The global retaining rings market is experiencing steady expansion, driven by rising demand across automotive, industrial machinery, and aerospace sectors. According to Grand View Research, the global snap rings (retaining rings) market was valued at USD 1.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. Similarly, Mordor Intelligence forecasts increasing adoption of precision-engineered fasteners in manufacturing, citing advancements in automation and miniaturization as key growth catalysts. With performance specifications becoming more stringent, the need for high-quality retaining ring sizes—from miniature components used in medical devices to heavy-duty rings in commercial vehicles—has propelled innovation among leading manufacturers. In this competitive landscape, seven companies have emerged as market leaders, distinguished by their global reach, technical capabilities, and extensive product portfolios catering to diverse dimensional and load requirements.

Top 7 Retaining Ring Sizes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Retaining Rings Manufacturer – Snap Rings

Domain Est. 1995

Website: pic-design.com

Key Highlights: PIC Design manufactures a variety of retaining rings in several sizes to fit your needs. Our selection includes internal & external rings in a variety of ……

#2 Arcon Ring

Domain Est. 1999

Website: arconring.com

Key Highlights: Arcon Ring is a trusted U.S. manufacturer and supplier of industrial retaining rings and snap rings for over 50 years. ISO-certified with in-stock inventory ……

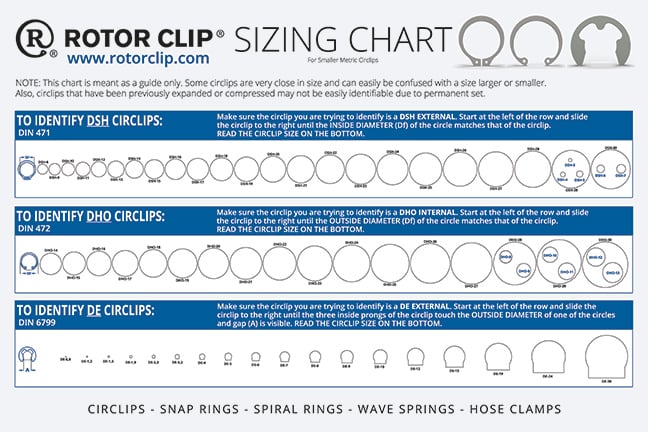

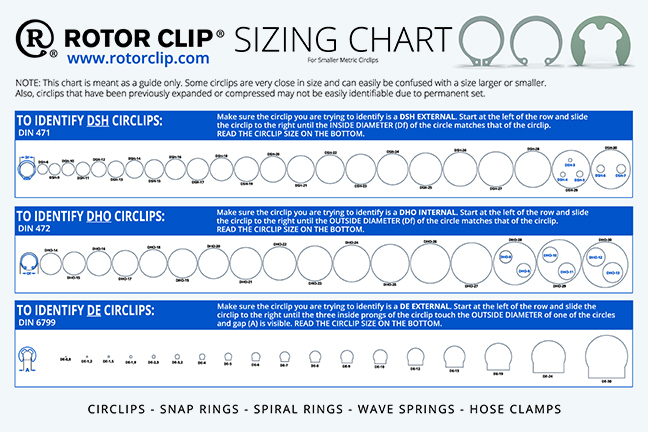

#3 Rotor Clip

Domain Est. 1997

Website: rotorclip.com

Key Highlights: Your comprehensive manufacturer and supplier of standard or custom retaining rings, wave springs, and hose clamps….

#4 Standard and Heavy

Domain Est. 1996

Website: americanring.com

Key Highlights: At American Ring, we specialize in manufacturing and supplying high-quality retaining rings that deliver exceptional performance in various industries….

#5 Retaining Rings

Domain Est. 1996

Website: daemar.com

Key Highlights: Rotor Clip is the global leader in the Manufacture of Retaining Rings and Constant Section Rings. Offering made in the USA Quality….

#6 Retaining Rings

Domain Est. 1997

Website: seeger-orbis.com

Key Highlights: Retaining rings for bores SEEGER rings for bores are also available in different sizes and designs. The retaining rings, too, are made of high-quality spring ……

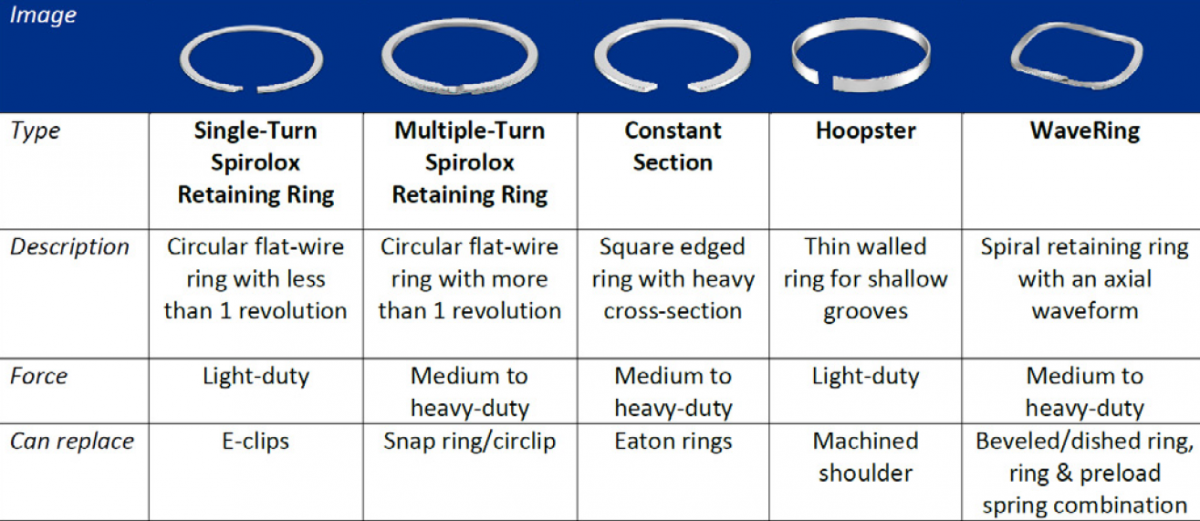

#7 Retaining Ring Types and Selection

Domain Est. 1998

Website: smalley.com

Key Highlights: You can find retaining rings based on assembly type and size using our Part Search Tool, or check out our Catalog for a full list….

Expert Sourcing Insights for Retaining Ring Sizes

2026 Market Trends for Retaining Ring Sizes

The retaining ring market is poised for notable shifts by 2026, driven by evolving industrial demands, advancements in manufacturing technologies, and growing precision requirements across key sectors such as automotive, aerospace, and industrial machinery. A critical aspect of this evolution is the trend in retaining ring sizes, which reflects broader changes in design efficiency, material usage, and application-specific engineering.

Increasing Demand for Miniaturized Retaining Ring Sizes

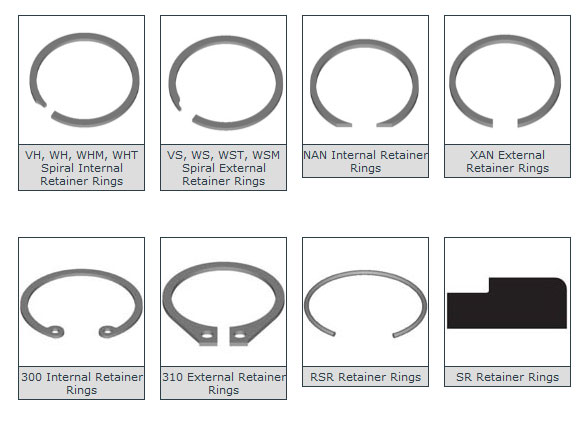

One of the most prominent trends shaping the 2026 market is the rising demand for smaller, precision-engineered retaining rings. As industries adopt compact designs—especially in medical devices, robotics, and consumer electronics—there is a growing need for miniature retaining rings, typically in sizes ranging from 1 mm to 10 mm in diameter. This shift is fueled by the miniaturization of components in electric vehicles (EVs), wearables, and advanced sensors. Manufacturers are responding by expanding their product lines to include ultra-small retaining rings with high tolerance and corrosion resistance, often made from stainless steel or specialty alloys.

Growth in Standard and Large-Sized Rings for Heavy-Duty Applications

While miniaturization is a major trend, there remains strong demand for standard and large-sized retaining rings (10 mm to over 200 mm) in heavy industries. The construction, oil and gas, and renewable energy sectors—particularly wind turbine manufacturing—require robust components capable of withstanding high stress and harsh environments. By 2026, market analysis suggests increased adoption of large-sized spiral and snap rings designed for durability and ease of installation in large shaft and housing systems. Advances in heat treatment and surface coatings are enhancing the performance of these larger rings, extending their service life and reducing maintenance costs.

Shift Toward Customization and Application-Specific Sizing

A key trend emerging by 2026 is the move away from one-size-fits-all solutions toward customized retaining ring sizes tailored to specific applications. End users in aerospace and defense, for example, require rings with non-standard dimensions and tight tolerances to meet rigorous safety and performance standards. As a result, suppliers are investing in flexible manufacturing processes such as CNC stamping and laser cutting to produce custom-sized retaining rings efficiently. Digital design tools and CAD integration are enabling faster prototyping and quicker turnaround times, supporting just-in-time manufacturing models.

Regional Variations in Size Demand

Regional market dynamics are also influencing retaining ring size trends. In North America and Europe, the focus on automation and Industry 4.0 is driving demand for precision-sized rings compatible with smart assembly systems. In contrast, emerging markets in Asia-Pacific—particularly China and India—are witnessing growth in mid-sized retaining rings due to expanding automotive and industrial equipment production. Local manufacturers are prioritizing cost-effective, standardized sizes to support high-volume manufacturing, though demand for precision sizes is rising with technological adoption.

Material and Manufacturing Innovations Impacting Size Capabilities

Technological advancements are expanding the feasible size range for retaining rings. New materials such as high-strength alloys, composites, and engineered plastics are enabling thinner, lighter rings without sacrificing load capacity. Additive manufacturing (3D printing) is beginning to play a role in producing complex or niche-sized rings that were previously difficult to stamp or form. As these technologies mature by 2026, they will allow manufacturers to offer a broader spectrum of retaining ring sizes with enhanced performance characteristics.

Conclusion

By 2026, the retaining ring market will be characterized by a bifurcated demand: one segment focused on miniaturization for high-tech applications, and another emphasizing durability and standardization for industrial use. Size trends will increasingly reflect application-specific needs, supported by innovations in materials, manufacturing, and customization. Companies that adapt to these evolving size requirements—offering scalable, precise, and reliable solutions—will be best positioned to capture growth in this dynamic market.

Common Pitfalls When Sourcing Retaining Ring Sizes (Quality, IP)

Sourcing retaining rings—especially with attention to precise sizes, quality standards, and intellectual property (IP) considerations—can present several challenges. Overlooking these factors may lead to performance failures, supply chain disruptions, or legal risks. Below are key pitfalls to avoid:

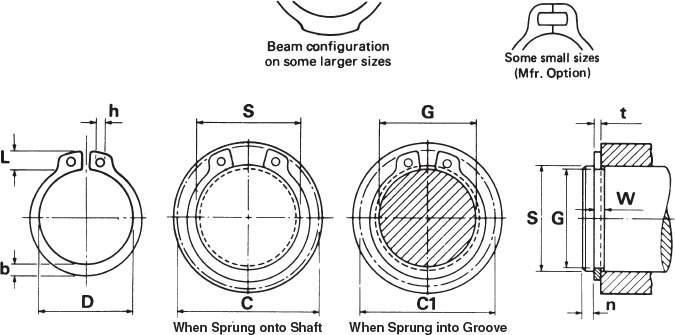

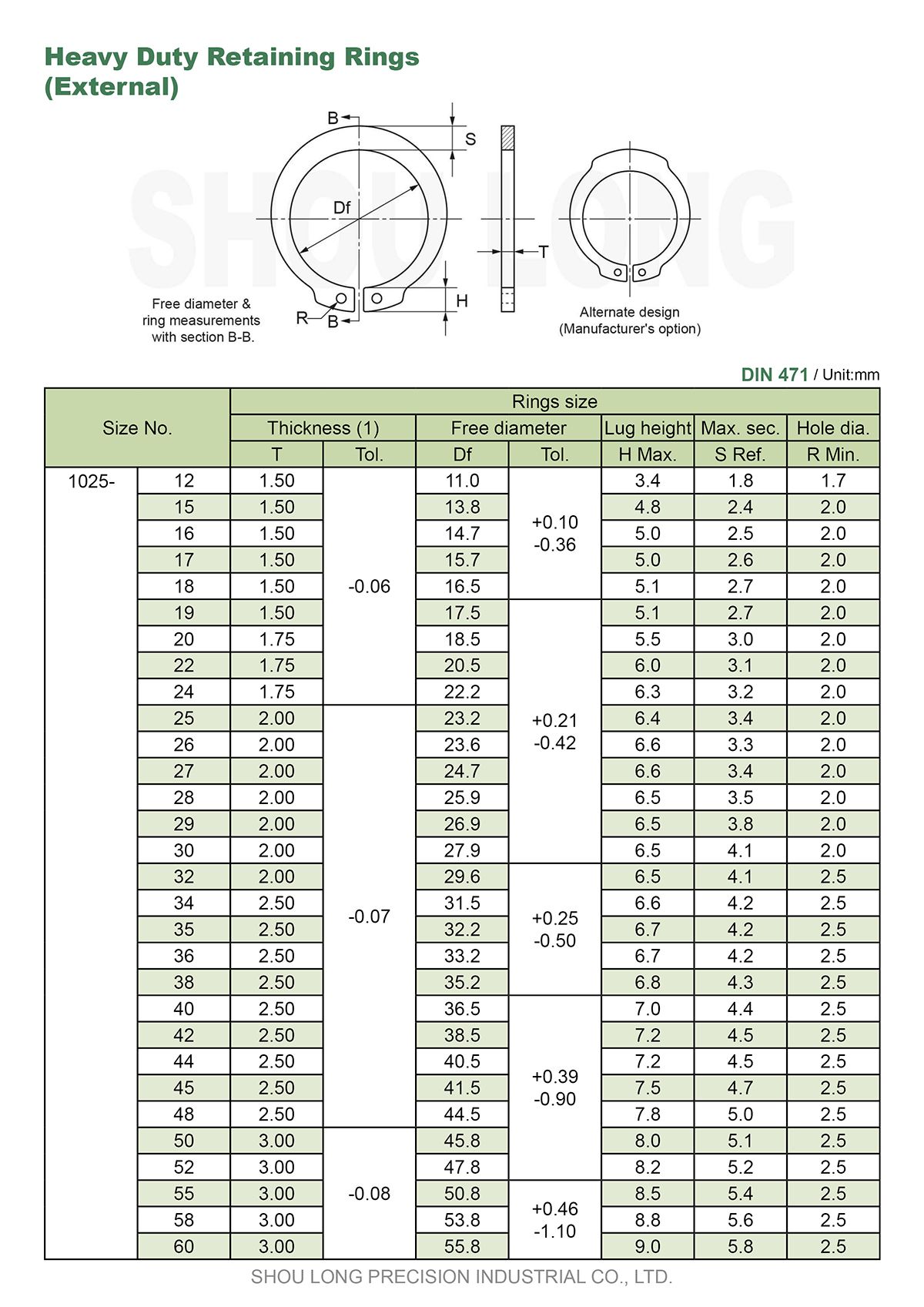

Inadequate Attention to Dimensional Accuracy and Tolerances

Retaining rings are highly precision-dependent components. Even minor deviations in inner/outer diameter, thickness, or free diameter can result in improper fit, premature failure, or assembly issues. Sourcing from suppliers without strict adherence to industry standards (e.g., ANSI/ASME, DIN, or ISO) or without proper metrology capabilities increases the risk of receiving out-of-spec parts.

Compromising on Material and Coating Quality

Low-quality materials—such as substandard spring steel or improper heat treatment—can lead to reduced fatigue life, corrosion, or deformation under load. Additionally, inadequate or inconsistent surface coatings (e.g., zinc plating, black oxide) may compromise environmental resistance. Always verify material certifications and perform batch testing when sourcing from new or unproven suppliers.

Ignoring Intellectual Property and Counterfeit Parts

Many retaining ring designs, especially those from established manufacturers (e.g., Smalley, Rotor Clip, Barnes Group), are protected by patents, trademarks, or proprietary engineering. Sourcing from third parties that replicate these designs without licensing can lead to IP infringement. Counterfeit or reverse-engineered rings often fail to meet performance standards and may expose your company to legal liability.

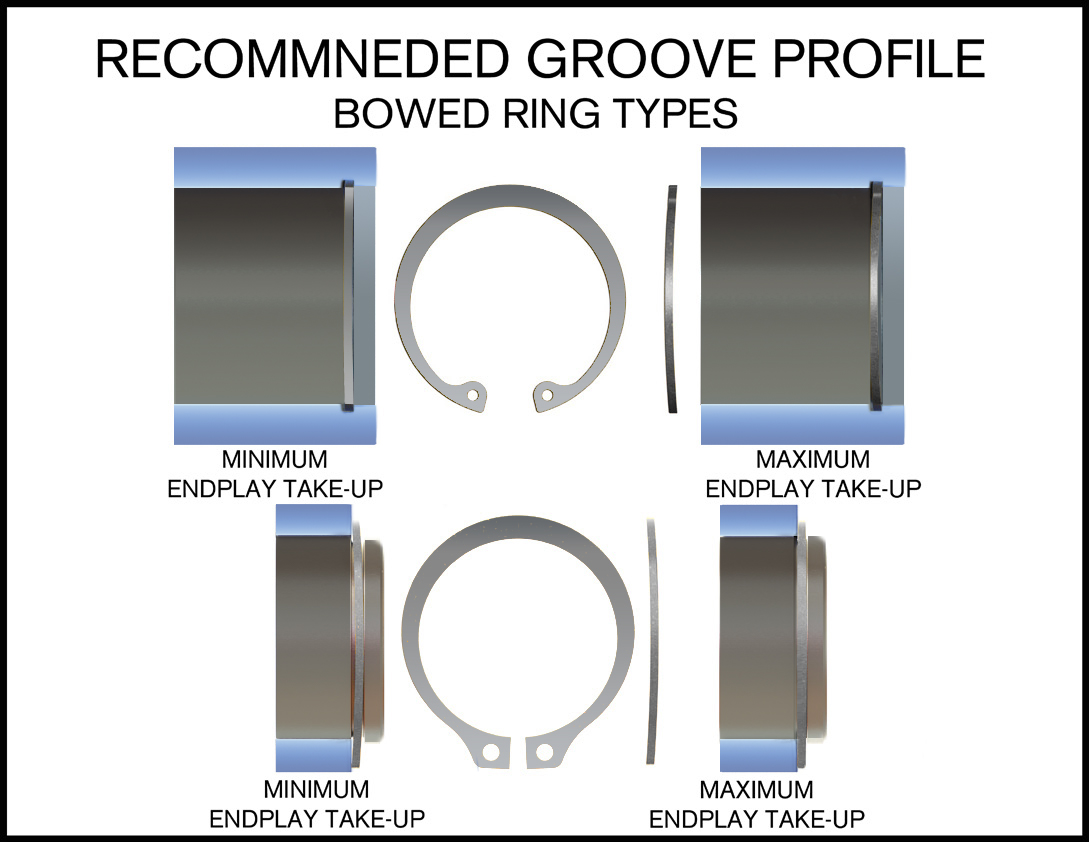

Overlooking Application-Specific Requirements

Not all retaining rings are interchangeable, even if dimensions appear similar. Factors like load type (axial vs. radial), groove design, temperature, and dynamic vs. static applications affect ring performance. Using generic or incorrectly specified rings can result in catastrophic failure. Always validate that the sourced ring meets the exact functional requirements of the assembly.

Relying on Inconsistent or Unverified Suppliers

Sourcing from suppliers without a proven quality management system (e.g., ISO 9001 certification) increases variability in product quality. Inconsistent batch-to-batch performance, poor documentation, or lack of traceability can undermine reliability. Conduct supplier audits and request samples with full certification before committing to large orders.

Failure to Confirm Compliance with Industry Standards

Depending on the industry—automotive, aerospace, medical—retaining rings may need to comply with additional standards (e.g., RoHS, REACH, DFARS). Neglecting these requirements can result in non-compliance penalties or product recalls. Ensure suppliers can provide documentation proving adherence to relevant regulatory and industry norms.

By proactively addressing these pitfalls, companies can ensure they source retaining rings that are dimensionally accurate, durable, legally compliant, and fit for purpose.

Logistics & Compliance Guide for Retaining Ring Sizes

Overview

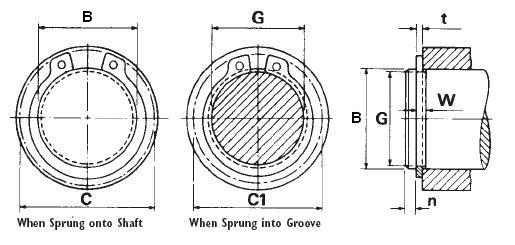

Retaining rings are critical mechanical fasteners used to hold components in place on shafts or within bores. Ensuring proper logistics handling and compliance with relevant standards is essential for product performance, safety, and regulatory adherence. This guide outlines best practices for managing retaining ring sizes throughout the supply chain while meeting industry and regulatory requirements.

Standardization and Sizing Compliance

Retaining rings must conform to recognized dimensional and material standards to ensure interchangeability and reliability. Key compliance standards include:

– ANSI/ASME B27.5 – Standard for retaining rings (excluding snap rings) used in general applications.

– DIN 471 / DIN 472 – German standards for shaft and housing retaining rings.

– ISO 14924 – Aerospace-specific retaining ring standards.

Ensure all retaining rings are manufactured and labeled according to these standards, with size markings that include:

– Nominal shaft or housing diameter

– Ring type (e.g., internal, external, spiral, beveled)

– Material (e.g., carbon steel, stainless steel)

– Finish (e.g., phosphate, zinc-plated)

Packaging and Labeling Requirements

Proper packaging prevents damage during transit and ensures traceability:

– Use anti-corrosion packaging (e.g., VCI paper) for ferrous materials.

– Clearly label each package with:

– Part number

– Retaining ring size (e.g., “30 mm Shaft Retaining Ring”)

– Quantity

– Compliance markings (e.g., RoHS, REACH)

– Lot or batch number for traceability

– Include a packing slip with full specification details and compliance certifications.

Storage and Handling

To maintain integrity and prevent deformation:

– Store in a dry, temperature-controlled environment (10°C–30°C recommended).

– Avoid stacking heavy loads on packages to prevent ring distortion.

– Use non-magnetic tools when handling precision rings to avoid contamination.

– Segregate sizes and types to prevent mix-ups; use labeled bins or drawers.

Transportation and Shipping

- Use cushioned, rigid containers to protect against vibration and impact.

- Follow UN packaging guidelines if shipping hazardous materials (e.g., certain plating chemicals with rings).

- For international shipments, ensure compliance with:

- REACH (EU) – Registration, Evaluation, Authorization, and Restriction of Chemicals.

- RoHS – Restriction of Hazardous Substances in electrical and electronic equipment.

- ITAR/EAR – If rings are used in defense or aerospace applications.

Documentation and Traceability

Maintain records for full compliance and audit readiness:

– Material Test Reports (MTRs) for raw materials.

– Certificate of Conformance (CoC) for each batch.

– Dimensional inspection reports verifying size tolerances.

– Chain-of-custody logs for high-reliability sectors (e.g., aerospace, medical).

Supplier and Quality Assurance

- Source from ISO 9001-certified manufacturers.

- Conduct regular audits to verify adherence to size specifications and process controls.

- Perform incoming inspection using calibrated gauges (e.g., ring groove micrometers, optical comparators).

Disposal and Environmental Compliance

- Recycle metal retaining rings through certified scrap metal processors.

- Follow local regulations for disposal of packaging materials (e.g., plastic trays, foam).

- Comply with waste electrical and electronic equipment (WEEE) directives where applicable.

Conclusion

Adhering to standardized sizing, proper packaging, and regulatory compliance ensures that retaining rings perform reliably and meet industry expectations. Consistent logistics practices—from manufacturing to end-user delivery—minimize risk, enhance traceability, and support quality assurance across all applications.

In conclusion, sourcing the correct retaining ring sizes requires a thorough understanding of application requirements, precise dimensional specifications, and compatibility with the corresponding groove or housing. Key factors such as internal vs. external rings, material type, tolerance standards (e.g., ASME, DIN), and load conditions must be carefully evaluated. Utilizing manufacturer catalogs, standard dimension charts, and digital measurement tools can significantly improve accuracy in selection. When standard sizes are unavailable, custom manufacturing or close equivalents may be considered, provided they meet performance and safety criteria. Ultimately, proper sourcing ensures optimal function, durability, and reliability of mechanical assemblies, minimizing risk of failure and maintenance costs.