The global ornamental metal fencing market, which includes raw iron fence manufacturing, is experiencing steady growth driven by rising demand in residential, commercial, and infrastructure sectors. According to Grand View Research, the global metal fencing market size was valued at USD 85.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. This growth is fueled by increasing construction activities, growing urbanization, and a heightened emphasis on security and aesthetic appeal in architectural design. Iron fencing, in particular, remains a preferred choice due to its durability, timeless appearance, and low maintenance. As demand continues to climb, a select group of manufacturers are rising to the forefront through innovation, scalability, and consistent quality. Based on production capacity, geographic reach, customer reviews, and industry recognition, here are the top 10 raw iron fence manufacturers shaping the market today.

Top 10 Raw Iron Fence Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Master Halco

Domain Est. 1996

Website: masterhalco.com

Key Highlights: Master Halco is your leading manufacturer and wholesale distributor of fencing & decking products across the US and Canada….

#2 Aluminum Fence

Domain Est. 1998

Website: ultrafence.com

Key Highlights: Our complete line of low-maintenance aluminum fencing products brings the traditional look of wrought-iron fence to Residential, Commercial and Industrial ……

#3 Iron World Fencing

Domain Est. 2005

Website: ironworldfencing.com

Key Highlights: The fastest-growing manufacturer and distributor of decorative and ornamental iron fencing, aluminum fencing, chain link, slide, and swing gates nationwide….

#4 American Fence and Supply

Domain Est. 1997

Website: afence.com

Key Highlights: We specialize in a wide variety of fencing products, including chain-link, split rail, vinyl rail, electric, ornamental, wood, and farm and ranch fencing. Our ……

#5 Fence Depot

Domain Est. 2002

Website: fence-depot.com

Key Highlights: We sell aluminum fence, wrought iron fence, and more directly to homeowners and contractors who are looking for high quality fence, railing and gate products ……

#6 Iron Fence Shop

Domain Est. 2009

Website: ironfenceshop.com

Key Highlights: Premium wrought iron & aluminum metal fences. Over 60 years of combined industry experience. Free shipping over $5000 with 25-year warranty. Call now!…

#7 Meridian Fence

Domain Est. 2009

Website: meridianfence.net

Key Highlights: Meridian Fence is Boise’s top fence company, offering a variety of fence types including Vinyl, Cedar, Ornamental Metal, Chainlink, and more. We provide ……

#8 American Iron Fence & Gates

Domain Est. 2013

#9

Domain Est. 2014

Website: ameristarperimeter.com

Key Highlights: We provide Fence & Security Solutions to protect what matters most. From the quality of materials, American made manufacturing, and the largest support team ……

#10

Domain Est. 2022

Website: davidiron.com

Key Highlights: We offer a wide range of fencing options including wrought iron, ornamental iron, security fences, and custom-designed gates. Each one is built for durability ……

Expert Sourcing Insights for Raw Iron Fence

H2: 2026 Market Trends for Raw Iron Fencing

The global market for raw iron fencing is poised for notable transformation by 2026, driven by evolving construction dynamics, material preferences, and sustainability trends. As urbanization continues and residential and commercial infrastructure expands—particularly in emerging economies—raw iron fencing remains a preferred choice for its durability, security, and timeless aesthetic. However, the market faces both opportunities and challenges shaped by economic, environmental, and technological factors.

-

Increasing Demand in Residential and Commercial Sectors

The residential construction boom, especially in regions like Asia-Pacific and Latin America, is fueling demand for decorative and functional fencing solutions. Raw iron fencing, known for its strength and customizable designs, is increasingly specified in high-end housing, gated communities, and institutional buildings. Similarly, the commercial sector—including industrial parks, schools, and government facilities—continues to rely on iron fencing for perimeter security, contributing to steady market growth. -

Shift Toward Powder-Coated and Corrosion-Resistant Treatments

While “raw” iron implies untreated metal, the 2026 market is seeing a trend toward pre-treated or powder-coated iron products sold in a semi-finished state. This allows end-users or contractors to customize finishes on-site while benefiting from enhanced rust resistance. Manufacturers are adapting by offering raw iron fencing with minimal protective coatings, striking a balance between authenticity and longevity. -

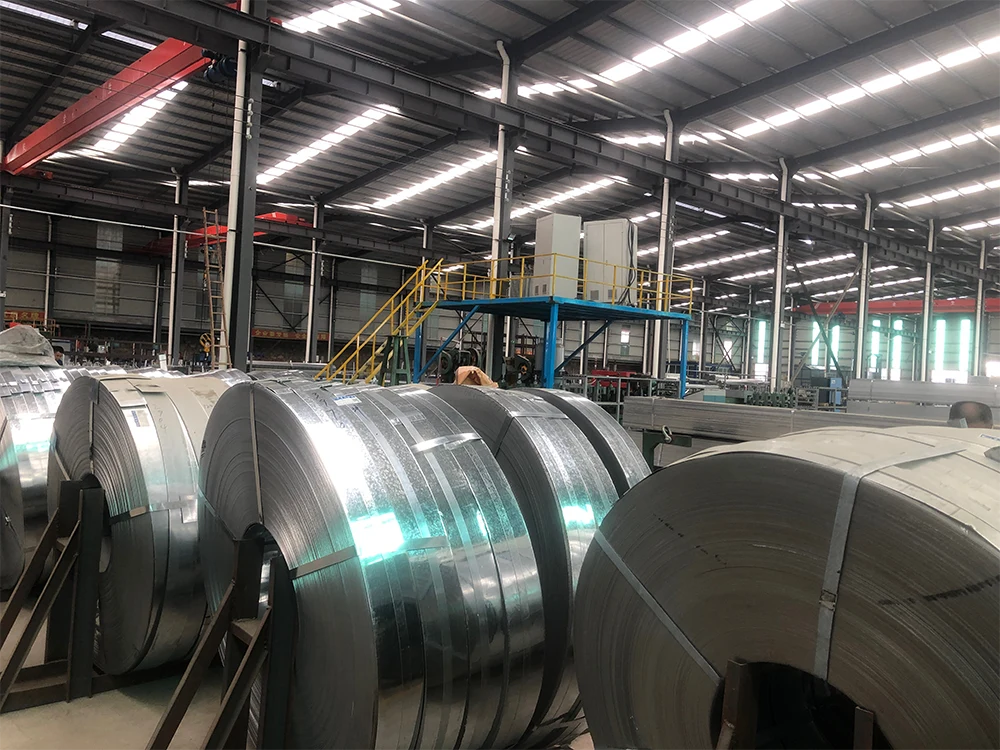

Sustainability and Recycled Material Usage

Environmental regulations and green building certifications (e.g., LEED) are pushing demand for sustainable materials. Iron, being highly recyclable, aligns well with eco-conscious construction practices. By 2026, an increasing number of raw iron fencing producers are expected to source scrap metal and use energy-efficient production methods, appealing to environmentally responsible buyers. -

Price Volatility and Supply Chain Adjustments

Iron prices remain sensitive to global steel markets, energy costs, and geopolitical tensions. Fluctuations in raw material costs may impact the affordability of raw iron fencing, prompting some consumers to consider alternatives like aluminum or composite materials. However, the superior strength and lifespan of iron continue to justify its premium in many applications. Supply chain resilience, including localized manufacturing and inventory management, will be critical for maintaining steady market availability. -

Growth of E-Commerce and Direct-to-Contractor Sales

Digital platforms are transforming how raw iron fencing is purchased. By 2026, more suppliers are expected to leverage online marketplaces, 3D design tools, and B2B portals to reach contractors, architects, and DIY consumers directly. This shift reduces distribution costs and enables faster project turnaround, especially for custom or modular iron fence systems. -

Regional Market Variations

In North America and Europe, demand is driven by renovation projects and heritage restoration, where wrought iron aesthetics are prized. In contrast, markets in India, Southeast Asia, and Africa are experiencing rapid growth due to new construction and infrastructure development. Local production hubs are emerging to reduce import dependence and cater to regional design preferences.

Conclusion

By 2026, the raw iron fencing market will be shaped by a confluence of durability demands, sustainability imperatives, and digital transformation. While competition from alternative materials persists, iron’s unmatched combination of strength, elegance, and recyclability ensures its continued relevance. Stakeholders who embrace innovation in coatings, supply chain efficiency, and customer engagement will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing Raw Iron Fence (Quality and Intellectual Property)

Sourcing raw iron fences—particularly for manufacturing, construction, or resale—can be a complex process that involves navigating both quality assurance and intellectual property (IP) concerns. Failing to address these aspects properly can lead to product failures, legal disputes, and reputational damage. Below are the most common pitfalls related to quality and IP when procuring raw iron fencing materials.

Poor Material Quality and Inconsistent Specifications

One of the most frequent issues is receiving iron that does not meet the required metallurgical or dimensional standards. This includes:

- Inadequate iron grade or composition: Some suppliers may provide substandard wrought or cast iron that is prone to rust, brittleness, or warping.

- Inconsistent thickness or dimensions: Variations in bar diameter or panel size can disrupt manufacturing processes and lead to installation problems.

- Surface defects: Pitting, scaling, or improper finishing can compromise both durability and aesthetics.

- Lack of material certifications: Reputable suppliers should provide mill test reports (MTRs) or certificates of conformance. Without them, verifying quality becomes difficult.

Lack of Quality Control in Manufacturing Process

Even if raw materials are adequate, poor fabrication practices can diminish the final product’s integrity. Common issues include:

- Inconsistent welding: Weak or uneven welds reduce structural strength and increase the risk of failure.

- Improper rust protection: Raw iron is highly susceptible to corrosion. If not treated with appropriate primers or coatings (e.g., galvanization), lifespan is significantly shortened.

- Inadequate quality audits: Buyers who do not conduct on-site inspections or third-party quality checks may unknowingly accept defective batches.

Intellectual Property Infringement

Iron fence designs—especially ornamental or custom patterns—may be protected under intellectual property laws. Key risks include:

- Copying patented designs: Some fence patterns or structural innovations are patented. Sourcing from suppliers who replicate these without authorization can expose the buyer to legal liability.

- Trademarked brand elements: Certain ironwork motifs or logos may be trademarked. Using them, even unintentionally, can lead to cease-and-desist orders or litigation.

- Design copyright issues: In some jurisdictions, artistic ironwork designs are protected under copyright law. Reproducing them without permission—whether for resale or commercial use—can result in infringement claims.

Insufficient Due Diligence on Suppliers

Many quality and IP problems stem from failing to vet suppliers adequately:

- Choosing low-cost vendors without verifying credentials: Bargain pricing often correlates with compromised materials or IP violations.

- Lack of transparency in supply chain: Suppliers may subcontract production to unvetted foundries or workshops that do not adhere to quality or legal standards.

- No contractual IP indemnification: Purchase agreements should specify that the supplier assumes responsibility for IP violations. Without this clause, the buyer may bear the legal consequences.

Conclusion

To mitigate these pitfalls, buyers should implement rigorous supplier qualification processes, demand material certifications, conduct quality audits, and verify the legal status of fence designs. Engaging legal counsel to review IP rights and including protective clauses in procurement contracts can further reduce risks associated with sourcing raw iron fencing.

Logistics & Compliance Guide for Raw Iron Fence

Product Classification and Identification

Raw iron fences typically fall under HS (Harmonized System) codes related to iron or steel structures. Common classifications include:

– 7308.90: Structures and parts of structures, of iron or steel (excludes fencing-specific entries in some regions).

– 7206–7216: May apply depending on the form (e.g., bars, rods) used in fence construction.

Verify the exact HS code with your country’s customs authority to ensure accurate tariff application and compliance.

Export and Import Regulations

- Export Controls: Check if raw iron products are subject to export restrictions or licensing requirements in the country of origin (e.g., U.S. Department of Commerce regulations for certain metal exports).

- Import Duties and Tariffs: Research applicable tariffs and trade agreements (e.g., USMCA, EU trade preferences) in the destination country. Anti-dumping or countervailing duties may apply to iron/steel imports.

- Import Permits: Some countries require import licenses or conformity certifications for metal construction products.

Packaging and Handling Requirements

- Corrosion Protection: Raw iron is prone to rust. Use VCI (Vapor Corrosion Inhibitor) paper, desiccants, or temporary protective coatings during transit.

- Securement: Securely bundle or cradle components to prevent shifting during transport. Use wooden skids or crates for fragile or long sections.

- Labeling: Clearly label packages with product description, weight, handling instructions (e.g., “Do Not Stack,” “Protect from Moisture”), and country of origin.

Transportation Logistics

- Mode of Transport: Choose based on volume and destination:

- Ocean Freight: Cost-effective for large shipments; use dry containers or flat racks for oversized pieces.

- Road/Rail: Suitable for regional delivery; ensure compliance with weight and dimension regulations.

- Incoterms: Define responsibilities using standard Incoterms (e.g., FOB, CIF, DDP) to clarify shipping, insurance, and customs obligations.

Customs Documentation

Prepare and verify the following for smooth clearance:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Import/Export Licenses (if applicable)

– MSDS (Material Safety Data Sheet), if required for handling

Environmental and Safety Compliance

- REACH/ROHS (EU): While primarily for chemicals, ensure coatings or treatments used on iron comply if applicable.

- OSHA (U.S.): Follow safe handling practices during loading/unloading to prevent injury from sharp edges or heavy components.

- EPA Regulations: Comply with any rules regarding surface treatments or emissions during processing (if applicable).

Quality and Standards Compliance

- ASTM/EN Standards: Ensure raw iron meets relevant specifications (e.g., ASTM A36 for structural steel, EN 10025 for hot-rolled steels).

- Testing and Certification: Provide mill test certificates (MTCs) confirming chemical composition and mechanical properties.

Risk Management and Insurance

- Cargo Insurance: Obtain all-risk marine or transit insurance covering damage, theft, and corrosion.

- Contingency Planning: Account for delays due to port inspections, weather, or customs audits.

End-of-Life and Recycling Considerations

- Recyclability: Iron is highly recyclable; communicate this attribute for sustainability compliance and end-user disposal planning.

- WEEE/ELV Directives: Not typically applicable to raw fencing, but relevant if integrated with electronic components (e.g., automated gates).

Recordkeeping and Audits

Maintain complete documentation for at least 5–7 years to support compliance audits, duty claims, or trade investigations. Include shipping logs, certificates, and customs filings.

Consult with a licensed customs broker or trade compliance expert to ensure adherence to all local and international regulations.

In conclusion, sourcing raw iron for fence fabrication requires a careful evaluation of material quality, supplier reliability, cost efficiency, and logistical considerations. Selecting high-grade raw iron ensures durability, strength, and resistance to environmental factors, which are essential for long-lasting fencing solutions. Establishing partnerships with reputable suppliers who adhere to industry standards helps maintain consistency and supports sustainable and ethical sourcing practices. Additionally, factoring in transportation costs, lead times, and local availability can significantly impact project timelines and overall expenses. By conducting thorough research and strategic planning, businesses can secure a reliable supply of raw iron that meets both performance requirements and budget constraints, ultimately contributing to the successful execution of fencing projects.