The global market for electrical protection components has seen steady expansion, driven by increasing demand for reliable power systems across industrial, commercial, and residential sectors. According to a report by Mordor Intelligence, the global fuse market was valued at USD 1.72 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2029. This growth is fueled by rising investments in energy infrastructure, the proliferation of electric vehicles, and stringent safety regulations mandating circuit protection devices. Within this landscape, resistive fuses—known for their precision in current limiting and thermal management—have gained prominence in high-performance applications. As demand escalates, several manufacturers have emerged as key players, combining innovation, scalability, and compliance with international standards to capture significant market share. Below is a data-informed overview of the top nine resistive fuse manufacturers shaping the future of electrical safety and system reliability.

Top 9 Resistive Fuse Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 PPTC Resettable Fuse

Domain Est. 2000

Website: fuzetec.com

Key Highlights: Strap-Type Devices Battery Strap PTC Resettable Fuses are designed to be resistance spot welded to battery cells or pack interconnect straps. They are utilized ……

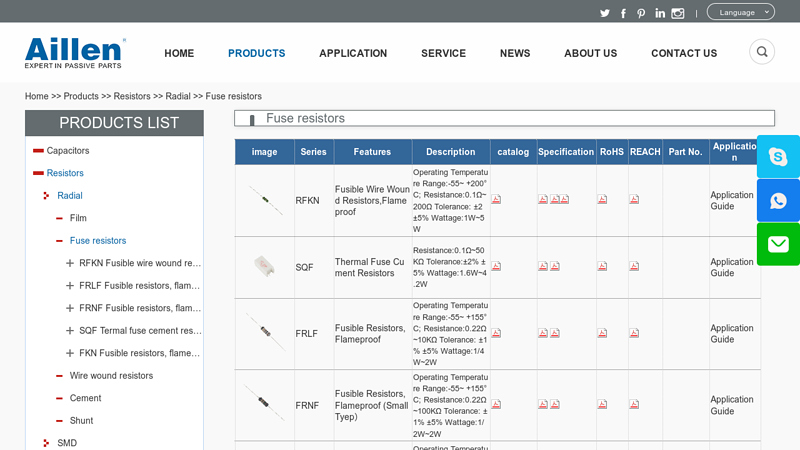

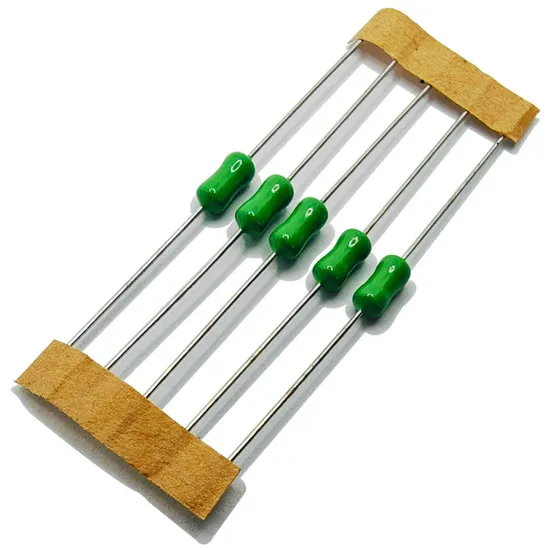

#2 Fuse Resistor

Domain Est. 2006

Website: aillen.com

Key Highlights: Fusible through-hole resistors. Designed to protect circuits from sudden transients and meet safety requirements. Image of AIllen’s fusible through-hole ……

#3 Ultra-low resistance glue-coated PPTC

Domain Est. 2020

Website: en.bhfuse.com

Key Highlights: BHFUSE, with its top-tier R&D team, pioneered the development of high-current and high-voltage PPTC in the industry, achieving remarkable market success….

#4 Products

Domain Est. 1996

Website: littelfuse.com

Key Highlights: We produce fuses, relays, semiconductors, switches, sensors, and other components that empower a more sustainable, connected, and safer world….

#5 Betterfuse Group

Domain Est. 2005

Website: betterfuse.com

Key Highlights: It has the protection function of over temperature and over current. Accessories Fuse Terminals. Fuse Holders, Fuse Clips. Selcetion Guide for Electronics….

#6 Mersen, Global expert in electrical power and advanced materials

Domain Est. 2006

Website: us.mersen.com

Key Highlights: Mersen develops customized solutions and delivers key products to its clients in order to meet the new technological challenges shaping tomorrow’s world….

#7 SETfuse

Domain Est. 2007

Website: setfuse.com

Key Highlights: SETfuse designs, manufactures, and markets industry-leading circuit control and safety protection components, providing comprehensive circuit safety solutions….

#8 Products

Domain Est. 2007

Website: setsafe.com

Key Highlights: SETsafe | SETfuse Designs, Manufactures and Markets industry-leading Circuit Control and Safety Protection Components, Providing Comprehensive Circuit Safety ……

#9 Dongguan City Chevron Electro【】

Domain Est. 2012

Website: chevronfuse.com

Key Highlights: The company primarily produces current fuses, including disposable SMD fuses, square plastic-encapsulated fuses, glass tube fuses, ceramic tube fuses, ……

Expert Sourcing Insights for Resistive Fuse

H2: 2026 Market Trends for Resistive Fuses

By 2026, the resistive fuse market is poised for moderate growth, driven by evolving demands in electronics, automotive, and industrial sectors. While facing competition from alternative protection technologies, resistive fuses maintain a critical niche due to their unique ability to combine current-limiting and resistive functions. Key trends shaping the market include:

-

Growth in Automotive Electronics: The proliferation of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and in-vehicle infotainment systems creates a surge in demand for reliable, compact circuit protection. Resistive fuses are increasingly used in battery management systems (BMS), DC-DC converters, and high-current distribution units where their dual functionality (current sensing and overcurrent protection) offers design advantages, reducing component count and board space.

-

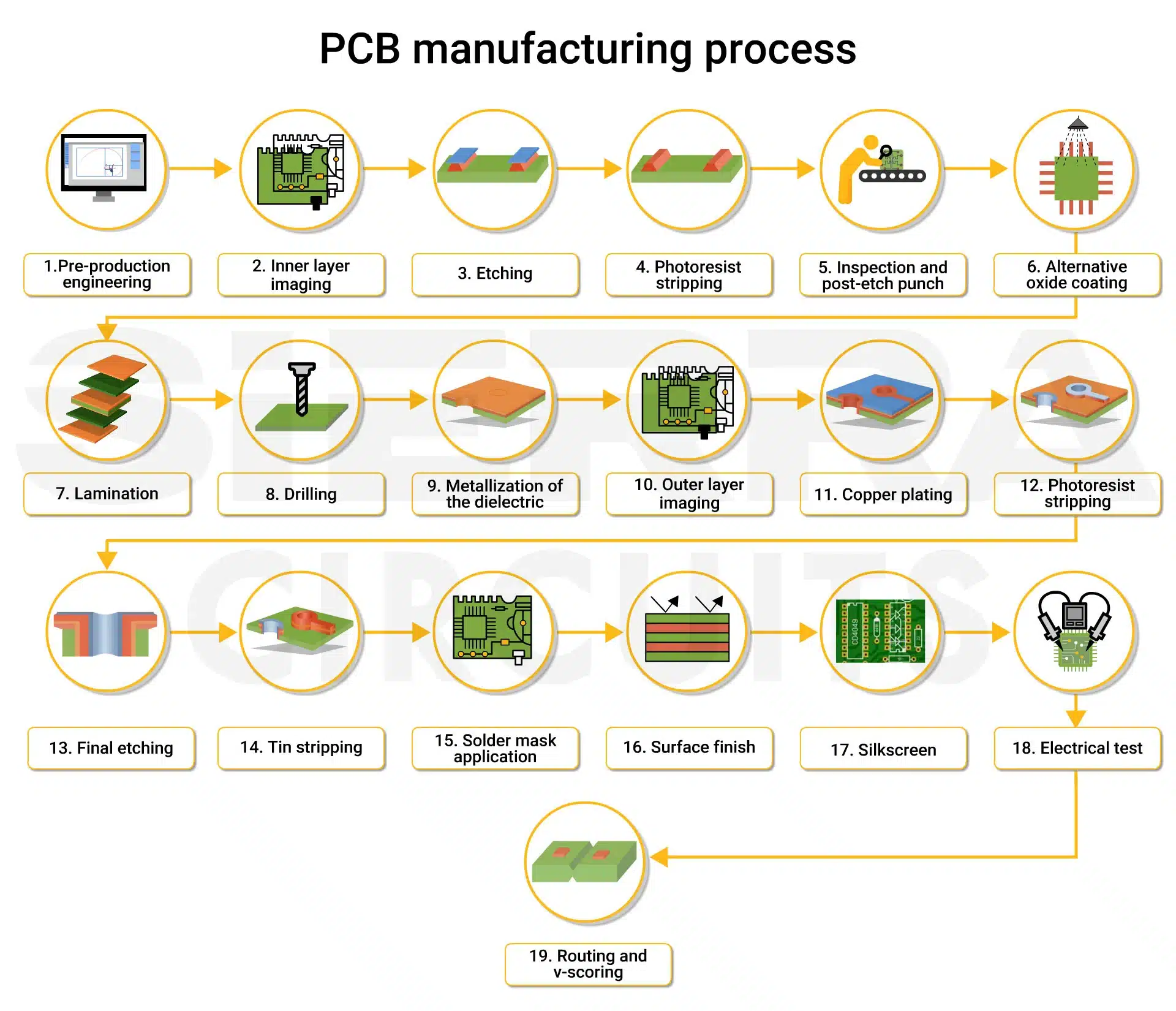

Miniaturization and Power Density: As electronic devices become smaller and power requirements increase, the demand for compact, high-performance components intensifies. Manufacturers are focusing on developing resistive fuses with lower resistance values (to minimize power loss and heat generation) and smaller form factors (e.g., 0603, 0402 chip sizes) suitable for densely populated PCBs in smartphones, wearables, and IoT devices.

-

Focus on Reliability and Safety: Stringent safety standards across industries (automotive AEC-Q200, industrial, medical) drive demand for highly reliable components. Resistive fuses offer predictable performance and fail-safe operation. The trend emphasizes enhanced materials (improved metallization, stable resistive elements) and rigorous testing to ensure long-term reliability under thermal cycling, vibration, and high surge conditions.

-

Material and Manufacturing Innovation: Advancements in thin-film and thick-film deposition technologies enable tighter tolerance control (e.g., ±1%, ±0.5%), improved temperature coefficient of resistance (TCR), and higher power ratings in smaller packages. Research into novel resistive materials aims to further reduce resistance drift over time and improve surge handling capabilities.

-

Integration and Hybrid Solutions: While pure resistive fuses remain prevalent, there is a growing trend towards integrated solutions. This includes resistive fuses combined with other passive components (e.g., in multi-chip modules) or designs that better facilitate integration with monitoring circuits for real-time current sensing and diagnostics, particularly in smart power systems.

-

Market Consolidation and Specialization: The market sees continued consolidation among passive component suppliers. Remaining players are increasingly focusing on high-reliability, high-performance segments (automotive, industrial, telecom) rather than competing solely on price in commoditized consumer electronics. Specialization in specific applications (e.g., high-pulse-withstand for power supplies) is a key differentiator.

-

Supply Chain Resilience: Lessons from recent global disruptions emphasize the need for robust supply chains. Leading manufacturers are investing in geographically diversified manufacturing, strategic inventory management, and strengthening relationships with raw material suppliers to ensure consistent availability, a critical factor for customers in long-life-cycle industries.

Conclusion: By 2026, the resistive fuse market will be characterized by steady growth fueled by automotive electrification and miniaturization trends. Success will depend on manufacturers’ ability to deliver highly reliable, miniaturized components with superior electrical characteristics (low R, tight tolerance, low TCR) through advanced materials and manufacturing, while navigating supply chain complexities and focusing on high-value applications. Resistive fuses will solidify their role as essential components in power-dense, safety-critical electronic systems.

Common Pitfalls Sourcing Resistive Fuses (Quality, IP)

Sourcing resistive fuses—components designed to both limit current and provide overcurrent protection—presents several critical challenges related to quality and intellectual property (IP). Overlooking these pitfalls can lead to product failures, safety hazards, and legal risks.

Inadequate Quality Assurance and Testing

One major pitfall is procuring resistive fuses without verifying comprehensive quality assurance processes. Low-cost suppliers may lack rigorous testing protocols for critical parameters such as current-limiting accuracy, thermal stability, and time-to-trip consistency. Without adherence to international standards (e.g., IEC 60127, UL 248), fuses may fail unpredictably under fault conditions, risking equipment damage or fire hazards. Buyers must ensure suppliers provide full test reports and certifications, and conduct independent batch testing when necessary.

Counterfeit or Substandard Components

The electronics supply chain is vulnerable to counterfeit resistive fuses, especially when sourcing from unauthorized distributors or gray-market channels. These components may use inferior materials—such as subpar resistive elements or casing materials—that degrade performance and safety. Counterfeits often fail prematurely or exhibit inconsistent resistance values, undermining the reliability of the entire system. Implementing strict supplier qualification procedures and using traceability tools (e.g., lot tracking, authenticity seals) can mitigate this risk.

Lack of Intellectual Property Verification

Another significant risk involves unintentional IP infringement. Some resistive fuse designs incorporate patented technologies in their construction, materials, or integration methods. Sourcing from manufacturers that do not license these technologies—or that replicate protected designs—can expose the buyer to legal liabilities, product recalls, or injunctions. It is essential to verify that the supplier has legitimate IP rights or proper licensing agreements, especially for high-volume or commercial applications.

Insufficient Technical Documentation and Support

Poor or incomplete documentation (e.g., missing datasheets, unclear specifications, or inaccurate performance curves) hinders proper integration and validation. Without reliable technical support, engineers may misapply the fuse, leading to system inefficiencies or safety issues. Ensure suppliers provide detailed specifications, application notes, and responsive engineering support to avoid integration pitfalls.

Overlooking Long-Term Supply Chain Stability

Resistive fuses with niche specifications may be discontinued without notice if sourced from suppliers with limited production capacity or poor lifecycle management. This can disrupt manufacturing and increase redesign costs. Prioritize vendors with proven supply continuity, obsolescence management programs, and clear product longevity commitments.

Avoiding these pitfalls requires due diligence in supplier selection, emphasis on certified quality systems, and proactive IP risk assessment. Engaging with reputable, transparent suppliers is key to ensuring both the performance and legal safety of resistive fuse integration.

Logistics & Compliance Guide for Resistive Fuses

This guide outlines key logistics and compliance considerations for handling, transporting, storing, and disposing of resistive fuses. These components, while generally low-risk, must be managed in accordance with applicable regulations to ensure safety and regulatory adherence.

Regulatory Classification and Documentation

Resistive fuses are typically classified as electronic components and are not subject to the same stringent regulations as hazardous materials. However, accurate documentation is essential. Ensure that Safety Data Sheets (SDS) are available, even if the component is not classified as hazardous, to provide transparency regarding materials used. Verify compliance with RoHS (Restriction of Hazardous Substances) and REACH regulations, especially when shipping to or within the European Union. Proper Harmonized System (HS) codes must be used during international shipments to avoid customs delays.

Packaging and Handling Requirements

Resistive fuses should be packaged to prevent physical damage and electrostatic discharge (ESD). Use anti-static bags or ESD-safe packaging materials when storing or shipping. Packaging must be robust enough to withstand standard handling during transportation, including vibration and compression. Clearly label packages with component details, part numbers, and handling instructions such as “Fragile” or “Electrostatic Sensitive Device” where applicable. Avoid exposure to moisture by using moisture barrier bags if necessary, particularly in humid environments.

Storage Conditions

Store resistive fuses in a clean, dry, and temperature-controlled environment. Ideal storage conditions are temperatures between 15°C and 30°C and relative humidity below 60%. Keep components away from direct sunlight, corrosive chemicals, and sources of electromagnetic interference. Organize inventory using a first-in, first-out (FIFO) system to prevent aging and ensure component reliability. Implement proper shelf-life tracking, especially if the fuses have moisture sensitivity levels (MSL) ratings.

Transportation Guidelines

Resistive fuses can typically be shipped via standard courier or freight services without requiring hazardous materials declarations. Confirm with carriers that electronic components are accepted under general cargo terms. For international shipments, ensure all export documentation—such as commercial invoices, packing lists, and certificates of origin—is complete and accurate. Be mindful of import restrictions or additional compliance requirements in destination countries, particularly those with strict electronics regulations.

Disposal and Environmental Compliance

Dispose of defective or obsolete resistive fuses in accordance with local electronic waste (e-waste) regulations. Do not discard in regular trash. Partner with certified e-waste recyclers who follow WEEE (Waste Electrical and Electronic Equipment) standards. Maintain records of disposal activities to demonstrate compliance during audits. Avoid incineration, as some fuses may contain trace materials that could release harmful substances when burned.

Audit and Recordkeeping

Maintain detailed records of procurement, inventory movement, shipping documentation, compliance certifications (RoHS, REACH), and disposal activities. These records support traceability and are essential during regulatory audits. Conduct periodic internal compliance reviews to ensure adherence to evolving logistics and environmental standards.

Conclusion on Sourcing Resistive Fuses:

Sourcing resistive fuses requires a careful balance between electrical performance, reliability, cost, and application-specific requirements. These specialized fuses, designed to provide both overcurrent protection and controlled resistance, are critical in sensitive electronic circuits where current limiting and fault protection are paramount.

After evaluating key suppliers, material quality, manufacturing standards, and testing certifications, it is evident that selecting a reliable source involves thorough due diligence. Prioritizing vendors with consistent quality control, adherence to international standards (such as UL, IEC, or AEC-Q200), and strong technical support is essential to ensure long-term performance and safety.

Additionally, considerations such as resistance tolerance, power rating, temperature stability, and physical footprint must align with the intended application—particularly in industries like automotive, industrial electronics, or telecommunications.

In conclusion, successful sourcing of resistive fuses depends on establishing strong partnerships with reputable manufacturers, maintaining clear specifications, and conducting rigorous validation testing. A strategic sourcing approach ensures not only compliance and reliability but also scalability and cost-efficiency in production.