Introduction: Navigating the Global Market for Real Wood Edge Banding

Real wood edge banding delivers premium, finished edges for cabinetry, casework, and panels. Across the USA and Europe, buyers face a persistent challenge: selecting the right species, dimensions, backers, adhesives, and finishes while balancing cost, lead time, and regional compliance. This guide provides a practical path through those decisions.

We offer both solid wood and wood veneer edge banding, with many species and sizes available and fast order fulfillment (most orders ship within 24 hours). Our portfolio includes pre-glued (iron-on, hot melt) and fleeceback (requires an edge bander/adhesive) options, and we can special order exotics on request.

How backers and adhesives compare:

| Backer | Adhesive type | Application method | Heat/moisture resistance | Recommended uses |

|—|—|—|—|—|

| Pre-glued | Hot melt | Iron or handheld applicator | Moderate | Shop or on-site, low–medium volume; rapid turnaround |

| Fleeceback | PUR or contact cement | Edge bander | High | Production lines, durability-critical applications |

Roll sizes vary by species; common dimensions include:

Illustrative Image (Source: Google Search)

| Width (in) | Length (ft) | Notes |

|—|—|—|

| 7/8 | 250–500 | Standard for most species; also 50 ft for select products |

| 1 | 250–500 | Available for Cherry and Birch, among others |

| 1.5 | 250–500 | Available for Cherry and Birch |

| 2 | 250–500 | Available for Cherry and Birch |

What this guide covers

- Species selection and grain matching

- Finish decisions: prefinished vs. on-site finishing

- Manufacturing methods: veneer-edge vs. solid wood edge banding

- Cost, inventory, and lead time strategies

- Global sourcing considerations (USA/EU)

- Logistics, taxes/VAT, and import/export basics

- Quality criteria and inspection

- Application workflows and common pitfalls

Your buyers want predictable quality and delivery. This guide shows how to specify the right edge banding and streamline procurement across regions.

Article Navigation

- Top 10 Real Wood Edge Banding Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for real wood edge banding

- Understanding real wood edge banding Types and Variations

- Key Industrial Applications of real wood edge banding

- 3 Common User Pain Points for ‘real wood edge banding’ & Their Solutions

- Strategic Material Selection Guide for real wood edge banding

- In-depth Look: Manufacturing Processes and Quality Assurance for real wood edge banding

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘real wood edge banding’

- Comprehensive Cost and Pricing Analysis for real wood edge banding Sourcing

- Alternatives Analysis: Comparing real wood edge banding With Other Solutions

- Essential Technical Properties and Trade Terminology for real wood edge banding

- Navigating Market Dynamics and Sourcing Trends in the real wood edge banding Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of real wood edge banding

- Strategic Sourcing Conclusion and Outlook for real wood edge banding

- Important Disclaimer & Terms of Use

Top 10 Real Wood Edge Banding Manufacturers & Suppliers List

1. Wood Edgebanding – Plywood Veneer Edge Banding

Domain: jsowoodproducts.com

Registered: 2004 (21 years)

Introduction: JSO Wood Products are experts in producing custom wood edge banding with our veneer or yours. Whatever be the size or species of the project, we can do a wider ……

2. Edge Banding for Wood Veneer – Many Popular Species Available!

Domain: wisewoodveneer.com

Registered: 2011 (14 years)

Introduction: 30-day returnsEdge banding is a great finisher for any wood veneer project. We carry many popular wood species in both iron-on and fleece-backed edge band varieties….

Illustrative Image (Source: Google Search)

3. A.V.E.C. American Veneer Edgebanding Co., Inc. – The leading …

Domain: avec-usa.com

Registered: 2002 (23 years)

Introduction: A.V.E.C. is a market leader in veneer edgings, offering a full range of real wood and industrial veneer edgings, and is a trendsetter in the industry….

4. Edgebanding Products

Domain: edgebanding-services.com

Registered: 1997 (28 years)

Introduction: Our CVR (Continuous Veneer Rolls) Edgebanding is made from real wood consciously sourced. With a wide variety of species, cuts and widths available these ……

5. Best wood-look edge banding? Cabinetmaker just said my … – Reddit

Domain: reddit.com

Registered: 2005 (20 years)

Introduction: I think Egger has the most realistic wood-look edgebanding because they have end grain as well as long grain. More work to band, but it looks great….

6. Edgebanding – Oakwood Veneer Company

Domain: oakwoodveneer.com

Registered: 1998 (27 years)

Introduction: 1–3 day delivery 60-day returnsDid you know that we carry veneer supplies? From edge banding to vacuum systems, we have you covered….

Illustrative Image (Source: Google Search)

Understanding real wood edge banding Types and Variations

Understanding Real Wood Edge Banding Types and Variations

Edge banding delivers a clean, durable, wood edge on panels and components. The right type depends on glue line, finishing, and throughput requirements. Below is a concise overview of the main real wood edge banding types, their key features, typical applications, and trade-offs.

Type-by-Type Comparison

| Type | Features | Applications | Pros | Cons |

|---|---|---|---|---|

| Pre-glued (iron-on) hot-melt | Real wood veneer with heat-activated hot-melt adhesive pre-applied to the back. Typically 7/8″–2″ widths; common roll lengths 250′–500′. | Shop assemblies, field touch-ups, low–mid volume runs, small parts. | Low setup cost; no edgebander required; quick application; species match available across catalog. | Lower moisture resistance and re-workability vs. machine-applied; sensitive to overheating and substrate prep; limited thickness control on prefinished |

| Fleeceback (machine-applied) | Real wood veneer on fleece or paper carrier; adhesive applied in roller applicator or nozzle. Requires edgebander/feeds. | Production lines, high-volume runs, cabinet/carcase edges, profile wrapping. | Strong glue line; better moisture resistance and edge integrity; flexible finishes (raw or topcoat after apply). | Capital equipment required; longer setup and changeovers; learning curve for setup and finishing |

| Prefinished real wood | Pre-sanded and pre-coated (e.g., UV-cured, medium-sheen) at the mill; available as pre-glued or machine-applied | Visible edges where finishing steps must be minimized; consumer-facing parts. | Consistent finish; no onsite topcoating for many SKUs; faster throughput; finish can be sourced to meet compliance needs (e.g., low VOC). | Price premium; care required with iron-on to avoid finish damage; may be limited to certain profiles and thicknesses |

| Unfinished (raw) real wood | Sandable real wood veneer on fleece or paper carrier; no factory finish | Shops needing custom color matching, staining, or matching adjacent parts; applications with proprietary finishes. | Full finishing control; can be tinted to match case goods; typically lower cost per roll. | Adds finishing steps (sanding, sealer/topcoat); schedule and QC impacts; finish must meet local VOC/HAPS requirements |

| PSA-backed (3M PSA veneer) | Real wood veneer with pressure-sensitive adhesive backing; peel-and-stick. Offered by some suppliers as separate category. | Field retrofit, labels, small parts, prototyping, signage; interior use. | Very fast installation; no heat or edgebander; user-friendly for small operations. | Lower moisture resistance and re-workability; limited roll lengths/sizes; face thickness and finish may be less robust than machine-applied systems |

Pre-glued (Iron-On) Real Wood Edge Banding

- What it is: Real wood veneer with a factory-applied hot-melt adhesive layer activated by an iron or hot-activation tool.

- Sizes (typical): 7/8″–2″ widths; 250′–500′ lengths; multiple species; popular widths like 7/8″, 1″, 1.5″, 2″.

- Finishes: Pre-glued options are available as both raw and prefinished for many species.

- Best fit: Small to mid-volume shops, jobsite assemblies, and parts requiring quick turnarounds without a banding machine.

- Pros

- Lowest barrier to entry (no edgebander or adhesives needed).

- Fast application; species match across a wide catalog.

- Pre-glued and fleeceback variants available for many species.

- Cons

- Heat-sensitive glue line; best for interior use and moderate durability.

- Overheating can damage prefinished faces and warp thinner stock.

- Setup and changeover time per part vs. machine-applied.

Fleeceback (Machine-Applied) Real Wood Edge Banding

- What it is: Real wood veneer on a fleece or paper carrier; adhesive is applied at the machine via rollers or nozzle and molten adhesive bead(s) are deposited to the substrate.

- Sizes (typical): 7/8″–2″ widths; 250′–500′ lengths; multiple species.

- Finishes: Primarily raw (unfinished), allowing post-apply finishing to match adjacent components.

- Best fit: Production lines and any application requiring a robust glue line and higher edge integrity.

- Pros

- Strong, reliable bond with good moisture resistance.

- Consistent application across parts; flexible finishing options.

- Supports longer runs and repeatability.

- Cons

- Requires edgebanding equipment, tooling, and trained operators.

- Higher capital and setup cost; changeovers can impact throughput.

Prefinished Real Wood Edge Banding

- What it is: Real wood veneer that is pre-sanded and pre-coated at the mill, often to a medium sheen or specified sheen level.

- Backer options: Available as pre-glued or fleeceback, depending on supplier and species.

- Sizes (typical): 7/8″ and 1″ widths; 250′–500′ lengths across multiple species.

- Best fit: Visible edges where consistent finish is critical and post-finishing must be minimized (e.g., retail fixtures, finished cabinet sides).

- Pros

- Uniform finish quality; minimal onsite finishing steps.

- Faster lead times for assembled parts; compliant finishes available depending on mill.

- Species variety (e.g., birch, cherry, walnut, oak, maple, teak, Sapele) across most widths.

- Cons

- Cost premium over raw stock.

- Heat management critical for pre-glued; risk of finish burn-through or haze if overheated.

Unfinished (Raw) Real Wood Edge Banding

- What it is: Real wood veneer with a fleece or paper carrier and no factory-applied finish.

- Sizes (typical): 7/8″–2″ widths; 250′–500′ lengths across multiple species.

- Best fit: Shops that need precise color/stain matching, use proprietary finishes, or want control over sheen and wear performance.

- Pros

- Full finishing control (toners, stains, sealers, topcoats).

- Typically lower roll cost; enables color coordination with casegoods.

- Cons

- Adds time: sanding, sealing, topcoating, and cure.

- Requires finishing QC to meet consistency and compliance standards.

PSA-Backed (3M PSA Veneer) Real Wood Edge Banding

- What it is: Real wood veneer with a pressure-sensitive adhesive backing applied at the factory; peel-and-stick installation.

- Typical use: Field assembly, small-format parts, labels, prototypes, interior signage; complements traditional edgebanding workflows.

- Pros

- Fastest installation for small parts; no heat or edgebander required.

- User-friendly for shop or field retrofits.

- Cons

- Lower bond strength and moisture resistance vs. hot-melt or glue-line systems.

- Limited roll sizes and lengths vs. standard edge banding.

Notes for USA and Europe

- Availability and species: Core North American and European species are broadly available; exotics are commonly offered via special order.

- Compliance and finishes: If prefinished, request mill documentation for finish types (e.g., low-VOC, formaldehyde-free) and relevant compliance statements (e.g., CARB Phase 2, TSCA Title VI, REACH/SVHC information as applicable). For Europe, note REACH obligations for substances supplied and request SVHC statements where needed.

- Production guidance: For high-volume, specify fleeceback with machine application and raw veneer to control finish. For mixed production and small runs, standardize on pre-glued and prefinished SKUs for speed, but align with site curing times and storage conditions.

Use this framework to choose the right edge banding variant per part family, production volume, finishing strategy, and compliance requirements.

Key Industrial Applications of real wood edge banding

Key Industrial Applications of Real Wood Edge Banding

Real wood edge banding—available in pre‑glued (hot‑melt) and fleeceback versions—delivers authentic grain, seamless matching with wood panels, and finishing flexibility. Typical roll widths are 7/8″, 1″, 1.5″, and 2″ (often in 250’–500′ lengths), with common species including Alder, Ash, Bamboo, Beech, Birch, Cherry, Maple, Oak, Pine, Walnut, and many exotics. Pre‑glued rolls suit shops with limited equipment; fleeceback optimizes machine‑applied installation for volume production. Both approaches offer strong bonds when properly prepared.

| Industry/Application | Representative Uses | Detailed Benefits |

|---|---|---|

| Architectural Woodworking | Wall panels, reception desks, storefronts, interior doors | Species/grain match to adjacent panels for consistent aesthetic; can be stained/finished on‑site; authentic look; suitable for both veneer and solid cores; stable under variable indoor humidity |

| Furniture & Casegoods | Office desks, credenzas, storage units, lockers | Seamless edge appearance on MDF/HDF/plywood; prefinished lines reduce field finishing; repairable (sanding/spot‑finish); durable against routine handling; easy inventory management via roll format |

| Kitchen & Bath Cabinetry | Cabinet doors, box edges, panels, endcaps | Real wood edge for premium look; compatible with standard cabinet shop workflows; matches veneer/plywood faces; withstands frequent use; available in traditional species (Maple, Cherry, Oak, Birch) |

| Retail & Commercial Interiors | Display fixtures, POS counters, wall systems | Authentic material elevates brand perception; fast install via pre‑glued for small batches or machine for fleets; color/finish alignment with project specs; resilient to normal service loads |

| Hospitality | Hotel casegoods, headboards, millwork | Real wood aesthetic across high‑touch components; repairability reduces lifecycle disruption; efficient sourcing in common roll lengths; complements engineered cores while delivering solid‑wood feel |

| Marine & Transportation Interiors | Yacht cabinetry, RV/van interiors, train interiors | Real wood appearance on engineered cores; adhesive and finishing flexibility for specialized environments; good dimensional stability with proper substrate and adhesive selection |

| Fixtures & POP Displays | Trade show booths, checkout counters, branded elements | On‑site finishing to project color; clean edge line on MDF/HDF; quick rework and touch‑ups; versatile species selection for brand alignment |

| Store Planning & Shopfitting | Shopfit modules, shelving, counters | Rapid turnaround with pre‑glued; scalable with edge‑banders for large programs; consistent grain continuity; cost‑effective compared to solid edging on engineered substrates |

Notes on choosing backer and workflow

- Pre‑glued (hot‑melt): minimal equipment; ideal for prototyping, small shops, and field repairs; best with clean substrates and controlled heat/pressure.

- Fleeceback: machine‑applied (PUR/EVA/etc.), highest throughput and quality; better suited for production lines and complex profiles.

3 Common User Pain Points for ‘real wood edge banding’ & Their Solutions

3 Common User Pain Points for Real Wood Edge Banding & Their Solutions

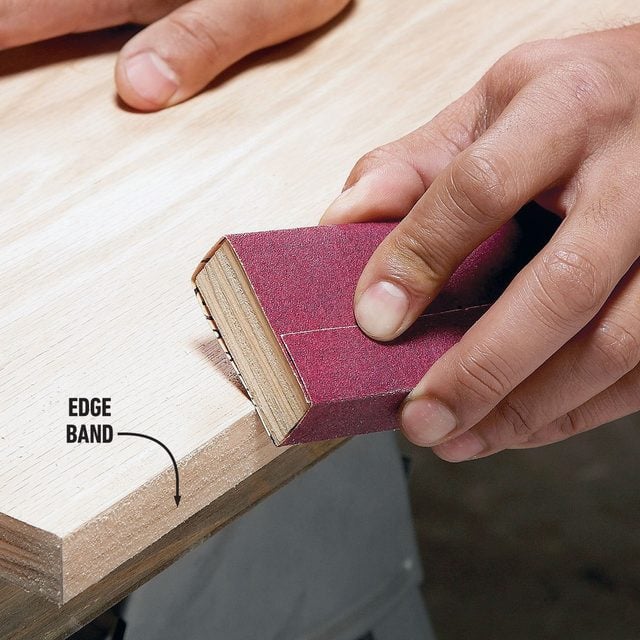

Scenario 1: Adhesion failures (pre-glue activation and edge-bond durability)

- Problem

- Peeling, edge-lift, or telegraphing of adhesive at splices when using pre-glued banding.

- Root causes

- Insufficient activation temperature/pressure/time.

- Inadequate surface prep (dust, oil, off-gassing from substrates).

- Solutions

- Backer selection:

- Pre-glued (hot-melt) for fast manual installs.

- Fleeceback for production lines/edge banders; machine + adhesive application for stronger, uniform bonds.

- Process controls:

- Set iron/bander per adhesive manufacturer specs; maintain consistent feed speed and pressure.

- Clean the substrate and edge (degrease if needed).

- Post-activation: roll压 or use trimming/rubbing sequence to ensure full contact.

- Product cues (from reference)

- Backers: pre-glued and fleeceback are offered on all stocked species; fleeceback requires an edge banding machine or adhesive application.

Scenario 2: Color/grain mismatch between banding and adjacent panels

- Problem

- Noticeable jumps in grain or tone at visible edges.

- Root causes

- Different veneer runs/lots and inconsistent veneer grain or species choice.

- Solutions

- Species/specification:

- Commit to a single species throughout the project or choose widely stocked species with consistent supply.

- Reconstituted veneer options can stabilize look across large jobs when species availability varies.

- Production control:

- Request veneer run or lot match; order complete inventory at once to reduce batch-to-batch variation.

- Match veneer orientation and sequence across panels.

- For cost consistency on larger runs, budget for widely available species (e.g., Birch) while retaining spec integrity.

- Product cues (from reference)

- Multiple species stocked (Cherry, Birch, Oak, Maple, Walnut, Bamboo, Ash, Beech, Mahogany, Teak, etc.), along with Reconstituted Veneer; popular roll widths are 7/8″, 1″, 1.5″, and 2″.

Scenario 3: Finish inconsistencies across multiple suppliers or batches

- Problem

- Varying sheen/color, visible banding seams, or need for onsite finishing post-installation.

- Root causes

- Mixed supplier finishes, different processes, or relying on raw veneer banding for all edges.

- Solutions

- Pre-finished banding where available to lock in sheen/color and reduce onsite finishing.

- Pre-finish options on select species (e.g., Birch, Cherry prefinished with medium sheen).

- When using raw banding, specify your target finish system and schedule; pre-sand to a consistent grit.

- Splicing strategy: choose long rolls (250′, 500′) to minimize splice seams on critical edges.

- Product cues (from reference)

- Prefinished Birch and Cherry edge banding available; most species offered in 250′ and 500′ roll lengths.

Note on supply stability: For large commercial projects, specify widely stocked species and plan for 250′–500′ roll lengths to minimize seams and batch variability. If a specific species or profile is not listed, work with your supplier to arrange special orders or alternative species that meet your performance, lead time, and budget requirements.

Illustrative Image (Source: Google Search)

Strategic Material Selection Guide for real wood edge banding

Strategic Material Selection Guide for Real Wood Edge Banding

1) What you’re deciding

Choose species, backing type, width, and finish to match:

– End-use conditions (moisture, wear, UV, cleanliness)

– Production equipment and volume

– Compliance and finish requirements

– Total cost-of-ownership (material, labor, rework)

2) Backing type selection: Pre-glued vs Fleeceback

| Attribute | Pre-glued (iron-on hot-melt) | Fleeceback (mechanical / edgebander adhesive) |

|---|---|---|

| Equipment | None (hand iron or small hot-melt tool) | Edgebander (continuous glue application) |

| Throughput | Low to moderate | High volume / automated |

| Bondline control | Moderate (heat/pressure sensitive) | High (consistent glue line; open time tunable) |

| Heat sensitivity | Higher risk near panels not rated for heat | Lower (no direct heat on panel) |

| Edge finish quality | Dependent on hand skill | Consistent; trimming is machine-controlled |

| Recommended uses | Prototyping, field repairs, small runs, tight budgets | Production lines, long runs, critical aesthetic edges |

| Typical glue line | Hot-melt (PE/EVA) | PUR/EVA/PVA depending on machine; generally flexible and robust |

Note: Hot-melt systems are solvent-free; typical VOC emissions are low. PUR systems generally meet stringent EU VOC standards when applied in controlled equipment. Always confirm substrate compatibility and cure/activation temperatures.

3) Species comparison (popular and available)

| Species | Typical price tier | Grain character | Stain/finish behavior | Stability in varying humidity | Typical use-cases |

|---|---|---|---|---|---|

| Alder | $ | Straight to wavy; consistent | Takes stain well; mild blotching | Moderate | Cabinets, millwork with light/medium finishes |

| Anigre | $$ | Often ribbon stripe; figured | Needs careful pre-stain; medium sheen recommended | Moderate | High-end retail, hospitality millwork |

| Ash | $–$$ | Prominent grain; light color | Accepts stain evenly | Moderate to good | Heavy-use doors, frames; high-contrast finished |

| Beech | $$ | Fine, tight grain; light | Stains evenly; excellent surface quality | Moderate | High-wear panels; light finishes |

| Birch | $ | Tight grain; pale | Stains well; prefinished option reduces labor | Moderate | High-volume casework, schools, healthcare |

| Cherry | $–$$ | Fine grain; warm tone; mellows with light | Medium blotching risk; prefinished often chosen | Moderate | Residential and commercial cabinetry |

| Douglas Fir | $ | Mixed grain, natural resin | Accepts stain; can show resin bleeding; seal before finish | Moderate | Rustic builds; budget millwork |

| Hickory | $$–$$$ | Bold grain; high contrast | Finishes well; color variation prominent | Moderate | Accent pieces, rustic/hospitality |

| Mahogany (genuine) | $$$ | Straight to interlocked; warm | Finishes well; premium aesthetic | Moderate | High-end millwork and furniture |

| Maple | $–$$ | Fine, uniform; neutral | Low-to-moderate blotching; takes clear coats well | Good | High-volume light finishes; prefinished common |

| Oak (Red/White) | $–$$ | Open pore; strong ray patterns | Needs pore-filling for smooth finish; heavy-duty | Moderate to good | Heavy-duty frames, durable door edges |

| Pine | $ | Knotty; rustic | Accepts stain; blotching possible | Moderate | Rustic/budget cabinetry and millwork |

| Sapele | $$–$$$ | Interlocked; ribbon figure; mahogany hue | Finishes smoothly; premium look | Moderate | High-end doors/panels; hospitality |

| Teak | $$$ | Straight, oily; stable | Oily; degrease/condition; premium patina | Good | High moisture/UV; marine millwork; lab/countertops |

| Walnut (genuine) | $$$ | Dark, figured; premium | Finishes well; clear coats enhance figure | Moderate | Architectural features, retail displays |

| Bamboo (natural/carbonized) | $ | Straight, consistent; plant fiber | Prefinished recommended to lock color | Generally good | Eco projects; consistent color needs |

Note: “Typical price tier” based on source starting prices ($ lowest to $$$ highest) for pre-glued/fleeceback in common widths. Prefinished birch/cherry carry a premium; prefinished often reduces finishing labor variability.

4) Sizing and production planning

| Item | Guidance |

|---|---|

| Width selection | Use slightly larger than substrate thickness + sanding allowance (typical work: add 0.5–1.0 mm margin; verify with your trimmer clearance). Popular widths from source: 7/8″, 1″, 1.5″, 2″. |

| Roll length | 50′ (tests/short runs), 250′ (typical production), 500′ (high-volume; fewer splices, less downtime). |

| Thickness | Match your existing veneer or finishing schedule; confirm with supplier. |

| Prefinished vs raw | Prefinished reduces finishing steps, improves consistency, and limits on-site staining variability. Use raw when you need exact color match to surrounding components or custom distressing. |

| Grain continuity | Plan for matching at miters and splices; select rolls from the same lot if critical to color/figure continuity. |

| Edge trimming | Use flush-trim knives and a scoring cut on panels to minimize chip-out; test before production. |

| UV exposure | Dark species (walnut, sapele) will lighten slightly over time; teak mellows; prefinished UV-stable clear coats mitigate shift. |

5) Moisture, heat, and compliance

- Moisture: Teak, maple, and Douglas fir show good stability in variable humidity. In kitchens/bathrooms or near sinks, prefer dense species or prefinished systems and ensure seal/finish continuity at edges.

- Heat: Pre-glued systems expose panels to heat; use temperature-rated substrates and adhesives, especially around heat sources (dishwashers, ovens). Fleeceback/PUR on an edgebander avoids panel heating.

- Chemical resistance: Open-grain woods (oak) may require pore-filling for chemical wipe-down environments. Teak resists moisture well but may require degreasing prior to finishing.

- Compliance: For USA, ensure FSC® availability if required; for Europe, ensure REACH compliance and suitable EU VOC standards. Confirm adhesive system meets necessary regulatory requirements.

6) Operational checklist

- Select backing based on equipment and volume (pre-glued for small runs and field work; fleeceback for production).

- Choose species by end-use: heavy wear (ash, beech, white oak), premium visual (walnut, sapele, anigre), moisture resistance (teak), cost stability (birch, maple).

- Decide on prefinished to reduce finishing labor variability.

- Confirm sizing margins with your trimmer and substrate tolerances.

- Source from same lot for color continuity in visible assemblies.

- Specify adhesives and finish systems compatible with substrates and environment.

7) Supplier availability snapshot (based on source)

| Species | Pre-glued? | Fleeceback? | Common widths | Common lengths | Prefinished available? | Starting price (pre-glued) |

|---|---|---|---|---|---|---|

| Alder | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| Anigre | Yes | Yes | 7/8″ | 250′, 500′ | No | $38.95 |

| Ash | Yes | Yes | 7/8″ | 250′, 500′ | No | $30.95 |

| Bamboo (Natural) | Yes | Yes | 7/8″ | 50′, 250′, 500′ | No | $26.95 |

| Bamboo (Carbonized) | Yes | Yes | 7/8″ | 50′, 250′, 500′ | No | $26.95 |

| Beech | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| Birch | Yes | Yes | 7/8″, 1″, 1.5″, 2″ | 50′ (7/8″), 250′, 500′ | Yes (Birch prefinished) | $12.95 |

| Cherry | Yes | Yes | 7/8″, 1″, 1.5″, 2″ | 50′ (7/8″), 250′, 500′ | Yes (Cherry prefinished) | $12.95 |

| Douglas Fir | Yes | Yes | 7/8″ | Not specified | No | Not specified |

| Hickory | Yes | Yes | 7/8″ | 250′, 500′ | No | $30.95 |

| Mahogany | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| Maple | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| Oak (White/Red) | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| Pine | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| Red Oak | Yes | Yes | 7/8″ | 250′, 500′ | No | $30.95 |

| Sapele | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| Teak | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| Walnut | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

| White Oak | Yes | Yes | 7/8″ | 250′, 500′ | No | $34.95 |

Short version: Match backing to your equipment, species to your performance/visual targets, and prefinished to reduce finishing risk. Plan widths/lengths against your trimmer setup and production volume. Confirm adhesive and finish compliance with local regulations and substrate limitations.

Illustrative Image (Source: Google Search)

In-depth Look: Manufacturing Processes and Quality Assurance for real wood edge banding

In-Depth Look: Manufacturing Processes and Quality Assurance for Real Wood Edge Banding

Process Overview (Manufacturing Steps)

Real wood edge banding is a continuous wood veneer–based trim manufactured to deliver consistent performance, tight tolerances, and strong adhesion to panels. Because it is wood, process controls focus on thickness accuracy, moisture stability, veneer quality, and join integrity. Reason: These factors drive finish quality, adhesion reliability, and end-use durability.

- Prep (log selection, veneer slicing, drying, scarfing)

- Forming (calendering, planing/feeder-sanding, thickness gauging)

- Assembly (splicing/join method, species matching, optional pre-finish)

- QC (thickness/tolerance, adhesion, moisture, bond type verification, dimensional stability, workability checks)

Reason: This staged flow ensures repeatability and defect prevention before roll-up. Reason: Controls upstream variance to avoid downstream assembly and application failures. Reason: Final QC confirms product suitability for both pre-glued (iron-on) and fleeceback (machine-applied) formats.

Manufacturing Process in Detail

1) Prep

– Log and veneer selection: Choose logs by grain quality and species availability; slice or rotary-cut veneer to target thickness and veneer yield. Reason: Consistency in veneer appearance and thickness starts here.

– Drying: Control veneer moisture to ensure dimensional stability (typical end-user ranges provided below). Reason: Minimizes later expansion/contraction and keeps adhesives effective.

– Sizing: Cut veneer to finished width bands; scarf (if used) to prepare for splicing. Reason: Enables continuous roll production with stable joins.

2) Forming

– Calendering/lamination: Build the veneer into a thicker strip with controlled compression and bonding. Reason: Creates uniform thickness and surface integrity.

– Planing/feeder sanding: Remove thickness variation and provide a clean, consistent surface. Reason: Smoothness reduces finishing issues and poor glue wetting.

– Thickness gauging: Calibrate to target thickness with tight tolerances. Reason: Ensures fit and finish on panel edges; tight tolerances simplify CNC operations.

Illustrative Image (Source: Google Search)

3) Assembly

– Splicing method: Use finger-jointed or scarf-jointed joins; select based on appearance and glue spread. Reason: Determines joint strength and aesthetics (continuous grain vs. visible joints).

– Species matching: Group consecutive sections by grain and color to maintain visual continuity. Reason: Reduces patchy appearance on installed edges.

– Optional pre-finish: Apply a medium-sheen finish for select species to reduce on-site finishing. Reason: Speeds installation and ensures finish consistency.

4) QC

– Thickness measurement: Record at multiple points across each roll. Reason: Confirms uniformity for tight fit on panel edges.

– Bond type verification: Test pre-glued hot melt activation and fleeceback glue compatibility. Reason: Ensures the specified adhesive performs under heat/pressure.

– Moisture check: Use moisture meters to verify target moisture content ranges by species. Reason: Prevents failures from excessive shrink/swell.

– Adhesion tests: Pull or shear checks for bond integrity (method tailored to adhesive system). Reason: Validates glue line strength before end-use.

– Dimensional stability: Spot-check bend radius and curl; verify roll geometry. Reason: Confirms good handling and application without cracking or bridging.

– Workability tests: Verify sanding, planing, and finish acceptance. Reason: Ensures end customers can achieve expected surface quality.

Reason: A structured QC regime reduces returns and improves customer trust. Reason: It also supports consistent cross-batch performance across large B2B orders.

Quality Standards (Relevant ISO-aligned practices)

- ISO 9001-based QMS: Documented procedures, control of process parameters, risk-based thinking, corrective actions. Reason: Provides a proven, internationally recognized framework for consistent manufacturing quality.

- ISO 24234 (adhesives for wood-based products): Selection and classification of adhesives; alignment with manufacturer specifications. Reason: Ensures adhesive choices match performance expectations (e.g., heat resistance, assembly speed).

- ISO 19595 and ISO 19639 terminology: Use standardized terms for adhesives and wood products. Reason: Ensures clear technical communication across USA and Europe.

- Dimensional control: Thickness gauging and tolerance protocols aligned with internal QA and industry practice. Reason: Tight tolerances reduce fit issues on advanced CNC edges.

- Moisture content controls: Monitor MC to typical end-user ranges before roll-up. Reason: Improves stability in final applications.

- Documented testing: Routine adhesive performance testing and dimensional stability checks. Reason: Evidence-based QA improves traceability and customer confidence.

- Regulatory alignment: REACH and RoHS (EU compliance for substances), VOC/indoor emissions (low-VOC adhesives where applicable). Reason: Meets legal and customer requirements in EU markets.

Note: Internal QA should be documented to ISO standards and product-specific test methods; adapt the depth of testing to buyer expectations and application demands. Reason: Balances practicality with rigorous assurance for B2B buyers.

Illustrative Image (Source: Google Search)

Backer Options and Performance

The WiseWood Veneer portfolio offers two backers with distinct application behaviors: Reason: Choosing the right backer directly impacts installation speed, equipment needs, and bond reliability.

- Pre-glued (iron-on)

- Roll widths: 7/8″ (typical lengths: 50′, 250′, 500′); 1″ and 1.5″ for select species. Reason: Covers most cabinet edge profiles and stock sizes.

- Backers: pre-glued (hot melt). Reason: Provides fast field installation with an iron or heat activator.

- Optional pre-finished with medium sheen. Reason: Minimizes onsite finishing for select species.

-

Examples across species (Alder, Anigre, Ash, Bamboo, Beech, Birch, Cherry, Douglas Fir, Maple, Oak, Pine, Sapele, Teak, Walnut, White Oak). Reason: Supports popular species widely used in USA and Europe.

-

Fleeceback (machine-applied)

- Roll widths: 7/8″ (typical lengths: 50′, 250′, 500′); 1″, 1.5″, and 2″ for select species. Reason: Enables high-throughput industrial edgebanders with adhesive spread control.

- Adhesive: Applied via edgebanding machine; compatible with common wood adhesives. Reason: Delivers consistent glue line and stronger, faster assembly under factory conditions.

To illustrate the trade-offs:

| Aspect | Pre-glued (Iron-on) | Fleeceback (Machine-applied) |

|---|---|---|

| Equipment | Iron or handheld heat source; minimal tooling | Edgebanding machine (adhesive applicator, feed, pressure, trimming) |

| Application speed | Best for small runs and field work; moderate cycle time | High-speed production; repeatable cycle times |

| Glue line control | Fixed by manufacturer; activated by heat | Adjustable glue application; better uniformity |

| Bond strength | Adequate for many shop/field uses; depends on heat/pressure | Higher strength and consistency when machine parameters are tuned |

| Widths | 7/8″ typical; select species up to 1.5″ | 7/8″ typical; select species up to 2″ |

| Lengths | 50′, 250′, 500′ | 50′, 250′, 500′ |

| Handling | Simple to install; requires careful surface prep | Requires machine setup and operator training |

| Pre-finish options | Available for select species with medium sheen | Typically unfinished; post-finish applied after trimming |

| Moisture sensitivity | Sensitive to pre-heating and panel conditions | Dependent on adhesive set and clamping; less variable when machine set |

| QC highlights | Verify activation temp/time; adhesion pull test on sample joints | Verify glue spread, temperature, feed speed; adhesion shear tests |

Reason: A side-by-side comparison clarifies where each solution excels. Reason: B2B buyers can align tooling, throughput, and quality targets to the right backer choice.

Representative Species and Sizes (WiseWood Veneer)

Most species are offered in pre-glued and fleeceback with widths around 7/8″ and lengths 50′, 250′, and 500′; some are available in 1″, 1.5″, and 2″. Reason: Reflects current supply patterns for USA and Europe.

| Species | Backers | Typical Roll Sizes (examples) | Notable Options |

|---|---|---|---|

| Alder | Pre-glued, Fleeceback | 7/8″ x 250′, 7/8″ x 500′ | — |

| Anigre | Pre-glued, Fleeceback | 7/8″ x 250′, 7/8″ x 500′ | — |

| Ash | Pre-glued, Fleeceback | 7/8″ x 250′, 7/8″ x 500′ | — |

| Bamboo (Carbonized, Natural) | Pre-glued, Fleeceback | 7/8″ x 50′, 7/8″ x 250′, 7/8″ x 500′ | — |

| Beech | Pre-glued, Fleeceback | 7/8″ x 250′, 7/8″ x 500′ | — |

| Birch | Pre-glued, Fleeceback | 7/8″ x 50′, 7/8″ x 250′, 7/8″ x 500′; 1″, 1.5″, 2″ | Prefinished birch (medium sheen) |

| Cherry | Pre-glued, Fleeceback | 7/8″ x 50′, 7/8″ x 250′, 7/8″ x 500′; 1″, 1.5″, 2″ | Prefinished cherry (medium sheen) |

| Douglas Fir | Pre-glued, Fleeceback | 7/8″ variants (select lengths) | — |

| Hickory, Mahogany, Maple, Pine, Sapele, Teak, Walnut, White Oak | Pre-glued, Fleeceback | 7/8″ x 50′, 7/8″ x 250′, 7/8″ x 500′ | — |

Reason: Real-world range informs manufacturing planning and purchasing. Reason: Ensures compatibility with available stock widths and pre-finish needs.

Moisture Content (Indicative Targets)

- Furniture and cabinetry interiors: 6–10% MC; panels near 7–9% typical. Reason: Avoids swelling, gapping, and glue-line stress in service.

- Structural panels and humid environments: 9–12% MC; application-specific. Reason: Reduces risk of shrinkage during seasonal changes.

- Monitoring: Calibrate meters for species and temperature; take readings along the roll. Reason: Ensures actionable data for adjustments.

Reason: Moisture control is the single most critical factor for dimensional stability post-installation.

Illustrative Image (Source: Google Search)

Thickness and Tolerances (Indicative Targets)

- Thickness: Calibrated to target band thickness; maintain tight tolerance across width and roll length. Reason: Provides clean mating with panel edges and consistent finish quality.

- Edge integrity: Verified after planing/sanding to ensure no soft spots or delamination. Reason: Prevents edge chip-out and finish inconsistencies.

Reason: Tight tolerances reduce rework in shops and improve CNC fit on automated lines.

Pre-finished Edge Banding (Selected Species)

- Prefinished birch and cherry are offered with a medium sheen in 7/8″ x 250′ and 7/8″ x 500′ (pre-glued and fleeceback). Reason: Addresses end customers seeking finish uniformity and reduced onsite labor.

Reason: Pre-finishing helps standardize aesthetics and meets B2B expectations for ready-to-install parts.

Typical Sizes and Pack Options (Summary)

| Backer | Widths | Lengths | Notes |

|---|---|---|---|

| Pre-glued | 7/8″; select species in 1″, 1.5″ | 50′, 250′, 500′ | Optional pre-finish for select species |

| Fleeceback | 7/8″; select species up to 2″ | 50′, 250′, 500′ | Requires edgebanding machine and adhesive |

Reason: Clear stock options support reliable procurement and production scheduling.

Quality Assurance Checklist (Alignment to ISO-based QA)

- Thickness: Measured at multiple points across roll width and length. Reason: Confirms uniformity for fit and finish.

- Moisture: Verified via meter; recorded per lot. Reason: Ensures dimensional stability.

- Adhesion: Activation and bond tests; pull/shear checks tailored to adhesive system. Reason: Validates glue line performance.

- Dimensional stability: Bend radius and roll geometry checks. Reason: Prevents application failures.

- Surface quality: Sanding/planing and finish acceptance tests. Reason: Guarantees consistent workability and appearance.

- Documentation: Batch logs, test results, and traceability to ISO 9001-based QMS. Reason: Enables corrective action and customer assurance.

Reason: A concise checklist supports consistent QA across sites and shipments.

Illustrative Image (Source: Google Search)

Why These Practices Matter

- They align with globally recognized quality frameworks (ISO 9001, ISO 24234, ISO 19595/ISO 19639) without overpromising on niche specs. Reason: Balances universality with practical manufacturing control.

- They address both USA and Europe expectations: regulatory alignment (REACH/RoHS), moisture and dimensional standards, and documented QA. Reason: Supports export markets and enterprise procurement criteria.

- They match real-world availability: two backers, popular widths and lengths, and common species (including pre-finished). Reason: Grounds decisions in what is actually stocked and shippable.

Reason: Together, these steps and standards produce consistent, reliable real wood edge banding—ready to meet industrial demands and customer specifications.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘real wood edge banding’

Practical Sourcing Guide: A Step-by-Step Checklist for Real Wood Edge Banding

Use this checklist to standardize RFQs, align with suppliers (USA/EU), and streamline production.

Step 1: Define Project Requirements

- End-use: Cabinetry, store fixtures, architectural panels, furniture components.

- Finish: Raw or prefinished (e.g., medium sheen per source: “Prefinished Birch/Cherry Edge Banding – medium sheen”).

- Volume: Monthly/annual usage; determine if roll or bulk pricing applies.

- Edge profile: Flush, eased, 2 mm radius, or CNC-machined contours.

- Logistics: Delivery window; must-order lead time; packaging needs.

Step 2: Specify Species and Color Match

- Match to existing components (cabinet doors, panels) using common species available per source:

- Alder, Anigre, Ash, Bamboo (Natural/Carbonized), Beech, Birch, Cherry, Douglas Fir, Hickory, Mahogany, Maple, Oak, Pine, Red Oak, Sapele, Teak, Walnut, White Oak.

- Require “real wood” (not reconstituted/PSA veneer unless explicitly needed).

- Specify grain orientation and whether species is “special order/exotic” if not listed (supplier can source “any exotic species available”).

Step 3: Confirm Sizing and Thickness

- Widths and lengths available (selected examples per source):

- Widths: 7/8″, 1″, 1.5″, 2″.

- Lengths: 50′, 250′, 500′ (species-dependent).

- Thickness: Confirm roll thickness and consistency; align with your panel caliper and trimming tolerance.

- Trim allowance: Specify oversizing for manual trimming (typical: 1–2 mm beyond final panel thickness).

Step 4: Select Backer and Adhesive System

- Pre-glued (iron-on): Hot melt adhesive; specify activation temperature, open time, and whether your shop will use an iron or edgebander with heat capability.

- Fleeceback: Requires a wood edgebander and adhesive (PVA/UF, film, or contact cement); confirm your equipment compatibility and glue line.

Step 5: Verify Finishing Readiness

- Raw: Requires your finishing workflow; state finish system (waterborne/solvent) and target sheen.

- Prefinished: “Prefinished Birch/Cherry” available with medium sheen; confirm surface sheen target matches your components.

- Specify whether you need stain-ready or clear-coated bands.

Step 6: Check Compliance and Certifications (US/EU)

- US: TSCA Title VI (CARB) Phase 2 compliance for formaldehyde emissions.

- EU: REACH compliance; specify formaldehyde class (e.g., E1).

- FSC: Request FSC/PEFC chain-of-custody if required.

- VOC/Flammability: Note any product-specific VOC or flame-retardancy needs.

- Obtain Safety Data Sheets (SDS) for adhesives and finishes.

Step 7: Quantify, Price, and MOQs

- Per-foot pricing: Sample pricing from source ranges (e.g., “Birch/Cherry starting at $12.95”; “Alder $34.95”; “Ash $30.95”; “Beech $34.95”; “Bamboo $26.95”; “Prefinished Birch/Cherry $54.95”).

- MOQ: Confirm per-roll minimums and mixed-species pallet policies.

- Waste factor: Include 5–10% depending on profile and run complexity.

Step 8: Set Lead Time and Shipping

- Stocked items: Source states “Most orders ship within 24 hours.”

- Special orders/exotics: Request lead time; confirm EU Incoterms/DDP options or US domestic shipping.

- Packaging: Specify roll winding, protective wrapping, and palletization.

Step 9: Quality Assurance (QA) Before First Run

- Veneer orientation/grain alignment (book- or flitch-matched).

- Color/lot consistency across batches (especially prefinished bands).

- Roll splicing integrity and absence of gaps.

- Adhesive performance test: peel strength and heat activation checks.

- Moisture content and acclimation before application.

- Dimensional tolerances (width, thickness, straightness).

Step 10: Pilot, Documentation, and Ordering

- Pilot run: Validate time to trim, edge quality, and finish compatibility.

- Documentation: Lock specs in your ERP/Purchasing system; archive SDOF/SDS and certificates.

- Ordering: Standardize SKU, backer type, and finish notes for repeatability.

Quick Species Reference (from source)

| Species | Backers | Roll Sizes (W x L) | Indicative Price (USD) |

|---|---|---|---|

| Alder | pre-glued, fleeceback | 7/8″ x 250′, 7/8″ x 500′ | starting at $34.95 |

| Anigre | pre-glued, fleeceback | 7/8″ x 250′, 7/8″ x 500′ | starting at $38.95 |

| Ash | pre-glued, fleeceback | 7/8″ x 250′, 7/8″ x 500′ | starting at $30.95 |

| Bamboo (Natural/Carbonized) | pre-glued, fleeceback | 7/8″ x 50′, 250′, 500′ | starting at $26.95 |

| Beech | pre-glued, fleeceback | 7/8″ x 250′, 500′ | starting at $34.95 |

| Birch (raw) | pre-glued, fleeceback | 7/8″ x 50′, 250′, 500′; 1″, 1.5″, 2″ x 250′, 500′ | starting at $12.95 |

| Birch (prefinished, medium sheen) | pre-glued, fleeceback | 7/8″ x 250′, 500′ | starting at $54.95 |

| Cherry (raw) | pre-glued, fleeceback | 7/8″ x 50′, 250′, 500′; 1″, 1.5″, 2″ x 250′, 500′ | starting at $12.95 |

| Cherry (prefinished, medium sheen) | pre-glued, fleeceback | 7/8″ x 250′, 500′ | starting at $54.95 |

| Douglas Fir | pre-glued, fleeceback | — | — |

| Hickory | pre-glued, fleeceback | — | — |

| Mahogany | pre-glued, fleeceback | — | — |

| Maple | pre-glued, fleeceback | — | — |

| Oak | pre-glued, fleeceback | — | — |

| Pine | pre-glued, fleeceback | — | — |

| Red Oak | pre-glued, fleeceback | — | — |

| Sapele | pre-glued, fleeceback | — | — |

| Teak | pre-glued, fleeceback | — | — |

| Walnut | pre-glued, fleeceback | — | — |

| White Oak | pre-glued, fleeceback | — | — |

RFQ Template (Copy–Paste)

- Company:

- Contact:

- Shipping address:

- Required delivery date:

- Species:

- Finish: Raw / Prefinished (sheen level):

- Width(s):

- Length(s):

- Backer: Pre-glued (hot-melt) / Fleeceback (requiring edgebander + adhesive):

- Thickness:

- Edge profile:

- Finish system compatibility:

- Compliance: TSCA Title VI / REACH / E1 / FSC/PEFC:

- Volume and ordering cadence:

- Lead time:

- Special notes/exotics:

- Attachments: drawings, photos, SDS/CoCs.

US/EU Logistics Notes

- US: Confirm in-stock items and 24-hour shipping when applicable; specify delivery windows and freight options.

- EU: Clarify Incoterms (e.g., DAP/DDP), VAT, and EU regulatory documentation; confirm packaging for customs clearance.

Supplier Note (from source)

“Edge Banding for Wood Veneer – Many Popular Species Available!” Most orders ship within 24 hours. Special orders accepted for exotics.

Comprehensive Cost and Pricing Analysis for real wood edge banding Sourcing

Comprehensive Cost and Pricing Analysis for Real Wood Edge Banding Sourcing

Cost drivers overview

- Material choice: species, width, length, and finish (raw vs prefinished).

- Adhesive system: pre-glued (iron-on, hot-melt) vs fleeceback (cold glue, requires an edgebander).

- Species surcharges: premium species, reconstituted options, and exotics are priced above baseline species (e.g., Birch, Cherry, Maple).

- Application method: iron-on (hand/Hot-melt) vs machine (urea-formaldehyde or PVAc hot-melts).

- Logistics: cartonization, weight/dimensional factors, and delivery speed (domestic vs international).

- Waste and rework: kerf, trimming, micro-bevel defects, and quality control losses.

1) Materials: Typical ranges and drivers

Pre-glued vs fleeceback

– Pre-glued: hot-melt adhesive pre-coated on the tape side. No on-site adhesive needed. Lower capital outlay; higher time-in-process and risk of bond failure if not handled properly.

– Fleeceback: requires adhesive and a dedicated edgebander or hand-roller approach. Higher capital but lower cycle time and generally better performance on larger runs.

Species pricing and size effects (based on WiseWood Veneer data)

– Indicative “starting at” per roll by species for typical width 7/8″:

– Alder: $34.95

– Anigre: $38.95

– Ash: $30.95

– Bamboo (Carbonized/Natural): $26.95

– Beech: $34.95

– Birch: $12.95

– Cherry: $12.95

– Prefinished Birch: $54.95

– Prefinished Cherry: $54.95

– Widths: birch/cherry commonly offered in 7/8″, 1″, 1.5″, 2″; price typically scales with width.

– Finishes: prefinished adds value and material cost (e.g., premium vs standard sheen).

Glue consumption and bonding performance

– Hand/Hot-melt: adhesive is built-in. Avoid overheating or prolonged pressure to minimize veneer telegraphing.

– Machine adhesives:

– Hot-melt adhesives: commonly 6–15 g/m (≈20–50 kg per 3,500 m). Hot-melt cost is generally lower than cold adhesives but provides lower water resistance and slightly lower durability under humid cycling.

– Urea-formaldehyde (UF) glue (with fleece): better creep resistance and more robust bond, especially in humid environments; requires adequate cure and ventilation.

– PVAc hot-melts: a bridge option with better water resistance than standard hot-melts but slower cycle times.

– EVA hot-melts: fastest cycles, best for interior furniture; reduced moisture resistance relative to UF or PVAc.

2) Application method: Unit costs

Assumptions for 3/4″ panels with a 5/8″ veneer band:

– Average trimming and inspection adds 5–15% more footage than panel footage.

– Scrap allowances: 2–8% depending on operator and machine.

Per linear foot (LF) calculations:

– Example: 5 linear feet of edge per panel.

– Total footage required per panel: 5 LF × (1 + 0.10 trim + 0.05 scrap) = 5.75 LF per panel.

– Material cost per panel: (5.75 LF / 500 LF per roll) × roll price.

Illustrative Image (Source: Google Search)

Example: Unfinished Birch, 7/8″, 500′, roll $12.95

– Material per panel: (5.75 / 500) × $12.95 ≈ $0.15.

Hand iron-on (Hot-melt)

– Typical cycle: 35–60 s per 8 ft (2.44 m) board.

– Cost model (illustrative):

– Labor rate: $35/h; time per board: ~0.75 min; labor cost: ~$0.44.

– Pre-glued band cost: $0.01–$0.12 per board depending on species/finish.

– Energy: negligible (<$0.02).

– Total indicative cost: $0.45–$0.58 per board (2.44 m).

– Per LF: ~$0.18–$0.24 per board (8 ft).

Machine application (Fleeceback with a good edgebander)

– Typical cycle: 6–15 s per 8 ft board, including feed.

– Cost model (illustrative):

– Labor rate: $50/h (operator+touch); time per board: ~0.2 min; labor cost: ~$0.17.

– Glue consumption: 12 g/m ≈ 0.04 kg/m (hot-melt). Adhesive cost ≈ $0.10 per m; per 2.44 m board: ~$0.24.

– Power: ~$0.03 per board.

– Total indicative cost: ~$0.44 per board (8 ft).

– Per LF: ~$0.06–$0.10; with premium glue or heavier glue consumption, up to ~$0.12–$0.20.

Quality and consistency

– Machine-applied edges yield tighter glue lines, faster trimming, and lower rework; hand iron-on is acceptable for short runs or field repairs but higher variability.

Illustrative Image (Source: Google Search)

3) Logistics: Domestic (USA) vs International (EU)

Domestic USA examples

– Typical weights (7/8″ roll):

– 500 ft roll: ~2.0–3.0 lb.

– 250 ft roll: ~1.0–1.5 lb.

– Indicative parcel shipping (illustrative):

– UPS Ground (2–5 lb, 12×8×8 in, 400–800 miles): ~$12–$20.

– UPS 2nd Day: ~$25–$45.

– UPS Next Day: ~$50–$90.

– Per roll delivery costs (500 ft roll):

– Ground: $0.024–$0.04 per LF (divide by 500).

– 2nd Day: $0.05–$0.09 per LF.

– Next Day: $0.10–$0.18 per LF.

International to EU (illustrative)

– Duties: real wood veneer edge banding typically Harmonized Tariff (HS 4408.92) with duty around 3.5% for eligible imports.

– Freight methods:

– Air courier (IATA dimensional weight): Example 5 kg shipment ≈ $25–$65 shipping; VAT at arrival (country-dependent).

– Ocean LCL: Example ~$60–$120 per cbm; 1 cbm ≈ 700–900 rolls (estimate only; confirm with your forwarder).

– Transit time:

– Air: 2–7 days.

– Ocean LCL: 20–40 days depending on lane and consolidation.

4) Total landed cost framework

- Total landed cost (TLC) per roll:

- TLC = Roll price + Adhesive consumption (if fleeceback) + Domestic/international logistics (freight, duties, VAT, insurance) + Labor cost (for the lot’s application footage).

- Practical for budgeting:

- Break down by linear foot using the trim/scrap multipliers and freight per LF.

5) Pricing-to-margin guidance (B2B)

- Price ladder: raw (species A) < raw (premium species) < species with reconstituted faces < prefinished (medium sheen) < special exotics.

- Positioning:

- Entry-level internal applications: Birch, Cherry (unfinished, 7/8″ pre-glued for quick jobs).

- Visible furniture/office furniture: White Oak, Ash, or prefinished Birch/Cherry for reduced finishing cost.

- Premium/exterior exposure: Oak/Walnut/Teak with UF or PVAc adhesives and fleeceback.

- Margin implications:

- Hand iron-on works for short runs but requires a premium to compensate higher labor content.

- Machine-run fleeceback allows better margins at scale and tighter TCO for premium species due to speed and reduced waste.

6) Tips to save cost

- Standardize widths and roll lengths across SKUs to simplify pricing and reduce dead stock.

- Use fleeceback where possible on runs >1,000 LF; it improves throughput and bond quality.

- Consolidate shipments; many rolls per carton improves freight efficiency per LF.

- Choose raw finishes for interior furniture and reserve prefinished for highly visible edges only.

- Specify species that align with natural waste characteristics (e.g., reduce kerf on soft species; be careful with veneer splits).

- Nest parts to minimize cut-offs and order widths that match your panel profile.

- For EU sourcing: consolidate partials and leverage full-carton quantities; select ocean LCL for cost control when timing allows.

- Work with vendors offering short lead times for “ready-to-ship” items to reduce expedite fees.

Example total landed cost (TLG) illustration

Unfinished Birch, 7/8″, 500′, roll $12.95

– Domestic ground shipping per roll (illustrative): ~$18.

– Application (machine-run, fleeceback, 100 boards, 2.44 m each):

– Adhesive cost: ~$58.

– Labor/power: ~$50.

– TLC:

– TLC ≈ $12.95 + $18 + $58 + $50 ≈ $138.95 for 100 boards.

– Per board (≈$1.39).

– Per linear foot (8 ft): ≈$0.17.

– Sensitivity:

– Air freight to EU on a 2.7 kg carton (example): $35 shipping + 3.5% duty + VAT.

– TLC would rise accordingly by the freight duty/VAT adders.

Notes

– Actual costs vary by region, carrier, species, adhesive type, and production environment.

– Confirm current adhesive pricing and duty/VAT with suppliers/forwarders before locking quotes.

Alternatives Analysis: Comparing real wood edge banding With Other Solutions

Alternatives Analysis: Comparing Real Wood Edge Banding With Other Solutions

When selecting edge banding for commercial projects, decision-makers must weigh material performance, total cost of ownership, installation efficiency, and aesthetic outcomes. Below is a comparative analysis of three primary edge banding solutions used in cabinetry, millwork, and furniture manufacturing.

Comparative Analysis Table

| Criteria | Real Wood Edge Banding | PVC/Plastic Edge Banding | Laminate Edge Banding |

|---|---|---|---|

| Initial Material Cost | Medium to High ($12.95-$54.95 per roll) | Low ($2-$8 per roll) | Medium ($8-$15 per roll) |

| Installation Labor | Medium (requires skilled application) | Low (easy application) | Medium (requires specific tools) |

| Durability | High (real wood, refinishable) | Medium (prone to chipping) | High (scratch resistant) |

| Aesthetic Appeal | Premium natural wood grain | Limited color/texture options | Realistic wood patterns |

| Maintenance | Low (occasional refinishing) | Low (wipe-clean only) | Low (hygienic, easy cleaning) |

| Repair Capability | High (sandalable/repairable) | Limited (replacement required) | Medium (difficult to repair) |

| Sustainability | High (renewable resource) | Medium (petroleum-based) | Medium (mixed materials) |

| Customization | High (species variety, staining) | Limited (pre-finished only) | Medium (limited species patterns) |

| End-Use Suitability | High-end commercial/residential | Budget commercial projects | Moderate commercial applications |

Analysis Summary

Real Wood Edge Banding delivers superior aesthetic quality and long-term value despite higher initial costs. The ability to refinish and repair makes it ideal for high-end projects where longevity and appearance are critical factors. The premium positioning justifies the cost difference in applications where quality perception drives purchasing decisions.

PVC/Plastic Edge Banding excels in cost efficiency and ease of installation, making it suitable for budget-conscious commercial projects. However, the limited repairability and lower perceived quality may impact long-term value. Best suited for high-volume, cost-sensitive applications where frequent replacement is acceptable.

Laminate Edge Banding offers a balanced solution between cost and performance, providing good durability and moderate aesthetic appeal. The consistent quality and easy maintenance make it suitable for commercial applications requiring hygienic surfaces and reliable performance.

Illustrative Image (Source: Google Search)

Decision Framework: Choose real wood for premium applications where aesthetic quality and long-term value drive purchasing decisions. Select PVC for budget-sensitive projects with high-volume requirements. Opt for laminate when balanced performance and moderate cost are priorities in commercial environments.

Essential Technical Properties and Trade Terminology for real wood edge banding

Technical foundations and commercial vocabulary for real wood edge banding in North America and Europe: what core adhesives/backers drive application performance, how dimensions and finishes map to production methods, what trade terms govern MOQ/lead time/customization, and which species/formats/certifications best align with export standards.

Core Construction and Application Systems

- Material: Real wood veneer formed into continuous rolls with carefully joined pieces to ensure grain continuity and minimal waste in production.

- Backers/adhesive systems:

- Pre-glued (hot-melt), no separate adhesive needed at the time of application.

- Fleeceback (unbacked), requires an edgebanding machine to apply adhesive (typically a hot-melt).

- PSA veneer (pressure-sensitive adhesive), peel-and-stick functionality for smaller runs and specialty work.

Adhesive and Backer Systems Overview

| System | Backing type | Application requirement | Typical use-case | Advantages | Considerations |

|---|---|---|---|---|---|

| Pre-glued (hot-melt) | Adhesive already applied to back | No adhesive required; heat/pressure application on site or simple machinery | Small shops, field repairs, prototyping | Fast setup; low capital cost | Limited reworkability; check heat resistance and substrate tolerance |

| Fleeceback | No pre-applied adhesive | Edgebanding machine with adhesive feed | High-throughput shops; panels with melamine or HPL | Strong bond; better control of glue line | Requires equipment investment; material flow management |

| PSA veneer | Pressure-sensitive adhesive | Peel-and-stick; no heat activation | Small sheet projects, specialty applications | Ease of use; no heat; repositionable | May be less heat-resistant than hot-melt systems |

Dimensional Specifications and Performance

- Width options commonly available: 7/8″, 1″, 1-1/2″, and 2″.

- Lengths: 50′, 250′, and 500′ per roll.

- Species availability can influence roll lengths; e.g., carbonized and natural bamboo often include a 50′ length while popular hardwoods often start at 250′ or 500′.

- Surface options: unfinished or prefinished with a medium-sheen finish.

- Backer options: pre-glued (hot-melt), fleeceback (requires machine/adhesive), and PSA in select product lines.

- Application performance characteristics: real wood edge banding follows the grain of the substrate, allowing tight bending radii typical for veneered edges and panels; choose pre-glued for light-duty and fleeceback/PSA for industrial-grade adhesion.

Surface Finishing Options

| Finish option | Sheen/appearance | Typical application | Pros | Considerations |

|---|---|---|---|---|

| Unfinished | Raw veneer; no topcoat | Post-application staining/finishing to match assembly | Full finish control; custom sheen | Requires shop finishing after application |

| Prefinished (medium sheen) | Factory-applied clear finish | Immediate installation, minimal finishing | Faster throughput; consistent appearance | Matching color across assemblies requires care |

Species and Availability

- Commonly stocked species: alder, anigre, ash, beech, birch, cherry, Douglas fir, hickory, maple, oak (and red/white oak), pine, sapele, teak, walnut, mahogany; carbonized and natural bamboo are available in select sizes.

- Backer coverage is broad across hardwoods and bamboo; typical widths range from 7/8″ to 2″ and lengths from 50′ to 500′, subject to species availability.

Trade Terms and Commercial Conditions

| Term | What it means | Typical practice | Notes/Variations |

|---|---|---|---|

| MOQ (Minimum Order Quantity) | Minimum quantity per SKU | Varies by SKU, species, and finish | May differ by species and width |

| Lead time | Days to ship from order receipt | Many in-stock items ship within 24 hours | Non-stock or custom orders require confirmation |

| OEM/custom sizes | Non-standard widths, lengths, or finishes | Available by special order | Species availability affects feasibility |

| Widths | Roll width | 7/8″, 1″, 1-1/2″, 2″ | Match to panel thickness and trimming tolerance |

| Lengths | Roll length per unit | 50′, 250′, 500′ | Shorter lengths may be species-specific (e.g., bamboo) |

| Backers | Pre-glued, fleeceback, PSA | Per species listing | PSA offered as peel-and-stick veneer options |

| Prefinished | Factory-applied medium sheen | Optional | Used for immediate installation |

| Exotic species | High-grade or specialty species | Available by request | Subject to sourcing and lead time |

Compliance and Certifications

- Real wood content: derived from true wood species; eco-compliant materials are standard for most vendors.

- Regional compliance: export-ready supply with regional presence in the USA and Europe; confirm country-specific certifications (e.g., REACH, CARB TSCA Title VI) for your project and supplier.

Fit-for-Purpose Selection by Production Scenario

- Small-batch/unfinished shops: 7/8″ to 1″ pre-glued rolls in unfinished cherry, maple, or oak; apply with heat/pressure and finish after installation.

- Industrial panel shops: 1″ to 2″ fleeceback in oak, birch, or ash for durable adhesive lines; configure edgebander for the selected hot-melt.

- Specialty/small-surface work: PSA veneer for quick prototyping and repair without heat activation.

- Species-specific needs: high-movement panels favor stable species like maple or birch; high-clarity finishes may favor prefinished cherry or walnut in a controlled env.

Glossary of Trade Terminology

- Pre-glued (hot-melt): Adhesive activated by heat/pressure at application.

- Fleeceback: Unbacked veneer requiring machine-applied adhesive.

- PSA (Pressure Sensitive Adhesive): Peel-and-stick backing.

- Reconstituted (recon): Man-made sliced wood veneer designed to simulate natural species aesthetics.

- MOQ: Minimum per-SKU order quantity.

- Lead time: Time to ship after order confirmation.

- OEM/custom: Non-standard widths/lengths/finishes.

Quick Reference: Typical Widths and Lengths by Species Group

| Species group | Widths (in) | Lengths (ft) | Notes |

|---|---|---|---|

| Popular hardwoods (cherry, maple, oak) | 7/8, 1, 1-1/2, 2 | 250, 500 | Prefinished options may be 7/8″ only |

| Bamboo (natural, carbonized) | 7/8 | 50, 250, 500 | Shorter 50′ rolls available |

| Birch, cherry, ash | 7/8 to 2 | 50, 250, 500 | Species-dependent |

Application Guidance

- Match width to panel thickness plus trimming allowance; 7/8″ handles most standard panels; 1–2″ for thicker or higher-trim allowances.

- Use fleeceback or pre-glued hot-melt systems for long runs; PSA for small formats and field adjustments.

- Apply finishing strategy before or after bonding depending on the selected surface (unfinished vs prefinished).

By grounding selection in backer/adhesive systems, dimensional availability, and clear trade terminology, you can standardize sourcing across USA and Europe while reducing rework and ensuring consistent edge quality.

Navigating Market Dynamics and Sourcing Trends in the real wood edge banding Sector

Navigating Market Dynamics and Sourcing Trends in the Real Wood Edge Banding Sector

Real wood edge banding remains a premium edge solution that signals quality and craftsmanship. This section outlines the market dynamics, sustainability norms, and sourcing best practices shaping demand across the USA and Europe.

Illustrative Image (Source: Google Search)

Overview and definitions

- Real wood edge banding is veneer-based edge trim that delivers authentic grain, species variety, and tactile feel compared to rigid PVC/ABS alternatives.

- Two backers define application and equipment needs:

- Pre-glued (iron-on): hot-melt adhesive, manual or simple tools, ideal for shops and field-service use.

- Fleeceback: carrier-backed veneer for industrial edgebanders using adhesives (EVA/PUR) or rollers, suited to higher volumes and repeatable bond quality.

Market dynamics shaping demand

| Dynamic | What’s changing | Why it matters | Implication for sourcing |

|---|---|---|---|

| Premiumization and aesthetic-led cabinetry | Rise in veneer-edge aesthetics, light/white oak looks, walnut/cherry, reconstituted species | Real wood finishes signal quality and material authenticity | Prioritize species availability, pre-finished options, and consistent grain batch control |

| Regional production footprints | USA: domestic furniture and casework rebuild; EU/EFTA: stable, advanced manufacturing with proximity to supply | Shorter lead-times, reduced transoceanic risk | Mix short-run domestic/regional sourcing with long-cycle species from overseas partners |

| Speed-to-market and lead-time variability | SKU proliferation, custom finishes, shorter campaigns | Demand for inventory availability and smaller batch sizes | Source core species regionally; plan forecast windows; use multiple suppliers per species |

| Supply chain volatility | Wood veneer quality and yield fluctuations; energy/melt adhesive costs | Bond failures and rework increase cost and delay | Use fleeceback machines for better bond control; qualify adhesive partners and validate adhesive migration claims |

| Regulatory tightening on timber and chemicals | EUDR, UK defo regs, REACH, TSCA Title VI, CARB ATCM/TSCA compliance checks | Documentation and traceability become pass/fail gates | Require chain-of-custody (FSC/PEFC), HS/HTS codes, and material data from suppliers; verify claims with documentation audits |

Sourcing trends by species, backers, and finishes

| Product/feature | Trend | Buyer priority | Typical lead-time pattern |

|---|---|---|---|

| Oak, white oak, walnut, cherry | High, consistent demand | Visual consistency, pre-finished readiness | Domestic short-run possible; long-run imports for exotic/high volume |

| Beech and birch | Strong in EU; solid in USA | Value-grade, reliable supply | Good domestic/European availability; long-run for specialty profiles |

| Reconstituted (dyed, exotic patterns) | Rising interest in exotic look at stable price | Design impact | Longer cycles; ensure EUTR/EUDR documentation |

| Pre-finished veneer edge banding | Growth in shops seeking finishing throughput reduction | Color/grain matching and finish durability | Pre-finished options often custom; plan 8–12+ weeks for specials |

| Fleeceback adoption | Growing in professional shops | Lower rework and faster runs | Requires edgebander investment and adhesive QA |

| Sustainability signals | FSC/PEFC requested in public/commercial projects | Compliance and ESG narratives | Source from certified supply; audit proof; align with EUDR reporting needs |

Compliance and sustainability checklist

| Requirement | Region | What suppliers must provide | Where it’s enforced |

|---|---|---|---|

| FSC or PEFC chain-of-custody | USA/EU | Controlled wood or full certificate; scope statements | Project specifications; corporate ESG audits |

| EUDR (timber due diligence) | EU/EFTA | Product/species/substance classification; geolocation info (as required); risk mitigation statements | Placed on the EU market; enforced by EU authorities and platform-level checks |

| UK deforestation regulation | UK | Similar product and deforestation proofs; HS code declarations | Imports into Great Britain |

| REACH compliance (chemicals) | EU/EFTA/UK | Adhesive and finish chemistry documentation; SVHC declarations | Product acceptance and market access |

| TSCA Title VI / CARB ATCM (formaldehyde) | USA | Certification from bonded MDF/plywood suppliers | MDF/plywood substrates used in casework |

| HTS codes and trade documentation | USA | Correct classification for veneer edge banding; country-of-origin | Customs clearance and tariff treatment |

| EUTR-style evidence of legality | EU | Supplier declarations, license numbers, transport documents | Procurement compliance reviews |

Cost drivers and pricing considerations

| Cost driver | Directional trend | Sourcing response |

|---|---|---|

| Veneer log quality and species availability | Volatile; premium species price-sensitive | Lock quarterly agreements; specify thickness/grade; allow substitute grades |

| Adhesive and energy costs | Elevated, periodic spikes | Validate claims; standardize adhesive system; benchmark bond cycle times |

| Labor and application throughput | Variable by region | Pre-finished to reduce on-site finishing; machine-grade fleeceback for speed |

| Logistics and cross-border handling | Mixed; port and air freight cycles | Multi-origin supplier strategy; regional warehousing |

| Compliance overhead | Rising documentation demand | Consolidate compliance data; vendor portals; periodic audits |

Best practices for USA and Europe

- Diversify supply by region: pair domestic/European core stocks with selected overseas specialty species.

- Choose backers aligned to throughput: pre-glued for flexibility; fleeceback for precision and volume.

- Require evidence, not promises: FSC/PEFC certificates, REACH/TSCA data, adhesive SDS, HS codes, and EUDR due diligence statements.

- Standardize dimensions and tolerances across suppliers to reduce fit and finish risk.

- Plan lead times: anticipate 2–6 weeks for standard core species and 8–12+ weeks for pre-finished or exotic/reconstituted items.

- Invest in QA: test bond strength, adhesive migration (where applicable), and color uniformity at receipt; maintain lot traceability.

Risk management playbook

| Risk type | What to do | Owner | When |

|---|---|---|---|

| Adhesive failures | Validate adhesive type; run test bonds; audit SDS | QA/production | Before first run and quarterly |

| Regulatory rejection | Verify certificates; run mock audits; fix data gaps | Compliance | Pre-shipment; semiannual review |

| Species substitution | Lock grades and acceptance criteria; sample approvals | Procurement/design | During RFQ and change orders |

| Lead-time slippage | Build buffer inventory for A-line SKUs; alternate routes | Supply chain | Seasonal peaks; Q4 |

| Batch inconsistency | Hold sample boards; implement lot release criteria | QA | Each lot received |

Practical vendor questionnaire (excerpt)

- Species list, thickness, backers available; pre-finished options and finishes.

- Minimum/maximum roll lengths; width tolerances; shipping units.

- FSC/PEFC certificate scope and license numbers; non-certified volumes (controlled wood).

- Adhesive system details; REACH/TSCA compliance; SDS and declaration availability.

- EUDR due diligence approach; required geolocation; HS/HTS codes; country-of-origin.

- Typical lead times by SKU; MOQs; returns and defect policy.

Outlook

Expect steady premiumization with rising attention to traceability, documented sustainability, and machine-grade fleeceback usage. North America will maintain hybrid sourcing—domestic and imported—while Europe leans on regional compliance maturity and diversified sourcing within the EFTA/EU zone. Buyers who standardize backer selection, certify compliance across the chain, and plan lead times by SKU tier will navigate volatility most effectively.

Frequently Asked Questions (FAQs) for B2B Buyers of real wood edge banding

B2B FAQs: Real Wood Edge Banding

1) What is real wood edge banding, and how is it produced?

Real wood edge banding is a continuous roll of real wood veneer, spliced and joined to create long, ready-to-apply strips for finishing exposed edges on panels and doors. It is typically supplied in two backer configurations:

– Pre-glued (iron-on): hot-melt adhesive applied to a paper/ fleece-like carrier for rapid installation with an iron or edge-banding machine.

– Fleeceback: a fibrous fleece carrier that requires a separate adhesive and an edge-banding machine for installation.

Common applications include veneered panels, cabinets, countertops, and commercial furniture edges. WiseWood can also special order exotic species not listed in stock.

2) What are the differences between pre-glued and fleeceback?

Use pre-glued for smaller runs, prototypes, and field adjustments where speed and low equipment cost matter. Use fleeceback for high-volume production, consistent glue lines, and stronger adhesion with edge-banding machines.

Illustrative Image (Source: Google Search)

| Attribute | Pre-glued (iron-on) | Fleeceback |

|---|---|---|

| Carrier | Paper/fleece composite | Non-woven fleece |

| Adhesive | Hot-melt pre-applied | Customer-applied |

| Install method | Iron or light-duty edge-banding machine | Edge-banding machine with separate adhesive (e.g., EVA, PVA, PUR) |

| Production speed | Moderate (manual process) | High (automated) |

| Bond strength | Good for light loads | Strong, consistent glue line |

| Typical use cases | Small lots, repairs, customization | OEM/OEM, volume production |

| Notable options | — | — |

3) What sizes and species are available?

Widths range from 7/8″ to 2″ (commonly 7/8″, 1″, 1.5″, 2″). Roll lengths include 50′, 250′, and 500′. Popular species include Alder, Anigre, Ash, Bamboo (natural and carbonized), Beech, Birch (including pre-finished), Cherry (including pre-finished), Douglas Fir, Hickory, Mahogany, Maple, Oak (including Red Oak and White Oak), Pine, Sapele, Teak, and Walnut.

| Stock size matrix (typical, select SKUs) | |||||

|---|---|---|---|---|---|

| Species | Widths (in) | Roll lengths | Backer | Pre-finished option | Starting price (USD) |

| Alder | 7/8″ | 250′, 500′ | Pre-glued, Fleeceback | No | 34.95 |

| Anigre | 7/8″ | 250′, 500′ | Pre-glued, Fleeceback | No | 38.95 |

| Ash | 7/8″ | 250′, 500′ | Pre-glued, Fleeceback | No | 30.95 |

| Bamboo (Natural, Carbonized) | 7/8″ | 50′, 250′, 500′ | Pre-glued, Fleeceback | No | 26.95 |

| Beech | 7/8″ | 250′, 500′ | Pre-glued, Fleeceback | No | 34.95 |

| Birch | 7/8″, 1″, 1.5″, 2″ | 50′, 250′, 500′ | Pre-glued, Fleeceback | Yes (7/8″) | 12.95 (raw); 54.95 (pre-fin.) |