The global resuscitator bag market is experiencing steady growth, driven by increasing demand for emergency medical devices, rising incidence of respiratory disorders, and expanding pre-hospital care infrastructure. According to Grand View Research, the global emergency medical devices market—of which resuscitator bags are a critical component—was valued at USD 15.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Mordor Intelligence projects similar momentum, citing the growing geriatric population, heightened focus on critical care readiness, and increased awareness of cardiorespiratory emergencies as key market drivers. As healthcare systems worldwide emphasize rapid response and life-saving interventions, the demand for reliable, high-performance manual resuscitator bags continues to rise. This increasing need has positioned several manufacturers at the forefront of innovation, quality, and global supply. Here are the top five resuscitator bag manufacturers leading the market through technological advancement, regulatory compliance, and widespread clinical adoption.

Top 5 Resuscitator Bag Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

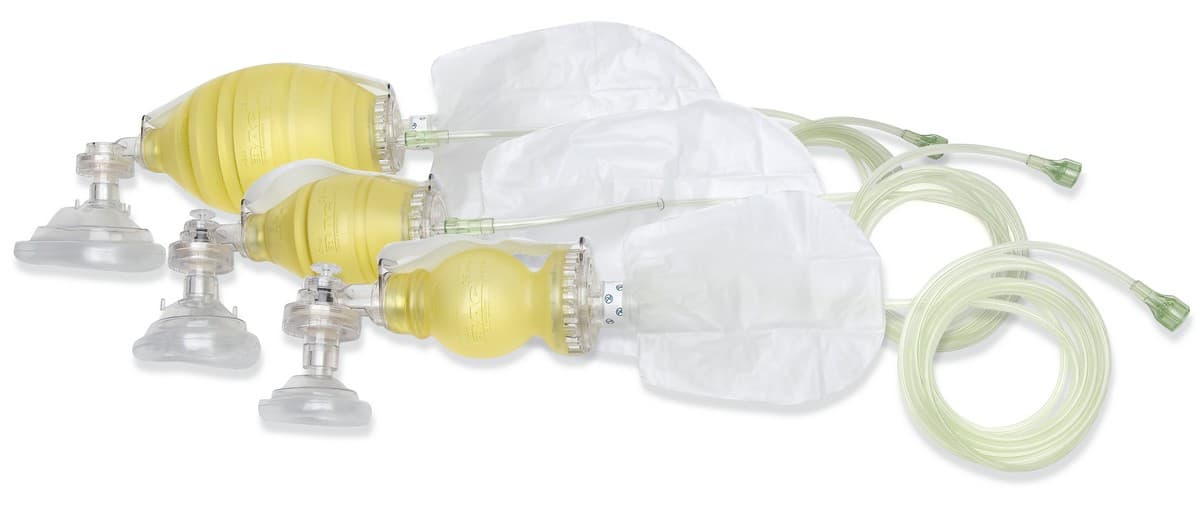

#1 The BAG II® Disposable Resuscitator

Domain Est. 1995

Website: laerdal.com

Key Highlights: The BAG II Disposable Resuscitator is Laerdal’s option for disposable ventilation. For lung ventilation on patients, without clean up and the risk of cross- ……

#2 Ambu® Resuscitators

Domain Est. 1996

Website: ambuusa.com

Key Highlights: Ambu developed the world’s first self-inflating resuscitator, designed for manual ventilation. Since then, the Ambu Bag has become synonymous with ……

#3 Bag

Domain Est. 1996

Website: intersurgical.com

Key Highlights: Intersurgical’s self inflating manual resuscitation systems, BVMs (Bag-Valve-Mask), are designed for use in resuscitation and emergency care….

#4 Our iconic Ambu bag, worth a celebration

Domain Est. 1996

Website: ambu.com

Key Highlights: The Ambu Bag revolutionized manual resuscitation. To this day, the Ambu bag continues to make a difference and save millions of lives around the world….

#5 GaleMed’s Dispo. Bag Infant Resuscitator Ambu Bag

Domain Est. 1999

Website: galemed.com

Key Highlights: GaleMed’s Dispo. Bag Infant Resuscitation device ensures consistent performance for effective newborn care. Experience the reliability of GaleMed Ambu bag….

Expert Sourcing Insights for Resuscitator Bag

H2: 2026 Market Trends for Resuscitator Bags

The global resuscitator bag market is poised for significant evolution by 2026, driven by technological advancements, increasing demand for emergency medical care, and the lasting impact of recent global health crises. Several key trends are expected to shape the market dynamics over the coming years.

1. Technological Integration and Smart Devices

A major trend in the 2026 resuscitator bag market is the shift toward smart, digitally enhanced resuscitators. Devices equipped with sensors, real-time feedback mechanisms, and connectivity features (such as Bluetooth and mobile app integration) are gaining traction. These innovations allow healthcare providers to monitor ventilation parameters, ensuring optimal tidal volume and minimizing the risk of lung injury. The integration of artificial intelligence for performance analytics and training simulations is also anticipated to grow, especially in pre-hospital and critical care settings.

2. Rising Demand in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa are expected to witness accelerated adoption of resuscitator bags due to expanding healthcare infrastructure, rising awareness of emergency preparedness, and government initiatives to improve emergency medical services (EMS). Increased funding for public health and ambulance services in countries like India, Brazil, and Indonesia will drive volume growth in these regions.

3. Focus on Portability and Durability

There is a growing preference for lightweight, compact, and durable resuscitator bags designed for use in diverse environments — from hospital ICUs to battlefield and disaster relief scenarios. Manufacturers are responding by developing rugged, easy-to-clean models with ergonomic designs. The demand for pediatric and neonatal-specific resuscitation devices is also rising, reflecting a broader emphasis on specialized care.

4. Regulatory Standards and Quality Compliance

By 2026, stricter regulatory requirements related to device safety, performance, and infection control are expected to influence product design and market entry strategies. Compliance with international standards such as ISO 8382 (for manual resuscitators) and FDA/CE regulations will become critical for manufacturers seeking global market access. Increased scrutiny post-pandemic has heightened the importance of quality assurance in resuscitation equipment.

5. Impact of Pandemics and Emergency Preparedness

The lessons learned from the COVID-19 pandemic continue to influence healthcare planning. Governments and healthcare institutions are investing in emergency stockpiles, including resuscitator bags, as part of pandemic preparedness programs. This trend is expected to sustain demand beyond 2026, particularly in public health systems and ambulatory care units.

6. Growth in Home and Pre-Hospital Care

With the expansion of home healthcare and telemedicine, there is a rising need for user-friendly resuscitator bags suitable for non-clinical settings. First responder kits, school health programs, and elderly care facilities are increasingly incorporating resuscitation devices, contributing to market diversification.

7. Competitive Landscape and Innovation

The market is becoming increasingly competitive, with key players such as Medtronic, Ambu A/S, Teleflex, and Allied Healthcare Products focusing on R&D, strategic partnerships, and geographic expansion. Innovations such as antimicrobial materials, disposable components, and single-patient-use designs are differentiating products and addressing infection control concerns.

In conclusion, the 2026 resuscitator bag market will be characterized by innovation, geographic expansion, and a strong emphasis on safety and efficiency. As healthcare systems worldwide prioritize emergency readiness and patient outcomes, resuscitator bags will remain a critical component of life-support infrastructure, evolving to meet the demands of modern medicine.

Common Pitfalls When Sourcing Resuscitator Bags (Quality and IP)

Sourcing resuscitator bags—critical medical devices used in emergency care—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking key pitfalls can lead to compromised patient safety, regulatory non-compliance, and legal risks.

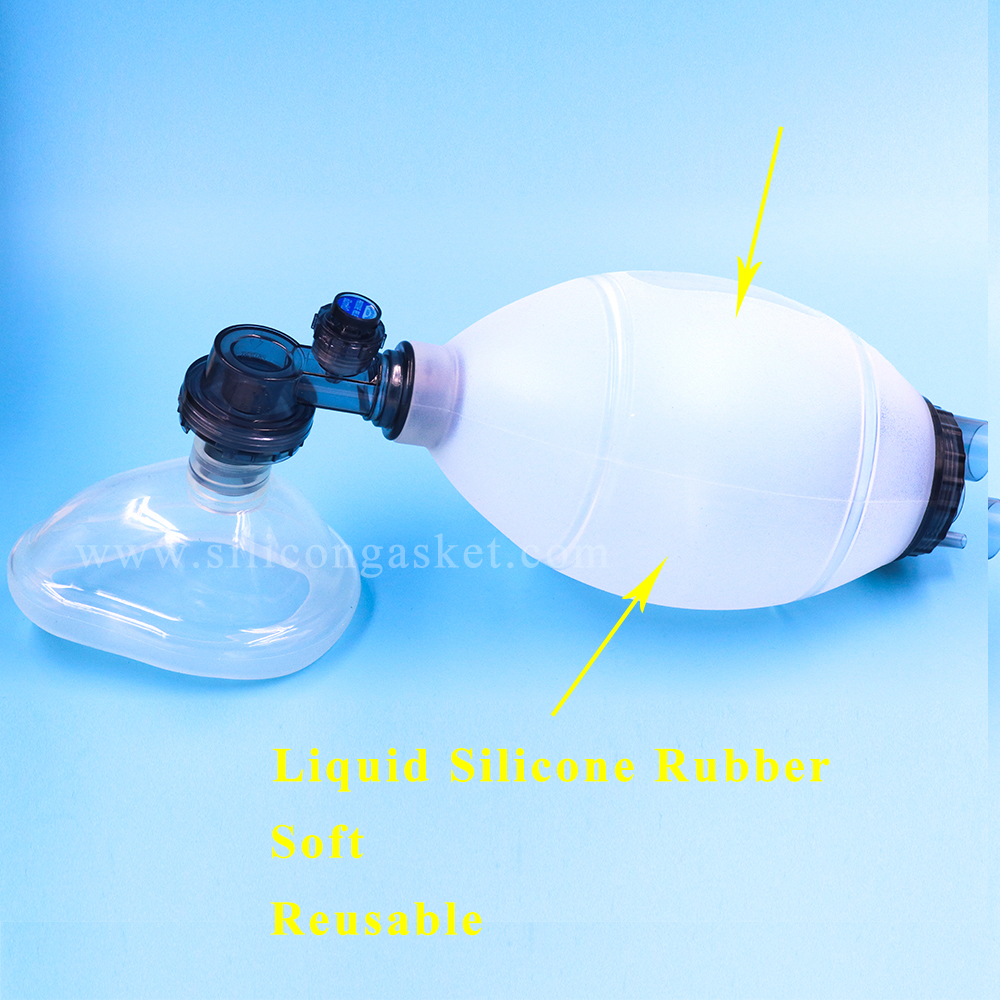

Poor Material Quality and Durability

Many low-cost resuscitator bags are made from substandard silicone or PVC, leading to cracking, loss of elasticity, or failure under pressure. This compromises effective ventilation and increases the risk of device failure during life-saving procedures. Sourcing from manufacturers without verifiable material certifications (e.g., USP Class VI, ISO 10993) exposes buyers to unreliable products.

Lack of Regulatory Compliance

Resuscitator bags are Class II medical devices in most jurisdictions (e.g., FDA 510(k), CE marking under MDR). A common pitfall is sourcing from suppliers who claim compliance but lack valid certifications or technical documentation. Non-compliant devices may be seized at customs or banned from clinical use, disrupting supply chains and exposing organizations to liability.

Inadequate Performance Testing

Some sourced resuscitator bags fail to meet minimum performance standards, such as consistent tidal volume delivery, minimal leakage, or proper valve function. Suppliers may not conduct or provide test reports (e.g., ISO 83818 compliance), leading to inconsistent clinical performance and potential harm to patients.

Counterfeit or IP-Infringing Products

A major IP risk involves sourcing resuscitator bags that copy patented designs, logos, or proprietary features of established brands (e.g., Ambu, Laerdal). Using counterfeit or IP-infringing devices not only violates intellectual property rights but may also indicate poor manufacturing controls and lack of clinical validation.

Missing or Falsified Documentation

Suppliers may provide incomplete or falsified documentation, including certificates of conformity, sterilization reports, or biocompatibility data. This undermines traceability and audit readiness, especially during regulatory inspections or post-market surveillance.

Inconsistent Quality Control Across Batches

Without strong quality management systems (e.g., ISO 13485 certification), manufacturers may produce resuscitator bags with inconsistent dimensions, valve alignment, or bag volume. This variability affects clinical reliability and increases the risk of user error during emergencies.

Supply Chain Transparency Gaps

Sourcing through intermediaries or unauthorized distributors increases the risk of receiving expired, repackaged, or diverted products. Lack of transparency in the supply chain makes it difficult to verify authenticity, track recalls, or ensure proper storage conditions.

Ignoring After-Sales Support and Training

Some suppliers fail to provide adequate user manuals, training materials, or technical support. This reduces effective device utilization and increases the likelihood of misuse, especially in low-resource settings where proper training is essential.

Avoiding these pitfalls requires thorough due diligence, including factory audits, review of regulatory documentation, verification of IP rights, and engagement with reputable, certified manufacturers.

Logistics & Compliance Guide for Resuscitator Bags

Regulatory Classification and Standards

Resuscitator bags, also known as manual resuscitators or bag-valve-mask (BVM) devices, are classified as medical devices and are subject to stringent regulatory oversight. In the United States, the Food and Drug Administration (FDA) categorizes most resuscitator bags as Class II devices, requiring 510(k) premarket notification to demonstrate substantial equivalence to a legally marketed predicate device. Key standards include ISO 8382:2018 for emergency resuscitators and ISO 10651-3:2009 for lung ventilators used in critical care. Compliance with these standards ensures device safety, performance, and consistency across manufacturing batches.

Global Market Access and Certifications

To distribute resuscitator bags internationally, manufacturers must comply with regional regulatory frameworks. In the European Union, conformity with the Medical Device Regulation (MDR) (EU) 2017/745 is mandatory, requiring a CE mark issued by a Notified Body. In Canada, Health Canada requires a Medical Device License (MDL) under the Medical Devices Regulations. Additionally, countries such as Australia (TGA), Japan (PMDA), and China (NMPA) have specific registration and certification processes. Pre-market submissions often require technical documentation, clinical evaluation reports, and proof of a certified Quality Management System (QMS), typically aligned with ISO 13485.

Labeling and Packaging Requirements

Proper labeling is critical for compliance and safe use. Resuscitator bags must display the device name, model number, manufacturer details, lot or serial number, expiration date (if applicable), and single-use or reusable designation. Labels must include standardized symbols per ISO 15223-1 and language requirements for the target market. Packaging must ensure sterility for single-use devices and withstand transportation stresses. Inner packaging should include instructions for use (IFU) in the local language, with critical warnings such as “For single patient use only” if applicable.

Supply Chain and Distribution Logistics

Resuscitator bags must be stored and transported under controlled environmental conditions, typically between 15°C and 30°C, and protected from direct sunlight, moisture, and physical damage. Temperature excursions during shipping must be monitored, especially for sterile products. Logistics partners should be validated to handle medical devices compliant with Good Distribution Practices (GDP). Serialization and traceability systems (e.g., UDI – Unique Device Identification) must be implemented to support recalls, inventory management, and regulatory reporting.

Post-Market Surveillance and Adverse Event Reporting

Manufacturers are required to maintain a post-market surveillance (PMS) system to monitor device performance and detect potential safety issues. Under FDA regulations, medical device reports (MDRs) must be submitted for device-related deaths, serious injuries, or malfunctions. Similarly, under EU MDR, incidents and field safety corrective actions (FSCAs) must be reported to relevant authorities. A robust quality management system must include procedures for complaint handling, corrective and preventive actions (CAPA), and periodic safety update reports (PSURs) where required.

Environmental and Disposal Compliance

Single-use resuscitator bags must be disposed of in accordance with biohazard and medical waste regulations, such as those outlined by the Environmental Protection Agency (EPA) or local health departments. Reusable components, if applicable, must be validated for reprocessing (cleaning, disinfection, and sterilization) and labeled accordingly. Manufacturers should support environmentally responsible disposal practices and comply with regulations such as the EU’s Waste Electrical and Electronic Equipment (WEEE) Directive when applicable.

Conclusion for Sourcing Resuscitator Bags

Sourcing resuscitator bags (also known as bag-valve-mask or BVM devices) is a critical procurement activity that directly impacts patient care, particularly in emergency, critical care, and transport settings. After thorough evaluation of suppliers, product quality, regulatory compliance, cost-effectiveness, and logistical considerations, it is evident that selecting the right resuscitator bag involves balancing clinical performance with safety, reliability, and value for money.

Key findings indicate that resuscitator bags must meet international standards such as ISO 8359 and be certified by regulatory bodies like the FDA, CE, or local health authorities to ensure safety and efficacy. Reusable and disposable options each have their advantages depending on the healthcare setting—reusable models offer long-term cost savings and environmental benefits when properly sterilized, while disposable versions provide convenience and reduce cross-contamination risks in high-turnover environments.

Supplier reliability, consistent supply chain, and technical support are equally important considerations. Preferred suppliers should demonstrate a proven track record, responsive customer service, and the capability to scale supply during emergencies or surges in demand.

In conclusion, the optimal sourcing strategy involves partnering with reputable suppliers offering high-quality, compliant resuscitator bags that meet clinical and operational needs. Establishing long-term agreements with performance-based contracts, combined with regular quality audits, will ensure continuous availability of reliable life-support equipment, ultimately supporting the delivery of safe and effective patient care across healthcare facilities.