The global rail infrastructure market is experiencing robust growth, driven by increasing urbanization, government investments in sustainable transportation, and the modernization of aging rail networks. According to a report by Mordor Intelligence, the global railway equipment market was valued at USD 68.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 4.5% from 2023 to 2028. This expansion is creating heightened demand for specialized maintenance and safety equipment, including rail jacks—critical tools used to safely lift and stabilize railcars during servicing and track work.

As rail operators prioritize efficiency, safety, and compliance, selecting reliable rail jack manufacturers has become a strategic imperative. With performance, durability, and load capacity being key decision factors, a handful of manufacturers have emerged as industry leaders, combining engineering excellence with global reach. Based on market presence, product innovation, and adherence to international safety standards, the following nine manufacturers represent the top players shaping the future of rail maintenance technology.

Top 9 Rail Jack Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

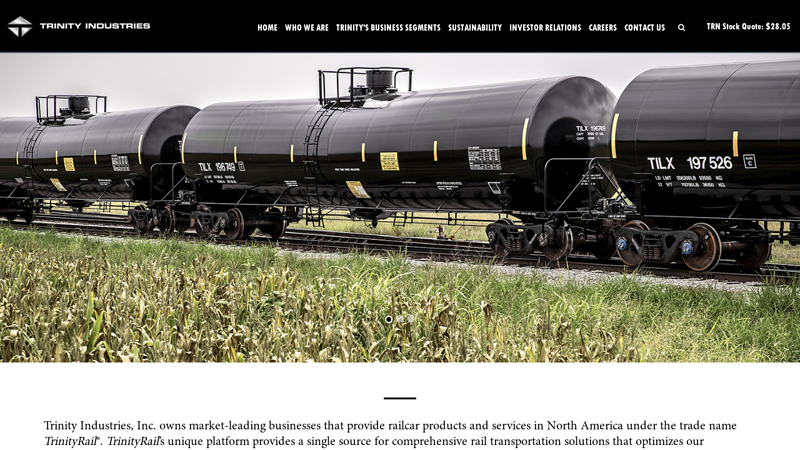

#1

Domain Est. 1996

Website: trin.net

Key Highlights: Trinity Industries, Inc. owns market-leading businesses that provide railcar products and services in North America under the trade name TrinityRail….

#2 Hi-Lift® Jack Co.

Domain Est. 1996

Website: hi-lift.com

Key Highlights: Manufacturer of “The Original Power Tool” Hi-Lift® Jack along with accessories and other recovery related equipment designed for off-road, farm, and rescue….

#3 Mi-Jack:

Domain Est. 1997

Website: mi-jack.com

Key Highlights: Mi-Jack Products provides Translift and Travelift RTG cranes along with parts, service, and automation for port, intermodal, and industrial applications….

#4 Enerpac

Domain Est. 1995

Website: enerpac.com

Key Highlights: We offer a wide selection of high-quality hydraulic equipment tailored to the specific needs of wind energy professionals….

#5 Portable Electric Jacks for Railcars & Locomotives

Domain Est. 1996

Website: whitingcorp.com

Key Highlights: The robust design & high-quality construction of Whiting portable electric jacks provide years of dependable service with minimum maintenance. Learn more….

#6 Hydra

Domain Est. 1997

Website: hydra-tech.net

Key Highlights: Enhance safety and efficiency with Hydra-Tech’s hydraulic jacks, stands and special tools for Railroad, Mining, and Construction industries….

#7 Our Innovative Products

Domain Est. 1998

Website: hydra-nor.com

Key Highlights: Our railway jacking equipment is trusted globally to get the job done. Safe, reliable, and efficient, they are second to none in the industry….

#8 Railcar Jack

Domain Est. 2006

Website: greenfieldpi.com

Key Highlights: Lifting Railcar Jacks from Greenfield Products are designed to perform under the toughest of conditions. Find out why we set the standard for lift jacks….

#9 Rail/Track Jacks

Domain Est. 2007

Website: pujaraengineers.com

Key Highlights: We manufacture many types of Rail Jacks i.e. conventional mechanical ratchet type track jack, head clamping/lifting screw type mechanical jack, A-frame ……

Expert Sourcing Insights for Rail Jack

H2: 2026 Market Trends for Rail Jack

The global rail infrastructure sector is poised for significant transformation by 2026, driven by increasing investments in sustainable transportation, digitalization, and aging network modernization. For Rail Jack—a specialized mechanical or hydraulic tool used for lifting railway vehicles during maintenance, repair, or track work—several key market trends are expected to shape demand, innovation, and competitive positioning in the second half (H2) of 2026.

-

Rising Rail Infrastructure Investment

Governments and private operators worldwide are accelerating investments in rail network expansion and modernization, particularly in Asia-Pacific, Europe, and North America. In H2 2026, continued rollout of high-speed rail projects (e.g., in India, Southeast Asia, and the U.S. via the Bipartisan Infrastructure Law) will drive demand for maintenance tools like Rail Jacks. Increased track laying and rolling stock deployment will necessitate robust maintenance ecosystems, boosting market opportunities. -

Focus on Safety and Automation

Regulatory bodies are tightening safety standards for rail maintenance operations. In H2 2026, there will be growing adoption of smart, automated, and fail-safe Rail Jack systems equipped with load sensors, wireless connectivity, and real-time monitoring. These “smart jacks” will integrate with predictive maintenance platforms, reducing human error and downtime. Companies offering IoT-enabled Rail Jacks are likely to gain a competitive edge. -

Shift Toward Lightweight and Portable Designs

With rail maintenance crews requiring faster, more mobile solutions, demand is rising for lightweight, portable, and modular Rail Jack systems. Aluminum alloys and composite materials will become more prevalent in jack construction. This trend will be especially prominent in urban transit systems and light rail networks, where space and ease of deployment are critical. -

Sustainability and Green Manufacturing

By H2 2026, environmental regulations and corporate ESG goals will influence the manufacturing of rail maintenance equipment. Rail Jack producers will increasingly adopt energy-efficient production methods, recyclable materials, and lower-emission logistics. Products with extended lifecycles and repairability will be favored, aligning with circular economy principles in the rail sector. -

Expansion of Aftermarket and Service Models

Original Equipment Manufacturers (OEMs) will shift toward service-based revenue models, offering Rail Jack leasing, maintenance contracts, and performance monitoring. In H2 2026, this trend will be accelerated by digital twin technology and predictive analytics, enabling proactive servicing and reducing total cost of ownership for rail operators. -

Geopolitical and Supply Chain Adjustments

Ongoing supply chain reconfigurations—especially in response to regionalization and nearshoring trends—will impact Rail Jack production. Manufacturers in H2 2026 will likely diversify sourcing and localize production facilities closer to key markets (e.g., India, Eastern Europe, Mexico) to mitigate risks and reduce lead times. -

Increased Competition and Consolidation

The Rail Jack market will see heightened competition from both established industrial toolmakers and new entrants specializing in rail technology. Strategic mergers and acquisitions are expected in H2 2026 as companies seek to expand product portfolios, access new markets, and integrate digital capabilities.

Conclusion

H2 2026 will be a pivotal period for the Rail Jack market, characterized by technological innovation, regulatory evolution, and strong demand from global rail infrastructure programs. Companies that invest in smart, sustainable, and user-centric designs—while adapting to shifting supply chains and service models—will be best positioned to capitalize on emerging opportunities in this niche but critical segment of rail maintenance equipment.

Common Pitfalls When Sourcing Rail Jacks: Quality and Intellectual Property Concerns

Sourcing rail jacks—critical tools used in railway maintenance and construction—can present significant challenges, particularly regarding quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to safety risks, project delays, legal disputes, and financial losses. Below are key pitfalls to avoid.

Poor Manufacturing Quality and Material Standards

One of the most frequent issues when sourcing rail jacks is inconsistent or substandard manufacturing quality. Low-cost suppliers may use inferior materials or cut corners in production, resulting in jacks that fail under load or wear out prematurely. This poses serious safety hazards in rail environments where equipment reliability is paramount. Buyers should verify that suppliers adhere to recognized industry standards (e.g., ISO, EN, or AAR specifications) and conduct third-party quality inspections before bulk procurement.

Lack of Certification and Compliance

Rail jacks used in professional or regulated environments must meet specific safety and performance certifications. Sourcing from suppliers who cannot provide valid test reports, CE marking, or other required compliance documentation increases the risk of non-compliance with local regulations. Always confirm that the product meets the technical and safety requirements of the target market and application.

Counterfeit or Reverse-Engineered Products

A major IP-related pitfall is the unintentional procurement of counterfeit or illegally reverse-engineered rail jacks. Some suppliers may replicate patented designs without authorization, exposing the buyer to legal liability, especially in jurisdictions with strict IP enforcement. These knock-offs often lack performance validation and may infringe on design or utility patents held by original equipment manufacturers (OEMs).

Inadequate Intellectual Property Due Diligence

Buyers often fail to perform proper IP due diligence when sourcing from third-party manufacturers, particularly in regions with weaker IP enforcement. This oversight can result in purchasing products that infringe on existing patents, trademarks, or technical designs. To mitigate this risk, conduct IP audits, request proof of design ownership or licensing agreements, and consider working with legal counsel to review supplier contracts.

Unclear Ownership of Custom Designs

When commissioning custom rail jacks, ambiguous contractual terms can lead to disputes over IP ownership. Suppliers may claim rights to design improvements or tooling, limiting the buyer’s ability to reproduce or modify the product in the future. Ensure that procurement agreements explicitly state that all IP developed during the project transfers to the buyer.

Supply Chain Transparency Issues

A lack of visibility into the supply chain increases the risk of receiving subpar components or unknowingly supporting IP violations. Suppliers may outsource production to unauthorized subcontractors using unlicensed designs or low-grade materials. Demand full transparency, conduct factory audits, and include contractual clauses requiring traceability and IP compliance throughout the supply chain.

By addressing these quality and IP-related pitfalls proactively, organizations can ensure the safe, reliable, and legally compliant sourcing of rail jacks.

Logistics & Compliance Guide for Rail Jack

This guide outlines the key logistics considerations and compliance requirements for the handling, transportation, and use of rail jacks—specialized lifting equipment used in railway maintenance and construction.

Purpose and Scope

This document applies to all personnel involved in the shipment, storage, operation, and maintenance of rail jacks. It ensures safe logistics practices and adherence to regulatory standards across jurisdictions.

Regulatory Compliance

Rail jacks must comply with industry and regional regulations, including but not limited to:

– OSHA 29 CFR 1910 Subpart N (U.S. Department of Labor standards for materials handling and storage)

– FRA (Federal Railroad Administration) requirements for equipment used on U.S. rail networks

– EN 13848 series (European standards for railway applications, track geometry)

– ISO 4301-2 (Crane and lifting equipment classification)

– Local rail authority specifications (e.g., Network Rail in the UK, Deutsche Bahn in Germany)

Operators and logistics teams must verify compliance with all applicable safety and engineering standards before deployment.

Transportation Guidelines

- Packaging & Securing: Rail jacks must be transported in secured crates or on pallets with anti-slip padding. Use tie-down straps rated for the equipment’s weight (check manufacturer specs).

- Load Distribution: Ensure even weight distribution on transport vehicles. Avoid overhanging loads exceeding legal limits.

- Documentation: Include shipping manifests, material safety data sheets (if applicable), and equipment certificates.

- Hazardous Materials: Confirm no hazardous components (e.g., hydraulic fluids) are present or properly labeled per DOT 49 CFR or ADR/RID for international rail/road shipments.

Storage Requirements

- Store rail jacks indoors in a dry, temperature-controlled environment to prevent corrosion.

- Elevate units off the floor using pallets to avoid moisture exposure.

- Keep hydraulic components sealed and protected from dust and contaminants.

- Implement a first-in, first-out (FIFO) system for inventory rotation.

Handling and Deployment

- Only trained and certified personnel may operate rail jacks.

- Conduct pre-use inspections for structural damage, hydraulic leaks, and wear on lifting pads.

- Ensure rail surfaces are clean and aligned before jack placement.

- Follow manufacturer load limits strictly—never exceed rated capacity.

- Use secondary safety supports when lifting rolling stock.

Maintenance and Certification

- Perform routine maintenance as per the manufacturer’s schedule (e.g., lubrication, seal inspection).

- Maintain detailed service logs, including dates, actions taken, and technician details.

- Recertify rail jacks annually or per regulatory cycle; keep certification records on file.

- Retire and replace equipment showing structural fatigue or non-compliant wear.

Training and Documentation

- Provide role-specific training for logistics, maintenance, and operational staff.

- Retain training records for audit purposes.

- All compliance documents (certifications, inspection reports, safety data) must be accessible and up to date.

Incident Reporting

Report any malfunction, safety concern, or non-compliance incident immediately. Conduct root cause analysis and implement corrective actions per organizational safety protocols.

Conclusion

Adherence to this guide ensures the safe, efficient, and compliant use of rail jacks throughout their lifecycle. Regular audits and updates to procedures are recommended to reflect changes in regulations or equipment specifications.

Conclusion for Sourcing Rail Jack

After a comprehensive evaluation of market suppliers, technical specifications, cost considerations, and logistical requirements, the sourcing of rail jacks has been strategically aligned with suppliers that offer a balance of quality, reliability, and cost-efficiency. The selected rail jacks meet all necessary safety standards and technical requirements for rail maintenance and track adjustment operations. By partnering with certified and experienced manufacturers, we ensure product durability, compliance with industry regulations, and timely delivery to support seamless railway operations. This sourcing decision enhances operational safety, supports maintenance efficiency, and contributes to long-term infrastructure integrity. Ongoing supplier performance monitoring and periodic reviews will further ensure sustained value and supply chain resilience.