The global hardwood lumber market, driven by rising demand in residential construction, flooring, and furniture manufacturing, continues to expand steadily. According to Grand View Research, the global solid wood flooring market—where red oak is a dominant species—was valued at USD 26.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Red oak, known for its durability, workability, and attractive grain, remains one of the most widely used hardwoods in North America. With increasing construction activity and a resurgence in hardwood interior finishes, demand for high-quality red oak board foot products has intensified—putting a spotlight on manufacturers that balance cost-efficiency, sustainability, and consistent supply. As of 2024, price competitiveness and production capacity have become key differentiators among leading suppliers. This analysis identifies the top 8 red oak price per board foot manufacturers, leveraging current pricing data, production volumes, and market presence to guide procurement decisions in a tightening supply landscape.

Top 8 Red Oak Price Per Board Ft Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shop Red Oak Lumber & Boards

Domain Est. 2007

Website: kjpselecthardwoods.com

Key Highlights: 12–15 day delivery 30-day returns… Red Oak wood for sale from KJP Select Hardwoods today … Red Oak Thin. 4.82 / 5.0. 60 Reviews. Original price $5.95 – Original price $15.95.Mi…

#2 Red Oak 4/4 Lumber

Domain Est. 1997

#3 Red Oak Lumber

Domain Est. 1997

Website: gahwd.com

Key Highlights: In stockRed Oak Lumber available in rough or surfaced with stright line ripped edge. Please specify in additional notes box desired thickness and SLR for straight line ……

#4 Builders FirstSource

Domain Est. 1998

Website: bldr.com

Key Highlights: Builders FirstSource is the nation’s largest supplier of structural building products, value-added components and services to the professional market….

#5 Red Oak lumber

Domain Est. 1999

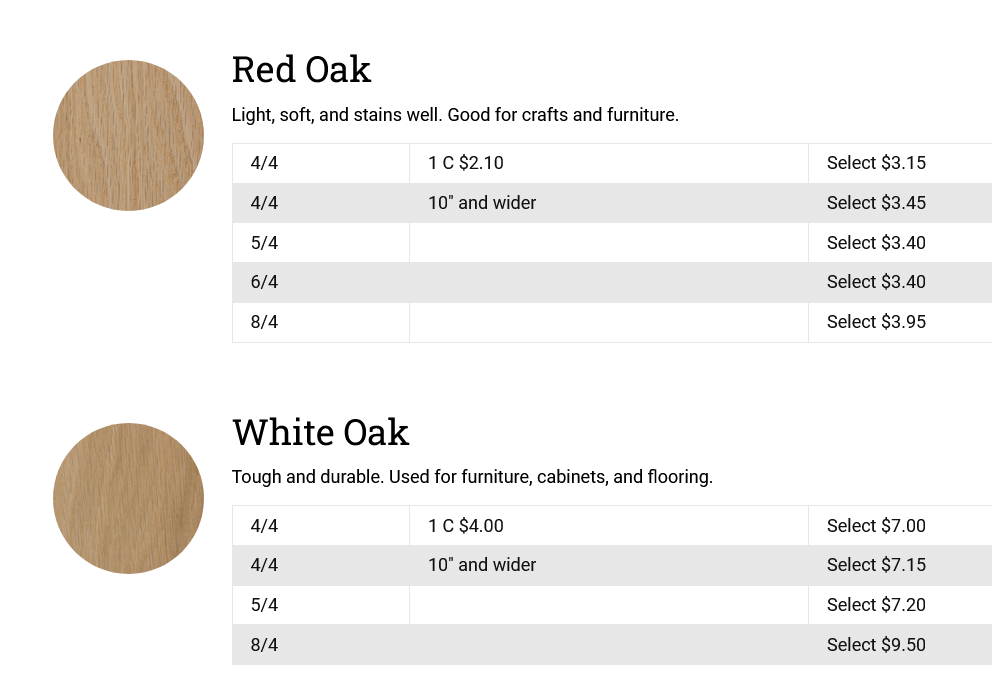

#6 Lumber Pricing

Domain Est. 2001

Website: sunrisesawmill.com

Key Highlights: For Mixed or Red Oak, our price per BF is $2.00/BF for 4″, 6″, & 8″ and $2.50 for 10″ and 12″ (the wider stock is more expensive per BF). For White Oak, our ……

#7 Red Oak Lumber for Sale near You

Domain Est. 2006

Website: woodvendors.com

Key Highlights: Wood Vendors has 4/4-8/4 Red Oak Lumber ready for prompt shipping throughout the USA. Prices start at $3.20 per BF. Call the Oak experts today at ……

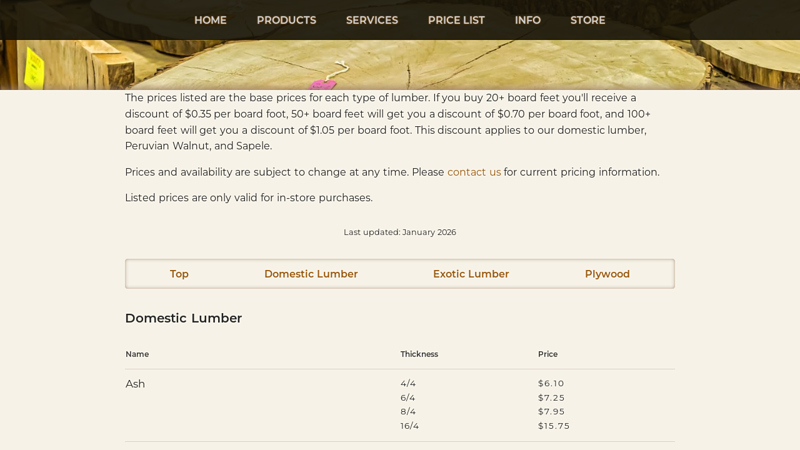

#8 Price List

Domain Est. 2009

Website: thewoodyard.com

Key Highlights: … board feet will get you a discount of $1.05 per board foot. This discount … Red Oak, 4/4, $6.10. 6/4, $6.60. 8/4, $7.45. 12/4, $14.45. White Oak, 4/4, $10.00. 4 ……

Expert Sourcing Insights for Red Oak Price Per Board Ft

H2: Projected 2026 Market Trends for Red Oak Lumber Price Per Board Foot

As we approach 2026, the market for red oak lumber—valued for its strength, aesthetic appeal, and widespread use in furniture, cabinetry, and flooring—is expected to reflect a confluence of supply dynamics, demand shifts, and macroeconomic influences. The price per board foot of red oak is anticipated to experience moderate growth, driven by several key trends.

1. Steady Demand in Residential Construction and Remodeling

The U.S. housing market is projected to maintain steady demand through 2026, supported by population growth, urbanization, and a growing preference for hardwood finishes in mid-to-high-end homes. As red oak remains a top choice for interior applications due to its workability and affordability compared to exotic hardwoods, demand is expected to remain resilient. Additionally, the ongoing trend of home improvement and remodeling—fueled by aging housing stock and low new construction rates in certain regions—will continue to bolster red oak consumption.

2. Sustainable Forestry and Certification Pressures

With increasing emphasis on environmental sustainability, consumers and manufacturers are favoring FSC (Forest Stewardship Council) and SFI (Sustainable Forestry Initiative)-certified hardwoods. Red oak, predominantly sourced from well-managed forests in the Eastern United States, benefits from this trend. However, stricter regulations and certification requirements may slightly increase production costs, potentially influencing prices upward by $0.10 to $0.25 per board foot by 2026.

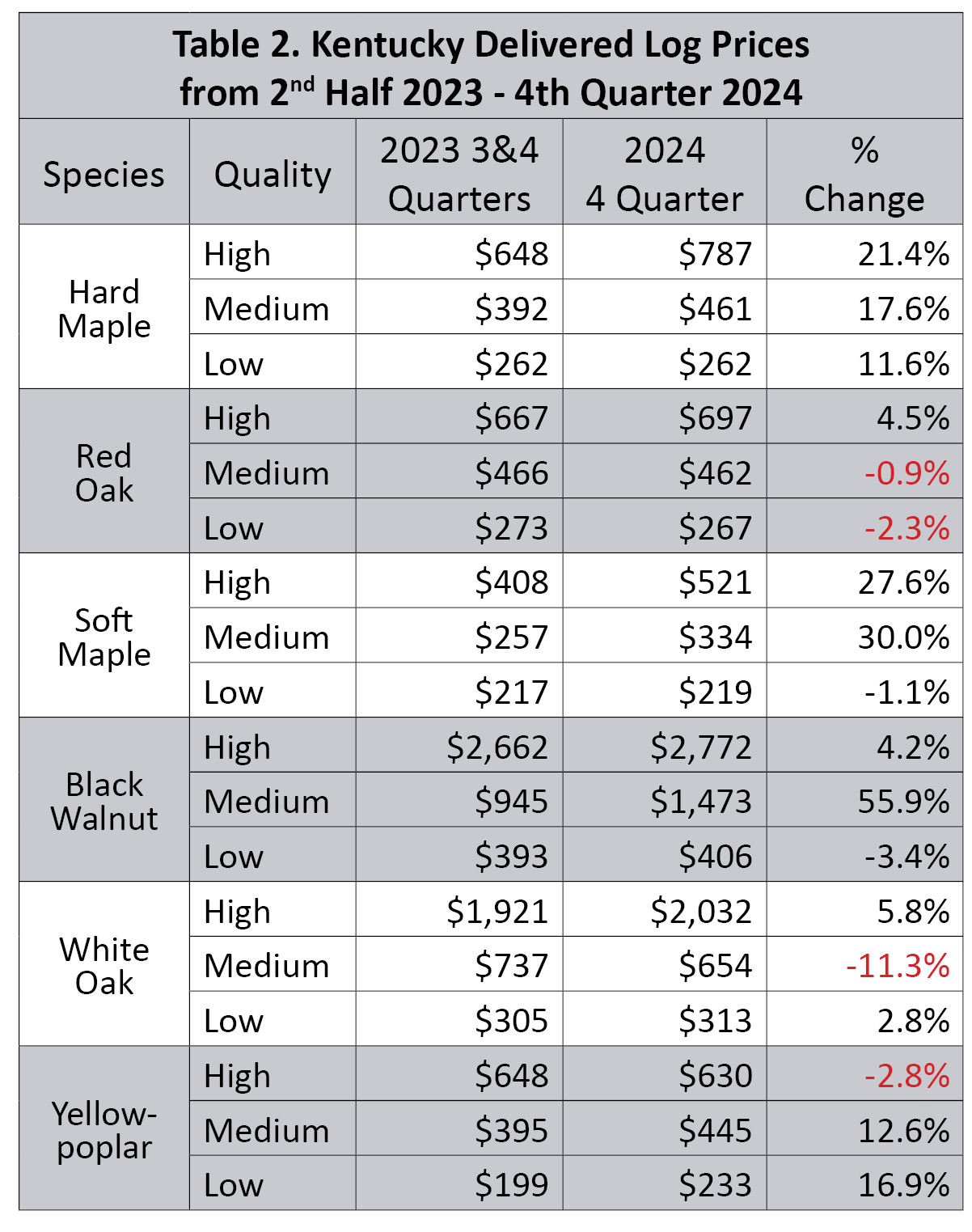

3. Supply Constraints and Log Availability

While red oak is relatively abundant, long-term supply could face headwinds. Aging timber stands, competition from other hardwood species (such as white oak), and regional pest infestations (e.g., oak wilt) may limit ideal harvest volumes. Additionally, labor shortages in the forestry and milling sectors could constrain processing capacity. These factors may contribute to tighter supply conditions, supporting price stability or modest increases.

4. Global Trade and Export Markets

Exports, particularly to Asia and Europe, play a growing role in U.S. hardwood markets. China and India’s rising middle class continues to drive demand for American hardwoods in furniture manufacturing. The U.S. hardwood export sector, supported by favorable trade policies and strong international relationships, is expected to remain robust. Increased export demand could tighten domestic supply and exert upward pressure on red oak prices.

5. Inflation and Input Costs

Inflationary trends in energy, transportation, and labor are expected to persist into 2026. These rising operational costs for sawmills and distributors are likely to be passed on to consumers. While red oak is less volatile than softwoods like pine, input cost pressures could push average prices from the current range of $2.50–$3.00 per board foot (for select & better grades) to $2.80–$3.30 by 2026.

6. Technological Advancements and Efficiency Gains

Adoption of precision milling, AI-driven yield optimization, and improved drying technologies may help offset some cost pressures. Increased efficiency in lumber production could moderate price increases, ensuring red oak remains competitive against engineered wood and alternative materials.

Conclusion

By 2026, the price of red oak lumber per board foot is projected to rise moderately, with an estimated increase of 10–15% from 2023–2024 levels, reaching a range of $2.80 to $3.40 depending on grade, region, and market conditions. Growth will be underpinned by steady domestic and international demand, sustainability trends, and inflation-driven cost increases. While supply-side challenges persist, the resilience of red oak’s market position and ongoing innovation in the hardwood sector are expected to support a stable and slightly higher pricing environment.

Common Pitfalls When Sourcing Red Oak at Price Per Board Foot (Quality and IP Considerations)

Sourcing red oak lumber by the board foot can be cost-effective, but buyers often encounter pitfalls related to quality and intellectual property (IP)—especially when working with custom millwork or proprietary designs. Being aware of these issues helps ensure you get the value and performance you expect.

1. Inconsistent Lumber Quality Despite Uniform Pricing

One of the most common issues is assuming that price per board foot reflects consistent quality. Red oak is graded (e.g., FAS, Select, #1 Common), and lower grades may contain more knots, stains, or irregular grain. Buyers may unknowingly pay premium prices for lower-grade material if grading standards aren’t clearly specified.

2. Lack of Clarity on Moisture Content

Pricing often doesn’t reflect moisture content, which significantly impacts stability and workability. Green (un-dried) red oak is cheaper but prone to warping. Kiln-dried lumber costs more but is essential for indoor applications. Failing to confirm moisture levels can lead to costly project delays or material failure.

3. Misunderstanding “Board Foot” Measurements

Errors in calculating board footage can lead to overpayment or under-ordering. A board foot is 144 cubic inches (1” x 12” x 12”), but inconsistent thickness or inaccurate supplier measurements may skew pricing. Always verify calculations and request detailed breakdowns.

4. Overlooking Regional Price and Supply Variability

Red oak availability and cost vary by region. Sourcing from distant suppliers may reduce upfront pricing but increase shipping costs and lead times. Local mills may offer better value and fresher stock, but buyers often overlook these trade-offs.

5. Intellectual Property Risks in Custom Fabrication

When sourcing red oak for custom millwork (e.g., moldings, furniture), IP concerns arise if designs are copied or used without authorization. Some suppliers may replicate your design for other clients unless protected by contracts or IP agreements. Always use non-disclosure agreements (NDAs) and clarify ownership of design files.

6. Hidden Costs from Poor Milling or Finishing

Lower-priced red oak may come with rough milling, inconsistent surfacing, or poor joinery prep. This increases labor costs during fabrication. Confirm surfacing standards (e.g., S4S – surfaced four sides) and finishing requirements upfront to avoid surprises.

7. Supplier Reliability and Certification Shortfalls

Not all suppliers adhere to sustainable forestry practices. Without certification (e.g., FSC, SFI), you risk reputational damage or compliance issues, especially in commercial or government projects. Verify sourcing ethics and chain-of-custody documentation.

8. Assumption That All Red Oak Looks the Same

Red oak varies in color and grain pattern based on harvest location and tree age. Batches from different mills may not match, leading to inconsistencies in staining or appearance. Request samples and specify color uniformity if aesthetics are critical.

By addressing these pitfalls proactively—clarifying grades, moisture content, measurements, IP rights, and supplier credentials—buyers can make informed decisions and avoid costly mistakes when sourcing red oak by the board foot.

Logistics & Compliance Guide for Red Oak Price Per Board Foot

When sourcing or selling red oak lumber, understanding the logistics and compliance requirements is essential to ensure smooth transactions, cost efficiency, and adherence to industry standards and regulations. This guide outlines key considerations related to pricing, transportation, handling, and compliance when dealing with red oak on a per board foot basis.

Understanding Red Oak Pricing Per Board Foot

The price of red oak lumber is typically quoted per board foot, a unit of volume measuring 144 cubic inches (1 foot long × 1 foot wide × 1 inch thick). Pricing fluctuates based on:

- Grade (e.g., FAS, Select, #1 Common)

- Thickness and width of boards

- Moisture content (e.g., kiln-dried vs. air-dried)

- Market demand and regional availability

- Sustainability certifications (e.g., FSC, SFI)

Always confirm the basis of pricing (e.g., random widths and lengths vs. specified dimensions) to avoid discrepancies.

Transportation and Logistics

1. Packaging and Handling

- Red oak is commonly bundled with metal or plastic strapping.

- Boards should be stickered (spaced with thin strips) during drying and transport to allow airflow and prevent mold.

- Use moisture barriers (e.g., plastic wrap) when shipping in humid or wet conditions.

2. Loading and Shipping

- Lumber must be loaded securely to prevent shifting during transport.

- Use flatbed trucks or enclosed trailers depending on distance and weather.

- Weight calculations are vital—red oak weighs approximately 3.6 pounds per board foot at 20% moisture content.

3. Regional Variations in Shipping Costs

- Freight costs vary by region; proximity to hardwood forests (e.g., Appalachian region) lowers inbound logistics costs.

- Cross-border shipments (e.g., U.S. to Canada or Mexico) require compliance with international trade regulations.

Regulatory and Compliance Considerations

1. Lacey Act Compliance (U.S.)

- Requires proof of legal harvest and chain-of-custody documentation.

- Importers and domestic traders must declare the species (Quercus rubra) and country of origin.

- Maintain records for at least two years.

2. ISPM 15 for International Shipping

- Wooden packaging (e.g., pallets) must be heat-treated and marked with the ISPM 15 stamp.

- Applies to exports and imports involving solid wood packaging material.

3. Environmental Certifications

- Buyers may require FSC (Forest Stewardship Council) or SFI (Sustainable Forestry Initiative) certification.

- Certified lumber may command a premium but opens access to eco-conscious markets.

4. Grading Standards

- Follow NHLA (National Hardwood Lumber Association) rules for grading.

- Proper grading ensures accurate pricing and avoids disputes.

Storage and Inventory Management

- Store red oak in a dry, well-ventilated warehouse to maintain moisture content (ideally 6–8% for indoor use).

- Elevate bundles off the floor to prevent moisture absorption.

- Rotate stock using FIFO (First In, First Out) to minimize aging and degradation.

Best Practices for Buyers and Sellers

- Use standardized contracts that specify grade, volume, moisture content, and delivery terms.

- Conduct pre-shipment inspections when dealing with international suppliers.

- Monitor market trends through industry reports (e.g., Random Lengths, Timber Market Report).

Conclusion

Effectively managing the logistics and compliance aspects of red oak lumber priced per board foot ensures legal operation, reduces risk, and enhances profitability. By adhering to transportation best practices, regulatory standards, and sustainable sourcing principles, stakeholders can maintain a competitive edge in the hardwood market.

In conclusion, sourcing red oak lumber by the board foot requires careful consideration of several factors that influence price, including geographical location, supplier reputation, wood quality (grades such as #1 Common or Select), thickness, and market demand. Prices typically range from $3.00 to $6.00 per board foot for air-dried or kiln-dried standard grades, though premium cuts or specialized milling can increase costs. Buying in bulk often yields discounts, while local suppliers may offer advantages in terms of reduced shipping costs and faster delivery. Additionally, staying informed about seasonal fluctuations and current market trends can help in securing the best value. By evaluating these variables and obtaining multiple quotes from reputable suppliers, woodworkers and builders can effectively manage costs while ensuring a reliable supply of high-quality red oak for their projects.