractor Single-Ended

Domain Est. 2004

#3 Sims vaginal retractor, 2 3/4”long x 1”wide, grip handle

Domain Est. 2003

Website: amblersurgical.com

Key Highlights: In stock $47.93 deliveryBuy Ambler Surgical Stainless Steel Sims vaginal retractor, 2 3/4”long x 1”wide, grip handle, made in Germany….

#4 Sims Vaginal Retractor, Grip Handle

Domain Est. 2006

#5 Sims Vaginal Retractor

Domain Est. 2006

Website: artisanmed.com

Key Highlights: Sims Vaginal Retractor Blade Small 2.5″,7.25″ Sims Vaginal Retractor Blade Small 2.5′′,7.25′′ RET-001 Read more Sims Vaginal Retractor Double End Large 5.5″…

#6 Sims Vaginal Retractor, hollow grip handle

Domain Est. 2009

Website: novosurgical.com

Key Highlights: In stock $23.30 deliveryNovo Surgical Sims Vaginal Retractor features a hollow grip handle that allows for better hold and control of the instrument during vaginal opening in ……

Expert Sourcing Insights for Retractor Sims

2026 Market Trends for Retractor Sims

As the simulation technology sector continues to evolve, Retractor Sims—advanced retractable simulation systems used in medical, aerospace, defense, and industrial training—are poised for significant transformation by 2026. These modular and space-efficient systems are gaining traction due to their adaptability and integration with emerging technologies. Below is an analysis of key market trends expected to shape the Retractor Sims industry in 2026.

Technological Integration and AI Enhancement

By 2026, Retractor Sims are anticipated to incorporate deeper artificial intelligence (AI) and machine learning (ML) capabilities. These integrations will allow simulations to adapt in real-time to user inputs, providing personalized training scenarios and improving learning outcomes. AI-driven analytics will enable instructors to assess performance metrics more accurately, making Retractor Sims a preferred choice in high-stakes environments such as surgical training and flight simulation.

Expansion in Medical Training Applications

The healthcare sector is expected to be the fastest-growing market for Retractor Sims. With increasing emphasis on minimally invasive surgery (MIS) and robotic-assisted procedures, retractable simulation platforms offer realistic, hands-on training without the risks associated with live patients. By 2026, demand will rise for compact, deployable systems in medical schools, residency programs, and continuing education centers, especially in urban areas with space constraints.

Growth in Defense and Aerospace Sectors

Military and aerospace organizations are investing heavily in advanced simulation technologies to reduce training costs and improve readiness. Retractor Sims, with their ability to be deployed and stored efficiently, are ideal for mobile training units and field operations. In 2026, defense contractors are expected to adopt Retractor Sims for pilot training, vehicle operation, and mission rehearsal, particularly in compact or temporary facilities.

Emphasis on Portability and Space Efficiency

Urbanization and the need for flexible training environments are driving demand for space-saving solutions. The retractable design of these systems allows for quick setup and takedown, making them suitable for multi-purpose training centers, mobile clinics, and pop-up training labs. This trend will be especially prominent in emerging markets where infrastructure limitations necessitate adaptable training tools.

Rising Adoption of VR and AR Hybrid Systems

Retractor Sims are increasingly being combined with virtual reality (VR) and augmented reality (AR) to create immersive, hybrid training environments. By 2026, these integrated systems will offer a seamless blend of physical interaction and digital visualization, enhancing realism and engagement. This convergence is expected to accelerate adoption across industries seeking cost-effective, high-fidelity training solutions.

Regional Market Expansion

While North America and Europe will remain dominant markets due to established healthcare and defense infrastructures, the Asia-Pacific region is projected to witness the highest growth rate. Countries like China, India, and South Korea are investing in advanced medical education and defense modernization, creating new opportunities for Retractor Sims providers.

Sustainability and Energy Efficiency

Sustainability concerns are influencing product design. By 2026, manufacturers are expected to prioritize energy-efficient components and recyclable materials in Retractor Sims to meet regulatory standards and corporate ESG (Environmental, Social, and Governance) goals. Modular designs will also support easier repairs and upgrades, reducing electronic waste.

Conclusion

The 2026 market for Retractor Sims is set for robust growth, driven by technological innovation, demand for flexible training solutions, and expansion across critical sectors. Companies that invest in AI integration, hybrid reality features, and sustainable design will be best positioned to capitalize on these emerging trends. As training environments become more dynamic and space-constrained, Retractor Sims will play an increasingly vital role in delivering effective, scalable simulation experiences.

Common Pitfalls Sourcing Retractor Sims (Quality, IP)

When sourcing retractor simulation models (Retractor Sims) for medical training, product development, or research, organizations often encounter significant challenges related to quality and intellectual property (IP). Failing to address these pitfalls can result in substandard training outcomes, legal exposure, and financial losses. Below are key issues to watch for:

Poor Build Quality and Inaccurate Anatomy

Many low-cost retractor sims on the market use inferior materials that degrade quickly or fail to mimic real tissue behavior. This includes unrealistic resistance, poor durability, and inaccurate anatomical landmarks, which compromise training effectiveness. Always verify material specifications and request samples before bulk procurement.

Lack of Standardization and Validation

Unvalidated simulators may not align with clinical standards or anatomical accuracy. Without third-party testing or peer-reviewed validation, users risk training on models that teach incorrect techniques. Ensure the supplier provides evidence of validation studies or clinical feedback.

Inadequate Customization and Scalability

Some vendors offer one-size-fits-all solutions that don’t accommodate specific surgical procedures or training objectives. Be cautious of sims that cannot be customized for different retractor types, tissue depths, or patient anatomies, as this limits their utility across training programs.

Intellectual Property Infringement Risks

Sourcing from manufacturers that replicate patented designs or use copyrighted anatomical data without authorization exposes buyers to legal liability. Always confirm that the retractor sim is developed under proper IP licenses or is an original design with clear ownership documentation.

Unclear IP Ownership in Custom Development

When commissioning custom sims, failure to define IP ownership in contracts can result in disputes. Suppliers may retain rights to the design, limiting your ability to reproduce or modify the model. Ensure contracts explicitly transfer IP rights to your organization when required.

Insufficient Documentation and Traceability

Poor record-keeping on materials used, design sources, or manufacturing processes can hinder regulatory compliance and quality audits. Demand full documentation, including material safety data sheets (MSDS), design schematics, and compliance certificates.

Avoiding these pitfalls requires due diligence, clear contractual agreements, and collaboration with reputable, transparent suppliers who prioritize both quality and IP integrity.

Logistics & Compliance Guide for Retractor Sims

This guide outlines the key logistical considerations and compliance requirements specific to the operation, deployment, and maintenance of Retractor Sims—simulated retraction systems used in training, testing, or virtual environments. Adhering to these standards ensures operational integrity, regulatory alignment, and safety across all use cases.

Purpose and Scope

This guide applies to all personnel involved in the development, deployment, operation, and maintenance of Retractor Sims across training facilities, simulation centers, and R&D environments. It covers hardware integration (if applicable), software licensing, data handling, safety protocols, and regulatory alignment.

System Classification and Regulatory Alignment

Retractor Sims are classified as simulation and training tools and may fall under broader regulatory frameworks depending on application context:

- Aviation & Aerospace: Compliance with FAA AC 120-XX (if used in flight crew training)

- Automotive Safety Testing: Alignment with ISO 6487 (impact simulation instrumentation) where applicable

- Medical Device Training: Adherence to IEC 62304 for software lifecycle if used in medical simulators

- General Software Simulations: Compliance with ISO/IEC 25010 for software quality standards

Ensure classification is reviewed during initial deployment and reassessed with any system modification.

Deployment Logistics

Deployment of Retractor Sims must follow standardized procedures:

- Hardware Requirements: Verify minimum system specifications (CPU, RAM, GPU, I/O interfaces) for real-time simulation performance.

- Software Installation: Use only authorized installation packages from approved repositories; maintain version control.

- Network Configuration: Isolate simulation networks where possible; use VLANs to separate simulation traffic from enterprise systems.

- Calibration & Validation: Perform pre-deployment calibration checks using certified test scripts to confirm retraction dynamics fidelity.

Data Management and Security

Retractor Sims may generate operational, performance, and user interaction data. Handling must comply with:

- Data Retention: Store simulation logs and user data per organizational policy (typically 90–365 days unless required longer for audits).

- Encryption: Encrypt stored and transmitted sensitive data using AES-256 or equivalent.

- Access Control: Implement role-based access (RBAC); only authorized instructors, engineers, and auditors may access raw simulation output.

- GDPR / CCPA Compliance: Anonymize user data where necessary; provide data access and deletion mechanisms if personal data is collected.

Operational Safety Protocols

Even in simulated environments, safety expectations must be maintained:

- Emergency Stop Simulation: Include a virtual E-stop function that halts all retraction sequences and logs the event.

- User Training: All operators must complete a certified orientation covering system limits, failure modes, and response protocols.

- Failure Mode Drills: Simulate retraction jams, over-speed, or sensor failure to train response procedures.

- Physical Interface Safety (if applicable): If Retractor Sims control physical mockups, ensure mechanical interlocks and emergency cutoffs are in place.

Maintenance and System Updates

Regular maintenance ensures simulation accuracy and system reliability:

- Scheduled Reviews: Perform monthly system health checks and quarterly functional validation.

- Patch Management: Apply software updates within 30 days of vendor release; test patches in a sandbox environment first.

- Version Control: Maintain a change log documenting all updates, configuration changes, and calibration adjustments.

- Backup Protocol: Conduct weekly backups of configuration files, user profiles, and calibration data; store offsite or in cloud with encryption.

Audit and Compliance Documentation

Organizations must maintain comprehensive records to support compliance audits:

- System Logs: Retain simulation start/end times, user IDs, scenarios executed, and anomalies encountered.

- Training Records: Document all operator certifications and refresher training completions.

- Incident Reports: Log any system malfunction, data breach, or safety concern with root cause analysis and resolution steps.

- Regulatory Filings: Submit required documentation to oversight bodies where mandated (e.g., FAA, EASA, OSHA equivalents).

Conclusion

Proper logistics and compliance management for Retractor Sims ensures accurate, safe, and legally defensible simulation operations. All stakeholders must adhere to this guide and participate in periodic reviews to maintain alignment with evolving standards and operational needs.

Conclusion for Sourcing Retractor SIMs:

In conclusion, sourcing retractor SIMs requires a strategic approach that balances cost, reliability, technical compatibility, and supplier credibility. After evaluating potential suppliers, considering network coverage, SIM form factors (standard, micro, nano, or embedded), and activation logistics, it is evident that selecting the right SIM solution is critical to ensuring seamless connectivity and performance of retractor devices in real-world applications.

Prioritizing reputable providers with proven track records in IoT/M2M services ensures robust network support, flexible data plans, and remote SIM management capabilities crucial for long-term deployment. Additionally, scalability and future-proofing—such as the use of eSIMs or multi-IMSI technology—can significantly enhance operational flexibility and reduce downtime.

Ultimately, a well-executed sourcing strategy for retractor SIMs not only supports current project requirements but also lays the foundation for scalable, reliable, and efficient connectivity as operations grow and evolve.