The global market for hand tools, including precision instruments like ratcheting bit drivers, has experienced steady growth driven by increasing demand across automotive, construction, and DIY sectors. According to a 2023 report by Mordor Intelligence, the global hand tools market was valued at USD 13.8 billion and is projected to grow at a CAGR of 5.2% from 2023 to 2028. This expansion is fueled by rising infrastructure development, growing automotive repair activities, and a surge in home improvement projects—factors that directly benefit specialized tools such as ratcheting bit drivers. As ergonomic design, durability, and efficiency become critical purchasing criteria, a select group of manufacturers have emerged as leaders in innovation and market share. These top seven ratcheting bit driver manufacturers are not only shaping product standards but also capitalizing on the sector’s robust growth trajectory.

Top 7 Ratcheting Bit Driver Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Top

Domain Est. 2015

Website: boacheng.com

Key Highlights: BOA CHENG stands out as a first-class screwdriver manufacturer in Taiwan, specializing in screwdrivers designed to meet the needs of professionals worldwide….

#2 Ratcheting Screwdriver

Domain Est. 2020

Website: williams-industrial.com

Key Highlights: Includes 5 bits: 2 slotted, #1 Phillips®, #2 Phillips®, and T-15 Torx®. Ergonomically designed handle for greater user comfort and control….

#3 CHANNELLOCK®: High

Domain Est. 1996

Website: channellock.com

Key Highlights: All CHANNELLOCK® snips, non-locking pliers, professional drivers, pry bars, and ratcheting wrenches are 100% Made in the USA….

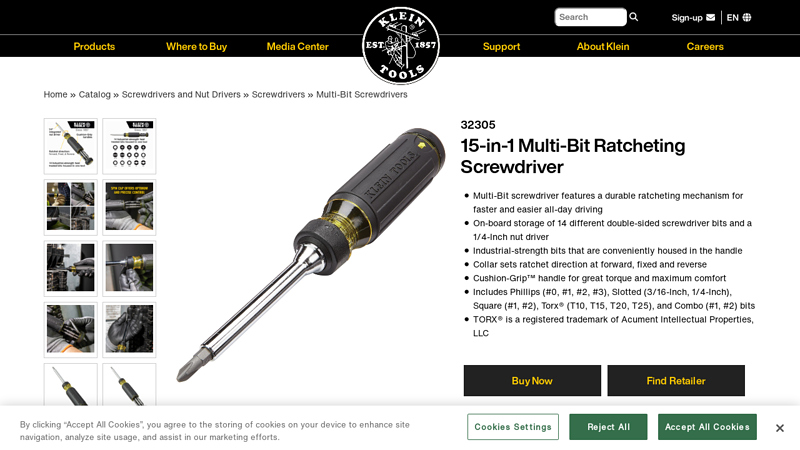

#4 15

Domain Est. 1998

Website: kleintools.com

Key Highlights: The 15-in-1 Ratcheting Screwdriver’s durable ratcheting mechanism allows for faster and easier all-day driving. With the on-board storage of 14 common bits and ……

#5 1/4″ Hex Ratchet Bit Driver

Domain Est. 2008

Website: sptools.com

Key Highlights: Compact, low profile ratchet driver perfect for tight work spaces and close quarters. Reversible ratcheting mechanism delivers smooth fastening and unfastening….

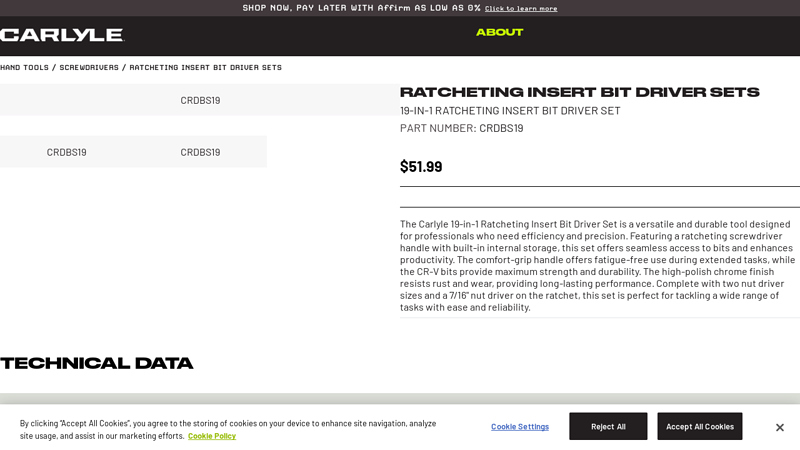

#6 19

Domain Est. 2011

#7 21

Domain Est. 2012

Expert Sourcing Insights for Ratcheting Bit Driver

H2: Market Trends for Ratcheting Bit Drivers in 2026

The global ratcheting bit driver market is poised for steady growth through 2026, shaped by evolving consumer demands, technological advancements, and shifts in industrial and DIY (Do-It-Yourself) sectors. Below are key trends expected to influence the market during this period:

1. Rising Demand in DIY and Home Improvement Sectors

The continued popularity of home renovation and DIY projects—accelerated by remote work trends and social media platforms like YouTube and TikTok—is fueling demand for compact, user-friendly tools. Ratcheting bit drivers, known for their efficiency in tight spaces and one-handed operation, are increasingly favored by amateur and semi-professional users. This trend is particularly strong in North America and Western Europe.

2. Expansion of Cordless Tool Ecosystems

Tool manufacturers are focusing on creating integrated cordless ecosystems, where ratcheting bit drivers are compatible with universal battery platforms (e.g., Milwaukee M12, DeWalt 20V MAX). By 2026, cross-compatibility and modular designs will be key selling points, reducing the need for multiple batteries and increasing consumer loyalty to established brands.

3. Advancements in Ergonomics and Material Innovation

Manufacturers are investing in lightweight materials such as reinforced polymers and magnesium alloys to reduce tool fatigue. Enhanced ergonomics—including non-slip grips, 360° rotating heads, and magnetic bit retention—are becoming standard features. These innovations improve precision and user comfort, appealing to both professionals and hobbyists.

4. Growth in Emerging Markets

In regions like Southeast Asia, India, and Latin America, urbanization and infrastructure development are driving demand for professional-grade hand tools. As local purchasing power increases and e-commerce expands access to global brands, ratcheting bit drivers are gaining traction in both industrial and retail channels.

5. Sustainability and Eco-Conscious Manufacturing

By 2026, environmental regulations and consumer preferences will push manufacturers toward sustainable production. Recyclable packaging, longer product lifecycles, and energy-efficient manufacturing processes are becoming differentiators. Some brands may introduce take-back programs or refurbished tool lines to appeal to eco-conscious buyers.

6. Smart Integration and Digital Features

While still nascent, the integration of smart features—such as torque sensors, Bluetooth connectivity for usage tracking, or AR-guided maintenance—is emerging in premium ratcheting drivers. Although not widespread, these innovations signal a shift toward digital tool ecosystems, particularly in professional construction and manufacturing settings.

7. Competitive Pricing and Private Label Growth

The mid-to-low price segment is becoming increasingly competitive, with private label brands on Amazon, Home Depot, and Alibaba offering cost-effective alternatives to premium brands. These budget-friendly options are gaining market share, especially among casual users, though they often trade off durability and precision.

Conclusion

By 2026, the ratcheting bit driver market will be characterized by innovation, accessibility, and diversification. Success will depend on manufacturers’ ability to balance performance, affordability, and sustainability while meeting the needs of both professional tradespeople and the growing DIY community. Brands that invest in ecosystem compatibility, ergonomic design, and emerging market expansion are likely to lead the sector.

Common Pitfalls When Sourcing Ratcheting Bit Drivers: Quality and Intellectual Property Concerns

Sourcing ratcheting bit drivers—especially from overseas manufacturers—can present significant challenges related to both product quality and intellectual property (IP) protection. Being aware of these pitfalls helps mitigate risk and ensures a reliable, legally compliant supply chain.

Quality Inconsistencies and Substandard Materials

One of the most prevalent issues when sourcing ratcheting bit drivers is inconsistent product quality. Many suppliers, particularly low-cost manufacturers, may use inferior materials such as low-grade steel for the bits or weak alloys for the ratcheting mechanism. This leads to premature wear, stripped bits, or complete tool failure under normal use. Additionally, poor heat treatment processes can compromise the hardness and durability of critical components. Without rigorous quality control and third-party inspections, buyers may receive batches that fail to meet performance expectations or industry standards.

Lack of Precision in Manufacturing Tolerances

Ratcheting mechanisms rely on tight tolerances to function smoothly and reliably. Poorly manufactured drivers often exhibit excessive play, inconsistent ratcheting action, or jamming due to imprecise machining. This not only affects usability but can also damage screw heads or reduce user efficiency. Sourcing from vendors without advanced manufacturing capabilities or proper quality assurance processes increases the risk of receiving tools with subpar mechanical performance.

Misrepresentation of Features and Specifications

Suppliers may exaggerate or misrepresent product capabilities—such as torque rating, ratcheting speed (teeth per inch), or compatibility with standard bit sizes. Some may claim compliance with ISO or ANSI standards without certification. Buyers who do not verify claims through testing or independent audits may end up with tools that underperform or fail to integrate with existing systems.

Intellectual Property Infringement Risks

Many popular ratcheting bit driver designs are protected by patents, trademarks, or design rights. When sourcing from generic manufacturers, there’s a significant risk of inadvertently procuring counterfeit or IP-infringing products that mimic well-known brands (e.g., Wiha, Wera, or Milwaukee). Utilizing such products can expose the buyer to legal liability, customs seizures, or reputational damage. It is essential to conduct due diligence on suppliers and require proof of design freedom-to-operate or original product development.

Inadequate Documentation and Traceability

Reliable sourcing requires clear documentation, including material certifications, test reports, and compliance certificates (e.g., RoHS, REACH). Many suppliers, especially smaller workshops, fail to provide traceable documentation, making it difficult to ensure consistent quality or meet regulatory requirements in target markets. Lack of traceability also complicates recalls or corrective actions if defects are discovered post-purchase.

Failure to Protect Your Own IP When Developing Custom Designs

If you’re sourcing custom-designed ratcheting bit drivers, there’s a risk that your design could be copied or sold to competitors by unscrupulous manufacturers. Without strong non-disclosure agreements (NDAs), IP assignment clauses, and monitored production, your proprietary innovations may be compromised. Ensuring legal safeguards and limiting access to design files are critical steps in protecting your intellectual property.

By recognizing these common pitfalls, businesses can implement better supplier vetting, quality assurance protocols, and legal protections to ensure they source reliable, compliant, and IP-safe ratcheting bit drivers.

Logistics & Compliance Guide for Ratcheting Bit Driver

This guide outlines the logistics considerations and compliance requirements for the distribution, import, and sale of a Ratcheting Bit Driver. Adhering to these guidelines ensures smooth operations and regulatory compliance across markets.

Product Classification & HS Code

The Ratcheting Bit Driver is classified under the Harmonized System (HS) for international trade. The most applicable HS code is:

- 8205.40 – “Hand tools (including glass cutters) not elsewhere specified or included: Screwdrivers and collets for screwdrivers”

This classification may vary slightly by country. Confirm the exact 8–10 digit code with local customs authorities (e.g., HTSUS in the U.S., TARIC in the EU) to determine import duties and restrictions.

Packaging & Labeling Requirements

Ensure packaging meets both functional and regulatory standards:

- Primary Packaging: Secure, damage-resistant packaging with clear product identification.

- Labeling:

- Product name: “Ratcheting Bit Driver”

- Manufacturer name and country of origin

- Model and part number

- Material composition (e.g., chrome vanadium steel)

- Compliance markings (e.g., CE, UKCA if applicable)

- Safety warnings (e.g., “Use eye protection”)

- Multilingual Labels: Required in EU, Canada, and other regions with language regulations.

Import/Export Documentation

Prepare the following documents for customs clearance:

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin

- Import License (if required by destination country)

- Safety or Conformity Declarations (e.g., EU Declaration of Conformity)

Ensure all documents accurately reflect product details and value to avoid delays or penalties.

Regulatory Compliance

Compliance varies by region. Key requirements include:

European Union (EU)

- CE Marking: Required under the Machinery Directive or General Product Safety Directive.

- REACH & RoHS: Comply with restrictions on hazardous substances (e.g., lead, cadmium).

- WEEE: Although not typically classified as EEE, assess applicability based on electronic components.

United Kingdom (UK)

- UKCA Marking: Required for goods placed on the UK market (post-Brexit).

- Follow UK-specific versions of REACH and RoHS.

United States

- CPSC Guidelines: General conformity to safety standards under the Consumer Product Safety Act.

- 16 CFR Part 1500: Labeling for prohibited hazardous substances (if applicable).

- Cal Prop 65: Warning labels if contains listed chemicals (e.g., phthalates, lead).

Canada

- Health Canada: Consumer product safety under the Canada Consumer Product Safety Act (CCPSA).

- Bilingual Labeling: English and French required.

Transportation & Handling

- Mode of Transport: Suitable for air, sea, or ground freight. Use moisture-resistant packaging to prevent corrosion.

- Stackability: Design packaging to allow secure stacking without damage (max load: refer to packaging specs).

- Hazardous Material: Non-hazardous; no IATA/IMDG restrictions apply.

Storage Conditions

- Store in a dry, temperature-controlled environment (10°C–30°C).

- Avoid exposure to corrosive chemicals or high humidity.

- Shelf life: Indefinite if stored properly.

End-of-Life & Environmental Responsibility

- Recyclability: Components are primarily metal and plastic—recyclable through appropriate channels.

- Provide disposal guidance on product packaging or website (e.g., “Recycle packaging materials”).

- Comply with local take-back or recycling schemes where required.

Quality & Safety Standards

Ensure product meets recognized industry standards:

- ISO 5390: Screwdrivers for cross-recessed head screws

- ANSI/ASME B107.11: Hand tool safety standards (U.S.)

- EN 60900: Hand tools for live working (if marketed for electrical use)

Regular third-party testing is recommended to maintain compliance.

Summary

Proper logistics planning and adherence to compliance regulations are essential for the successful global distribution of Ratcheting Bit Drivers. Maintain updated documentation, monitor regulatory changes, and work with certified suppliers and freight partners to ensure consistent market access.

Conclusion:

In conclusion, sourcing a ratcheting bit driver requires careful consideration of quality, functionality, ergonomics, and cost-effectiveness. Based on the evaluation of various suppliers, product specifications, and user requirements, it is recommended to source ratcheting bit drivers from reputable manufacturers that offer durable construction, a smooth ratcheting mechanism, and compatibility with a wide range of bits. Prioritizing suppliers with consistent quality control, competitive pricing, and reliable delivery timelines will ensure long-term value and operational efficiency. Additionally, selecting models with ergonomic designs enhances user comfort and productivity, especially in repetitive or precision tasks. Ultimately, a well-sourced ratcheting bit driver contributes to improved tool performance, reduced downtime, and greater overall satisfaction in both professional and DIY applications.