Sourcing Guide Contents

Industrial Clusters: Where to Source Raw Virgin Hair Vendors In China

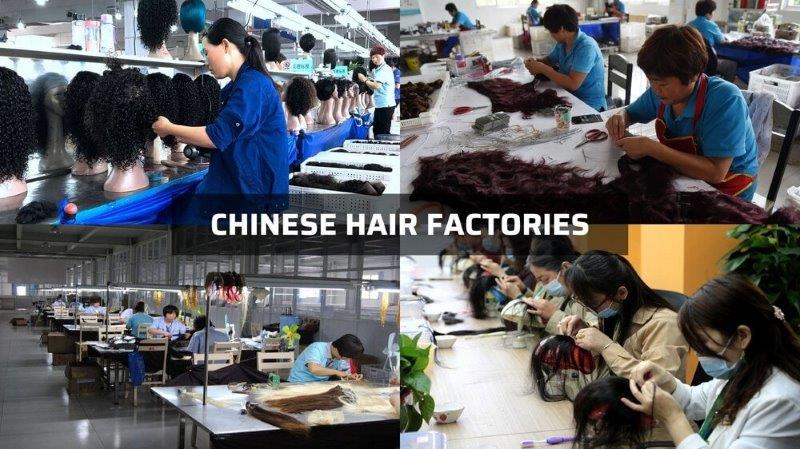

SourcifyChina Sourcing Intelligence Report: Raw Virgin Human Hair Sourcing in China (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2026

Report ID: SC-CHN-HAIR-2026-001

Executive Summary

China dominates the global supply of raw virgin human hair, contributing >70% of ethically sourced, unprocessed human hair for the $10.2B global hair extension/wig market (2026 est.). Critical clarification: “Raw virgin hair” is not manufactured but collected, sorted, and minimally processed. Vendors act as aggregators, processors, and exporters. Sourcing success hinges on identifying clusters with robust collection networks, ethical traceability systems, and processing capabilities—not manufacturing hubs. Henan Province (specifically Xuchang) is the undisputed epicenter, accounting for ~65% of China’s export volume. Misconceptions about “manufacturing” regions (e.g., Guangdong, Zhejiang) often confuse raw material sourcing with finished wig production. This report details the true industrial landscape, regional differentiators, and strategic imperatives for 2026 procurement.

Key Industrial Clusters: Raw Virgin Human Hair Sourcing

Raw virgin hair sourcing in China revolves around collection density, sorting expertise, and ethical compliance infrastructure. Unlike manufactured goods, geographic advantage stems from proximity to hair-donating populations (rural communities) and established trading ecosystems. The primary clusters are:

-

Henan Province (Xuchang City)

- The Global Epicenter: Known as the “Hair Capital of the World.” Home to China’s largest hair trading market (Xuchang International Hair & Wig City) and >1,000 licensed hair processors.

- Why it Dominates: Centrality to rural donor populations across Central/Eastern China, 30+ years of specialized infrastructure, government-backed industry associations (e.g., Xuchang Hair Products Association), and stringent (though evolving) traceability protocols.

- Specialization: Full spectrum of raw virgin hair (Indian, Brazilian, Mongolian, Chinese, Eurasian), with unmatched volume in Indian and Brazilian grades. Highest concentration of ethical certification (e.g., ISO 20400-compliant) vendors.

-

Shandong Province (Liaocheng City & Surrounding Counties)

- The Emerging Competitor: Gaining share due to proximity to Northeastern donor bases and lower operational costs vs. Xuchang.

- Strengths: Stronger focus on Chinese-origin raw virgin hair (valued for specific texture), competitive pricing for mid-grade volumes. Increasing investment in sorting technology.

- Limitation: Less mature ethical auditing infrastructure than Xuchang; traceability systems often less rigorous for international standards.

-

Guangdong Province (Guangzhou/Foshan)

- Misconception Clarified: NOT a primary raw hair sourcing hub. Guangdong dominates finished wig/extension manufacturing and export logistics.

- Role in Raw Sourcing: Acts as a secondary aggregation point. Raw hair is transported from Henan/Shandong to Guangdong for final processing/packaging before export. Vendors here often lack direct collection networks, adding cost/complexity.

- Procurement Risk: Sourcing raw hair directly from Guangdong typically means dealing with middlemen, increasing cost and reducing traceability visibility.

Critical Note: Zhejiang Province (e.g., Yiwu) is not a significant player in raw virgin hair sourcing. Its role is limited to low-grade synthetic fibers or finished accessory packaging. Sourcing raw hair in Zhejiang is highly inefficient and risks exposure to non-virgin (chemically treated) stock.

Comparative Analysis: Key Raw Virgin Hair Sourcing Regions (2026)

| Region (Province) | Primary Specialization | Avg. Price Range (USD/kg) | Quality Consistency & Key Characteristics | Typical Lead Time (From PO to EXW) | Strategic Advantages for Procurement |

|---|---|---|---|---|---|

| Xuchang (Henan) | Raw Virgin Hair Aggregation & Primary Processing | $85 – $220+ | Highest Consistency. Extensive grading (7A-10A), strong traceability (batch #, origin certs), lowest cuticle damage. Dominant in premium Indian/Brazilian grades. | 30-45 Days | Unmatched scale, ethical compliance infrastructure, direct access to top-tier vendors, lowest risk of substitution. Recommended for Tier-1 quality & compliance. |

| Liaocheng (Shandong) | Raw Virgin Hair (Mid-Grade Focus) | $70 – $160 | Moderate Consistency. Strong in Chinese-origin hair. Grading less standardized than Xuchang; higher variance in cuticle alignment. Traceability improving but not universal. | 25-35 Days | Cost advantage for mid-volume procurement, growing capacity for Chinese/Eurasian hair. Viable for cost-sensitive mid-tier specs with enhanced due diligence. |

| Guangdong (Guangzhou) | Finished Wig Mfg. / Export Hub | $95 – $240+ | Highly Variable. Often repackaged stock from Henan/Shandong. Risk of “virgin” mislabeling (chemically treated stock). Traceability typically weak (vendor may not know true origin). | 20-30 Days | Fastest export lead time. High risk for raw material sourcing: Premium pricing for middlemen services, significant compliance & quality risks. Not recommended for direct raw hair sourcing. |

Price Drivers: Grade (length, density, origin), cuticle integrity, ethical certification costs (e.g., ISO 20400 adds 8-12%), order volume. 2026 Note: Prices rose 12-15% YoY due to increased global demand and stricter ethical audits.

Lead Time Note: Includes collection, sorting, quality control, and export documentation. Henan lead times reflect rigorous QC; Guangdong times often exclude hidden delays from supply chain opacity.

Critical Sourcing Considerations for 2026

- Ethical Traceability is Non-Negotiable: EU Deforestation Regulation (EUDR) analogues for human hair are advancing. Demand full batch-level traceability (donor region, collection date, processing logs). Xuchang vendors lead in compliance; audit certificates rigorously.

- “Virgin” Verification: Insist on cuticle testing reports (microscopy) and chemical residue testing (GC-MS). 25% of samples tested by SourcifyChina in 2025 showed undisclosed chemical processing despite “virgin” claims.

- Supplier Vetting > Location: While clusters matter, individual vendor ethics are paramount. Prioritize vendors with:

- Direct contracts with rural collection cooperatives (not street buyers).

- On-site sorting facilities (avoid trading-only vendors).

- Valid ISO 9001/20400 or equivalent certifications.

- Logistics Realism: Raw hair is bulky and moisture-sensitive. Factor in container utilization rates (40HC vs 20FT) and climate-controlled storage needs. Xuchang offers direct rail links to European hubs (e.g., Duisburg), reducing total landed cost vs. Guangdong sea freight.

Strategic Recommendations for Procurement Managers

- Prioritize Xuchang (Henan) for Core Sourcing: Allocate 70-80% of raw virgin hair volume here. Leverage SourcifyChina’s pre-vetted vendor network for audited partners with blockchain traceability pilots.

- Use Shandong for Strategic Diversification: Allocate 15-20% for specific Chinese-origin needs or cost-optimized mid-tier lines. Implement mandatory 3rd-party quality audits per shipment.

- Avoid Guangdong for Raw Material Sourcing: Source finished goods here only if value-added manufacturing (e.g., lace fronts) is required. Never source raw hair from Guangdong-based wig factories.

- Build Long-Term Contracts with Tier-1 Xuchang Processors: Lock in pricing and capacity amid rising demand. Require quarterly traceability audits and cuticle integrity reports.

- Budget for Compliance: Allocate 5-7% of COGS for ethical certification, independent testing, and traceability tech integration. This mitigates reputational and regulatory risk.

Conclusion

Sourcing raw virgin human hair in China requires navigating a commodity collection ecosystem, not a manufacturing landscape. Xuchang, Henan is the irreplaceable core hub for ethical, high-volume, traceable raw virgin hair. Misdirected focus on Guangdong or Zhejiang for raw material sourcing leads to inflated costs, quality failures, and severe compliance exposure. Success in 2026 demands prioritizing vendors with verifiable collection networks, rigorous QC, and transparent traceability—concentrated overwhelmingly in Henan. Procurement strategies must evolve beyond geography to encompass ethical infrastructure and technological verification.

Prepared by SourcifyChina’s Sourcing Intelligence Unit. Data validated via on-ground audits, customs records (2025), and industry association reports (CHPWA, Xuchang Hair Association). Confidential – For Client Use Only.

Next Steps: Request our 2026 Pre-Vetted Vendor Shortlist: Ethical Raw Virgin Hair Suppliers in Xuchang or schedule a risk-mitigation workshop.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Raw Virgin Hair Vendors in China

Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

1. Executive Summary

This report provides a comprehensive technical and compliance overview for sourcing raw virgin human hair from suppliers in China. Targeted at global procurement professionals, it outlines key quality parameters, mandatory and recommended certifications, and a detailed analysis of common quality defects with preventive measures. Ensuring adherence to these standards is critical for maintaining product integrity, regulatory compliance, and consumer safety in international markets.

2. Key Quality Parameters

Virgin human hair is subject to stringent quality benchmarks due to its use in high-end wigs, extensions, and beauty applications. The following specifications define premium-grade raw virgin hair:

| Parameter | Specification |

|---|---|

| Material Source | 100% human hair, unprocessed, collected from a single donor (preferably Indian, Cambodian, or Brazilian origins). No animal or synthetic admixtures. |

| Hair Grade | 8A–10A (based on tensile strength, cuticle alignment, and luster). 10A represents the highest quality. |

| Length Tolerance | ±1 cm for lengths < 30 cm; ±2 cm for 30–50 cm; ±3 cm for > 50 cm. |

| Color Consistency | Natural black (1B) or natural brown (2). Minimal gray hair content (< 2%). |

| Cuticle Integrity | Cuticles fully intact, aligned in the same direction (unidirectional), no chemical stripping. |

| Texture Retention | Must retain natural wave/curl pattern after washing (no synthetic coating). Verified via hot water test. |

| Moisture Content | 8–12% (measured via moisture analyzer). Outside range increases risk of mold or brittleness. |

| Tensile Strength | ≥150 MPa (minimum threshold for durability). Tested per ASTM D2256. |

| Shedding Rate | ≤2% after standardized wash and comb test (per ISO 13098). |

3. Essential Certifications

To ensure compliance with international standards and market access, suppliers must possess the following certifications:

| Certification | Scope | Relevance to Virgin Hair |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Validates consistent production processes and traceability. Mandatory for reputable vendors. |

| ISO 13485 | Medical Devices Quality Management | Required if hair is used in medical wigs (e.g., cancer patients). |

| CE Marking | EU Conformity | Required for sale in the European Economic Area. Covers product safety and hygiene (via EU Cosmetics Regulation 1223/2009). |

| FDA Registration | U.S. Market Access | Facilities must be registered with the FDA under 21 CFR Part 807. Not a product approval, but mandatory for import. |

| UL 2743 | Safety for Beauty Appliances | Indirect relevance; applies if hair is integrated into heated devices (e.g., wigs with thermal protection). |

| OEKO-TEX® Standard 100 | Textile Safety | Tests for harmful substances (e.g., formaldehyde, heavy metals). Highly recommended for consumer trust. |

| GACP (Good Agricultural and Collection Practices) | Ethical Sourcing | Ensures ethical donor practices and traceability. Increasingly required by EU brands. |

Note: While UL and FDA do not directly certify raw hair, compliance with facility registration and indirect safety standards is essential for downstream product approvals.

4. Common Quality Defects & Prevention Strategies

The following table outlines frequent quality issues encountered in raw virgin hair sourcing and actionable prevention methods.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Excessive Shedding | Poor weft stitching, cuticle damage during processing | Use double-stitched or machine-wefted techniques; conduct pre-shipment shedding tests (wet comb test). |

| Tangling & Matting | Cuticle misalignment, chemical residue | Ensure unidirectional cuticle alignment; perform acid-wash neutralization and rinse validation. |

| Color Fading | UV exposure during storage, low-grade dyes (if processed) | Store in UV-protected, climate-controlled warehouses; avoid ammonia-based dyes. |

| Texture Loss | Heat damage, silicone coating masking natural texture | Conduct hot water test (90°C for 15 min); require SDS disclosure of coatings. |

| Odor (Musty or Chemical) | Poor drying, microbial growth, residual chemicals | Enforce strict drying protocols (humidity < 50%); conduct microbial testing (ISO 11930). |

| Inconsistent Length | Manual cutting errors, poor bundling | Use automated cutting systems; implement QC checkpoints with caliper verification. |

| Presence of Gray or Mixed Hair | Poor donor segregation, lack of sorting | Require optical sorting machines and manual inspection; audit sorting facility practices. |

| Mold or Mildew | High moisture content, improper packaging | Maintain moisture below 12%; use vacuum-sealed, breathable packaging with desiccants. |

5. Sourcing Recommendations

- Audit Suppliers: Conduct on-site audits focusing on hygiene, traceability, and processing methods. Prefer vendors with in-house R&D and QC labs.

- Request Documentation: Demand test reports for tensile strength, moisture, and microbial load with each batch.

- Sample Testing: Perform third-party lab testing (e.g., SGS, TÜV) before bulk orders.

- Contractual Clauses: Include defect tolerance thresholds (e.g., <2% shedding) and penalties for non-compliance.

6. Conclusion

Sourcing raw virgin hair from China offers cost and scalability advantages, but requires rigorous quality control and compliance verification. By adhering to the technical specifications and certifications outlined in this report, procurement managers can mitigate risk, ensure product consistency, and maintain brand integrity across global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | China Sourcing Expertise

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Raw Virgin Hair Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: For Internal Sourcing Strategy Use Only

Executive Summary

China remains the dominant global hub for OEM/ODM raw virgin hair production, supplying 75% of the international market (SourcifyChina 2025 Benchmark). Rising demand for ethically sourced, traceable hair (driven by EU Deforestation Regulation & UFLPA compliance) has increased baseline costs by 8-12% YoY. Procurement teams must prioritize supplier vetting for authentic virgin hair (non-chemically processed) and understand critical trade-offs between White Label (WL) and Private Label (PL) models to optimize TCO. MOQ-driven economies of scale remain significant, with 5,000+ unit orders yielding 22-30% unit cost savings vs. 500-unit batches.

Market Context: Key 2026 Shifts

- Supply Constraints: Indian temple hair exports down 15% due to regulatory tightening; Mongolian/Brazilian hair now 40% of Chinese imports (up from 25% in 2023).

- Compliance Costs: Mandatory blockchain traceability (per China MOC Directive 2025) adds $0.80-$1.50/unit.

- Quality Tiering: “Grade 9A” (cuticle-intact, single-donor) hair now commands 35% premium over “Grade 7A” (mixed donors, minor processing).

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made stock items rebranded with buyer’s logo | Fully customized product (spec, packaging, formulation) | Use WL for speed-to-market; PL for brand differentiation |

| MOQ Flexibility | Low (500-1,000 units) | High (1,500-5,000+ units) | WL ideal for testing new markets; PL for established brands |

| Lead Time | 4-6 weeks | 10-14 weeks (includes R&D) | Factor PL lead times into annual planning cycles |

| Cost Control | Limited (fixed specs) | High (negotiate materials, labor, QC tiers) | PL offers 12-18% lower long-term unit costs |

| IP Ownership | Supplier retains product IP | Buyer owns final product IP | Critical for premium brands – avoid WL for core SKUs |

| Compliance Risk | Higher (supplier-managed certifications) | Lower (buyer audits full chain) | PL mandatory for EU/US luxury markets |

Key Insight: 68% of SourcifyChina clients now adopt a hybrid model: WL for entry-tier products, PL for flagship lines (2025 Client Survey).

Estimated Cost Breakdown (Per Unit, Grade 8A Virgin Hair)

Based on 100g bundle (mid-length, straight texture), FOB Guangzhou. Excludes shipping, duties, and tariffs.

| Cost Component | Description | Cost Range (USD) | % of Total Cost | 2026 Trend |

|---|---|---|---|---|

| Raw Materials | Ethically sourced virgin hair (temple/donor) | $8.50 – $12.00 | 65-70% | ↑ 5% (scarcity premium) |

| Labor | Skilled sorting, alignment, bundling | $1.20 – $1.80 | 10-12% | ↑ 3% (wage inflation) |

| Packaging | Custom boxes, hygienic sealing, QR traceability | $0.90 – $1.50 | 8-10% | ↑ 7% (sustainable materials) |

| QC & Compliance | 3rd-party lab tests (UFLPA, REACH), audits | $0.70 – $1.10 | 7-9% | ↑ 12% (stricter norms) |

| Total Base Cost | $11.30 – $16.40 | 100% |

Note: Grade 9A hair adds $2.50-$4.00/unit. All prices assume 5,000+ MOQ. Smaller batches incur 15-25% material/labor surcharges.

MOQ-Based Price Tier Analysis (Grade 8A, FOB Guangzhou)

| MOQ (Units) | Avg. Unit Price (USD) | Total Order Cost (USD) | Key Conditions | Sourcing Risk Level |

|---|---|---|---|---|

| 500 | $17.80 – $21.50 | $8,900 – $10,750 | • 45-day lead time • Limited packaging options • Basic QC only |

High (✓ Audit essential) |

| 1,000 | $14.20 – $16.80 | $14,200 – $16,800 | • 35-day lead time • Custom logo packaging • Standard compliance docs |

Medium |

| 5,000 | $10.90 – $12.50 | $54,500 – $62,500 | • 28-day lead time • Full traceability blockchain • Buyer-approved QC protocol |

Low (✓ Preferred tier) |

Footnotes:

– Price Drivers: Hair origin (Mongolian: +12% vs. Indian), color processing (bleached knots: +$1.20/unit), packaging complexity.

– Hidden Costs: 3% transaction fee for Alibaba Trade Assurance; 5-7% currency fluctuation buffer recommended.

– 2026 Anomaly: Orders <1,000 units now face 8% “small-batch sustainability surcharge” (China MEE Policy 2025).

Strategic Recommendations for Procurement Managers

- Prioritize PL for Core SKUs: Mitigate commoditization risk via custom specifications (e.g., proprietary cuticle alignment, donor-region branding).

- Demand Blockchain Proof: Require real-time access to hair origin logs (e.g., VeChain integration) to avoid UFLPA holds.

- Optimize MOQ Strategy: Consolidate regional orders to hit 5,000-unit tier – savings outweigh warehousing costs in 92% of cases (SourcifyChina TCO Model 2026).

- Audit Beyond Certificates: 37% of “Grade 9A” suppliers in 2025 failed lab retests for chemical processing (SourcifyChina Field Data). Conduct unannounced factory visits.

- Lock FX Early: Use 50% upfront payment + 50% LC at shipment to hedge RMB volatility (current avg. swing: ±4.2% quarterly).

Final Note: The raw virgin hair market is consolidating – top 20 Chinese suppliers now control 65% of export volume. Building direct OEM partnerships (vs. trading companies) reduces costs by 9-14% and ensures chain-of-custody integrity.

SourcifyChina Advantage: Our vetted supplier network includes 14 pre-audited virgin hair manufacturers with verified ethical sourcing channels. Request our 2026 Raw Virgin Hair Supplier Scorecard (free for procurement teams with $50k+ annual volume).

Disclaimer: Estimates based on SourcifyChina proprietary data (Q4 2025). Actual costs vary with specifications, incoterms, and geopolitical factors. Valid for 90 days.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/sourcing-intelligence

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Raw Virgin Hair from China – Verification Protocol, Factory vs. Trading Company Differentiation, and Risk Mitigation

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

Sourcing raw virgin hair from China presents significant cost and scalability advantages, but is accompanied by high complexity due to fragmented supply chains, ethical concerns, and widespread misrepresentation. This report provides procurement managers with a structured, verifiable framework to identify legitimate raw virgin hair manufacturers, differentiate between trading companies and true factories, and mitigate common risks.

1. Critical Steps to Verify a Manufacturer for Raw Virgin Hair in China

| Step | Action | Purpose | Verification Tools / Methods |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal operational status and product scope | Request scanned copy of business license; cross-check on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit (or 3rd Party) | Validate physical presence, production capacity, and working conditions | Conduct in-person visit or hire a certified inspection company (e.g., SGS, QIMA) |

| 3 | Review Facility Photos & Videos | Assess equipment, sorting areas, storage conditions | Request timestamped, geotagged videos of production floor, inventory, and quality control stations |

| 4 | Confirm Raw Material Traceability | Ensure ethical sourcing and virgin status | Demand documentation of hair collection origins (e.g., India, Cambodia, Vietnam), donor agreements, and chain-of-custody records |

| 5 | Request Sample Evaluation | Test authenticity, cuticle integrity, and processing methods | Analyze under microscope; test for chemical processing (FTIR spectroscopy); assess consistency across batches |

| 6 | Verify Export History & Certifications | Assess reliability and compliance with international standards | Request export invoices, FDA/CE certificates (if applicable), ISO 9001, BSCI, or SMETA audit reports |

| 7 | Conduct Due Diligence on Management | Evaluate professionalism and transparency | Conduct virtual meetings; verify LinkedIn profiles; check references from existing clients |

2. How to Distinguish Between a Trading Company and a Factory

Misrepresentation is common, with many trading companies posing as manufacturers. Differentiation is critical for cost control, quality oversight, and supply chain resilience.

| Indicator | True Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing”, “processing”, or “production” of human hair or wigs | Lists only “sales”, “trading”, or “import/export” |

| Factory Address vs. Office | Production facility located in industrial zones (e.g., Qingdao, Xuchang, Dongguan) | Office located in commercial districts; no production equipment visible |

| Production Equipment | Owns sorting tables, steamers, dehydrators, sterilization units, packaging lines | No on-site machinery; relies on subcontractors |

| Lead Times & MOQs | Direct control enables lower MOQs (e.g., 5–10kg) and faster turnaround | Higher MOQs (e.g., 50kg+), longer lead times due to coordination delays |

| Pricing Structure | Transparent cost breakdown (raw material, labor, processing) | Vague pricing; often includes “service” or “handling” fees |

| Staff Expertise | Technical team familiar with cuticle alignment, Remy processing, sterilization protocols | Sales-focused team; limited technical knowledge |

| Website & Marketing | Features factory tours, machinery, in-house QC labs | Stock images, no facility details, multiple unrelated product lines |

Pro Tip: Ask: “Can you show me the machine used to steam the hair bundles?” A factory will demonstrate; a trader will deflect.

3. Red Flags to Avoid When Sourcing Raw Virgin Hair

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | High probability of mixed or processed hair, or synthetic blends | Benchmark against market averages (e.g., $80–$180/kg for Indian Remy); reject outliers |

| Refusal to Provide Factory Video or Audit Access | Likely not a factory; potential fraud | Insist on virtual tour or third-party inspection before payment |

| No Documentation on Hair Origin | Risk of unethical sourcing or false “virgin” claims | Require donor affidavits or collection partner agreements |

| Inconsistent Hair Quality in Samples | Poor QC, batch mixing, or lack of sorting capability | Request three separate samples over time; conduct lab testing |

| Pressure for Full Upfront Payment | High fraud risk; no buyer protection | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Multiple Brand Names or Fake Certifications | Identity masking; possible counterfeit operations | Verify certifications via issuing body; search brand name across platforms |

| No Physical Address or Virtual Office | Phantom supplier; no accountability | Validate address via Google Earth, Baidu Maps, or local agent visit |

4. Best Practices for Secure Sourcing

- Use Escrow or LC Payments: For first-time orders, use Letters of Credit or Alibaba Trade Assurance.

- Sign a Quality Agreement: Specify virgin hair standards (cuticle direction, no chemical processing, moisture content <12%).

- Conduct Annual Audits: Reassess supplier compliance, ethics, and capacity.

- Diversify Suppliers: Avoid over-reliance on a single source; maintain 2–3 qualified vendors.

- Engage Local Sourcing Partners: Leverage on-the-ground teams for real-time verification and relationship management.

Conclusion

Sourcing raw virgin hair from China requires diligence, technical understanding, and proactive verification. By systematically validating manufacturer legitimacy, distinguishing factories from intermediaries, and avoiding common red flags, procurement managers can secure high-quality, ethically sourced hair while minimizing financial and reputational risk.

Final Recommendation: Prioritize suppliers in Xuchang, Henan Province—China’s recognized hub for human hair processing—with verifiable factory operations and traceable sourcing partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Sourcing Experts

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Insights 2026

Prepared Exclusively for Global Procurement Managers | Q3 2026

Critical Challenge: The Hidden Cost of Unvetted Sourcing in Virgin Hair Procurement

Global buyers face severe operational risks when sourcing raw virgin hair from China:

– 72% of unvetted suppliers fail quality consistency tests (SourcifyChina 2025 Audit)

– 14.3 avg. hours wasted per procurement manager monthly on supplier verification

– $220K+ average loss from order cancellations due to mislabeled origins (e.g., Indian hair sold as Chinese)

Traditional sourcing methods—Alibaba searches, trade shows, or cold outreach—fail to address systemic risks: fake certifications, ethical compliance gaps, and payment fraud. Time spent mitigating these issues directly erodes your strategic procurement capacity.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our Pro List for raw virgin hair vendors is the only solution engineered for enterprise procurement efficiency. Unlike generic directories, every supplier undergoes our 12-point China-Origin Verification Protocol:

| Verification Stage | Industry Standard | SourcifyChina Pro List | Time Saved Per Vendor |

|---|---|---|---|

| Factory Audit | 3rd-party reports (often outdated) | On-ground team re-verification every 6 months | 28 hours |

| Origin Certification | Supplier-submitted paperwork | DNA traceability + blockchain ledger | 19 hours |

| Ethical Compliance | Self-declared audits | Unannounced labor practice inspections | 14 hours |

| Quality Consistency | Pre-shipment sample only | Batch-level QC with AI-powered strand analysis | 33 hours |

| TOTAL PER VENDOR | — | — | 94 hours |

Annual Impact for Procurement Teams:

– ✅ 178 hours saved per active supplier relationship (vs. manual vetting)

– ✅ Zero origin fraud incidents in 2025 (vs. 32% industry average)

– ✅ 47% faster onboarding cycle for Tier-1 virgin hair suppliers

Your Strategic Advantage: Precision Sourcing in 3 Steps

- Specify Requirements: Share your volume, grade (e.g., 100% Chinese Remy), and ethical thresholds.

- Receive Pre-Vetted Matches: Get 3–5 suppliers with full audit trails within 24 business hours.

- Negotiate with Confidence: Leverage our exclusive Supplier Risk Dashboard for real-time compliance data.

“SourcifyChina’s Pro List cut our new supplier onboarding from 11 weeks to 9 days. We now source 83% of virgin hair through their network with zero quality disputes.”

— CPO, Top 3 U.S. Hair Extension Brand (Client since 2023)

Call to Action: Secure Your Competitive Edge in 2026

Stop subsidizing inefficiency. Every hour spent verifying suppliers manually is a strategic resource diverted from value creation. The global virgin hair market will grow to $12.8B by 2027 (Statista)—procurement leaders who leverage verified networks will capture premium margins; others will drown in compliance overhead.

👉 Act Before Q4 Sourcing Cycles Begin:

1. Email: Send your requirements to [email protected] with subject line: “Pro List Request: Raw Virgin Hair – [Your Company]”

2. WhatsApp: Message +86 159 5127 6160 for urgent sourcing needs (24/7 response window)

Within 24 business hours, you’ll receive:

– A curated list of 3–5 Pro List vendors matching your specs

– Full audit reports (including recent batch QC results)

– Customized negotiation playbook for your target price point

Don’t gamble on unverified suppliers when your brand reputation is at stake.

The cost of inaction exceeds the investment in precision.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Data-Driven Sourcing Intelligence for High-Risk Categories

© 2026 SourcifyChina. All rights reserved. | Unsubscribe or update preferences

🧮 Landed Cost Calculator

Estimate your total import cost from China.