The global rebreather market is experiencing steady expansion, driven by rising demand across military, commercial diving, and technical diving sectors. According to Grand View Research, the global diving equipment market was valued at USD 1.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030—fueled significantly by advancements in rebreather technology and increased underwater exploration activities. Dräger, a leader in life-support systems, plays a pivotal role in this growth, particularly in closed-circuit rebreathers (CCRs) used in demanding environments. While Dräger itself is a primary manufacturer, the ecosystem around Dräger-based rebreathers includes key third-party developers and integrators who enhance, service, or customize systems for niche applications. The following list highlights the top three manufacturers and integrators closely associated with Dräger rebreather technology, based on innovation, market presence, and adoption in professional diving communities.

Top 3 Rebreather Dräger Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rebreather

Domain Est. 1994

Website: draeger.com

Key Highlights: Dräger diving rebreathers are closed-circuit or semi-closed-circuit underwater rebreather, developed for military rebreather diving….

#2 Interspiro

Domain Est. 1996

Website: interspiro.com

Key Highlights: Interspiro develops premium respiratory protection and equipment for diving, firefighting, emergency escape and rescue operations….

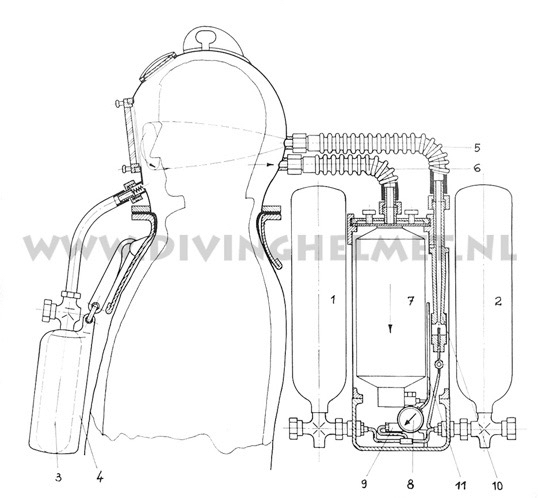

#3 Dräger LAR 8000

Domain Est. 2012

Website: draeger-mo.com

Key Highlights: The Dräger LAR 8000 is a rebreather for tactical diving that can be used in a closed circuit (CCR) or, for greater depths, in a semi-closed circuit (SCR). The ……

Expert Sourcing Insights for Rebreather Dräger

H2: Market Trends for Rebreather Technology – Dräger in 2026

As we approach 2026, the market for rebreather technology—particularly within the medical, diving, and defense sectors—is experiencing significant transformation driven by technological innovation, regulatory changes, and increasing demand for precision respiratory support. Dräger, a globally recognized leader in medical and safety technology, is strategically positioned to capitalize on several key trends shaping the rebreather market.

-

Growing Demand in Medical Ventilation and Anesthesia

In the healthcare sector, rebreather systems—especially closed-circuit anesthesia workstations and advanced ventilation solutions—are seeing increased adoption due to their efficiency in gas use and environmental benefits. Dräger’s line of anesthesia machines, such as the Apollo and Perseus A500, integrates rebreather principles to reduce waste anesthetic gas emissions (WAGE), aligning with global sustainability goals. By 2026, stricter environmental regulations in Europe and North America are expected to accelerate the shift toward low-flow and closed-circuit anesthesia, boosting Dräger’s market share in this segment. -

Technological Integration and Smart Systems

Advancements in IoT, AI, and real-time monitoring are enabling smarter rebreather systems that optimize gas delivery and enhance patient safety. Dräger has been investing heavily in digital health platforms such as the Dräger Enterprise Solution, which allows remote monitoring and predictive maintenance of anesthesia and ICU equipment. By 2026, integration with electronic medical records (EMR) and AI-driven clinical decision support is expected to become standard, positioning Dräger’s connected rebreather systems as preferred solutions in modern operating rooms and intensive care units. -

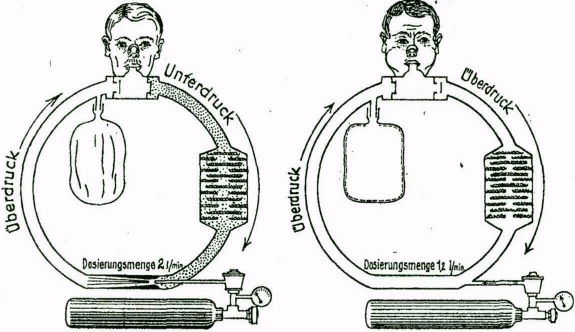

Expansion in Military and Diving Applications

Outside healthcare, Dräger maintains a strong presence in military and commercial diving with rebreathers like the LAR V and Ray. As defense budgets rise globally—particularly in NATO countries—there is growing investment in stealth diving and underwater special operations. Dräger’s closed-circuit rebreathers, known for their reliability and low acoustic signature, are likely to see increased procurement. Additionally, the civilian technical diving market is expanding, with more recreational divers adopting rebreathers for longer bottom times. Dräger is expected to respond with consumer-friendly models and enhanced training partnerships by 2026. -

Sustainability and Regulatory Pressures

Environmental concerns over greenhouse gas emissions from volatile anesthetics (e.g., desflurane) are driving hospitals to adopt rebreather-based low-flow techniques. Regulatory bodies such as the European Environment Agency and U.S. EPA are expected to implement stricter guidelines on medical gas emissions by 2026. Dräger’s leadership in eco-conscious anesthesia delivery positions it favorably, with products designed to minimize environmental impact while maintaining clinical efficacy. -

Emerging Markets and Healthcare Infrastructure Growth

In regions such as Asia-Pacific, Latin America, and the Middle East, expanding healthcare infrastructure and rising surgical volumes are creating new opportunities for advanced anesthesia systems. Dräger is likely to strengthen its distribution networks and offer tiered product solutions tailored to emerging economies, making rebreather-capable anesthesia machines more accessible.

Conclusion

By 2026, Dräger is poised to benefit from converging trends in sustainability, digital health, and global defense needs. Its expertise in integrating rebreather technology across medical, military, and industrial applications—combined with a strong R&D pipeline and regulatory foresight—positions the company as a market leader. Strategic investments in smart, eco-efficient, and connected systems will likely solidify Dräger’s competitive advantage in the evolving rebreather landscape.

Common Pitfalls Sourcing Rebreather Dräger (Quality, IP)

Sourcing Dräger rebreathers—particularly for diving, medical, or industrial applications—requires careful attention to both product quality and intellectual property (IP) considerations. Failure to address these areas can result in safety risks, legal exposure, and operational inefficiencies. Below are key pitfalls to avoid:

1. Compromised Quality Due to Unauthorized Suppliers

One of the most significant risks is purchasing rebreathers from unauthorized or third-party vendors who may offer lower prices but lack genuine quality assurance. Dräger products are precision-engineered medical and safety devices, and counterfeit or refurbished units may not meet original safety and performance standards.

- Risk: Substandard materials, improper calibration, or outdated firmware can compromise user safety, especially in life-support environments.

- Best Practice: Always source through Dräger-authorized distributors or directly from Dräger. Verify supplier credentials and request serial number validation.

2. Lack of Traceability and Certification

Genuine Dräger rebreathers come with full documentation, including certificates of conformity, calibration records, and traceable manufacturing data. Sourcing from unverified channels often means missing or falsified documentation.

- Risk: Inability to prove compliance with regulatory standards (e.g., CE, FDA, ISO) during audits or inspections.

- Best Practice: Demand complete documentation and verify authenticity through Dräger’s customer support or online portals.

3. Intellectual Property Infringement

Rebreather technology often includes patented components, firmware, and software systems protected under Dräger’s IP. Unauthorized replication or modification—such as cloning firmware or using non-genuine parts—can lead to IP violations.

- Risk: Legal action from Dräger for infringement, product seizure, or liability in case of failure due to modified components.

- Best Practice: Avoid third-party firmware, clones, or “compatible” parts that mimic Dräger designs. Use only OEM components and licensed software.

4. Voided Warranties and Lack of Support

Units sourced through unofficial channels typically come without valid warranties. Additionally, Dräger may refuse service, repairs, or software updates for devices not registered through proper channels.

- Risk: High long-term costs due to lack of technical support and inability to upgrade or maintain the device.

- Best Practice: Confirm warranty status and service eligibility before purchase. Register the device with Dräger post-acquisition.

5. Use of Non-Compliant Spare Parts and Consumables

Even if the rebreather is genuine, using non-Dräger parts (e.g., scrubber canisters, sensors, hoses) can degrade performance and create safety hazards.

- Risk: System malfunction due to incompatible components; potential breach of safety regulations.

- Best Practice: Use only Dräger-approved spare parts and consumables to maintain system integrity and compliance.

6. Inadequate Training and Documentation

Unauthorized suppliers rarely provide comprehensive training or up-to-date user manuals. Dräger rebreathers require specific operational knowledge, especially in technical diving or medical ventilation applications.

- Risk: Improper use leading to user error, equipment failure, or injury.

- Best Practice: Ensure access to official Dräger training programs and documentation as part of the sourcing process.

By prioritizing authorized sourcing channels, verifying product authenticity, and respecting intellectual property rights, organizations can ensure the safe, compliant, and effective use of Dräger rebreather systems.

Logistics & Compliance Guide for Rebreather Dräger

2. Regulatory Compliance and Safety Standards

2.1 International Regulatory Requirements

The Dräger rebreather, including models such as the Dräger Dolphin or Dräger Ray, is a life-support diving apparatus subject to stringent international regulations. Compliance with the following standards is mandatory for legal import, export, distribution, and operation:

-

ISO 13293:2012 – Recreational diving services — Requirements for diving equipment — Rebreathers

This standard specifies safety and performance criteria for rebreathers used in recreational diving. All Dräger rebreathers must meet ISO 13293 for certification in European Economic Area (EEA) and many other international markets. -

Medical Device Regulation (MDR) – EU 2017/745

If the Dräger rebreather is classified as a medical device (e.g., for hyperbaric or therapeutic use), it must comply with EU MDR. However, most diving rebreathers are classified under recreational or industrial safety equipment. -

CE Marking

Dräger rebreathers intended for the European market must carry a valid CE mark, indicating conformity with health, safety, and environmental protection standards. -

DOT (Department of Transportation) – USA

For transportation of rebreathers containing compressed gas cylinders (e.g., oxygen, diluent), compliance with U.S. DOT regulations under 49 CFR is required. Cylinders must be certified, labeled, and transported in accordance with hazardous materials (HazMat) rules. -

IATA Dangerous Goods Regulations (DGR)

When shipping internationally by air, rebreathers with gas cylinders are classified under Class 2 (Gases). The following apply: - Oxygen cylinders: UN1072, Compressed oxygen, 2.2 (non-flammable, non-toxic gas)

- Air/diluent cylinders: UN1002, Compressed air, 2.2

- Packaging must meet IATA DGR Section II or Section I requirements depending on quantity

- Proper labeling, documentation, and declaration (Shipper’s Declaration for Dangerous Goods) are mandatory

2.2 National and Regional Compliance

-

USA – FDA and OSHA

While rebreathers for recreational diving are not typically regulated by the FDA, occupational use (e.g., commercial diving) may require compliance with OSHA 29 CFR 1910.400+ (Commercial Diving Operations). Employers must ensure equipment meets safety standards and operators are trained. -

Canada – Transport Canada & CSA Standards

Rebreathers with gas cylinders must comply with Transportation of Dangerous Goods (TDG) Regulations. CSA Z275.2 outlines standards for commercial diving, relevant for professional use. -

Australia – AS/NZS 2299.1

For professional diving operations, rebreathers must meet AS/NZS 2299.1: Occupational diving operations — Standard operational practice. -

UK – HSE Diving at Work Regulations 1997

Dräger rebreathers used in occupational diving must comply with Health and Safety Executive (HSE) guidelines, including maintenance, training, and equipment certification.

2.3 Environmental and Export Controls

-

REACH and RoHS (EU)

Dräger rebreathers must comply with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives regarding materials used in construction. -

ITAR and EAR (USA)

Most Dräger rebreathers are not ITAR-controlled. However, certain advanced models with military or dual-use capabilities may fall under the Export Administration Regulations (EAR) administered by the Bureau of Industry and Security (BIS). Verify ECCN (Export Control Classification Number); typical classification is EAR99 (low-risk, general commodity).

2.4 User Certification and Training Requirements

- Dräger strongly recommends or requires certified training for rebreather use (e.g., through Dräger-approved agencies such as TDI, PADI Rebreather, or IANTD).

- Operators must hold valid certifications to use the rebreather legally in professional contexts.

- Training records and equipment logs must be maintained for audit and compliance purposes.

2.5 Maintenance and Documentation

- All Dräger rebreathers must undergo regular servicing per Dräger OEM guidelines (typically annually or after 100 dives).

- Service records, calibration logs (for oxygen sensors), and hydrostatic test dates for cylinders must be kept and made available for inspection.

- Only authorized Dräger service centers may perform major repairs or certifications.

2.6 Import and Customs Documentation

When importing/exporting Dräger rebreathers:

– Provide commercial invoice, packing list, and bill of lading/air waybill

– Include product specifications and CE certification

– Declare any compressed gas cylinders separately with UN number, net quantity, and hazard class

– In some countries (e.g., India, Brazil), pre-shipment inspections or import licenses may be required

Note: Regulatory requirements vary by country and use case (recreational vs. professional). Always verify local compliance before shipping or deploying Dräger rebreathers. Consult Dräger technical support or legal compliance teams for model-specific guidance.

Conclusion for Sourcing Dräger Rebreathers

Sourcing Dräger rebreathers presents a strategic decision that balances advanced technological capabilities, reliability, and long-term operational safety. Dräger, as a globally recognized leader in life-support and diving technology, offers rebreather systems—such as the Dräger LAR V and the Dräger Ray—that are engineered to meet rigorous military, commercial, and technical diving standards. These units are known for their durability, precise gas control, and integrated safety features, making them suitable for demanding underwater environments.

When sourcing Dräger rebreathers, key considerations include initial procurement costs, comprehensive training requirements, ongoing maintenance support, and availability of spare parts. While Dräger systems may carry a higher upfront investment compared to some alternatives, their proven track record in mission-critical applications, strong regulatory compliance, and extensive service network justify the cost for organizations prioritizing safety and performance.

In conclusion, sourcing Dräger rebreathers is a sound choice for professional diving operations where reliability, performance, and safety are non-negotiable. Partnering with authorized Dräger suppliers ensures access to genuine equipment, technical expertise, and after-sales support, ultimately enhancing operational efficiency and diver safety. Organizations should evaluate their specific operational needs, lifecycle costs, and training infrastructure before finalizing procurement, but Dräger remains a top-tier option in the rebreather market.