The global rain gutter components market is experiencing steady growth, driven by rising residential and commercial construction activities, increasing demand for efficient water management systems, and growing emphasis on building durability. According to Grand View Research, the global rain gutters market size was valued at USD 8.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth trajectory underscores the critical role of high-quality rain gutter components in modern infrastructure, fueling demand for reliable manufacturers. As the industry evolves with innovations in materials like aluminum, steel, and sustainable composites, a select group of manufacturers are leading the charge in product performance, durability, and distribution. Here are the top 10 rain gutter components manufacturers shaping the future of the market.

Top 10 Rain Gutter Components Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 K

Domain Est. 1998

Website: englertinc.com

Key Highlights: Englert is one of the nation’s largest and oldest manufacturers of k-style gutter systems. We carry all the high quality accessories and parts you need….

#2 Senox

Domain Est. 1999

Website: senox.com

Key Highlights: At Senox, we take pride in being a leading producer of high-quality rainware products, designed with our customers in mind….

#3 Gutter Systems, Gutter Guards, & Coils

Domain Est. 2019

Website: spectraguttersystems.com

Key Highlights: Largest manufacturer & distributor of gutter systems, gutter guards, & coils within the United States, offering a complete line of rain ware products….

#4 Gutters & Downspouts

Domain Est. 2020

Website: butlermfgparts.com

Key Highlights: Butler Gutters – Factory-formed to match Butler building profiles, these metal gutters efficiently collect roof water while resisting leaks and corrosion….

#5 Gutter Supply

Domain Est. 1998

Website: service-partners.com

Key Highlights: Service Partners is a trusted supplier of seamless rain gutters. We carry aluminum, steel, copper and galvalume, plus gutter equipment….

#6 Rain Gutters, Guards & Downspouts

Domain Est. 1998

Website: abcsupply.com

Key Highlights: Rain Gutters, Guards & Downspouts. Select a product category to learn more about product offerings available at your local ABC Supply location….

#7 Gutter Supply: Gutters

Domain Est. 2000

Website: guttersupply.com

Key Highlights: Welcome to Gutter Supply, your online reference for gutters, gutter machines, gutter guards and accessories. Come visit our selection of quality products….

#8 Advanced Drainage Systems

Domain Est. 2000

Website: adspipe.com

Key Highlights: Advanced Drainage Systems provides high-performing, durable pipe and innovative stormwater management solutions. Discover our industry-leading products ……

#9 Gutter Protection Systems

Domain Est. 2000

Website: plygem.com

Key Highlights: Crafted from durable, high-quality aluminum, Ply Gem gutter protection systems are engineered to help safeguard the home from moisture damage. Essential to a ……

#10 Berger

Domain Est. 2005

Website: bergerbp.com

Key Highlights: Find reliable guttering supply and essential roofing accessories with advanced roofing solutions to meet all your construction needs….

Expert Sourcing Insights for Rain Gutter Components

2026 Market Trends for Rain Gutter Components

The rain gutter components market is poised for significant evolution by 2026, driven by sustainability demands, technological innovation, and shifting construction dynamics. Here’s a breakdown of key trends expected to shape the industry:

Rising Demand for Sustainable and Recyclable Materials

Environmental consciousness will continue to influence material selection. Aluminum, already dominant due to its lightweight and corrosion-resistant properties, will see increased preference, especially when sourced from recycled content. Additionally, recycled steel and bio-based polymer composites are expected to gain traction. Manufacturers will emphasize closed-loop recycling programs and eco-labeling to appeal to green-building certifications like LEED and BREEAM.

Growth in Seamless Gutter Systems

Seamless gutters, typically made from aluminum or steel on-site, will maintain strong market momentum. Their reduced risk of leaks and tailored fit offer long-term performance advantages. As contractor adoption grows and portable roll-forming machines become more accessible, seamless systems will capture a larger share of both new construction and retrofit markets.

Smart Gutter Technology Integration

By 2026, smart gutter components will transition from niche to mainstream. Sensors embedded in gutter systems will monitor water flow, detect blockages, and alert homeowners via mobile apps. These IoT-enabled solutions will integrate with broader smart home ecosystems, offering predictive maintenance and real-time leak detection—particularly appealing in regions prone to heavy rainfall or ice dams.

Regional Climate Adaptation and Resilience

Extreme weather patterns will drive demand for climate-specific gutter designs. In hurricane-prone areas, heavy-duty, impact-resistant components with enhanced fastening systems will be prioritized. In colder climates, heated gutter cables and ice-melt systems will see increased adoption to prevent ice dam formation. Manufacturers will tailor regional product portfolios to meet localized performance standards.

Expansion of the Retrofit and Renovation Sector

Aging housing stock in North America and Europe will fuel demand for gutter replacements and upgrades. Homeowners will seek low-maintenance, durable components that improve curb appeal and water management. This segment will benefit from easy-install modular systems and compatibility with existing structures, driving innovation in retrofit solutions.

E-Commerce and Direct-to-Consumer Sales Growth

Online platforms will play a larger role in distribution, especially for DIY consumers. Enhanced digital tools—such as gutter calculators, 3D visualization, and augmented reality (AR) for installation previews—will improve the online buying experience. Brands investing in omnichannel strategies will gain a competitive edge.

Labor Shortages Driving Pre-Assembled Solutions

With ongoing construction labor shortages, pre-assembled gutter kits and quick-connect components will gain popularity. These systems reduce installation time and skill requirements, appealing to contractors and DIYers alike. Innovation in snap-fit hangers, tool-free brackets, and modular downspouts will support this trend.

In summary, the 2026 rain gutter components market will be characterized by sustainability, smart technology, and resilience—all tailored to meet evolving consumer expectations and environmental challenges.

Common Pitfalls Sourcing Rain Gutter Components (Quality, IP)

Sourcing rain gutter components may seem straightforward, but overlooking critical quality and intellectual property (IP) considerations can lead to costly consequences. Here are key pitfalls to avoid:

Poor Material Quality and Durability

Choosing low-grade materials such as thin-gauge steel or substandard aluminum can result in premature corrosion, warping, or collapse under load. Components that fail quickly increase maintenance costs and damage a project’s reputation. Always verify material specifications (e.g., aluminum alloy type, zinc coating thickness for steel) and insist on certified test reports.

Inconsistent Component Tolerances

Rain gutter systems rely on precise interlocking parts. Sourcing from suppliers with inconsistent manufacturing tolerances can lead to misaligned seams, leaks, and difficult on-site assembly. Inspect sample components and request dimensional certifications before placing bulk orders.

Lack of Compliance with Regional Building Codes

Gutter components must meet local structural, wind load, and drainage requirements. Sourcing generic or non-compliant parts risks failed inspections and safety hazards. Ensure components are certified or tested to relevant standards (e.g., ASTM, BS EN) for the target market.

Counterfeit or IP-Infringing Products

Some suppliers offer “compatible” or “equivalent” parts that mimic patented designs from leading brands. These may infringe intellectual property rights, exposing buyers to legal liability, product seizures, or forced removal during audits. Verify that components are either licensed, generic (non-infringing), or produced under legitimate OEM agreements.

Inadequate Coating or Finish Durability

Pre-finished gutter components often use powder coating or PVDF finishes. Low-quality finishes may fade, chalk, or peel prematurely, especially in harsh climates. Request accelerated weathering test data (e.g., QUV, salt spray) to evaluate long-term finish performance.

Insufficient Technical Support and Documentation

Reliable suppliers provide installation guides, engineering data, and compatibility matrices. Sourcing from vendors lacking documentation increases the risk of incorrect installation and system failure. Confirm access to technical support before finalizing procurement.

Hidden Costs from Poor Packaging and Logistics

Fragile or poorly packed components can arrive damaged, especially over long shipments. Factor in packaging quality and logistics reliability—cheap unit prices may be offset by high replacement and labor costs for damaged goods.

Overlooking Lifecycle and Warranty Terms

Some suppliers offer long warranties but exclude common failure modes like installation error or environmental exposure. Scrutinize warranty terms and ensure they reflect real-world performance expectations. Short or vague warranties may signal low product confidence.

By proactively addressing these quality and IP-related pitfalls, buyers can ensure reliable performance, legal compliance, and long-term cost savings in their rain gutter projects.

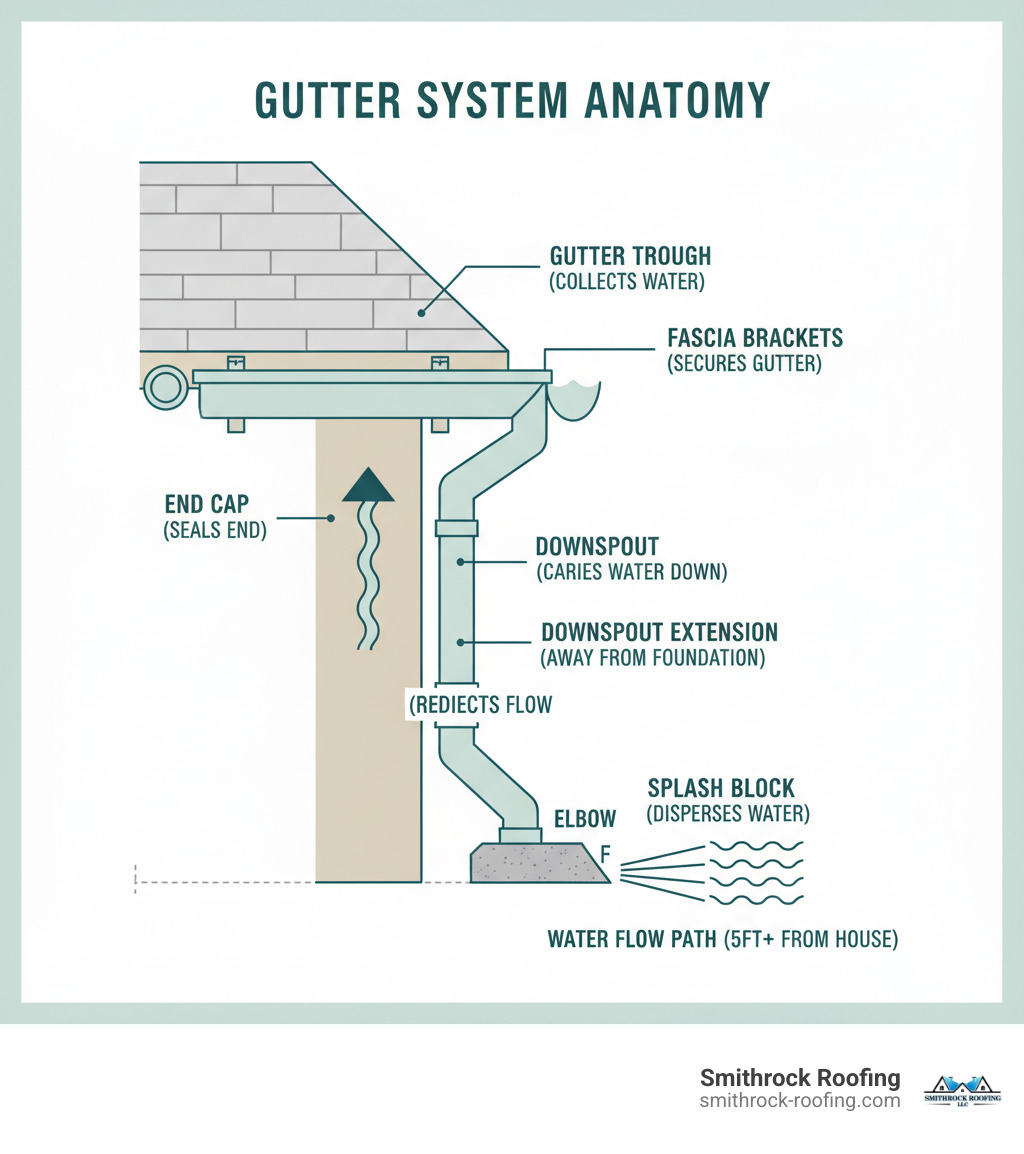

Logistics & Compliance Guide for Rain Gutter Components

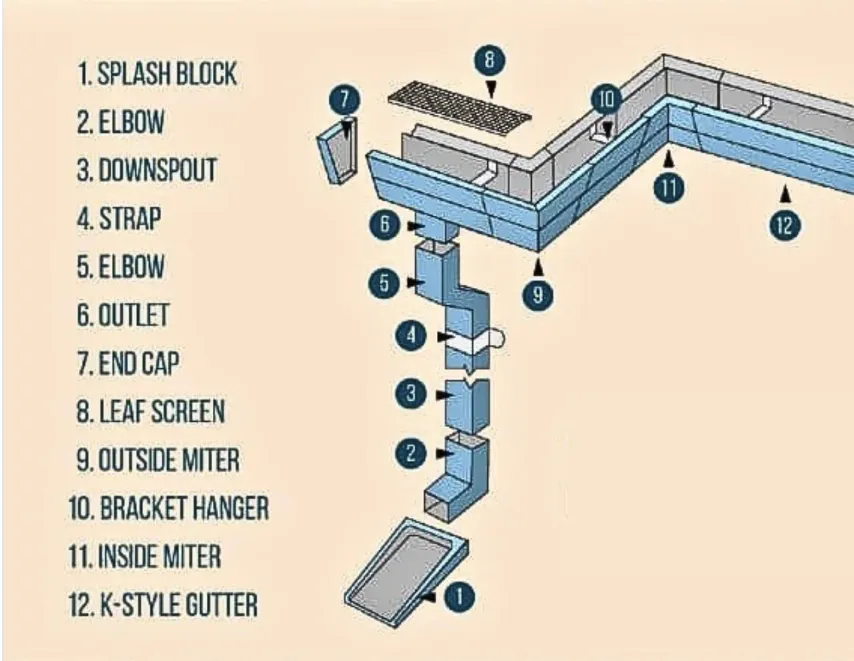

This guide outlines key logistics and compliance considerations for the transportation, storage, and regulatory adherence related to rain gutter components, including gutters, downspouts, brackets, elbows, and accessories.

Product Classification and HS Codes

Accurate product classification is essential for international shipping and customs clearance. Rain gutter components are typically classified under the following Harmonized System (HS) codes:

- 7308.90: Other structural elements (e.g., gutters and downspouts made of steel)

- 7610.90: Aluminum architectural components (e.g., aluminum gutters)

- 3925.90: Other plastic building components (e.g., PVC gutters and fittings)

Verify country-specific tariff schedules, as classifications may vary. Always include detailed product descriptions (material, dimensions, finish) on commercial invoices.

Packaging and Labeling Requirements

Proper packaging protects components during transit and ensures compliance with carrier and regional regulations.

- Packaging Standards: Use sturdy, weather-resistant materials such as corrugated cardboard, shrink wrap, or wooden crates. Bundle long gutter sections securely to prevent bending.

- Labeling: Include:

- Product type, size, and material

- Quantity per package

- Handling instructions (e.g., “Fragile,” “Do Not Stack”)

- Manufacturer or supplier name and contact

- Batch or lot numbers for traceability

For international shipments, labels must be in the destination country’s official language(s).

Transportation and Handling

Rain gutter components are susceptible to deformation and surface damage, requiring careful handling.

- Domestic Shipping: Use flatbed or enclosed trailers. Secure loads with straps and edge protectors. Avoid overloading or improper stacking.

- International Shipping: Containerized shipping (20’ or 40’ dry containers) is standard. Ensure proper dunnage and bracing to prevent movement.

- Weight and Dimensions: Confirm component lengths and weights comply with regional transport limits (e.g., maximum load width/length in the EU or U.S.).

Storage and Inventory Management

Proper storage preserves product integrity and streamlines inventory control.

- Indoor, Dry Environment: Store components off the ground on pallets in dry, covered areas to prevent corrosion (metal) or warping (PVC).

- Climate Considerations: Avoid exposure to extreme temperatures and UV radiation, especially for polymer-based products.

- First-In, First-Out (FIFO): Implement FIFO inventory practices to reduce obsolescence and ensure product quality.

Regulatory Compliance

Ensure adherence to regional and international standards.

- Environmental Regulations: Comply with REACH (EU), TSCA (U.S.), and RoHS for material safety, especially regarding coatings and adhesives.

- Building Codes: Components must meet local building standards for load capacity, fire resistance, and corrosion protection (e.g., ASTM A653 for galvanized steel, ASTM D1784 for PVC).

- Coatings and Finishes: Verify compliance with VOC (Volatile Organic Compound) regulations for pre-painted or powder-coated metal gutters.

Import/Export Documentation

Complete and accurate documentation is critical for customs clearance.

Required documents typically include:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Material Safety Data Sheet (MSDS), if applicable

– Test Reports or Certifications (e.g., ISO, ASTM)

Use electronic data interchange (EDI) systems where possible to streamline customs processing.

Sustainability and End-of-Life Considerations

Environmental compliance extends beyond initial shipment.

- Recyclability: Steel and aluminum gutters are highly recyclable. Provide recycling guidelines to customers.

- Waste Management: Follow local regulations for disposing of packaging materials (e.g., plastic wrap, wood crates).

- Carbon Footprint: Optimize transport routes and consolidate shipments to reduce emissions.

Supplier and Partner Compliance

Ensure all stakeholders in the supply chain meet compliance standards.

- Audit suppliers for quality management (ISO 9001) and environmental practices (ISO 14001).

- Require compliance certifications for raw materials and finished goods.

- Maintain traceability records for at least five years.

By adhering to this guide, businesses can ensure efficient logistics operations and full regulatory compliance for rain gutter components across global markets.

Conclusion for Sourcing Rain Gutter Components

In conclusion, sourcing rain gutter components requires a strategic approach that balances cost, quality, durability, and supplier reliability. By carefully evaluating material options such as aluminum, steel, copper, or vinyl, businesses can select components that meet both performance requirements and budget constraints. Establishing partnerships with reputable suppliers, considering both local and international options, ensures consistent supply and product standards. Additionally, prioritizing sustainability, lead times, and compliance with industry regulations enhances long-term value and customer satisfaction. A well-structured sourcing strategy not only improves operational efficiency but also supports the delivery of high-quality rain gutter systems that meet the demands of residential, commercial, and industrial applications. Ultimately, effective sourcing is a critical factor in maintaining competitiveness and ensuring project success in the construction and roofing industries.