The global automotive exhaust system market is undergoing significant transformation, driven by tightening emissions regulations, rising demand for fuel-efficient vehicles, and growing consumer interest in performance and acoustics. According to Mordor Intelligence, the global exhaust system market was valued at approximately USD 43.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5.8% from 2024 to 2029. A critical component within this ecosystem is the resonator—a device engineered to fine-tune exhaust noise and improve engine efficiency. As vehicle manufacturers and aftermarket suppliers prioritize sound quality and regulatory compliance, the demand for high-performance resonators is on the rise. This growth is further supported by Grand View Research, which highlights increasing adoption of advanced exhaust technologies in both passenger and commercial vehicles, particularly in emerging markets across Asia-Pacific and Latin America. With innovation accelerating and competition intensifying, identifying the leading resonator for exhaust manufacturers becomes essential for industry stakeholders navigating this evolving landscape.

Top 10 Resonator For Exhaust Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Universal Mufflers & Resonators

Domain Est. 1995

Website: borla.com

Key Highlights: 5-day delivery · 30-day returnsUniversal. Reversible design. Compact size is perfect for applications with limited space; Un-Notched necks are designed for weld in installation….

#2 15150S

Domain Est. 1996

#3 Exhaust Systems, Cat

Domain Est. 1997

Website: dynomax.com

Key Highlights: DynoMax® Performance Exhaust is a leading brand of stainless steel exhaust systems, cat-back systems, axle-back systems and stainless steel muffler ……

#4 Walker Exhaust Systems

Domain Est. 1999

Website: walkerexhaust.com

Key Highlights: Providing performance-grade mufflers and exhaust kits for a wide variety of makes and models, Walker is the name to trust in OE-quality exhaust parts….

#5 Pro Series Packed Resonators

Domain Est. 1999

#6 Mufflers and Resonators

Domain Est. 2000

Website: vibrantperformance.com

Key Highlights: We offer one of the most complete offerings of Mufflers & Resonators in the industry, providing the ideal upgrade for virtually any type of car or truck, ……

#7 Exhaust Resonator Pipe, X & H Pipes Products

Domain Est. 2003

Website: pypesexhaust.com

Key Highlights: 3-day delivery 730-day returnsExhaust Resonator Pipe; X & H Pipes. 1996-1998 Mustang X-Pipe Exhaust Kit | High Flow Ceramic Catalytic Converters | 409 Stainless Steel | Designed …..

#8 Exhaust Products

Domain Est. 2006

Website: apemissions.com

Key Highlights: From the catalytic converter to exhaust tail pipe and everything in-between, AP is unmatched for product depth and diversity, coverage and quality….

#9 ARK Performance Inc

Domain Est. 2006

Website: arkperformance.com

Key Highlights: 4-day deliveryXtreme Quality Makes Xtreme Performance. From high-performance exhaust systems to precision-engineered suspension, stylish wheels and aerodynamic components ……

#10 xforce performance exhaust

Domain Est. 2014

Expert Sourcing Insights for Resonator For Exhaust

H2: Market Trends for Resonators for Exhaust in 2026

The global market for resonators in exhaust systems is anticipated to witness steady growth by 2026, shaped by evolving regulatory standards, technological advancements, and shifts in automotive manufacturing. H2 (hydrogen) as a clean energy vector is emerging as a pivotal influence on exhaust system design, including the role and evolution of resonators. Below is an analysis of key 2026 market trends for resonators for exhaust, with a focus on the impact of the H2 economy.

1. Shift Toward Hydrogen-Powered Vehicles Driving Design Innovation

With increased investment in hydrogen fuel cell electric vehicles (FCEVs), automakers are rethinking exhaust system components. While traditional internal combustion engines (ICEs) produce exhaust gases requiring noise attenuation via resonators, FCEVs emit only water vapor and minimal byproducts. However, auxiliary systems such as hydrogen combustion engines (H2-ICEs)—being developed by companies like Toyota and BMW—still generate exhaust noise and thus require acoustic tuning. In this context, resonators are being redesigned for lower volume, optimized frequency damping, and integration into compact hydrogen exhaust paths.

2. Lightweight and Corrosion-Resistant Materials

The push for efficiency in hydrogen vehicles demands lighter and more durable components. By 2026, resonators are expected to increasingly use advanced materials such as aluminized stainless steel, titanium alloys, and composite coatings to resist moisture and potential embrittlement from hydrogen exposure. These materials enhance longevity and maintain acoustic performance in harsh operating environments.

3. Integration with Smart Exhaust Systems

The rise of intelligent vehicle platforms enables adaptive exhaust technologies. In H2-powered or hybrid systems, resonators may be integrated with active noise control (ANC) systems and variable valve actuators. These “smart resonators” can adjust backpressure and sound profiles in real time, improving efficiency and passenger comfort. OEMs are expected to partner with acoustics specialists to develop modular resonator units compatible with H2 propulsion systems.

4. Regulatory Influence and Emission Standards

Global emissions regulations, such as Euro 7 and China 7, are pushing automakers to minimize all forms of pollution—including noise. Even in low-emission H2 applications, noise regulations remain stringent. Resonators are critical in meeting these acoustic standards. By 2026, regulatory compliance will drive demand for high-efficiency resonators tailored to hydrogen combustion characteristics, which differ from gasoline or diesel engines in frequency and amplitude.

5. Regional Market Dynamics

Europe and Japan are leading in H2 infrastructure and vehicle adoption, creating early demand for specialized exhaust components like resonators. In contrast, North America is seeing growth in heavy-duty hydrogen trucks, where larger, robust resonators are needed to manage noise from high-torque H2-ICEs. China, while focusing on battery-electric vehicles, is also investing in hydrogen for commercial transport, indirectly supporting resonator innovation.

6. Aftermarket and Retrofit Opportunities

As legacy ICE vehicles are converted to run on hydrogen (via retrofit kits), there is a growing aftermarket for modified exhaust systems. Resonators designed specifically for hydrogen combustion—accounting for different gas velocities and temperature profiles—are expected to become a niche but expanding segment by 2026.

Conclusion

By 2026, the resonator for exhaust market will be increasingly influenced by the hydrogen economy. While traditional demand from ICE vehicles will persist, especially in emerging markets, innovation will be driven by H2-powered transportation. Resonators will evolve from passive noise-dampening components to intelligent, material-advanced systems optimized for hydrogen’s unique operational profile. Companies that align their R&D with H2 integration, lightweight engineering, and smart acoustics will lead the next phase of growth in the exhaust component sector.

Common Pitfalls When Sourcing Resonators for Exhaust Systems

Sourcing resonators for exhaust systems—especially for automotive or industrial applications—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance issues, compliance risks, legal disputes, and supply chain disruptions. Below are key pitfalls to avoid:

Poor Material and Build Quality

One of the most frequent issues is receiving resonators made from substandard materials or with inconsistent manufacturing. Low-grade stainless steel or aluminized steel may corrode prematurely, especially in harsh environments. Poor welding, incorrect internal baffle placement, or thin gauge metal can compromise acoustic performance and durability, leading to early failure and customer complaints.

Mitigation Tip: Require material certifications (e.g., ASTM standards), conduct factory audits, and implement rigorous incoming quality inspections or third-party testing.

Inaccurate Acoustic Tuning

Resonators are designed to target specific noise frequencies. Sourcing a unit with incorrect dimensions, inlet/outlet configurations, or internal design can result in ineffective noise cancellation or unwanted drone. This often happens when suppliers copy designs without understanding the underlying acoustics.

Mitigation Tip: Validate performance with acoustic testing data and ensure the supplier can demonstrate tuning for your specific engine or system requirements.

Non-Compliance with Emissions and Noise Regulations

Exhaust components must comply with regional regulations (e.g., EPA, Euro standards). A poorly sourced resonator may alter backpressure or noise output in ways that violate these rules, leading to certification failures or legal liability.

Mitigation Tip: Confirm that the resonator design meets applicable regulatory standards and request compliance documentation from the supplier.

Intellectual Property (IP) Infringement

Many resonator designs are protected by patents—especially those with unique internal geometries or tuning technologies. Sourcing from suppliers who reverse-engineer or copy proprietary designs can expose your company to IP litigation, even if unintentional.

Mitigation Tip: Conduct IP due diligence. Require suppliers to warrant that their designs do not infringe on third-party patents and consider consulting legal counsel for high-risk components.

Lack of Traceability and Documentation

In regulated industries, full traceability—including material batch numbers, manufacturing dates, and test results—is essential. Suppliers who fail to provide proper documentation make it difficult to manage recalls, warranty claims, or quality investigations.

Mitigation Tip: Specify documentation requirements in contracts and audit supplier records as part of your quality management system.

Supply Chain Instability and Counterfeit Risk

Sourcing from unverified or low-cost suppliers—particularly in regions with weak IP enforcement—increases the risk of counterfeit or non-conforming parts. This can disrupt production and damage brand reputation.

Mitigation Tip: Work with reputable suppliers, use secure procurement channels, and consider on-site audits or blockchain-based traceability systems.

By proactively addressing these pitfalls, companies can ensure they source resonators that meet performance, durability, and legal requirements while minimizing risk across the supply chain.

Logistics & Compliance Guide for Resonator for Exhaust

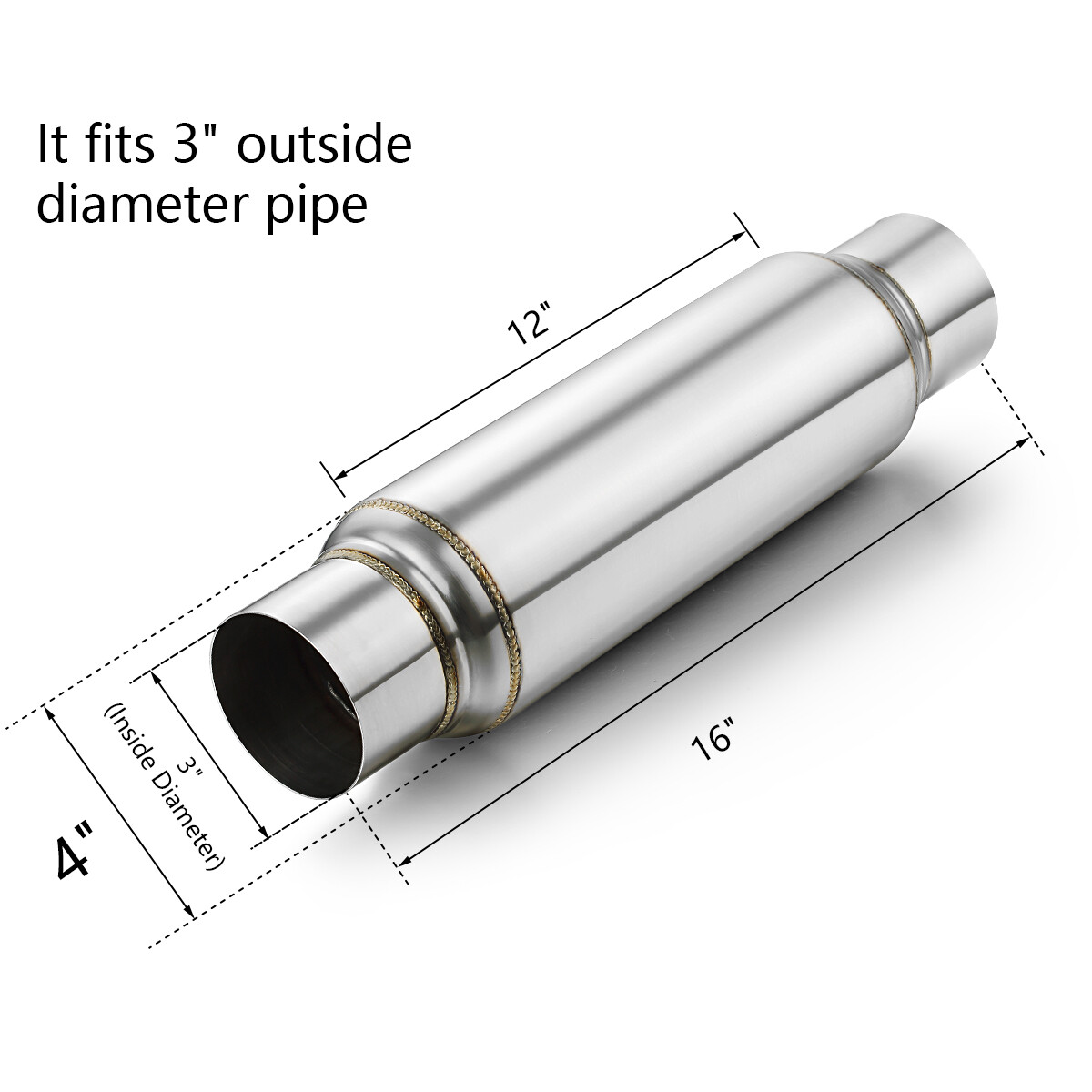

Overview of the Resonator for Exhaust

A resonator for exhaust is an essential component in a vehicle’s exhaust system designed to reduce noise by canceling out sound waves. Unlike a muffler, which dampens overall noise, a resonator targets specific frequencies to fine-tune the exhaust note and improve acoustic performance. These components are commonly made from stainless steel, aluminized steel, or other durable materials to withstand high temperatures and corrosive environments.

This guide outlines logistics considerations and compliance requirements for the import, export, distribution, and installation of resonators for exhaust systems.

Harmonized System (HS) Code Classification

The correct HS code is critical for customs clearance, duty calculation, and regulatory compliance.

- Recommended HS Code (varies by country):

8708.29.50 – Parts and accessories of bodies (including cabs), for tractors, motor vehicles for the transport of ten or more persons, motor cars, and other motor vehicles principally designed for the transport of persons (other than tractors).

Note: Some countries may classify exhaust resonators under 8708.29.60 (exhaust manifolds and exhaust pipes) or 7326.90 (other articles of iron or steel). Always verify with local customs authorities.

Import/Export Documentation Requirements

To ensure smooth logistics and compliance with international trade regulations, the following documents are typically required:

- Commercial Invoice: Must include detailed product description (e.g., “Stainless Steel Resonator for Automotive Exhaust System”), quantity, value, country of origin, and HS code.

- Packing List: Specifies weight, dimensions, packaging type, and number of units per shipment.

- Bill of Lading (B/L) or Air Waybill (AWB): Proof of shipment and contract of carriage.

- Certificate of Origin: Required by many countries to determine tariff eligibility, especially under free trade agreements (e.g., USMCA, EU agreements).

- Import/Export License (if applicable): Some jurisdictions may require permits for automotive parts, particularly if made from strategic materials.

- Safety Data Sheet (SDS): Not typically required unless the product contains hazardous coatings or materials.

Regulatory Compliance

1. Environmental and Emissions Regulations

-

EPA (U.S. Environmental Protection Agency):

Aftermarket exhaust components must comply with the Clean Air Act. Installing a resonator that alters emissions systems or bypasses catalytic converters may violate EPA regulations. Resonators should not interfere with emission control devices. -

EU Emission Standards (Euro 6 and beyond):

In the European Union, modifications to exhaust systems must comply with EU type-approval regulations. Resonators sold as replacement parts must not compromise the vehicle’s original emissions certification. -

CARB (California Air Resources Board):

In California, aftermarket parts must be Executive Order (EO) certified if they are intended for use on emissions-controlled vehicles. Resonators that affect emissions may require CARB certification.

2. Noise Regulations

-

FMVSS No. 141 (U.S.):

Sets permissible noise levels for motor vehicles. Aftermarket exhaust systems, including resonators, must not exceed specified sound limits. -

EU Noise Directive (2007/46/EC):

Exhaust systems must comply with noise level restrictions. Resonators should maintain compliance with original equipment noise standards. -

Local Municipal Ordinances:

Many regions have local noise ordinances that restrict vehicle sound levels. Ensure resonators are designed to meet or exceed these standards.

3. Material and Safety Standards

-

REACH (EU):

Regulates the use of hazardous substances in articles. Ensure materials used (e.g., coatings, welds) comply with REACH restrictions. -

RoHS (Restriction of Hazardous Substances):

Applies if electronic components are integrated (rare for standard resonators). -

DOT Compliance (U.S.):

While resonators are not directly regulated by the Department of Transportation, they must not compromise vehicle safety or structural integrity.

Packaging and Labeling Requirements

-

Packaging:

Use durable, moisture-resistant packaging to prevent corrosion during transit. Use anti-rust coatings or VCI (Vapor Corrosion Inhibitor) paper for steel components. -

Labeling:

Each unit or shipping container must include: - Part number

- Country of manufacture

- Manufacturer name and address

- HS code (optional but recommended)

- Compliance marks (e.g., CE mark if applicable, CARB EO number)

- Handling instructions (e.g., “Fragile,” “Do Not Stack”)

Transportation and Logistics Considerations

-

Mode of Transport:

Suitable for ocean, air, or ground freight. Ocean freight is cost-effective for bulk shipments; air freight is preferred for urgent orders. -

Weight and Dimensions:

Typical resonator weight: 5–15 lbs (2–7 kg); dimensions vary by vehicle make/model. Optimize palletization to maximize container or truck space. -

Storage Conditions:

Store in dry, indoor environments to prevent rust. Avoid exposure to salt, moisture, or extreme temperatures. -

Insurance:

Ensure cargo insurance covers damage, loss, or customs delays.

Aftermarket vs. OEM Considerations

-

OEM (Original Equipment Manufacturer):

Subject to stricter quality and traceability standards. Requires alignment with vehicle manufacturer specifications. -

Aftermarket:

Must provide clear installation guidelines and disclaimers regarding emissions and noise compliance. Avoid marketing language that suggests emissions system modification unless certified.

Return and Warranty Logistics

- Establish a reverse logistics process for defective or incorrect shipments.

- Provide warranty registration and claim procedures.

- Track returns to identify potential compliance or quality issues.

Conclusion

Successfully managing the logistics and compliance of exhaust resonators requires attention to classification, documentation, environmental regulations, and transportation best practices. Ensuring adherence to regional laws—especially emissions and noise standards—is critical for market access and long-term business viability. Partnering with experienced freight forwarders and legal counsel can help mitigate risks and streamline global distribution.

Conclusion for Sourcing a Resonator for Exhaust Systems:

After evaluating various factors such as performance requirements, material quality, acoustic tuning, cost, and supplier reliability, it is evident that sourcing the right resonator for an exhaust system is crucial for achieving optimal sound control, backpressure management, and overall vehicle performance. A well-designed and properly sourced resonator effectively reduces unwanted noise frequencies without sacrificing exhaust flow, contributing to a smoother and more refined driving experience.

When selecting a supplier, priority should be given to manufacturers with proven expertise in exhaust acoustics, consistent quality control, and the ability to customize solutions based on specific engine characteristics and regulatory standards. Additionally, considering factors like material durability (e.g., stainless steel vs. aluminized steel), manufacturing methods (e.g., formed vs. straight-through design), and compliance with emissions and noise regulations ensures long-term reliability and performance.

In conclusion, a strategic sourcing approach—balancing technical specifications, cost-efficiency, and supplier capability—will lead to the successful integration of a high-performance resonator that meets both engineering objectives and customer expectations.